|

Santosh Kumar Associate Professor School Of Management Presidency University, Bangalore, India talksant@gmail.com |

Dr. Gargi Path Shukla Associate Professor School Of Management IMS Unison University, Dehradun, India gargipant87@gmail.com |

As the bulk of the population, mainly from rural areas, is still not participated in the comprehensive economic growth, the notion of financial inclusion (FI) becomes a big problem for the policy makers of the country. FI supports in formation of improved and better sustainable economy in the country. It supports in the empowerment of women, weaker and underprivileged sections of society with the task of building self-sustainable and well informed society. The study has used three different research phases: identification of factors from the literature, interviews with experts of industry and designing a DMTOP framework. The identification phase led to the selection of twenty five factors from past literatures and by suggestion from industrial experts. Further the selected factors are divided into seven different dimensions. The framework was used to understand impact of identified factors on urban and rural facilities separately. This study seeks to identify the impact contribution of factor towards FI; the results are very helpful for policy makers to achieve objectives of FI. The framework has seven dimensions with different impact value on the urban and rural facilities. The factors are showing an overall impact percentage of 51.62 and -6.45 as on existing urban and rural facilities respectively.

Keywords: Financial Inclusion (FI), Factors, Decision Making Threat and Opportunity (DMTOP).

As the bulk of the population, mainly from ruralIndia, is not contributing to the comprehensive economic growth, the notion of financial inclusion (FI) becomes a big problem for the policy makers of the country , as CRISIL Inclusix index have a value of 53 for rural areas and 58 for urban areas (CRISIL Report ,2018).The concept of FI refers to complete access to a broad range of financial services at a affordable cost. This is not limited to banking services but also to the other financial services such as equity and insurance products (RBI Speech,The Committee on Financial Sector Reforms, Chairman: Dr.Raghuram G. Rajan) Even after achieving the position of the fastest growing economy, the majority of the population does not have access to formal credit system. With the development of the economy, particularly when the focus is on the sustainable development concept, there should be an endeavor to insure participation from all the parts of the society. But thefinancial un-awareness and illiteracy among the rural population is stopping the sustainable growth of the Indian economy .This is a serious matter for the development of the country.To conquer such hindrances, the organized financial sector of the country emerged with a number of scientific innovations such as; credit and debit cards, ATM (automated teller machine), internet banking and Mobile banking, etc. Though use of these technologies brought massive changes in the urban population, a major portion of the rural population is still very far from use of thesetechnologies. FI helps in creation of sustainable and improved economy by the empowerment of women, weaker and underprivileged sections of society with the task of buildingself-sustainable and well informed society. The main objective of FI is to widenreach ofthe financial and banking services to the un-served population. The government bodies and banksare working rigorously towards achieving the objective mainly in rural areas of the country. As on March 31, 2017 total 48807 branches and 38201 branches were functioning in the rural and semi-urban areasrespectively(dbie.rbi.org.in, 2018) Government of India (2008), defines FI as the continuous process of ensuring availability ofadequate credit and financial services where needed by weaker sections of society at areasonable cost. The Planning Commission of India (2009) defines FI as commitment to provide allrequired financial services at anaffordable price. These services include banking, insurance and equity products. Dr. K.C. Chakrabarty, Deputy Governor of Reserve Bank of India in October, 2011 defines FI as a structured process of facilitating financial services and products to the people from low income and weaker section of the society at an affordable cost in a very transparent manner.( RBI press release , Aug -2009) Financial stability in the economy is outcome of FI and financial education. The World Bank conducted in 2011a study of data on Global Financial Inclusion (GFI), which explainscondition of factors showing how citizens of different countries bank, pay, save, invest, borrow and manage risk.It found thatapproximate 62 percent of the adult’population worldwide are having a bank account while India falls behind by meeting10 percent in thesame category. This data become worst in the rural population, less than 20 percent of populations are having at least an account in any bank or financial institution. Linkages with new technologies have shown a good improvement in path achievement of FI, as the best examples can be mobile based financial services. Such services have record an average growth of approximate45% y-o-y from last 3 years times. The beginning of the FI can be traced as an initiative of the United Nations with the main goals to provide complete financial services; savings, insurance, credit, payment, remittance and other services to all the households at a reasonable cost.(world bank , April 2018)The study of financial services access became significantright after the completion of All-India Rural Credit surveyin the 1950s. The report of the survey revealed major market share of unstructured money lenders in rural finance. Only the urban populations have access of structured finance. Such conditions continued in the country till start of FI growth model by in the 2000s. Even many years after establishment of the National Bank for Agriculture and Rural Development (NABARD) in 1982 and Regional Rural Banks (RRBs) in 1975.In the last few years, GOI hastaken many new initiatives to achieve the goal of FI. Some important schemes like Direct Benefit Transfer for LPG –DBTL (to stop leakages); Swabhimaan (to give banking facilities); Rupay Card (to enhance electronic payment system); BHIM (to increase mobile payment system); USSD Based Mobile Banking (to offer the facility of mobile banking); Pradhan Mantri Jan-Dhan Yojana (to provideuniversal access to banking facility with at least one basic banking account for every household), demonetization of 500 and 1000 currency notes and many more. The demonetization virtually forced all adult Indians to transact with the structured and formal banking system. The GOI, RBI and NABARD (National Bank for Agriculture and Rural Development) have taken many measures and initiatives’ to improve the reach of financial services in the country, as summarized in Table 1below.

