|

Sheikh Farhan Ashraf Ph.D. Scholar School of Management Science & Engineering Jiangsu University, Zhenjiang, Jiangsu P.R. China. Corresponding author: fhsheikh08@yahoo.com |

Dr. Cai Li School of Management Science & Engineering Jiangsu University, Zhenjiang, Jiangsu P.R. China. |

Rehan Sohail Butt Ph.D. Scholar School of Management Science & Engineering Jiangsu University, Zhenjiang, Jiangsu P.R. China. |

Shumaila Naz Ph.D. Scholar School of Management Science & Engineering Jiangsu University, Zhenjiang, Jiangsu P.R. China. |

Zuhaib Zafar Ph.D. Scholar School of Management Science & Engineering Jiangsu University, Zhenjiang, Jiangsu P.R. China. |

This research paper is to explore the small family business longevity with regards to education and its effects on succession planning in Pakistan. The small family businesses play a vital role in strengthening, growth, and development to the economy of Pakistan. Data were collected from small family business by using systematic sampling method and the sample size was 486as respondents. The technical software Smart PLS used to test the hypothesis using technique PLS-SEM Partial least square (Structural equation modeling). Results revealed that customer focus management (CFM), business strategies (BS), and education (EDU) has a positive and significant result in direct relation but education as moderator has insignificant and negative relation between customer focus management and succession planning (SP). Thus, education is not moderating between CFM and BS on succession planning. This result will help small family business in succession planning and leads toward Small medium enterprises. Moreover, Implications and limitations of the research work are expounded.

Keywords: Succession planning (SP); Education (EDU);Customer focus management (CFM); Business Strategies (BS); Small family business (SFB); Pakistan

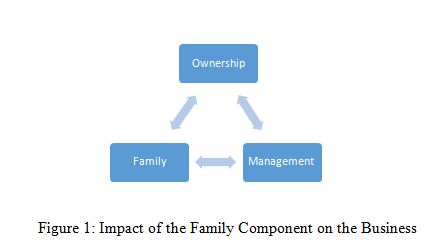

The involvement of two or more family members having ownership, support, and control in a business known as a family business (Beckhard & Dyer Jr, 1983). In every country, small family businesses play an accelerating role to make the economy strong (Griffeth, Allen, & Barrett, 2006). Nowadays, small family business being highly focused, expectation from small family businesses is very high for the stability and smooth economic growth, raising local and international market, generating opportunities and making framework according to the market and economy of the country (Marler, Botero, Massis, & Vittorio, 2017). Normally succession planning is not a big deal but not much common in family businesses, it's effective while moving the small family business to the next generation from the founder (Ibrahim, Dumas, & McGuire, 2001; Jaskiewicz, Combs, & Rau, 2015). Some of the researchers say “the three main problems of Family Businesses: Succession then Succession and then again Succession” (Liu, Eubanks, & Chater, 2015; Miller, Steier, & Le Breton-Miller, 2003). The family businesses get many opportunities while staying in the market to enjoy higher profit and help in developing the economy of the country. The small family business has a unique trait to earn a higher financial return from the market (Cumming, Deloof, Manigart, & Wright, 2019). Family businesses with business policies, practices, thoughts, and strategies, also transfer and followed by the next generation as previous successors learned from their forefathers(Ibrahim et al., 2001). While successors have confidence insignificance of craftsmanship, reflecting things in love, profoundly submerged with music, feel originality in things, innovation in outlet, having some poetry, occasionally have some deep thoughts, rarely go for daydreams, and seldom for some emotional like of pictures and painting(Rajabi, Brashear-Alejandro, & Chelariu, 2018). The small family business has a vital role in the economy of Pakistan. There are 3.2m(million) family business are in Pakistan, while SME’s accounts for 35% share in value addition of the economy (Chrisman, Chua, & Sharma, 2005). Conferring to Tax ordinance of Pakistan, SME capital minimum Rs. 25m and turnover required up to Rs. 200m. As per updated information, small family businesses are more in number than big businesses, they provide more opportunity for employees and reduce unemployment in Pakistan (Ward, 2016b). According to the survey, near 30% of businesses continued to the next generation (Griffeth et al., 2006; Jaskiewicz et al., 2015). Though succession planning in a small family business is very important and hard for the successors to transfer or give authorities it’s necessary to adopt for the interest and development of next new generation (Marler et al., 2017). Therefore decision-making ability is very crucial for the survival and development of family business (Gómez-Mejía, Haynes, Núñez-Nickel, Jacobson, & Moyano-Fuentes, 2007; Swagger Jr, 1991).Various studies stated that less than 33% of families owned family business and continued to the next (second) generation after the founder’s retirement, further more just 50% of those family businesses turn in next generation(Birley, 1986; Dumas, 1990; Hollander & Bukowitz, 1990; James, 1999; Jaskiewicz et al., 2015; Liu et al., 2015). For the longevity of the family, business successors face many issues, while succession planning neglected on large bases linked to the education, although family businesses are unique institution of learning (Gillis‐Donovan & Moynihan‐Bradt, 1990). Family members typically play controlling role in both management and ownership (Fig.1). Therefore, integration and management of family component will have certain effects on success of succession process (Walsh, 2011). Fig. 1 shows the family component has impact on ownership and management issues of the family business.

Family Business Succession; Managing the All-Important Family Component (Walsh, 2011)According to an American philosopher’s observation “who didn’t get any experience from past mistakes should go for it again” George Santayana (Ward, 2016a). Family members play important role in taking the risk and bring innovation in business, giving human access to the family business, capital budgeting, social environment and passionate capital that helps in the endurance of family businesses ventures (Jaskiewicz et al., 2015). Nowadays, the most crucial problem challenging by the family business is lack of abilities to leadership across the generation, key dimensions such as succession planning, time management, selection of successor and social issues (Griffeth et al., 2006; Marler et al., 2017).Currently, the family business has moved to hot, knowledgeable and ample topic for the 21st-century researchers and for this paper family business has been segmented into first, second and third generations(Ibrahim et al., 2001; Miller et al., 2003). Sharing knowledge in family business helps to make the future bright, categorically identify the entities of family business members, indeed among the first-second-third and fourth generation for business, customers of the family business and self-analysis for the business. Last over the decade, research on small family business increases, mostly quantitative (Live Questions), but research describes unfortunately still not much change in family business infect going downwards (Cumming et al., 2019). Several definitions to describe family business and maturity of the market which helps the researcher in literature (Rajabi et al., 2018; Subhan, Mehmood, & Sattar, 2013). The purpose of this study is to give knowledge to the successor, he/she can rule, manage, lead, observe and run the business as per his/her own will (Wiklund, Nikolaev, Shir, Foo, & Bradley, 2019).

