|

(A Study of Selected Private Rural Banks in Karimnagar District of Telangana State) Dr. E. HARI PRASAD & Prof. G. V. BHAVANI PRASAD |

In the present competitive economy banking sector has been facing dynamic challenges in concerning both customer base and performance. The indispensable competitive strategic role of this sector is vital one in managing the customers. Providing service quality is highly significant function of service industry in today’s competitive environment. Service quality is the excellent strategy and plays a key role in service sector in general and banking sector in particular to satisfy the customers’ needs and retain them. The present study aims at assessing the service quality that delivered by the banks in rural areas, using SERVQUAL model.

In many countries service sector plays dominant role in the markets. According to (Kotler, 2003), in the US economy, nearly 80 per cent of the employment opportunities provided and 76 per cent of the GDP contributed by the service sector. In India also service sector playing greater role in the nation’s economy by contributing nearly 64 per cent of the GDP, having higher share in exports, 42 per cent of total exports from India, and providing high number employment opportunities. This indicates that the growing importance of the service sector. That is the reason why, companies well recognized the need for the better service quality and are looking for ways to perform better and attract and retain their customers in a high competitive manner (Wang. Y., 2003). Many researchers have been focused on this area of service quality for the last few years and recognized as one of the most important strategy of the business firms in the service sector to improve financial as well as marketing performance.

(Newmn, 2001) Service quality has been defined as the degree and direction between customer service expectations and perceptions. Perceived service quality is defined as how well a service satisfies the expectations of customers. Service quality has an impact on profitability and costs, as service quality influences customer satisfaction; it impacts customer retention, reduces costs and increases profitability.

It is, thus, service quality has been identified as a key determinant of the intention to use a service, and has, therefore, been extensively under study.

Importance of Service Quality

Service quality is considered as the most critical determinant of competitiveness for establishing and sustaining satisfying relationship with customers (Lewis, 1989). Business firms including banks have recognized the fact that the only one best way to manage the competition is the quality differentiation. Advance technology, customer oriented corporate culture, a well designed service-system and excellent information system are the major factors that decide the superior quality of service of an organization. Providing excellent service quality and maintaining the high customer satisfaction is the important issue and the challenge facing contemporary service industry (Hung, 2003). Thus Service Quality is an important subject in both public and private sectors business firms and service industries. Banking sector is not an exception to this.

Before independence the banking system in India was in private sector and in very weak position. To strengthen the banking system then government established Reserve Bank India (RBI) in 1935 and empowered to regulate banking companies by issue of directive, inspection, amalgamation, mergers etc. Major action was taken 1949 by passing the Banking regulation Act which was very important in respect of structural reforms in the banking sector. This act had given extensive regulatory powers to RBI over the banks in India. Nationalization of banks was another major step of the government (14 banks on 19th July, 1969 and 6 banks on 15th April, 1980) to constitute the public sector banks. These public sector banks occupied a vital role in Indian economy in general and banking sector in particular. Government implemented many social welfare schemes through these banks. Prior to globalization there was very little competition in the banking sector and the public sector banks played dominating role in terms of size of assets? Due to changing global scenario, the government recognized the need to introduce reforms to make banking industry more competitive. Thus, the government had made policy changes like deregulation of interest rates and dilution of consortium lending requirement. Moreover, banking sector had been opened up to the private sector. With this, new banks have been set up in private sector, called as new private sector banks, foreign banks have entered the Indian banking sector and existing banks in private sector (old private sector banks) changed their level of operations. All these increased the competition among the banks and efficiency of the banking industry.

Survival of banks, in heavy competition, depends upon how the banks are providing quality services to their customers. Service quality is a comparison of expectations with performance. From the viewpoint of business administration, service quality is an achievement in customer service. It reflects at each service encounter (Bhatia, Assessment of Service Quality in Public and Private Sector Banks of India with Special Reference to Lucknow City). A customer's expectation of a particular service is determined by factors such as recommendations by peers, personal needs and past experiences. The expected service and the perceived service sometimes may not be equal, thus leaving a gap. The service quality model or the ‘GAP model’ developed by the authors- Parasuraman, Zeithaml and Berry at Texas and North Carolina in 1985, highlights the main requirements for delivering high service quality. It identifies ‘gaps’ that cause unsuccessful delivery of service. Customers generally have a tendency to compare the service they 'experience' with the service they 'expect'. If the experience does not match the expectation, there arises a gap.

Service Quality Dimension - Service Quality Gap Model (SERVQUAL)

The gap model (also known as the "5 gaps model") of service quality is an important customer-satisfaction framework. In "A Conceptual Model of Service Quality and Its Implications for Future Research" (The Journal of Marketing, 1985), A. Parasuraman, VA Zeitham and LL Berry identify five major gaps that face organizations seeking to meet customer's expectations of the customer experience.

SERVQUAL is one the tools used in measuring the quality of services. According to Buttle (1996), SERVQUAL is for the measuring and managing the quality of service. Asubeonteng et al (1996) also intimated that the model is used to measure the quality of service from the customer’s point of view. The originators of the model are Parasuraman, Zeithamal and Berry. It was developed in 1985 but was polished in their subsequent articles (Parasuraman et al 1988). The main aim of SERVQUAL is to have a standard and a reliable tool that can be used to measure the quality of services in different service sectors. Originally, those who developed SERVQUAL introduced ten service quality dimensions or attributes. These are: 1. Tangibles, 2. Reliability, 3. Responsiveness, 4. Competency, 5. Courtesy, 6. Communication, 7. Credibility, 8. Security, 9. Access and 10. Understanding the customer.

