|

Muhammad Mohsin PhD Scholar, College of Business Administration Liaoning Technical University, China |

Sobia Naseem PhD Scholar Institute for Optimization and Decision Analytics Liaoning Technical University, China |

Dr. Saqib Muneer Assistant Professor Faculty of Economics and Finance University of Hail, Hail, Saudi Arabia |

Shazia Salamat MS Scholar College of Business Administration Liaoning Technical University, China. |

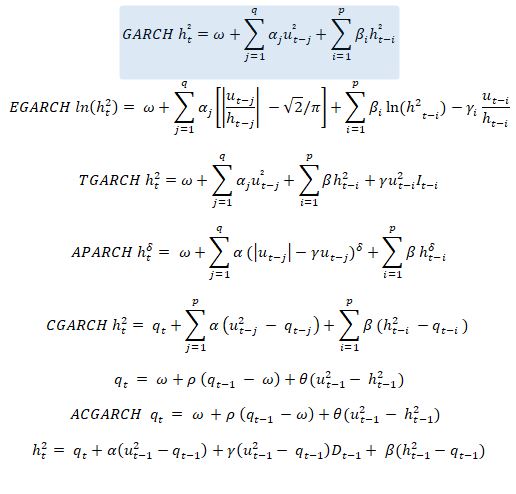

This paper approaches GARCH type models for exchange rate volatility modeling over the period of 1st January 2005 to 31st December 2018 with daily data of exchange rate from Pakistan against US dollar. Volatility clustering and leverage effect are more stylized facts of exchange rate which captures by applying the symmetric and asymmetric models. Based on the GARCH family model, the results are shown the significance of exchange rate under GARCH model and extensions of GARCH family such as PGARCH, TGARCH, CGARCH and ACGARCH. Except of PGARCH and TGARCH, the summation of ARCH and GARCH value is more than one. Exceeding value of estimated persistent coefficient from one is indicating an explosive mean reverting process. Negative significance of EGARCH’s leverage value is guaranteed the existence of negative shocks effect on exchange rate volatility.

