A Refereed Monthly International Journal of Management

Role of Financial Institutions in promoting Microfinance through SHG Bank Linkage Programme in India

Author

|

Dr. Manpreet Arora

Assistant Professor

Department of Accounting and Finance

School of Business and Management Studies

Central University of Himachal Pradesh

TAB, Shahpur, HP

arora.manpreet3@gmail.com

9816343330

|

Swati Singh

Research Scholar

Department of Accounting and Finance

School of Business and Management Studies

Central University of Himachal Pradesh

TAB, Shahpur, HP

swatidogra6317@gmail.com

9816255103 |

Abstract

Rural poor and women are of major concern in developing nations. Microfinance programmes in India have proved to be a powerful tool for the betterment and empowerment of poor especially women. NABARD being an apex body for the rural India has taken effective steps regularly for bringing the women at par with men in rural areas by assisting them financially as well as technically to ultimately become micro entrepreneurs. In SHG Bank Linkage Programme, banks have played a vital role in providing financial services to people through the effective channel of SHGs. The strengthening of the SHG System along with other models of providing microfinance is necessary for promoting extensive financial inclusion in rural sector. SHG Bank Linkage Model with the continuous support to major players in banking sector ensures increased financial inclusion of the rural India. Disbursing credit to the members is the mainstay of microfinance programmes. It will help the members to become self-regulating and supplement their family. Bank Loans play an essential role in ensuring better performance of the group and its members. The rationale of this study is to scrutinize the role of Microfinance as developmental tool which focuses on the banking and financial services availed through SHG Bank Linkage Programme by rural poor including women. We have also analysed the contribution of SHG Bank Linkage Programme in providing credit to the SHGs across various states of India.

Keywords: Microfinance, Self Help Groups, SHG Bank Linkage Programme

Introduction

Micro Finance has laid a positive impact on the quality of life of millions of poor people by providing greater access to credit, savings, insurance, transfer, remittances and other financial services which would otherwise are unreachable. These financial services are provided to customers for meeting their day today financial needs.

Banks have to incur certain transaction costs regardless of whatever the amount of money is involved in the transactions. There is a breakeven point below which the banks do not lend thus it becomes very difficult for these banks to lend to people with small credit needs. It is necessary for a bank to accept collaterals so that in case of any delinquent clients; amount can be recovered through sale of these collaterals. So due to these limitations it is difficult for the banks to fill the gap between the demand and supply of the financial services. Therefore, microfinance plays a strong and vital role in Indian financial system.

Microfinance is a very helpful tool for attaining sustainable growth goals of a financial system. Government of India and Reserve Bank of India are two important institutions who have taken initiatives for finding out the solution for the problems faced by the poor. Institutional credit was considered an important tool or mechanism for alleviation of poverty and generation of employment as a development strategy in 1980’s. Important aspects of this strategy were-

- Expansion of institutional structure

- Direct lending to the priority sector

- Subsidised interest rates to the poor

However, it failed to achieve its objectives drastically. To meet the needs of the poor and underprivileged, providing the microfinance services are the better solution. That is why various financial institutions are engaged in providing these services to poor. Saving facility in microfinance is very important as it provides opportunity to create a thrift and pool funds for further investment. These pooled resources can be used for investment purposes and consumption, meeting their family needs like education of children, purchasing food and non-food items etc.

The rural sector is growing at a fast pace. This sector is being developed with the help of society and government. Even the agricultural sector is being modernized with consistent efforts. New techniques are used for improving agricultural production. For improving production and using advance techniques, it is necessary to have adequate finance. A considerable portion of the India’s population is still below the poverty line which supports the need of such programmes that can help in meeting the needs of such population (Kumar, 2009).

Microfinance has emerged as an important tool for poverty alleviation also. Along with poverty alleviation, it also focuses on other issues like health, education, employment of its members. These programmes focus on improving the social and financial status of the participants of the programmes. The dearth of money makes it difficult to finance livelihood activities and improve the standard of living. Microfinance programmes were stared for reducing the gap between rich and poor. These programmes provide a great opportunity of self-employment to the members of these groups. These programmes try to focus on the upliftment of the people belonging to low income group and underprivileged.

The main features of a Microfinance initiative are-

- Organizing poor into groups so that they can avail the benefits of group lending

- Microfinance services like providing microcredit, promoting savings, and helping in providing micro insurance to poor

- The services are provided to the poor who are not covered under bank services earlier

- Creation of self employment and reduction of poverty

- Savings of members are pooled to form common fund

- Helps in improving women empowerment

For creating financial inclusive environment, it is necessary to make strategies and policies which are helpful for the poor. Thereby they are motivated to form a group of people in the same village. Further the group of people are organized into Self Help Groups (SHGs). It is an association of 10-20 people, who organize themselves into informal groups. Mutual Trust among the members, joint liability and peer pressure among the groups members are some of the important features of these groups. Features of the SHGs are as following:

- Association of 10-20 people

- Informal group based on mutual trust

- Homogenous in character

- Pool saving in the form of thrift

- Disburse loan out of the pooled resources

- Amount of loan and frequency of repayment is decided by SHGs

- Repayment are based on peer pressure

SHG Bank Linkage Programme

With the goal of promoting sustainability and growth of rural economy through credit support, other financial services and new innovative programmes, NABARD started Self Help Group Bank Linkage Programme in India in 1992. More than 8 million groups have been formed and savings of Rs 37000 crores has been pooled. The RBI estimates that there are about 40 percent of the population which is excluded from financial services. Therefore, SHG Bank Linkage Programme helps in covering the unbanked population under the banking services. There are number of Self Help Promoting Institutions which are involved in the promotion and formation of SHGs. They encourage and motivate the people at village level to formulate groups of 10-20 people and contribute small savings to form pool of monetary resources. These pooled resources can be further distributed among the needy members in the form of loans. This programme is a step towards linking the formal financial sector with informal sector in the economy.

