|

Nasser Saki(Corresponding Author) PhD Student of Accounting Central Tehran Branch, Islamic Azad University Tehran, Iran E-mail:- nasser.saki2017@gmail.com |

Ali EsmaeilzadehMaghari (PhD) A member of the scientific board slamshahr Branch, Islamic Azad University Tehran, Iran |

Mahtab Arab M.Sc. in Accounting Qazvin Branch, Islamic Azad University Tehran, Iran |

Reza Heidari PhD student of Accounting Central Tehran Branch, Islamic Azad University Tehran, Iran |

The purpose of the present researchwas to examine the potential relationship of asset growth and profitability indexwith the expected stock returnsin the listed companies on Tehran Stock Exchange (TSE). Three types of variable were involved:net asset growth, profitability, profitability index derived from net asset growth, and growth opportunities were the independent variables;expected stock return was the dependent or outcome variable; and firm value, free cash flows (FCFs), and earnings were used as control variables.The data analysison a sample of450 firm-yearsfromTehran Stock Exchangein the period 2009-2014 indicated net asset growth (QInv i,t), profitability (Proi,t), and profitability index derived from net asset growth (ProqInvi,t) as the covariates ofthe firmexpected stock returns.

Keywords: Asset Growth; Profitability Index (PI); Stock Return

The purpose of financial reporting is to provide useful information to economic actors. Useful information ought to be relevant and reliable. Providing relevant and reliable information, and in general, quality information, also promotesthe capital market efficiency (Rezazadeh, 2016). Due to the high sensitivity of investors to maximization of their return on the investments made and the choice of the best investment portfolio in capital markets, a significant part of the research in accounting and finance has been dedicated to the capital marketcondition and prediction of stock return. William Sharpe (1964), John Lintner (1965), and Jan Mossin (1966)originally developed and proposed the capital asset pricing model (CAPM) which later was criticized and its ability as a comprehensive model for explaining the relationship of risk and return was challenged. Doubts and uncertainty about this single-factor modelwere strengthened with appearance of contradictoryempirical evidence documented by Banz (1981), Keim (1983) and Rosenberg (1985).These authors found that firm size and book-to-market equity (B/M) ratioadded to the explanation of the cross-section of average return provided by market βs (Ahmadpour and Azimian, 2012).

Tehran Stock Exchange (TSE) is considered as one of the pillars of Iran’s capital marketwhose progress and development would bringprosperity and development to the national economy. Therefore, study of all factors affecting this market, including the factors leading toan increasing investorinclination and positive attitude to stock exchange, are particularly important. In other words, by understanding and detailed analysis of different investment strategies,investors will be able to choose certain strategy, given its risk and return, and this in turn, will result in optimum allocation of resources on stock exchange. In the investment process, success and profitabilitydepends on accurate analysis and knowing about the stock and market condition, and every investor should only after careful study and analysis of the target securityenter intobuying or sellingit.Such analysis, however, requires efficient analytic tools and methods in order for to have reliable assessment.

According toNovy-Marx (2014), Profitability, as measured by the ratio of a firm’s gross profits (revenues minus cost of goods sold) to its assets, has roughly the same power as book-to-market equity ratio predicting the cross-section of average returns. Gross profits-to-assets is also complimentary to book-to-market (B/M) ratio, contributing economically significant information above that containedin valuations, even among the largest, most liquid stocks (Novy-Marx, 2014: 1). These statements frankly contradict the obtained results from recent studies. Fama and French (2008) note that Profitability sorts produce the weakest average hedge portfolio returns. Only the small group produces EW and VW abnormal hedge returns more than two standard errors from zero. Thus, hedge returns do not provide much basis for the conclusion that, with controls for market cap and B/M , there is a positive relation between average returns and profitability (Fama and French, 2008: 1663).

