|

Dr. Amiya Kumar Mohapatra Associate Professor (Economics) Fortune Institute of International Business, New Delhi, India |

Fiscal management and consolidation becomes the key to achieve sustainable growth, economic stability and social development. Among various macroeconomic and fiscal indicators, fiscal deficit is one of the pertinent tools to assess the fiscal space and fiscal road map of India apart from analyzing revenue deficit and primary deficit. To ensure sustained growth and foster economic development, Government of India has enacted FRBMA (Fiscal Responsibility and Budget Management Act-2003) to achieve fiscal consolidation and prudent fiscal management. To arrest fiscal imbalances and to bring economy in order, Kelkar Committee (2012) has prescribed that the fiscal deficit (5.1 per cent in 2012-13) should be kept at 3 per cent of GDP by 2016-17 that is by the end of Twelfth Five Year Plan. However, it was delayed by two years to accommodate fiscal and structural challenges like demonetization and global uncertainties. Finance Minister of India has taken utmost care to achieve the fiscal deficit target of 3.2 per cent of GDP in the current budget 2017-18, through higher expenditure followed by revenue augmentation. Precisely speaking, efficient management of expenditure and enhancing the revenue base and effective tax buoyancy are the keys to fiscal consolidation.

Fiscal management and consolidation becomes the key to achieve sustainable growth, economic stability and social development; especially in the post-demonetization and in the ongoing GST (goods and services taxes) regime. Amidst various macroeconomic and fiscal indicators, fiscal deficit is the potent tool to assess the fiscal space and fiscal road map of India apart from analyzing revenue deficit and primary deficit. Fiscal deficit is essentially used to gauge the macroeconomic outcomes of the budget and determines the future course of actions of the government in addressing the long term objectives of the economy and fiscal discipline.

To ensure sustained growth and foster economic development, Government of India has enacted FRBMA (Fiscal Responsibility and Budget Management Act-2003) to achieve fiscal consolidation and prudent fiscal management. To arrest fiscal imbalances and to bring economy in order, Kelkar Committee (2012) has prescribed that the fiscal deficit (5.1 per cent in 2012-13) should be kept at 3 per cent of GDP by 2016-17 that is at the End of Twelfth Plan. However, it was delayed by two years to accommodate fiscal and structural challenges like demonetization and global uncertainties.

Fiscal deficit is defined as "the excess of government total expenditure over government total receipts except borrowing”. More precisely; it indicates dependency of our country on total borrowing to finance its deficit during a particular fiscal year and it is considered as signpost of debt liabilities and above all it determines the financial soundness of a country. This furnishes a holistic view of the government's sources of funding situation in terms of borrowings and subsequently its impact on the economy.

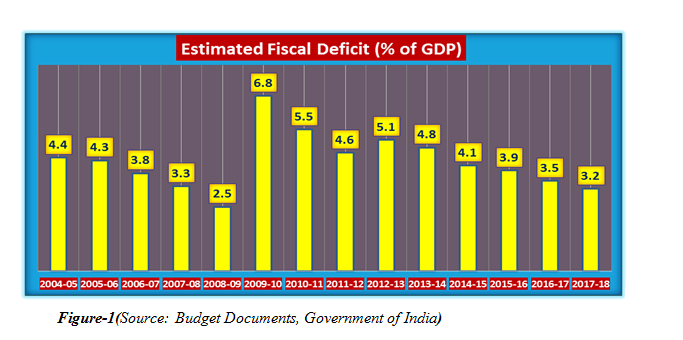

In the post-FRBMA (2004-05 to 2017-18) period, estimated fiscal deficit is used to assess the impact analysis and helps in reviewing the present needs and future state of affairs of our country.

Owing to implementation of FRBMA as a mechanism and policy intervention, the estimated fiscal deficit has reduced to a great extent; ranging from 5.1 per cent, 4.8 per cent, 4.1 per cent, 3.9 per cent, 3.5 per cent and 3.2 per cent during 2012-13 to 2017-18 respectively. This shows a gradual fall in fiscal deficit and set the path for fiscal consolidation. Previously, fiscal deficit had shot up to 6.8 per cent of GDP in 2009-10 and remained above 4.6 per cent due to adoption of expansionary fiscal stimulus package to combat ill effect of global meltdown.

In spite of a lot of pressing needs, the Finance Minister of India has kept the targeted fiscal deficit at 3.2 per cent of GDP in the current budget (2017-18), as per the FRBM review committee recommendations. In addition to above, he has also made provision for higher capital expenditure, with a clear indication towards positive outcome through sustainable development.