SHG Bank Linkage Programme is one of the successful programmes in India. This programme leads to bridging the formal and informal financial sectors of the economy. The prime motive of a financial institution is the promotion of financial inclusion by including the rural poor under the services of banking sector. This is fulfilled by microfinance programme introduced by NABARD i.e. Lead Bank Scheme was introduced in 1969 in which banks were allotted certain districts for development of banking sector in that particular district (RBI,2009). Thus, microfinance sector plays a very crucial role in promoting financial inclusion (Karmakar, 2009). Opening “No frill accounts “and creating awareness about financial literacy by organising special programmes for the poor and unbanked is the motive behind financial programme. Microfinance Institutions are used for providing financial services like deposit, credit, and insurance facilities mainly microfinance services (RBI circular, 2005).

Role of Financial Institutions in promoting Microfinance through SHG Bank Linkage Programme in India

Both formal and informal institutions earlier ignored the poor (Rutherford, 2000). The banking sector failed to cater the needs of adequate number of poor regardless of so much growth of this sector. Even some of the government programmes like Integrated Rural Development Programme initiated for the purpose of development of rural sector failed due to high default rate on the part of borrowers. Some loopholes in the formal financial sector led to the emergence of microfinance sector in India (Fisher and Sriram, 2002). Restructuring of the financial system is necessary to make effective contribution to the development of the economy. The microfinance sector has played an important role in the financial system, where poor can be outreached by bridging gap between formal and informal financial system.

The SHG system is more elastic and is more appropriate for environment prevailing in the Indian economy (Harper, 2002). Microfinance system is based on mutual trust and joint liability. Members of these programmes have information about each other which promotes social cohesion (Ghatak, 1999; Armendáriz & Morduch, 2005). The SHG Bank Linkage Programme has proved to be one of the successful programmes. The programme has showed positive impact on the economic and social status of the members (Puhazhendi and Satyasai, 2002; Kabeer & Noponen, 2005; Sharma, 2008; Sinha, Parida & Baurah, 2012).

The SHG Bank Linkage Programme has played an effective role in improvement empowerment status of the women members. The women spend the amount of loan on the welfare of their family and children. The women should have control over the use of the loan amount failing to which the programme will have least impact on its members (Goetz and Gupta, 1996; Rahman, 1999; Leach and Sitaram, 2002)

Status of SHG Bank Linkage Programme in India

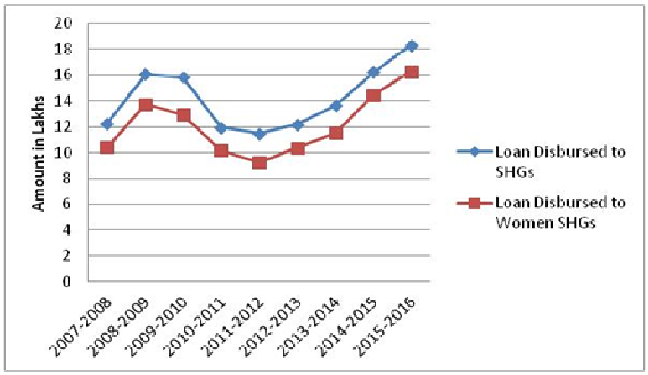

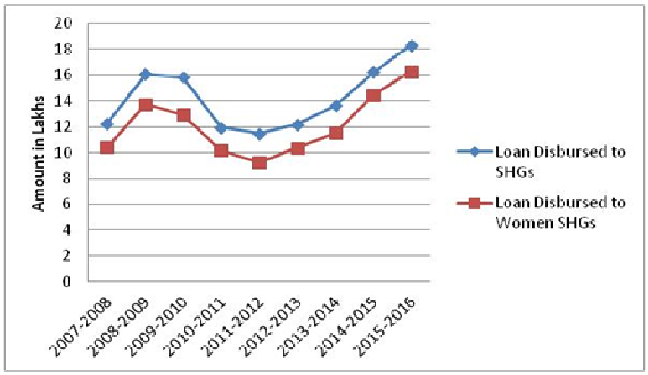

Financial institutions are playing a vital role in promoting the SHG Bank Linkage Programme by disbursing credit to the members. The table 1 shows the status of credit disbursed through bank linkage programme in India since 2007 upto 2015. Credit is the important service provided to the poor through SHG Bank Linkage Programme. The members of SHGs can improve their living standard by employing these funds for meeting the personal consumption needs and production needs. It clearly gives an indication of growing relevance of the micro financial activities in rural India. This table also highlights the fact that women are playing an important role in these programmes. As the most of the credit facility is availed by the rural women. This gives a clear idea about the important role played by microcredit in the uplift-ment of the poor women. It helps them to come over the patriarchal mindsets of Indian society and provides them independence.

The poor rarely have an access to financial services through the formal financial sector. They address their need for financial services through a variety of financial relationships; which are mostly informal. This is one fruitful and effective way of linking them to the credit mainstream.

