A Refereed Monthly International Journal of Management

The Impact of Information Asymmetry and Liquidity Risk on Financial Flexibility:

A case study of selected Corporations of Tehran Stock Exchange

Author

|

Hanieh Karimi

Department of Accounting

Kermanshah Branch

Islamic Azad University

Kermanshah, Iran

|

Babak Jamshidinavid

Department of Accounting

Kermanshah Branch

Islamic Azad University

Kermanshah, Iran

E-mail:- jamshidinavid@iauksh.ac.ir

|

Abstract

The present study is examining the impact of information asymmetry and liquidity

risk on financial flexibility of the selected corporations listed in Tehran Stock

Exchange. The present research is applied in term of its endeavor and also sectional

as it is based on time. The quantitative data is used and the research design is

descriptive and causal as it is examining the relationship between variables such

as information asymmetry, liquidity risk and financial adaptability. For the study

148 listed corporations of Tehran Stock Exchange has been selected for the study

and have been studied between year 2012 to year 2016. In the research, information

asymmetry and liquidity risk of stock are independent variables and their effects

on financial flexibility as the dependent variable in the form of regression model

based on paneling data have been experimentally tested. The research conclusions

indicate that information asymmetry has negative yet significant impact on financial

flexibility while liquidity risk of stock has significant positive consequence on

financial flexibility. All together effect of information asymmetry and liquidity

risk variables on financial flexibility is negative and yet significant. Eventually,

on the basis of conclusions inferred from tests of hypotheses, it can be suggested

that managers should perform suitable functions such as; appropriate disclosure,

accuracy of financial structure, supplement of suitable financial support and reducing

unsuitable conservation. With the help of above mentioned actions, domain difference

of sale and buy bid price and risk of stock liquidity will decrease which will lead

to more financial flexibility. Moreover, it is suggested that investors should look

into extent of risk liquidity of stock in while making investment and they should

avoid investment when the difference of sale and buy price is higher than the corporation

buying stock.

Keywords : Information Asymmetry, Liquidity Risk of Stock, Financial

Flexibility.

Introduction

One of the most imperative factors in investment decision making is suitable and

relative information. If required information’s are distributed asymmetrically (information

transformation will be done unequally between individuals), it can lead to different

conclusions about the subject. It is more important to evaluate Quality information

available rather than information available to the investment decision maker. While

information asymmetry increases of a corporation, its potential value will be different

from a value that investors distinguish in capital market for intended stock. Finally,

stock real values of corporations will be different from expected values by investors.

What is considered in capital markets is that the most of the individuals who invest

in the stock market are normal people and their only ways to access important information,

are the information which are published by corporations. One of these kinds of publications

is annual financial reports where announcement of each share profit and profit is

anticipated by corporations and then is announced for public. If there are individuals

who have more information among investors, who are active in capital markets, will

be in better situations than others because they are aware of announcements about

profit so, they can influence on market supply and demand. Otherwise, they can cause

price spread. The main reason is existence of information asymmetry in capital market

and based on it informative individuals of profit announcement (or important news)

will be situated in better conditions than others. One of the important points that

should always be suggested in capital market especially in Tehran Stock Exchange

id efficiency discussion and based on it existent information in market will reflex

their effects on price stock. The reason for existence of accounting can be defined

as information asymmetry that one of the transaction part has more formation than

another part based on efficiency market hypothesis. This factor is because of internal

transaction and information, (Ghaemi & Vatanparast, 2004).

Investment refinement in a stock depends on liquidity power of its stock which is

one of the dimensions of optimized division process. In fact, liquidity risk is

the main characteristics market sub structural factors that risks individual capital

and play very important roles in investors decisions for buy and sale of their stocks.

Eventually it can be said that liquidity is one of the big sources of risk for investors,

(Piqueria, 2006). Lack of liquidity occurs when stock price in reactions to few

shocks changes rapidly. In fact, lack of liquidity may have negative effect on stock

value, (Martinez & Miguel, 2005). Liquidity is a simple recusant concept that

will not be directly visible. Liquidity easiness and change of an asset to cash

flow is called liquidity, (Pastor & Stambaugh, 2003).

