|

Dr. Budheshwar Prasad Singhraul Assistant Professor Department Of Commerce Guru Ghasidas Vishwavidyalya Bilaspur, Chhattisgarh, India |

Yogita Satish Garwal Research Scholar Department Of Commerce Guru Ghasidas Vishwavidyalya Bilaspur, Chhattisgarh, India |

A cashless transaction in India is an effort to move towards a cashless economy by minimising the use of physical cash. The main objective of the study is to present the current status of India in usage of digital currency in comparison to other developed countries and find the challenges and opportunities which are associated with the cashless transaction in India. The data of different countries which are related to usage of digital currencies has been gathered. Data is gathered by using secondary data collection method and then graphical representation is being used. The findings of the study revealed that the introduction of cashless economy in India can be seen as a step in the right direction of economy growth and development. It has been conducted to unravel the challenges and opportunities of cashless economy by promoting electronic money instruments, developing electronic financial infrastructures and spreading digital transaction habits among people. Demonetisation announcement (2016) is a revolutionary move towards the cashless economy in India. The study recommends that more people should start using digital payment methods which will serve a cashless economy or less cash economy.

Keywords: Cashless Economy, Digital Currency, Global Economy, GDP (Gross Domestic Product), Economic Freedom, Internet

Transform in to a cashless economy is an international issue and many of the countries already almost become cashless economy. A cashless economy is where financial transactions are not being done in the terms of currency notes, coins or physical cash money. It was in trend by barter age of cashless transaction and other methods of exchange like food crops or other goods (Humphrey, D.B, 2014). However, the new concepts of cashless transactions in cashless economy are made with the help of digital currencies where legal tender (money) is exchanged and recorded only in the electronic digital form. So many challenges and opportunities are associated with the effects of digital transactions.

Indian population where 98 per cent of total economic transactions by volume is being done through cash (Economic times, Nov. 23, 2016), much of the cash transactions being done in the country are small exchange for goods or services. The penetration of Pos terminals is not enough. Millions of people still do not have a bank account, internet network and connection is not proper, lack of knowledge to use online payment methods. These are some of the challenges are there in the country especially in small towns, rural areas and untapped markets in urban India, need to be resolved and people make assure that to adopt digitalisation in their payment system. It is a big task in front of the government of India and their policy maker to transform their society into a cashless economy or less cash economy with the India’s fast growing population.

The introduction of cashless transaction has made the government of India to move towards cashless economy. India was the world's fastest growing major economy in the last quarter of 2014 (G20 an International Forum). India also topped the World Bank 's growth outlook for 2015-16 for the first time with the economy rate having grown 7.6% in 2015-16 and also expected to grow 8.0%+ in 2016-17. It is seen that growth of the Indian economy in the future is positive.

India has already introduced some of the option of payment methods such as Ola money and PayTM accounts to pay rents via internet banking, Indian government has taken a decision of demonetisation (2016) by discontinuation of all 500 and 1000 banknotes, as it would no longer be recognised as legal tender. This move has been executed with the aim to curb the circulation of “black money” in the country and associated problems. India is going towards cashless economy very fast but it may be a long process for years to become complete cashless economy or less cash economy.

The main concept of the cashless economy is that to make people use digital payment methods for their transaction of money for goods and services fully, without elimination of physical cash from economic market completely. Limited cash in circulation support to control growth of inflation rate.

Quantity theory of money (QTM) states that money supply and price level in an economy are in direct proportion to one another. When there is a change in the supply of money, there is a proportional change in the price level and vice-versa (Irving Fisher, 1911). Whenever money supply rose abnormally in the past in an economy, inflationary situation developed there. May not be the relationship a proportional one, but excessive increase in money supply leads to inflation (Nikita Dutta).

The Theory’s Calculations is expressed as:

MV=PT (the Fisher Equation)

Each variable denotes the following:

M = Money supply

V = Velocity of Circulation (the number of times money changes hands)

P = Average Price Level

T = Volume of Transaction of Goods and Services

In the 1950s, Milton Fried man came out with a thesis that “inflation is always and everywhere a monetary phenomenon”. These words are enough to establish the essence of quantity theory of money inflation is largely caused by the excessive growth of money supply and by nothing else.

Increase of cashless economy or cashless transaction is generate less cash or no cash demand in the market and create scope of develop for QTM theory and it may be a grateful participation to develop a healthy economy for long run.