|

1. Customer Service Centers 2. Credit CounselingCenters 3. Adhaar Scheme 4. The National Agricultural Insurance Scheme 5. No-frill Account 6. Ease in Know Your Customer norms 7. General Credit Card 8. Project on Processor Cards 9. Micro Finance Development Fund 10. Rural Volunteers as Book Writers |

11. Role of NGOs, SHGs and MFIs 12. BF and BC models 13. Micro Pension Model 14. Nationwide Electronic Financial Inclusion System 15. Project Financial Literacy 16. National Rural Financial Inclusion Plan 17. Financial Inclusion Fund 18. Project on “e-Grama” 19. SHG-Post Office Linkage 20. Farmers’ Club Program |

21. FinancialInclusion Technology Fund 22. Separate Plan for Urban Financial Inclusion and Electronic Benefit Transfer Scheme 23. Financial Literacy through Audio Visual medium - Doordarshan 24. Support to Cooperative Banks and RRBs for setting up of Financial Literacy Centers |

Source:“RBI, Economic Survey, Government of India, Various Issues” Despite concerted efforts by the government, RBI and NABARD, issues related to financial inclusion, there is a continuedneed to be looked at more carefully in order to address them by taking appropriate measures. An attempt was made to study the key issues and current state of FI in the country by talking to various experts and stakeholders in the process.To support these government initiatives, it becomes crucial to study the dimensions and factors of FI and their impact on urban and rural population distinctly. Hence, this study is considered to find out the dimensions and factors contributing inFI and study the effect by use of Decision Making Threat and Opportunity (DMTOP) model for urban and rural areas separately. Policy makers are required to change the factors impactingFI to achieve the objectives for sustainability in the long run. This paper is one of the preliminary attempts to conduct such study to get impact relationship, by expert survey method. To provide a systematic approach to the study, the research paper has been divided into following sections; the review of past and published literature along with the gap in research have been discussed in Section 2, Section 3 provides details of the research methodology. The formation, application and interpretation of DMTOPare covered in Section 4. The results and implications have been covered in Section 5 of the Study while Section 6 presents the limitations and scope for future research.

This section of the study is summarizing the outcomes of past literatures for the understanding of FI, its dimensions and factors and research methodology to establish a framework for the study.