Table 1 Status of Credit Disbursement in India

|

|

Loans Disbursed to SHGs

|

Loan Disbursed to Women SHGs

|

% of women SHGs of total SHGs

|

|

Year

|

No. of SHGs

(Lakh)

|

Amt

( Crore)

|

No. of SHGs

(Lakh)

|

Amt

(Crore)

|

No. of SHGs

(Lakh)

|

Amt

(Crore)

|

|

2007-2008

|

12.27

|

8849.26

|

10.41

|

7474.26

|

84.79

|

84.46

|

|

2008-2009

|

16.09

|

12253.51

|

13.75

|

10527.38

|

85.4

|

85.9

|

|

2009-2010

|

15.86

|

14453.30

|

12.94

|

12429.37

|

81.6

|

86

|

|

2010-2011

|

11.96

|

14547.73

|

10.17

|

12622.33

|

85

|

86.8

|

|

2011-2012

|

11.48

|

16534.77

|

9.23

|

14132.02

|

80.54

|

85.5

|

|

2012-2013

|

12.20

|

20585.36

|

10.37

|

17854.31

|

85.1

|

86.7

|

|

2013-2014

|

13.66

|

24017.36

|

11.52

|

21037.97

|

84.3

|

87.6

|

|

2014-2015

|

16.26

|

27582.31

|

14.48

|

24419.75

|

89.05

|

83.53

|

|

2015-2016

|

18.32

|

37286.90

|

16.29

|

34411.42

|

88.92

|

92.29

|

Source: Status of Microfinance (Various reports), NABARD

The SHG Bank Linkage Programme has laid a profound social impact especially in rural India (Anand, 2002). A plethora of studies conducted on the effectiveness of the programme, have highlighted its impact on the social empowerment process (Kim, Watts, Hargreaves, Ndhlovu, Phetla, Morison, & Pronyk, 2007). In various countries including India SHG programmes have enabled the households to spend more on education, assets, improved maternal health and better nutrition, housing and health (Thorat, 2006)

In almost all the years the increasing trend can be seen in the loan disbursed to SHG’s including women SHG’s. The percentage of women SHG’s is continuously growing at a very fast pace.

MFIs are the fundamental organizations in many countries that make individual microcredit loans accessible directly to the villagers, micro entrepreneurs, poor women and poor families. MFI is like a small bank or a ‘mini bank’ with the same greater challenges and capital needs which focuses on small ventures but the responsibility is quite high in terms of serving economically-marginalized populations.

A variety of institutions offer microfinance which include commercial banks, NGOs (Non-governmental Organizations), cooperatives, regional rural banks and sectors of government banks. The emergence of profit making MFIs is growing. In India, these ‘for-profit’ MFIs are referred to as Non-Banking Financial Companies (NBFC). NGOs are the main players in this segment but they mainly work in remote rural areas. The basic objective of these NGO’s is providing financial services to the persons with no or little access to the formal set of banking and related services. Microfinance institutions have emerged speedily to try to meet this demand. However, their outreach is very small compared with the demand. Similarly, very few institutions involved in microfinance are profitable.

Now commercial banks in developing countries including India have begun to perceive microfinance not only as a precious public relations tool but a commercial venture and are establishing to examine the micro-finance market in a much deeper sense. Similarly Regional Rural Banks and the Co-operative banks are emerging fast in this stream. The amount saved by these SHG’s with these MFI’s is increasing at a rapid speed. The table below shows the amount saved by SHG’s with commercial banks, RRBs and cooperative banks.

Saving linked SHGs under SHG Bank Linkage Programme

The members of SHG’s form a pool of money by making monthly contribution of small amount and then depositing it in the savings account opened with bank in the name of SHG. These programmes provide the opportunity to the members to save money. It helps to create awareness among related to banking facilities and other related services provided by the banks. The following table shows the progress of savings of the SHGs with the different banks involved in this programme.

