|

Ritika Aggarwal (Department of Economics, PGDAV College, Delhi University) |

While calculating the equilibrium level of income in a macroeconomic framework, we assume the variable ‘G’ to be autonomously given, thus implying that public expenditure variable is beyond control. However, if we assume that this is a policy variable, then there should be some factors that bring about changes in public expenditure. This paper is aimed to focus our attention to this analysis.

Several economists have introduced various theories on the growth of public expenditure due to the increase in national income, higher tax revenue and other factors. Multiple evidences are also available in the literature supporting these theories. In this paper, we have included some empirical tests on the Indian public expenditure data, and we find evidence validating most of the theories on the growth of public expenditure.

Keywords: Public Expenditure, Growth, Tax Revenues

The function of the public sector is not single-purposed, but comprises a variety of subfunctions, including distribution of income and growth stabilization. However, our main emphasis here is on the role of public sector in the provision of satisfaction of public wants. Public wants must be provided for through the budget and be made available free of any direct charge to the user. Public goods are non-rival and non-excludable in nature. This implies that one person’s partaking of benefits does not reduce the benefits available to others. However, since the benefits are available to all, consumers will not voluntarily offer payments, may not reveal demand and act as free riders. The market mechanism fails to provide a social good efficiently. Linkage between producer and consumer is broken and the government must step in to provide for such goods.

Apart from expenditures on law and order, monetary stabilization and regulation, social services such as health, education and welfare absorb largest proportion of government expenditure. Rationale behind many social programs is redistribution, or to ensure that no one falls below a minimum loving standard in the economy. Buchanan (1965) divides government expenditure into productive expenditure and transfer expenditure. The former measures government’s purchase of real goods and services and the latter explains the transfer of purchasing power from general taxpayers to specific individuals and groups. With the process of economic growth, social and economic relationships become more complex, thereby giving importance to increased public expenditure as a necessary condition for functioning of market economy. This role of public expenditure will change in the course of development as budgetary function changes according to the needs of the economy.

Government expenditure is considered to be determined by interaction of demand and supply factors and a stable behavioural function of a few specific variables.

Provision of public goods is made in response to the wishes and demands of people, which is being collectively satisfied. Such provision would increase the total size of public expenditure. The primary demand side factors are:

On the supply side, the main determinant of public expenditure is the national income, which not only determines the taxable capacity of the individuals but also the resource raising capacity of the government. At lower levels of national income, the constrained revenue possibilities have limitations on expanding government expenditure. Raising revenue through taxes beyond a certain limit is difficult and any attempt to do so would have an adverse effect on work efforts, savings and private capital formation, which in turn would have an adverse effect on the total resources available to the government for spending.

Musgrave and Cuthbertson (1953) argue that absolute public expenditure increases as population, productivity and per capita income increases. It is important to consider growth of public expenditure in relation to total income because rising expenditure requires increasing tax yield, which in turn depends on required change in the level of tax rates.

Musgrave (1969) distinguishes between economic, social, cultural and political factors as determinants of the growth of public expenditure. He argues that as per capita income increases due to increasing productivity, share of public goods in total output will be determined by income elasticities of demand for private against public consumer goods and on the appropriate mix of the capital stock between private and public investment goods as the stock increases.

Changes in cultural values, greater sense of social responsibility for welfare of individuals, transition from authoritarian to representative government may also have a significant impact on public expenditures.War and major disturbances may also have a profound effect on timing of expenditure growth, causing sharp temporary departure from underlying trends.

This section highlights the main economic theories of public expenditure, namely:

Wagner’s Law

Adolph Wagner, the famous German political economist believed that a functional relationship exists between the economic growth and the growth of its public sector. According to him, growth is an inherent feature of all developed economies. His generalizations about public expenditure are based on direct inference from historical evidence from Britain, United States, France, Germany and Japan.

Wagner’s law of increasing state activity suggests that as per capita income and output increases, the public sector will grow in proportion to total economic activity. He believed that the cause of relative growth of government is social progress and the resulting changes in the relative spheres of private and public economy.