Overall, prior research argues that the profitability of value strategies is mechanical. Firms for which investors require high rates of return (i.e., risky firms) are priced lower, and consequently have higher book-to-markets, than firms for which investors require lower returns. Because valuation ratios help identify variation in expected returns, with higher book-to-markets indicating higher required rates, value firms generate higher average returns than growth firms (Ball 1978, Berk 1995). While this argument is consistentwith risk-based pricing, it works just as well if variation in expected returns is driven bybehavioral forces. Lakonishok, Shleifer, and Vishny (1994) argue that low book-to-marketstocks are on average overpriced, while the opposite is true for high book-to-market stocks,and that buying value stocks and selling growth stocks represents a crude but effectivemethod for exploiting misvaluations in the cross-section (Novy-Marx, 2014: 2).

More profitable firms earn significantly higher average returns than unprofitable firms. They do so despite having, on average, lower book-to-markets and higher market capitalizations. Because strategies based on profitability are growth strategies, they provide an excellent hedge for value strategies, and thus dramatically improve a value investor’s investment opportunity set. In fact, the profitability strategy, despite generating significant returns on its own, actually provides insurance for value; adding profitability on top of a value strategy reduces the strategy’s overall volatility, despite doubling its exposure to risky assets. A value investor can thus capture the gross profitability premium without exposing herself to any additional risk (??).

Therefore, a performance measure in order for to be effective, not only should be able to reflect current performance, but also show the extent and direction of the firm future growth. At any rate, the measure that provides investors with better information regarding anquality investing is regarded superior to and preferred over other competing measures (Campbell, Hilscher, and Szilagyi, 2008). Net asset growth, profitability, and profitability index derived from net asset growth, the firm growth opportunities and their impact on the stock expected return could be crucial in realizing and accomplishing the firm’s ultimate goal. Considering the main purpose of this research, the authors seek to find out whether net asset growth and profitability have any real effect on the expected stock returns in the listed companies on Tehran Stock Exchange.

The continuous development and increasing complexity of the financial markets has led to an increasing demand for various tools, techniques and models to assist investors in making optimum investment choices and choosing the most suitable portfolio. In response to this need, various theories, models, and methods for financial asset pricing and calculation of stock return forecasts have been proposed which needto be constantly developed and further modified. Among such models are the firm capital assets pricing model and profitability model in which researchersover the last decades, since their introduction, have developed an increasing interest.

Present research, examining the relationship of quality investing and profitability with expected share return, touches upon a crucial decision making issue both in practice and theory,that is, prediction of the firm performance (expected share return) for the TSE-listed firms.

Cooper, Gulen, and Schill (2008) investigated how asset growth rate, along with other firm growth indicators, contributed to explanation of cross-section of stock return. They found asset growth rates as strong predictors of future abnormal returns. Asset growth retains its forecasting ability even on large capitalization stocks. They compare asset growth rates with the previously documented determinants of the cross-section of returns (i.e., book-to-market ratios, firm capitalization, lagged returns, accruals, and other growth measures), and found that a firm's annual asset growth rate emerges as an economically and statistically significant predictor of the cross-section of U.S. stock returns.

Cooper et al (2009) examined the relationship between asset growth and future stock returns in the U.S. firms. Their findings indicated a negative relationship between the two variables. In addition, they found that the firma with a low asset growth have 20 percent excess return in the following year.

Anderson and Garcia-Feijóo (2006) growth in capital expenditures and stock return on a sample of 2500 firm-years from among the actively trading stocks on NYSE and concluded that with an increase in capital expenditures, the effect of other predictors of return, including B/M asset ratio, is reduced.

Bixia, Xu. (2007) examined the effect of business unit lifecycle on expected return. The results most importantly indicated that the stages of the business lifecycle significantly contributedto the value relevance of common risk factors.

Magina et al (2012), using financial performance ratios, estimated asset growth. Their results supported the use of financial performance ratios for prediction of asset growth with 85% precision in large firms.

Feng Chen, Ole-Kristian Hope, Qingyuan Li, and Xin Wang (2011), in a paper titledFinancial Reporting Quality and Investment Efficiency of Private Firms in Emerging Markets, investigated the impact of financial reporting quality (FRQ) on efficiency of investments in private firms in developing markets, using the World Bank data on these firms. They found a positive relationship between FRQ and investment efficiency of the understudy firms. Further, they found bank financing was rising among these companies and incentives to minimize revenues for tax purposes were declining. Such association between the incentives for paying less tax and revenue informational role has a long history in the research literature and used to be considered as relevant. One of the purposes of FRQ is facilitating efficient capital allocation. This is particularly important for improvement of the firm investment decisions. In sum, the results supported their hypothesis that increased financial transparency has the potential to reduce and mitigate both the problems of underinvestment and overinvestment. Nevertheless, these findings are often limited to large publicly held American companies.

