Ms. Chetna Singh* and Prof. Raj Kumar**

Purpose – The purpose of this research paper is to study the financial literacy and investment behaviour of the working women and also to find out their most preferred and popular investment instruments.

Design/methodology/approach – Descriptive research having 168 female teaching faculties of Banaras Hindu University as respondent for the study. Questionnaire technique was followed to obtain the required information which was divided into two parts. The first part covers the demographic information and the second part coves 14 investment questions. The data was collected from the respondents about their financial knowledge through questionnaire consisting of questions relating to their knowledge of different financial investment avenues and their own choices of investment.

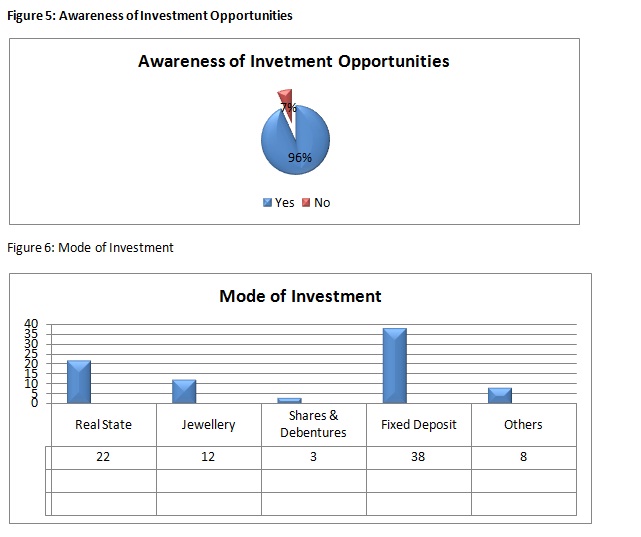

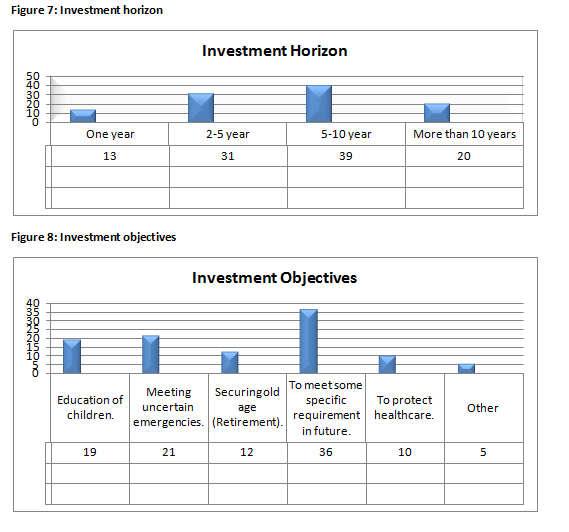

Findings – The study found that in spite of working at good positions women were not feeling confident while taking their own investment decisions, were investing for shorter period of time and have moderate risk appetite. The study also reveals that the most preferable investment avenue among women is fixed deposits.

Originality/value – The present study is considered the first of its kind conducted on the female teaching faculties of BHU. To the best of knowledge, no such studies have been conducted regarding studying of financial literacy relating to the knowledge of different financial investment avenues and choices of investment in BHU.

Research limitations – The present study covers only female teaching faculties of BHU, further expansion in the study could be made out with all the teaching staff of BHU as well as other educational institutes in Varanasi.

Keywords – Financial literacy, Investment behaviour, Financial instruments, Investment avenues.

*Research Scholar, Institute of Management Studies, BHU.

Email Id: schetna2007@gmail.com, chetnas@fmsbhu.ac.in

**Director & Dean, Institute of Management Studies, BHU.

Email Id: rajkumar_bhu@rediffmail.com, rajkumar@fmsbhu.ac.in.

Financial literacy comprises the set of skills and knowledge which helps an individual to make informed financial decisions. It helps an individual to monitor the effective utilisation of financial resources thus helping in overall economic security. Financial literacy is directly related to the wellbeing of an individual and society as a whole, since it helps an individual to manage their personal financial matters like savings, investments, tax planning, retirement planning, etc. and enables them to understand how more money can be generated and used in more effective and efficient manner.

In the view of Criddle (2006), being financially literate includes learning about the choice of many alternatives for establishing financial goals. Financial literacy is defined as the ‘ability of an individual to make informed judgments and to take effective decisions regarding the use and management of money’ (ASIC: 2003, Noctor, Stoney and Stradling: 1992).