GOI and RBI have accorded high importance to Financial Inclusion to aid the inclusive growth of the economy. The concept of FI gives focus on many other interrelated provisions; financial services, framing policy,full-service electronic bank account, allocation of Electronic Payment Access Points for easy deposit and withdrawal facilities, provision of credit products, investment and deposit products, insurance and risk management products by formal institutions. The RBI report on comprehensive financial servicesrecommended for formation of a SFRC (State Finance Regulatory Commission) as a working group of all the state level financial regulators and FRA (Financial Redress Agency). The FRA will take care of customer grievance across all financial products in coordination with the respective regulator (RBI ,2014).Micro-Finance Institutions (MFIs) loans have direct relation with the financial inclusion, but the operation is not sufficient to eradicate the misconduct in finance mainly in rural area (Kamath, 2008). The Micro-Finance institutions (MFIs) have a major role in the achievement of goals of FI. The penetration and distribution of MFIs have direct impact on access of structure credit in rural area (Kumar, 2017). The FI and its criteria is not very clear to most of the population, mainly in rural area. There is still needs which should be discussed to make FI more competent and user friendly (Reddy, 2016). FI has been improved after execution of PMJDY (Pradhan Mantri Jan Dhan Yojana) and the deposits as well credit disbursement by banks have been increased (Tripathi and Singh., 2015).FI has a important impact on a number of bank branch and saving to GDP ratio of the country. A significant growth has been observed in case of ATMs growth in the country (Iqbal& Sami, 2017). Factors of formal borrowing are identified such as; being male, higher educational qualification, having a bank account. These factors are positively correlated with the FI (Mukhopadhyay P. J., 2016). Microfinance revolution needs to strengthen through support of digital and social media in order to increase financial literacy leads to financial sustainability (Hans, 2016). The regulator has to create appropriate regulatory surroundings to keep the interest of all the stakeholders of FI (Garg & Agarwal, 2014). Banks play a very crucial role in FI initiative, so theirperformances should also be measured (Thyagarajan & Nair, 2016). Only 33.86 percent of adults have a formal bank account in the year 2016 in Ethiopia, which is used for keeping money safe, send and receive payments, and to get credit services and foreign exchange services (Baza&Rao, 2017). Many rural people, mainly south India, are included in FI financiallybut not by social and personal level (Cnaan et. al. 2012). Religion plays a very important role in achievement of FI in the country. Approximate50% of the financially excluded population areMuslims in India (Beg & Mullick, 2016). Usage, barriers and access to financial services are the three dimensions to calculate the degree of FI. Out of these three dimensions,access to financial inclusion is the most important dimension to measure the level of FI (Dara, 2016). Classification and analysis of the barriers to FI lead to deeper understanding of the FI. Lack of trust and social restriction caused by the informal transfer hamper saving in Latin America and creates the supply side barriers in FI (Cavallo and Serebrisky, 2016). Many studies had highlighted the factors and barriers towards achievement of FI in different countries (Majumdar and Gupta 2013, Gasparini et. al. 2005, Cressy 2002, Arya 2015, Koku 2015, Barr and Litan, 2007) .The factors identified in these studies are taken into account for framework formation.

The study of FI is not very new but it attracted sights of academicians after start of many new initiatives from government in thelast few years.With the growth of economy in India, sustainability in long run is one of the key issues before decision makers. The policy makers are not able to achieve 100% FI even after 70 years of independence , which creates a problem pertaining to urban- rural gap. The factors and their impact behind the gap should be studied in detail.There arefew studies that have looked into thefactors and challenges in the field of FI. We are unable to find any literature for impact study or any interactive model to rank factors for FI, especially in the Indian context. This paper is one of the preliminary attempts to fill this gap of literature and study impact of factors on urban and rural areas separately for achievement of objectives of FI. The twenty-fivefactors are found as shown in Table 1, based on previously published literatures and suggestions from selected experts. The decision making methodology is applied on the identified barriers to rank them as per its importance in decision making.The Table 2 examines the dimensions and factors influencing FI, identified and studied by various researchers.

|

Sr No. |

Factors |

Description |

Author(s) |

|

1 |

(credit Absorption Capacity) Not enough money |

Lack of access to bank |

Global Findex Report, 2014 Bhuvana & Vasantha 2016 |

|

2 |

Irregular income |

The main cause of financial exclusion of poor people is irregular income and various uncertainties in cash flow. |

Acharya, &Parida, 2013 |

|

3 |

High cost |

High cost to reach the financial institution is the major obstacle for financial inclusion. |

Bhuvana & Vasantha, 2016 Gupta, 2015 |

|

4 |

Financial Illiteracy |

Illiteracy about financial products and services available in the market limits the awareness level and ability to overcome of poor people.

|

Acharya, &Parida, 2013 Gupta, 2015

|

|

Sr No. |

Factors |

Description |

Author(s) |

|

5 |

Legal identity (Tough know your customer norms) |

Lack of legal identities like identity cards, birth certificates or written records often exclude women, ethnic minorities, economic and political refugees and migrant workers from accessing financial services restricts the growth of financial inclusion. |

