|

P. K Ranju

Research Scholar Department of Business Administration Mangalore University Mangalagangothri, Karnataka |

Dr. T. Mallikarjunappa

Professor Department of Business Administration Mangalore University Mangalagangothri, Karnataka |

Industry Effects of Cross-border M&As: Evidence from Short-run Market Reaction of the Indian Acquirers

In this study we investigate the impact of cross-border M&As (CB M&As) on acquirers from different industries in India. Using event study methodology, we assess the effects of CB M&A announcements on acquirers belonging to different industries. The results show that acquirers in the healthcare and high technology industries gain significantly from the announcement of CB M&As. Acquirers from the healthcare and high technology industries experience positive and significant CIAARs (cumulative industry average abnormal returns) of 4.17% and 4.46% respectively during the 11-day event window. On the other hand acquirers in all other industries experience insignificantly negative or positive CIAARs. Overall findings of this study show that the wealth effects of CB M&As for acquirers differ depending on the industry to which they belong to.

Keywords: Acquirers, CB M&As, Event Study Methodology, Industry effects, India

JEL Classification: G34, G14

Globalisation has made the business highly competitive both domestically and internationally. In this highly competitive environment companies have started to venture abroad in pursuit of growth. There are different strategies, like greenfield investments, mergers and acquisitions (M&As), joint venture and strategic alliance, that companies can employ to enter the foreign market. Cross-border M&As (CB M&As) are considered as an important entry strategy for foreign direct investment. What drive the companies to involve in CB M&As are same as in the case of other foreign direct investment decisions. To strategically enhance firm’s competitive advantages, to better exploit the a firm’s asset, to diversify the risk and quick entry into the foreign market are the factors which drives companies to engage in CB M&As (Li, Li and Wang, 2016).There has been a heated debate on whether the announcement of CB M&As create wealth for the shareholders of acquiring companies or not. Present literature on this issue has provided conflicting results. Studies by Mentz and Schiereck (2008), Gubbi et al. (2010), Bhagat, Malhotra and Zhu (2011),Nicholson and Salaber (2013), Edmura et al. (2014), Gregory and O’Donohoe (2014); Rani, Yadav and Jain (2015a, b), Zhu, Xia and Makini (2015) and Li, Li and Wang (2016)provide evidence of wealth creation to the acquirers frokiym the announcements of cross-border M&As. On the other hand, Dutta and Puia (1995), Black et al., (2007), Dos Santos, Erunza and Miller (2008), Uddin and Boateng (2009), Nnadi and Tanna (2013) and Drymbetas and Kyriazpoulos (2014) report that CB M&As do not create wealth for the acquirer company shareholders, instead results in significant value destruction.

Studies have also found that there are certain firm specific and deal specific factors which affect the stock price performance of acquirers during the announcement period. One of the significant factors is the industry to which the company belongs to. Kiymaz and Baker (2008) reported that wealth effects to acquirers range from significantly positive to significantly negative depending on the Industry. To the best of our knowledge, there are no studies in Indian context on the industry effects of CB M&As. Hence in this study we investigate the industry effects of CB M&As by using a sample of 224 CB M&As announced and completed during the period 1st January, 2000 to 20th May, 2016 in India. We found that acquirers from the healthcare and high technology industries gain significantly from the announcement of CB M&As. This study contributes to the extant literature on CB M&As by providing evidence that wealth effects of acquirers varies from significantly positive to negative depending on the industry to which the acquirer belongs to.

In the following we proceed as follows; in the next section we provide the literature review. In the third section we discuss the data and methodology used in this study. Empirical results and discussion have been provided in the fourth section. Finally, fifth section concludes the study.