Table – 1 Definition of Original Ten SERVQUAL Dimensions

|

Sl. No. |

Dimension |

Definition |

|

1 |

Tangibles |

Appearance of physical facilities, equipment personnel and communication materials. |

|

2 |

Reliability |

Ability to perform the promised service dependably and accurately. |

|

3 |

Responsiveness |

Willing to help customers and provide prompt service. |

|

4 |

Competence |

Possession of the required skills and knowledge to perform the service. |

|

5 |

Courtesy |

Politeness, respect consideration and friendliness of contact personnel. |

|

6 |

Credibility |

Trustworthiness, believability, honesty of service provider. |

|

7 |

Security |

Freedom from danger, risk of doubt. |

|

8 |

Access |

Approachability and ease of contact. |

|

9 |

Communication |

Keeping customers informed in language they can understand and listening to them. |

|

10 |

Understanding the Customer |

Making the effort to know customers and their needs. |

|

Source: Zeithmal, Parasuraman and Berry, (1988) Delivering Quality Service, New York, Free Press, p 21-22 (Modified) |

||

|

Table - 2 |

|

|

Ten Dimension (Original Model) |

Five Dimension (Later Model) |

|

Tangibles |

Tangibles |

|

Reliability |

Reliability |

|

Responsiveness |

Responsiveness |

|

Competence Courtesy Credibility Security |

Assurance |

|

Access Communication Understanding the customer |

Empathy |

|

Source: Zeithmal, Parasuraman and Berry, (1988) Delivering Quality Service, New York, Free Press, p 26. |

|

However, in the 1988 article, these were pruned to five (Parasuraman et al 1988). These are, 1. Tangibles, 2. Reliability, 3. Responsiveness, 4. Assurance and 5. Empathy. Tangibility refers to the physical environment in which the service provider operates. It comprises the physical facilities available, workers, and equipment and communication materials. Reliability concerns the ability with which the service organization can deliver the service dependably and accurately. Empathy on the other hand, is about the special care and attention given to individual customers when being served. Responsiveness is also the preparedness of the service provider to assist customers and render as quick of prompt service as possible. Assurance too is in connection with knowledge and the courteous attitude of staff and their ability to instill, trust and confidence in customers.

|

Table – 3 Definition of Service Quality Dimensions |

||

|

Sl. No. |

Dimension |

Definition |

|

1 |

Tangibles |

Appearance of physical facilities, equipment personnel and communication materials. |

|

2 |

Reliability |

Ability to perform the promised service dependably and accurately. |

|

3 |

Responsiveness |

Willing to help customers and provide prompt service. |

|

4 |

Assurance |

Knowledge and courtesy of employees and their ability of convey trust and confidence. |

|

5 |

Empathy |

Caring, individualized attention the firm provides its customers. |

|

Source: Zeithmal, Parasuraman and Berry, (1988) Delivering Quality Service, New York, Free Press, p 26. |

||

Based on the five service quality dimensions, two sets of twenty-two statements or questionnaire are developed, (Donnelly et al 1995 and Iwarden et al, 2003). The questionnaires are a seven-point Likert scale. Robinson (1999) also explains that one set is about customers expectations (expectation of service quality before using the service) and the other set measures customer perceptions (perceptions of quality after using the service). The difference between the two; perceptions (P) and expectations (E) constitute the service quality gap. The quality gaps according to Parasuraman (2004) and the Tahir and Bakar (2007) are five. These are:

Service Quality Dimension in Banks

Several researchers have suggested that the search for universal conceptualization of the service quality construct may be futile (Levist, 1981; Lovetock, 1983). The service quality construct is either industry or context specific (Babakus and Boller, 1992). The measurement of the service quality construct is multidimensional. In its original structure, service quality consists of five dimensions (Parasuraman et al., 1988; Carman, 1990; Rust and Oliver, 1994). These are:

The included variables to measure the service quality of commercial banks were ranging from seventeen to fifty seven variables (Narul Islam, 2005; Verma and Vehra, 2000; Sharma and Mehta, 2004; Elango and Gudep, 2006; Sharma and Sharma, 2007; Bhat, 2004; Levesque and Gorden, 1996; Bhat, 2005; Zillur, 2005; Gani and Bhat, 2003). In the present study, the included service quality variables are twenty.

Review of Literature

It is relevant to refer briefly to the previous studies and research in the related areas of the subject to find out and to fill up the research gaps. The following are the some studies conducted by the eminent authors and practitioners on the area of service quality of banks.

(Dhandabani, 2010), Examined the nature of linkage between service quality and customer loyalty in Indian retail banking. Study used confirmatory factor analysis to identify the service quality dimension. The resulted dimensions are Reliability, Responsiveness, Knowledge and recovery; and Tangibles. The service quality dimensions lead to customer satisfaction and the customers’ satisfaction leads to customer’s loyalty. The structural equation model reveals that there is no significant direct linkage between service quality and customers loyalty. At the same time, the service quality has a significant indirect impact on customer’s loyalty especially through customer’s satisfaction.