The research proves, in case of successors retirement or death, less than 0.3% of the business continued by the second generation and for the third generation half of the share than the second-generation sustain for future limitation(Breton‐Miller, Miller, & Steier, 2004; Lobley, Baker, & Whitehead, 2010). Moreover, deep research on family business showed much stress in adopting succession process (Brockhaus, 2004; Morris, Williams, Allen, & Avila, 1997; Poza, 2013). The family business owner should have attitude of challenging behavior, decision making ability and concept of succession planning, this will help successor to avoid loss and give stability to the business in long term (de Vries, 1993; Ramadani & Hoy, 2015). In this study, education intend to play important role for incumbent and succession but this may bring mess in family businesses (Gagné, Sharma, & De Massis, 2014). A study conducted on three Portuguese family firms, moreover education is not much involved as compare to values and culture, education may affect succession planning (Davis, 1968). The smart successor can raise the level of business with experience, market knowledge and showing profitable domain for the growth of small family business (Sirmon & Hitt, 2003).Therefore, it is proved the experience and knowledge of successor is more vital than the available resources (Clayton & Radcliffe, 2018). Furthermore, considered how much owner is realistic and awareness to handle critical issues of family business (Miller, Le Breton‐Miller, &Lester, 2010). However, for the successors personal qualities and traits become dominant factors for the business (Carland, Hoy, Boulton, & Carland, 2007). A study conducted in Mexico addressed the patterns of entrepreneurial succession (Davis, 1968). It is stated that by birth no one is a successor (Goldberg, 1996). The owner’s confidence on abilities and capabilities to control, reluctance to become higher, desires may effect positive for the success of small family business (Handler, 1992). In 1962 Family Business Centre was launched by Léon and Katie Danco to convey knowledge and make infrastructure for the family businesses, the aim of this Centre to educate and assist basic needs of business to the family members by providing residence to facilitator and experts to give, exchange innovating ideas with family business successors. In start of nineties several research articles published in “Family Business Review”, give direction to current researchers to study in small family businesses and during the last period refer to the published articles, most rehashed topics were: succession process, fiscal and legal issues interpersonal family dynamics, family firm’s consultancy, business growth, and performance(Straus, Gelles, & Steinmetz, 2017).

Why we emphases on customer satisfaction? Because we want to fulfill customer’s expectation and needs initially, for the time being, and forever (Butz Jr & Goodstein, 1996; Handler, 1992). However, the familiar and trustworthy successor in family businesses has importance to the relationship between customers and employees (DeNoble, Ehrlich, & Singh, 2007; Marshall et al., 2006; Wang, Watkins, Harris, & Spicer, 2004). Customers play vital role in generating revenue in certain years and also help to shift successfully family business to the next generation, only handling of financial issues is not the key to success, several other elements are involved such as customer’s relationship, shareholders and operational work are the essential and important components for the success of small family business (Doppelt, 2017; Wang et al., 2004). However, other than dealing of financial matters the mechanism of board, long-term planning, targeting goals, customer’s loyalty and stability are involved for the growth of small family business (Ahmad & Yaseen, 2018). The effective progress, developments and customer’s satisfaction isn’t base on firm size, though customer only concerned with personal benefits (Hatten, 2015; Longenecker, Petty, Palich, & Hoy, 2013; Reijonen, 2008).

The data of last 40 years describes family and non-family businesses are mainly based on strategies (Chrisman, Chua, Pearson, & Barnett, 2012; Chrisman et al., 2005; Miller, Le Breton‐Miller, & Scholnick, 2008). Family elements impact the strategies, and the way by strategies are executed (Brunninge, Nordqvist, & Wiklund, 2007; Van Gils, Huybrechts, Minola, & Cassia, 2019). Most of the researchers examined that in last ten years the family businesses with proper check and balance of their financial transactions earned more and also gets improvement in profit, than those who don’t have any written plans for their businesses (Peters & Buhalis, 2004). Therefore, entrepreneurial planned strategies and family strategies are different from each other in businesses (Zahra, Hayton, & Salvato, 2004).The research shows strategies for small family business are still limited, it’s a suggestion by the researcher that there should be more strategies for the growth of the small family businesses (Abdille, 2013; Upton, Teal, & Seaman, 2003). However, researchers say that the business strategies and management theories are at excessive pace to understand succession planning processes of businesses (Mazzola, Marchisio, & Astrachan, 2008) (Pardo-del-Val, 2009).It is stated that motivation by incumbent in the family firm is the pathway to successful succession process (Gilding, Gregory, & Cosson, 2015).

The small family businesses are necessary for the growth of Pakistan’s economy. A survey of State Bank of Pakistan says 80-90 percent businesses represent 44% gross national products of Pakistan. In Pakistan, the family businesses are considered as a unique institute. Significantly in specific situation, which covers two different dissimilar collective groups (i.e., Businesses and family) are profoundly incorporated. In family businesses “relationship among family and business is significantly related and attuned” (Davis, 1968). Although the communication in the family business is natural but sometimes it creates problems (Brockhaus, 2004). Recently research on family succession planning process examined and heightened the awareness about demographic issues, the ratio of the succession planning process increases double but still, it’s below 50% (Burton & Walford, 2005). Showing inability in the succession planning process cited obstruction survival (Handler, 1992). Many researchers studied and dared to propose the arguments which are not much in favor of continuity and succession planning of a firm (Astrachan & Kolenko, 1994). The statistical date of family business says from first to next (second) generation only 30% of family businesses survive and half of second to the third generation (Beckhard & Dyer Jr, 1983; Clinton & Gamble, 2019). The most and vital fear faces in the family business involved the transformation of leadership, authorities, decision making power and continuing business ownership (Handler, 1992) (Davis, 1968). For the better future of family businesses, researcher defined that the constitution made in the family business by the founder will be helpful in addressing to the next generations for the betterment of family business, and to control firm issues among generation owners (Astrachan & Kolenko, 1994).

The researchers examined education and training has a significant impact on the succession process, many studies related to family business proposed the strong correlation between innovation and education (Kimberly & Evanisko, 1981).However, some of the researchers stated that acceptance level of the family business owner is directly related to the change and education upon his willingness (Datta & Guthrie, 1994). Whereas still many of the studies are not able to clear the relation between education and succession planning. The family business owner should show his willingness to accept innovation and reduce authorities of controlling organization, this will show a positive impact in the relationship of owner’s level of education and succession process to some extent, where as education intent a vital role in legitimizing the chosen successor (Morris et al., 1997). Here is the theory states that mostly higher education gives effective performance while diploma level or less education has a lesser impact on performance in small family business (Goldberg, 1996). Education builds the successors to such level, which a firm needs for its development (Breton‐Miller et al., 2004; Cabrera‐Suárez, De Saá‐Pérez, & García‐Almeida, 2001; Goldberg, 1996; Long & Chrisman, 2014). Therefore, “the potential successor should go for some college or technical education to overcome the problems”, it’s accepted with facts that education plays a very important role in the growth of the economy (Beckhard & Dyer Jr, 1983). Education is the key to success and development for stronger culture which helps new generation of small family business to grow (Lundstrom & Stevenson, 2006).Education emphasis to successor in societal development, accept teamwork, absorption capacity, dynamic capacity and bring the change (Johansen, Schanke, & Clausen, 2012). For the growth and development of business, there should be some professional education and training which helps the successor to overcome the issues faced during business (Sharma, Hoy, Astrachan, & Koiranen, 2007). Therefore, many researcher says education correlates with success of successor, so far transferring family business information to descendant from ancestor is delegated and proper professional education helps descend ant to grow(Breton‐Miller et al., 2004). Research and studies are suggesting to motivate and educate the successor to use educational tools for personal and business development (Miller et al., 2010). Success is associated with time management, sometime education and time restraint are growth obstructing factors for small family business(Morris et al., 1997).Therefore, positive attitude of the successor associate with the growth of family business with economy of the country(Miller et al., 2010). Moreover, this paper is to motivate family incumbent and policymakers to build intention in establishing, development by making strategies for small family business succession process and try to reduce conflicts between successors and incumbents(Ip & Jacobs, 2006). The successor has a fear of losing attorney in business; the successor is not much interested to have economic or professional education in family members and business (Harveston, Davis, & Lyden, 1997). Therefore, the education and innovation have positive relationships among each other, while demonstrating formal education and willingness of accepting the change leads the successor towards several achievements (Kimberly & Evanisko, 1981).