Gupta, 2015 RBI Report, 2008 Global Findex Report, 2014 |

|

6 |

Bank charges |

Banking transactions are free in most of the countries as long as the account has the sufficient cost to make the transaction. The other banking charges affect the people with low income group and create a financial barrier to inclusion. |

Acharya, &Parida ,2013 .RBI Report, 2008 |

|

7 |

Terms and conditions |

Maintaining the minimum account balance and other terms and conditions relating to use of account often dissuade people from using such product and services. |

Gupta, 2015 RBI Report, 2008 |

|

8 |

Technology and New Initiative in IT |

Making the people tech savvy and maintaining the quality of security at the highest level is a challenge in the financial sector. |

Bhuvana & Vasantha, 2016 Gupta, 2015 Lapukeni (2015) |

|

9 |

Low aspiration value of Business Correspondents (BC) or Agent Banking as a profession |

The eligibility criterion for being a BC is Class 10 education with a very low salary. |

Singh et.al. (2014) |

|

10 |

Lack of suitability of retired personnel as BCs

|

A lack of enthusiasm was observed among retired personnel for the idea of working as BCs. They feared that their independence would be curtailed if they were to take up the BC role and so they recommended involving working professionals |

Singh et.al. (2014), RBI Report, 2008 |

|

11 |

Low transaction limits for Ultra Small Branches (USBs)

|

Prior to the announcement by the Prime Minister on August 15, 2014, the maximum rupee value of transactions permissible for USBs had been fixed at Rs. 5,000 |

Singh et.al. (2014) |

|

12 |

Preference for a brick and mortar branch |

it was revealed that a large segment of the population was not comfortable with salesman like BC and preferred a brick and mortar branch for banking. |

Singh et.al. (2014) |

|

13 |

Role of Post offices |

Incomplete account but also affordable credit facilities to conduct their businesses and insurance facilities to have financial security in case of troubles in the family.

|

Singh et.al. (2014) |

|

Sr No. |

Factors |

Description |

Author(s) |

|

14 |

Role of Fair Price Shops |

There is a large network of fair price shops in the country which is well above the bank branch network including kiosks and BCs. Also, many of the fair price shop owners are familiar with the rural people which will again ensure trust in the banking. |

Singh et.al. (2014), RBI Report, 2008 |

|

15 |

Automatic Teller Machines (ATMs) , white labeled ATMs And Deposit taking Machines |

The user can withdraw cash through these machines, check his account balances and use it for some other small transactions. |

Singh et.al. (2014) , Lapukeni (2015) |

|

16 |

Computerized transactions in Kiosk and Internet Banking/ Mobile Banking |

Computers at kiosk can directly connect to banks website and use the website for banking transactions like deposits, withdrawals, etc. |

Singh et.al. (2014), Lapukeni (2015) |

|

17 |

Role of Mobile Phones

|

Only 50 percent of Indians today hold a savings account and one in seven individuals have access to banking credit. On the other hand, 74 percent of households possess a mobile phone |

Singh et.al. (2014) , Lapukeni (2015) |

|

18 |

Education Level |

The rural clients are not highly educated and it creates a problem in the growth and expansion of FI. |

Nasir S.(2013) |

|

19 |

Uneven Population Density |

Uneven population density is an issue which create problem in growth and expansion of the organization which isrequired by rural population not urban areas. |

Nasir S.(2013) |

|

20 |

Payments’ Platform and Mobile wallet. |

The payment for purchase can be done by giving instruction using other platform rather than banks; mainly have three types of operation model……. · Bank led Model · Joint Venture Model · Third party Model |

Singh et.al. (2014) |

|

21 |

E-commerce growth |

Use ofE-commerce sites is not only growing in urban area but also becoming popular in semi urban and rural market. Transactions of e-commerce have impact on electronic payment system. |

Suggested by experts

|

|

22 |

Growth in Malls and organized shops |

Organized shops, super markets and malls are spreading their arms in semi urban area, which promotes use of credit and debit cards in shopping |

|

|

23 |

High Acceptability of electronic payment system in shopping |

Even shops of rural market are using different electronic payments acceptance methods |

|

|

24 |

Payment and collection banking |

These initiatives from GOI , allow companies with low capital to enter into banking business , which impact penetration in rural markets. |

|

|

25 |

Demonetization |

Ban on usage of Rs.500 and Rs.1000 old currency, i.e. Mahatma Gandhi Series, note from 8th Nov 2016. |