One of the characteristics of commercial units that can help managers to maximize

corporation value is maintaining financial flexibility. Financial flexibility is

organizational ability in recognition of changes, opportunities and threats, rapid

and effective adaptation with new situations to receive suitable performance. Flexibility

can play important role in empowering mangers about use of investment opportunities

in future and capital market problems has made keeping financial flexibility for

corporations to use profitable opportunities. Myers, (1984), indicated that ow threats

of corporations` liabilities can stop their uses of profitable opportunities and

evaluating of commercial unit even when managers and shareholders are interested

in using opportunities, (Khodaeivalehzaghrad & Raretaimori, 2009). Optimized

reservation of sources can cause corporations to be successful in market and corporations

can follow market opportunities successfully and they should benefit from activity

benefits in market. Based on the mentioned factors, this research is investigating

the effect of information asymmetry and liquidity risk of stock on financial flexibility

of corporations.

Research Background

Khadarahmi & et.al. (2015), in their research on “The effect of information

asymmetry on stock price future downfall risk of the accepted corporations in Tehran

Stock Exchange”, concluded that in the situation of lack of information asymmetry,

stock price will fall and lead to increased risk because of non-existence of current

flow of information between managers and investors.

Shaerianaghiz & et.al. (2015), in their research “Relationship between financial

flexibility and kind of financial supplement of the accepted corporations in Tehran

Stock Exchange”, concluded that financial flexibility had positive yet significant

relationship.

Habibisaamr & et.al. (2014), in their research “Relationship between liquidity

risk and market risk with growing stock return and AHP valuing in Tehran Stock Exchange”,

concluded that there was a linear inverse relationship between risk and stock’s

real return.

Bonaime & et.al. (2016), in their research “Financial flexibility expense: observations

of stock rebuy” pointed out that correlation between financial flexibility and corporations

management was less than that of correlation between financial flexibility and profit.

Increase of profit management amount would increase financial flexibility expense

while increase of amount of institutional management supervision would decrease

financial flexibility expense.

De La Bruslerie & Latrous (2014), found that there was a positive meaningful

relationship between ownership structure and leverage indicators of financial flexibility.

Theoretical Bases

Conceptual Definitions

Information Asymmetry

If one part of transaction in a transaction has more information than other part,

there will be information asymmetry, (Ghaemi & Vatanparast, 2004).

Liquidity Risk

Liquidity risk occurs when an individual investor, business or financial institution

cannot meet short-term debt obligations. The investor or entity may be unable to

convert an asset into cash without giving up capital and/or income due to a lack

of buyers or an inefficient market. If owner of stock exchange can`t sell his stock

easily in one secondary market, this factor will cause a kind of risk for him. While

liquidity is higher in stock exchange market, amount of this risk will decrease.

While process change of an asset to cash flow is long or possibility of this change

encounters with doubts, it will have liquidity risk, (Chan & et.al. 2007).

Financial Flexibility

Financial flexibility is the corporation ability to encounter unexpected pauses

in cash flow. It means that ability of demanding loan from different sources, capital

increase, and sale of properties and guidance of corporation operations are for

facing with variable situations. Moreover, financial flexibility based on accounting

standard is ability of commercial unit in term of effective performances to change

amount and time of its cash flows in such a way to show necessary reflection about

unexpected events, (Bagherbaigi, 2011).

Corporation Size

Corporation size means activity mass and amount of a corporation. Corporation size

is an important factor that may effect on capital and accessible amount to cash

flow by different sources.

Growth Opportunities

It is market value ratio to clerical value of shareowners` rights and it is a measurement

criterion for corporation growth.

Operational Definitions

Information Asymmetry

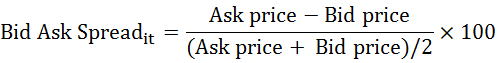

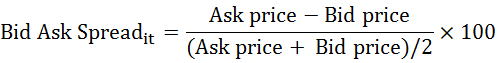

To calculate information symmetry in Tehran Stock Exchange following model will

be used. This model has been used for the first time by Venkatesh & Chiang in

1986 to determine bid price domain to buy and sell stock. Then, other individuals

have used this model in their researchers; the mentioned model is as follow:

Bid Ask Spread it: domain of suggesting price for buy and sale of i corporation

stock in t duration.

Ask Price: average of suggesting price for sale of i corporation stock in t duration.

Bid Price: average of suggesting price for buying of i corporation stock in t duration.

