|

Dr. Yagna Vyas B.V.Patel Institute of Management Uka Tarsadia University Bardoli, Dis: Surat, Gujarat (M) 8866917998 yagna.vyas@utu.ac.in |

Gold sector and GST both plays a vital role in Indian Economy. Employment generated from the development of gold sector and GST. The primary objective of the study is to check the jeweler’s awareness of GST and the effects of GST on gold jewellery price. The data has been collected from the registered jeweler of Vapi & Valsad city and total 100 questionnaires have been filled in person. The majority of the jeweler comprises of manufacturer as compared to trader. It has been found that they are aware about the registration process, late fees and its interest. Even they are not taking all the deadlines as burdensome. Supply chain is the major factor for affecting gold and jewellery prices and the other reason is implementation of GST. In old tax system (VAT) the rates applicable was less as compared to GST. The limitation and further scope of the study that limited number of jewelers cannot generalize the whole population. The expansion of geographic location gives more strength for research results and this study only includes unorganized sector, for further research organized sector study can be done.

Keywords: GST, Gold Jewellery Sector, Economic growth.

The gold sector plays a vital role in Indian economy; it contributed approximate 7% of country’s GDP. This sector is based on import & export even it includes labor works which also increases the employment in country. India is a hub of gold and jewellery market even skilled labors available at cheaper rates. The government of India also focuses on export promotion in gold sector. 100% FDI through automatic route has been allowed by the Government of India. With the booming gold sector implementation of GST plays a vital role. GST applied to all the sectors except alcohol for human consumption and petrol and petroleum products. The GST on gold and gold jewellery applied at 3% whereas, it includes customs duty of 10% and making charges of 5%. As the government charges more rates on gold and gold jewellery as compared to previous tax regime. The earnings of government increases through the changes in rates, even with the help of digitalization in GST more transparency is maintained. Input tax credit was not available on all transactions previously in VAT & CST but now in GST ITC is the important link between two parties for getting the benefit of their credits. For composition tax ITC is not applicable. The CBIC has to encourage the GST payers not to go for composition tax but with regular tax they can get the benefit of input tax credits.

(Dr.V.R.Nedunchezhian, 2018) This report is focused on the key issues related to public domain and the industrial circles. They pointed the important issues that are discussed vividly among the public, the impact survey was conducted with small and micro business traders for response on the overall impact of GST on their business and some significant factors that were impacted the actual outcome. It was imperative from the response survey that the opinions of the respondent’s are neither too neither negative nor positive and it was balanced condition. If the government can ensure to address some of the teething issues, the process could lead to sustainable economic development in the country. (Teoh Chai Teng, 2016) They have focused on the construction capital cost and housing property price will increase with the implementation of GST and it also influence the housing developer and housing property price. They have collected the details from the developer regarding their views of GST impact on the housing prices of Malaysia. The objective of the study was to compute the effects of tax on price of property. They surveyed 36 housing developer and an experiences property consultant who comes from Henry Butcher (International Asset Consultant) at Penang, Malaysia so that they identify the major GST effect on construction capital cost. They argue this impact was significant for the public administrators for making considerable changes required on implementing or changing the rates of GST for the construction industry. They have pointed that, building materials and land acquisition are the major construction impact gain from the GST implementation further capital flow turnover was the prior and significant impact that developer facing and subsequently result to an increment on housing property price in which end buyer is the one who suffer the price increment where government is the one who plays an important role in transferring such scenario into a win-win situation and the objectives of this study had been achieved. (Sahoo, 2016),In this paper they evaluated the impact of GST (Goods and Services Tax) on Indian Tax system. GST levied on manufacture, sale and consumption of goods as well as services at the national level. It replaces all indirect taxes levied on goods and services by the Central Government and State Governments. GST is the only indirect tax that directly affects all sectors and sections of our economy. In this paper they explained the concepts of GST and its evolution in India. Then they discussed the salient features of GST and its computation. They highlighted the benefits of the GST for Indian economy. This paper also shows the challenges to implement GST and how to overcome it. Discussed the possible challenges and threats and opportunities that GST brings before us to strengthen our free market economy.

1. To study the awareness of gold jewelers about Goods and Services Tax compliance 2. To check the effect on price of jewellery after Goods and Services Tax implementation

The data has been collected from the registered jeweler of Vapi & Valsad city. Total 100 questionnaires have been filled in person. The jeweler comprises of manufacturer or trader or both.

The respondent has been asked about the type of his business

From the above chart it can be seen that 38% of the jeweler’s only deals in trading while only 19% percent deals in manufacturing of gold jewellery. Whilst the majority of the jeweler’s deal in both manufacturing and trading.