(Desta, 2011) Studied by assessing and measuring the banking service quality perception of the SBI branch customers; and examining the relationship between service quality, customer satisfaction and positive word of mouth and found that the expectations of bank customers were not met and that the largest gap was found in the reliability dimension. This dimension also had the largest influence on customer satisfaction and overall satisfaction of bank customers had a positive effect on their word-of-mouth. The study also suggested that input from employees on what constitutes “service excellence” will be beneficial. The bank need to reassess “what customers expect from the bank” and provide client specific services. It needs to invest on employee training programs that will provide employees with an understanding of service culture and service excellence particularly at front line levels. Employee training programs should focus on interpersonal communication and customer care factors in order to be able to meet the customers’ need for personalized service.

Study was conducted (Santhiyavalli, 2011) to evaluate the service quality of SBI by adopting the SERVQUAL technique developed by A.parasuraman et al (1988) and found that that among five dimensions ‘Reliability’, ‘Responsiveness’, Empathy’ and ‘Tangibility’ are the major factors responsible for customer satisfaction which stood at 90 percent regarding the services provided by State Bank of India. Thus based on the percent level of customer satisfaction, the State Bank of India has scope to improve the quality of the service rendered to its customers to ensure their loyalty.

(Maya Basant Lohani, 2012) examined on service quality in selected banks and measured in five dimensions by using SERVQUAL scale developed by Parasuraman et al (1988 and revealed that there exist a small perceptual difference regarding overall service quality with the respective banks. The study of found that banks have more concentration on the tangible factor like a computerization, physical facilities, etc. to attract the customers. The dimensions Reliability, Responsiveness and Assurance are found to be the most vital and strategic determinants of service quality and customer satisfaction for both public and private sector banks. If banks want to sustain customers on a long term basis, bankers should work towards 100% customer satisfaction that automatically foster customer delight.

(Jain, 2012) In their study “Customer Perception on Service Quality in Banking Sector: With Special Reference to Indian Private Banks in Moradabad Region” try to learn and understand the customer perception regarding service quality and to learn and understand the different dimension of service quality in banks. The Sample size used is 100 and the sample universe is Moradabad. The service quality model developed by Zeithamal, Parsuraman and Berry (1988) has been used in the present study. The analysis reveals that among the private sector banks all the dimensions of service quality are equally important.

(Dr. Rupa Rathee, 2014), Studied the service quality gaps in banks after nationalization of commercial banks. With the entry of new generation, tech-savvy, private banks the banking sector has become too competitive. Gap analysis was applied to find the gaps between expected and performed service in private banks to find the difference between male and female perception and expectation. This study provided an insight into which attributes of service quality in private bank were most important in providing satisfaction to customers and areas where significant gaps existed. It concluded that the highest gap was found in the dimension of reliability and empathy and suggested that the banks have to reduce this gap giving individual personal attention to understand customer specific needs. The customers trust the public sector banks. These banks have existed in the market for a longer period than the private sector banks. The reliability factor is a positive factor for these banks. Therefore private banks should position themselves in the market on the basis of this dimension and promote themselves aggressively. It becomes imperative for the private sector banks to train their employees to treat the customers with empathy.

Statement of Problem

Extensive research has been done by eminent scholars, academicians and practitioners on service quality in the banking industry. All these studies have concentrated on urban areas only. No concrete study found out the perceptions of rural customers about the quality of banks’ services in India. There is a need for an extensive study on the rural customers’ perceptions on the service quality in banking service offered in rural areas. Hence this research study was undertaken.

Objectives of the Study

The following are the main objectives of the present paper:

Methodology

In this paper an attempt has been undertaken to carry out a descriptive study regarding various factors of service quality in selected bank.

Data Collection

The study was conducted by taking HDFC bank branches in rural areas in Karimnagar district of Telangana State. The required data was collected from two sources namely Primary Data and Secondary Data. Primary data was collected through structured questionnaire from the existing bank customers. Secondary data was collected from the previous publications.

Sampling Unit

The sample unit consists of customers of the HDFC bank in Karimnagar district of Telangana state in India. The respondents are farmers, Employees and Business Persons.

Size of the Sample1

|

Table - 4 |

|

|

SAMPLE SIZE |

|

|

Particulars |

No. |

|

No. of Mandals Selected for the study (10% of the Total 57 Mandals in the District) |

6 |

|

Target Groups (Farmers, Employees, and Business People) |

3 |

|

No. of Respondents from each group |

10 |

|

Total Sample Size |

180 |

|

No. Respondents Responded |

168 |

|

% of the Respondents Responded |

93.33 |

Techniques of Analysis of Data

So, collected data was analyzed with the help of statistical tools such as averages, percentages, paired sample test (PST) etc. The results are interpreted with the help of percentages in a meaningful manner.