Liquidity Risk

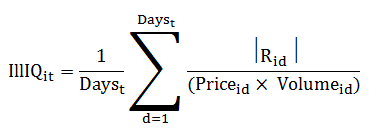

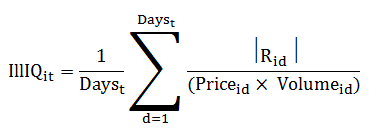

Criterion of liquidity risk is Amicus in this research that is expressed as follow;

IIIQ it= ratio of lack of i stock liquidity in t duration

R id= yearly absolute return of i stock in d day

Price id= i stock price in d day

Volume id= numbers of i stocks in d day in transaction market

Days t= numbers of days that in t duration the possibility of i stock

transaction performance in market will be.

While daily average of transaction mass is high, stock will have high liquidity

and can be transacted easily in market. If daily average of transaction mass is

high, its market price will have lesser changeability because transactions should

be big enough to have effect on stock market price. The above formula numerator

indicates stock daily absolute return that has positive relationship with change

of stock market price. While price constancy is more in market, the formula numerator

will be smaller. Finally, it can be said that higher amount of Amihud lack of liquidity

standard has relationship with lower liquidity of market, (vice versa).

Financial Flexibility

Financial leverage= clerical value of total liability / clerical value of total

properties

Growth Opportunities

In this research, growth opportunity is used as controlling variable that is calculated

as:

Growth opportunity= market value / clerical value

Corporation size

In this research, corporation size is used as controlling variable that is calculated

as:

Corporation size= Ln (yearly pure sale mass)

Research Methodology

Every research should have special research design and method should be used on

the basis of relevant objectives, should use suitable method and instrument to gather

and analyze data that. The research is “applied” in term of its objectives, and

it is “sectional” based on its time. The data used in the research is “quantitative”

whereas the research performance method is “descriptive.. All Statistic population

includes 856 corporations and 148 corporations have been chosen as the research

statistic sample by systematic deletion. In this research, at first random method

was used to gather data and information. In the library part, research theoretical

bases have been gathered from Persian and Latin special books and magazines, and

then the research data have been done by data gathering of chosen corporations by

reference tom their financial statements, descriptive footnotes, weekly reports

and monthly stock exchange through Rahavard Novin Software. Finally, tests of hypotheses

will be done by accumulation of gathered data and doing considerable calculations.

Research Hypotheses

First Hypothesis: Information asymmetry has significant effect on financial flexibility

of corporations.

Second Hypothesis: liquidity risk has significant effect on financial flexibility

of corporations.

Third Hypothesis: information asymmetry and liquidity risk have significant effects

on financial flexibility of corporations.

Specification of Test Kind and Method of Analysis

The statistical tests have been used to check data and to recognize homogeneity

or in homogeneity of research data. Chow Test and F Limer Statistic have been used.

Statistic hypotheses of this test will be described as follow:

H0: Pooling Data

H1: Panel Data

While this test conclusions are based on paneling data use, fixed effects or random

effects models should be used to estimate research model. Husman Test should be

performed to choose one the models.

H0: Random Effects

H1: Fixed Effects

Table 1: conclusions of Chow Test to recognize homogeneity or in homogeneity of

sections

|

Hypothesis test

|

F

|

Statistical probability of F

|

Result of Chow Test

|

|

Research model

|

14.501

|

0.000

|

Paneling data

|

As indicated in the above table, Chow Test conclusion represents that received probability

for F statistic in all research hypotheses is less than 5 percent, so this hypothesis

test data in all models will be use as paneling.

Hausman Test

In this test, Chi-square statistic with K freedom degree will be used. If received

Chi-Du is more than table amount, null hypothesis of random effects will be rejected

and fixed effects hypothesis will be accepted.

Table2: conclusions of Hausman Test to recognize use of fixed or random effects

|

Hypothesis test

|

Statistic amount

|

Statistical probability

|

Test result

|

|

Research model

|

49.030

|

0.000

|

Fixed effects

|

In this test H0 is based on data paneling model with random effects and its contrast

hypothesis, H1 is based on data paneling model with fixed effects. If statistic

of Hausman test is bigger than its crisis amounts or its probability is less than

5 percent, H0 will be rejected and use of fixed effects model will be accepted.

Based on received conclusions of Hausman Test for the research model, while error

is 5 percent, amount of Hausman statistic for this model will be 49.030 and P-Value

<0.05, so H0 will be rejected. Rejection of H0 indicates that method of random

effects is not homogenous and fixed effects method should be used.

Test Conclusions of the Research Hypotheses

In this study, model estimation method is based on panel data. This method is based

on time series information from 2012 to 2016 of 148 accepted corporations` data

in Tehran Stock Exchange. All the estimated numbers for each model variables will

be based on Million Rial. Used software program in this research is Eviews 8 software.