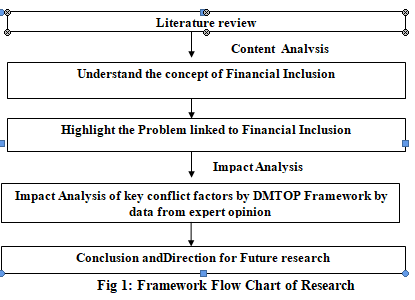

The Section will explain the framework and suitability of the framework to solve the identified problem in the field of FI. The methodology start with content finding which includes mining of past studies and literaturein similar field,as it is extensivelyaccepted method for exploratorytype of research in social science area. In the introductory stage of this study, content analysis is used to identify problems of rural population that arise due tolack ofaccess to structured credit supply. Someresearch hasbeen conducted in the area by taking data from high geographical coverage, mainly in India. A working paper of IIM Bangalore, under guidance of RBI chair professor, Charan Singh, is a very good attempt to fill the gapSingh et al. 2014. The dimensions and factors influences FI, identified and studied by different researchers, as shown in Table 2, has been considered for impact analysis in the paper.The identified factors are further divided into different dimensions on the basis of their similarities. The impact of factors has been critically analyzed by Decision Making Threat and Opportunity (DMTOP) frame work purposed by Kumar and Adlakha2018, as per methodology framework flow chart shown in figure 1.

The DMTOP model is a simple quantitative framework based on trichotomous scale i.e. -1,0,+1, to study the impact on two of more distinct facilities. Here, this framework is used to study the impact of identified dimensions and factors on two facilities, urban and rural facilities.’+1’ as impact value, if the factor has positive contribution on the facility, ‘-1’ for negative contribution while ‘0’ indicates no contribution. At last an Impact Percentage (IP) has to be considered by use of calculation shown in Eq. 1, the outcome of IP indicates contribution level. The ‘-ve’ or ‘+ve’ sign indicates the direction of contribution. The improvement in model has been done by calculation of impact factors the every dimension as well to study the impact of that particular sets of factors on urban and rural facilities separately A survey ofselected experts, distribution shown in Table 3, has been conducted to get scores on selected factors on -1, 0 and +1 scale, by a structured questionnaire.

〖 IP〗_Facility=(sum of impact values assigned for facility)/(Maximum possible impact value )*100

More than 80 experts were contacted, on the basis of predefined selection criteria, from different but related area of expertise such as academicians, professionals, researchers, village heads and government officers. Only 35 participated in the survey as shown in Table 3 below. Academicians were selected as experts onthe basis of their education, having adoctorate or minimum 07 years of teaching experience in domain of finance, Banking, economics, management planning, Village heads, professionals, and officers were considered as expert on the basis of their tenure in service with aminimum of 5 years’ service. If a dimension of factors has placed at different place on 3- rating scale by different experts, maximum frequency value of scale is being used in model explanation.

|

Total number of expert interviewed |

35 |

|

Academicians (urban population only) |

10 |

|

Village Heads |

13 |

|

Officers |

10 |

|

Others ( Researchers & Professionals) |

2 |

This section is structured approach, based on the opinions gathered from experts on the basis of pre-decided scale of the previous section, on the identified rural –urban areas. The calculation of the impact analysis model, Decision Making Threat and Opportunity (DMTOP), are given in the Table 4. The different dimensions, sets of factors, are showing different level of contribution on urban and rural areas; some of them have same type of impact on the both facilities. Even after lots of schemes introducedand improvement measuresundertakenby GOI to bridge the demographic gap between urban and rural population, “the demographic factors” dimensionis still showing 100 % negative impact on rural areas. All the factors of the dimension have negative impact on the growth of FI in rural area, while some of them are neutral (no impact) in case of urban areas.