Being a hot topic, the causes and effects of M&As have been of interest to various researchers all over the world. Vast amount of literature is available with respect to M&As. In this section we focus only on the existing evidence on shareholder wealth effects of acquirers in different industries.Ferris and Park (2001)examined the long-run post-acquisition performance of acquiring firms in the U.S. telecommunications industry. They used an industry and size matched sample of non-merging regulated firms as a benchmark to calculate the change in performance. They found that acquiring firms underperform their size and industry matched control firms. Similarly, Kohers and Kohers (2001)for U.S acquirers that purchase target firms in the high-tech industry report significant erosion in the post-acquisition long-term return.For US M&As during the period 2009-2012, Stunda (2014) reported that firms engaged in M&As in all industry except oil and gas industry along with banking and financial services industry experience negative impact on the stock prices. He also argues that stock price reaction could be different depending upon the industry. Contrary to above studies, Lee and Lim (2006) found that strategic alliance like M&As and joint ventures create value for companies involved in it. They also reported that value of non IT firms increased more than the value of the IT firms. Their analysis was based on a sample of 170 announcements involving US companies. Likewise, Koenig and Mezick (2004) concluded that post-merger productivity of US pharmaceutical companies improved during the post-merger period compared to the pre-merger period.In the Indian context, Kalghatgi (2012)Investigated impact of M&As on the acquirer company shareholders’ wealth in the high-technology industry and Jucunda and Sophia (2014)studied a sample of 78 acquisition announcements in the manufacturing industry. Both the studies concluded that the announcement of M&As do not have any impact on the shareholders’ wealth.Azhagaiah and Sathishkumar (2014) for a sample of 39 acquirer firms in the manufacturing sector reported that M&As result in the significant positive improvement of operating performance.

A stream of literature has examined the wealth effects of M&As in the financial sector. For example, Sharkas, Hassan and Lawrence (2008) investigated the cost and profit efficiency of bank mergers happened in the U S banking industry during the period 1985 to 1999 using stochastic frontier approach. The sample for their study was 440 banking mergers. They found that cost and profit efficiencies of banks have improved as a result of merger. Similarly, Anand and singh (2008) and Kumar and Suhas (2010) reported that the merger announcements in the Indian banking industry results in positive wealth effects to the acquirer. On the other hand, findings of Kalra, Gupta and Bagga (2013) werecontradictoryto the findings of aforementioned studies in the financial sector. They investigated the post-merger performance efficiency in the Indian banking industry by comparing pre-merger and post-merger profitability and liquidity ratios and also by measuring shareholder wealth effects of mergers occurred during the period 2000 to 2011 and reported absence of any significant improvement in the financial performance.

Using 869 acquirers and 795 targets Kiymaz and Baker (2008) examined the short-term market reaction to the announcement of large domestic M&As involving public U.S firms with public targets from 1989 to 2003.They concluded that the wealth effects of large M&As for the acquiring and target firms can be significantly positive, significantly negative, or not significantly different from zero depending on the industry. These findings shed light on the abundance of existing research on wealth effects of M&As by revealing the importance of industry classification in determining wealth effects for target and acquirer firms. Whether the importance of industry classification in determining wealth effects holds true or not in the case of CB M&As has not got much needed attention of the researchers. For automotive supply industry Mentz and Schiereck (2008)examined the stock price reactions to cross-border M&As by using a sample of 100 horizontal CB M&As completed during the period 1981-2004 and found evidence of significant wealth creation for acquiring companies involved in theCB M&As.In the Indian context, Srivastava and Prakash (2013) examined whether the cross-border acquisitions result in value creation for the acquirers in the pharmaceutical sector by using 30 cross-border acquisitions by Indian pharmaceutical firms listed on National Stock Exchange and found that CB M&As neither result in improved operating performance nor create value.

There are studies on impact of cross-border M&As on the shareholders’ wealth (e.g., Hudgins and Seifert, 1996; Lowinski, Schiereck and Thomas, 2004; Danbolt, 2004; Dos Santos, Erunza and Miller, 2008; Mann and Kohli, 2011; Nnadi and Tanna, 2013; Drymbetas and Kyriazpoulos, 2014; Rani, Yadav and Jain, 2015 a, b; Li, Li and Wang, 2016) and studies have also been done by taking a particular industry (e.g., Mentz and Schiereck, 2008;Srivastava and Prakash, 2013) . Nonetheless,evidence on effects of CB M&A announcements on acquirers belonging to different industries is limited, which leaves gap in the literature. Accordingly, this paper examines the wealth effects of CB M&As for acquirers belonging to different industries in India.