Estimated models have been introduced based ob exhibited hypotheses as regression

models of multi-variables.

Test Conclusions of the First Hypothesis

For the first hypothesis, H0 and H1 will be as:

H0: information asymmetry does not have significant effect on financial flexibility

of corporations.

H1: information asymmetry has significant effect on financial flexibility of corporations.

Regression model for the research first hypothesis will be as:

FFit = α0 + β1 BASit + β2

RISKit + β3 BASit*RISKit + β4

CSit +β5 GO it

Received conclusions of this test will be as:

Table 3: test conclusions of the first hypothesis

|

Variable name

|

Variable symbol

|

Coefficient

|

Standard deviation

|

t statistic

|

Prob.

|

Result

|

|

Fixed amount

|

C

|

0.528

|

0.418

|

1.264

|

0.0001

|

meaningful

|

|

Information asymmetry

|

)1βBAS)

|

-0.099

|

0.046

|

-2.137

|

0.0024

|

meaningful

|

|

Corporation size

|

β4 (CS)

|

0.443

|

0.110

|

4.027

|

0.2451

|

Lack of meaningful

|

|

Growth opportunity

|

β5 (GO)

|

0.092

|

0.049

|

1.875

|

0.0452

|

meaningful

|

|

F statistic

Meaningful level (Prob.)

|

|

38.231

0.000

|

|

Watson-Durbin statistic

|

|

2.139

|

|

Determination coefficient (R2)

Adjusted determination coefficient (Adj R2)

|

|

0.479

0.432

|

Test Result

Based on the test conclusions of the research first model, level of significance

of statistic (0.000) is less than error level and total regression model is significant.

Watson-Durbin statistic (2.139) is in region from 1.5 to 2.5. So, correlation doesn`t

exist between model error members. The value of t is significant (p<0.05) and

due to negative value for β1 coefficient, the test conclusions indicate that information

asymmetry has negative significant effect on financial flexibility, so H0 of the

research can be rejected in 5 percent error level. Moreover, t statistic of the

accepted error level for β2 of this test conclusion indicates that controlling variable

of corporation size does not have meaningful relationship with flexibility and t

statistic of the accepted error level for β5 of this test conclusion indicates controlling

variable of corporation growth opportunity has positive meaningful relationship

with flexibility. Determination coefficient and adjusted determination coefficient

indicate that entered variables in regression can explain 43 percent of dependent

variable changes.

Conclusion

Based on the results received from the tests, it can be concluded that information

asymmetry has negative yet significant effect on financial flexibility in 5 percent

error level. Controlling variable of corporation size has no meaningful relationship

with financial flexibility and growth opportunity variable has positive meaningful

relationship with financial flexibility. Research estimated variable will be as:

FFit= 0.528-0.099BAS+0.443CS+0.092Go

Test Conclusions of the Second Hypothesis

For the first hypothesis, H0 and H1 will be as:

H0: liquidity risk does not have significant effect on financial flexibility of

corporations.

H1: liquidity risk has signifiant effect on financial flexibility of corporations.

Regression model for the research second hypothesis will be as:

FFit = α0 + β1 BASit + β2

RISKit + β3 BASit*RISKit + β4

CSit +β5 GO it

Received conclusions of this test will be as:

Table 4: test conclusions of the second hypothesis

|

Variable name

|

Variable symbol

|

Coefficient

|

Standard deviation

|

t statistic

|

Prob.

|

Result

|

|

Fixed amount

|

C

|

0.528

|

0.418

|

1.264

|

0.0001

|

meaningful

|

|

Liquidity risk of stock

|

β2(Risk)

|

0.637

|

0.148

|

4.291

|

0.0057

|

meaningful

|

|

Corporation size

|

β4(CS)

|

0.443

|

0.110

|

4.027

|

0.2451

|

Lack of meaningful

|

|

Growth opportunity

|

β5 (GO)

|

0.092

|

0.049

|

1.875

|

0.0452

|

meaningful

|

|

F statistic

Meaningful level (Prob.)

|

|

38.231

0.000

|

|

Watson-Durbin statistic

|

|

2.139

|

|

Determination coefficient (R2)

Adjusted determination coefficient (Adj R2)

|

|

0.479

0.432

|

Test Result

Based on the test conclusions of the research second model, level of significance

of statistic (0.000) is less than error level and total regression model is meaningful.

