Assistant Professor, Department of Business Administration, Assam University, Silchar

Professor, Department of Statistics, Assam University, Silchar

The study attempts to investigate and compare the selected banks on Electronic Banking Quality attributes. Later the study prepares an index based on the performance of banks. A sample of 400 respondents were collected from the districts of Southern Assam, India based on post stratified random sampling. Descriptive statistics were used to measure the performance mean scores. For developing the overall performance index simple arithmetic calculations were conducted. Later to find out whether the means obtained are significantly different, one way ANOVA have been calculated and further investigation is done with the help of Tukey’s Post Hoc Test. The results revealed that there is a significant difference of performances of the selected banks on different quality attributes. As a result indexing of the banks based on performance was possible. An overall performance index has been computed to find the overall position of the banks under study based on the quality dimensions .The index obtained is very helpful in identifying the position or overall status of E-banking service of a particular bank under study. From the mean scores obtained the banking organizations can identify and measure the difference in scores from the top position and differences of scores with its competitors.

Key words: E-banking, Performance, Index, Qualitative Dimensions, Post Hoc Test

In the context of banking, the distribution channel is known as delivery channel. According to (Kotler & Armstong, 1999), a distribution channel is a set of interdependent organizations (intermediaries) involved in the process of making a product or service available for use or consumption by the consumer or business user.

Electronic banking is a bigger platform than just banking via the Internet (Nasri, 2011). The definition of Electronic Banking varied from time to time. (Nitsure, 2003) defined Electronic Banking as provision of banking products and services through electronic delivery channels. E-banking is defined as the automated delivery of new and traditional banking products and services directly to customers through electronic, interactive communication channels (Salehi, 2010) . The different types of E-banking are internet banking, mobile banking, debit card, credit card, telephone banking, TV based banking etc.

Based on the conceptualization of E- Banking quality dimensions derived from literature review, the closely related parameters are grouped together into four dimensions i.e. E-banking Channel Design, Reliability, Responsiveness and Security.

|

Dimensions |

Closely related dimensions |

Reference |

|

E-banking channel Design |

Website interactivity, Website in- formativeness, website ease of use, Navigation structure ,Information content, richness, Graphic style, website usability, Website aesthetics |

(Gupta & Bansal, 2012), (Molapo, 2008), (Costas, Vasiliki, & Dimitrious) , (Swaid & Wigand, 2009), (Jun & Cai, 2001), (Montoya-Weiss, Voss, & Grewal, Fall 2003), (Yang, Jun, & Peterson, 2004), (Rahman, Cripps, Salo, Hussain, & Zaheer, 2013), (Barnes & Vidgen, 2002) , (Lee & Lin, 2005) , (Wolfinbarger & Gilly, 2003). |

|

Reliability |

Security, Privacy, Trust, Accuracy |

(Wolfinbarger & Gilly, 2003), (Lee & Lin, 2005), (Barnes & Vidgen, 2002) , (Rahman, Cripps, Salo, Hussain, & Zaheer, 2013), (Yang, Jun, & Peterson, 2004) , (Woldie, Hinson, Iddrisu, & Boateng, 2008), (Jun & Cai, 2001), (Bauer, Hammerschmidt, & Falk, 2005), (Swaid & Wigand, 2009), (Gupta & Bansal, 2012) |

|

Responsiveness |

Timeliness, Queue management |

(Lee & Lin, 2005), (Yang, Jun, & Peterson, 2004), (Woldie, Hinson, Iddrisu, & Boateng, 2008), (Jun & Cai, 2001), (Joseph, McClure, & Joseph, 1999), (Bauer, Hammerschmidt, & Falk, 2005), (Swaid & Wigand, 2009), (Molapo, 2008), (Gupta & Bansal, 2012) |

|

Service |

Site contact, transaction support, Feedback/compliant Management |

(Wolfinbarger & Gilly, 2003), (Rahman, Cripps, Salo, Hussain, & Zaheer, 2013), (Molapo, 2008), (Bauer, Hammerschmidt, & Falk, 2005), (Joseph, McClure, & Joseph, 1999) |

The objective of the current study is to measure the performance of banks in different dimensions, develop an overall performance index and conduct multiple comparisons from the responses of E-banking users specifically the salaried employees.