In order to elicit the impact of CB M&As on acquirers from different industries in India, we use a sample of 224 deals announced and completed during the period 1st January, 2000 to 20th May, 2016.CB M&As data are sourced from Thomson ONE database maintained by the Thomson Reuters. Thomson ONE provides detailed information about the M&A deals like date of the announcement, form of the deal, industry of the acquirer and target, acquirer and target nation, public status of the companies involved etc.Stock price data and index data are obtained from Prowess database maintained by Centre for Monitoring Indian Economy (CMIE). There were 3118 CB M&As during the study period in which acquirer is an Indian company. We used certain criteria to arrive at the final sample for our study. First of all, we eliminated all the deals in which acquirer company is not a public company. Then we eliminated rumoured, pending and withdrawn deals. We also excluded deals involving acquisition of assets and acquisition of shares less than 25%. We then excluded the M&A deals in the financial sector from the sample due to the different nature of assets and liabilities of the financial firms and different financial reporting of these companies (Dos Santos, Errunza and Miller, 2008; Rani, Yadav and Jain, 2013; Narayanan and Thenmozhi, 2014). We also eliminated the M&A deals that are followed within two years of an earlier one to measure the effect of each announcement properly. Finally, those announcements for which enough share price data is not available for conducting event study methodology and deals influenced by confounding events have also been excluded.All these criteria resulted in the final sample of 224 CB M&A announcements. This sample selection process has been depicted in the Table 1.

We categorisethe acquirer companies into different industries based on the classification given by Thomson ONE database. Thomson ONE proprietary macro-level industry classifications are based on SIC Codes and there are 14 macro-level classifications comprised of more than 85 mid-level categories. In our final sample, there are companies from 9 different industries. Table 2 provides the industry wise distribution of the sample. Maximum number of CB M&As in our sample belongs to materials industry with 61 deals, followed by high-technology industry with 48 deals.

Table 1: Sample selection process

| Total number of outbound cross-border M&As involving Indian acquirer during the period 1st January 2000 to 20th May 2016. | 3118 | |

| Less: Ø Cross-border M&As by companies that are not public. Ø Pending, rumours, intended, status unknown and withdrawn deals. Ø Acquisition of assets and acquisition of less than 25% interest. Ø CB M&As by financial sector companies Ø M&As that is followed within two years of an earlier one. Ø Trading data not available and companies having non-synchronized trading. Ø Confounding events | 1431 677 535 16 167 32 36 | 2894 |