Watson-Durbin statistic (2.139) is in region from 1.5 to 2.5. So, correlation doesn`t

exist between model error members. As the t statistics is lower than p value and

due to negative value for β1 coefficient, the test conclusions indicate that liquidity

risk has positive meaningful effect on financial flexibility, so H0 of the research

can be rejected in 5 percent error level. Moreover, t statistic of the accepted

error level for β4 of this test conclusion indicates that controlling variable of

corporation size does not have significant relationship with flexibility and t statistic

of the accepted error level for β5 of this test conclusion indicates controlling

variable of corporation growth opportunity has positive meaningful relationship

with flexibility. Determination coefficient and adjusted determination coefficient

indicate that entered variables in regression can explain 43 percent of dependent

variable changes.

Conclusion

Based on the received conclusions of the test, it can be concluded that liquidity

risk of stock has meaningful effect on financial flexibility in 5 percent error

level. Controlling variable of corporation size has no meaningful relationship with

financial flexibility and growth opportunity variable has positive meaningful relationship

with financial flexibility. Research estimated variable will be as:

FFit= 0.528+ 0.637RISK+0.443CS+0.092Go

Test Conclusions of the Third Hypothesis

For the first hypothesis, H0 and H1 will be as:

H0: information asymmetry and liquidity risk do not have significant effect on financial

flexibility of corporations.

H1: information asymmetry and liquidity risk have significant effect on financial

flexibility of corporations.

Regression model for the research third hypothesis will be as:

FFit = α0 + β1 BASit + β2

RISKit + β3 BASit*RISKit + β4

CSit +β5 GO it

Received conclusions of this test will be as:

Table 5: test conclusions of the second hypothesis

|

Variable name

|

Variable symbol

|

Coefficient

|

Standard deviation

|

t statistic

|

Prob.

|

Result

|

|

Fixed amount

|

C

|

0.528

|

0.418

|

1.264

|

0.0001

|

meaningful

|

|

Liquidity risk of stock

|

β2(Risk)

|

0.637

|

0.148

|

4.291

|

0.0057

|

meaningful

|

|

Information asymmetry

|

β2(BAS)

|

-0.99

|

0.046

|

-2.137

|

0.0024

|

meaningful

|

|

Information symmetry* Risk

|

β3(BAS*Risk)

|

-0.167

|

0.037

|

-4.522

|

0.0328

|

Meaningful

|

|

Corporation size

|

β4(CS)

|

0.443

|

0.110

|

4.027

|

0.2451

|

Lack of meaningful

|

|

Growth opportunity

|

β5 (GO)

|

0.092

|

0.049

|

1.875

|

0.0452

|

meaningful

|

|

F statistic

Meaningful level (Prob.)

|

|

38.231

0.000

|

|

Watson-Durbin statistic

|

|

2.139

|

|

Determination coefficient (R2)

Adjusted determination coefficient (Adj R2)

|

|

0.479

0.432

|

Test Result

Based on the test conclusions of the research second model, meaningful level of

statistic (0.000) is less than error level and total regression model is meaningful.

Watson-Durbin statistic (2.139) is in region from 1.5 to 2.5. So, correlation doesn`t

exist between model error members. The value of t is significant (p<0.05) and

due to negative value for β1 coefficient, the test conclusions indicate that liquidity

risk and information asymmetry have negative significant effect on financial flexibility,

so H0 of the research can be rejected at 5 percent level of significance. Moreover,

t statistic of the accepted error level for β4 of this test conclusions indicates

that controlling variable of corporation size does not have meaningful relationship

with flexibility and t statistic of the accepted error level for β5 of this test

conclusions indicates controlling variable of corporation growth opportunity has

positive meaningful relationship with flexibility. Determination coefficient and

adjusted determination coefficient indicate that entered variables in regression

can explain 43 percent of dependent variable changes.

