Dr. Hiteshkumar Thakkar

Assistant Professor of Economics,

Gujarat National Law University,

Gandhinagar, Gujarat (INDIA)

Email ID: hthakkar@gnlu.ac.in

Global Financial Architecture (GFA) evolved and matured after post-G-20 London Summit where Financial Stability Board (FSB) emerged as a true International Macro-Prudential Regulator (IMaPR). In the Global Financial Architecture, the focus shifted from Micro-Prudential Regulation to Macro-Prudential Regulation. The stability and sustainability of the global financial systemis the mandate of Macro-Prudential Supervision. The FSB-IMF have jointly undertaken collaborative early warning exercises to strengthen assessments of systemic risks and provide adequate firewall and regulatory measures in response to systemic risks. The FSB does not create any legal rights or obligations towards member nations to implement the international standards. For the implementation of theinternational standard, the onus lies on peer pressurefrom the member jurisdiction. Therefore, the FSB is part of soft law mechanism where the member jurisdiction prefersto execute international standard and they demonstrate that theirdomestic rules and regulationsareupgradedin accordance withinternationalrules and regulations. Over and above, the FSB make astrongfollow-up to non-cooperative jurisdiction.As a result, the member nations are strictly implementing the recommendations or standards as laid down by Macro-Prudential Regulator. The institutionalizing of FSB will increase economic efficiency, and it will encourage member jurisdiction and non-members jurisdictionto implement the international financial standards. Whether FSB will play a vital role and mark its footprint as a World Financial Organization (WFO)or Supra Global Financial Authority in the Global Financial Architecture? This paper has focused on the mechanism of global financial architecture during post G-20 London Summit. Over and above, whether FSB emerged as an effectiveInternational Macro-Prudential Regulator in the Global Financial Architecture (GFA)?

Keywords: Global Financial Architecture (GFA), International Macro-Prudential Regulator (IMaPR), World Financial Organization (WFO), and Financial Stability Board (FSB)

The Global Financial Architecture (GFA) consists of institutions, their participants and regulators/standard setting bodies those act on a Supranational level. It is the combination of Micro-Prudential Regulators (IMF, World Bank, BIS, OECD, BCBS, IASB, IAIS, IOSCO, CPMI, and CGFS) and Macro-Prudential Regulators (IMF and FSB) acting at the global level. The Global Financial Architecture deliberate and deliver on most essential rules, best practice, and guidelines that are required to reduce fragility and market-basedrisk. It prepares guidelines for the various sector such as a central bank, banking, securities market, insurance, and corporate sector. It also focuses on concern related to governance, accounting, capital adequacy, risk management, transparency, and payment and settlement. The GFA provide minimum standards which serve as a soft law. The term “macro-prudential” has become increasingly common in discussions of possible changes to regulatory and supervisory frameworks. The macro-prudential policy as a policy that uses primarily prudential tools to limit systemic or system-wide financial risk, thereby limiting the incidence of disruptions in the provision of key financial services that can have serious consequences for the real economy, by identifying and addressing common exposures, risk concentrations, linkages and interdependencies that are sources of contagion and spillover risks that may jeopardize the functioning of the system as a whole.The macro-prudential policy is a complement to micro-prudentialpolicy and it interacts with other types of public policy that have an impact on financial stability. No matter how different policy mandates are structured, addressing financial stability and systemic risk is a common responsibility.The Global Financial Architecture (GFA), for example, IADI, IAIS and FSB, focused on developing the prudential financial regulation. These Micro and Macro-Prudential Regulators prepare guidelines for the various sectors such as insurance market, banking sector, securities market and corporate sector as per the new transformation in GFA.