Table 2 Savings of SHGs with Banks

|

|

Commercial Banks

|

Regional Rural Banks

|

Cooperative banks

|

|

Year

|

No of SHG

|

Saving Amount

|

No of SHG

|

Saving Amount

|

No of SHG

|

Saving Amount

|

|

2006-07

|

22,93,771

|

1,89,241.44

|

1,183,065

|

115,829.39

|

683,748

|

46,199.96

|

|

2007-08

|

28,10,750

|

2,07,773.45

|

13,86,838

|

1,16,648.83

|

8,12,206

|

54,116.67

|

|

2008-09

|

3549509

|

277298.94

|

1628588

|

198975.08

|

943050

|

78287.80

|

|

2009-10

|

4052915

|

367389.24

|

1820870

|

129937.49

|

1079465

|

122544.16

|

|

2010-11

|

4323473

|

423006.42

|

'1155076

|

125084.19

|

1983397

|

143539.67

|

|

2011-12

|

4618086

|

415298.04

|

2127368

|

130013.93

|

1214895

|

109829.49

|

|

2012-13

|

4076986

|

553257.05

|

2038008

|

152710.20

|

1202557

|

115758.22

|

|

2013-14

|

4022810

|

663145.63

|

2111760

|

195985.73

|

1294930

|

130610.18

|

|

2014-15

|

4135821

|

663067.47

|

2161315

|

234657.37

|

1400333

|

208259.23

|

|

2015-16

|

4140111

|

903388.77

|

2256811

|

248428.13

|

1506080

|

217322.11

|

Source: Status of Microfinance (Various reports), NABARD

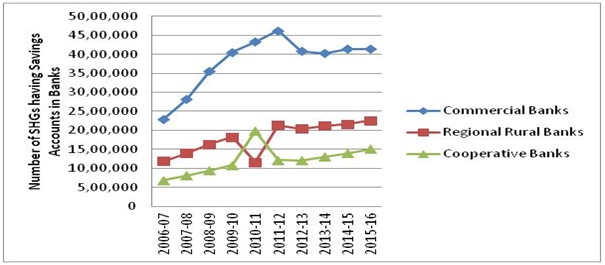

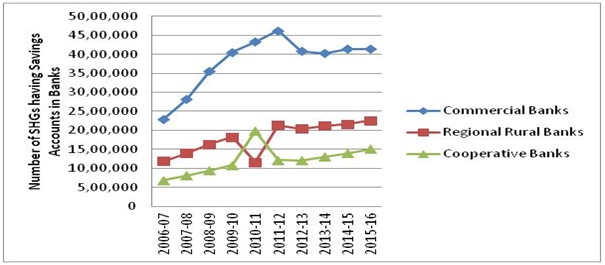

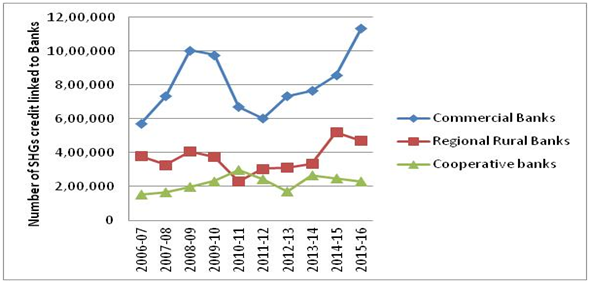

Figure 2 Graph showing the progress of number of SHGs having Savings accounts with Banks

Figure 2 shows the growth in the number of SHGs linked to banks having saving accounts with the banks. Out of these banks, Commercial Banks have the largest number of SHGs having savings accounts with the banks. It is a clear indication that commercial banks are playing a great role in this programmme. There is continuous increase in the number of SHGs linked to the banks since 2007 upto 2012. In 2013, there is fall in the number of SHGs linked with banks. Looking at the contribution of RRBs, the number of SHGs having savings account with the banks , increased upto 2010. In 2011, there is fall in the number of SHGs linked which again increased in 2012. After 2013, the number of SHGs are increasing but at less fluctuating rate. In Cooperative banks, the number of SHGs are increasing till 2011 and there is fall in the number of SHGs in 2012 and then increased after 2012. More number of SHGs have savings account with Commercial Banks followed by Regional Rural Banks and Cooperative banks.

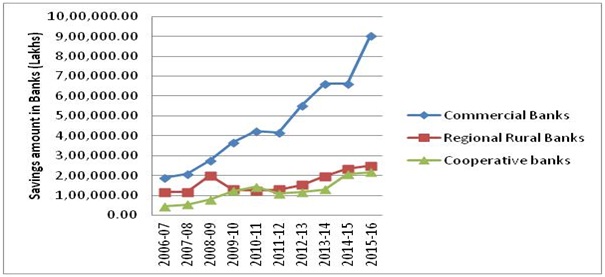

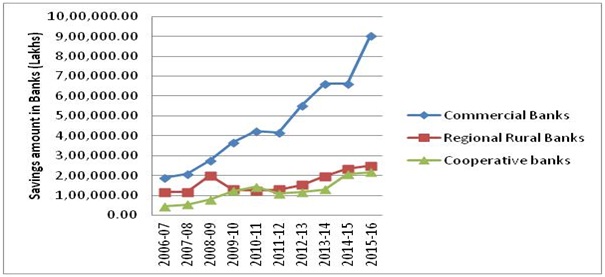

Figure 3 Graph showing the progress of savings amount of SHGs in Banks

Figure 3 shows the growth in the savings amount of SHGs linked to banks. Out of these banks, Commercial Banks have the largest number of SHGs having highest amount of savings with the banks with slight fall in the year 2011-2012. There is continuous increase in the number of SHGs linked to the banks since 2007 upto 2012. In RRBs, the amount of savings of SHGs with the banks increased upto 2008-2009. In 2009-2010, there is fall in the amount of savings upto 2010-2011. In 2011-2012, the amount of savings in the bank accounts of SHGs increased. In Cooperative banks, the number of SHGs are increasing till 2011 and there is fall in the number of SHGs in 2012 and then increased after 2012. More number of SHGs have savings account with Commercial Banks followed by Regional Rural Banks and Cooperative banks

Loan disbursed to SHGs under SHG Bank Linkage Programme

Providing an access to credit forms an important part of this programme. The members participate in these programmes for meeting their financial needs. All these players of financial system have made an effective contribution in the upliftment of the SHGs. The table 3 shows the number of SHGs credit linked to banks and the amount of credit disbursed to the linked SHGs.