Conclusion

Based on the received conclusions of the test, it can be concluded that liquidity

risk of stock has meaningful effect on financial flexibility in 5 percent error

level. Controlling variable of corporation size has no meaningful relationship with

financial flexibility and growth opportunity variable has positive meaningful relationship

with financial flexibility. Research estimated variable will be as:

FFit= 0.528+ 0.637RISK -0.099BAS -0.167BAS*RISK+0.443CS+0.092Go

Table 6: Summery of independent variable effectiveness conclusions on dependent

variables.

|

Dependent variable

|

Financial flexibility

|

|

Result

|

Effect

|

Variables

|

|

Rejection of H0

|

Negative

|

Information asymmetry

|

Independent variables

|

|

Rejection of H0

|

Positive

|

Liquidity risk

|

|

Rejection of H0

|

Negative

|

Asymmetry *Risk

|

Research Findings in Term of Test Division of each of the Hypotheses

First Hypothesis

Based on the research first model test conclusions, meaningful level of statistic

(0.000) is less than error level and total regression model is meaningful. Watson-Durbin

statistic (2.139) is in region from 1.5 to 2.5. So, correlation doesn`t exist between

model error members. The value of t is significant (p<0.05) and due to negative

value for β1 coefficient, the test conclusions indicate that information asymmetry

has negative meaningful effect on financial flexibility, so H0 of the research can

be rejected in 5 percent error level.

On the basis of hypothesis test it can be concluded that information asymmetry has

negative meaningful effect on financial flexibility, it means that the effect of

information asymmetry on financial flexibility is a reversed effect.

As mentioned before in the theoretical bases, information asymmetry occurs when

individuals inside or outside of the corporation access to the information that

other individuals are not aware of. This lack of information balance will cause

information asymmetry. While amount of information asymmetry in stock market is

higher, it will stock sale and buy bids. It means that negative secret information

divulgence will cause stock supply be more and sale bid price be higher and vice

versa. Without information asymmetry, as mentioned before information will increase

domain of sale and buy bid price and will stop retail investors` investments. Otherwise,

demand amount for corporation stock will decrease and finally, stock liquidity will

move down and this function will be followed by corporation access to financial

sources because they can sell less stock. Creditors know stock liquidity amount

of a corporation in Tehran Stock Exchange as they use to evaluate their performances

on regular basis. Based on conclusions of research hypothesis test, it can be concluded

that if information amount increases, corporation access amount to financial sources

will be less and the corporation financial flexibility will decrease. These conclusions

are similar to that of the researches done by Langford & Watts (2008), Behartachia

& et.al. (2008), and Antoniewgpiou & et.al. (2011). Moreover, this research

hypothesis conclusions will be correlated to the Iranian done researches by Khodarahmi

& et.al. (2015), Saghafi & et.al. (2013), and Khodamipoor & et.al. (2012).

Second Hypothesis

Based on the test conclusions of the research second model, meaningful level of

statistic (0.000) is less than error level and total regression model is meaningful.

Watson-Durbin statistic (2.139) is in region from 1.5 to 2.5. So, correlation doesn`t

exist between model error members. The value of t is significant (p<0.05) and

due to negative value for β1 coefficient, the test conclusions indicate that liquidity

risk has positive meaningful effect on financial flexibility, so H0 of the research

can be rejected in 5 percent error level.

Received conclusion of this hypothesis test indicates increase liquidity risk of

stock will be followed by increase of corporation financial flexibility. It means

the direct effect of liquidity risk on financial flexibility. Based on research

theoretical bases, it is expected logically that with danger increase amount of

lack of stock liquidity, corporation stock demand, corporation financial access

amount and corporation financial flexibility will decrease. However, this hypothesis

result can be proved for another subject. It can be expressed as; corporations that

have been run or corporations whose stocks don`t have high liquidity in stock exchange

are more conservatism corporations, it means that they will avoid investment opportunities

or postpone unnecessary payments because they can reserve their financial sources

to pay and react for necessary and suddenly payments immediately. So, it can be

said that, corporations that are aware of high risk of their stock liquidity, will

reserve more amount of cash flow to have sufficient financial sources for their

necessary payments, so this approach expresses that liquidity risk of high stock

can increase amount of cash low reservation by corporations` financial managers

and this function will increase amount of corporation financial flexibility.

This research hypothesis conclusions are against the researches done by, Skoobin

& Wan Hool (2010), and Arsalan & et.al. (2010), moreover; they are against

the researches done in Iran such as; Habibisamar & et.al. (2014), while these

conclusions are correlated with the researches done by Falahshams & Hashemei,

(2015).

Third Hypothesis

Based on the test conclusions of the research second model, meaningful level of

statistic (0.000) is less than error level and total regression model is meaningful.