The famous definition for succession planning process “The eventual feasibility and consequent which bring positive change towards business and individual” (Beckhard & Dyer Jr, 1983; Cabrera‐Suárez et al., 2001; Chrisman et al., 2005; Handler, 1992; Morris et al., 1997). The family succession planning process (transferring authorities to the next generation) could be highly antagonistic and passionate issue for successor, which can create huge conflicts for the business and family as well, so management of a company should develop some planning and mechanisms with valid structure for the organization and family to avoid issues while in transferring of leadership from one to other generation (Kesner & Sebora, 1994).The latest research stated that an announcement by the leader’s contrivance and legitimizing new changes with subordinates and peers of the company will help to reduce and avoid political issues of family business(Christensen, 1959).However, concerned with communication it’s not easy for the current successor to eliminate all issues/conflicts, to avoid problems successor should consider succession process of transferring leadership to the next generation, needed legitimacy to avoid further issues(Vancil, 1987). To maintain consistent growth, successful leadership, conflictual conducts, stability, continuity and identity of the family business the important mechanism is to implement a succession process in business(Christensen, 1959).In broader term family business involved many variables such as environment, organization and group level, individual and interpersonal skills, education and age all plays a vital role for the success of succession planning(Handler, 1992). As per researchers succession planning process in a family business is highly correlated with the founder’s age (Lansberg, 1988). The old executive owners of a family business has strong affiliation and commitments to the business(Michael & Becker, 1973).Age and education plays an imperative protagonist in family business succession planning (Carlsson & Karlsson, 1970).The founder’s age is significantly related to succession planning(Lansberg, 1988). Latest Research directs that the founders have a strong vow than youngers and more peril antagonistic to the organization(Michael & Becker, 1973).The formation of policies for succession planning demonstrate that the owner is fair with family business and help in mitigating risk for the betterment of the business for future (Carlsson & Karlsson, 1970).As the age of the owner increases, need to prepare certain evolution to increase the control in the family business, besides this also focus on succession planning (Kets de Vries, 1985). The succession planning in a family business gives fear to the owner of losing control in an organization, avoiding the preferential behavior of next generation/children’s, threat to stature social loss in the community (Lansberg, 1988). Whereas the fear of inevitable death, enervate illness forces the owner of the family business to have succession planning process for his/her family business (Cabrera‐Suárez et al., 2001). The success of successor and success of succession planning has positive relationships among each other (Dyer, 1986; Goldberg, 1996; Handler, 1992; Ward, 2016a). Consensus to the succession process should be projected long, handled as its planned (Ambrose, 1983; Barnes & Hershon, 1976; Beckhard & Dyer Jr, 1983; Handler, 1992; Lansberg, 1988; Sonnenfeld & Spence, 1989; Trow, 1961). The purpose of succession planning is to prepare for the necessity to ensure the family coherence and continuity of family business to the next generation. It’s essential to have a succession process for the betterment of the future with respect to family and family business” (Lansberg, 1988).The succession planning process is necessary to the development of the successors and family business. For the betterment of the successor, there should be some chart plan and pool to use the talent of the successor for future (De Massis, Chua, & Chrisman, 2008). For business development, firm needs potential and active candidates to avail their abilities and development plans for the business.

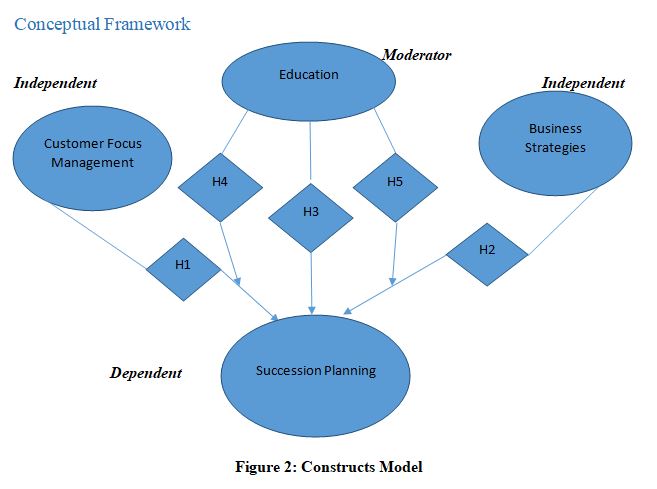

H1: Customer focus management has an association with the succession planning in a small family business. H2: Business strategies have a significant impact on the succession planning in a small family business. H3: Education has a positive and significant effect on the succession planning process. H4: There is a negative and insignificant moderation effect of Education on succession planning and customer focus management in the small family business. H5: Education has insignificant moderation between business strategies and succession planning in the small family business.

To investigate the factors for this paper target population was a small family business of famous cities of Pakistan such as Karachi, Lahore, Islamabad, Faisalabad, Multan, and Gujranwala. This study conducted primary research, data was collected from the small family business and questionnaire was filled physically from small family entrepreneurs because they were not much educated. The component of successor and incumbent used to analyze surveillance of four generations, including daily routine operational work. The questionnaire was distributed to 630 respondents out which 486 were serious respondents, non-serious responded questionnaires and missing values were excluded. The closed-ended questionnaire was used, the confidentiality of respondents was assured. The missing values were deleted.