| Final sample (3118-2894) | 224 | |

Source: Thomson ONE

Table 2: Industry wise distribution of sample

| Industry | Number of announcements |

| Consumer products and services | 15 |

| Consumer staples | 20 |

| Energy and power | 11 |

| Healthcare | 24 |

| High technology | 48 |

| Industrials | 33 |

| Materials | 61 |

| Media and entertainment | 6 |

| Telecommunications | 6 |

| Total | 224 |

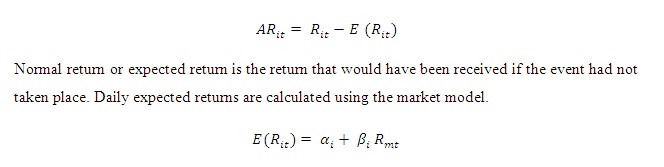

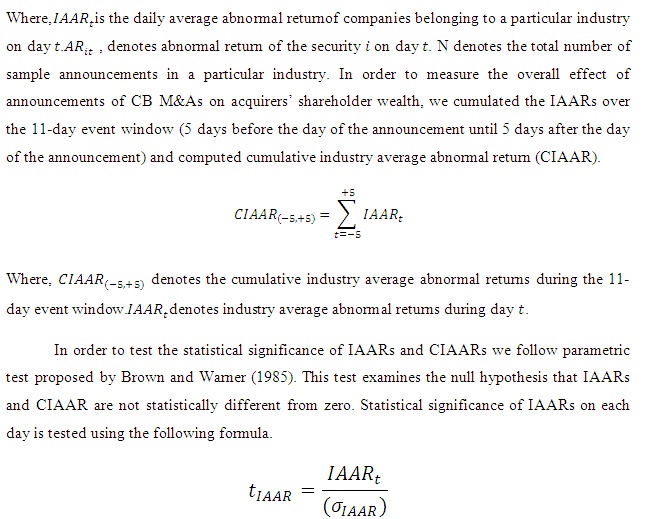

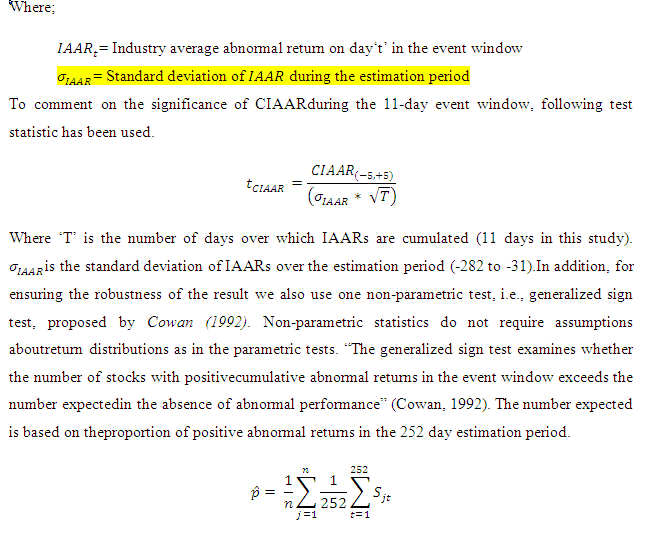

We employ an event study methodology to draw inferences about the impact of CB M&A announcements on the acquirers from different industries. The impact of a specific unanticipated event related to a company on the wealth of its shareholders is examined with the help of event study methodology( Brown and Warner, 1985; MacKinlay, 1997 ). In this study, the announcement of CB M&As is considered as the event and the announcement date as provided in the Thomson ONE is defined as the event day (t=0). If the announcement day happened to be a trading holiday, next trading day is considered as the event day. The impact of an event is assessed by measuring the abnormal returns (AR). Abnormal returnsfor each company are calculated as the excess of actual returnsof company on day , i.e., Rit, over the expected return, i.e., E (Rit).

Where presents the normal return of the security ‘ i’ when is 0, measures the sensitivity of company return ( ) to the market return. Denotes the market return, in this study, S&P BSE Sensex is used as the market proxy. For each announcement we use the 252 (-282 to -31) trading days, i.e., 282 days before the event day till 31 days before the event day, as estimation period. Market model parameters are computed by an OLS (ordinary least square) regression of company returns ( on market return ( over the 252 days estimation period.

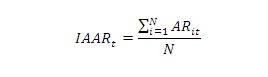

Abnormal returns of companies belonging to each industry are averaged to find out the industry average abnormal return (IAAR) for day .

In this section we discuss the empirical results and findings of the study. Using event study methodology we investigate theimpact of CB M&A announcements on acquirers from different industries in India. The results of event study methodology have been provided in the Table 3 and Table 4. Table 3 presents the IAARs on the day of the announcement and the results of parametric and non-parametric tests.

