|

Dr. Rana Tahir Naveed Associate Professor Department of Business Administration Art & Social Sciences University of Education Lahore, Pakistan Contact No. 91-9465043568 Ranatahir28@hotmail.com |

WaseemUlHameed School of Economics Finance & Banking (SEFB), Universiti Utara Malaysia (UUM), Malaysia Expert_waseem@yahoo.com |

Ahmad Mohmad Albassami University Putra Malaysia (UPM) |

Dr.Mahsa Moshfegyan Salahadin University, Eebil m.mahsa@live.com |

: Online Tax System (OTS) has received a great attention worldwide, particularly in developed countries. However, developing countries are still lacking behind such as Pakistan. Success of OTS yet not achieved in Pakistan. Low performance of OTS is based on various issue, especially due to low Tax Service Quality (TSQ). To address this problem, the prime objective of this study is to inspect the impact of TSQ on OTS and to examine the mediating role of information communication technology (ICT). Cross-sectional research design and quantitative research approach was selected. Data were collected through 5-point Likert scale and questionnaires were distributed among those taxpayers who use OTS by using convenience sampling. SmartPLS 3 was utilized to analyze the data. Results of the study revealed that informativeness, reliability and responsiveness have relationship with ICT. Moreover, it is found that ICT has significant positive relationship with OTS. This study contributed to the literature by introducing ICT as a mediating variable to enhance the OTS. Thus, the current study is beneficial for tax authorities to enhance the tax collection level.

Keywords: Online tax system, informativeness, reliability, responsiveness, ICT, tax service quality.

1. Introduction Online Tax System (OTS) has received an excessive attention worldwide through the advancement of information technology (IT), which affects the tax administration system (Mustapha & Sheikh, 2014). OTS increases the tax collection rate in various countries which effect positively in the nation’s economy. As the OTS makes positive impact on the economy by elevating income generation level as well as tax compliance by the taxpayers (Mustapha & Obid, 2015). It is also important because of convenience, time saving and one of the most cost effective from both the tax administrators as well as the taxpayers (Azmi, 2012). However, the current situation of OTS in Pakistan is not in the favor of economy. The gross domestic product (GDP) to tax ratio in Pakistan is very low, as in 2012 Pakistan was among the worst tax collector countries worldwide (World Bank, 2012), as shown in Figure 1.1. This problem is based on low tax collection rate. OTS is not working adequately which decreases the tax collection rate.