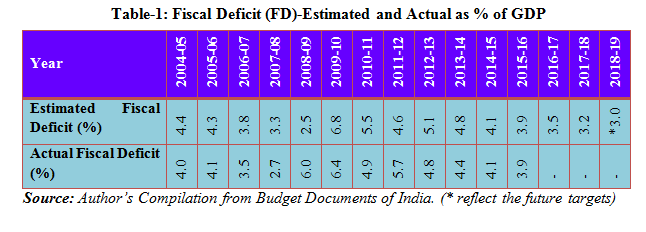

It is also essential to understand what is planned and what has been achieved, in terms of ‘deviations’ between the actual and estimated fiscal deficit between 2004-05 to 2017-18. The ‘Deviation’ which reflects the definite fiscal discipline of the government, was in control since last five years ranging from 0.0 to 0.4 per cent. In the last couple of years, deviation is at the least and indicates seriousness with respect to prudent fiscal management and fiscal responsibility in India.

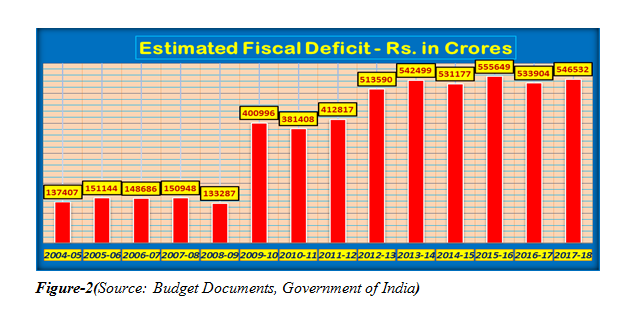

The total borrowing of the government in absolute terms has increased manifold which is a matter of concern during 2008-09 to 2015-2016. There has been a steep rise in the estimated absolute fiscal deficit from Rs. 1, 33,287 crores to Rs. 5, 55,649 crores which is more than four times in a span of seven years. But in the present and previous budget, government has shown its serious intent not only to reduce the fiscal deficit in percentage form but also in terms of absolute value that is Rs. 5, 46,532 crores. Fiscal responsibility of the government of India rests on containing fiscal deficit both in absolute as well as the percentage form to achieve fiscal consolidation.

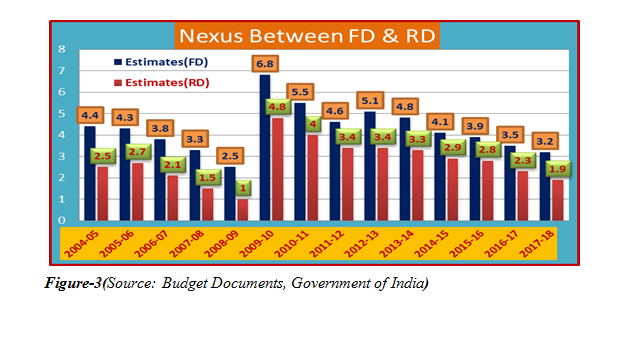

Revenue deficit (RD) and capital expenditure are the key constituents of fiscal deficit. So, it is presumed that government adheres to debt as a source to accommodate the revenue shortfall and to meet the capital expenses. Therefore, fiscal prudence depends on how the government manages the revenue deficit in particular. We found a high degree of positive correlation between the revenue deficit and fiscal deficit (refer figure-3). Although the estimated revenue deficit is falling from 4.8 per cent in 2009-10 to 1.9 per cent in 2017-18, still it contributes considerably to the fiscal deficit.

In an ever changing economic environment, the only thing that is constant is the ‘CHANGE’. To keep pace with the ‘CHANGE’, our Finance Minister rightly set a committee under the leadership of Former Revenue and Expenditure Secretary Mr. N.K. Singh to review the FRBM act after a gap of thirteen years, to understand its relevance and approach in the present fiscal framework considering various macroeconomic challenges and global uncertainties. FRBM review committee has done a serious and elaborative exercise in scrutinizing the act in the realm of present need and future focus and come up with a model of sustainable debt path to achieve fiscal stability, consolidation and able to create space to accommodate various developmental needs of the nation.

The committee recommended shifting the focus of budget analysis in terms fiscal deficit to debt-GDP ratio and set the target to keep the same at 60 per cent by 2023 and keeping fiscal deficit at 3 per cent for next three years. Further, the government has proposed to have the value of fiscal deficit to be fit in a range than a fixed value; to provide fiscal space to the government to accommodate any global shocks and economic uncertainities.