Li et al (2012) examined predicting power of asset growth for future, expected stock return. Their sample included the data of 23 countries from three continents of America, Europe and Asia. The obtained results indicated high predicting power of asset growth indicators regarding expected stock return. This predicting power also persisted for the next 4 years after the date of initial measurement. Moreover, they claimed that their results also held true for different samples, including the samples from large, small, and companies located in one geographical region.

Ho et al (2013) investigated the relationship ofcash flows forecasts, cost of capital, and expected return. They, given theearnings forecasts of the firms based on the models and indicators of estimated cash flows, emphasized on the firm cost of capital and analyzed large samples of firms in the period 2000 to 2010. They found that earnings forecasts were based on other forecasts in connection with cash flow forecasts and derived from the factors associated to earnings forecasts. In addition, regarding cost of capital and its relationship with expected stock return, they concluded that the indicators of expected return are the very forecasts made in regard to stock return. They further found evidence for support of the significant relationship between expected return and estimated cash flows and adjusted it according to the cost of capital basic model.

Karimi and Sadeghi (2013) investigated capital asset investment and financialrestrictions inside and outside the countryfor a group of the listed companies on Tehran Stock Exchange (TSE). The statistical population included 148 manufacturing companies for the period 2006 through to 2011. In this study, domestic financial restrictions were measured by the ratio of operating cash flow (OCF) to equity and foreign financial restrictionswere measured by firm size. Data analysis and test of hypotheses, using Error Correction Model, indicated a positive and significant relationship between firm size and investment sensitivity to cash flows, and therefore, with an increase of foreign financial restrictions, investment sensitivity to cash flows increases accordingly. From here, they derived a negative and significant relationship between operating cash flows (OCF) and investment sensitivity to cash flows. Thus, a reduction of domestic financial limitations was associated with an increase in investment sensitivity to cash flows.

Tehrani and Hesarzadeh (2014) examined the effect of free cash flows (FCFs) and financing restriction on investment levels in 120 listed companies on Tehran Stock Exchange (TSE) during 2003-2011. According to their results, the relationship between FCFs and high levels of investment was significant.Therewas no significant relationship between financing restriction and low levels of investment in the TSE-listed firms.

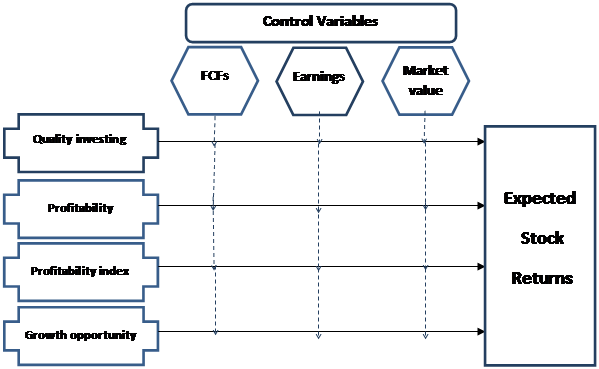

The potential link between three groups of variables is outlined in the research model below (figure 1).

Figure- 1 The Conceptual Model

In view of the research theoretical and empirical backgroundsand the research conceptual model, and in order to achieve the research objectives and answer the research questions, the following hypotheses are posited:

Hypothesis 1: There is a significant inverse relationship between net asset growth and expected stock returns of the TSE-listed firms .

Hypothesis 2: There is a significant direct relationship between profitability and expected stock returns of the TSE-listed firms .

Hypothesis 3: There is a significant direct relationship between profitability index (PI) derived from net asset growth and expected stock returns of the TSE-listed firms .

Hypothesis 4: There is a significant inverse relationship between growth opportunities and expected stock returns of the TSE-listed firms .