Data Analysis and Study Results

To collect the required data, two hundred and forty questionnaires were distributed to selected six HDFC bank customers in rural areas to know their opinions on service quality of bank in selected six mandals of Karimnagar district in Telangan state in India and two hundred and twenty eight were returned. The response rate was 93.33 per cent. An average of 15.83 per cent of total respondents was responded from each mandal.

|

Table – 5 |

|||

|

Demographic Details of Respondents - HDFC Bank |

|||

|

Variable |

Category |

No. |

Percentage (%) |

|

Mandal Areas |

Siricilla |

20 |

12.35 |

|

Huzurabad |

22 |

13.84 |

|

|

Jagitial |

30 |

18.52 |

|

|

Jammikunta |

30 |

18.52 |

|

|

Sultanabad |

30 |

18.52 |

|

|

Metpally |

30 |

18.52 |

|

|

Total |

162 |

100.00 |

|

|

Gender |

Male |

159 |

98.15 |

|

Female |

3 |

1.85 |

|

|

Total |

162 |

100.00 |

|

|

Age |

Less than 30 |

50 |

30.86 |

|

31 - 40 |

68 |

41.98 |

|

|

41 - 50 |

35 |

21.60 |

|

|

51 - 60 |

9 |

5.56 |

|

|

More than 60 |

0 |

0.00 |

|

|

Total |

162 |

100.00 |

|

|

Marital Status |

Married |

148 |

91.36 |

|

single |

14 |

8.64 |

|

|

Total |

162 |

100.00 |

|

|

Educational Qualifications |

Master Degree |

18 |

11.11 |

|

Graduation |

62 |

38.27 |

|

|

Professional Degree |

10 |

6.17 |

|

|

Intermediate |

29 |

17.90 |

|

|

SSC |

33 |

20.37 |

|

|

Less Than SSC |

10 |

6.18 |

|

|

Total |

162 |

100.00 |

|

|

Occupation |

Farmers |

42 |

25.93 |

|

Business |

60 |

37.04 |

|

|

Employees |

60 |

37.04 |

|

|

SHGs |

0 |

0.00 |

|

|

Total |

162 |

100.00 |

|

|

Income |

Less than Rs.50,000 |

2 |

1.23 |

|

Rs.50,001 - 1,00,000 |

37 |

22.84 |

|

|

Rs.1,00,001 - 5,00,000 |

98 |

60.49 |

|

|

Above Rs. 5,00,000 |

25 |

15.49 |

|

|

Total |

162 |

100.00 |

|

The results of demographic profile of the respondents under study revealed that gender was almost evenly split in the proportions of 98.15 per cent males and 1.85 per cent females. 30.86 per cent of the respondents were below the age group of 30 years. 41.98 per cent in between 31 – 40 years, 21.60 per cent of respondents in between the age group of 41 – 50 years and 5.56 per cent in between the age group of 51 – 60. 91.36 per cent of respondents were married and 8.64 per cent respondents were unmarried.

The highest number of respondents i.e. 38.27 per cent of the total respondents possessed the degree qualification, 20.37 per cent had 10th class qualification, 17.90 per cent respondents had completed intermediate education, 11.11 per cent possessed master degree qualification. The remaining 6.17 per cent of the total respondents possessed professional qualification. 6.18 per cent of respondents had possessed only formal education i.e. less than 10th class, these were illiterates and mostly belonged to farmers.

The data relating to occupation shows that 37.04 per cent of the total respondents belonged to business and employees category, 25.93 per cent belonged to farmer category. The highest number respondents indicating 60.49 per cent of the total were in the Rs. 1, 00,001 to Rs. 5, 00,000 income group. 22.84 per cent of the total 162 respondents were fall in the income group of Rs. 50,001 – 1, 00,000 and 15.49 per cent of total respondents were in the income group of Rs. 5, 00,000 above and remaining 1.23 per cent indicating only two respondents were in the income group of less than Rs. 50,000.

EAVALUATION OF SERVICE QUALITY IN HDFC BANK IN KARIMNAGAR

|

Table – 6 ASSESSMENT OF SERVICE QUALITY IN HDFC BANK |

||||||

|

Sl. No. |

Expected Quality (E) |

Mean |

Perceived Quality (P) |

Mean |

Gap (E-P) |

% Gap |

|

A. TANGIBLES |

||||||

|

1 |

The Bank must possess the sophisticated and good looking infrastructure. |

4.92 |

My Bank has the sophisticated and good looking infrastructure. |

4.03 |

0.90 |

18.00 |

|

2 |

Physical facilities at banks should be visual and attractive. |

4.90 |

Physical facilities at my banks are visual and attractive. |

4.03 |

0.87 |

17.40 |

|

3 |

Bank employees have to be in neat dress and appear dignified. |

4.90 |

My Bank employees are in neat dress and appearing dignified. |

4.29 |

0.62 |

13.40 |

|

4 |

Materials (statements or passbook) with bank should be visual and excellent. |

4.88 |

Materials (statements or passbook) with my bank are visual and excellent. |

4.03 |

0.84 |

16.80 |

|

Total |

19.60 |

Total |

16.38 |

3.22 |

||

|

Average (19.60/4) |

4.90 |

4.09 |

0.81 |

16.20 |

||

|

B. RELIABILTY |

||||||

|

5 |

If the bank promises something, it will do. |

4.87 |

If my bank promises something, it will certainly do. |

3.91 |

0.96 |

19.20 |

|

6 |

If customers have problems, the bank has to show sincere interest in solving them. |

4.88 |

If customers have problems, my bank will show sincere interest in solving it. |

4.02 |

0.86 |

17.20 |

|

7 |

The bank ought to perform the services at right time. |

4.90 |

My bank performs the services at right time. As per time mentioned. |

4.00 |

0.91 |

18.20 |

|

8 |

The bank should provide service at the time it promises to do so. |

4.88 |

My Bank provides service at the time it promises to do so. |

3.95 |

0.93 |

18.60 |

|

9 |

The Bank should keep accurate/error-free records. |

4.88 |

My Bank keeps accurate/error-free records. |

4.25 |

0.63 |

12.60 |

|

Total |

24.42 |

Total |

20.13 |

4.29 |

||

|

Average (24.42/5) |

4.88 |

4.03 |

0.86 |

17.20 |

||

|

C. RESPONSIVENESS |

||||||

|

10 |

Employees of the bank ought to inform customers exactly when service will be performed. |