Table 3 Loan disbursed to SHGs by Banks

|

|

Commercial Banks

|

Regional Rural Banks

|

Cooperative banks

|

|

Year

|

No of SHG

|

Credit Amount

|

No of SHG

|

Credit Amount

|

No of SHG

|

Credit Amount

|

|

2006-07

|

571,636

|

391,894.32

|

381,199

|

205,273.10

|

152,914

|

59,871.43

|

|

2007-08

|

7,35,119

|

5,40,390.35

|

3,27,650

|

2,65,184.14

|

1,65,001

|

79,351.75

|

|

2008-09

|

1004587

|

806053.10

|

405569

|

319349.01

|

199430

|

99949.28

|

|

2009-10

|

977521

|

978018.55

|

376797

|

333320.06

|

232504

|

133991.75

|

|

2010-11

|

669741

|

972455.27

|

229620

|

162556.33

|

296773

|

319761.59

|

|

2011-12

|

600807

|

994204.49

|

304809

|

502605.15

|

242262

|

156667.23

|

|

2012-13

|

735577

|

1338500.70

|

312010

|

562652.22

|

172234

|

157383.52

|

|

2013-14

|

767253

|

1603749.35

|

333420

|

628813.35

|

265748

|

169173.14

|

|

2014-15

|

855724

|

1733412.66

|

522139

|

772522.19

|

248375

|

252296.21

|

|

2015-16

|

1132281

|

2518497.23

|

470399

|

916492.88

|

229643

|

293699.98

|

Source: Status of Microfinance (Various reports), NABARD

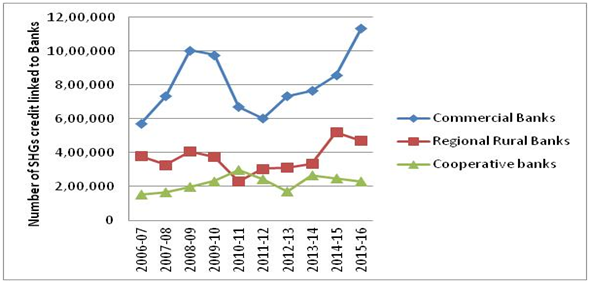

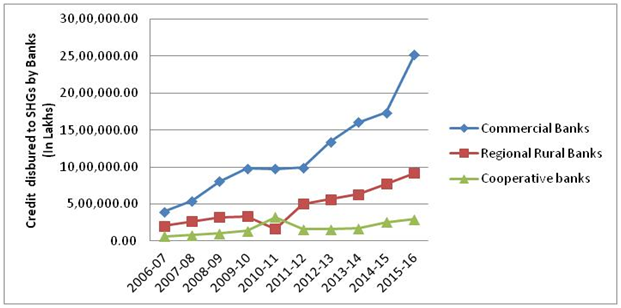

Figure 4 Graph showing the progress of number of SHGs credit linked to Banks

Figure 4 shows the progress of number of SHGs credit linked to Banks. Out of these banks, Commercial Banks have the largest number of SHGs credit linked to banks. There is great fluctuation in the number of SHGs credit linked to the banks. The number of SHGs credit linked to bank increased upto 2008-2009 and in 2009-2010 it decreased and continued decreasing upto 2011-2012. It again increased from 2012-2013 upto 2016. In RRBs, the SHGs credit linked to banks increased also showed great fluctuation. In 2010-2011, there is fall in the number of SHGs credit linked to banks. In 2014-2015, the number of SHGs credit linked to the bank increased to maximum point. In Cooperative banks, the number of SHGs credit linked to SHGs increased upto 2010-2011 and there is fall in the number of SHGs in 2011-2012 upto 2012-2013. More number of SHGs have savings account with Commercial Banks followed by Regional Rural Banks and Cooperative banks.

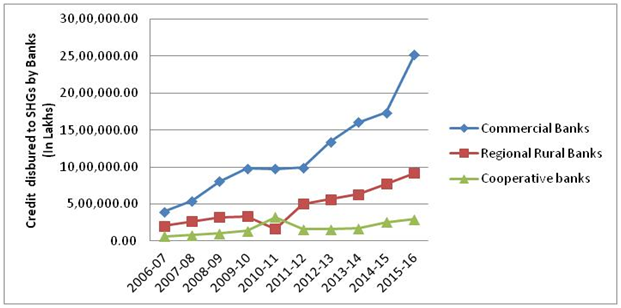

Figure 5 Graph showing the progress of amount of Credit disbursed to S-HGs by Banks

Figure 5 shows the growth in the credit amount disbursed to SHGs linked to banks. Commercial Banks have disbursed maximum credit to the SHGs. There is continuous increase in the credit disbursed to the SHGs from 2007 to 2016. In RRBs, the amount of credit disbursed to SHGs increased upto to 2009-2010. In 2010-2011, there is fall in the amount of credit disbursed in the year 2010-2011. In 2011-2012, the credit amount disbursed again increased from the year 2011-2012. In Cooperative banks, the credit amount increased upto 2010-2011 and there is fall in the year 2011-2012. It further increased from 2012-2013 upto 2015-2016.

Based on the figures available in Table 2 and 3, the correlation between the credit disbursed and the amount saved is calculated.

The correlation between the saving amount deposited by the SHG members and amount of loan disbursed of different banks help us in analyzing the role of microfinance in the development of economy. The savings and credit amount of all the banks is highly correlated to each other. The correlation between the saving amount and credit amount is significant at 0.00, 0.003 and 0.001for Commercial Banks, Regional Rural Banks and Cooperative Banks respectively.

|

Correlations

|

|

|

Credit amount disbursed by Commercial Banks

|

Saving amount deposited by SHG members in Commercial Banks

|

|

Credit amount disbursed by Commercial Banks

|

Pearson Correlation

|

1

|

.989**

(0.00)

|

|

Saving amount deposited by SHG members in Commercial Banks

|

Pearson Correlation

|

.989**

(0.00)

|

1

|

|

**. Correlation is significant at the 0.01 level (2-tailed).

|

Source: Output based on SPSS calculations

|

Correlations

|

|

|

Credit amount disbursed by RRB

|

Saving amount deposited by SHG members in RRB

|

|

Credit amount disbursed by RRB

|

Pearson Correlation

|

1

|

.836**

(.003)

|

|

Saving amount deposited by SHG members in RRB

|

Pearson Correlation

|

.836**

(.003)

|

1

|

|

**. Correlation is significant at the 0.01 level (2-tailed).

|

Source: Output based on SPSS calculations

Correlations

|

|

|

Credit amount disbursed by Cooperative Banks

|

Saving amount deposited by SHG members in Cooperative Banks

|

|

Credit amount disbursed by Cooperative Banks

|

Pearson Correlation

|

1

|

.869**

(.001)