Variable is the property of an observed unit (observation unit). It is a quantity that can take on different amounts (as it moves) from one unit to another or from one state to another. Variables can be defined in two terms: conceptual and operational. As a concept, it is treated as a word or term referred to by other words or terms.In this type of definition, abstract words and hypothetical criteria are used to make a term or concept intelligible. Operational definition, relying on objective and tangible aspects or features of a variable, specifies the researcher’s efforts to measure and/or manipulate that variable.

As mentioned earlier, the variables considered in this study are divided into three groups of independent, dependent, and control variables. Thus, net asset growth, profitability, profitability index derived from net asset growth, and growth opportunities are considered independent variables; firm expected stock return dependent variable; and firm value, free cash flows (FVFs), and earnings (profit ratio) control variables.

1. Independent variables

Independent variables are the variables through which dependent variable(s) are explained or predicted. The independent variables in this research are operationalized and measured as below.

1.1. Net asset growth ( QInvi,t )

For calculation of the firm quality investing (regardless of the value in absolute terms), we followed the method of Chan et al (2001) using the following formula:

![]()

Where

GW = is the asset growth rate calculated as:

![]()

In which

Asseti,t = total assets this year

Asseti,t-1 = total assets in the previous year

And GD0 = sales growth rates of the firms calculated as follows:

![]()

In which

Sali,t = the amount of sales this year

Sali,t-1 = the amount sales in the previous year

1.2. Profitability ( Proi,t )

According to Feng Chen et al (2011), the firm optimum financial performance is calculated as the mean value of the results obtained from the following two formulas:

![]()

Where

Income = net profit (operating income)

Assets = book value of assets

Sales = company sales

And

1.3. Profitability index derived from net asset growth ( ProqInvi,t )

This variable is obtainedfrom the interaction of profitability and net asset growth (Novy-Marx, 2014).

1.4. Growth opportunities ( Log(B/M)i,t )

Growth opportunities are proxied by natural logarithm of book-to-market (B/M) equity ratio (Fama and French, 2008).

![]()

2. Dependent variable

Dependent variables are the variables whose changes are observed or measured in order for the effect of independent variables on them to be identified or determined.

2.1. Expected stock returns ( ExpRi,t )

It is defined as the estimated return investors expect to earn in the next period (Firer and Williams, 2003).

Sharpe in his studies demonstrated that market orientation in response to the expected return of a security is unique which is equal to the risk-free asset return (r) plus relative risk of the security times the difference of the market portfolio return minus the risk-free asset return expressed as follows (Campbell et al, 2008):

![]()

Where

Eri = expected returns

rf = risk-free return of an asset

βi = security relative risk

rm = market portfolio return

portfolio return (total return) is obtained from sum of price and cash dividend changes, given the amount paid as capital:

Where

TEPt = end-of-day stock index

TEPt-1 = stock index on the first day

XiP = shareholder cash input to capital increase

Ci = number of shares in the period

Dit = dividend per share

Pit = stock price in the period

t = the understudy period

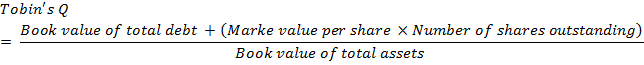

3. Control variables

3.1. Firm value (Tobin’s Q)

In this study, for measurement of firm value, Tobin’s Q was used which is obtained from the following formula:

3.2. Free cash flows (FCFs)

Free cash flows of business enterprises, in this study, are measured based on the model of Rajan et al (2000). In this model, free cash flows are defined as operating income (OI) before depreciation minus total tax, interest expenses, and cash dividend, and is standardized by dividing it by total assets (Asness, Porter, and Stevens, 2000), as is given by the following equation.

![]()

In which

FCFi,t = free cash flows of stock i at time t

INCi,t = operating income of stock i at time t before depreciation

TAXi,t = taxes

INTEXPi,t = interest expenses

CSDIVi,t = dividend paid to common stockholders

ASSETi,t = book value of total assets

3.3. Earnings ( Eari,t )

According to the research of Carlson and et al (2004), ratio of retained earnings can be calculated by the following formula:

Eari,t =

![]()

For analysis of the first hypothesis, the following regression model was used:

[The model]

The regression models in this study are derived from the models usedin Firer and Williams (2003), and the variables were modifiedconsistent with Novy-Marx (2014) as follows:

[Research models and modified variables]

The model for test of the research hypothesis:

Table 1 presents a summary statistics of research variables.