For small family business succession planning, here is the compressed demographic information with responses of 486, the target population was small family businesses and distributed questionnaires were (N=630), questionnaires with missing values and suspicious responses were deleted. In return, the total responses were (N=486) and the ratio was 77% of total distributed questionnaires.

|

No of Generations/Cities |

Karachi |

Islamabad |

Lahore |

Faisalabad |

Multan |

Gujranwala |

Total |

|

First |

47 |

54 |

79 |

57 |

31 |

22 |

290 |

|

Second |

18 |

22 |

28 |

33 |

13 |

6 |

120 |

|

Third |

12 |

14 |

5 |

21 |

4 |

3 |

59 |

|

Fourth |

2 |

3 |

3 |

8 |

1 |

0 |

17 |

|

Grand Total |

79 |

93 |

115 |

119 |

49 |

31 |

486 |

Here in Table 1, the ranged ages of respondents (15-25 years) and were 190 with 39%, (26-35 years) were 104 with 21%, (36-45 years) were 42 with 9%, (46-55 years) were 116 with 24% and 34 respondents were 56 plus in age with 7% of total respondents

All constructs were quantified on 5-point Likert-scale from “strongly disagree = 1” to “strongly agree = 5”. To evaluate business strategies (BS), succession planning (SP) and customer focus management (CFM) elements. For CFM scale was used and consists of 29 items [104]. For business strategy (BS), scale used with 5 dimensions and 24 elements (Kirk, Miller, & Miller, 1986; Kotha & Vadlamani, 1995). The succession planning (SP) was tested which consist of 20 elements (Sonfield & Lussier, 2004), followed by (Ahmad & Yaseen, 2018) and education was measured by using a scale of (Zondo, 2016). To measure the level of education, 4 levels were made for Technical school, undergraduate, graduate and postgraduate.

Figure 2 depicted hypotheses to be tested, by using 3.0 version software named smart-PLS and partial least square equation modeling techniques used on collected data (Ringle, Wende, & Becker, 2015). This software is reputed for its vigor in evaluating, the establishment of the theory and analytical application. Additionally, it’s known and famous in an exploratory analysis (Joe F Hair, Ringle, & Sarstedt, 2011; Joseph F Hair, Ringle, & Sarstedt, 2012). According to the scholar’s point of view, PLS software is based on case selection where observed values are being analyzed (F. Hair Jr, Sarstedt, Hopkins, & G. Kuppelwieser, 2014; Reinartz, Haenlein, & Henseler, 2009). According to latest research PLS has 2 steps (Barclay, Higgins, & Thompson, 1995; Cegarra-Navarro, Reverte, Gómez-Melero, & Wensley, 2016). The first step covers model measurement which helps the researcher to evaluate the relation between latent and observed variables. The second step includes numerous test between study variables, which helps in the assessment of prognostic investigation of the causal relationship of variables. To evaluate small family businesses customer’s focus management, business succession planning, education and business strategies PLS is used to examine and analyze the relationship and association of all the above factors.

This method is concerned with data obtained from different sources. So, precautions used in the procedure were observed to evade common method bias (Podsakoff, MacKenzie, & Podsakoff, 2012). In the procedure of filling the questionnaire, it was clearly informed to the respondents that the collection of data is purely for scientific research and it will remain confidential. There was the little issue of common bias method because respondents were not much educated, for the current research valid scale was applied on all constructs.

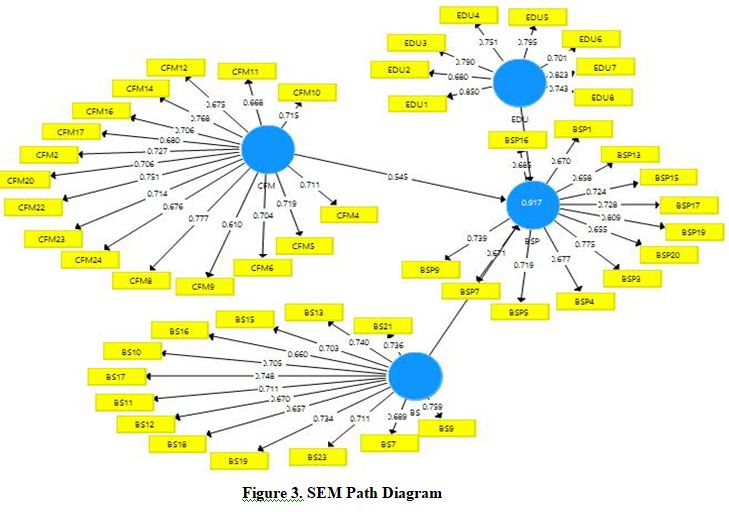

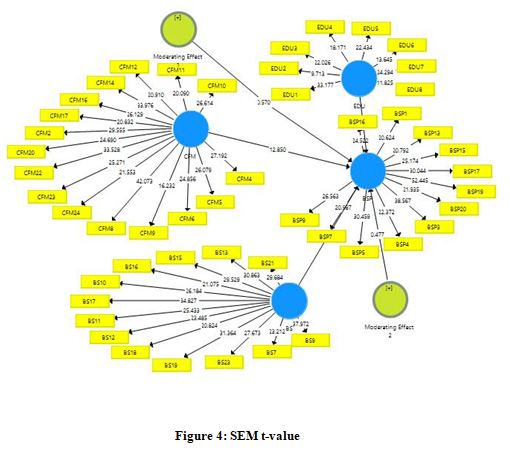

Measurement model specifies causation among latent variables and dimensions (Joseph F Hair, Hult, Ringle, Sarstedt, & Thiele, 2017). The latent variables were observed for validity and reliability. When measurements scale of all constructs are convergent and items loading is greater than 0.50 is to be considered (Joe F Hair et al., 2011). The internal reliability of variables was measured by Cronbach’s alpha. The result explores the reliability of all constructs constancy and examined by Cronbach’s alpha > 0.70 (Chin, 1998). Therefore figure 3 and picture 4 below validate SEM factor loadings and t-Values which represent paths model. To ensure the study, variable are more reliable, composite reliability (CR) was calculated. In below picture 4 showed composite reliability (CR) values were beyond 0.70 (Nunnally, Bernstein, & Berge, 1967). In Figure 4 having Confirmatory factor analysis (CFA) with latent values SP, EDU, CFM and BS which were ˃0.5 were deleted respectively (Lowry & Gaskin, 2014). To ensure the reliability of studied constructs, construct reliability (CR), discriminant validity and Average variance (AVE) of items are examined, AVE of studied constructs is more than 50%(Vinzi, Chin, Henseler, & Wang, 2010). Therefore, results show all constructs exhibit are accepted else than moderators. The data result proves the behavior of incumbent towards the successor influence affection and attention in the family business. Scholar stated that there is a feeble relation between the level of business planning and education perceiving family harmony(Breton‐Miller et al., 2004).