Keywords: Exchange rate volatility, GARCH type models, Leverage effect

The volatile nature of exchange rate against US dollar in Pakistan becomes the keen interesting topic among the researchers. Volatility in exchange rate is considered as an uncertain and high-risk factor of erosion of capital market due to that developing economies are facing much impairment in their financial market (Javed, Ali et al. 2016). Two proportions of volatility are usually utilized in financial figuring; chronicled (Historical) and inferred (Implied) unpredictability. Recorded instability is determined from the bygone estimations of an exchange rate. The prearranged progression of previous day-to-day exchange rates figures it out the standard deviation and yearly volatility of daily rate fluctuation. When the financial market and economy have not experienced basic fluctuation than previous perceivable future volatility is good evaluation method. The volatility of market is determined by the market member’s appraisals that what is probably going to latter on in the market. The single estimation factor of option price is known so the assessment of volatility more absolute and accurate for quoted price. The reason for this figuring is the Black Scholes option pricing model, as per cost of an alternative is controlled by accompanying: the present cost of the advantage (the conversion standard or a stock or a product), the strike cost at which the choice can be worked out, the rest of the ideal opportunity for development of option, the risk free rate of interest, and assets volatility (or the exchange rate).According to data and previous studies exchange rate variability is similar to many other financial related resources. Currency traders are touchy enough about the currency estimation because of currencies influence each other. Macroeconomic execution of economies imperatively behind the two monetary forms; changes in the direction of susceptibility about the ultimate fate either the economy will make dealers become disconcerted and less fervent to hold specific currency. Variability in the hedger’s extent versus opportunists can likewise alter the fluctuation of currency. National banks are determinant of monetary standard fluctuation with their goals declarations to mediate or generally in the business sector. It is ordinarily trusted that national banks can impression the estimation of their money at most in the short run, they can surely cause an adjustment in the volatility. The high volatile exchange rate creates more anxiety for investors; although it’s inefficiency to financial policies mark of the financial market because Pakistani rupee is unswervingly losing its value against US dollar (Parveen, Khan et al. 2012). Pakistani currency face the deprecation since 1947 the independence of Pakistan. In 1982, the State bank of Pakistan decided to de-linked rupee from US dollar for currency stabilization and achieved the goal of stabilization in 2000. From 2000 to start of 2018 Pakistani rupee got the stabilization position and after election of 2018 exchange rate again faces the high rate of volatility (Khan and Ismail 2012, Rehman 2014). The deprecating exchange rate can be controlled by reducing inflation rate and increase interest rate at a specific level (Bhatti and Din 2001). Multinational companies, Banks, sock market even the whole economy gets affected with the fluctuation of exchange rate (Rehman 2014). Stable exchange rate plays the role of backbone for developed economy (Khan and Ismail 2012). The rate of exchange rate highly influenced inflation rate, exchange disturbance raise the inflation rate which create an adverse condition for economy of a country after a specific limit (Assery and Peel 1991, Hunt, Conway et al. 1998, Sadeghi 2006).Many countries has shifted exchange rate from fixed regime to floating exchange rate, the importance of exchange rate volatility and modeling of volatility became more important in 1973(Hartman 1972, De Grauwe 1988, Asseery and Peel 1991, Fišer and Horvath 2010, Pavasuthipaisit 2010). Downward movements of exchange rate are always shown high rate of volatility and the symmetric and asymmetric effects are influenced the exchange rate returns. Aim of the study will be investigated the exchange rate fluctuation against US dollar using GARCH family models to identify and investigate the direction of influence investigate, the short& long-run dynamics of the volatility by these models (Naseem, Mohsin et al. 2018).No literature is available on this topic mostly the research work or previous studies have been done on the fluctuation and relation of macroeconomic variable with exchange rate as well as recognition of exchange rate importance in the development of economy.

This study consists on the daily exchange rate data of Pakistani rupee against US dollar from start of 2005 to end of 2018 to check the fluctuation of exchange rate. The GARCH family models are used in present study i.e. GARCH, EGARCH, TGARCH, Asymmetric Power ARCH (APARCH), Component GARCH (CGARCH) and Asymmetric Component GARCH (ACGARCH) to check exchange rate volatility. Three basic parameters are used to check the good-to-fit model from optimal models like as Akaike (AIC), Bayesian (BIC) and Hannan-Quinn (HQ). The selected model is the one with the minimum criteria values (Ding, Granger et al. 1993).

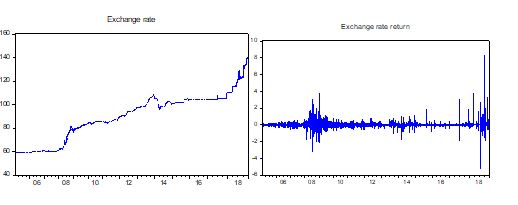

Table 1 shows the results of the descriptive statistics of the exchange rate. The mean value of the exchange rate is 0.02109, skewness is positive 4.14182, and the value of kurtosis is positive as well as more than 3 which mean the data of exchange rate is leptokurtic. The graphic representation of data shows from 2005 to onward the value of exchange rate against the US dollar move to upward

|

Table-1 Descriptive Statistics |

||||

|

Mean |

0.02109 |

Maximum |

8.285297 |

|

|

Minimum |

-5.265823 |

Skewness |

4.141872 |

|

|

Kurtosis |

126.974 |

Observations |

4165 |

|

|

Median |

0 |

Jarque-Bera |

2679166 |

|

|

Std. Dev. |

0.336775 |

|

|

|

The table 2 shows that the result of simple OLS on consent value. The ARCH effect displays F-statistics is significant at 1% level of significant mean that in this series of Exchange rate having heteroskedasticity ((Naseem, Mohsin et al. 2018). The presence of heteroskedasticity is very notable for clustering volatility since the ARCH effect found in the models, so the different GARCH model performed with the Normal distribution. The GARCH model is useful to finding variance dynamics and the EGARCH, PGARCH, TGARCH used to found the existence of leverage effect (Abdullaha, 2017).