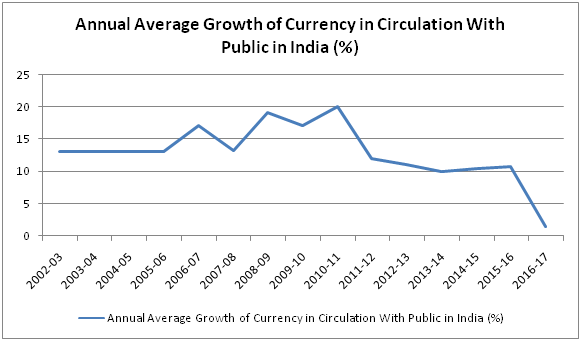

Figure-1

Source: Economic Survey Calculation (2016-17) projected calculation for 2016-17

The demise of cash and the emergence of a cashless society pose a lot of benefits for the society (Humphrey et.at., 1996). According to CBN (2011), an effective and modern payment system is positively correlated with economic growth. In the growth of Global economy, digital currency has a key role for transaction of money for businessmen, consumers and governments around the world. Almost 25 percent of worldwide consumer spending was through some form of payment card, up from 16 percent in 2003. The report says, Digital currency delivered an additional $1.1 trillion to the global economy cumulatively in the six years from 2003 through 2008. On average, that represents a 0.5 percent increase in total annual gross domestic product (GDP). During the same period, real Global GDP grew by an average of 3.4 percent (Moody’s, 2008).

Country’s economic health can be measured by the evaluation of country’s economic growth and development. Economic growth is usually indicated by an increase in the country’s gross domestic product (GDP) which is the total value of any goods and services produced in the country mostly it is associated with the new technologies and development. In other way economic development is usually indicated by an increase in citizens’ quality of life which covers literacy rate, life expectancy and poverty etc. (Duggeri Ashley)

Digitalisation of traditional payment methods is a revolutionary development of banking industries, Internet services and mobile industries. Digital payment methods provide more economic freedom to people. It may give an opportunity to establish new technologies and developments worldwide, resulting growth of the country’s GDP and economy. New developments of industries provide more employments, increase in per capita income, improve people quality life etc.

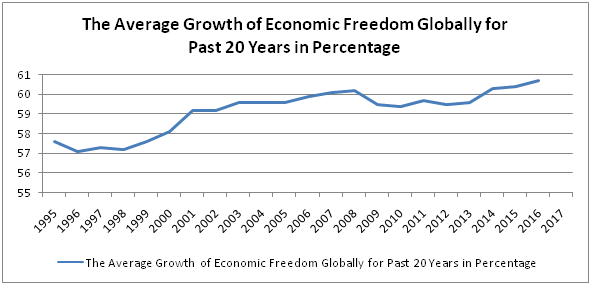

Digital currencies can provide economic freedom to business transaction of their users anywhere in the world. Economic freedom is which allows people in different countries to trade with each other. They can start and expand their business globally by transfer or accept payments with safe and secure transaction in just a few hours around the world. It reduces corruption and bribery too. In the last two decades, the average growth of Economic freedom globally is only 3 percent (from 57% to 60% approximately – Figure-2) (Index of Economic Freedom 2017) but increase of digital currency can develop more economic freedom in the world which can serve new technologies and innovations, growth in GDPs, more opportunities of employments, reduce corruption and terrorism and raise peace and happiness all over the world.

Figure-2

Source: 2017 Index of Economic Freedom

Macro and Bandiera (2004) argued that increased usage of cashless banking instruments strengths monetary policy effectiveness and that the current level of e-usage does not pose a threat to the stability of the financial system. Hord (2005) emphasizes the fact that electronic payments lower costs for business. The more payment that is processed electronically, the less money is spent on paper and postage. According to a new study by Visa, the cost of cash transactions in India is equivalent to 1.7 per cent of the gross domestic product (GDP). To put that figure in perspective, the central government's capital expenditure in 2016-17 was marginally lower at 1.6 per cent of GDP (Ishan Bakshi, Oct. 6, 2016). It will save a huge amount of money that is spending annually in printing and maintaining currency. Currently less than 1% of all consumption expenditure is incurred through cashless instruments (Bappaditya Mukhopadhyay and Sambit Rath, 2011). Electronic Payments as argued by (Cobb, 2005) have a significant number of economic benefits apart from their convenience and safety. The process creates greater transparency and accountability leading to greater efficiency and better economic performance (Al Sheikh, 2005).