Table- 1 Summary statistics of research variables (n = 450)

|

Statistical measures |

Mean |

Median |

St. Dev. |

Min |

Max |

|

ExpRi,t |

0.262 |

0.181 |

0.805 |

-1.169 |

0.947 |

|

QInvi,t |

-0.161 |

0.600 |

1.945 |

-0.272 |

0.737 |

|

Proi,t |

0.108 |

0.055 |

0.184 |

-0.161 |

1.249 |

|

ProqInvi,t |

-0.163 |

0.001 |

1.618 |

-0.918 |

0.773 |

|

Log(B/M)i,t |

-0.240 |

-0.252 |

0.263 |

-0.868 |

0.396 |

|

Tobin’s Q |

1.631 |

1.172 |

1.366 |

0.015 |

8.958 |

|

FCFi,t |

0.151 |

0.120 |

0.158 |

-0.272 |

0.934 |

|

Eari,t |

0.172 |

0.151 |

0.153 |

-0.397 |

0.751 |

Number of observations for each variable in the above table is 450 (75 firms

![]() 6 years). Mean column gives average figures for each variable, e.g. 0.262 as the

mean of the variable ( ExpRi,t ) indicates that the firm expected

stock return in the sample companies is 26 percent. And the statistical measure

median shows the highest frequency for each variable. The mean firm value (Tobin’s

Qi,t)of 1.636 indicates average market-to-book value of the company’s

assets in the sample firms. The mean free cash flows ( FCFi,t )

of 0.151 indicates that on average, the ratio of operating income (OI) before depreciation

minus total tax, interest expenses, and cash dividend in the sample companies is

about 15 percent of total assets. Moreover, the mean of the variable earnings (Eari,t)

indicates that in the sample firms, ratio of retained earnings to book value of

total assets is about 17 percent on average.

6 years). Mean column gives average figures for each variable, e.g. 0.262 as the

mean of the variable ( ExpRi,t ) indicates that the firm expected

stock return in the sample companies is 26 percent. And the statistical measure

median shows the highest frequency for each variable. The mean firm value (Tobin’s

Qi,t)of 1.636 indicates average market-to-book value of the company’s

assets in the sample firms. The mean free cash flows ( FCFi,t )

of 0.151 indicates that on average, the ratio of operating income (OI) before depreciation

minus total tax, interest expenses, and cash dividend in the sample companies is

about 15 percent of total assets. Moreover, the mean of the variable earnings (Eari,t)

indicates that in the sample firms, ratio of retained earnings to book value of

total assets is about 17 percent on average.

The results of standard deviation in table 1indicate that net asset growth ( QInvi,t ) and the profitability index (PI) derived from net asset growth ( ProqInvi,t ) had the highest fluctuation and dispersion. It seems that the two variables had little stability during the research period.

The min and max columns refer to the smallest and biggest observations for each variable. The figures – 1.169 and 0.947 refer to minimum and maximum expected returns ( ExpRi,t ) in 2009 which belonged to Iran Radiator Company and Iran Yasa Company, respectively.

The figure – 0.272 and 0.737 are the minimum and the maximumnet asset growth ( QInvi,t ) belonging to Saipa Company in 2013 and Pars Darou Company in 2009, respectively. The minimum (- 0.918) and maximum (0.773) profitability index derived from net asset growth ( ProqInvi,t )belonged to Orumieh Cement in 2014 and Sina Darou Company in 2009, respectively. And the values – 0.397 and 0.751 are the minimum and maximum earnings (Eari,t) belonging respectively to Alumtech Company in 2013 and Informatics Services Company in 2009.

This research examines the relationship of quality investing and profitability with expected stock returns of the TSE-listed companies. For test of hypotheses, multivariate linear regression analysis with pooled data (firm-years) was used. In this method, all the collected information, amalgamated into 450 firm-years, were entered into the regression equation. This method, due to increased number of observations, is believed to be more accurate than cross-sectional (year-to-year) method.