|

DMTOP ON Key Dimensions of FI |

||||

|

NO. |

Key Factors |

Impact on Urban Population (IPU ) |

Impact on Rural Population (IPR) |

|

|

The demographic factors |

||||

|

1 |

Education Level |

+1 |

-1 |

|

|

2 |

Uneven Population Density |

0 |

-1 |

|

|

3 |

Irregular income |

+1 |

-1 |

|

|

4 |

Legal identity (know your customer) |

+1 |

-1 |

|

|

5 |

Gender gap |

0 |

-1 |

|

|

6 |

(credit Absorption Capacity)Not enough money |

0 |

-1 |

|

|

|

Impact percentage for dimension I |

+50 |

-100 |

|

|

Business Correspondents (BC) of Agent Banking |

||||

|

7 |

Low aspiration value of Business Correspondents (BC) or Agent Banking as a profession |

0 |

-1 |

|

|

8 |

Lack of suitability of retired personnel as BCs |

0 |

-1 |

|

|

9 |

Low transaction limits for Ultra Small Branches (USBs) |

0 |

-1 |

|

|

10 |

Preference for a brick and mortar branch |

0 |

-1 |

|

|

|

Impact percentage for dimension II |

0 |

-100 |

|

|

Services availability or Reach of Financial institution |

||||

|

11 |

Role of rural /semi urban branches |

0 |

+1 |

|

|

12 |

Role of Post offices |

+1 |

+1 |

|

|

13 |

Role of Fair Price Shops |

0 |

+1 |

|

|

14 |

Payment and collection banking |

+1 |

+1 |

|

|

|

Impact percentage for dimension III |

+50 |

+100 |

|

|

Cost and Regulation |

||||

|

15 |

High cost |

0 |

-1 |

|

|

16 |

Bank Charges |

-1 |

-1 |

|

|

17 |

Terms and conditions |

-1 |

-1 |

|

|

18 |

Tough KYC norms |

0 |

-1 |

|

|

|

Impact percentage for dimension IV |

-50 |

-100 |

|

|

Technology Initiatives |

||||

|

19 |

Automatic Teller Machines (ATMs) , white labeled ATMs and Deposit taking Machines |

+1 |

+1 |

|

|

20 |

Computerized transactions in Kiosk |

+1 |

0 |

|

|

21 |

Role of Mobile Phones |

+1 |

+1 |

|

|

22 |

Payments’ Platform. |

+1 |

0 |

|

|

|

Impact percentage for dimension V |

+100 |

+50 |

|

|

The Mobile Phone Use factors |

||||

|

23 |

Mobile based Payments’ Platform |

+1 |

+1 |

|

|

24 |

Bank led Model Mobile wallet |

+1 |

+1 |

|

|

25 |

Joint Venture ModelMobile wallet |

+1 |

0 |

|

|

26 |

Third party Model Mobile wallet |

+1 |

+1 |

|

|

27 |

Mobile wallet operated by telecom operators |

+1 |

+1 |

|

|

|

Impact percentage for dimension VI |

+100 |

+80 |

|

|

Other Interlinked Factors |

||||

|

28 |

E-commerce growth |

+1 |

0 |

|

|

29 |

Growth in Malls and organized shops |

+1 |

0 |

|

|

30 |

High Acceptability of electronic payment system in shopping |

+1 |

+1 |

|

|

31 |

Demonetization |

+1 |

+1 |

|

|

|

Impact percentage for dimension VII |

+100 |

+50 |

|

|

|

Total Maximum Impact Value assigned |

+30 |

+30 |

|

|

|

Overall Impact percentage |

IPU=51.62 |

IPR= -6.45 |

|

Source: Compiled by Researcher on the basis of experts opinion The factor of Business Correspondents (BC) of Agent Banking dimension is oneof the major initiatives of policy makers to achieve FI in rural areas only, so the factor hasno impact on the urban population. Due to lack of clarity and quality in the process all of the factors are contributing negative towards FI as per experts. The factors of Services Availability or Reach of Financial Institutions dimension are having either positive or no impact on the area towards FI. They are showing 100% contribution in rural area and 50% in urban area, as rural branches and fairprice shops are only operating inrural areasfor FI. The factors of Cost and Regulation dimension are showing either negative or no impact. This is really a matterof concern for policy makers, as any increase in cost of services will stop people from comingto the bank and any decrease will cause a big dent in the income of the banks. Similarly regulation hasa dual impact, as ease in regulation for credit may lead to problem of higher default rate while a tough regulation may impact the volume of credit disbursement. Other Interlinked Factors dimension is a set of all the factors, which are not created to impact the objectives of FI directly. The growth of these factorsis contributing in achievement of FI. They are having either positive or no impact in both the facilities. E-commerce growth and growth in malls are contributing substantially in urban market but very little in rural market. So, their impact value is ‘0’ for rural areas. Any type of Technology Initiatives will have positive impact of FI, but factors like computerized transactions in Kiosk and Payments’ Platform are not used much into ruralareas. Joint Venture Model Mobile wallet is the only factor of set “The Mobile Phone Use factors” is showing neutral impact on achievement of FI in rural facility , rest of them are contributing into FI in both rural & urban areas. It may be seen for thatTable 4, the overall value of Impact percentage on existing urban areas (IPU) is 51.62 and Value of Impact Percentage on existing rural facility (IPR) is -6.45 as per DMTOP framework, which indicate thatidentified factors don’t have positive impact towards achievement of objectives assigned in FI for rural areas.