During the 1990’s, the growing popularity of electronic banking made the use of non-cash transactions and settlements popular among the residents of some of the most technologically advanced nations of the world. Digital payments methods became well established in countries across the world by 2010’s. There are some of the countries (Table-1) have adopted different mode of digital payment that encouraged the public to opt for cashless transaction options.

Table-1 Mode of Digital Payment and use in Percentage of different Countries

|

Name of Country |

Mode of Digital Payment |

Digital Transaction as per 2015, Worldatlas |

|

Sweden |

Internet Banking, Mobile Banking, Credit & Debit Cards and E-Krona in near future |

59% |

|

Norway |

Electronic-Banking |

- |

|

Denmark |

Payment Cards, Mobile Banking and E-Krone in near future |

- |

|

Belgium |

Debit Cards and Sixdots a Mobile app |

93% |

|

France |

Mobile Banking, Contact-less Cards and M-POS |

92% |

|

United Kingdom |

Paym a Mobile Payment System |

89% |

|

Somaliland |

Mobile Banking |

- |

|

Kenya |

M-PESA and M-Shwari (Mobile Payment app) |

- |

|

Canada |

Payment Cards and Online Wallet |

90% |

|

South Korea |

Credit & Debit Cards |

29% |

|

Singapore |

iBanking, Mobile wallet and Contactless cards |

61% |

|

Netherlands |

E.dentifier Cards Readers, iDeal and Debit Cards |

60% |

|

USA |

e-Banking, Mobile Banking and Card Payments |

45% |

|

Australia |

Internet Banking, NAB a Mobile Banking app and Card Payments |

35% |

|

Germany |

Online banking and EC-Karte a Debit Card |

33% |

|

Spain |

Internet Banking, Debit and Credit Cards |

16% |

|

Brazil |

Boleto, TEF (Online Payments Methods) and Domestic Credit Cards |

15% |

|

Japan |

Online banking, Mobile Banking and Card Payments |

14% |

|

China |

Internet Banking and CUP Cards |

10% |

|

India |

Electronic Banking, Credit and Debit Card Payments |

2% |

India is a country where 98 per cent of total economic transactions is done through cash and has 26 per cent internet access and there are only 200 million users of digital payments services (ICT Fact and Figure 2015). The world Bank’s Global findex shows that Indians are significantly less familiar with digital banking and the use of credit or debit cards, making transactions using mobile phones, and using the internet to pay bills.

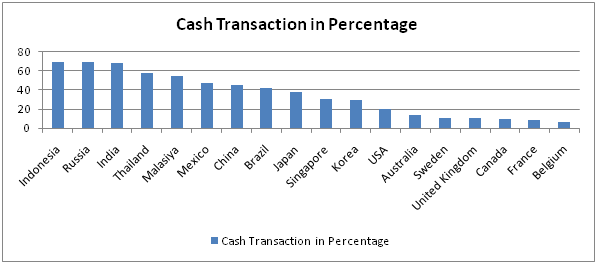

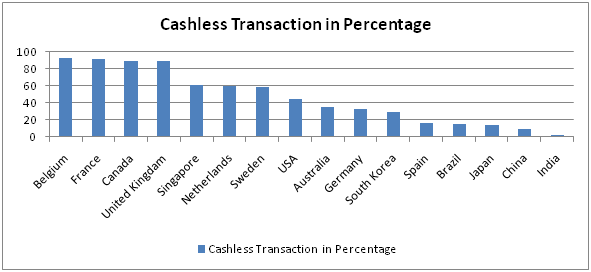

Different Countries in cash transaction (Figure-3) and cashless transaction (Figure-4).

Figure-3

Source: CLSA Report, Compiled by: Puneet Wadhwa, November 14, 2016

Figure-4

Source: www.worldatlas.com , 2015

Electronic databases and online libraries are searched for relevant literature using a comprehensive set of keywords and graphical representation relating to cashless technology of different countries including India. Information was gathered from web based search engines, published literatures.

Secondary Data: The secondary data are collected through government records, Articles, Journals, Survey reports, Research Data and Websites information.