|

Table-2 Ordinary Least Square |

||||

|

EXCHANGE RATE (Dependent Variable) |

||||

|

OLS |

||||

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

C |

0.02109* |

[0.005218] |

4.041535 |

0.000 |

|

The ARCH Test /Heteroskedasticity Test |

||||

|

F-statistic |

19.12995* |

Prob. F(1,4162) |

0.000 |

|

|

R^2 |

19.05157* |

Prob. Chi-Square(1) |

0.000 |

|

|

Standard errors are presented in square brackets. *, **, *** are indicate 1%, 5% and 10% level of significance respectively. |

||||

|

Table-3 GARCH Family Model with Normal Distribution

|

||||||

|

|

GARCH |

EGARCH |

PGARCH |

TGARCH |

CGARCH |

ACGARCH |

|

Mean Constant (μ) |

0.031182* |

0.041796* |

0.047414* |

0.008738* |

0.018954* |

0.012203* |

|

[0.003695] |

[0.002077] |

[6.10E-05] |

[0.00329] |

[0.003744] |

[0.003743] |

|

|

Variance Constant(ω) |

0.017381* |

-1.130396* |

0.077063* |

0.016754* |

0.277391* |

0.125437* |

|

[0.000251] |

[0.008259] |

[0.001774] |

[0.000182] |

[0.011959] |

[0.008888] |

|

|

ARCH (α ) |

0.616166* |

0.732422* |

0.329218* |

0.235737* |

0.998961* |

0.970354* |

|

[0.009772] |

[0.006561] |

[0.002142] |

[0.00997] |

[0.000113] |

[0.001998] |

|

|

GARCH (β) |

0.488663* |

0.727799* |

0.254583* |

0.511445* |

0.285233* |

0.178164* |

|

[0.002852] |

[0.004762] |

[0.007548] |

[0.003339] |

[0.016307] |

[0.013858] |

|

|

α+β |

1.104829 |

1.460221 |

0.583801 |

0.747182 |

1.284194 |

1.148518 |

|

EGARCH (γ) |

… |

-0.252026* |

… |

… |

… |

… |

|

… |

[0.006187] |

… |

… |

… |

… |

|

|

PGARCH ( δ) |

… |

… |

0.620883* |

… |

… |

… |

|

… |

… |

[0.006296] |

… |

… |

… |

|

|

PGARCH (γ) |

… |

… |

0.63961* |

… |

… |

… |

|

… |

… |

[0.002794] |

… |

… |

… |

|

|

TGARCH (γ) |

… |

… |

… |

0.741563* |

… |

… |

|

… |

… |

… |

[0.018864] |

… |

… |

|

|

ACGARCH / CGARCH (ƿ) |

… |

… |

… |

… |

0.01704* |

0.09314* |

|

… |

… |

… |

… |

[0.000686] |

[0.003928] |

|

|

ACGARCH / CGARCH (Ɵ) |

… |

… |

… |

… |

0.288786* |

0.531374* |

|

… |

… |

… |

… |

[0.009206] |

[0.013748] |

|

|

ACGARCH (γ) |

… |

… |

… |

… |

… |

-0.305746* |

|

… |

… |

… |

… |

… |

[0.017598] |

|

|

LL |

-325.9528 |

-338.2488 |

-327.2947 |

-251.0441 |

162.5864 |

-78.56225 |

|

AIC |

0.158441 |

0.164825 |

0.160045 |

0.12295 |

-0.075192 |

0.041086 |

|

SIC |

0.164524 |

0.17243 |

0.169171 |

0.130555 |

-0.066066 |

0.051732 |

|

HQ |

0.160593 |

0.167515 |

0.163274 |

0.12564 |

-0.071964 |

0.044852 |

|

ARCH (1) |

0.00071 |

0.013943 |

1.310299 |

0.005255 |

0.002328 |

0.000252 |

|

Prob. |

0.9788 |

0.906 |

0.2524 |

0.9422 |

0.9615 |

0.9873 |

|

JB |

4289706 |

2659910 |

96.40914 |

3123929 |

2999224 |

3362939 |

|

Prob. |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

The above table-3 presents the result of the GARCH family under the normal distribution. The mean equation in all GARCH model is significant at 1% level of significance. In all GARCH models, the parameters of consistency ARCH (α) and GARCH (β) are positively significant at 1% level of significance but the sum of both are more than 1 which shows the data is beyond of consistency(Lee 1991, Abdullah, Siddiqua et al. 2017). The result of the asymmetric model EGARCH (1, 1) captures the leverage effect (γ). The coefficient of (γ) is negative and significant at 1% level of significance which found that the