In this section, for test of hypotheses, first, the relationships which might exist between the independent and control variables on the one side, and the dependent variable (expected stock return) are examined. The obtained results from the multivariate linear regression analysis of the hypothesized relationships are presented in table 2.

Table- 2 The results of the regression analysis for the hypothesized relationships

|

Statistical method: multivariate linear regression analysis on a sample of 450 firm-years (at 95% confidence interval) |

||||

|

The model overall significance |

Durbin-Watson |

R2 |

Adjusted R2 |

|

|

0.8807 |

0.000 |

1.780 |

0.311 |

0.308 |

As can be seen from the above table, the relationship of theindependent variables quality investing , profitability , profitability index derived from net asset growth , and growth opportunities , and control variables firm value , free cash flows ( FCFs ), and earnings with the dependent variable expected stock return was examined and statistically analyzed based on a multivariate, linear regression model for a sample of 450 firm-years. The Durbin-Watson statistic (1.780) confirms absence of serial autocorrelation in residuals. The modified R2 (0.308) indicates that 31 percent of changes in expected returns (dependent variable) can be explained by changes in independent and control variables. However, about 69 percent of changes in the expected stock return are explained by factors other than those mentioned here. The Sig value of the ANOVA column in the above table (0.000) is smaller than 0.05, whereby significance of the regression model is confirmed.

1.Test of the first hypothesis

The p-value (significance level) for the variables net asset growth ( QInvi,t ), firm value ( Tobin’s Qi,t ), free cash flows ( FCFi,t ), and earnings ( Eari,t ) is below 5 percent, indicating significant effect of these variables on the firm expected return ( ExpRi,t ). In addition, beta coefficient which shows the type of relationship and slope of the regression line, is negative for the above variables, with the exception of FCFs, which implies an inverse relationship so as with an increase of the mentioned variables, expected return declines and vice versa. Thus, given the regression results, the relationship between quality investing and expected return is confirmed.

Table- 3 The results of regression analysis for the first hypothesis

|

Variable |

β coefficient (standardized) |

p-value |

t-statistic |

VIF |

Tolerance |

|

|

-0.003 |

0.041 |

-2.057 |

1.029 |

0.972 |

|

Tobin's – Q |

- 0.035 |

0.000 |

- 7.515 |

1.131 |

0.884 |

|

|

0.130 |

0.033 |

4.797 |

1.064 |

0.940 |

|

|

- 0.023 |

0.009 |

- 5.343 |

1.035 |

0.966 |

2.Test of the second hypothesis

The p-value in table 4 for the variables profitability ( Proi,t ), firm value ( Tobin’s Qi,t ), free cash flows ( FCFi,t ), and earnings (Ear i,t), which is below 5 percent, indicates significant effect of the mentioned variables on expected stock returns. In addition, the beta coefficient (β) for the variables profitability and FCFs is a positive figure, implying that with an increase in these variables, expected return rises as well.

Table- 4 The results of regression analysis for the second hypothesis

|

Variable |

β coefficient (standardized) |

p-value |

t-statistic |

VIF |

Tolerance |

|

|

0.012 |

0.000 |

7.254 |

1.029 |

0.972 |

|

Tobin's – Q |

- 0.035 |

0.000 |

- 7.509 |

1.131 |

0.884 |

|

|

0.129 |

0.033 |

4.789 |

1.064 |

0.940 |

|

|

- 0.025 |

0.009 |

- 5.358 |

1.035 |

0.966 |

Overall, the results of the regression analysis for the second hypothesis confirm presence of a relationship between profitability and expected stock return.

3.Test of the third hypothesis

The p-value in table 5 for the variables profitability index derived from quality investing ( ProqInvi,t ), firm value ( Tobin’s Qi,t ), free cash flows ( FCFi,t ), and earnings (Eari,t), which is below 5 percent, indicates significant effect of the mentioned variables on expected stock returns. In addition, the beta coefficient (β) for the variables profitability index derived from quality investing ( ProqInvi,t ) and FCFs ( FCFi,t ) is a positive figure, implying that an increase in these variables is accompanies with a corresponding increase in expected returns.