Presenting the critique of this law, F. Pryor argues that neither highly developed nor highly underdeveloped countries fit Wagner’s generalization. Peacock and Wiseman (1967) observe that Wagner’s argument suffers from two main drawbacks. Firstly, it is based upon an organic self-determining theory of the state, which is not the prevailing theory in most western nations. Secondly, Wagner’s hypothesis overlooks the significant “time pattern” or “process” of public expenditure growth.

Peacock and Wiseman’s Hypothesis

Peacock and Wiseman questioned the generality of Wagner’s law and introduced their hypothesis to explain time pattern of growth of government in democratic countries. Their analysis is based on British economy for the period 1890-1955, wherein they observed that British public sector has grown on a “step-like” rather than a “continuous growth” basis.

Peacock and Wiseman suggest that government expenditure depends on revenues raised by taxation, i.e. decisions about expenditures are influenced by political factors that are different from choices made through market. What are inherent in this nature of choices are separate ideas of citizens as to what is the desirable public expenditure and reasonable burden of taxation. Thus, divergence of the revenue and expenditure ideas of citizens is of potential relevance as a means of explaining the time pattern of government expenditure growth in a large number of societies.

Peacock and Wiseman approach to government spending trends is more modest than the Wagner hypothesis. It does not claim to be a law and merely attempts to point out some characteristics of the growth pattern. However, this hypothesis does not apply to the pattern of public sector growth in the Unites States, even though governmental activity in Europe has been closely related to major social disturbances such as war and depression.

Samuelson’s Theory

Samuelson (1954) represents the pure theory of public expenditure in which he gives a mathematical exposition to determine the most efficient way of allocating resources, i.e. an efficient combination of public and private goods.

He assumes that there are two goods in the economy where X is a private good and G is a public good. There are two individuals S1and S2. Utility function of S1is given as U1 = U1(X1,G) and similarly for S2 is given as U2 = U2(X2, G). The cost of production of public good is C(G) and the total resource ownership of the two individuals be W1 + W2.

Our aim is to maximize U1 subject to the constraint that U2is kept at a prefixed level of utility, say U2, and a resource constraint, i.e., X1+X2 + C(G) = W1 + W2. Setting up the Lagrange, we get:

L = U1(X1, G) + λ1[W1 + W2 - X1-X2 – C(G)] + λ2[U2 - U2(X2, G)]

The first order conditions are:

This implies that MRS1 + MRS2 = MRT where MRS1 and MRS2 are the marginal rates of substitution for S1 and S2 respectively, and MRT is the marginal rate of transformation (or the marginal cost of public good).

Samuelson’s theory of public expenditure emphasizes on an efficient allocation of public and private goods in an economy, thus, indirectly pointing towards a greater uniformity in the public expenditure pattern for provisioning of public goods.

Baumol’s Unbalanced Growth Model

Baumol (1967) through his model of unbalanced growth explains how public expenditure might be expected to grow at a faster rate than the rest of the economy. According to him, public sector is less productive than the rest of the economy, but the wage rate remains the same in the two sectors.

Increased productivity in the productive sector can support the increased wages with no necessary increase in the wage costs. The wage rates would also increase in the unproductive sector, which will result in an increase in the unit costs. The products of the unproductive sector would hence be driven off the market as a result of continually increasing costs. However, this will not occur if market demand is inelastic or there is a strong political demand. Thus there is a rise in the relative expenditure of non-productive sector because progress of the productive sector adds to the cost of unproductive sectors.

Public sector is considered to be less productive because it cannot make use of the technological advances. Hence the cost in public sector relative to private sector would increase and governmental expenditure would rise at a faster rate than national income.

In order to support the theories of public expenditure growth and study their validity in various western and other economies, several economists have tried to work these theories empirically. Peacock and Wiseman, who examined the public expenditure trends for UK for the period 1890-1955, made the biggest contribution to the empirical literature. From 1841 to 1890, the share of government expenditure declined from 11% of GNP to 9% of GNP. This however increased to 12% in 1905, 24% in 1923 and 37% in 1955.

Musgrave (1969) examines the course of public expenditures for UK, USA and Germany. He observes that the total public expenditure as a percentage of GNP increased in all three countries. The biggest factor of increase was in the social services including education, welfare programs, housing etc.