OECD defines financial literacy “as a combination of awareness, knowledge, skill, attitude, and behaviour needed to make sound financial decisions and ultimately achieve individual financial well-being”. The National Financial Educators Council defines financial literacy as: “Possessing the skills and knowledge on financial matters to confidently take effective action that best fulfils an individual’s personal, family and global community goals.” The Government Accountability Office (GAO) defines financial literacy as: “the ability to make informed judgments and to take effective actions regarding the current and future use and management of money. It includes the ability to understand financial choices, plan for the future, spend wisely, and manage the challenges associated with life events such as a job loss, saving for retirement, or paying for a child’s education.”

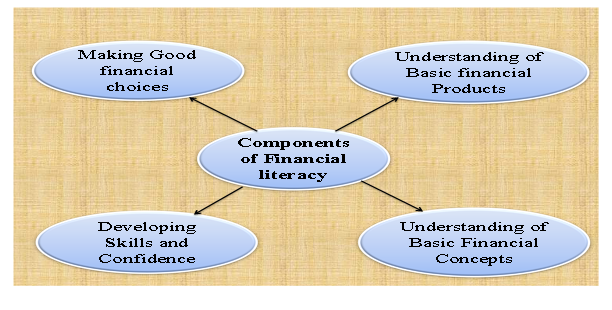

The basic components of financial literacy may include-

The understanding of basic financial products an individual may need throughout their life like maintenance of bank accounts, their savings and insurance plans etc. Understanding of basic financial concepts which may include computation of compound interest, present and future value of money, knowledge of annuity, risk & return of investments, protection and diversification and so on. Developing skills and confidence to make aware of financial risk and opportunities presents in the financial market. Making good financial choices regarding saving, spending, investing and managing debt throughout one’s life.

Lusardi. A. (2006) conducted a study on Planning and Financial Literacy: How Do women Fare? The objectives of the study were to examine the saving behaviour of women, to analyse how women plan for retirement, tools & sources of information used for planning and to analyse the financial literacy of women. Study was conducted on 1,264 respondents, among which 60% are women who are of 50 yrs old or older and 64% are married. Regression method and multivariate analysis was used to know the importance of financial literacy and the relationship with planning in the total sample and among women only, and found that women had little financial literacy, retirement calculation was not an easy task particularly for women and they are much more rely on family, friends and advisers for their financial planning.

Klatt. M. (2009) conducted a study on An Assessment of Women's Financial Literacy. Objective of the study was to identify the barriers preventing knowledge and understanding from being translated into actual behaviour, what resources are needed to provide women with financial information and whether there is a need for more resources and training programs on financial literacy for women. The study was conducted on 300 women aged 16 and above but only 167 women responded out of 300. The mean, variance, and standard deviation were used for analysis and found that there are some barriers that women face in regards to financial matters, trends showing that women are not participating fully in retirement planning and not as comfortable as men in seeking financial advice and also reveals that education plays an important role in the financial literacy of women and there is a need for workshops and seminars on money management and investing are needed. Variables used for the study were Demographic factors, investment decisions and services of financial advisor.

Chijwani. M. et al. (2014) conducted a study of financial literacy among working women in Pune. The objective of study is to find out the most popular & preferred investment instruments. The study is conducted on working women in Pune, between age group of 20-40 and who are at least graduate. Study is empirical based on survey method and sample was conducted on a random basis. The study found that the most popular investment avenue among the females interviewed is systematic investment plan.

D'Ancona. E. L. (2014) conducted a study on Financial Literacy and Financial Inclusion of Women in Rural Rajasthan- a Case Study of the Indian School of Microfinance for Women’s Financial Education Project. The objective of this paper was to explore the impact of financial education and other forms of training on borrowers and entrepreneurs using SHGs & microfinance. The study was exploratory in nature and conducted on 2500 women. Study was conducted through a combination of obtrusive observation of the methods used in MEDP training and qualitative interviews with the program coordinator and the participants in the training and concludes that financial literacy contributes to financial inclusion among the rural and tribal women living near Udaipur. Due to gender inequality in rural Rajasthan places SHGs & programs like ISMW’s MEDP Training prove to be too demanding for women .This study also found some significant social benefits from the MEDP Training including negotiating power and increased status of women within their communities. This study was based on variables like Literacy, knowledge of financial terms and work schedule.