Success of the budget is measured by the outcome and its impact on the economy as a whole, not just by the total outlay. Containing fiscal deficit is just about not fixing a number or figure rather it is considered as a serious exercise which reflects the understanding of underlying factors and forces and the causes and sources of borrowing and the demand for which these funds get used. The sustainable model of fiscal framework look forward to a situation where adverse effects of high fiscal deficit get well-adjusted by higher spending on various capital assets and on various welfare programs. Hence; ‘Sustainable Model’ (3M: More Expenditure and More Revenue Model ) finds a strategic place in the current budget and our Honourable Finance Minister has taken utmost care to achieve the fiscal deficit target of 3.2 per cent of GDP through higher expenditure followed by revenue augmentation. This is where, the beauty of quality and sustainability intersects.

The current budget 2017-18 has choosen the path of sustainable model of fiscal deficit with keeping revenue deficit at 1.9 per cent as against 2.00 per cent as proposed and set the path for developmental expenditure like infrastructure, social sector etc. Therefore, the focus of the budget shifted to capital expenditure which means creation of assets and increase in investment with anticipation of multiplier effects. Besides, emphasis is given to rationalise and scrutinize all the expenditure to tune with the fiscal goals and adhere to quality expenditure.

The provision of expenditure segregation in terms of revenue and capital and removal of plan and non-plan classification is the distinct feature of the current budget. Besides, government increased the budgeted expenditure by Rs. 1, 32, 328 crores over the revised estimates of the previous year within the limited space of 3.2 per cent fiscal deficit and set the GDP growth rate at 11.75 per cent.

In the era of Demonetisation and GST, keeping the fiscal deficit at 3.2 per cent, pronounces the government’s commitment to achieve fiscal discipline. Further, the success of demonetisation will open up new avenues of tax revenue augumentation and bring undisclosed income to the tax bracket, thereby raise the revenue receipts and further bring down the fiscal deficit in the subsequent year by revenue deficit reduction.

In contrast to the fiscal deficit 3.2 per cent, the government has increased its spending by more than 3.5 per cent and clearly indicating a trade off in favour of public expenditure. This is the sign of adoption of positive approach towards fiscal management.Therefore, just looking at number (fiscal deficit) and saying good or bad, stands inappropriate unless and until one understands the nature and purpose of expenditure and outcome of the same in terms of employment, investment and infrasructure development. Allocation to capital expenditure has increased by 25.4 per cent is the pivotal point of the current budget in terms of focus on sustainable development. Besides, net market borrowing of the government is restricted to Rs. 3.48 lakh crores which is much lower than Rs. 4.25 lakh crores of the previous year.This also indicates the intent of the government to reduce the debt liabilties.

FRBM review committee introduced an ‘Escape Clause’ to deviate 0.5 per cent in the said fiscal deficit to accommodate structural complexities and uncertain fiscal changes due to internal and external environment. But government has set the targeted fiscal deficit at 3.2 per cent, even after the recommendation, showing its seriousness in achieving fiscal discipline. This is reflected in the last couple of years, in terms of minimum gap among various fiscal indicators between estimated and actual. Efficient and effective management of expenditure and enhancing the revenue base and tax buoyancy are the keys to fiscal consolidation and fiscal prudent management.

Mohapatra, A. K. (2016). Assessing fiscal prudence through various deficit indicators. Yojana -A Development Monthly- Vol-60, Special Issue (English) August 2016, pp. 66-69

Mohapatra, A. K., (2014). Budget 2014-15- Emphasis on Inclusive Development. Kurukshetra - A Journal on Rural Development, Vol. 62 (6), 11-13

Mohapatra, A. K., (2014). Fiscal Deficit: Trends and Implications. Yojana-A Development Monthly -Special Issue (English) August 2014, pp. 36-40

Ahluwalia, M. S. (2002). Economic reforms in India since 1991: Has gradualism worked?The Journal of Economic Perspectives,16(3), 67-88.

Martinez-Vazquez, J., & Rider, M. (2006). Fiscal decentralization and economic growth: a comparative study of China and India.Indian Journal of Economics and Business, 1-18.

Özatay, F. (1997). Sustainability of fiscal deficits, monetary policy, and inflation stabilization: The case of Turkey.Journal of Policy Modeling,19(6), 661-681.