4.87 |

Employees of my bank inform customers exactly when service will be performed. |

3.61 |

1.26 |

25.20 |

|

11 |

The Bank employees ought to give excellent service to its customers |

4.87 |

My Bank employees give excellent service to its customers |

4.03 |

0.84 |

16.80 |

|

12 |

The Bank employees must be willing to help the customers. |

4.87 |

My Bank employees are always willing to help customers. |

4.02 |

0.85 |

17.00 |

|

13 |

The Bank employees should be always ready to respond to customers’ requests. |

4.87 |

Bank employees always ready to respond to customers’ requests. |

4.04 |

0.83 |

16.60 |

|

Total |

19.60 |

Total |

15.70 |

3.90 |

||

|

Average (19.60/4) |

4.90 |

3.92 |

0.98 |

17.60 |

||

|

D. ASSURANCE |

||||||

|

14 |

The Bank employees should always try to infuse confidence in the customers. |

4.87 |

My Bank employees always try to instill confidence in customers. |

4.02 |

0.85 |

17.00 |

|

15 |

Customers (you) have to feel safe in transactions with the Bank’s employees. |

4.87 |

Customers (me) always feel safe in transactions with my bank’s employees. |

4.15 |

0.72 |

14.40 |

|

16 |

The Bank employees always ought to be courteous and polite with customers. |

4.87 |

My Bank employees always courteous and polite with customers. |

4.13 |

0.74 |

14.80 |

|

17 |

The Bank must possess employees have complete knowledge to answer queries of customers. |

4.87 |

My Bank employees have complete knowledge to answer queries of customers. |

4.09 |

0.78 |

15.60 |

|

Total |

19.60 |

Total |

16.40 |

3.20 |

||

|

Average (19.60/4) |

4.90 |

4.10 |

0.80 |

16.00 |

||

|

E. EMPATHY |

||||||

|

18 |

The Bank has to give individual attention to customers. |

4.87 |

My Bank gives individual attention to customers. |

3.72 |

1.15 |

23.00 |

|

19 |

The Bank operating hours must be convenient to all customers. |

4.87 |

My Bank operating hours is convenient to all the customers. |

4.35 |

0.52 |

10.40 |

|

20 |

Bank employees ought to understand the specific needs of their customers. |

4.87 |

Bank employees understand the specific needs of customers. |

3.91 |

0.96 |

19.20 |

|

Total |

14.70 |

Total |

11.99 |

2.71 |

||

|

Average (14.70) |

4.90 |

4.00 |

0.90 |

18.00 |

||

|

Table – 7 AVERAGE SCORE OF SERVICE QUALITY FACTORS OF HDFC |

|||||

|

Sl. No. |

Categories |

Expected SQ (E) |

Actual SQ (P) |

SQ Gap (E-P) |

per cent of Gap |

|

1 |

2 |

3 |

4 |

(4*100)/5 |

|

|

1 |

Tangibles |

4.90 |

4.09 |

0.81 |

16.20 |

|

2 |

Reliability |

4.88 |

4.03 |

0.85 |

17.00 |

|

3 |

Responsiveness |

4.90 |

3.92 |

0.98 |

19.60 |

|

4 |

Assurance |

4.90 |

4.10 |

0.80 |

16.00 |

|

5 |

Empathy |

4.90 |

4.00 |

0.90 |

18.00 |

|

Total |

24.48 |

20.14 |

4.34 |

||

|

Average |

4.90 |

4.03 |

0.87 |

17.40 |

|

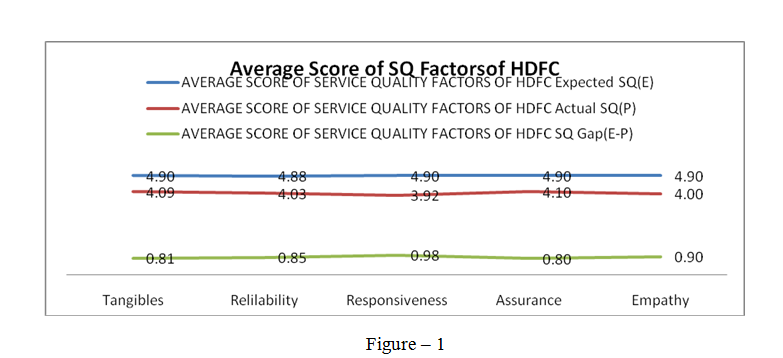

The above tables 4.19 and 4.20 reveal that the level of expectation of the service quality of the customers for dimentions namely tangibles, reliability, responsiveness, assurance and empathy are rated between 4 and 5 points implies that the respondents rated these dimentions in between ‘agree and strongly agree’. The level of perceived quality regarding the above five dimentions rated by the respondents between 3 – 5 implies ‘neutral to strongly agree for the services provided by HDFC bank. The gap score is very less in ‘Assurance’ reveals that customers are highly satisfied with the assurance aspects associated with the service. Responsiveness and Empthy factors have the greater average gap score 0.98 and 0.90 respectively, implies dissatifaction of customers in respect to these factors.