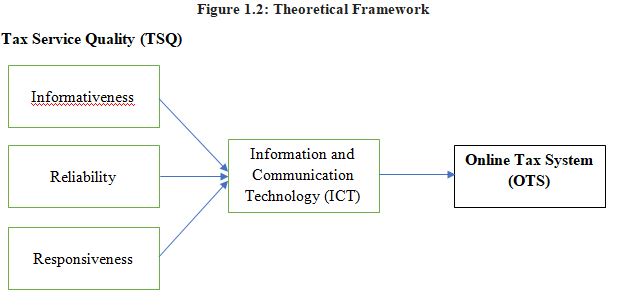

Figure 1.1 shows the Pakistan’s tax to gross domestic product (GDP) ratio is among the worst 15 countries in 2012. However, there was little improvement in 2013. This worse ratio is leaded by the low tax collection rate in Pakistan. Low performance of OTS is based on various issues. However, the major issue is Tax Service Quality (TSQ). Service quality provided by various tax authorities is not up to the mark which effect the tax collection rate through OTS. TSQ could be explained as the total taxpayers' evaluation as well as perceptions related with adequate electronic service by internet marketplace (Zeithaml, Parasuraman, & Malhotra, 2002). TSQ is one of the most important elements to enhance the taxpayers to use OTS rather than physical visit to the tax authorities. However, these problems could be solved by providing a good TSQ through informativeness, reliability and responsiveness from the tax authorities. As informativeness, reliability and responsiveness have significant positive impact with tax service quality and OTS (Mustapha & Obid, 2015). Additionally, role of information communication technology (ICT) is crucial between TSQ and OTS. Because OTS is based on information technology. By using ICT, taxpayers use electronic payment system to pay tax amount which is quite easy. As electronic payment has various features such as security, ease to use, acceptability, efficiency as well as privacy (Chou, Lee, & Chung, 2004; Cotteleer, Cotteleer & Prochnow, 2007; Kousaridas, Parissis & Apostolopoulos, 2008; Linck, Pousttchi & Wiedemann, 2006; Tsiakis & Sthephanides, 2005), which increase the satisfaction level of customers. It increase the satisfaction level, satifaction enahnce commitement which leads motivation (Hussain, Rizwan, Nawaz & ul Hameed, 2013) to pay tax amount and it also satisfy the tax authorities to handle tax collection system. Therefore, ICT playing a mediating role between TSQ and OTS.

The prime objective of this study is to inspect the impact of TSQ on OTS and to examine the mediating role of ICT. To achieve this major objective, there are four sub-objectives. 1. To examine the relationship of informativeness and ICT 2. To examine the relationship of reliability and ICT 3. To examine the relationship of responsiveness and ICT 4. To examine the relationship of ICT and OTS 5. To examine the mediating role of ICT. This study contributed to the literature by introducing ICT as a mediating variable to enhance the OTS, particularly in Pakistan. As the ICT has the ability to promote OTS by facilitating TSQ elements such as informativeness, reliability and responsiveness. Thus, ICT provides a way to handle OTS issues.

TSQ is one of the most significant elements of OTS. Service quality is not only important for taxpayer, but it also important for administrators or tax authorities. According to Warrington, Abgrab and Caldwell (2000), research on service quality should comprise the views of both the provider as well as the receiver. Therefore, online tax service quality is not only important for taxpayers, it is also important for tax authorities to carry the system smoothly. According to Azmi (2012) research work on OTSis associated with e-service quality to assess the level of their performance. Katono (2011) discussed various dimensions of service quality and focused on information, reliability and responsiveness. Consistent with Katono (2011), current study also focused on three dimensions of TSQ, namely, informativeness, reliability and responsiveness. Informativeness is the quality of information given on the OTS website and offered by the various tax authorities for filing tax return (Barrios, 2010). It could be further described as the quality of information that is provided on tax related websites by producers while meetingwith clients as well as described by different call center representatives (Parasuraman, Zeithaml & Berry, 1988). Therefore, provision of information on online tax website is most important element. Moreover, According to Negash (2003), OTS which is more precise as well as appropriate to use when the different type of information given is in the interest of the taxpayers. Therefore, OTS website should consist of precise, relevant and complete information and should be easy to understand. However, it requires ICT to management all information accurately and accessible to the taxpayers. As with the development of latest information technologies, it is quite accessible for the tax managers to upgrade tax administration system (Adeyemi, 2013). Therefore, ICT is key to success in OTS. Furthermore, reliability is a procedure through which the system gains certain capability to evaluate management function precisely by assessing the requisition (Miazee & Rahman, 2011). It is one of the important measures of service quality as described by Miazee and Rahman (2011). Thus, reliability is vital to enhance the TSQ and TSQ is most important to facilitate OTS. According to Mustapha and Obid (2015), reliability has significant positive impact on OTS. However, it is quite hard to approach good reliability without ICT. As ICT is one of the key elements to develop a good OTS. Therefore, a good TSQ in sense of reliability could be achieved through ICT. Thus, there is a relationship between reliability and ICT. Nevertheless, responsiveness is also another key element of TSQ. Responsiveness is designed on how quickly the tax managers in are replying to any investigations made by the tax payers (Mustapha & Obid (2015) which requires ICT. Responsiveness in terms of the response to feedback is one of the dimensions of TSQ (Liljander, Gillberg, Gummerus & van Riel, 2006). Therefore, quality could be improved through responsiveness. The element such as responsiveness justifies more consideration with regards to TSQ (Parasuraman et al. 1988). According to Mustapha and Obid (2015), responsiveness has significant positive relationship with OTS. However, ICT is essential to provide good response. As quick response is only possible with latest technology. Therefore, responsiveness is important to achieve good quality tax services and good response could be achieved through ICT.