Herber (1967) suggests that Peacock and Wiseman hypothesis does not apply neatly to the pattern of public sector growth in USA. Although the evidence of 20th century expansion of federal government and decline in the local government component does support concentration process, the relationship of public sector economic activity to aggregate economic activity experienced a decline. This was inconsistent with the Peacock and Wiseman prediction that new disturbance creates tolerance level for taxation.

Goffman and Mahar (1971) have studied the influence of permanent factors such as incomes, prices and population, on absolute expenditure growth in Haiti, Dominican Republic, Costa Rica, Panama, Honduras and Guyana. They observe that even after these permanent influences are given due credit, a sizeable proportion of growth in public expenditure remains unexplained. However, patterns exhibited were similar to Peacock and Wiseman’s. They argue that developed economies demand more public expenditure because economic development requires such expenditures.

Wagner and Weber (1977) studied a sample of 34 countries for the post World War-II period. They found that, for some countries, Wagner’s law seems to hold, but for others it does not. Western democracies seem to be on the side of growing size of public sector with exceptions of France, Germany and Iceland. Weight of evidence remains inconclusive to suggest that there is no universal Wagnerian law of public spending. Different patterns of countries relate to different histories of institutional evolution.

Bird (1971) observes that trends for UK were not inconsistent with Wagner’s hypothesis. For Germany also, expenditure grew more than the increase in real per capita income. Wagner’s law was not disproved in aggregate for Canadian data. Similar trends were obtained for Sweden, Norway and USA.

Thorn (1967) on the contrary discussed about the social and dynamic forces which form the pattern of evolution of public expenditures and revenues during the processes of economic growth, substantially in excess of the rate of growth of national product. On the basis of this hypothesis, he derives four empirical propositions:

These propositions are supported by substantial empirical evidence from Canada, Germany, Italy, Norway, Sweden, UK and USA.

K.N.Reddy (1970) observes that in India, for the period 1872-1947, government expenditure has grown at a faster rate than total output and removal of permanent influences such as population and price changes has not affected secular growth, which is in line with the Wagnerian hypothesis.

In this section we work the theories empirically for the Indian case by studying the trends in the public expenditure in the post-reform period, and comparing these vis-à-vis changes in total tax revenue collected and GDP. Data is obtained for the time period 1995-2015 from the Indian Public Finance Statistics, Ministry of Finance (http://finmin.nic.in/reports/ipfstat.asp).

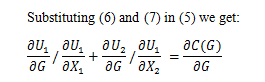

It can be seen in Figure1 below that the overall public expenditure has increased from Rs.3 Lakh Crore in 1995-96 to Rs. 35 Lakh Crore in 2014-15.During the same period, the GDP has increased from Rs 11 Lakh Crore to Rs.129 Lakh Crore. This increasing trend in the public expenditure with the increase in output is in line with the Wagnerian hypothesis. However, no clear trend is visible in the total expenditure as a percentage of the GDP.

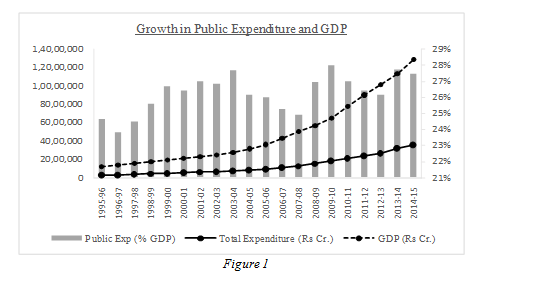

A similar analysis is conducted for the change in total tax revenue collected. It is observed that the public expenditure increases in line with the tax revenue over the time period under consideration, thus supporting the Peacock and Wiseman which suggests that government expenditure depends on revenues raised by taxation. It may also be noted from Figure 2 that the expenditure is higher than the tax revenue collected by the government, thus resulting in budgetary deficit.

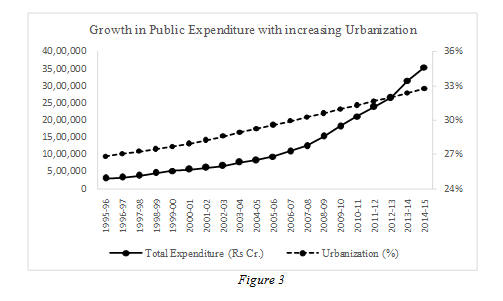

We also obtain data on urbanization (urban population as a percentage of the total) from the World Bank open data source for the same time period. It is evident from Figure 3 that there exists a positive correlation between the proportion of urban population and the overall government expenditure, owing to the increased demand for public goods and facilities due to urbanization.