presence of asymmetric in volatility of the negative events have a strong impact on the volatility of exchange rate. In the model of EGRCH the leverage coefficient negative is a restriction (McKinnon and Pill 1999, Patton 2006, Goudarzi and Ramanarayanan 2011). The result of PGARCH (1,1) shows the coefficient of leverage effect is significant positively at 1% level. The positive coefficient means that negative past value of residuals increase the volatility promote, (Jayasuriya, Shambora et al. 2009, Sobia Naseem 2019). The coefficient of power term (δ) is ≠ 2 which mean that there is not a standard GARCH model (Ding, Granger et al. 1993). In the result of TGARCH (1,1) the coefficient of leverage effect also positive significant at 1% level. Which mean that bad news having more affected the negative conditional news as compare to positive news. The component of GARCH used to found the long and short effect component (You, 2013; (Jayasuriya, Shambora et al. 2009). In this study CGARCH and ACGARCH as (Katsiampa 2017)are significant on 1% level of confidence which indicate the long and short-run also influenced the volatility of exchange rate (Katsiampa 2017). However, the sum of ARCH effect and the GARCH effect is exceeded in all GARCH models then 1 except PARCH and TGARCH. If the sum of (α+ β) is more the one mean that the residuals are non-stationary and the variance indefinite but if (α+ β) less than one mean that the residuals are stationary (Hamdan, Abzakh et al. 2011). The best model was chosen on the base of Log likelihood (LL), Akaike Criterion (AK), Schwarz Criterion (SIC) and Hanna-Quinn Criteria (HQ). In the above models, the CGARCH model hasa maximum value of LL 162.5864 and least value of Akaike Criterion (AK), Schwarz Criterion (SIC) and Hanna-Quinn Criteria (HQ). On the bases, these evolutions CGARCH model is best as associated to other models. The ARCH model expressions that the value of F-Statistics is insignificant in all GARCH types’ model means that have no further effect of heteroskedasticity. The Jarque–Bera test is significant at 1% level in all GARCH type models which mean error is normally distributed.

To check the relative level of economic health of country some macroeconomic variables such as Interest rate, Inflation and Exchange rate are played crucial rule. Pakistan is developing country and the exchange rate plays important role in the country level trade. In this study to check the symmetric and asymmetric effect in the Exchange rate against dollar different GARCH type models used i.e. GARCH (1, 1), EGARCH (1, 1), PGARCH (1, 1), TGARCH (1, 1) CGARCH (1, 1) and ACGARCH (1, 1). The period of data contains 1st January 2005 to 31st December 2018. The results shows that the ARCH effect and the GARCH effect term significant in all Models means that symmetric effect has in volatility. To check the asymmetric effect in other different models used like as EGARCH, PGARCH, TGARCH, CGARCH and ACGARCH. The results of all these models found the existence of leverage stimulus in the volatility of exchange rate and PGARCH, TGARCH results also shows bad news are more effect on conditional variance as compared to positive news (Katsiampa 2017). This study concluded that the Pakistani currency against dollar is high volatile. To stable the exchange rate government should adopt strong step. This study is important for foreign investor as well as domestic investor, policy maker, researcher and Government.