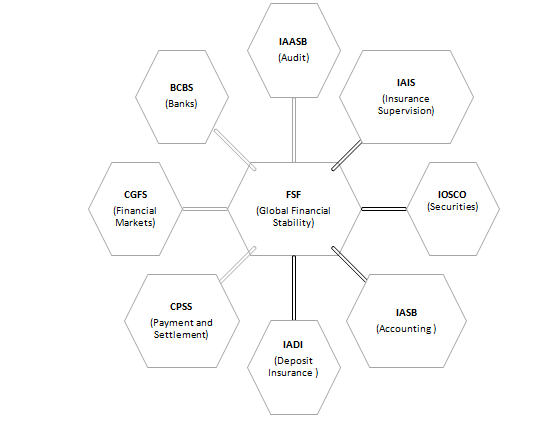

There were series of regional crises occurred in Asia, Latin America, and Russia in 1997-1998 which has challenged the Global Financial Architecture (GFA).In the backdrop of this crisis, the G-7 form committee under the able guidance of Hans Tietmeyer prepared a report. This proposalhighlighted for setting up of Macro-Prudential Regulatory Framework for closer cooperation and coordination between many international financial regulatory bodies to promote global financial stability and surveillance (Jason Liberi, 2014). The report highlighted the need to overcome issues of Macro-Prudential Regulation (Mikdashi, 2001) which has given birth of the Financial Stability Forum (FSF)[i] in 1999. The focus of FSF was to assess vulnerabilities affecting the global finance, to oversee action needed to address these vulnerabilities and to improve coordination among all stakeholders responsible for financial stability and sustainability. For fulfilling these mandates, the forum meets twice a year. The stakeholders consist of the finance minister, central bank governor, and head of financial supervisory authorities of the G-7 countries, along with international standard-setting bodies, international economic organization, and international financial institutions (BIS Review, Hans Tietmeyer 1999).Its chief representatives are from the IMF, World Bank, Bank for International Settlements (BIS), Organization for Economic Cooperation and Development (OECD), Basel Committee on Banking Supervision (BCBS), International Accounting Standards Board (IASB), International Association of Insurance Supervisors (IAIS), International Organization of Securities Commissions (IOSCO), Committee on Payment and Settlement Systems (CPSS), and Committee on the Global Financial System (CGFS).The FSF has provided the platform to the Micro-Prudential Regulator (sector specific), various national financial regulatory and supervisory bodies to act as a medium, an instrument of information exchange and policy formulation in a collaborative effort with the other stakeholders. Its organizational framework provides a forum to discuss a set of international standards and best practices among a variety of interested players in the global finance. The following figure I illustrate the role of Financial Stability Forum (FSF) in the Global Financial Architecture.

Figure I: Micro-Prudential Regulators interaction with Financial Stability Forum (FSF)in GFA[ii]

[i] Mr. Andrew Crockett General Manager for the Bank of International Settlements (BIS) appointed as first chairman of the Forum for a period of three years.

[ii] BCBS (G-10 Governors, BIS, Basel), CGFS (G-10 Governors, BIS, Basel), CPMI (G-10 Governors, BIS, Basel), FSF (G-7 Ministers and Governors, BIS, Basel), IAASB (Audit Standards: PIOB & IFAC, New York), IADI (Deposit Insurance, BIS, Basel), IAIS (Insurance Supervision, BIS, Basel), IASB (Accounting Standards, IASCF, London), IOSCO (Securities regulation, Madrid), and PIOB (Audit Standards, IFAC, Madrid)

FSF lackedwider membership, and it is hard to implement standards when non-members did notparticipatevoluntarily or otherwise. It started the journey without including developing or emerging economies and other important stakeholders other than G-7 countries(Jason Liberi, 2014, p. 25). The FSF could not implement standards into practice and failed to learn a lesson from the 1990’s financial failure. The creation of FSF was not subject to states enactment. It was an informal association of G-7 countries representatives without an official legal mandate. The presence of FSF was absolutely insignificant during the Global Financial Crisis (2007-10);infact it was the IMF and World Bank stimulus package that helped the world economy to recover from Global Financial Crisis. The FSF did not fulfill thedesiredmandate. It has failed as International Macro-Prudential Regulator in GFA. So, the proposal of Hans Tietmeyer as an FSF had not marked its footprint in the GFA.

The Global Financial Crisis (GFC) which intensified in 2008, with the collapse of Lehman Brothers Bank. The GFC demonstrated serious lacuna in the GFA. The crisis was not only restricted to the US but also intensely spread from one nation to systematically important regions, and finally became contagious worldwide(Arner and Buckley, 2010, p. 2). The reforms in the Global FinancialArchitecture (GFA) started to enhance the monitoring of systemic stability and to strengthen the relations between Macro and Micro-Prudential Regulation. At the global level, coordination initially took place through the G-7 countries and at the institutional level, through the FSF to the major stakeholders. However, the post-G20 London Summit(2009) changed from G7/FSF to G20/FSB. The FSB has laid a strong foundation of the global financial regulatory mechanism.