In result table 2 shows, acceptable values are exceeded from required values in structural model. The validity of the discrimination determined by the comparison among the correlation and Square root of AVE between combinations. There is a strong relationship between variables and researchers contended (Fornell & Larcker, 1981). Table 2 describes mean, standard deviation, Cronbach’s alpha, rho_A, composite reliability, AVE and correlation matrix of studied variables with validation in numbers.

|

|

Mean |

SD |

CB α |

rho_A |

CR |

(AVE) |

BSP |

BS |

CFM |

EDU |

|

SFB |

3.597 |

0.825 |

0.91 |

0.913 |

0.924 |

0.505 |

0.711 |

|

|

|

|

BS |

3.609 |

0.837 |

0.918 |

0.919 |

0.93 |

0.504 |

0.939 |

0.71 |

|

|

|

CFM |

3.578 |

0.864 |

0.933 |

0.935 |

0.941 |

0.501 |

0.947 |

0.941 |

0.708 |

|

|

EDU |

3.737 |

0.834 |

0.905 |

0.941 |

0.92 |

0.591 |

0.167 |

0.135 |

0.15 |

0.769 |

|

Mod 1 |

|

|

1 |

1 |

1 |

1 |

0.081 |

0.094 |

0.08 |

0.074 |

|

Mod 2 |

|

|

1 |

1 |

1 |

1 |

0.09 |

0.094 |

0.092 |

0.073 |

In the Figure, 4 relationships of latent variables were analyzed by structural model (Kinabalu, 2017). To evaluate significant results of the path of coefficient, (5000 subsamples two-tail test) technique bootstrapping is used. The revealed result shows in path coefficient that EDU has a significant influence on CFM and BS, supported by H4 and H5. The path coefficient results revealed in Table 3, where both CFM (β = 0.543, S.D = 0.042, t-value 12.85, p value = 0.000) and BS (β = 0.425, S.D = 0.042, t-value 10.077, p value = 0.000) has a positive and significant impact on SP and accepted the hypothesis respectively, support provided for H1 and H2. Moreover, our moderating variable EDU (β = 0.028, S.D = 0.013, t-value 2.071, p value = 0.039)also has a significant positive impact on SP, thus supporting H3. However, the interaction between CFM and EDU reports negative coefficient (β = -0.022, S.D = 0.039, t-value 0.570, p value = 0.569) but insignificant. Therefore, the EDU does not moderate between CFM and SP, thus rejecting H4. Similarly, the interaction between BS and EDU reports insignificant coefficient and positive, however, the EDU does not moderate between BS and SP, thus rejecting H5.

|

|

β |

Mean |

S.D |

t-Value |

p Value |

Status |

|

CFM |

0.543*** |

0.541 |

0.042 |

12.85 |

0.000 |

Accepted |

|

BS |

0.425*** |

0.427 |

0.042 |

10.077 |

0.000 |

Accepted |

|

EDU |

0.028** |

0.030 |

0.013 |

2.071 |

0.039 |

Accepted |

|

CFM*EDU˃SP |

-0.022 |

-0.025 |

0.039 |

0.570 |

0.569 |

Not accepted |

|

BS*EDU˃SP |

0.018 |

0.02 |

0.038 |

0.039 |

0.633 |

Not accepted |

The current study revealed the factors influence in succession planning for the small family business. Research on these factors shows the result that CFM, BS integrative towards succession planning. So we cannot avoid the importance of business strategies because with-out business strategies it’s not easy to give growth to a business. This paper contributes to the importance of customer focus to retain the customer, survival, and longevity of the business. Policies, strategies, rules and regulations, friendly behavior made by higher authorities (Directors) influence stakeholder’s expectation, interest, customer behavior towards business and play a vital role in succession process of family businesses (Wheelen & Hunger, 2011). There is much variation in the results of the successor’s education in the family business. As incumbent gets higher or professional education, changes business line or goes for a line extension to some corporate level business. This change effects succession planning and business, create conflicts between incumbent and successor, but this change brings change into the business level from a small business into medium size family business. Education plays a vital role in business succession, give advantage in retaining customer and consistent growth to the business. The successor/incumbent use education in business and made good policies for the betterment of business but the districts focused in this paper gets the result which shows insignificant result and negative impact on succession planning. Education plays a vital role in corporate business but in family business successors don’t want to lose their worth and powers of taking decisions for the betterment of the business. However rational and appropriate decisions with string strategies give many benefits in the long run to the business and will play a vital role in succession planning and process also. In previous studies education effects positively to the family business but in this paper education is not playing effective role in succession planning the incumbent has different style of doing business and want to have authorities of decision in Pakistan, due to education the business and strategies get few changes and this involve some ambiguities between successor and incumbent due to high-level education or education. No doubt business gets boom due to high-level education but successor don’t want to lose his entity. Successors make strategies for personal and customer benefits in the family business. The researcher had some views about informal governance mechanism which has importance and plays a vital role for the family business. The current study shows education is not much important for succession planning and for the growth of the business but actually the reason behind is power which hits the successor worth in business. Although it’s not essential to have proper education for business, though education resolve may conflicts and issues in the family business and give new ideas for the betterment of business and customer satisfaction by different kinds of strategies. Although succession planning process is very slow in the long run it plays a vital role and gives greater reward but on the other hand, lose in family business due to loose succession planning is irreplaceable. New generation gives more attention to customer satisfaction, decisions making and strategies for business growth. We can promote the life of small family businesses and this will be beneficial for Pakistan’s economy.

As we tried to conclude many essential and important aspects regarding small family business, customer satisfaction, business strategies, and education. It comes to know in research small family business is a backbone not only in Pakistan but for every country it plays a vital role for entrepreneurs, entrepreneur’s development and for the growth of the economy. Survival of small business is compulsory as a small business is linked with many other businesses and giving benefits to many families. Small family business increases the employment ratio for family members and then family members. Although high risk involved due to incumbents because they are new in business and not much aware of nature and strategies which has to use for customer satisfaction, growth and survival of the family business. It’s not easy to develop new business and as incumbents are new to business and owners don’t want to lose their decision making power regarding business in this case little negligence of an incumbent can give much lose to the family business. The rational and non-emotional decision for succession planning in family business gives growth to the family business and on other hands emotional and bias decision in succession planning lead business to the end stage. Right decision at right time strategy is needed in succession planning to achieve and ensure the successor success of the family business. The family business is much involved in some sort of charity business and also in accommodating many unemployed in their business. The family business generates maximum and a greater volume of profit to the business. Due to fewer resources and time, researcher couldn’t be able to capture a large number of the family business. Growth of small business gives growth to Pakistan’s economy. Although the study tried to analyze all variables and their effects but couldn’t be able to analyze all variables generation wise. This paper includes that education plays a negative role in family business because in Pakistan we have a traditional business and in traditional business owner/successor don’t want any interference in their decisions. Succession in any matter has not much importance in Pakistan. Nowadays much focus on women empowerment but still, it’s equal to nothing. Although successor wants an extension of business from small to small medium enterprises but no sharing in authorities. Education gives maturity to the incumbents but old traditions and successor take this as loss of their worth. As on direct effect, education has an impact but indirectly in between customer focus and business strategies There is no proper infrastructure for a small family business in Pakistan. There is no specific education for entrepreneurs. There is some professional education in Pakistan which contribute to the small family business. The role of education can come into being in the near future when the second or third generation has some education related to business or technical entrepreneurial. This can bring some change and succession planning to become essential need of business, if we talk about current situation the district we choose for data collection are not involved in much qualifies business owners so far very less number for successor generation is educated and if there are some educated incumbents in family business the successors don’t like their much interference in decisions. Now a day’s trend started for educated incumbents in family business not much. This study was conducted on small family business successors and was limited to some famous businesses in city side areas. As in hypotheses direct relation of customer focus, business strategies and education have significant relation on succession planning but two hypotheses were found insignificant. Hypothesis and literature show first-second and somehow the third generation doesn’t have much focus on succession planning and didn’t find much difference among these generations. Only the difference is in debt financing that first generation founders are more involved and have much finance for the business as compare to the second, third and fourth generation. There is no spurious relationship found in the hypothesis.