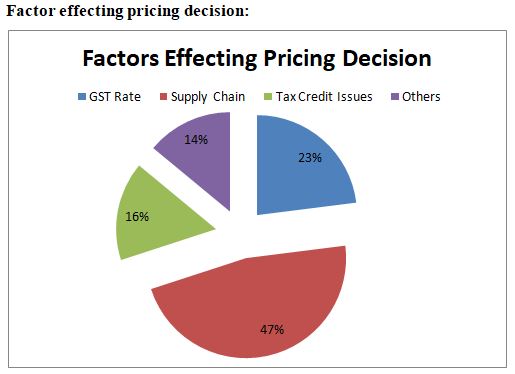

From the above chart it can be seen that 47% of jeweler decide their price according to the supply chain rate, 23% of the jeweler decide prices according to the GST rate applicable to them. Out of the remaining, 14% have other reasons for making the pricing decision like the gold rate as on that day, and the last 10% of the jeweler state the reason of their price influence as vendors not passing on the tax credit.

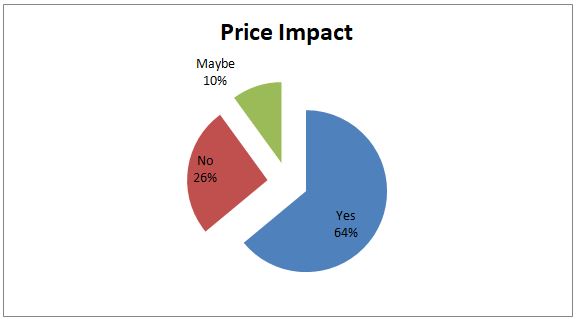

From the above chart it can be seen that, 64% of the jewelers are positive that there is impact of GST on price of jewellery and 26% of the jeweler says GST have no impact on price of the product. 10% of the jewelers are still in the doubt about whether it has impacted or not

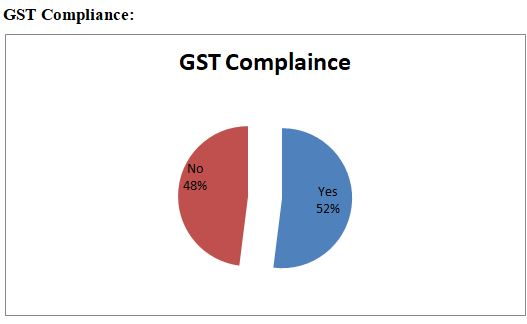

It can be seen from the above chart that, 52% of the registered jeweler feels that introduction of the Goods and Services Tax have not at all affected their compliance and the remaining of 48% have to say that it have increased their burden.

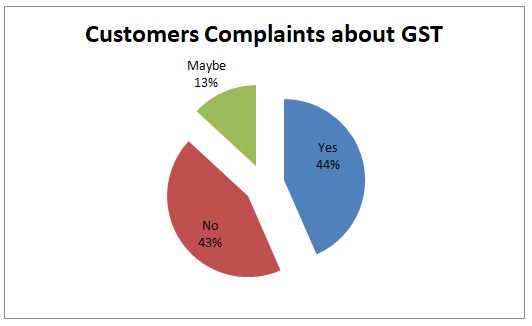

From the above chart it can be seen that 44% of the jeweler’s customer have complaints about the higher GST rates as compared to VAT, whereas 43% of the jeweler’s customers have no complaints about increased rate of GST. For other 13% are unsure if the customers complained about the prices or not.

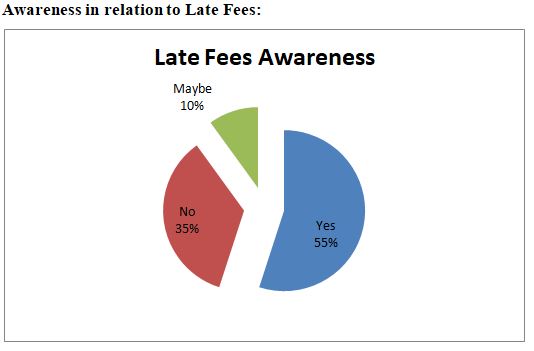

According to the results of the survey 56% of the jewelers are aware about the penalties that they might need to pay. 35% of the jewelers are not at all aware if there were penalties at all and the remaining 10% of the jewelers we not fully aware about the late fees and penalties.

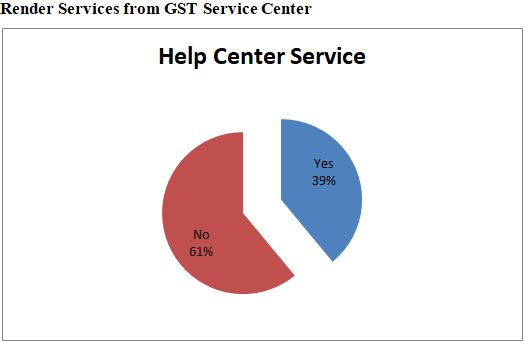

Almost more than 60% of the jewelers do not render the services provided by the government service centers

85% of the jeweler are happy and feel that it will bring a positive change in India whereas, 15% feel that it is just a political move are will bring no positive change in India.