3.1. Emergence of Financial Stability Board (FSB) in GFA

The process of development of FSF was gradual and continuous till it reached maturity in the international financial organization. It firstly broadened the membership to G-20 countries, where financial authorities of developing or emerging countrieswere included and become prominent players in the global financial system. Further, in G-20 summits such as the London Summit led to the establishment of a Financial Stability Board (FSB) as a successor to the Financial Stability Forum (FSF). The FSB was designed to develop stronger institutional setup so that it could efficiently collaborate with national financial authority, standard-setting bodies (SSB) and international financial institutions (IFI) in addressing vulnerabilities and market risk. For the institutional setup, the FSB would consist of a Chairperson, a Steering Committee, the Plenary, SSBs, IFIs and a Secretariat. The Plenary is the decision-making organ and the Steering Committee is an executive body. The membership includes the current FSF members plus rest of the G-20, Spain, and the European Commission. FSB pursue and puts it effort on implementing international financial standards, periodic peer reviews, accountability and transparency of the global financial system.

The framework of global financial regulation was based on the objective to strike a balance between Micro-Prudential Regulation and Macro-Prudential Regulation(Kern Alexander, 2014, p. 7-8). However, after the global financial crisis, the international regulatory mechanism shifted focus from Micro-Prudential Regulation to Macro-Prudential Regulation. The FSB was the first step in this direction. It was builtalong the lines of sustainable global Macro-Prudential Regulation.[1] It encompasses a membership of national financial regulators, central bankers, International Financial Institutions (IFIs), sector-specific international supervisors and standard-setting bodies (SSBs) who are responsible for financial stability. Its mission is to ensure that national and international authorities and relevant international supervisory bodies shall more effectively coordinate their respective responsibilities to support international financial stability, thus improving the function of the overall markets.

3.2. Development of FSB through G-20 Heads of Government Level Summit

The Financial Stability Board’s enlarged mandate was approved by the Heads of State and Government of the G-20 to establish the Financial Stability Board with a stronger institutional basis and enhanced capacity (London Summit, 2 April 2009, “Declaration on Strengthening the Financial System”). The Pittsburgh Summit endorsed FSB’s original Charter and also set out the objectives (Pittsburgh Summit, 25 September 2009). The Seoul Summit affirmed the FSB's role in coordinating at the international level, the work of national financial authorities and international standard-setting bodies in developing and promoting the implementation of effective regulatory, supervisory and other financial sector policies in the interest of global financial stability (Seoul Summit Leaders’ Declaration, 12 November 2010).

The FSB plays a crucial role in promoting the reform of international financial regulation. The G20 called for thestrengthening of the FSB’s capacity resources and governance through the establishment of the FSB on an enduring organizational basis (Cannes Summit, 4 November 2011, Cannes Summit Final Declaration). The FSB will promote strong regulatory, supervisory function and foster a level playing field through consistent policy implementation, across sectors and jurisdictions. It sets out concrete steps to strengthen its capacity, resources, and governance by enduring organizational footing (G20 Los Cabos Summit on 19 June 2012: Strengthening FSB Capacity, Resources, and Governance). In Los Cabos Summit, it restated and amended its Charter which reinforces certain elements of its mandate, including its role in standard setting and in promoting Members’ implementation of international standards and accepted the G20 and FSB commitments and policy recommendations. It was then decided to pursue a gradual approach to the institutionalization of the FSB by establishing it as an association under Swiss law and thereby vesting it with legal personality. On 28 January 2013, the FSB established itself as a not-for-profit association under Swiss law with its seat in Basel, Switzerland (Preface, FSB - 2nd Annual Report 2015) which has put FSB one step closer to achieve the status of International Organization in the near future.

The FSB has adopted twelve key standards for sound financial systems, all of which are legally non-binding soft law. Nevertheless, they are incorporatedby most of the regulatory regimes of all countries. Since the establishment of FSB, it has been addressing a diverse range of regulatory concerns such as supervisory colleges to monitor each large international financial firms, principles for cross-border cooperation on crisis managementetc. It has engaged multilateral dialogues to resolve home-host and global issues.

The FSB provides aplatform to Micro-Prudential Regulators in deliberating and discussing the standard prior to implementation in the member jurisdiction. These Micro-Prudential Regulators coordinate with one another and member jurisdiction while preparing international standards. The mechanismprovides cross verification of existing standards accordance with adynamic change in the global financialarchitecture.