Here in this paper performance is measured under quality dimensions stated above. Descriptive statistics were used to measure the performance mean scores. For developing the overall performance index simple arithmetic calculations were conducted in excel. Later to find out whether the means obtained are significantly different, one way ANOVA have been calculated to test the difference of means.

Since ANOVA can only tell whether groups in the sample differ, it cannot tell which groups differ, hence to further investigate which pair of groups in the sample are differing, TUKEYS PostHoc Test is conducted. Tukey's method (also known as Tukey's honestly significant difference) is commonly used to determine the minimum difference between means of any two groups before they can be considered significantly different[i].

A survey was conducted keeping in mind the study area i.e. Cachar, Hailakandi and Karimganj districts of Assam, India. The top eleven banks were selected based on their presence in the surveyed area. Considering an error of 5 %, sample of 400 units were taken into study based on post stratified random sampling. The sample consists of persons who are salaried employees at the same time E-banking users of their respective banks. The number of respondents collected from each bank was based on proportional allocation that they contribute in the total population.

Table 2: Bank wise sample size collected

| Slno. | Name of bank | Total no of Customers(Population) as on 2014 | Sample collected out of 400 |

| 1 | STATE BANK OF INDIA | 399206 | 246 |

| 2 | ICICI BANK LTD | 7800 | 5 |

| 3 | AXIS BANK LTD | 20000 | 12 |

| 4 | HDFC BANK LTD. | 7374 | 5 |

| 5 | UNION BANK OF INDIA | 67239 | 41 |

| 6 | BANK OF BARODA | 16429 | 10 |

| 7 | CANARA BANK | 25688 | 16 |

| 8 | VIJAYA BANK | 14500 | 9 |

| 9 | UCO BANK | 54593 | 34 |

| 10 | INDUSIND BANK LTD | 3000 | 2 |

| 11 | PUNJAB NATIONAL BANK | 32843 | 20 |

| Total | 648672 | 400 |

This section deals with the analysis and results about performance obtained from responses.

Reliability tests were conducted to ensure the validity and precision of the statistical analysis and accordingly Cronbach’s Alpha(α) for the main dimensions were calculated as below:

Table 3: Reliability Statistics of the dimensions

| No. | Constructs | No of Items | Coefficient |

| 1 | E-Banking Channel design | 6 | 0.850 |

| 2 | Reliability | 5 | 0.801 |

| 3 | Responsiveness | 4 | 0.816 |

| 4 | Service | 4 | 0.834 |

| Overall | 19 | 0.891 |

7.2 Performance of banks based on responses

The following tables have been obtained by calculating the mean of the responses separately for each bank under consideration for the four individual dimensions. Hence for different dimensions we had different mean scores of different banks under study.