CA Anupama & Joshi. B. (2015) conducted a study on financial literacy of women and its effect on their investment choice decision. The objective is to evaluate the financial literacy of working and financially independent women and its impact on their investment decisions. The study is conducted on 85 educated working women in educational sector in Gautam Budh Nagarhas. Study concluded that Financial Knowledge leads to better life standards, independence in financial decision making and better empowerment and there is a drastic need for financial literacy programs to make women confident in making sound financial decisions.

Haque. A. & Zulfiqar. M. (2015) conducted a study on women’s economic empowerment through financial literacy, financial attitude and financial wellbeing. The objective of the study is to assess the level of financial literacy, financial attitude and financial wellbeing of working women and to examine the relationship between financial literacy, financial attitude, financial wellbeing and economic empowerment of working women. Study is conducted on 300 working women of non- financial sector of Pakistan. Study found that the financial literacy, financial attitude and financial wellbeing are significantly & positively related with economic empowerment.

Phelomenah et al. (2015) conducted a study on the role of financial literacy on the profitability of women owned enterprises in Kitui Town, kitui Country, Kenya. The objective of the study was to establish role of budgeting, cash management, savings and record keeping on the profitability of women owned business. The sample size was 76 business women. The variables selected for the study was Budgeting, Cash management, Savings and Record keeping. The tools used for the study was Descriptive statistics: to establish patterns, trends and relationships, measures of central tendency and dispersion used to analyse the collected data, presented using tables and figures. The study concluded that budgeting, cash management, savings and record keeping significantly influenced profitability of women owned business.

Akisimire. R et al. (2015) tried to examine the relationship and effect of microfinance on the entrepreneurial empowerment of women using evidence from the Central and Eastern regions of Uganda in their paper microfinance and entrepreneurial empowerment of women: the Ugandan context. The study was based on 150 women of Eastern & western region of Uganda. Multiple regression and correlation techniques was used to establish the relationship between the variables and to establish the influence of microfinance on women’s entrepreneurial empowerment and found that microfinance and social capital have a significant relationship with entrepreneurial empowerment and concludes that microfinance is an important tool towards the entrepreneurial empowerment of women in a resource perspective.

Saha. B. (2016) makes an effort to study the extent of financial literacy among working women of Raipur city and the study was conducted on 100 working women of Raipur city. Percentage and cross analysis were used for analysis of the data and study concluded that working women have good basic knowledge about risk free investment products, very less basic knowledge about risky investments, credit products are better known among them. Variables used for the study were financial products (investment, credit & insurance), credit products and insurance products.

Arora. A. (2016) conducted a study Assessment of Financial Literacy among working Indian women. The objective of the study was to assess the financial literacy level of women and was conducted on 700 working women of urban areas of Rajasthan among which only 444 were responded. Results of the study show that the general awareness about financial planning tools and techniques among women remains poor even today, in 21st century and concluded that women have performed comparatively better in terms of financial attitude and behavior as compared to financial knowledge score. The study was based on three variables i.e. financial knowledge, financial behavior and financial attitude.

3.1 Participation

The study population was composed of the female teaching faculties of Banaras Hindu University. The university website provides email id of 168 female teaching faculties which covers all the institutes, departments and faculties of the University. Questionnaires were sent on all the 168 email id among which 25 were found wrong, so only 143 female teaching faculties were included in the study. However, only 103 questionnaire forms were included in the study since 40 questionnaires were returned incomplete or not answered.

3.2 Instruments

The questionnaire was prepared by the researchers in accordance with the relevant literatures available (Lusardi. A. (2006); Klatt. M. (2009). It was kept short and precise so that participants may not lose their interest or got tired. The questionnaire consist two sections namely demographical information and Investment questions.

Demographical Information: This section contains demographical questions which include name, age, designation, annual salary, marital status and cast.

Investment Questions: This section consists of 14 questions related to the investment behaviour of the participant.

3.3 Data Collection and Analysis

For the purpose of study both primary and secondary data was used. Primary data was collected from 168 female teaching faculties of BHU have been collected through questionnaire and secondary data has been collected through various websites, magazines, journals and articles. Frequencies and percentage were used for data analysis and presented through graphs and charts.