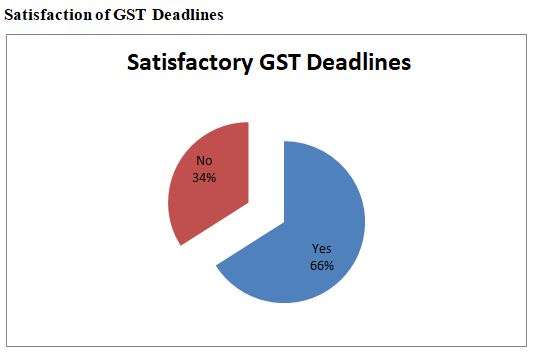

After the survey it turned out that 66% of the jewelers think that they are provided with ample amount of time and they are able to file the returns with ease and without any haste, while 34% of the jewelers have to say that they are not at all satisfied with the deadlines been provided to them and they think that the deadline should be extended so that can avoid the late fees and penalties

1) 64% of the respondents have their ages between 31 years to 50 years, they are enough experienced in their business. 2) All the businesses have 3% tax rate applicable. Overall rate on gold jewellery is 18%, but jeweler shares only 3 % applicable rates. 3) In this study the manufacturers are more as compared to trader, so they need to share the real applicable rates of GST on jewellery. 4) Supply chain rate is the major factor influencing pricing decision as compared to all other factors like GST rates, Input tax credit and gold price. 5) Majority of the respondent says there is an impact of GST for fixing price of the product. Whereas some shares that there is no impact of GST for fixation of price the product. 6) It is really a difficult task for the businessman to comply new tax regime in their businesses. More than 50% of the respondents find no burden for compliance GST and 48% of the respondents feel difficulty and burdensome work during the compliance of GST. Monthly and quarterly filling and even facing problem of network issues for last days payments. 7) Before implementing GST, VAT was chargeable in gold & gold jewellery and it was approximately 14% but now in GST actual rate on gold is 3% but customs duty 10% and additional tax of 5% on making charge of jewellery has been charged. Still 44% of the respondents have said that the tax rate is VAT regime and GST regime hasn’t made any difference in tax amount. 8) Awareness of GST rules and regulation about the filling return dates, durations, bills, credits etc. Majority (55%) of the respondents are aware about the late fees and its penalties and interests. 9) For any query related to GST implementation or maintenance of GST new rules and regulations 60% of the respondents never take any help from the GST help center, only 40% takes help from the GST service station for any query. Normally they appointed CA for filling returns and all queries. 10) For the development of economy, tax plays a major role in the form of revenue generation. If the revenue generation increases with the increase in employment and GDP will also increase. So, 85% of the respondents thought that introduction of the Goods and Services tax will make a positive impact on the economy 11) As per the regular payment of taxes and filling returns, in GST there are different dates required to be followed by registered dealers. Total 66% of the respondents are satisfied with the deadlines provided for filing GST returns.

1. Limited number of jewelers cannot generalize the whole population. 2. Expansion of geographic location gives more strong for research results. 3. In this study only unorganized sector has been taken, for further research organized jewelers study can be considered.

Goods and Services Tax implemented and still faced problem for compliance. They are enough aware about GST registration process, form filling, different rates, late fees penalties and interest. The jeweler takes help from chartered accountants and consultants in relation to any query but they are not feeling free to direct contact to help center of GST. Still the awareness regarding any query or confusion very few are taking help from GST help center. The awareness must be more to be increased in near future. Awareness session of GST has been conducted by CBIC in every state.

https://www.ibef.org/industry/gems-jewellery-india.aspx https://en.wikipedia.org/wiki/Goods_and_Services_Tax_(India) https://home.kpmg/content/dam/kpmg/in/pdf/2018/02/Budget18-India%20GST-survey.pdf Dr.V.R.Nedunchezhian, M. S. (2018). Analysis of impact of GST with reference to Perspective of Small Business Stakeholders.International Journal of Pure and Applied Mathematics,119 (17). Sahoo, D. S. (2016). GOODS AND SERVICES TAX (GST) IN INDIA: A STEP TOWARDS SUSTAINABLE. International Research Journal of India , II (III). Teoh Chai Teng, D. R. (2016). EFFECT OF GOODS AND SERVICES TAX (GST) ON CONSTRUCTION CAPITAL COST AND HOUSING PROPERTY PRICE. Medwell Journals, 2016 , 11 (12).