Table 4: Performance on E- Banking Channel Design

| BANK | E Banking Channel Design(Mean Scores) |

| SBI | 5.927 |

| ICICI | 6.067 |

| AXIS | 6.556 |

| HDFC | 5.767 |

| UNION | 5.959 |

| BOB | 6.167 |

| CANARA | 5.719 |

| VIAJAYA | 5.870 |

| UCO | 5.549 |

| INDUSIND | 5.500 |

| PNB | 5.750 |

Table 5: Performance on Reliability

| BANK | Reliability (Mean Scores) |

| SBI | 5.928 |

| ICICI | 5.840 |

| AXIS | 6.383 |

| HDFC | 5.600 |

| UNION | 5.863 |

| BOB | 6.220 |

| CANARA | 4.988 |

| VIAJAYA | 5.356 |

| UCO | 5.735 |

| INDUSIND | 6.200 |

| PNB | 5.923 |

| BANK | Responsiveness (Mean Scores) |

| SBI | 5.933 |

| ICICI | 6.300 |

| AXIS | 6.292 |

| HDFC | 5.650 |

| UNION | 6.012 |

| BOB | 6.225 |

| CANARA | 5.969 |

| VIAJAYA | 5.472 |

| UCO | 5.507 |

| INDUSIND | 6.000 |

| PNB | 5.438 |

Table 7: Performance on Service

| BANK | Service (Mean Scores) |

| SBI | 5.821 |

| ICICI | 5.650 |

| AXIS | 6.229 |

| HDFC | 5.050 |

| UNION | 4.927 |

| BOB | 5.525 |

| CANARA | 5.406 |

| VIAJAYA | 5.083 |

| UCO | 5.522 |

| INDUSIND | 4.875 |

| PNB | 4.900 |

[i] http://www.statstodo.com/Posthoc_Exp.php

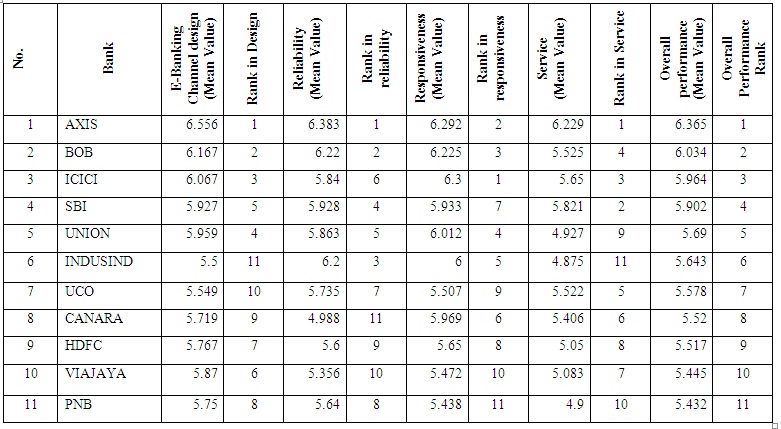

Table 8: Overall Performance Index

The overall performance index Table 8: suggests that as per the overall ranking of performance is concerned, AXIS bank tops the list with score 6.365 out of 7, which is followed by Bank of Baroda with score 6.034. In the third position is ICICI bank with SBI in fourth position. At the bottom we have Punjab National Bank.

Now we need to find out whether the means obtained are significantly different. Thus we use one way ANOVA to test the difference of means.

After conducting the one way ANOVA we obtain the following result.

Table 9: One Way ANOVA for difference of means

| ANOVA | ||||||

| Source of Variation | SS | Df | MS | F | P-value | F crit |

| Between Groups | 3.485123 | 10 | 0.348512 | 2.795071 | 0.012706 | 2.132504 |

| Within Groups | 4.114709 | 33 | 0.124688 | |||

| Total | 7.599832 | 43 |

Here since p value is less than 0.05 and at the same time F (Critical value) is less than F value, we reject the null hypothesis and state that the mean scores obtained are not equal, i.e. the differences in mean scores are significant.

Now to further investigate which pair of groups in the sample are differing TUKEYS PostHoc Test is conducted. The table below shows the multiple comparisons of means each of different banks

| Table 10: Multiple Comparisons | ||||||

| Scores Tukey HSD | ||||||

| (I) Banks | (J) Banks | Mean Difference (I-J) | Std. Error | Sig. | 95% Confidence Interval | |