4.1 Objectives of the Study

The main objective of the study is to examine that the importance of cashless policies in the economy of a country and how it affects to their economic growth. Specifically the objective of this study includes:

a) To find out the status of India in comparison of other countries in terms of cashless economy.

b) To find out various challenges and opportunity associated with the implementation of the cashless policies in India.

c) To find out solutions to be adopted against challenges associated with the implementation of the cashless policies in India.

4.2 Limitation of the Study

This study is limited in terms of providing model scope to show the relationship between cashless policies and different variables of finance

4.3 Scope of the study

Work on the cashless economy is scarce, so scope of study is more. Researchers further need to understand the mechanism of cashless policies effecting cashless payments and their effect on the Indian economy.

Challenges of Cashless Economy

In the process of digitalisations of an economy of the country, it is very important to assure that the availability of proper sources to setup require technology and sufficient manpower to provide prompt services in time. A bank account is a primary requirement for digitalisation. Hence Banks have a core responsibility to improve and develop them self -first. There are some challenges in the process of cashless economy in India.

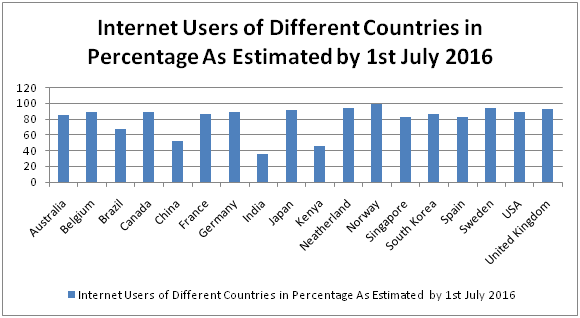

a) Internet plays vital role between banks and customers to receive and deliver information, this forms of banking is describes as Internet banking (Reserve Bank of India, 2001). The figures showing in Figure-5 the percentage of Internet users of India in comparison of other develop countries.

Figure-5

Source: Internet Live Stats ( www.InternetLiveStats.com )

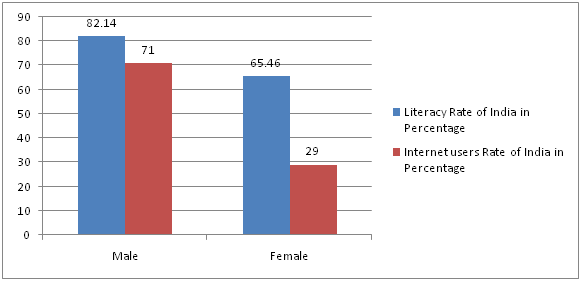

Financial literacy is another big challenge in India to adopt digital currency system. Financial literacy basically has based on the use of technology to effectively use the power of medium like computer, mobile and internet to enable people to have skills, knowledge or information about financial instruments. In India, the total literacy rate is 74.04%. (Indiafact, March 17, 2013 as per India Census 2011). Out of that, Male literacy rate is 82.14% and Female literacy rate is 65.46% according to Census 2011 and Internet users number of Male is 71% and Female is 29% respectively can see in Figure-6.

Figure-6

Source: Indiafact, March 17, 2013 as per India Census 2011

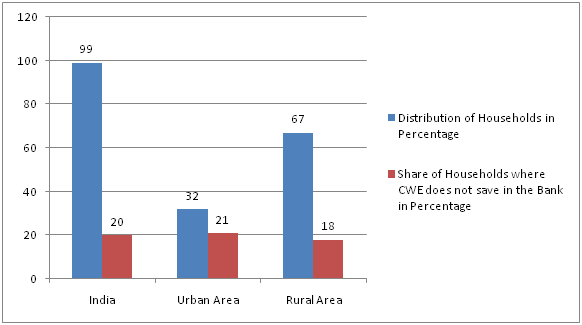

b) Though bank accounts have been opened through Pradhan Mantri Jan-Dhan Yojna (PMJDY), most of them are not in operation. There were 256 million accounts, roughly one for every household. Opening accounts only does not empower citizens to make digital financial transactions. A recent investigation found that 23% of PMJDY accounts lie empty; 10 million accounts held only Rs. 1 and only 33% of all were ready to use their Rupay cards (September, 2016). 99% of households in both rural and urban India have at least one member with bank account. In one of every five Indian households is a chief wage earner (CWE). CWE is a breadwinner who does not save money in a bank (MRSI 1998). We can see the Figure-7 and it is clear that still huge population are there in the country who are not operating their transaction through banks even having accounts in the bank.