It’s not easy to transfer business from one generation to the next generation. This study grabs the incumbent’s attention towards decision making, customer satisfaction, business strategies to make the relationship easy between customer and successors. It’s concluded by the study that incumbent involved in the family business to make some business policies and strategies to enhance the business, design some strategies that should be implement in the family business and make the succession planning process smooth. This act will enhance the ratio of longevity, employment, strength among family members, tax payments and revenue generation for the small family business. This act will reduce conflicts among incumbents and successor and family members involved in the business. This study will give positive wipes to incumbents, importance, and awareness about succession planning. The successor should change the traditional business style this will leads the small business into the medium-size family business. This study shows that education should be involved in the family business through incumbents. This will give confidence to the incumbent to show and enhance his/her capabilities, mitigate the issues and fear of decisions. This will create a good and strong relationship between the successor and incumbents. It is recommended that education should be involved in the family business to give chance to incumbents to show his/her capability and have confidence in his/her capabilities. This will also help him to take decisions in business terms with customers and applying new strategies. This study will help the family and business to grow parallel.

|

Variable |

Loading |

Variable |

Loading |

Variable |

Loading |

Variable |

Loading |

|

CFM10 |

0.715 |

BS10 |

0.705 |

EDU1 |

0.85 |

BSP1 |

0.67 |

|

CFM11 |

0.668 |

BS11 |

0.711 |

EDU2 |

0.68 |

BSP13 |

0.658 |

|

CFM12 |

0.675 |

BS12 |

0.67 |

EDU3 |

0.79 |

BSP15 |

0.724 |

|

CFM14 |

0.768 |

BS13 |

0.74 |

EDU4 |

0.751 |

BSP16 |

0.685 |

|

CFM16 |

0.706 |

BS15 |

0.703 |

EDU5 |

0.795 |

BSP17 |

0.728 |

|

CFM17 |

0.68 |

BS16 |

0.66 |

EDU6 |

0.701 |

BSP19 |

0.809 |

|

CFM2 |

0.727 |

BS17 |

0.748 |

EDU7 |

0.823 |

BSP20 |

0.655 |

|

CFM20 |

0.706 |

BS18 |

0.657 |

EDU8 |

0.743 |

BSP3 |

0.775 |

|

CFM22 |

0.751 |

BS19 |

0.734 |

|

|

BSP4 |

0.677 |

|

CFM23 |

0.714 |

BS21 |

0.736 |

|

|

BSP5 |

0.719 |

|

CFM24 |

0.676 |

BS23 |

0.711 |

|

|

BSP7 |

0.671 |

|

CFM4 |

0.711 |

BS7 |

0.689 |

|

|

BSP9 |

0.739 |

|

CFM5 |

0.719 |

BS9 |

0.759 |

|

|

|

|

|

CFM6 |

0.704 |

|

|

|

|

|

|

|

CFM8 |

0.777 |

|

|

|

|

|

|

|

CFM9 |

0.61 |

|

|

|

|

|

|

Funding: Self –organized cluster entrepreneurship behavior reform, evolution, and promotion strategies study (No.16BGL028), China National Social Science Foundation; [2] Study on Bottleneck and Innovation of Postindustrial Intellectual capital development in Jiangsu Province (No.14JD009), Jiangsu Province Social Science Foundation Project. [3] Interactive effect between Self-Organized Innovation and Industrial cluster, Jiangsu Province Graduate Scientific Research Innovation Project.