H1: There is a relationship between informativeness and ICT. H2: There is a relationship between reliability and ICT. H3: There is a relationship between responsiveness and ICT. H4: There is a relationship between ICT and OTS

Additionally, from the above discussion, it is concluded that informativeness, reliability and responsiveness have significant relationship with ICT and ICT has significant relationship with OTS. Thus, by following the instructions of Baron and Kenny (1986), ICT can be used a mediating variable. Hence, following hypotheses are proposed;

H5: ICT mediates the relationship between informativeness and OTS. H6: ICT mediates the relationship between reliability and OTS. H7: ICT mediates the relationship between responsiveness and OTS.

The current study adopted a quantitative research approach and followed a cross-sectional research design. As quantitative researchtechnique is a suitable technique to test the hypothesis (Shuttleworth, 2008). Data were collected from the taxpayers. Only those taxpayers were selected which were using OTS.

The sample consists of taxpayers in Pakistan. Data were collected by means of questionnaire. Questionnaires were filled by applying convenience sampling technique among those taxpayers who use OTS. The sample size was selected by using the series of Comrey and Lee (1992). Comrey and Lee (1992) provide sample in a series for inferential statistics.“Sample having less than 50 participants will observed to be a weaker sample; sample of 100 size will be weak; 200 will be adequate; sample of 300 will be considered as good; 500 very good whereas 1000 will be excellent.” Therefore, three hundred (300) sample size was selected.

All the measures were adapted from previous studies. Questionnaire was consisted of three sections related to informativeness, reliability, responsiveness, ICT and OTS. This section of the study used previous literature and already used studies. However, the5-point Likert scale was used for the measurement of all items ranging from “Strongly Disagree (1)” to “Strongly Agree (5).

The hypothesized model of the current research study was tested by using the SmartPLS 3. In this process, various tests related to the measurement model and structural model was performed. Partial Least Square (PLS) is one of the suitable tools to analyze the primary data.

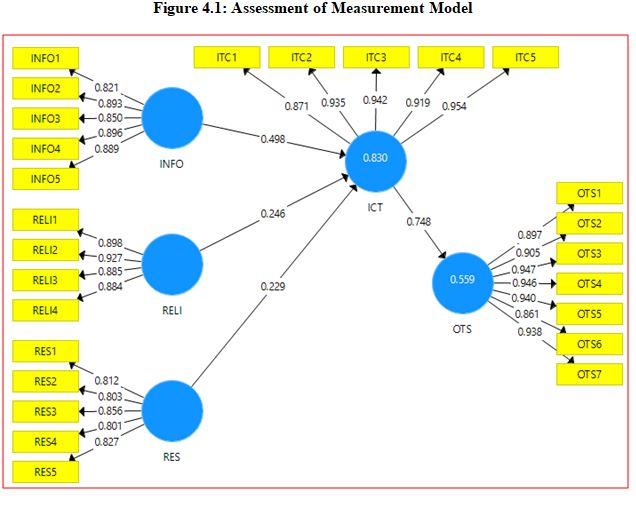

First part PLS-SEM analysis carried out to confirm the reliability as well as validity. By following SEM, the assessment of outer model has been examined precisely through SmartPLS 3.0 (Ringle, Wende & Becker, 2015). For this purpose, discriminant validity, reliability as well as convergent validity was observed as shown in Figure 4.1 and Table 4.1.