|

Table – 8 Paired Samples Test |

|||||||||||

|

Paired Differences |

t |

df |

Sig. (2-tailed) |

||||||||

|

Mean |

Std. Deviation |

Std. Error Mean |

95per cent Confidence Interval of the Difference |

||||||||

|

Lower |

Upper |

||||||||||

|

TANGIBLES |

|||||||||||

|

Pair 1 |

EQ1 - PQ1 |

.500 |

.662 |

.052 |

.397 |

.603 |

9.617 |

161 |

.000 |

||

|

Pair 2 |

EQ2 - PQ2 |

.568 |

.609 |

.048 |

.473 |

.662 |

11.865 |

161 |

.000 |

||

|

Pair 3 |

EQ3 - PQ3 |

.309 |

.514 |

.040 |

.229 |

.388 |

7.640 |

161 |

.000 |

||

|

Pair 4 |

EQ4 - PQ4 |

.321 |

.693 |

.054 |

.213 |

.429 |

5.896 |

161 |

.000 |

||

|

RELIBILITY |

|||||||||||

|

Pair 1 |

EQ5 - PQ5 |

.586 |

.889 |

.070 |

.448 |

.724 |

8.394 |

161 |

.000 |

||

|

Pair 2 |

EQ6 - PQ6 |

.451 |

.740 |

.058 |

.336 |

.565 |

7.753 |

161 |

.000 |

||

|

Pair 3 |

EQ7 - PQ7 |

.352 |

.645 |

.051 |

.252 |

.452 |

6.945 |

161 |

.000 |

||

|

Pair 4 |

EQ8 - PQ8 |

.395 |

.653 |

.051 |

.294 |

.496 |

7.697 |

161 |

.000 |

||

|

Pair 5 |

EQ9 - PQ9 |

.296 |

.649 |

.051 |

.196 |

.397 |

5.812 |

161 |

.000 |

||

|

RESPONSIVENESS |

|||||||||||

|

Pair 1 |

EQ10 - PQ10 |

.512 |

.790 |

.062 |

.390 |

.635 |

8.255 |

161 |

.000 |

||

|

Pair 2 |

EQ11 - PQ11 |

.216 |

.507 |

.040 |

.137 |

.295 |

5.420 |

161 |

.000 |

||

|

Pair 3 |

EQ12 - PQ12 |

.222 |

.535 |

.042 |

.139 |

.305 |

5.292 |

161 |

.000 |

||

|

Pair 4 |

EQ13 - PQ13 |

.210 |

.551 |

.043 |

.124 |

.295 |

4.849 |

161 |

.000 |

||

|

ASSURNACE |

|||||||||||

|

Pair 1 |

EQ14 - PQ14 |

.259 |

.505 |

.040 |

.181 |

.338 |

6.530 |

161 |

.000 |

||

|

Pair 2 |

EQ15 - PQ15 |

.253 |

.477 |

.037 |

.179 |

.327 |

6.754 |

161 |

.000 |

||

|

Pair 3 |

EQ16 - PQ16 |

.191 |

.505 |

.040 |

.113 |

.270 |

4.822 |

161 |

.000 |

||

|

Pair 4 |

EQ17 - PQ17 |

.333 |

.610 |

.048 |

.239 |

.428 |

6.950 |

161 |

.000 |

||

|

EMPATHY |

|||||||||||

|

Pair 1 |

EQ18 - PQ18 |

.531 |

.973 |

.076 |

.380 |

.682 |

6.946 |

161 |

.000 |

||

|

Pair 2 |

EQ19 - PQ19 |

.426 |

.787 |

.062 |

.304 |

.548 |

6.892 |

161 |

.000 |

||

|

Pair 3 |

EQ20 - PQ20 |

.605 |

.783 |

.062 |

.483 |

.726 |

9.833 |

161 |

.000 |

||

Hypothesis

H0 = There is no significant difference between opinions of customers of HDFC BANK Bank in

respect of expected and perceived quality.

HA = There is significant difference between opinions of customers of HDFC BANK Bank in

respect of expected and perceived quality.

At the a = 0.05 level of significance, there exists enough evidence to conclude that there is a difference between expected and perceived service quality variable and dimensions that are ‘Tangibles”, ‘ Reliability’, Responsiveness’, ‘Assurance’ and ‘Empathy’. It is clearly establishes the significant difference between expected and perceived service quality dimensions of HDFC bank.

It is clear that there is difference in customers’ opinions of HDFC in respect of the service quality. It requires the bank officials should more responsive and respond immediately to the queries and provide the needed information to the customers. Therefore it is needed proper attention of bank officials on adjusting the bank operating timings that is convenient to all type of customers particularly employees and make a focus on the needs of customers to reduce the service quality gap which lead to increase the satisfaction level of customers.

Overall Service Quality of HDFC Bank

Having discussed the opinions of respondents from the selected HDFC bank in respect of influencing factors, Importance and Actual quality of facilities and amenities, service timings, service encounters and service quality aspects, an attempt is made to study the opinions of respondents on overall service quality, SQ meeting the needs of the customers overall satisfaction, loyalty and making recommendation to relatives and friends. The analysis is presented in the following paragraphs.