Table-5 The results of regression analysis for the third hypothesis

|

Variable |

β coefficient (standardized) |

p-value |

t-statistic |

VIF |

Tolerance |

|

|

0.012 |

0.000 |

7.254 |

1.029 |

0.972 |

|

Tobin's – Q |

- 0.035 |

0.000 |

- 7.509 |

1.131 |

0.884 |

|

|

0.129 |

0.033 |

4.789 |

1.064 |

0.940 |

|

|

- 0.025 |

0.009 |

- 5.358 |

1.035 |

0.966 |

Overall, the results of the regression analysis for the third hypothesis confirm existence of a relationship between profitabilityindex and expected stock return.

4. Test of the fourth hypothesis

The p-value in table 6 for the variables firm value ( Tobin’s Qi,t ), free cash flows ( FCFi,t ), and earnings ( Eari,t ) is below 5 percent, indicating significant effect of the mentioned variables on expected stock returns. In addition, the beta coefficient (β) for these variables,with the exception of FCFs ( FCFi,t ),is a negative value, implying thatan increase in these variables is accompanied with a decrease in expected returns, and vice versa.

Table-6 The results of regression analysis for the fourth hypothesis

|

Variable |

β coefficient (standardized) |

p-value |

t-statistic |

VIF |

Tolerance |

|

|

0.052 |

0.174 |

- 1.836 |

1.140 |

0.877 |

|

Tobin's – Q |

- 0.074 |

0.000 |

- 7.897 |

1.131 |

0.884 |

|

|

0.128 |

0.033 |

4.777 |

1.064 |

0.940 |

|

|

- 0.013 |

0.009 |

- 5.181 |

1.035 |

0.966 |

Thus, given the results of the regression analysis, the fourth hypothesis claimingasignificant inverse relationship between growth opportunities and expected stock return is not tenable and has to be rejected.

5.Test of hypotheses in brief

Table 7provides a sketchy summary onthe fate of the research hypothesisbased on the obtained results from test of the hypotheses, using multivariate linear regression analysis.

Table- 7 Final decision on the research hypotheses

|

Hypothesis |

Decision |

|

H1: a significant inverse relationship between QInvi,t and ExpRi,t |

Accept |

|

H2: a significant direct relationship between Proi,t and ExpRi,t |

Accept |

|

H3: a significant direct relationship between ProqInvi,t and ExpRi,t |

Accept |

|

H4: a significant inverse relationship between Log(B/M)i,t and ExpRi,t |

Reject |

The obtained results from test of hypotheses the relative (partial) information value in the relationship between net asset growth and the profitability extracted from balance sheet and income statement. Thus, historical items from balance sheet and their accrual-based measurement provide relevant information about future activities of business units and their state of profitability in coming periods. It follows that accrual-based measurement of financial statements and balance sheet historical items is considered of “effective” informational worth to users. In the meantime, given the impact of profitability index, it appears that investors are more sensitive to earnings and profitability-related information, that is, the majority of investorsis more concerned abouta business current and short-term situation than to its future and long-term situation, and negatively reacts to inventory accumulation and major investment in fixed assets, at least in short term. And for this reason, profitability ratios had relevant information content. In interpretation of the obtained result from test of the fourth hypothesis,it could be argued that in theoretical works, book-to-market (B/M) ratio indicates the firm potential future growth. Therefore, given its links with potential growth opportunities and future development, there is probably a relationship between this ration and expected stock return. However, this relationship was not found in Tehran Stock Exchange, which may suggest the investors on Tehran Stock Exchange (TSE) do not pay enough attention tofuture growth opportunities of the firm.

Each result in this study has certain implication(s) for different players on this market, including decision making authorities, managers of the listed companies, investors, and financial analysts.Based on the obtained results from test of the hypotheses, the following suggestions are made:

Given the relation existing between quality investing and expected returns of the companies on this market,the respective decision making authorities are expected by making due decisions to provide criteria and methods for optimum investment.