|

Construct |

Indicators |

Loadings |

Composite Reliability |

AVE |

|

Informativeness (INFO) |

INFO1 INFO2 INFO3 INFO4 INFO5 |

.821 .893 .850 .896 .889 |

.940 |

.758

|

|

Reliability (RELI) |

RELI1 RELI2 RELI3 RELI4 |

.898 .927 .885 .884 |

.944 |

.808 |

|

Responsiveness (RES) |

RES1 RES2 RES3 RES4 RES5 |

.812 .803 .856 .801 .827 |

.911 |

.672 |

|

Information and Communication Technology (ICT) |

ICT1 ICT2 ICT3 ICT4 ICT5 |

.871 .935 .942 .919 .954 |

.967 |

.855 |

|

OTS |

OTS1 OTS2 OTS3 OTS4 OTS5 OTS6 OTS7 |

.897 .905 .947 .946 .940 .861 .938 |

.975 |

.846

|

According to different studies (e g., Fornell & Larcker, 1981; Hair&Lukas, 2014) average variance extracted (AVE) must be equal to 0.50or above and the composite reliability must be equal or greater than 0.70. Moreover, factor loading should be more than 0.5 which will validate the convergent validity (Hair, Black, Babin, Anderson, & Tatham, 2010). Table 4.1 shows factor loading is more than 0.5, composite reliability more than 0.7 and AVE more than 0.5. Furthermore, discriminant validity was examined to determine the model external consistency, on the basis of correlation among the latent variables, the value of the variables was compared with the square root of AVE’s. It is shown in Table 4.2.

|

|

ICT |

INFO |

OTS |

RELI |

RES |

|

ICT |

0.925 |

|

|

|

|

|

INFO |

0.880 |

0.870 |

|

|

|

|

OTS |

0.748 |

0.724 |

0.920 |

|

|

|

RELI |

0.811 |

0.773 |

0.797 |

0.899 |

|

|

RES |

0.838 |

0.835 |

0.682 |

0.786 |

0.820 |

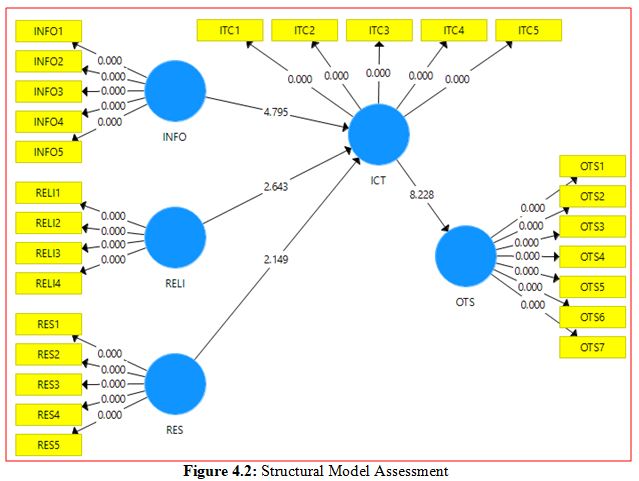

Bootstrapping is one of the good techniques in PLS to examine the relationship of variables. Here, the t-value 1.96 was considered as minimum level to accept the hypotheses. According to Hair et al., (2014), PLS (SEM) bootstrapping method for hypotheses testing and mediation is one of the best methods for quantitative studies because it is suitable for small samples.

|

|

(β) |

(M) |

(STDEV) |

T Statistics |

P Values |

|

ICT -> OTS |

0.748 |

0.744 |

0.091 |

8.228 |

0.000 |

|

INFO -> ICT |

0.498 |

0.496 |

0.104 |

4.795 |

0.000 |

|

RELI -> ICT |

0.246 |

0.244 |

0.093 |

2.643 |

0.008 |

|

RES -> ICT |

0.229 |

0.232 |

0.107 |

2.149 |

0.032 |

Figure 4.2 and Table 4.3 illustrates the results of analysis. Table 4.3 shows that all hypothesis is accepted, and mediating exists between all independent variables (informativeness, reliability, responsiveness) and dependent variable (online tax system). ICT playing a mediating role between independent variables (informativeness, reliability, responsiveness) and dependent variable (online tax system). Table 4.4 shows the mediation effect of ICT which is also significant in all three cases.