Watson-Durbin statistic (2.139) will be in this distance from 1.5 to 2.5. So, correlation

doesn`t exist between model error members. Based on lowering of t statistic of P-Value

from acceptance error level 5 percent and in attention to negative amount of t statistic

for β3 coefficient, the test conclusions indicate that liquidity risk and information

asymmetry have negative meaningful effect on financial flexibility, so H0 of the

research can be rejected in 5 percent error level.

Based on the received conclusions of this research hypothesis, it can be expressed

that if amount of stock liquidity risk stock with information asymmetry of a corporation

increase, corporation access amount to financial sources will be less and finally,

corporation financial flexibility will decrease. It means that lack of information

asymmetry with stock liquidity risk will decrease corporation financial flexibility.

When a corporation will be encountered with gap in demand and supply because of

lack of suitable information divulgence. The mentioned subject will decrease usual

shareholders` demands to buy their stocks and this factor will make corporation

stock liquidity risk goes higher and it will be followed by corporation access decrease

to external financial sources and they should use internal financial sources such

as; conserved profit or partners` suggested profits to supply financial part of

their corporations. In this situation, corporation will face with financial limitation

that have direct effect on lack of corporation financial flexibility.

Conclusion

Based on the received conclusions of the research three hypotheses it can be concluded

that increase lack of information asymmetry will create obstacle from corporation

stock buy for public and only individual who access to secret information will benefit

and it result will cause that investors will encounter with decrease of the values

of their stocks. Because domain of buy and sale bid price will increase and corporation

stock liquidity will be less and it is a reason for increase of corporation financial

limitation amount and decrease of corporation financial flexibility. However, corporations

that without lack of information asymmetry their sale and buy are high can because

of other reasons such as; new running corporation or systematic risk of inflation,

downturn or barriers for ingredient import from outside of the country can be reasons

for high risk of corporation stock. In these situations corporations can store their

cash flows in attention to their stock liquidity risks to use them in time of sudden

payments to have answer ability to these situations. So, they will be in high level

in term of financial flexibility. Finally, a corporation that has both information

asymmetry and high stock liquidity risk it is expected logically that corporation

access amount to financial sources will decrease not only by stock sale but also

by financial supplement such as; loan and this function will be the result of high

financial limitation and decrease of corporation financial flexibility.

Suggestions from Test Conclusions of Hypotheses

1) In consideration to the first hypothesis conclusions, it can be said that lack

of information asymmetry has negative effects for corporation investors and this

factor only benefit will be for the individuals who access secret information. This

research hypothesis indicates that if lack of information asymmetry increases, corporation

financial flexibility will be less. By considering this factor it is suggested that

managers should stop existing lack of information asymmetry because it will cause

endangering of stock liquidity in stock exchange market. The main sources of this

subject can cause suitable internal control creations with information suitable

divulgence that cause misuses of organization internal individuals. With decrease

of lack of information asymmetry amount, it can be expected that corporation stock

will have higher demand in market and stock liquidity amount will increase. Moreover,

it is suggested that investors in stock exchange should consider structure of corporation

guideline system such as, presents of institutional investors in mixture of investors

and presents of irresponsible members in the board mixture and competition status

in product market. In addition to, corporations whose stock have been transacted

by investigating financial statements of the previous durations conclude that their

information divulgence amount will be suitable and will cause barriers for lack

of information asymmetry.

2) Based on the received conclusions of the second hypothesis, liquidity risk amount

will increase corporation financial flexibility amount. It is suggested that financial

managers should consider other suitable ways to increase their financial flexibility

amount in spite of cash flow storage such as; financial leverage increase as same

as suitable size of corporation payment ability, correctness of corporation capital

structure and investment in the projects with less risks. Cash flow storage can

increase corporation financial flexibility; however, it will cause barrier for the

corporation use of profitable opportunities. So, it is suggested that cash flow

storage should be for contrast of stock liquidity risk in the acceptable and suitable

level to the corporation capacity. Moreover, it is suggested that investors in stock

exchange shouldn`t know financial flexibility and on time payment of stock profit

as their stock choice criterions because it may be that financial flexibility will

be the result of high cash flow storage and high risk of lack of stock liquidity

and these reasons can`t be valuable for the corporation profitability.