The Basel Committee on Banking Supervision (BCBS) emphasis on developing the quality of banking standards worldwide and implement best practices for expeditious banking regulation globally.The Committee on the Global Financial System (CGFS) take care on the short-term observing of the global financial system state of affairs, along with long-term focuses on strengthening the global monetary system by enhancing of market operation and promoting financial stability and sustainability.The Committee on Payments and Market Infrastructures (CPMI) endorses the safe, secure and effective payment and clearing, settlement.International Association of Deposit Insurers (IADI) look after the enhancing the efficient deposit insurance systems andInternational Association of Insurance Supervisors (IAIS) promotes internationally harmonious guidelines for the insurance industry. On the other hand, Macro-Prudential Regulatoras an FSBdevelops stronger institutional setup so that it could efficiently bringing together among national financial authority, standard-setting bodies (SSB) and international financial institutions (IFI) in resolving the problem of instability and market risk. As a result, Macro and Micro Prudential Regulators are accountable for monetary stability and sustainability purpose in GFA.

The International Association of Insurance Supervisors (IAIS) workwith FSBin enhancing regulation of the insurance industry on domestic and international levels to maintain efficient, fair, just, safe and stable insurance markets for the benefit and protection of policyholders.The International Accounting Standards Board (IASB)work on issues relating to develop and promote a single set of high-quality, understandable, enforceable and globally accepted International Financial Reporting Standards (IFRS). The International Organization of Securities Commissions (IOSCO) is the internationally recognized body that brings together the world's securities regulators and is recognized as the global standard setter for the securities sector.The IMF plays an active role in FSB governance and conducts Early Warning Exercises in coordination with FSB (Article 2 (h)). The Organization for Economic Co-operation and Development (OECD) promotes the global forum for transparency and exchange of information for tax purposes in the form of a multilateral framework, where, exchange of information is carried out by both OECD and non-OECD economies, since 2000. The World Bank and the IMF’s preparation of FSAPs peer review mechanism is a necessary framework to reveal the information about overall stability in the global financial system. The United Nations (UN) associated institutions, the United Nations Economic and Social Council (ECOSOC), the United Nations Conference on Trade and Development (UNCTAD), and the Millennium Development Goals (MDGs) have provided a platform to stakeholders to raise questions or discuss/debate issued related to the global financial architecture framework. However, on the ground, UN bodies have a limited role in the global financial architecture(GFA).

The FSB peer review process undertakes thematic country peer reviews. The thematic review has implemented standards agreed within FSB, with particular attention to consistency in cross-country implementation of norms. FSB has followed guidelines set by other peer review mechanism of IMF and World Bank, such as Financial Sector Assessment Program (FSAP) and Reports on the Observance of Standards and Codes (ROSCs). It has set up more than thirty Supervisory colleges for large complex financial institutions which meet and address issues on a continuous basis.

The FSB, as an International Macro-Prudential Regulator provides a platform for interaction to Micro-Prudential Regulator (IAIS, IOSCO, OECD, IASB, etc.) to work out ways for Macro-Prudential Stability and, by and large, bring balance in the global financial regulatory system. The following figure II describes the structure of global financial architecture framework.

Figure II: Global Financial Architecture Framework

| International Organization | State-to-State Contact Groups | Transgovernmental Networks | Private Standard-Setting and Opinion-Making Bodies | |

| Example | IMF, World Bank, WTO, OECD, BIS | G-7, G-8, G-10, G-20 | FSB,BCBS, IOSCO, IAIS | IASB, S&P |

| Characteristics | Treaty-based, Large Secretariat, Policy administrating, Limited Policy making | Protocols,No secretariats, Policy-making | MOU, Small Secretariats, Information sharing, Policy coordination, Policy administration | Private sector experts |

| Regulatory tasks | Sovereign loans, Economic development, Technical assistance, Standards enforcement | Crisis response, Regulatory initiatives, Networks creation | Rules and standards on prudential aspects of banking, Securities, Insurance | Technical standards |

| Examples of achievements | FSAP | Creation of BCBS, CPMI, CGFS | Development of sectoral prudential standards | IFRS, New Supervisory Tools |