The current study is inclusive of dimensions from supply as well as demand side of FI. The study is one of the primary attempts of its type to gather all the factors andis divided intoseven different sets according to similarity in their character. By dint of many attempts and practices from policy makers, rural populations are very far from being a part of a main stream financial system. The overall combined impact of these factors wasonly 51.62% in urban population while it was-6.45% on rural population. Thesefactors are very crucial for the study of FI in term of rural and urban areas as complete FI is required for sustainable economicdevelopment of thecountry. The current government has taken many good initiatives in last few years towards financial inclusion, but complete FI seems to be elusive. The current study has made an attempt to identify all the majorcontributors to achieve FI goal from different published reports,from government andalso fromexpert opinion. Some of the factors are contributing positively for FI in urban areas while rural area is still un-affectedby them. Some of the factorsare showing either negative or no impact, like factors of Cost and Regulations. They are in fact a matter of concern for policy makers, as any increase in cost of services will stop people from comingto the bank and any decrease will causea big dent in the income of the banks.This is highlighting a huge gap between urban-rural populations. All these would enlarge the gap between urban and rural, making conflicts more visible, and increasing the likelihood of a mass disturbance. This means that, without properly bridging the gap between urban and rural areas, it could trigger a series of risks to the economic sustainability

The current study has been limited to explore the major inequality key area and impact on these key factors on rural and urban populations in terms of achievements of FI. Somefactors of such inequality between Urban- rural populations are identified but not used in the research due to limitation of time. These should be addressed in future research. There is a lot of scope to test and improvethe used framework, DMTOP (Decision Making threat and Opportunity), in other areas of problem solving.

Acharya, D. &Parida, T.K, (2013), Financial Inclusion in India: Why Not Happened. Indian Institute of Banking & Finance (IIBF) India, Available at www.iibf.org.in/...report/Final-Report-on-FI-for-IIBF-by-DAcharya-and-TParida.pdf

Arya, P. K. (2015). Financial Inclusion and their role in inclusive growth.International Journal of Management, IT and Engineering, 5(2), 79.

Barr M. A. Kumar.& R. E. Litan. (2007). Building Inclusive Financial Systems: A Framework for Financial Access. Washington, DC: Brookings Institution Press.

Baza1U.A&Rao S. K, (2017),Financial Inclusion in Ethiopia. Available, International Journal of Economics and Finance; Vol. 9(4), pp. 191-201.

Beg S & Mullick H. N, (2016), Increasing Financial Inclusion Through Islamic Banking In India, International Journal of Business Management & Research, Vol. 6(1), pp. 27-34.

Bhuvana M, Vasantha S,(2016), Drivers of Financial Inclusion to Reach Out Poor,Arabian Journal of Business and Management Review ,Vol.6:235.

Cavallo, E. A. &Serebriskt, T., (2016) Saving for Development: How Latin America and the Caribbean Can Save More and Better, Palgrave Macmillan ,10.1057/978-1-349-94929-8.

Cnaanet. al., (2012), Financial Inclusion: Lessons From Rural South India, Journal of Social Policy, Vol. 41(01), pp.183 – 205.

Cressy.R. (2002). Introduction: Funding Gaps. Economic Journal , 112 (477), 1-16.

CRISIL (2018), report on financial inclusion published on 28 Feb 2018, retrieve from https://www.crisil.com/en/home/newsroom/press-releases/2018/02/indias-financial-inclusion-improves-significantly.html

Dara R. N, (2016), Multidimensional Index Measures of Digital Financial Inclusion in Emerging Markets: A Case of India, International Research Journal of Marketing and Economics, Vol. 3(6), pp. 10-29.