Abdille, H. M. (2013). The Effects Of Strategic Succession Planning On Family Owned Businesses In Kenya. Unpublished dissertation. School of Business, University of Nairobi. Ahmad, Z., & Yaseen, M. R. (2018). Moderating role of education on succession process in small family businesses in Pakistan. Journal of Family Business Management, 8(3), 293-305. Ambrose, D. M. (1983). Transfer of the family-owned business. Journal of Small Business Management (pre-1986), 21(000001), 49. Astrachan, J. H., & Kolenko, T. A. (1994). A neglected factor explaining family business success: Human resource practices. Family Business Review, 7(3), 251-262. Barclay, D., Higgins, C., & Thompson, R. (1995). The partial least squares (PLS) approach to casual modeling: personal computer adoption ans use as an Illustration. Barnes, L. B., & Hershon, S. A. (1976). Transferring power in the family business. Harvard business review, 54(4), 105-114. Beckhard, R., & Dyer Jr, W. G. (1983). Managing continuity in the family-owned business. Organizational dynamics, 12(1), 5-12. Birley, S. (1986). Succession in the family firm: The inheritor's view. Journal of small business management, 24, 36. Breton‐Miller, I. L., Miller, D., & Steier, L. P. (2004). Toward an integrative model of effective FOB succession. Entrepreneurship theory and practice, 28(4), 305-328. Brockhaus, R. H. (2004). Family business succession: Suggestions for future research. Family Business Review, 17(2), 165-177. Brunninge, O., Nordqvist, M., & Wiklund, J. (2007). Corporate governance and strategic change in SMEs: The effects of ownership, board composition and top management teams. Small Business Economics, 29(3), 295-308. Burton, R. J., & Walford, N. (2005). Multiple succession and land division on family farms in the South East of England: A counterbalance to agricultural concentration? Journal of Rural Studies, 21(3), 335-347. Butz Jr, H. E., & Goodstein, L. D. (1996). Measuring customer value: gaining the strategic advantage. Organizational dynamics, 24(3), 63-77. Cabrera‐Suárez, K., De Saá‐Pérez, P., & García‐Almeida, D. (2001). The succession process from a resource‐and knowledge‐based view of the family firm. Family Business Review, 14(1), 37-48. Carland, J. W., Hoy, F., Boulton, W. R., & Carland, J. A. C. (2007). Differentiating entrepreneurs from small business owners: A conceptualization Entrepreneurship (pp. 73-81): Springer. Carlsson, G., & Karlsson, K. (1970). Age, cohorts and the generation of generations. American Sociological Review, 710-718. Cegarra-Navarro, J.-G., Reverte, C., Gómez-Melero, E., & Wensley, A. K. (2016). Linking social and economic responsibilities with financial performance: The role of innovation. European Management Journal, 34(5), 530-539. Chin, W. W. (1998). Commentary: Issues and opinion on structural equation modeling: JSTOR. Chrisman, J. J., Chua, J. H., Pearson, A. W., & Barnett, T. (2012). Family involvement, family influence, and family–centered non–economic goals in small firms. Entrepreneurship theory and practice, 36(2), 267-293. Chrisman, J. J., Chua, J. H., & Sharma, P. (2005). Trends and directions in the development of a strategic management theory of the family firm. Entrepreneurship theory and practice, 29(5), 555-575. Christensen, C. R. (1959). Management succession in small and growing enterprises: Division of Research, Graduate School of Business Administration, Harvard …. Clayton, T., & Radcliffe, N. (2018). Sustainability: a systems approach: Routledge. Clinton, E., & Gamble, J. R. (2019). Entrepreneurial Behavior as Learning Processes in a Transgenerational Entrepreneurial Family Entrepreneurial Behaviour (pp. 237-260): Springer. Cumming, D., Deloof, M., Manigart, S., & Wright, M. (2019). New directions in entrepreneurial finance. Journal of Banking & Finance, 100, 252-260. Datta, D. K., & Guthrie, J. P. (1994). Executive succession: Organizational antecedents of CEO characteristics. Strategic Management Journal, 15(7), 569-577. Davis, S. M. (1968). Entrepreneurial succession. Administrative Science Quarterly, 402-416. De Massis, A., Chua, J. H., & Chrisman, J. J. (2008). Factors preventing intra-family succession. Family Business Review, 21(2), 183-199. de Vries, M. F. K. (1993). The dynamics of family controlled firms: The good and the bad news. Organizational dynamics, 21(3), 59-71. DeNoble, A., Ehrlich, S., & Singh, G. (2007). Toward the development of a family business self-efficacy scale: A resource-based perspective. Family Business Review, 20(2), 127-140. Doppelt, B. (2017). Leading change toward sustainability: A change-management guide for business, government and civil society: Routledge. Dumas, C. A. (1990). Preparing the new CEO: managing the father‐daughter succession process in family businesses. Family Business Review, 3(2), 169-181. Dyer, W. G. (1986). Cultural change in family firms: Jossey-Bass. F. Hair Jr, J., Sarstedt, M., Hopkins, L., & G. Kuppelwieser, V. (2014). Partial least squares structural equation modeling (PLS-SEM) An emerging tool in business research. European Business Review, 26(2), 106-121. Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of marketing research, 18(1), 39-50. Gagné, M., Sharma, P., & De Massis, A. (2014). The study of organizational behaviour in family business. European Journal of Work and Organizational Psychology, 23(5), 643-656. Gilding, M., Gregory, S., & Cosson, B. (2015). Motives and outcomes in family business succession planning. Entrepreneurship theory and practice, 39(2), 299-312. Gillis‐Donovan, J., & Moynihan‐Bradt, C. (1990). The power of invisible women in the family business. Family Business Review, 3(2), 153-167. Goldberg, S. D. (1996). Research note: Effective successors in family-owned businesses: Significant elements. Family Business Review, 9(2), 185-197. Gómez-Mejía, L. R., Haynes, K. T., Núñez-Nickel, M., Jacobson, K. J., & Moyano-Fuentes, J. (2007). Socioemotional wealth and business risks in family-controlled firms: Evidence from Spanish olive oil mills. Administrative Science Quarterly, 52(1), 106-137. Griffeth, R. W., Allen, D. G., & Barrett, R. (2006). Integration of family-owned business succession with turnover and life cycle models: Development of a successor retention process model. Human Resource Management Review, 16(4), 490-507. Hair, J. F., Hult, G. T. M., Ringle, C. M., Sarstedt, M., & Thiele, K. O. (2017). Mirror, mirror on the wall: a comparative evaluation of composite-based structural equation modeling methods. Journal of the Academy of Marketing Science, 45(5), 616-632. Hair, J. F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: Indeed a silver bullet. Journal of Marketing theory and Practice, 19(2), 139-152. Hair, J. F., Ringle, C. M., & Sarstedt, M. (2012). Partial least squares: the better approach to structural equation modeling? Long Range Planning, 45(5-6), 312-319. Handler, W. C. (1992). The succession experience of the next generation. Family Business Review, 5(3), 283-307. Harveston, P. D., Davis, P. S., & Lyden, J. A. (1997). Succession planning in family business: The impact of owner gender. Family Business Review, 10(4), 373-396. Hatten, T. S. (2015). Small business management: Entrepreneurship and beyond: Nelson Education. Hollander, B. S., & Bukowitz, W. R. (1990). Women, family culture, and family business. Family Business Review, 3(2), 139-151. Ibrahim, B., Dumas, C., & McGuire, J. (2001). Strategic decision making in small family firms: an empirical investigation. Journal of Small Business Strategy, 12(1), 80-90. Ip, B., & Jacobs, G. (2006). Business succession planning: a review of the evidence. Journal of small business and enterprise development, 13(3), 326-350. James, H. S. (1999). Owner as manager, extended horizons and the family firm. International journal of the economics of business, 6(1), 41-55. Jaskiewicz, P., Combs, J. G., & Rau, S. B. (2015). Entrepreneurial legacy: Toward a theory of how some family firms nurture transgenerational entrepreneurship. Journal of business venturing, 30(1), 29-49. Johansen, V., Schanke, T., & Clausen, T. H. (2012). Entrepreneurship education and pupils' attitudes towards entrepreneurs Entrepreneurship-Born, Made and Educated: IntechOpen. Kesner, I. F., & Sebora, T. C. (1994). Executive succession: Past, present & future. Journal of management, 20(2), 327-372. Kets de Vries, M. F. (1985). The dark side of entrepreneurship. Harvard business review, 