|

|

Saving amount deposited by SHG members in Cooperative Banks

|

Pearson Correlation

|

.869**

(.001)

|

1

|

|

**. Correlation is significant at the 0.01 level (2-tailed).

|

Source: Output based on SPSS calculation

Implications

The high correlation between the amount disbursed as credit to the SHG members and the saving amount saved by the members clearly indicate the policy adopted by the financial institutions in regard to providing credit based upon the proportion of amount saved in the banks. Simply sating, the banks provide credit to the SHG’s on the basis of amount saved by the SHG’s. It ultimately induces saving habit in the group to a great extent. The basic fundamental principle of economic growth states that saving and investments leads to capital formation which ultimately increases the level of economic growth of the country. This induced habit of savings in order to get more credit not only helps in economic growth but it also improves the per capita income of the members of the group, which in turn improves the standard of living of the members. When most of the members availing credit facility are women, it further indicates the upliftment of the social as well as the economic status of rural women as whole.

Conclusion

The facts and figures stated above clearly depicts that the microfinance is emerging as an important tool for the economic and social upliftment of the rural India by contributing towards economic development. Commercial banks are playing an important role through SHG Bank Linkage programme in providing ample credit opportunities to the poor especially women. This in turn paves way for the entrepreneurial growth and development by establishing micro, medium and small entrepreneurial ventures.

References

Anand, J. S. (2002). Self-help groups in empowering women: Case study of selected SHGs and NHGs . Kerala Research Programme on Local Level Development, Centre for Development Studies.

Armendáriz, B., & Morduch, J. (2010). The economics of microfinance. MIT press.

Fisher, T., Sriram, M., & Harper, M. (2002). Beyond micro-credit: Putting development back into micro-finance. Oxford: Oxfam

Ghatak, M. (1999). Group lending, local information and peer selection. Journal of Development Economics, 60(1), 27-50.

Goetz, A. M., & Gupta, R. S. (1996). Who takes the credit? Gender, power, and control over loan use in rural credit programs in Bangladesh. World development, 24(1), 45-63.

Harper, M. (2002). Promotion of self help groups under the SHG bank linkage programme in India. Paper presented at the Seminar on SHG-bank Linkage programme at New Delhi

Kabeer, N., & Noponen, H. (2005). Social and Economic Impacts of PRADAN's Self Help Group Microfinance and Livelihoods Promotion Program: Analysis From Jharkhand, India.

Kim, J. C., Watts, C. H., Hargreaves, J. R., Ndhlovu, L. X., Phetla, G., Morison, L. A., ... & Pronyk, P. (2007). Understanding the impact of a microfinance-based intervention on women’s empowerment and the reduction of intimate partner violence in South Africa. American journal of public health , 97 (10), 1794-1802.

Leach, F., & Sitaram, S. (2002). Microfinance and women's empowerment: A lesson from India. Development in Practice, 12(5), 575-588.

Puhazhendhi, V., & Satyasai, K. (2002). Empowerment of Rural Women through Self Help Groups: An Indian Experience. National Bank News Review, 18(2), 39-47.

Rahman, A. (1999). Micro-credit initiatives for equitable and sustainable development: Who pays? World development, 27(1), 67-82. doi:

http://dx.doi.org/10.1016/S0305-750X(98)00105-3

Rutherford, S. (2000). The poor and their money.New Delhi:Oxford University Press.

Sharma, H. (2008). Functioning and Impact of Microfinance: Evidence from Himachal Pradesh. Reforming Indian agriculture: towards employment generation and poverty reduction: essays in honour of GK Chadha, 269-290.

Sinha, Parida, P. C., & Baurah, P. (2012). The impact of NABARD's Self Help Group-Bank Linkage Programme on poverty and empowerment in India. Contemporary South Asia, 20(4), 487-510.

Thorat, Y. S. P. (2006). Rural credit in India: Issues and concerns. Indian Journal of Agricultural Economics, 61(1), 1.

The SHG Bank Linkage Programme has laid a profound social impact especially in rural India (Anand, 2002). A plethora of studies conducted on the effectiveness of the programme, have highlighted its impact on the social empowerment process (Kim, Watts, Hargreaves, Ndhlovu, Phetla, Morison, & Pronyk, 2007). In various countries including India SHG programmes have enabled the households to spend more on education, assets, improved maternal health and better nutrition, housing and health (Thorat, 2006)

In almost all the years the increasing trend can be seen in the loan disbursed to SHG’s including women SHG’s. The percentage of women SHG’s is continuously growing at a very fast pace.

MFIs are the fundamental organizations in many countries that make individual microcredit loans accessible directly to the villagers, micro entrepreneurs, poor women and poor families. MFI is like a small bank or a ‘mini bank’ with the same greater challenges and capital needs which focuses on small ventures but the responsibility is quite high in terms of serving economically-marginalized populations.

A variety of institutions offer microfinance which include commercial banks, NGOs (Non-governmental Organizations), cooperatives, regional rural banks and sectors of government banks. The emergence of profit making MFIs is growing. In India, these ‘for-profit’ MFIs are referred to as Non-Banking Financial Companies (NBFC). NGOs are the main players in this segment but they mainly work in remote rural areas. The basic objective of these NGO’s is providing financial services to the persons with no or little access to the formal set of banking and related services. Microfinance institutions have emerged speedily to try to meet this demand. However, their outreach is very small compared with the demand. Similarly, very few institutions involved in microfinance are profitable.