Table 3: IAARs on the day of the announcement

| Industry | IAARs | t value | G Sign test (Z) |

| Consumer products and services | 1.52% | 1.807 | 2.113* |

| Consumer staples | -0.66% | -0.962 | -0.062 |

| Energy and power | 1.91% | 2.327* | 1.142 |

| Healthcare | 1.33% | 2.439* | 1.304 |

| High technology | 2.10% | 3.917** | 2.237* |

| Industrials | 2.09% | 4.668** | 3.231** |

| Materials | -0.10% | -0.286 | -0.433 |

| Media and entertainment | 1.70% | 1.303 | 1.044 |

| Telecommunications | 1.6% | 1.465 | 1.024 |

Source: Authors’ computation

Note: * and ** indicate significance at 5% and 1% level of significance respectively

It is apparent from the table that the impact of CB M&A announcements on acquirers from different industries are not the same. Consumer staples industry and materials industry experience insignificant negative returns on the day of the announcement. On the other hand, consumer products and services industry, media and entertainment industry and telecommunications industry experience insignificant positive returns. Interestingly, we observe significant positive returns for acquirers from the energy and power, health care, Industrials and high-technology industries on the day of the announcement. Highest returns are reported for the high-technology and Industrials with IAARs of 2.10% and 2.09% respectively. Both the parametric and non-parametric tests show that IAARs are statistically significant for Industrials and high-technology industries. Energy and power industry and healthcare industry experience significant and positive returns of 1.91% and 1.33% respectively on the day of the announcement. Analysis of returns on the day of the announcement shows that, returns are positive and significant only for acquirers from the energy and power, health care, Industrials and high-technology industries.

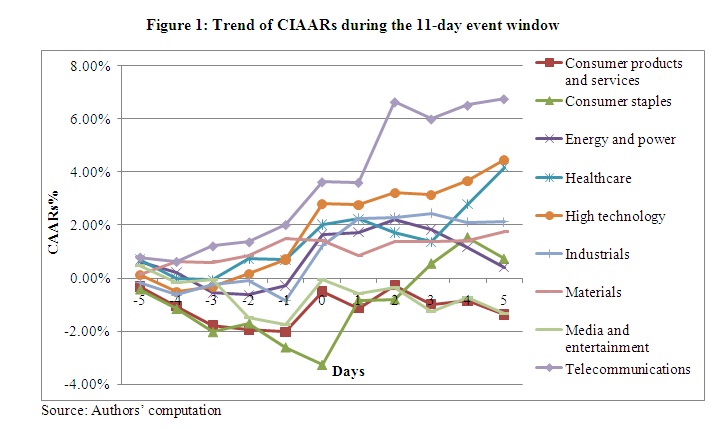

The overall impact of CB M&A announcements on acquirers across different industries has been measured by observing the statistical significance of CIAARs during the 11-day event window.Table 4 presents the wealth effects associated with CB M&As across industry groups during the 11-day event window.

Table 4: CIAARs during the 11-day event window

|

Industry |

11-Day CIAARs |

t value |

G Sign test (Z) |

|

Consumer products and services |

-1.38% |

-0.497 |

0.041 |

|

Consumer staples |

0.73% |

0.322 |

-0.062 |

|

Energy and power |

0.42% |

0.154 |

-0.067 |

|

Healthcare |

4.17% |

2.312* |

2.124* |

|

High technology |

4.46% |

2.506* |

1.658 |

|

Industrials |

2.12% |

1.428 |

0.781 |

|

Materials |

1.75% |

1.470 |

0.596 |

|

Media and entertainment |

-1.32% |

-0.307 |

0.225 |

|

Telecommunications |

6.8% |

1.847 |

1.844 |

Note: * and ** indicate significance at 5% and 1% level of significance respectively

Table 4 shows that CIAARs are positive and significant during the 11-day event window for the acquirers from the healthcare and high technology industry. Healthcare and high technology industry experience positive CIAARs of 4.17% and 4.46% respectively. Consumer staples (0.73%), energy and power (0.42%), industrials (2.12%), materials and telecommunication (6.8%) industries experience insignificantly positive returns. On the other hand, acquirers experience insignificantly negative CIAARs in consumer products and services industry (-1.38%) and media and entertainment industry (-1.32%). These findings suggest that the wealth effects of CB M&Asfor the acquirers differacross industries. To put it in simple words, the wealth effects of CB M&As for the acquirers can be significantly positive, insignificantly positive or insignificantly negative depending on the industry. The trend of CIAARs during the 11-day event window has been depicted in the Figure 1.