Abdullah, S., et al. (2017). "Modeling and forecasting exchange rate volatility in Bangladesh using GARCH models: a comparison based on normal and Student’s t-error distribution." Financial Innovation 3(1): 18. Asseery, A. and D. A. Peel (1991). "The effects of exchange rate volatility on exports: Some new estimates." Economics letters 37(2): 173-177. Assery, A. and D. Peel (1991). "The effects of exchange rate volatility on exports: Some new estimates." Economics letters 37(2): 173-177. Bhatti, R. H. and M.-u. Din (2001). "Determining Pak Rupee Exchange Rates vis-à-vis Six Currencies of the Industrial World: Some Evidence Based on the Traditional Flow Model [with Comments]." The Pakistan Development Review: 885-897. De Grauwe, P. (1988). "Exchange rate variability and the slowdown in growth of international trade." Staff Papers 35(1): 63-84. Ding, Z., et al. (1993). "A long memory property of stock market returns and a new model." Journal of empirical finance 1(1): 83-106. Fišer, R. and R. Horvath (2010). "Central bank communication and exchange rate volatility: a GARCH analysis." Macroeconomics and Finance in Emerging Market Economies 3(1): 25-31. Goudarzi, H. and C. Ramanarayanan (2011). "Empirical analysis of the impact of foreign institutional investment on the Indian stock market volatility during world financial crisis 2008-09." International Journal of Economics and Finance 3(3): 214-226. Hamdan, A. M., et al. (2011). "Investigating the Asymmetric Recognition in the Bahrain Stock Exchange." International Management Review 7(2): 19. Hartman, R. (1972). "The effects of price and cost uncertainty on investment." Journal of economic theory 5(2): 258-266. Hunt, B., et al. (1998). "Exchange rate effects and inflation targeting in a small open economy: a stochastic analysis using FPS." Reserve Bank of New Zealand Discussion Paper(G99/4). Javed, S. A., et al. (2016). "Exchange Rate and External Competitiveness: A Case of Pakistan." Jayasuriya, S., et al. (2009). "Asymmetric volatility in emerging and mature markets." Journal of Emerging Market Finance 8(1): 25-43. Katsiampa, P. (2017). "Volatility estimation for Bitcoin: A comparison of GARCH models." Economics letters 158: 3-6. Khan, A. Q. and M. Ismail (2012). "Analysis of the factors affecting exchange rate variability in Pakistan." exchange 2(3). Lee, K. Y. (1991). "Are the GARCH models best in out-of-sample performance?" Economics letters 37(3): 305-308. McKinnon, R. I. and H. Pill (1999). "Exchange-rate regimes for emerging markets: moral hazard and international overborrowing." Oxford review of economic policy 15(3): 19-38. Naseem, S., et al. (2018). "Volatility of pakistan stock market: A comparison of Garch type models with five distribution." Amazonia Investiga 7(17): 486-504. Parveen, S., et al. (2012). "Analysis of the factors affecting exchange rate variability in Pakistan." Academic Research International 2(3): 670. Patton, A. J. (2006). "Modelling asymmetric exchange rate dependence." International economic review 47(2): 527-556. Pavasuthipaisit, R. (2010). "Should inflation-targeting central banks respond to exchange rate movements?" Journal of International Money and Finance 29(3): 460-485. Rehman, M. (2014). "Analysis of Exchange Rate Fluctuations: A Study of PKR VS USD." Journal of Managerial Sciences 8(1). Sadeghi, M. (2006). Inflation targeting exchange rate model for an oil producing country: the case of Iran, Brazil: Global Finance Conference.