3) Finally, third hypothesis conclusion indicates that information asymmetry and

liquidity risk together can stop corporation financial flexibility increase and

they will decrease corporation financial ability. So, it is suggested that mangers

should make appropriate decisions to decrease information asymmetry and stock liquidity

risk such as; suitable divulgence, financial structure correctness, suitable financial

supplement, investment in profitable projects, decrease of unsuitable storage of

cash flow and other similar functions. Because they can decrease domain difference

of buy and sale bid price and decrease stock liquidity risk, so corporation accesses

to financial sources easily and own more financial flexibility. In addition to,

it is suggested to creditors and banks that corporation should have appropriate

performance of information suitable divulgence during previous durations for giving

loans and credits and corporations should have information suitable divulgence amount.

It is suggested that investors should invest in the corporations that have less

stock liquidity risk and existence of liability in balance sheet can`t be reason

for the corporation weakness. It should be clarified that financial supplement have

been for what purposes and it is not the only negative factor for investments in

the projects but it can increase relative corporation stock value. So, not only

mentioned factors but also financial flexibility should be considered.

References

- Bagherbaigi, M., Pooralikelayeh. M.R., Armin, A. (2011), “Investigating relationship

between financial flexibility with growth situations and future value of the accepted

corporations in Tehran Stock Exchange”, The First Meeting of Management Discussion

Gradation Solutions, Accounting & Industrial Engineering in Organizations

- Habibisamar, J., Tehrani, R., Ansari, K. (2014), “Investigating relationship between

liquidity risk and market risk with valuing and growing stock return of AHP in Tehran

Stock Exchange”, Magazine of Stock Exchange Management & Financial Engineering,

No. 23, p.p. 39-58

- Khodarahmi, B., Foroghnezhad, H., Sharifi, M.J., Talebi, A.R. (2015), “The effect

of information asymmetry on future downturn risk of stock price in the accepted

corporation of Tehran Stock Exchange”, Researching & Scientific Quarterly of

Property Management & Financial Supplement, 4 th Year, No. 3, p.p.

39-58

- Khodaeivalehzaghrad, M., Raretaimoori, M. (2009), “The effect of financial flexibility

on investment decisions”, Magazine of Financial Management & Financial Portfolio

Management, No. 3, p.p. 155-173

- Shaerianaghizh, S., Bolo, Gh., Mohsenimalekirastaghi, B. (2015), “Relationship

between financial flexibility and financial supplement kind in the accepted corporation

of Tehran Stock Exchange”, 6th year, No. 22, p.p. 171-190

- Ghaemi, M.H., Vatanparast. M.R. (2004), “Investigating accounting information

role in decrease of information asymmetry in Tehran Stock Exchange”, Investigations

of Accounting and Auditing, 12th Year, No. 41, p.p.85-103

-Vakilirfard, H.R., Rostami, V. (2009), “Analysis of information asymmetry gap domain

between profession members, producers, and users of accounting information based

on qualitative accounting information and financial reporting”, Management Accounting,

3rd Duration, No. 6, p.p. 25-39

-Amihud, Y. (2002) Illiquidity and Stock Returns: Cross – Section and Time Series

Effects, Journal of Financial Markets5, PP. 31–56.

-Bonaime, A. A., Hankins, K. W., & Jordan, B. D (2016). "The cost of financial

flexibility: Evidence from share repurchases". S0929-1199(16) 30018-9, pp. 1-50.

-Chan, J. S. P., Hong, D., & Subrahmanyan, M. G. (2007)." A tale of two prices:

Liquidity and asset prices in multiple market". Journal of Banking &Finance,

Vol. 32, pp 947-960.

-De La Bruslerie, Hubert and Latrous Imen. (2014). Ownership Structure and Debt

Leverage: Empirical Test of a Trade-off Hypothesis on French Firms. Journal of Multinational

Financial Management, 22 (4): PP.111-130.

-Martinez, A., & Miguel, N. B (2005). "Asset pricing and liquidity risk: A empirical

investigation of the Spanish stock market". International Review of Economics and

Finance 14, 81–103.

-Myers, S. and Majluf, N. (1984). Corporate financing and investmentdecisions when

firms have information that investors do not have. Journal Finance Economic , 13,

187–221.

-Pastor, L., & Stambaugh, R. (2003)." Liquidity risk and expected stock returns".

Journal of Political Economy 111, 642–685.

-Piqueira, N (2006). "Trading activity, illiquidity costs and stock returns, working

paper". Princeton University, Social Science ElectronicPublishing, Inc.

-Venkatesh, P. C., and R. Chiang, (1986) “Information Asymmetry andthe Dealers Bid-

Ask Spread: A Case Study of Earnings and Dividend Announcements ".The Journal of

Finance,Vol.41,No.5,pp 1089-1102.