Figure-7

Source: ICE 360 Degree Survey Dec 15, 2016

c) India has a wide network of small retailers in all over countries area and most of they do not have enough resources to invest in electronic payment infrastructure to receive and make payments digitally.

d) The perception of consumers on use of credit and debit cards and belief that cash helps you negotiate better.

e) There is also vested interest in not moving towards cashless economy and most card and cash users fear that they will be charged more if they use cards. Further, non-users of credit cards are not aware of the benefits of credit cards due to lack of awareness of new technologies and financial literacy.

f) Indian banks are making it difficult for digital wallets issued by private sector companies to be used on the respective bank websites. It could be restrictions on using bank accounts to refill digital wallets or a lack of access to payments gateways. Regulators will have to take a tough stand against such rent-seeking behaviour by the banks.

Opportunities of Cashless Economy

The main advantage of cashless transactions is that a proper record of all economic transactions is possible to keep. It is remedy to remove black market or underground economies that often prove damaging national economies. Since, cash is the primary mode of transactions in money laundering and terrorism financing, a cashless economy discourages such activities. Central government also get benefit from such cashless transactions as it allows central control of money supply and it is easier to monitor income tax paid by an individual. Cashless transactions are helpful in the context of negative global inflation and quantitative easing. Going cashless is also reducing the levels of corruption prevalent in the country.

Some more benefits of cashless economy are as follows:

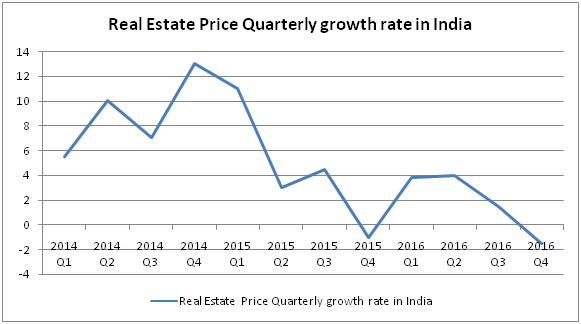

a) Real estate prices will reduce because of curbs on black money as most of black money is invested in Real estate.

Figure-8

Source: Knight Frank and Survey Calculation

b) There is a process of issuance of currency where government bear costs against designing, developing, printing, storing, transporting and placing etc. All this can be avoided by digitalisation of cash transactions. In Financial year 2015, RBI spent Rs. 27 billion for currency issuance and management.

c) It pave way for universal availability of banking services to all as no physical infrastructure is needed other than digital. People can make their payments and receive globally.

d) There is greater efficiency in welfare programmes as money is wired directly into the accounts of recipients with great transparency.

e) There are efficiency gains as transaction costs will also come down by using methods of digital payments.

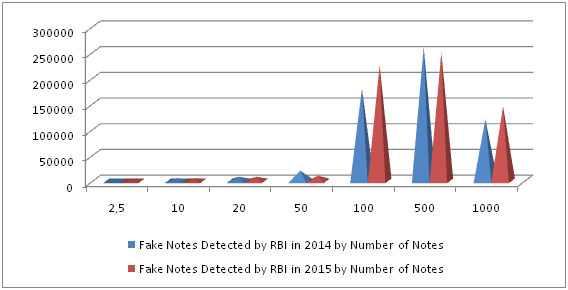

f) In India, 1 in 7 notes is supposed to be fake, which has a huge negative impact on economy. By going cashless transaction, accountability of notes and coins in circulation will be possible.

Figure-9

Source: Ministry of Home Affairs and RBI (Updated by November 9, 2016, Mayank Jain)

g) Soiled or tobacco stained notes full of germs are a norm in India. There are many such incidents in our life where we knowingly or unknowing give and take germs in the form of rupee notes. This can be avoided.

h) In the recent trends of digitalisation will reduce costs of operating ATM’s.

i) Impact of digital transactions increase in GDP by emerging markets resulting growth of country economy.

Findings and Suggestions

The findings of the study show that India in terms of using digital payment methods is still very poor in comparison to other developed countries in the world. As many countries are already turned up with their electronic payment system, India is in its initial stage and most of the population are dependent on cash based transaction because of unavailability of proper internet connectivity, lack of awareness and knowledge of financial transaction, charges on card payments and un operational bank accounts.