| Lower Bound | Upper Bound | |||||

| SBI | ICICI | -.062000 | .249688 | 1.000 | -.92411 | .80011 |

| AXIS | -.462750 | .249688 | .741 | -1.32486 | .39936 | |

| HDFC | .385500 | .249688 | .894 | -.47661 | 1.24761 | |

| UNION | .212000 | .249688 | .998 | -.65011 | 1.07411 | |

| BOB | -.132000 | .249688 | 1.000 | -.99411 | .73011 | |

| CANARA | .381750 | .249688 | .899 | -.48036 | 1.24386 | |

| VIJAYA | .457000 | .249688 | .754 | -.40511 | 1.31911 | |

| UCO | .324000 | .249688 | .963 | -.53811 | 1.18611 | |

| INDUSIND | .258500 | .249688 | .993 | -.60361 | 1.12061 | |

| PNB | .470250 | .249688 | .723 | -.39186 | 1.33236 | |

| ICICI | SBI | .062000 | .249688 | 1.000 | -.80011 | .92411 |

| AXIS | -.400750 | .249688 | .869 | -1.26286 | .46136 | |

| HDFC | .447500 | .249688 | .776 | -.41461 | 1.30961 | |

| UNION | .274000 | .249688 | .988 | -.58811 | 1.13611 | |

| BOB | -.070000 | .249688 | 1.000 | -.93211 | .79211 | |

| CANARA | .443750 | .249688 | .784 | -.41836 | 1.30586 | |

| VIJAYA | .519000 | .249688 | .599 | -.34311 | 1.38111 | |

| UCO | .386000 | .249688 | .893 | -.47611 | 1.24811 | |

| INDUSIND | .320500 | .249688 | .965 | -.54161 | 1.18261 | |

| PNB | .532250 | .249688 | .565 | -.32986 | 1.39436 | |

| AXIS | SBI | .462750 | .249688 | .741 | -.39936 | 1.32486 | ||||||||||

| ICICI | .400750 | .249688 | .869 | -.46136 | 1.26286 | |||||||||||

| HDFC | .848250 | .249688 | **.057 | -.01386 | 1.71036 | |||||||||||

| UNION | .674750 | .249688 | .242 | -.18736 | 1.53686 | |||||||||||

| BOB | .330750 | .249688 | .957 | -.53136 | 1.19286 | |||||||||||

| CANARA | .844500 | .249688 | **.059 | -.01761 | 1.70661 | |||||||||||

| VIJAYA | .919750* | .249688 | *.029 | .05764 | 1.78186 | |||||||||||

| UCO | .786750 | .249688 | **.099 | -.07536 | 1.64886 | |||||||||||

| INDUSIND | .721250 | .249688 | .170 | -.14086 | 1.58336 | |||||||||||

| PNB | .933000* | .249688 | *.025 | .07089 | 1.79511 | |||||||||||

| HDFC | SBI | -.385500 | .249688 | .894 | -1.24761 | .47661 | ||||||||||

| ICICI | -.447500 | .249688 | .776 | -1.30961 | .41461 | |||||||||||

| AXIS | -.848250 | .249688 | **.057 | -1.71036 | .01386 | |||||||||||

| UNION | -.173500 | .249688 | 1.000 | -1.03561 | .68861 | |||||||||||

| BOB | -.517500 | .249688 | .603 | -1.37961 | .34461 | |||||||||||

| CANARA | -.003750 | .249688 | 1.000 | -.86586 | .85836 | |||||||||||

| VIJAYA | .071500 | .249688 | 1.000 | -.79061 | .93361 | |||||||||||

| UCO | -.061500 | .249688 | 1.000 | -.92361 | .80061 | |||||||||||

| INDUSIND | -.127000 | .249688 | 1.000 | -.98911 | .73511 | |||||||||||

| PNB | .084750 | .249688 | 1.000 | -.77736 | .94686 | |||||||||||

| UNION | SBI | -.212000 | .249688 | .998 | -1.07411 | .65011 | ||||||||||

| ICICI | -.274000 | .249688 | .988 | -1.13611 | .58811 | |||||||||||

| AXIS | -.674750 | .249688 | .242 | -1.53686 | .18736 | |||||||||||

| HDFC | .173500 | .249688 | 1.000 | -.68861 | 1.03561 | |||||||||||

| BOB | -.344000 | .249688 | .945 | -1.20611 | .51811 | |||||||||||

| CANARA | .169750 | .249688 | 1.000 | -.69236 | 1.03186 | |||||||||||

| VIJAYA | .245000 | .249688 | .995 | -.61711 | 1.10711 | |||||||||||

| UCO | .112000 | .249688 | 1.000 | -.75011 | .97411 | |||||||||||

| INDUSIND | .046500 | .249688 | 1.000 | -.81561 | .90861 | |||||||||||