Although acquirers from energy and power, health care, industrials and high-technology industries experience significantly positive returns on the day of the announcement, the results involving the 11-day event window show that CB M&As result in statistically significant abnormal returns only in the healthcare and high-technology industry.Companies in the healthcare industry have been crossing the borders to acquire the overseas companies. The strategy of CB M&As helps healthcare companies in acquiring new product portfolios, brands, research laboratories and technologies to overcome their technological deficiencies and strengthen their innovative capabilities(Jayanthi, Sivakumar andHaldar, 2016).Certainlythe spate of CB M&As in the healthcare sector since 2000 (UNCTAD, 2006) coupled with the economies of scale in R&D (Koenig and Mezick, 2004) and other benefits indicate that healthcare industry sees advantages in CB M&As. Our findings uphold this argument by showing significantly positive wealth creation for the acquirers in the healthcare industry. The results also show that high technology firms are able to generate higher wealth for the acquirers from the announcement of CB M&As.High technology industry encompasses a number of different industries, from bio-technology to information technology to electronic devices. Focus on innovation is the key characteristic of all these different areas (Kohers and Kohers, 2001). A large number of CB M&As in India primarily involve technology intensive industry in which India has a high competitive advantage (Nicholson and Salaber, 2013). The finding of this study shows that the market sees CB M&As in the high-technology industry as value creating.

This study assesses the wealth effects of CB M&A announcements for acquirers belonging to different industries by employing event study methodology. Using a sample of 224 CB M&As announced and completed by companies belonging to different industries during the period1st January, 2000 to 20th May, 2017, we find that that the wealth effects of CB M&As for the acquirers differ across industries. The wealth effects of CB M&As for the acquirers can be significantly positive, insignificantly positive or insignificantly negative depending on the industry. Based on the CIAARs during the 11-day event window, this study shows that CB M&As result in statistically significant abnormal returns only in the healthcare and high-technology industry.Acquirers from the healthcare and high technology industries experience significantly positive CIAARs of 4.17% and 4.46% respectively during the 11-day event window. This finding corroborates the large number of CB M&As taking place in the healthcare and high technology industries in India to obtain strategic assets. The findings of this study are in line with the findings of Kiymaz and Baker (2008), they also document that the wealth effects of large domestic M&As in U.S for the acquiring and target firms differ depending on the industry. We contribute to the existing literature on CB M&As by revealing the importance of industry classification in determining the presence of wealth effects. We also document that in an emerging country like India, technology and innovation oriented industries like healthcare and high technology are able to create value by venturing abroad.

Anand, M., & Singh, J. (2008). Impact of merger announcements on shareholders’ wealth: Evidence from Indian private sector banks. Vikalpa , 33 (1), 35–54.

Azhagaiah, R., &Sathishkumar, T. (2014). Impact of Merger and Acquisitions on Operating Performance: Evidence from Manufacturing Firms in India. Managing Global Transitions , 12 (2), 121-139

Bhagat, S., Malhotra, S., & Zhu, P. (2011). Emerging country cross-border acquisitions: Characteristics, acquirer returns and cross-sectional determinants. Emerging Markets Review , 12 (3), 250-271. doi:10.1016/j.ememar.2011.04.001

Black, E. L., Doukas, A. J., Xing, X., &Guo, J. M. (2013). Gains to Chinese Bidder Firms: Domestic vs. Foreign Acquisitions. European Financial Management , 21 (5), 905-935. doi:10.1111/j.1468-036x.2013.12031.x

Brown, S. J., & Warner, J. B. (1985). Using daily stock returns. Journal of Financial Economics , 14 (1), 3-31. doi:10.1016/0304-405x(85)90042-x

Danbolt, J. (2004). Target Company Cross-border Effects in Acquisitions into the UK. European Financial Management , 10 (1), 83-108. doi:10.1111/j.1468-036x.2004.00241.x

Datta, D. K., &Puia, G. (1995). Cross-border acquisitions: An examination of influence of relatedness and cultural fit on shareholder value creation in U.S. acquiring firms. Management International Review , 35 (4), 337-359.