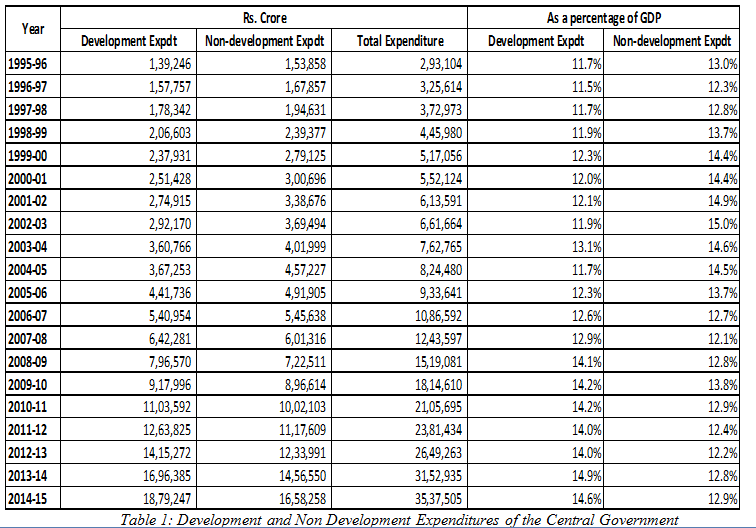

It is also important to look into the classification of government expenditure into plan and non-plan expenditure. Plan expenditures comprise of all the expenditures of the government which are included in the central plan, while non-plan expenditures are committed expenditures on completed schemes of earlier plans and the interest on borrowings. Most recently, from the Budget 2017-18, it has been suggested that these two heads should be merged to facilitate ease in resource allocation and monitoring. There is another classification of government expenditures i.e., Development expenditures and Non-development expenditures. Development expenditures are broadly defined to include all items of expenditure that are designed directly to promote economic development and social welfare. Non-development expenditures include expenditure pertaining to the general services rendered by the government such as preservation of law and order, defence of the country and the maintenance of the general organs of the government.

Table 1 shows that the total public expenditures have increased from Rs. 2,93,104 crore in 1995-96 to Rs. 35,37,505 crore in 2014-15. Total expenditure as a percentage of GDP has been varying between 25-30 percent over the time period 1995-2015. Levels of development expenditure followed a trend similar to that of the total public expenditure. The share of Development Expenditures in the GDP rose from 12 percent in 1995-96 to 15 percent in 2014-15. Non-development expenditure continues to be a larger proportion of the total expenditure. Defence, debt services and administrative expenses are so large and so significant that they are responsible for keeping non-development expenditure at a high level. The share of non-developmental expenditures in total expenditures of the centre grew from 52.5 percent in 1995-96 to 55.5 percent in 2004-05. Post this period, the trend reversed and it fell to 46.9 percent in 2014-15.

This paper attempts to study the underlying factors affecting the growth of public expenditure and theories indicating the trends in public expenditure growth.

The first and the most important attempt to study public expenditure was made by Adolph Wagner, who described that state activity increases with an increase in the output in the economy. However, this Wagnerian law was not found to be universal, and it was based on historical evidences only.

Theory of public expenditure stems from the Pareto optimal allocation of private and public goods in the economy to which Samuelson has presented a detailed analysis. Differences in trends and differences in sources of trends also suggest differences in applicability of each theory to different economies. However, these wide and fluctuating differences may be attributed to different economic, political, institutional and social factors present in each economy.

At the theoretical level, it is argued that public choice and associated theoretical formulations have improved our understanding by insisting that growth of public expenditure must be explained by utility maximising behaviour of demanders and suppliers of public services through political and economic behaviour. Yet, there is a lack of establishment of laws through conceptual and econometric problem. Hence it can be concluded that if we treat public expenditure as a policy variable, then we have to analyze the factors that affect it, the laws that explain its behaviour and its impact on other variables in the economy, especially economic growth.