Now commercial banks in developing countries including India have begun to perceive microfinance not only as a precious public relations tool but a commercial venture and are establishing to examine the micro-finance market in a much deeper sense. Similarly Regional Rural Banks and the Co-operative banks are emerging fast in this stream. The amount saved by these SHG’s with these MFI’s is increasing at a rapid speed. The table below shows the amount saved by SHG’s with commercial banks, RRBs and cooperative banks.

Saving linked SHGs under SHG Bank Linkage Programme

The members of SHG’s form a pool of money by making monthly contribution of small amount and then depositing it in the savings account opened with bank in the name of SHG. These programmes provide the opportunity to the members to save money. It helps to create awareness among related to banking facilities and other related services provided by the banks. The following table shows the progress of savings of the SHGs with the different banks involved in this programme.

Table 2 Savings of SHGs with Banks

The SHG Bank Linkage Programme has laid a profound social impact especially in rural India (Anand, 2002). A plethora of studies conducted on the effectiveness of the programme, have highlighted its impact on the social empowerment process (Kim, Watts, Hargreaves, Ndhlovu, Phetla, Morison, & Pronyk, 2007). In various countries including India SHG programmes have enabled the households to spend more on education, assets, improved maternal health and better nutrition, housing and health (Thorat, 2006)

In almost all the years the increasing trend can be seen in the loan disbursed to SHG’s including women SHG’s. The percentage of women SHG’s is continuously growing at a very fast pace.

MFIs are the fundamental organizations in many countries that make individual microcredit loans accessible directly to the villagers, micro entrepreneurs, poor women and poor families. MFI is like a small bank or a ‘mini bank’ with the same greater challenges and capital needs which focuses on small ventures but the responsibility is quite high in terms of serving economically-marginalized populations.

A variety of institutions offer microfinance which include commercial banks, NGOs (Non-governmental Organizations), cooperatives, regional rural banks and sectors of government banks. The emergence of profit making MFIs is growing. In India, these ‘for-profit’ MFIs are referred to as Non-Banking Financial Companies (NBFC). NGOs are the main players in this segment but they mainly work in remote rural areas. The basic objective of these NGO’s is providing financial services to the persons with no or little access to the formal set of banking and related services. Microfinance institutions have emerged speedily to try to meet this demand. However, their outreach is very small compared with the demand. Similarly, very few institutions involved in microfinance are profitable.

Now commercial banks in developing countries including India have begun to perceive microfinance not only as a precious public relations tool but a commercial venture and are establishing to examine the micro-finance market in a much deeper sense. Similarly Regional Rural Banks and the Co-operative banks are emerging fast in this stream. The amount saved by these SHG’s with these MFI’s is increasing at a rapid speed. The table below shows the amount saved by SHG’s with commercial banks, RRBs and cooperative banks.

Saving linked SHGs under SHG Bank Linkage Programme

The members of SHG’s form a pool of money by making monthly contribution of small amount and then depositing it in the savings account opened with bank in the name of SHG. These programmes provide the opportunity to the members to save money. It helps to create awareness among related to banking facilities and other related services provided by the banks. The following table shows the progress of savings of the SHGs with the different banks involved in this programme.

Table 2 Savings of SHGs with Banks

Figure 2 shows the growth in the number of SHGs linked to banks having saving accounts with the banks. Out of these banks, Commercial Banks have the largest number of SHGs having savings accounts with the banks. It is a clear indication that commercial banks are playing a great role in this programmme. There is continuous increase in the number of SHGs linked to the banks since 2007 upto 2012. In 2013, there is fall in the number of SHGs linked with banks. Looking at the contribution of RRBs, the number of SHGs having savings account with the banks , increased upto 2010. In 2011, there is fall in the number of SHGs linked which again increased in 2012. After 2013, the number of SHGs are increasing but at less fluctuating rate. In Cooperative banks, the number of SHGs are increasing till 2011 and there is fall in the number of SHGs in 2012 and then increased after 2012. More number of SHGs have savings account with Commercial Banks followed by Regional Rural Banks and Cooperative banks.

Figure 3 Graph showing the progress of savings amount of SHGs in Banks

Figure 2 shows the growth in the number of SHGs linked to banks having saving accounts with the banks. Out of these banks, Commercial Banks have the largest number of SHGs having savings accounts with the banks. It is a clear indication that commercial banks are playing a great role in this programmme. There is continuous increase in the number of SHGs linked to the banks since 2007 upto 2012. In 2013, there is fall in the number of SHGs linked with banks. Looking at the contribution of RRBs, the number of SHGs having savings account with the banks , increased upto 2010. In 2011, there is fall in the number of SHGs linked which again increased in 2012. After 2013, the number of SHGs are increasing but at less fluctuating rate. In Cooperative banks, the number of SHGs are increasing till 2011 and there is fall in the number of SHGs in 2012 and then increased after 2012. More number of SHGs have savings account with Commercial Banks followed by Regional Rural Banks and Cooperative banks.

Figure 3 Graph showing the progress of savings amount of SHGs in Banks

Figure 3 shows the growth in the savings amount of SHGs linked to banks. Out of these banks, Commercial Banks have the largest number of SHGs having highest amount of savings with the banks with slight fall in the year 2011-2012. There is continuous increase in the number of SHGs linked to the banks since 2007 upto 2012. In RRBs, the amount of savings of SHGs with the banks increased upto 2008-2009. In 2009-2010, there is fall in the amount of savings upto 2010-2011. In 2011-2012, the amount of savings in the bank accounts of SHGs increased. In Cooperative banks, the number of SHGs are increasing till 2011 and there is fall in the number of SHGs in 2012 and then increased after 2012. More number of SHGs have savings account with Commercial Banks followed by Regional Rural Banks and Cooperative banks

Loan disbursed to SHGs under SHG Bank Linkage Programme

Providing an access to credit forms an important part of this programme. The members participate in these programmes for meeting their financial needs. All these players of financial system have made an effective contribution in the upliftment of the SHGs. The table 3 shows the number of SHGs credit linked to banks and the amount of credit disbursed to the linked SHGs.