| PNB | .258250 | .249688 | .993 | -.60386 | 1.12036 | |||||||||||

| BOB | SBI | .132000 | .249688 | 1.000 | -.73011 | .99411 | ||||||||||

| ICICI | .070000 | .249688 | 1.000 | -.79211 | .93211 | |||||||||||

| AXIS | -.330750 | .249688 | .957 | -1.19286 | .53136 | |||||||||||

| HDFC | .517500 | .249688 | .603 | -.34461 | 1.37961 | |||||||||||

| UNION | .344000 | .249688 | .945 | -.51811 | 1.20611 | |||||||||||

| CANARA | .513750 | .249688 | .613 | -.34836 | 1.37586 | |||||||||||

| VIJAYA | .589000 | .249688 | .421 | -.27311 | 1.45111 | |||||||||||

| UCO | .456000 | .249688 | .757 | -.40611 | 1.31811 | |||||||||||

| INDUSIND | .390500 | .249688 | .886 | -.47161 | 1.25261 | |||||||||||

| PNB | .602250 | .249688 | .390 | -.25986 | 1.46436 | |||||||||||

| CANARA | SBI | -.381750 | .249688 | .899 | -1.24386 | .48036 | ||||||||||

| ICICI | -.443750 | .249688 | .784 | -1.30586 | .41836 | |||||||||||

| AXIS | -.844500 | .249688 | **.059 | -1.70661 | .01761 | |||||||||||

| HDFC | .003750 | .249688 | 1.000 | -.85836 | .86586 | |||||||||||

| UNION | -.169750 | .249688 | 1.000 | -1.03186 | .69236 | |||||||||||

| BOB | -.513750 | .249688 | .613 | -1.37586 | .34836 | |||||||||||

| VIJAYA | .075250 | .249688 | 1.000 | -.78686 | .93736 | |||||||||||

| UCO | -.057750 | .249688 | 1.000 | -.91986 | .80436 | |||||||||||

| INDUSIND | -.123250 | .249688 | 1.000 | -.98536 | .73886 | |||||||||||

| PNB | .088500 | .249688 | 1.000 | -.77361 | .95061 | |||||||||||

| VIJAYA | SBI | -.457000 | .249688 | .754 | -1.31911 | .40511 | ||||||||||

| ICICI | -.519000 | .249688 | .599 | -1.38111 | .34311 | |||||||||||

| AXIS | -.919750* | .249688 | *.029 | -1.78186 | -.05764 | |||||||||||

| HDFC | -.071500 | .249688 | 1.000 | -.93361 | .79061 | |||||||||||

| UNION | -.245000 | .249688 | .995 | -1.10711 | .61711 | |||||||||||

| BOB | -.589000 | .249688 | .421 | -1.45111 | .27311 | |||||||||||

| CANARA | -.075250 | .249688 | 1.000 | -.93736 | .78686 | |||||||||||

| UCO | -.133000 | .249688 | 1.000 | -.99511 | .72911 | |||||||||||

| INDUSIND | -.198500 | .249688 | .999 | -1.06061 | .66361 | |||||||||||

| PNB | .013250 | .249688 | 1.000 | -.84886 | .87536 | |||||||||||

| UCO | SBI | -.324000 | .249688 | .963 | -1.18611 | .53811 | ||||||||||

| ICICI | -.386000 | .249688 | .893 | -1.24811 | .47611 | |||||||||||

| AXIS | -.786750 | .249688 | **.099 | -1.64886 | .07536 | |||||||||||

| HDFC | .061500 | .249688 | 1.000 | -.80061 | .92361 | |||||||||||

| UNION | -.112000 | .249688 | 1.000 | -.97411 | .75011 | |||||||||||

| BOB | -.456000 | .249688 | .757 | -1.31811 | .40611 | |||||||||||

| CANARA | .057750 | .249688 | 1.000 | -.80436 | .91986 | |||||||||||

| VIJAYA | .133000 | .249688 | 1.000 | -.72911 | .99511 | |||||||||||

| INDUSIND | -.065500 | .249688 | 1.000 | -.92761 | .79661 | |||||||||||

| PNB | .146250 | .249688 | 1.000 | -.71586 | 1.00836 | |||||||||||

| INDUSIND | SBI | -.258500 | .249688 | .993 | -1.12061 | .60361 | ||||||||||

| ICICI | -.320500 | .249688 | .965 | -1.18261 | .54161 | |||||||||||

| AXIS | -.721250 | .249688 | .170 | -1.58336 | .14086 | |||||||||||

| HDFC | .127000 | .249688 | 1.000 | -.73511 | .98911 | |||||||||||

| UNION | -.046500 | .249688 | 1.000 | -.90861 | .81561 | |||||||||||