Investors and financial analysts would get better result in their estimation of the firm expected return by allowing for the structure of investment in assets and the extent of the changes in sales of products and services.

Considering that managers, among others, are charged with maximization of the shareholder wealth, and given the link between the firm profitability and expected stock return, general meetings of the firms are expected to take action and grant managers enough authority,enabling them to devise effective solutions and mechanisms for boosting up the firm share price/value.

Further, the absence of a relationship between growth opportunities and expected return perhaps could be ascribed to lack of enough interest in growth prospects and future development among the investors on TSE. This issue needs to be duly addressed and resolved in general meetings and other corporate decision making bodies by careful diagnosis of the main causes and barriers.

1. Asness, C.S., Porter, R.B., Stevens, R., (2000). Predicting stock returns using industry-relative firm characteristics. Unpublished working paper.AQR Capital Management, Greenwich, CT.

2. Campbell, J.Y., Hilscher, J., Szilagyi, J., (2008). In search of distress risk. Journal of Finance 63, 2899–2939.

3. Carlson, M., Fisher, A., Giammarino, R., (2004). Corporate investment and asset pricing dynamics: implications for the cross section of returns. Journal of Finance 56, 2577–2603.

4. Chan, K., Chan, L.K.C., Jegadeesh, N., Lakonishok, J., (2006). Earnings quality and stock returns. Journal of Business 79, 1041–1082.

5. Chan, L.K.C., Lakonishok, J., Sougiannis, T., (2001).The stock market valuation of research and development expenditures. Journal of Finance 56, 2431–2456.

6. Chen, L., Novy-Marx, R., Zhang, L., (2010).An alternative three–factor model. Unpublished working paper.

7. Choi, Young M. Ju, HyoK, Park, YoungK, (2014). Do dividend changes predict the future profitability of firms? Accounting and Finance 51, 869–891.

8. Cooper, M., H. Gulen, and M. Schill, (2008), "Asset Growth and the Cross-Section of Stock Returns," Journal of Finance 68, 1609-1651.

9. Fama, E., and K. French, (1992), "The Cross-Section of Expected Stock Returns ", Journal of Finance, 47, 427-465.

10. Fama, E.F., French, K.R., (2006). Profitability, investment and average returns. Journal of Financial Economics, 82, 491–518.

11. Fama, E.F., French, K.R., (2008). Dissecting anomalies. Journal of Finance 63, 1653–1678.

12. Feng C,"Ole-Kristian H(2010) Financial Reporting Quality and Investment Efficiency of Private Firms in Emerging Markets", Rotman School of Management University of Toronto,20(10): 35-42.

13. Firer, S. and Williams, S. M. (2003). Intellectual capital and traditional measures of corporate performance. Journal of Intellectual Capital, 4(3): 348-360.

14. Hou, K., Zhang, Y., Zhuang, Z., (2013). Understanding the Variation in the Value Relevance of Earnings: A Return Decomposition Analysis. Working Paper. Ohio State University.

15. Karimi, F. and Sadeghi, M. (2013), Domestic and Foreign Financial Restrictions and their Relationship with Capital Assets Investment in the Listed Companies on Tehran Stock Exchange, Quarterly Journal of Financial Accounting , 1(4): 43-58.

16. Novy-Marx, R., (2009).Competition, productivity, organization and the cross section of expected returns. Unpublished working paper.

17. Novy-Marx, R., (2011).Operating leverage. Review of Finance 15, 103–134.

18. Marx, R., (2014), " Profitability,, expected, returns, and, quality, investing ", Journal of Financial Economics 108 (14) 1–28.

19. Ohlson, J.A., (1980). Financial ratios and the probabilistic prediction of bankruptcy. Journal of Accounting Research 18, 109–131.

20. Tehrani, R. and Hesarzadeh, R. (2014), The Effect of Free Cash Flows and Restriction on Financing on Overinvestment and Underinvestment, Accounting Research , 3, 50-67.

21. VakiliFard, H. and Eftekharnejad, F. (2014), The Effect of Retained Earnings and Dividend Payment on Future Profitability and Stock Return, Research in Financial Accounting and Auditing , 1(4).