Overall Service Quality of HDFC Bank

|

Table – 9 Overall Service Quality of HDFC Bank |

||||

|

Particulars |

Frequency |

Percent |

Mean |

SD |

|

Very Poor |

0 |

0 |

4.40 |

0.572 |

|

Poor |

0 |

0 |

||

|

Average |

7 |

4.3 |

||

|

Good |

84 |

51.9 |

||

|

Very Good |

71 |

43.8 |

||

|

Total |

162 |

100.0 |

||

The table – 4.22 reveals that the opinions of the customers on overall service quality of HDFC bank in Karimnagar district. The opinions are rated with the help of 5 point Liker Scale’ ranging 1 – 5 points indiciating ‘Very Poor – Very Good’. Repondents of HDFC bank rated the Overall Service Quality between 4 – 5 implies ‘Good to Very Good’ for the services provided by the bank. The highest number of respondents representing 51.90 per cent of the total had expressed that the service quality of the bank as ‘good’ and following 43.80 per cent indicating 71 in number rated as ‘very good’. Customer opined overall service quality as ‘average’ by 7 in number representing 4.30 per cent. No customer rated the service quality as ‘poor and very poor’.

It is tested to prove the relation between service quality (dependent variable) and demographical details of respondents (independent variables) of HDFC bank through paired sample t- test.

|

Table – 10 Paired Samples Test |

|||||||||

|

Paired Differences |

t |

df |

Sig. (2-tailed) |

||||||

|

Mean |

Std. Deviation |

Std. Error Mean |

95per cent Confidence Interval of the Difference |

||||||

|

Lower |

Upper |

||||||||

|

Pair 1 |

Area of Bank - Overall SQ |

-.667 |

1.858 |

.146 |

-.955 |

-.378 |

-4.566 |

161 |

.000 |

|

Pair 2 |

gender - Overall SQ |

-3.377 |

.590 |

.046 |

-3.468 |

-3.285 |

-72.850 |

161 |

.000 |

|

Pair 3 |

Age - Overall SQ |

-1.389 |

1.035 |

.081 |

-1.549 |

-1.228 |

-17.078 |

161 |

.000 |

|

Pair 4 |

Qualification - Overall SQ |

-1.222 |

1.576 |

.124 |

-1.467 |

-.978 |

-9.869 |

161 |

.000 |

|

Pair 5 |

Occupation - Overall SQ |

-2.284 |

1.006 |

.079 |

-2.440 |

-2.128 |

-28.897 |

161 |

.000 |

|

Pair 6 |

Annual Income - Overall SQ |

-1.494 |

.858 |

.067 |

-1.627 |

-1.361 |

-22.163 |

161 |

.000 |

|

Pair 7 |

Marital Status - Overall SQ |

-3.309 |

.653 |

.051 |

-3.410 |

-3.207 |

-64.530 |

161 |

.000 |

H0 – There is no significant relation between service quality and bank type, area of the bank, age, gender, qualification, occupation, annual income and marital status of the respondents of HDFC bank.

H1– There is significant relation between service quality and bank type, area of the bank, age, gender, qualification, occupation, annual income and marital status of the respondents of HDFC bank.

The significance value at 0.05 is zero, hence it is rejected the null hypothesis and concluded that the difference in opinions of customers about service quality due to bank type, area of the bank, age, gender, educational qualification, occupation, annual income and marital status of respondents is significant and is just not a matter of chance.

Overall Satisfaction against the Service Quality

After studying the responses of respondents of HDFC bank against various aspects of service quality, an attempt is made to know their satisfaction level and furnished in the table – 4.25. The opinions are rated with the help of 5 point Liker Scale’ ranging 1 – 5 points indiciating ‘Very Dissatisfied – Very Satisfied’.

|

Table – 11 Overall Satisfaction Against the Service Quality |

||||

|

Particulars |

Frequency |

Percent |

Mean |

SD |

|

Strongly Dissatisfied |

0 |

0 |

4.51 |

0.514 |

|

Dissatisfied |

0 |

0 |

||

|

Neutral |

1 |

.6 |

||

|

Satisfied |

77 |

47.5 |

||

|

Very Satisfied |

84 |

51.9 |

||

|

Total |

162 |

100.0 |

||

The average of satisfaction level of repondents of HDFC Bank lied between 4 – 5 implies ‘satisfied to very satisfied’ for the services provided by the bank. The highest number of respondents representing 51.90 per cent of the total were very satisfied and following 47.50 per cent indicating 77 in number were satisfied. Only one customer who was neutral either satisfied or dissatisfied in respect of satisfaction level. No customer was dissatisfied with the services of HDFC bank.