| BOB | -.390500 | .249688 | .886 | -1.25261 | .47161 | |||||||||||

| CANARA | .123250 | .249688 | 1.000 | -.73886 | .98536 | |||||||||||

| VIJAYA | .198500 | .249688 | .999 | -.66361 | 1.06061 | |||||||||||

| UCO | .065500 | .249688 | 1.000 | -.79661 | .92761 | |||||||||||

| PNB | .211750 | .249688 | .998 | -.65036 | 1.07386 | |||||||||||

| PNB | SBI | -.470250 | .249688 | .723 | -1.33236 | .39186 | ||||||||||

| ICICI | -.532250 | .249688 | .565 | -1.39436 | .32986 | |||||||||||

| AXIS | -.933000* | .249688 | *.025 | -1.79511 | -.07089 | |||||||||||

| HDFC | -.084750 | .249688 | 1.000 | -.94686 | .77736 | |||||||||||

| UNION | -.258250 | .249688 | .993 | -1.12036 | .60386 | |||||||||||

| BOB | -.602250 | .249688 | .390 | -1.46436 | .25986 | |||||||||||

| CANARA | -.088500 | .249688 | 1.000 | -.95061 | .77361 | |||||||||||

| VIJAYA | -.013250 | .249688 | 1.000 | -.87536 | .84886 | |||||||||||

| UCO | -.146250 | .249688 | 1.000 | -1.00836 | .71586 | |||||||||||

| INDUSIND | -.211750 | .249688 | .998 | -1.07386 | .65036 | |||||||||||

| *. The mean difference is significant at the 0.05 level. ** The mean difference is significant at the 0.1 level. | ||||||||||||||||

From the Table 10 it is clear that the differences of means are significant for the pairs such as AXIS-HDFC, AXIS-CANARA, AXIS-VIJAYA, AXIS-UCO and AXIS-PNB. The differences of means in rest of the pairs are insignificant.

The user responses in a likert scale were tapped to identify the performance score of banks in different dimensions. Finally an overall performance index has been computed to find the overall position of the banks under study based on the quality dimensions of electronic banking services. The computation is made by combining the performance of the banks in each category or dimensions of E-banking services. The overall performance index suggests that as per the overall ranking of performance is concerned, AXIS bank tops the list with score 6.365 out of 7, which is followed by Bank of Baroda with score 6.034. In the third position is ICICI bank with SBI in fourth position. At the bottom we have Punjab National Bank. The index obtained is very helpful in identifying the position or overall status of E-banking service of a particular bank under study. From the mean scores obtained the banking organizations can identify and measure the difference in scores from the top position and differences of scores with its competitors. Since the index is developed based on sample from each bank under proportional allocation of number of customers, hence few banks have very low respondents as population is very low. As such the index cannot be generalized and the results may be different with larger respondents, location and many other factors.

AL-Hawari, M., & Ward, T. (2006). The effect of automated service quality on Australian banks'financial performance and the mediating role of customer satisfaction. Marketing Intelligence & Planning , 24 , 127-147.

Barnes, S. J., & Vidgen, R. T. (2002). An interective approach to the assesment of E- Commerce Quality. Journal of Electronic Commerce Research , 3 (3).

Bauer, H. H., Hammerschmidt, M., & Falk, T. (2005). Measuring the quality of e-banking portals. International Journal of Bank Marketing , 23 (2), 153 - 175.