India needs to come up with the new policies of digital transactions. It is recommended that government should promote their agencies and private sector service providers to spread financial literacy at a great extend especially in rural areas. Government should provide extra benefits on digital transaction payments and offer extra incentives or interest rate on cash saving in bank accounts. At the same time reduction in charges of digital transaction or exemption completely on digital banking should be offered for few initial years which can be more helpful for speeding up the process of digitalisation of payments in India.

The objective of this study is to find the challenges and opportunities of cashless economy. Cashless economy can be achieved by adoption of proper methods of digital payments. It only requires full proved new financial policies, centralised administrative control, regular monitory attention on the bankers, government agencies and other private service. Safe and secured services like immediate certification of payments , clear statement of their accounts, no hidden charges, full control on money, shorten process of transaction by fulfil of mandatory information . As an overall review, most of the major developed countries in the world are moving in a very excellent way of cashless economy. A history of delayed in development in India is too long. Now the time, India should progress in full steam ahead and create a new legacy. This is time to embrace the cashless economy like other developed countries and we must make the most of it.

1. Currency, D. (2017). Danish Central Bank To Digitalize National Currency . Coin Telegraph . Retrieved 14 March 2017, from https://cointelegraph.com/news/danish-central-bank-to-digitalize-national-currency

2.http://www.hindustantimes.com/analysis/india-is-far-away-from-being-a-cashless-economy-here-s-why/story-ybFui5M53JPFyD1MGvHigJ.html

3. http://hh.diva-portal.org/smash/get/diva2:1079619/FULLTEXT01.pdf

4. https://usa.visa.com/dam/VCOM/download/corporate/media/moodys-economy-white-paper-feb-2013.pdf

5.http://www.hindustantimes.com/analysis/india-is-far-away-from-being-a-cashless-economy-here-s-why/story-ybFui5M53JPFyD1MGvHigJ.html

6. http://hh.diva-portal.org/smash/get/diva2:1079619/FULLTEXT01.pdf

7.https://www.researchgate.net/publication/2311989_Strategic_Challenges_for_Internet_Banking_in_Japan_and_Singapore_-_Anything_to_learn_from_the_US

8.http://www.hindustantimes.com/analysis/india-is-far-away-from-being-a-cashless-economy-here-s-why/story-ybFui5M53JPFyD1MGvHigJ.html

9.https://www.researchgate.net/publication/2311989_Strategic_Challenges_for_Internet_Banking_in_Japan_and_Singapore_-_Anything_to_learn_from_the_US

10. Jun, M. & Cai, S. (2001). The key determinants of Internet banking service quality: a content analysis. International Journal Of Bank Marketing , 19 (7), 276-291. http://dx.doi.org/10.1108/02652320110409825

11. Khosla, S. (2017). India is far away from being a cashless economy. Here’s why . http://www.hindustantimes.com/ . Retrieved 14 March 2017, from http://www.hindustantimes.com/analysis/india-is-far-away-from-being-a-cashless-economy-here-s-why/story-ybFui5M53JPFyD1MGvHigJ.html

12. Sharma, G. (2016). Study of internet banking scenario in India. International Of Emerging Research In Management And Technology , 5 (5), 43-48. Retrieved from https://www.ermt.net/docs/papers/Volume_5/5_May2016/V5N5-138.pdf

13. Suresh Chandra, D. (2015). The Electronic Banking Revolution in India. The Journal Of Internet Banking And Commerce , 20 (2). http://dx.doi.org/10.4172/1204-5357.1000110

14. Sweden's Central Bank Considers Digital Currency - eMarketer . (2017). Emarketer.com . Retrieved 14 March 2017, from https://www.emarketer.com/Article/Swedens-Central-Bank-Considers-Digital-Currency/1015051

15. Young, J. (2017). Moving Toward a Cashless Society: Norway’s Two Largest Banks Abandon Cash . BTCMANAGER . Retrieved 14 March 2017, from https://btcmanager.com/moving-toward-a-cashless-society-norways-two-largest-banks-abandon-cash/

Websites

www.emarketer.com

www.Economy.com

www.study.com

www.google.com

www.worldatlas.com

www.infowars.com

www.en.wikipedia.org

www.peoi.org

www.investoprdia.com

www.businessdictonary.com

www.imf.org

www.flame.org.in

www.economicshelp.org

www.InternetLiveStats.com