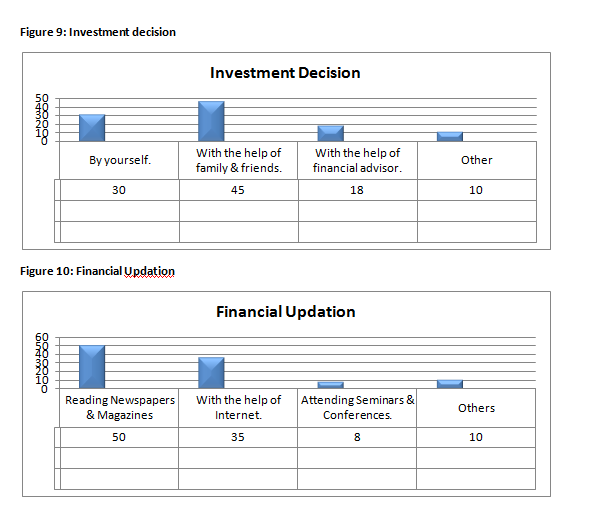

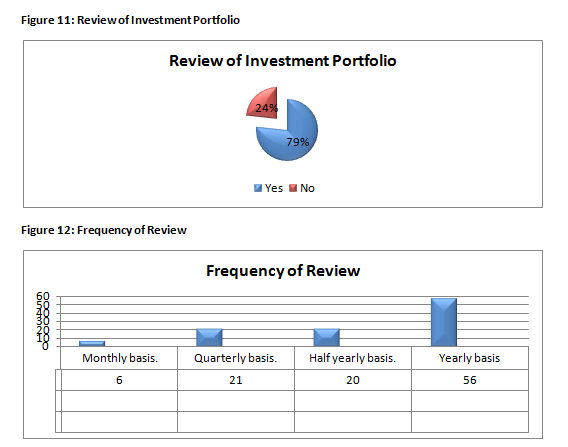

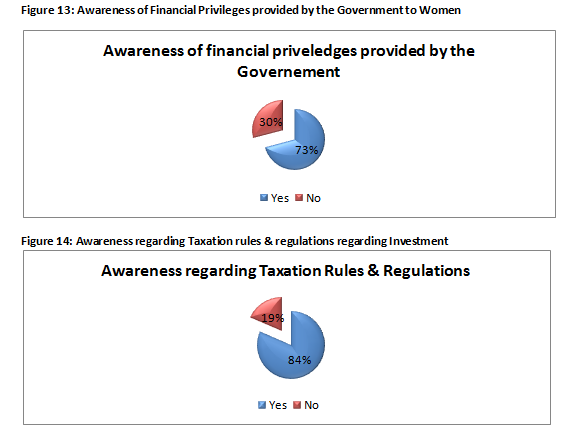

From the study it may be concluded that there is a huge need for conducting financial literacy programs especially for women to develop an understanding of investment behaviour for taking effective investment decisions. The study shows that majority of the women were investing their earned money in one or another investment instruments by taking help of their family and friends. In spite of working at good positions they were not feeling confident while taking their own investment decisions and were investing for shorter period of time. The study also reveals that the most preferable investment avenue among women is fixed deposits. Moreover, women are less active in reviewing their investment portfolios, and were less aware about the financial privileges provided by the government to women.

Further analysis of paper indicates that women are less aware about the different investment opportunities available in the market and have a moderate risk appetite as majority of them invest their earned money in fixed deposit. So they should be educated about investments and how these investments will help them in their real economic development.

Saha, M. B. (2016), A Study of Financial Literacy of Working Women of Raipur City, International Journal of Recent Trends in Engineering & Research, 2(11).

Table 1: Demographic Detail of Respondents

| Frequency | Percent | ||

| Age | 25-35 | 20 | 19.42 |

| 35-45 | 45 | 43.69 | |

| 45-55 | 23 | 22.33 | |

| Above 55 | 15 | 14.46 | |

| Designation | Retired Professor | 08 | 07.77 |

| Professor | 23 | 22.33 | |

| Associate Professor | 21 | 20.39 | |

| Assistant Professor | 51 | 49.51 | |

| Marital Status | Married | 85 | 82.52 |

| Single | 05 | 04.85 | |

| Widow | 10 | 09.71 | |

| Separated | 03 | 02.92 | |

| Caste | General | 81 | 78.64 |

| OBC | 09 | 08.74 | |

| SC/ST | 06 | 05.83 | |

| Other | 07 | 06.79 |