Source: Pan, E.,2010, p. 248

The FSB plays a key role in promoting reform in sectors such as OTC derivatives, securitization markets, credit rating agencies, and hedge funds. It has worked in close collaboration with Basel Committee to upgrade rules in the quality of capital requirement, counter-cyclical capital buffer, higher capital in off-balance sheet activities and developed a baseline leverage ratio. FSB and IOSCO jointly work to streamline centrally cleared counterparties mechanism in OTC derivatives market. It has set up more than thirty Supervisory colleges for large complex financial institutions, which meet and address issues on a continuous basis and take actions immediately so that no financial firms are deemed “too big to fail”. This supervisory college has provided a platform for sharing of information and ideas between supervisors of different jurisdictions, on global financial issues. In Los Cabos Summit, it restated and amended its Charter which reinforces certain elements of its mandate, including its role in standard setting and in promoting members’ implementation of international standards. The FSB has also accepted the G20 commitments and policy recommendations. The FSB is gradually being institutionalized as an association under Swiss law, which has provided it with the status of a legal personality under the International Economic Law.

The FSB’s ability to coordinate global financial regulation, depends on, the level of the representatives that attend the Plenary. Article 10 of FSB confirms seriousness towards policy implementation, where “central bank governor or immediate deputy, head or immediate deputy of the leading regulatory agency and deputy finance minister or deputy head of finance ministry are to participate in the session. Along with them, the Plenary includes the chairs of the main SSBs, a high-level representative of the IMF, the World Bank, BIS, and OECD”. The Regional Consultative Groups provide a structured mechanism for interaction of the FSB members with non-members, regarding the various FSB initiatives underway and planned. These groups promote the implementation of the main standards in non-member jurisdictions.

The FSB facilitates and coordinates the alignment of the activities of the SSBs to address any regulatory overlaps or gaps. It clearly demarcates the jurisdiction of specific bodies incorporating the changes in national and regional regulatory structures relating to prudential and systemic risk, market integrity and investor and consumer protection, infrastructure, as well as accounting and auditing. The FSB, as an International Macro-Prudential Regulator provides a platform for interaction to Micro-Prudential Regulators (IAIS, IOSCO, OECD, IASB, etc) to work out ways for Macro-Prudential stability and, by and large, bring balance in the Global Financial Architecture (GFA).

The macro-prudential ex-ante supervisory powers, include licensing, authorization, compliance with regulatory standards, and ex-post crisis management measures, like, recovery plans or support from the lender of last resort. The mechanism of macro-supervision along with overseeing bailout package is required to comply with macro-prudential policies like maintaining stability in the exchange rate, interest rate, and fiscal policy. Tools of Micro-Prudential Supervision also need to be efficiently applied. The FSB/G-20 required to intervene in the financial system at an early stage to prompt corrective action and ensure compliance with regulatory standards(Kern Alexander, 2015, p. 32).

The FSB has encouraged host state supervisors to participate in supervisory colleges to oversee the cross-border operations of financial groups. This supervisory college has provided a platform for sharing of information and ideas between supervisors of different jurisdictions, on global financial issues. Thismechanism helps to identify joint risk assessment, based on consensus, on the suitable risk-based capital buffer. Their principal task is to coordinate ongoing supervisory activities for financial group and also during emergency conditions. Further, the supervisory colleges streamline the norms for home country control, with limited host country intervention. The host financial authorities should concentrate on implementing a risk-based model of regulatory practices in international banking. The host country regulatory authorities have greater decision-making power to implement macro-prudential tools to control high risk taken by international banking groups. For example, the foreign bank has to maintain subsidiaries in every jurisdiction where they have significant operations and follow minimum capital adequacy ratio in these subsidiaries. The international banking has switched to a decentralized approach to managing risks in the host state. Though the Basel III norms are not legally binding; theserules support in restricting the supervisory authority’s discretion to apply regulatory controls to a foreign bank’s operations in the host country’s.