|

|

(β) |

(M) |

(STDEV) |

T Statistics |

P Values |

|

INFO -> ICT-> OTS |

0.256 |

0.253 |

0.071 |

3.588 |

0.001 |

|

RELI -> ICT-> OTS |

0.321 |

0.319 |

0.092 |

3.446 |

0.002 |

|

RES -> ICT-> OTS |

0.258 |

0.254 |

0.06 |

4.296 |

0.000 |

Additionally, it is found that all the independent variables such as informativeness, reliability and responsiveness contributed 83% (R2=0.830) to ICT and ICT contributed 55.9% (R2=0.559) in OTS. According to Chin (1998), OTS has strong R2. Additionally, predictive relevance (Q2) shows the quality of the model which should be above zero (Chin, 1998). It is shown in Table 4.6.

|

Constructs |

R2 |

Variance Explained |

|

Online Tax System (OTS) |

0.830 |

Strong |

|

ICT |

0.559 |

Moderate |

|

SSO |

|

SSE |

Q² (=1-SSE/SSO) |

|

|

Online Tax System (OTS) |

861 |

|

743.156 |

0.137 |

During the current research study, it is observed that TSQ is most important element for OTS success. It is quite tough to encourage taxpayers to pay their tax through OTS without good TSQ. Moreover, it found that ICT is important to provide good quality tax services. As ICT provides a link between good TSQ and OTS. To provide a good TSQ, informativeness, reliability and responsiveness are most important elements. ICT has the ability to promote these three elements in the favor of OTS. Therefore, ICT playing a vital role between TSQ and OTS. Hence, in Pakistan, tax collection rate could be enhanced by introducing good quality OTS. It is recommended to the tax authorities to enhance TSQ by introducing ICT, particularly in Pakistan. Future research could be more beneficial by introducing various other measures of service quality and “perceived ease of use” could be used as moderator in the framework of current study.

Findings of the current study is more beneficial for Pakistani tax system. Because the tax system in Pakistan is not appropriate. Tax service quality is low due to which the tax collection is much lower in Pakistan as compared to the other countries. Therefore, this study provides the ICT as one of the tools which has the ability to facilitate TSQ and OTS. Thus, implementation of ICT has the ability to increase TSQ which automatically increases the OTS. Hence, this study is beneficial for practitioners while making the strategies for OTS.

OTS system is different in each country. The rules and regulations have significant difference in each country. Moreover, the behavior of general public towards tax is also different. Therefore, the results of the current study cannot generalize to other countries. The future research must include other developing countries to generalize the results. Additionally, cross-sectional design was adopted due to which causal inferences from the population were not possible. The future research should be carried out on longitudinal research design. Finally, the future research must be carried out by including more factors related to the TSQ.