Dos santos, M. B., Errunza, V. R., & Miller, D. P. (2008). Does corporate international diversification destroy value? Evidence from cross-border mergers and acquisitions. Journal of Banking and Finance , 32 , 2716-2724. Retrieved from http://doi.org/10.1016/j.jbankfin.2008.07.010

Drymbetas, E., &Kyriazopoulos, G. (2014).Short-term stock price behaviour around European cross-border bank M&As. Journal of Applied Finance and Banking , 4 (3), 47-70. Retrieved from http://www.scienpress.com/Upload/JAFB/Vol%204_3_3.pdf

Eckbo, B. E., &Thorburn, K. S. (2000). Gains to Bidder Firms Revisited: Domestic and Foreign Acquisitions in Canada. The Journal of Financial and Quantitative Analysis , 35 (1), 1-25. doi:10.2307/2676236

Edamura, K., Haneda, S., Inui, T., Tan, X., &Todo, Y. (2014). Impact of Chinese cross-border outbound M&As on firm performance: Econometric analysis using firm-level data. China Economic Review , 30 , 169-179. doi:10.1016/j.chieco.2014.06.011

Ferris, S. P., & Park, K. (2001). How different is the long-run performance of mergers in the telecommunications industry? Advances in Financial Economics , 127-144. doi:10.1016/s1569-3732(02)07007-x

Gregory, A., &O'Donohoe, S. (2014). Do cross border and domestic acquisitions differ? Evidence from the acquisition of UK targets. International Review of Financial Analysis , 31 , 61-69. doi:10.1016/j.irfa.2013.09.001

Gubbi, S. R., Aulakh, P. S., Ray, S., Sarkar, M. B., &Chittoor, R. (2010). Do international acquisitions by emerging-economy firms create shareholder value? The case of Indian firms. Journal of International Business Studies , 41 (3), 397-418. doi:10.1057/jibs.2009.47

Hudgins, S. C., & Seifert, B. (1996). Stockholder returns and international acquisitions of financial firms: An emphasis on banking. Journal of Financial Services Research , 10 (2), 163-180. doi:10.1007/bf00115674

Jayanthi, B., Sivakumar, S., &Haldar, A. (2016). Cross-border Acquisitions and Host Country Determinants: Evidence from Indian Pharmaceutical Companies. Global Business Review , 17 (3), 684-699. doi:10.1177/0972150916630452

Jucunda, M. E., & Sophia, S. (2014). Do Acquisitions Add Value to Acquirers in India? A Study on the Sensitivity of the Stock Market and Acquirer Returns. Indian Journal of Finance , 8 (5), 5-18. doi:10.17010/ijf/2014/v8i5/71914

Kalghatgi, J. (2012). Mergers and Acquisitions in Indian Information Technology Industry and its Impact on Shareholders' Wealth. International Journal of Research in Commerce, IT & Management , 2 (4), 118-127.

Kalra, N., Gupta, S., &Bagga, R. (2013). A Wave of Mergers and Acquisitions: Are Indian Banks Going Up a Blind Alley? Global Business Review , 14 (2), 263-282. doi:10.1177/0972150913477470

Kiymaz, H., & Baker, H. K. (2008). Short-term performance, industry effects, and motives: evidence from large M&As. Quarterly Journal of Finance and Accounting , 47 (2), 17–44.

Koenig, M. E., & Mezick, E. M. (2004). Impact of mergers & acquisitions on research productivity within the pharmaceutical industry. Scientometrics , 59 (1), 157–169.

Kohers, N., &Kohers, T. (2001). Takeovers of Technology Firms: Expectations vs. Reality. Financial Management , 30 (3), 35-54. doi:10.2307/3666375

Kumar, B. R., &Suhas, K. M. (2010).An analytical study on value creation in Indian bank mergers. Afro-Asian Journal of Finance and Accounting , 2 (2), 107–134.