The growing significance of macro-prudential regulation has led the FSB to work in an interconnected manner with the IMF. The IMF-FSB have undertaken collaborative early warning exercises to strengthen assessments of systemic risks and provide adequate firewall and regulatory measures in response to systemic risks. The combination of the IMF’s macro-financial expertise with FSB’s coordination of the regulatory gaps has strengthened the IMF’s information and surveillance mechanism in accordance with the broader interconnected regulatory framework, for efficient monitoring in GFA. This framework has minimized thecost of monitoring the macro-prudential regulation. The global financial institutions (IMF, World Bank and MDBs) has provided the US $ 1.1 trillion finance immediately to mitigate and overcome the counter-cyclical effect, bank recapitalization, the balance of payment problem and liquidity crunch. The Financial Sector Assessment Program (IMF/World Bank) peer review has been in accordance with the FSB Core guidelines. The Non-Cooperative Jurisdictions (NCJs) has been placed in public domain based on their adherence to prudential regulations. The FSB has developed a toolbox of measures to promote adherence to prudential norms with NCJs. This process enables greater dialogue to raise compliance with international standards in all jurisdictions.

The success of the FSB/IMF collaboration in macro-prudential regulation will determine its effectiveness, accountability and legitimacy of its standards and recommendations for countries not represented in the G20. The legitimacy and leadership of the G20 will be enhanced if the views of the non-member countries are also incorporated and the partnership between the FSB and the IMF is a first step towards addressing this concern. However, the mere involvement of the IMF will not deal with the existing weaknesses in the international financial architecture because the IMF itself has been subject to extensive criticism on legitimacy grounds, on account of its allocation of SDRs and voting rights. The IMF policies are in favour of towards G-20 advanced countries. In the current times, the IMF has restructured its governance and mandates to enhance its legitimacy and accountability and to reorient its policies towards a more holistic approach.

4.1. FSB as a World Financial Organization / Supra Global Financial Regulator

Unlike the multilateral financial institutions, the FSB lacks a legal form and any formal power, given that it’s Charter is an informal and non-binding memorandum of understanding for cooperation, adopted by its members. In fact, Article 23 cautions that the “Charter is not intended to create any legal rights and obligations,” putting the onus of the implementation of any decision on peer pressure rather than on the enforcement of legal obligations. In an implicit acknowledgment of this fact, the Charter itself emphasizes the “collaborative” approach in Articles 1 and 2 of the FSB, in pursuing its objective and mandate.

On the other hand, the notion of a supra global financial regulator replacing the international soft law regime along the lines of WTOregulation looks impossible in the existing framework. However, the supra regulator can substantially influence sovereign supervision and regulatory decision in multi-jurisdiction where membership is universal across the globe regardless of size, and economic contribution. The supra global financial regulatory, variously named by a number of renowned economists as a World Financial Organization (WFO) or World Financial Authority (WFA) (Kern Alexander and others, 2014, p. 19). The present international standards are implemented based on aconsensus approach. It is voluntary in nature where the initiative lies with national authority with some flexibility. However, the WFO’s approach on the implementation of international standards is stringent, rigid and time-bound manner. The WFO will continue amending and updating rules and regulation as per the dynamics in GFA. The authority of WFO will be questioned based on legal and political sovereignty issues where state sovereignty is handed over to the WFO. The idea of the set-up of supranational authority will infringe upon the power of national authorities to monitor financial system. The legitimacy of WFO depends upon real substance and utility based on the principle of the rule of law. The idea of World Financial Organization (WFO) looks far-fetched from current existing reality. However, the actions of FSB are moving towards the global financial regulator or International Macro-Prudential Regulator.

The global financial crisis revealed serious fault lines in GFA. The crisis was not restricted to one region or state but intensely spread worldwide. The coordination of post-global financial crisis took place through G-20 countries and at the organizational level, through FSB, (from G-20 London Summit 2009) which emerged as the first comprehensive Global Macro-Prudential Regulator. The objective of Global Financial Architecturewas to strike a balance between Micro-Prudential Regulation and Macro-Prudential Regulation. The FSB is a platform of national financial regulators, central bankers, International Financial Institution (IFIs), Sector specific international supervisors and Standard-Setting Bodies (SSBs). Its mission is to ensure that national and international authorities and relevant international supervisory bodieseffectively coordinate their respective responsibilities, to support international financial stability, thus improving the function of the overall markets.Whether FSB emerged as an effectiveInternational Macro-prudential Regulator in the Global Financial Architecture?The operation and surveillance of FSB as a Macro-Prudential Regulation at international level is a huge task, and there are various challenges, such as whether the macro-prudential tools will vary based on cyclical shocks, whether the regulator will intervene in all sectors or a particular sector and what are the parameters to determine the particular sector, how will the issue of sovereignty be addressed while intervening with regard to non-member jurisdiction? It is hard to reach consensus on these questions because measures the work in one jurisdiction may not be suitable in another jurisdiction. Further, it is also challenging to get evidence of different instruments their result and outcome. FSB lacks institutionalization capacity. In fact, FSB cannot be compared with IMF, World Bank, EU, OECD, and WTO, which employ a staff of a few hundred or thousand.The FSB as a Macro-Prudential framework needs more time to learn from their experience, with the gradual implementation of international standards. Its efficacy varies in different jurisdiction given diverse financial setup. The FSB, as a Macro-Prudential Regulator, along with Micro-prudential regulators work on soft law mechanism. The new international standards implemented are based on coordination approach with member states, including the non-member states, by informing them about new standards, from time to time, as per changes in the International Financial Architecture.