Adeyemi, A. (2013). Assessing the Effects of Taxation System on Nigerian Economic Growth. In Proceedings of 2013 International Conference on Poverty Alleviation Income Redistribution & Rural Development in Developing Countries (p. 185). Azmi, A. A. C., Kamarulzaman, Y., & Hamid, N. H. A. (2012). Perceived Risk and the Adoption of Tax E-Filing. World Applied Sciences Journal,20(4), 532–539. Barrios, A. P. (2010). Factors influencing taxpayers’ intention to adopt free electronic tax filing (free file). Baron, R. M., & Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of personality and social psychology, 51(6), 1173. Chen, C. W., & Huang, E. (2006). Predicting Taxpayers’ Acceptance of Online Taxation Use. In Proceedings of the 5th WSEAS International Conference on E-ACTIVITIES, Venice, Italy. Chin, W. W. (1998). Commentary: Issues and opinion on structural equation modeling. MIS Quarterly, 22(1), vii–xvi. Chou, Y., Lee, C., & Chung, J. (2004). Understanding m-commerce payment systems through the analytic hierarchy process. Journal of Business Research, 57(12), 1423-1430 Comrey, A. L., & Lee, H. B. (1992). A first course in factor analysis (2nd ed.).Hillside, NJ: Erlbaum Cotteleer, M. J., Cotteleer, C. A., & Prochnow, A. (2007). Cutting checks: challenges and choices in B2B e-payments. Communications of the ACM, 50(6), 56-61. Fornell, C., & Larcker, D.F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of marketing research, 39-50. Hair Jr, J.F., & Lukas, B. (2014). Marketing research. McGraw-Hill Education Australia. Hair, J.F., Black, W.C., Babin, B.J., Anderson, R.E., & Tatham, R.L. (2010). Multivariate Data Analysis. Prentice Hall. Hussain, S., Rizwan, M., Nawaz, M. S., & ul Hameed, W. (2013). Impact of Effective Training Program, Job Satisfaction and Reward Management System on the Employee Motivation with mediating role of Employee Commitment. Journal of Public Administration and Governance, 3(3), 278-293. Katono, I. W. (2011). Student evaluation of e-service quality criteria in Uganda: the case of automatic teller machines. International Journal of Emerging Markets, 6(3), 200–216. Kousaridas, A., Parissis, G., & Apostolopoulos, T. (2008). An open financial services architecture based on the use of intelligent mobile devices. Electronic Commerce Research and Applications, 7(2), 232-246. Liljander, V., Gillberg, F., Gummerus, J., & van Riel, A. (2006). Technology readiness and the evaluation and adoption of self-service technologies.Journal of Retailing and Consumer Services, 13(3), 177–191. Linck, K., Pousttchi, K., & Wiedemann, D. G. (2006). Security issues in mobile payment from the customer viewpoint In Proceedings of the 14th European Conference on Information Systems (ECIS 2006), Goteborg, Schweden, 1–11. Miazee, M., & Rahman, M. (2011). E-Service Quality and Customer Satisfaction: A Study of Online Customers in Bangladesh. Mustapha, B., & Obid, S. N. B. S. (2015). Tax Service Quality: The Mediating Effect of Perceived Ease of Use of the Online Tax System. Procedia-Social and Behavioral Sciences, 172, 2-9. Mustapha, B., & Sheikh, S. N. B. (2014). The Influence of Technology Characteristics towards an Online Tax System Usage: The Case of Nigerian Self-Employed Taxpayer. International Journal of Computer Applications, 105(14). Parasuraman, A., Zeithaml, V. A., & Berry, L. L. (1988). Servqual: A multiple-item scale for measuring consumer perc. Journal of retailing, 64(1), 12. Ringle, C.M., Wende, S., & Becker, J.-M. (2015). "SmartPLS 3." Boenningstedt: SmartPLS GmbH, http://www.smartpls.com. Shuttleworth, M. (2008). Quantitative Research Design. Viitattu 17.4. 2015. Retrieved from http://www.experiment-resources.com/quantitative-research-design.html Tsiakis, T., & Sthephanides, G. (2005). The concept of security and trust in electronic payments. Computers & Security, 24(1), 10-15. Wang, J. (2013). The OTS Small Business Tax Review: a positive start to simplify the UK tax system. Warrington, T. B., Abgrab, N. J., & Caldwell, H. M. (2000). Building trust to develop competitive advantage in e-business relationships. Competitiveness Review: An International Business Journal, 10(2), 160-168. Zeithaml, V. A., Parasuraman, A., & Malhotra, A. (2002). Service quality delivery through web sites: a critical review of extant knowledge. Journal of the academy of marketing science, 30(4), 362-375.