|

Table 4.26 Paired Samples Test |

|||||||||

|

Paired Differences |

t |

df |

Sig. (2-tailed) |

||||||

|

Mean |

Std. Deviation |

Std. Error Mean |

95per cent Confidence Interval of the Difference |

||||||

|

Lower |

Upper |

||||||||

|

Pair 1 |

Area of Bank - Overall Satisfaction |

-.784 |

1.733 |

.136 |

-1.053 |

-.515 |

-5.758 |

161 |

.000 |

|

Pair 2 |

gender - Overall Satisfaction |

-3.494 |

.549 |

.043 |

-3.579 |

-3.409 |

-81.027 |

161 |

.000 |

|

Pair 3 |

Age - Overall Satisfaction |

-1.506 |

1.011 |

.079 |

-1.663 |

-1.349 |

-18.966 |

161 |

.000 |

|

Pair 4 |

Qualification - Overall Satisfaction |

-1.340 |

1.631 |

.128 |

-1.593 |

-1.086 |

-10.453 |

161 |

.000 |

|

Pair 5 |

Occupation - Overall Satisfaction |

-2.401 |

.929 |

.073 |

-2.545 |

-2.257 |

-32.902 |

161 |

.000 |

|

Pair 6 |

Annual Income - Overall Satisfaction |

-1.611 |

.858 |

.067 |

-1.744 |

-1.478 |

-23.902 |

161 |

.000 |

|

Pair 7 |

Marital Status - Overall Satisfaction |

-3.426 |

.588 |

.046 |

-3.517 |

-3.335 |

-74.194 |

161 |

.000 |

It is also tested to prove the relation between customers’ overall satisfaction towards service quality (dependent variable) and demographical details of respondents (independent variables) of HDFC bank through paired sample t- test.

H0 – Customers’ satisfaction does not vary in respect of bank type, area of the bank, age, gender, qualification, occupation, annual income and marital status of the respondents HDFC bank.

H1– Customers’ satisfaction varies in respect of bank type, area of the bank, age, gender, qualification, occupation, annual income and marital status of the respondents HDFC bank.

The significance value at 0.05 is zero, hence it is rejected the null hypothesis and concluded that the difference in customers’ satisfaction towards service quality due to bank type, area of the bank, age, gender, educational qualification, occupation, annual income and marital status of respondents is significant and is just not a matter of chance.

Conclusion

Service quality should be used as a strategic tool to get a competitive advantage over the competitors. With the increasing levels of globalization of the Indian banking industry, and adoption of universal banks, the competition in the banking industry has intensified. Any where’ and ‘any time banking now become a reality Recognition of service quality now acts as a competitive weapon.

The SERVQUAL model was used to assess and compare the service quality delivered by three major banks operating in rural areas of Kaimnagar district. Analysis of gap score reveals that the highest gap score in the dimension ‘Tangible’ (0.81) indicates poor service quality.

The results of the analysis show that the customers rated the bank rated in between good and very good on all the five dimensions of service quality. In order to stay competitive, the bank needs to improve on their service quality especially in the identified areas ‘Tangibility’ and ‘Empathy’ which are the major responsible factors for customer satisfaction regarding the services provided by the bank. The Bank needs to be more responsive and train its staff how to show empathy to their customers. The overall service quality obtained shows that, although the customers are satisfied with the bank, still proper attention is require to improve the service quality to retain the existing customers and to attract new customers.

Bhatia, M. B. (2012, October). Assessment of Service Quality in Public and Private Sector Banks of India with Special Reference to Lucknow City. International Journal of Scientific and Research Publications, 2(10), 1 - 7.

Bhatia, M. B. (n.d.). Assessment of Service Quality in Public and Private Sector Banks of India with Special Reference to Lucknow City. International Journal of Scientific and Research Publications,, 2(10), 1 - 7.

Desta, T. S. (2011, november). Perceived Quality of Services Rendered by Commercial Banks: A Case Study of State Bank of. International Journal of Research in commerce and Management, 2(11), 26 - 36.

Dhandabani, S. (2010, July-Dec.). LINKAGE BETWEEN SERVICE QUALITY AND CUSTOMERS LOYALTY IN COMMERCIAL BANKS. International Journal of Management & Strategy, 1(1), 1-22.

Dr. Rupa Rathee, D. A. (2014, July). To Identify Service Quality Gaps in Banking Sector: A Study of Private Banks. International Journal of Emerging Research in Management &Technology, 3(7), 101-106.

Hung, Y. H. (2003). Service Quality Evaluation of Service Quality Performance Matrix. Total Quality Management & Business Excellence, 14(1), 79 - 89.

Jain, V. G. (2012). "Customer Percepetion on Service Quality in Banking Sector". With Special Reference to Indian Private Banks in Moradabad Region. International Journal of Research in Finance & marketing (IJRFM), 2(2), 597-610.

Kotler, P. (2003). Marketing Management. NJ: Englewood Cliffs: Prentice-Hall.

Lewis, B. (1989). Quality in Service Sector - A Review. Interntional Journal of Brand Marketing,, 7(5), 4 - 12.

Maya Basant Lohani, D. P. (2012, October). Assessment of Service Quality in Public and Private Sector Banks of India with Special Reference to Lucknow City. International Journal of Scientific and Research Publications, 2(10), 1 - 7.

Newmn, K. (2001). interrogting SERVQUAL: A Criticl Assessment of Service Quality Measurement in a High Street Retail Bank. International Journal of Bank Marketing, 19(3), 126-139.

Santhiyavalli, D. M. (2011, September). Customer’s perception of service quality of State Bank of India - A Factor Analysis. International Journal of Management & Business Studies, 1(3), 78-84.

Wang. Y., H. &. (2003). The Antencedents of SErvice Quality and Product Quality and their Influences on Bank Reputation: Evidence from Banking Industry in Chaina. Managing Service Quality, 13(1), 72-83.

Wang.Y.Lo H & Huj, Y. (2003). The Antencedents of Service Quality and Product Quality and Their Influence on Bank Reputation: Evidence from Banking Industry in Chaina. Managing Service Quality , 72-83.