Arner, D.W.and Buckley, R.P. (2010). ‘Redesigning the Architecture of the Global Financial System’, Melbourne Journal of International Law , 11(2), p. 2.

Arner, D.W.and Taylor, M.W., (2009).'The global financial crisis and the financial stability board: Hardening the soft law of international financial regulation' UNSWLJ , 32 , p.488.

BIS Review (Hans Tietmeyer 1999) Report on International Cooperation and Coordination in the Area of Financial Market Supervision and Surveillance (1-6). Report to G-7 Finance Ministers and Central Bank Governors, unpublished.

Bieri, D.S., (2009).'Financial stability, the Basel Process and the new geography of regulation', Cambridge Journal of Regions, Economy and Society , 2 (2), pp.331.

Buckley, R. P., & Arner, D. W. (2011). From crisis to crisis: the global financial system and regulatory failure (Vol. 14). Kluwer Law International.

‘Chapter Global Administrative Law-americanbar.org’, p. 3. Retrieved from: http://www.americanbar.org/content/dam/aba/publications/administrative_regulatory_law_newsletters/international_law.authcheckdam.pdf (Accessed: 13-Feb-16).

Cottier, T., Lastra, R.M., Tietje, C.and Satragno, L. (2014). The rule of law in monetary affairs: editor, Lucía Satragno : Cambridge University Press.

Davies, H. and Green, D., (2013). Global Financial Regulation: The Essential Guide (Now with a Revised Introduction) . John Wiley & Sons.

Edward Hida (13 May, 2015). Global risk management survey, ninth edition: Operating in the new normal: Increased regulation and heightened expectations . Retrieved from: http://dupress.com/articles/global-risk-management-survey-financial-services/ (Accessed: 12-Feb-16).

Eric Helleiner (2013). Global Financial Governance & Impact Report 2013: FSB . Retrieved from: http://www.new-rules.org/what-we-do/global-financial-governance-a-impact-report/fsb-governance-a-impact (Accessed: 20-Mar-16).

Erik Denters (2009). ‘Regulation and Supervision of The Global Financial System: A Proposal for Institutional Reform’, Amsterdam Law Forum , 1(3), pp. 63–82. Retrieved from: http://amsterdamlawforum.org/article/download/84/136 (Accessed: 13-Feb-16).

FSB (2012). ‘Report to the G20 Los Cabos Summit on Strengthening FSB Capacity, Resources and Governance’. Retrieved from: http://www.fsb.org/wp-content/uploads/r_120619c.pdf (Accessed: 12-Feb-17).

FSB (2013). ‘Overview of Progress in the Implementation of the G20 Recommendations for Strengthening Financial Stablility’. Retrieved from: http://www.fsb.org/wp-content/uploads/r_130905c.pdf?page_moved=1 (Accessed: 12-Feb-17).

FSB (2015). ‘2nd Annual Report: 1 April 2014 – 31 March 2015’. Retrieved from: http://www.fsb.org/wp-content/uploads/FSB-2nd-Annual-report.pdf (Accessed: 12-Feb-17).

FSB Our History - Financial Stability Board . Retrieved from: http://www.fsb.org/about/history/?page_moved=1 (Accessed: 31-Jan-16).

G-20 London Summit, Declaration on Strengthening the Financial System (2009). Retrieved from: http://www.fsb.org/wp-content/uploads/london_summit_declaration_on_str_financial_system.pdf (Accessed: 12-Feb-17).

G20 London Summit Global Plan for Recovery and Reform (Statement Issued by the G20 Leaders, 2009). Retrieved from: http://www.g20.utoronto.ca/2009/2009communique0402.html (Accessed: 12-Feb-17).