Broderick, A. J., & Vachirapornpuk, S. (2002). Service quality in Internet banking: the importance of customer role". Marketing Intelligence & Planning , 22 (6), 327-335.

Christos, F. (2008). Internet Banking Websites Performance in Greece. Journal of Internet Banking and Commerce , 13 (3).

Costas, Z., Vasiliki, V., & Dimitrious, P. An evaluation of the performance of hotel websites using the managers' views about online Information services.

Gupta, K. K., & Bansal, I. (2012). Development of an instrument to measure Internet Banking service quality in India. Journal of Arts, Science & Commerce , 3 (2(2)).

Hiltunen, M., Laukka, M., & Luomala, J. (2002). Mobile User Experience. Helsinki IT press .

Joseph, M., McClure, C., & Joseph, B. (1999). Service quality in the banking sector: the impact of technology on service delivery. International Journal of Bank Marketing , 17 (4), 182 - 193.

Jun, M., & Cai, S. (2001). The key determinants of Internet banking service quality: a content analysis. International Journal of Bank Marketing , 19 (7), 276 - 291.

Kenova, V., & Jonasson, P. (2006). Quality Online Banking Services. Business Administration. JÖNKÖPING: J ÖNK Ö P ING INT E RNA T I ONA L B U S INE S S S CHO O L.

Kotler, P., & Armstong, G. (1999). PRINCIPLES OF MARKETING (Eighth ed.). Prentice Hall.

Lee, G. G., & Lin, F. H. (2005). Customer perceptions of e-service quality in online shopping. International Journal of Retail & Distribution Management , 33 (2), 161-176.

Molapo, M. N. (2008). An assessment of Internet banking service quality. Dissertation, University of Johannesburg, Business Management, Johannesburg.

Montoya-Weiss, M. M., Voss, G. B., & Grewal, D. (Fall 2003). Determinants of online channel use and overall satisafaction with a relational, multichannel service provider. Academy of marketing science journal , 31 (3), 448.

Nasri, W. (2011). Factors Influencing the Adoption of Internet Banking in Tunisia. International Journal of Business and Management , 6 (8), 143-160.

Nitsure. (2003). E-banking: Challenges and Opportunities. Economic and Political Weekly .

OLAYINKA, D. W. (2012). AN ASSESSMENT OF ELECTRONIC BANKING PERFORMANCE. Manchester: University of Manchester.

Parasuraman, A., Zeithaml, V., & Berry, L. (1988). SERVQUAL: A Multiple-item Scale for Measuring Consumer Perceptions of Service Quality. Journal of Retailing , 64 (1).

Rahman, S. U., Cripps, H., Salo, J., Hussain, R. I., & Zaheer, A. (2013). Determinants of Satisfaction with E-Retailing: The Role of Usability Factors. Middle-East Journal of Scientific Research , 17 (11), 1537-1545.

Salehi, M. (2010). E-Banking in Emerging Economy: Empirical Evidence of Iran. International Journal of Economics and Finance , 2 (1).

Singhal, D., & Padhmanabhan, V. (2008). A Study on Customer Perception Towards Internet Banking: Identifying Major Contributing Factors. The Journal of Nepalese Business Studies , V (1).

Swaid, S. I., & Wigand, T. R. (2009). Measuring The Quality Of E-Service: Scale Development And Initial Validation. Journal of Electronic Commerce Research , 10 (1).

Wilson, G., & Sasse, M. (2004). From doing to being:getting closer to user experience. Interacting with computers , 16 , 697-705.

Woldie, A., Hinson, R., Iddrisu, H., & Boateng, R. (2008). Internet Banking: An Initial Look at Ghanaian Bank Consumer Perceptions”. Bank and Bank systems , 3 (2), 35-46.

Wolfinbarger, M., & Gilly, M. (2003). eTailQ: dimensionalizing, measuring and predicting etail quality. Journal of Retailing , 183-198.

Yang, Z., Jun, M., & Peterson, R. T. (2004). Measuring customer perceived online service quality: Scale development and managerial implications. International Journal of Operations & Production Management , 24 (11), 1149-1174.