Lee, S.-Y.T., & Lim, K. S. (2006). The impact of M&A and joint ventures on the value of IT and non-IT firms. Review of Quantitative Finance and Accounting , 27 (2), 111–123. https://doi.org/10.1007/s11156-006-8792-5

Li, J., Li, P., & Wang, B. (2016). Do cross-border acquisitions create value? Evidence from overseas acquisitions by Chinese firms. International Business Review , 25 (2), 471-483. doi:10.1016/j.ibusrev.2015.08.003

Lowinski, F., Schiereck, D., & Thomas, T. W. (2004). The Effect of Cross-Border Acquisitions on Shareholder Wealth — Evidence from Switzerland. Review of Quantitative Finance and Accounting , 22 (4), 315-330. doi:10.1023/b:requ.0000032601.84464.52

MacKinlay, A. C. (1997). Event Studies in Economics and Finance. Journal of Economic Literature , 35 (1), 13-39. Retrieved from http://www.jstor.org/stable/2729691

Mann, B. J., &Kohli, R. (2011).Target shareholders' wealth creation in domestic and cross‐border acquisitions in India. International Journal of Commerce & Management , 21 (1), 63-81. doi:10.1108/10569211111111702

Mentz, M., &Schiereck, D. (2008). Cross-border mergers and the cross-border effect: the case of the automotive supply industry. Review of Managerial Science , 2 (3), 199-218. doi:10.1007/s11846-008-0022-1

Narayan, P., &Thenmozhi, M. (2014). Do cross-border acquisitions involving emerging market firms create value. Management Decision , 52 (8), 1451-1473. doi:10.1108/md-04-2014-0227

Nicholson, R. R., &Salaber, J. (2013). The motives and performance of cross-border acquirers from emerging economies: Comparison between Chinese and Indian firms. International Business Review , 22 (6), 963-980. doi:10.1016/j.ibusrev.2013.02.003

Nnadi, M., &Tanna, S. (2013).Analysis of cross‐border and domestic mega‐M&As of European commercial banks. Managerial Finance , 39 (9), 848-862. doi:10.1108/mf-01-2010-0006

Rani, N., Yadav, S. s., & Jain, P. (2013). Market Response to The Mergers and Acquisitions : An Empirical Study from India. Vision, 17 (1), 1-16.

Rani, N., Yadav, S. S., & Jain, P. (2015). Market Response to Internationalization Strategies: Evidence from Indian Cross-border Acquisitions. IIMB management Review, 27 (2), 80-91.

Rani, N., Yadav, S. S., & Jain, P. K. (2015).Impact of mergers and acquisitions on shareholders' wealth in the short-run: An event study approach. Vikalpa , 40 (3), 293-311.

Sharkas, A. A., Hassan, M. K., & Lawrence, S. (2008). The Impact of Mergers and Acquisitions on the Efficiency of the US Banking Industry: Further Evidence. Journal of Business Finance & Accounting , 35 (1-2), 50-70. doi:10.1111/j.1468-5957.2007.02059.x

Srivastava, R., &Prakash, A. (2014).Value creation through cross-border mergers and acquisitions by the Indian pharmaceutical firms. Journal of Strategy and Management , 7 (1), 49-63. doi:10.1108/jsma-03-2013-0017

Stunda, R. (2014). The market impact of mergers and acquisitions on acquiring firms in the U.S. Journal of Accounting and Taxation , 6 (2), 30-37. doi:10.5897/JAT2014.0142

Uddin, M., &Boateng, A. (2009).An analysis of short‐run performance of cross‐border mergers and acquisitions. Review of Accounting and Finance , 8 (4), 431-453. doi:10.1108/14757700911006967

UNCTAD. (2006). World investment report 2006: FDI from Developing and Transition Economies: Implications for Development . New York and Geneva: United Nations.

Zhu, H., Xia, J., & Makino, S. (2015). How do high-technology firms create value in international M&A? Integration, autonomy and cross-border contingencies. Journal of World Business , 50 (4), 718-728. doi:10.1016/j.jwb.2015.01.001