Table 3 Loan disbursed to SHGs by Banks

Figure 3 shows the growth in the savings amount of SHGs linked to banks. Out of these banks, Commercial Banks have the largest number of SHGs having highest amount of savings with the banks with slight fall in the year 2011-2012. There is continuous increase in the number of SHGs linked to the banks since 2007 upto 2012. In RRBs, the amount of savings of SHGs with the banks increased upto 2008-2009. In 2009-2010, there is fall in the amount of savings upto 2010-2011. In 2011-2012, the amount of savings in the bank accounts of SHGs increased. In Cooperative banks, the number of SHGs are increasing till 2011 and there is fall in the number of SHGs in 2012 and then increased after 2012. More number of SHGs have savings account with Commercial Banks followed by Regional Rural Banks and Cooperative banks

Loan disbursed to SHGs under SHG Bank Linkage Programme

Providing an access to credit forms an important part of this programme. The members participate in these programmes for meeting their financial needs. All these players of financial system have made an effective contribution in the upliftment of the SHGs. The table 3 shows the number of SHGs credit linked to banks and the amount of credit disbursed to the linked SHGs.

Table 3 Loan disbursed to SHGs by Banks

Figure 4 shows the progress of number of SHGs credit linked to Banks. Out of these banks, Commercial Banks have the largest number of SHGs credit linked to banks. There is great fluctuation in the number of SHGs credit linked to the banks. The number of SHGs credit linked to bank increased upto 2008-2009 and in 2009-2010 it decreased and continued decreasing upto 2011-2012. It again increased from 2012-2013 upto 2016. In RRBs, the SHGs credit linked to banks increased also showed great fluctuation. In 2010-2011, there is fall in the number of SHGs credit linked to banks. In 2014-2015, the number of SHGs credit linked to the bank increased to maximum point. In Cooperative banks, the number of SHGs credit linked to SHGs increased upto 2010-2011 and there is fall in the number of SHGs in 2011-2012 upto 2012-2013. More number of SHGs have savings account with Commercial Banks followed by Regional Rural Banks and Cooperative banks.

Figure 5 Graph showing the progress of amount of Credit disbursed to S-HGs by Banks

Figure 4 shows the progress of number of SHGs credit linked to Banks. Out of these banks, Commercial Banks have the largest number of SHGs credit linked to banks. There is great fluctuation in the number of SHGs credit linked to the banks. The number of SHGs credit linked to bank increased upto 2008-2009 and in 2009-2010 it decreased and continued decreasing upto 2011-2012. It again increased from 2012-2013 upto 2016. In RRBs, the SHGs credit linked to banks increased also showed great fluctuation. In 2010-2011, there is fall in the number of SHGs credit linked to banks. In 2014-2015, the number of SHGs credit linked to the bank increased to maximum point. In Cooperative banks, the number of SHGs credit linked to SHGs increased upto 2010-2011 and there is fall in the number of SHGs in 2011-2012 upto 2012-2013. More number of SHGs have savings account with Commercial Banks followed by Regional Rural Banks and Cooperative banks.

Figure 5 Graph showing the progress of amount of Credit disbursed to S-HGs by Banks

Figure 5 shows the growth in the credit amount disbursed to SHGs linked to banks. Commercial Banks have disbursed maximum credit to the SHGs. There is continuous increase in the credit disbursed to the SHGs from 2007 to 2016. In RRBs, the amount of credit disbursed to SHGs increased upto to 2009-2010. In 2010-2011, there is fall in the amount of credit disbursed in the year 2010-2011. In 2011-2012, the credit amount disbursed again increased from the year 2011-2012. In Cooperative banks, the credit amount increased upto 2010-2011 and there is fall in the year 2011-2012. It further increased from 2012-2013 upto 2015-2016.

Based on the figures available in Table 2 and 3, the correlation between the credit disbursed and the amount saved is calculated.

The correlation between the saving amount deposited by the SHG members and amount of loan disbursed of different banks help us in analyzing the role of microfinance in the development of economy. The savings and credit amount of all the banks is highly correlated to each other. The correlation between the saving amount and credit amount is significant at 0.00, 0.003 and 0.001for Commercial Banks, Regional Rural Banks and Cooperative Banks respectively.

Figure 5 shows the growth in the credit amount disbursed to SHGs linked to banks. Commercial Banks have disbursed maximum credit to the SHGs. There is continuous increase in the credit disbursed to the SHGs from 2007 to 2016. In RRBs, the amount of credit disbursed to SHGs increased upto to 2009-2010. In 2010-2011, there is fall in the amount of credit disbursed in the year 2010-2011. In 2011-2012, the credit amount disbursed again increased from the year 2011-2012. In Cooperative banks, the credit amount increased upto 2010-2011 and there is fall in the year 2011-2012. It further increased from 2012-2013 upto 2015-2016.

Based on the figures available in Table 2 and 3, the correlation between the credit disbursed and the amount saved is calculated.

The correlation between the saving amount deposited by the SHG members and amount of loan disbursed of different banks help us in analyzing the role of microfinance in the development of economy. The savings and credit amount of all the banks is highly correlated to each other. The correlation between the saving amount and credit amount is significant at 0.00, 0.003 and 0.001for Commercial Banks, Regional Rural Banks and Cooperative Banks respectively.