63(6), 160-167. Kimberly, J. R., & Evanisko, M. J. (1981). Organizational innovation: The influence of individual, organizational, and contextual factors on hospital adoption of technological and administrative innovations. Academy of management journal, 24(4), 689-713. Kinabalu, K. (2017). Psychometric Evaluation of Malay Version of Peritraumatic Distress Inventory (M-PDI) and Peritraumatic Dissociative Experiences Questionnaire (M-PDEQ) Using the Sample of Flood Victims in Kuching, Sarawak, Malaysia" Ferlis Bullare Bahari,“Mohd Dahlan A. Malek,“Adeymend Reny Japil. The Social Sciences, 12(6), 907-911. Kirk, J., Miller, M. L., & Miller, M. L. (1986). Reliability and validity in qualitative research (Vol. 1): Sage. Kotha, S., & Vadlamani, B. L. (1995). Assessing generic strategies: an empirical investigation of two competing typologies in discrete manufacturing industries. Strategic Management Journal, 16(1), 75-83. Lansberg, I. (1988). The succession conspiracy. Family Business Review, 1(2), 119-143. Liu, C., Eubanks, D. L., & Chater, N. (2015). The weakness of strong ties: Sampling bias, social ties, and nepotism in family business succession. The Leadership Quarterly, 26(3), 419-435. Lobley, M., Baker, J. R., & Whitehead, I. (2010). Farm succession and retirement: some international comparisons. Journal of Agriculture, Food Systems, and Community Development, 1(1), 49-64. Long, R. G., & Chrisman, J. J. (2014). Management succession in family business: Sage Publications: London, UK. Longenecker, J. G., Petty, J. W., Palich, L. E., & Hoy, F. (2013). Small business management: Nelson Education. Lowry, P. B., & Gaskin, J. (2014). Partial least squares (PLS) structural equation modeling (SEM) for building and testing behavioral causal theory: When to choose it and how to use it. IEEE transactions on professional communication, 57(2), 123-146. Lundstrom, A., & Stevenson, L. A. (2006). Entrepreneurship policy: Theory and practice (Vol. 9): Springer Science & Business Media. Marler, L. E., Botero, I. C., Massis, D., & Vittorio, A. (2017). Succession-related role transitions in family firms: The impact of proactive personality. Journal of Managerial Issues, 29(1), 57-81. Marshall, J. P., Sorenson, R., Brigham, K., Wieling, E., Reifman, A., & Wampler, R. S. (2006). The paradox for the family firm CEO: Owner age relationship to succession-related processes and plans. Journal of business venturing, 21(3), 348-368. Mazzola, P., Marchisio, G., & Astrachan, J. (2008). Strategic planning in family business: A powerful developmental tool for the next generation. Family Business Review, 21(3), 239-258. Michael, R. T., & Becker, G. S. (1973). On the new theory of consumer behavior. The Swedish Journal of Economics, 378-396. Miller, D., Le Breton‐Miller, I., & Lester, R. H. (2010). Family ownership and acquisition behavior in publicly‐traded companies. Strategic Management Journal, 31(2), 201-223. Miller, D., Le Breton‐Miller, I., & Scholnick, B. (2008). Stewardship vs. stagnation: An empirical comparison of small family and non‐family businesses. Journal of management studies, 45(1), 51-78. Miller, D., Steier, L., & Le Breton-Miller, I. (2003). Lost in time: Intergenerational succession, change, and failure in family business. Journal of business venturing, 18(4), 513-531. Morris, M. H., Williams, R. O., Allen, J. A., & Avila, R. A. (1997). Correlates of success in family business transitions. Journal of business venturing, 12(5), 385-401. Nunnally, J. C., Bernstein, I. H., & Berge, J. M. t. (1967). Psychometric theory (Vol. 226): McGraw-hill New York. Pardo-del-Val, M. (2009). Succession in family firms from a multistaged perspective. International Entrepreneurship and Management Journal, 5(2), 165-179. Peters, M., & Buhalis, D. (2004). Family hotel businesses: strategic planning and the need for education and training. Education+ Training, 46(8/9), 406-415. Podsakoff, P. M., MacKenzie, S. B., & Podsakoff, N. P. (2012). Sources of method bias in social science research and recommendations on how to control it. Annual review of psychology, 63, 539-569. Poza, E. J. (2013). Family business: Cengage Learning. Rajabi, R., Brashear-Alejandro, T., & Chelariu, C. (2018). Entrepreneurial motivation as a key salesperson competence: trait antecedents and performance consequences. Journal of Business & Industrial Marketing, 33(4), 405-416. Ramadani, V., & Hoy, F. (2015). Context and uniqueness of family businesses Family businesses in transition economies (pp. 9-37): Springer. Reijonen, H. (2008). Understanding the small business owner: What they really aim at and how this relates to firm performance: A case study in North Karelia, Eastern Finland. Management Research News, 31(8), 616-629. Reinartz, W., Haenlein, M., & Henseler, J. (2009). An empirical comparison of the efficacy of covariance-based and variance-based SEM. International Journal of research in Marketing, 26(4), 332-344. Ringle, C. M., Wende, S., & Becker, J.-M. (2015). SmartPLS 3. Boenningstedt: SmartPLS GmbH, http://www. smartpls. com. Sharma, P., Hoy, F., Astrachan, J. H., & Koiranen, M. (2007). The practice-driven evolution of family business education. Journal of Business Research, 60(10), 1012-1021. Sirmon, D. G., & Hitt, M. A. (2003). Managing resources: Linking unique resources, management, and wealth creation in family firms. Entrepreneurship theory and practice, 27(4), 339-358. Sonfield, M. C., & Lussier, R. N. (2004). First-, second-, and third-generation family firms: A comparison. Family Business Review, 17(3), 189-201. Sonnenfeld, J. A., & Spence, P. L. (1989). The parting patriarch of a family firm. Family Business Review, 2(4), 355-375. Straus, M. A., Gelles, R. J., & Steinmetz, S. K. (2017). Behind closed doors: Violence in the American family: Routledge. Subhan, Q. A., Mehmood, M. R., & Sattar, A. (2013). Innovation in Small and Medium Enterprises (SME’s) and its impact on Economic Development in Pakistan. Paper presented at the Proceedings of 6th international business and social sciences research conference. Swagger Jr, G. (1991). Assessing the successor generation in family businesses. Family Business Review, 4(4), 397-411. Trow, D. B. (1961). Executive succession in small companies. Administrative Science Quarterly, 228-239. Upton, N., Teal, E. J., & Seaman, S. L. (2003). Growth Goals, Strategies and Compensation Practices of US Family and Non-Family High-Growth Firms: A Comparative Analysis. The International Journal of Entrepreneurship and Innovation, 4(2), 113-120. Van Gils, A., Huybrechts, J., Minola, T., & Cassia, L. (2019). Unraveling the impact of family antecedents on family firm image: A serial multiple-mediation model. Journal of Family Business Strategy. Vancil, R. F. (1987). Passing the baton: Managing the process of CEO succession: Harvard Business School Pr. Vinzi, V. E., Chin, W. W., Henseler, J., & Wang, H. (2010). Handbook of partial least squares: Springer. Walsh, G. (2011). Family Business Succession: Managing the all-important family component: KPMG Enterprise. Wang, Y., Watkins, D., Harris, N., & Spicer, K. (2004). The relationship between succession issues and business performance: Evidence from UK family SMEs. International Journal of Entrepreneurial Behavior & Research, 10(1/2), 59-84. Ward, J. (2016a). Keeping the family business healthy: How to plan for continuing growth, profitability, and family leadership: Springer. Ward, J. (2016b). Perpetuating the family business: 50 lessons learned from long lasting, successful families in business: Springer. Wheelen, T. L., & Hunger, J. D. (2011). Concepts in strategic management and business policy: Pearson Education India. Wiklund, J., Nikolaev, B., Shir, N., Foo, M.-D., & Bradley, S. (2019). Entrepreneurship and well-being: Past, present, and future: Elsevier. Zahra, S. A., Hayton, J. C., & Salvato, C. (2004). Entrepreneurship in family vs. non–family firms: a resource–based analysis of the effect of organizational culture. Entrepreneurship theory and practice, 28(4), 363-381. Zondo, R. W. D. (2016). Elusive search on the influence of entrepreneurship education in the private institutions of higher learning in South Africa: A paradigm for developing students into innovative thinkers. 104. jbenedict (2017), “Customer focus measurement questionnaire”, available at: http://touchstoneconsulting. net/customer-focus-measurement-questionnaire/ (accessed December 27, 2018).