Dbie.RBI , (2018) ,Branch data report , retrieves from https://dbie.rbi.org.in/BOE/OpenDocument/1608101727/OpenDocument/opendoc/openDocument.faces?logonSuccessful=true&shareId=0

Garg, S & Agarwal, P. (2014), Financial Inclusion in India – a Review of Initiatives and Achievements, IOSR Journal of Business and Management, Volume 16(6), pp. 52-61.

Gasparini L. F. Gutiérrez A. Támola L. Tornarolli. & G. Porto. (2005). Finance and Credit Variables in Household Surveys of Developing Countries. Universidad Nacional de La Plata, Argentina, and World Bank. Washington, DC, mimeo.

Global findex Report 2014 - World Bank Group.Available from.https://datatopics.worldbank.org/.../WB_GlobalFindex_GlobalInfographic_0406_final.pdf

Gupta, D (2015) , Key Barriers Faced in Implementing Financial Inclusion. International Journal of Engineering Technology. Management and Applied Sciences 2:02-21.

Hans B. V, (2016), Initiatives and Impact of Financial Inclusion in India, Journal of Exclusive Management Science, Vol. 5(10), pp. 1-6.

Iqbal. A. B & Sami S, (2017), Role of banks in financial inclusion in India. Contaduría y Administración.

Kamath, Rajalaxmi (2008) "Ramanagaram Financial Diaries: Loan repayments and cash patterns of the urban slums", IIMB Working paper 268.

Koku, P. S. (2015). Financial exclusion of the poor: a literature review. International Journal of Bank Marketing, 654-668.

Kumar, S. (2017), Analysis of Key Barriers to Growth of Microfinance Institutions: An Approach Based on Interpretive Structural Modelling, The Microfinance Review, Vol.9 (2), pp. 38-55.

Kumar,S.&Adlakha, A., (2018), “The Smart City Mission as Factor for Urban Rural Gap- an Impact Analysis”, ITIHAS-The Journal of Indian management, Vol.8(1), pp.28-37.

Lapukeni AF (2015), Financial Inclusion and the Impact of ICT: An Overview. American Journal of Economics, Vol 5, pp. 495-500.

Majumdar, C., & Gupta, G. (2013).Financial Inclusion in Hooghly. Economic & Political Weekly, 48(21), 55-60.

Mukhopadhyay P. J., (2016), Financial Inclusion in India: A Demand-side Approach, Economic and political weekly, Vol. 51(49), pp. 46-54.

Nasir S., (2013) Microfinance in India: Contemporary Issues and Challenges, Middle east journal of scientific research 15 (2), pp 191-199, 2013.

RBI,(2008), Financial Inclusion in India – An Assessment, retrieves from https://rbidocs.rbi.org.in/rdocs/Speeches/PDFs/MFI101213FS.pdf

RBI, (2009, Aug), A press release as on 13 Aug 2009 , retrieves from https://www.rbi.org.in/scripts/BS_SpeechesView.aspx?Id=432

RBI (2014), “Report on comprehensive financial services for small businesses and low Income households” (Chairman: Dr. N. Mor).

Reddy, V. C, (2016), 12 Pillars' Framework for Successful Financial Inclusion in India, Indian Journal of Finance, Vol. 10(12).

Singh, C., Mittal, A., Goenka, A., Goud, C R P., Ram, K., Suresh, R. V., Chandraka , R., Garg, R., &Kumar,U., (2014) , Financial Inclusion in India: Select Issues , IIMB WORKING PAPER NO: 474, retrieve fromhttps://iimb.ac.in/research/sites/default/files/WP%20No.%20474.pdf

Thyagarajan, G.,& Nair. J, (2016), Financial Inclusion In India – A Review, International Journal of Science Technology and Management, Vol. 5(8), pp. 426-432.

Tripathi, R. and Singh, P.T. (2015), Proposed Basel III Implementation: Are Indian Commercial Banks Ready, Apeejay Journal of Management Sciences and Technology, 3 (1), October, 20-38 .

World bank report ( 2018 ,April) , Financial Inclusion Overview , Retrieves from http://www.worldbank.org/en/topic/financialinclusion/overview