|

Dr. Bhavna Sharma, Assistant Professor, Department of Commerce, BPS Mahila Viswavidyalya, Khanpur Kalan, Sonipat, Haryana,131305 E mail: bhavnasharma.univ@gmail.com |

The paper attempts to measure service quality provided by Indian commercial banks to their customers. The measurement of gap is computed in major dimensions of service quality which are identified on the basis of responses of customers with the help of factor analysis. These major dimensions are pre-sale services, product features, office services, behavioural responses and after sale services. It is found that the gap in post sale services is highest followed by office services and in pre sale service the gap is minimum. It is very dangerous for the banks in building their brand image. It is also found that the scores of expectations and perceptions of bankers’ are lower in comparison of borrowers’ scores. It means bankers are not able to understand the borrowers’ level of expectations and perceptions, which create other gaps in service design and even delivery.

For surviving in current competitive banking industry, most of the banks are making efforts to create most appropriate strategy for their customers. Banks are now paying more attention to actual and potential customers. Service quality is considered as a strategic tool in this competitive era. Providing excellent service quality and customer satisfaction are the important issues and challenges in front of the current service industry. Service Quality is very important topic under discussion in both private and public sectors. Perceptions of service quality are based on multiple dimensions; there is no general argument as to the nature and content of the dimensions (Brady and Cronin, 2001). Given the importance of services to overall economies worldwide and the strategic impact of service quality perceptions, the appropriate conceptualization and measurement of the service quality construct represents an important concern for services marketers (Cronin, 1994). The concept of service quality is believed complicated to define and measure because of its intangible nature. In the past three decades, significant research has been conducted in identifying service quality measurement tools. Service quality is defined as the gap between what was expected and what is delivered has received strong support from operationalisation of SERVQUAL in terms of different scores. Although this operationalisation has been criticized for its statistical inadequacies, it remains the most popular and frequently used definition (Rajpoot et al., 2000)

Most of the empirical researchers have a little consensus about the definitions and measurement scale of service quality. Definitions and measurement scales reported in the literature supported that gap computed between perceptions and expectations remains the most used measurement tool of service quality. Service quality is a dynamic concept and universally accepted in all services sectors. Every organization wants to improve their services to meet the competition. For maintaining the standards of service quality, every organization always try something new policy to satisfy the customers.

Grönroos (1984) found that the dimension of service quality in universal terms consist of efficient and mechanical quality. Further, Grönroos (1984, 1998) identified two service lead dimensions, namely technical quality and functional quality. Technical quality focuses on interactions with the service provider in fulfilling the customer’s basic needs. Functional quality relates to the process dimension, which evaluates the manner of delivery of the particular service from the service provider. In technical quality, there are five factors in focus: employees’ knowledge, technical solutions, machine quality, technical ability, automated systems. Service quality dealings with how well a service is delivered compared to customer hope. Every customer has a expectation of the service they want to obtain when they go to a bank. Banks maintain a record of existing customer very effectively; this thing attracts a lot of new customers. Knowledge of the banks scheme, cost of various sources is also attract the customers for availing the services of particular bank. Service quality is a comparison of expectations with performance SQ=P-E. Superior service quality may attach to economic performance.

There are needs to find out most influencing dimension to service quality in banking sectors. It is apparent from the review of literature that there is a little consensus of opinion and much disagreement about how to measure service quality. Moreover, it is very important to note that without adequate information on both the quality of service expected and perceptions of service received can be highly misleading from both a policy and operational perspective. Exact information on service quality gaps can help managers to diagnose where performance improvement can best be targeted. After observing such relevant articles, it was found that many researchers examined and studied different aspects of service quality like, appearance, empathy, reliability, cost effective, policy, assurance etc. effects on consumer’s response towards the service quality of banks. Therefore, it becomes vital to identify the most important dimensions of service quality from customers’ perspectives and to measure the service quality provided by these banks to the customers. Therefore, the present study focuses on identifying the key dimensions of service quality and various service quality gaps and other issues related with service quality measurement in Indian retail banking sector. Another aim is to point out how management of service improvement can become more logical and integrated with respect to the prioritized service quality dimensions and their affections on increasing/decreasing service quality gaps.

Objectives of the Study

To discuss traditional and modern model for measurement of service quality given by empirical researchers.

To measure the service quality provided by selected Indian banks through computation of service quality gaps under various identified dimensions.

To suggest strategies for the improvement of service quality of these banks.

Models of service quality gap

This model is a customer-oriented to improve the quality of services. Parasuraman, Zeitham and Berry identified five main gaps that face organizations in explore of to meet customer's expectations of the customer experience. There may be differences in this model between five aspects.

The five gaps that organization should determine manage and reduce:

Gap 1 gap among what customers expect and what managers think.

Gap 2 gap between organization perception and the actual requirement of the customer experience.

Gap 3 gap from the experience requirement to the delivery of the experience.

Gap 4 gap between the freedom of the customer experience and what is communicated to customers.

Gap 5 gap between a customer's perception of the experience and the customer's expectation of the service.

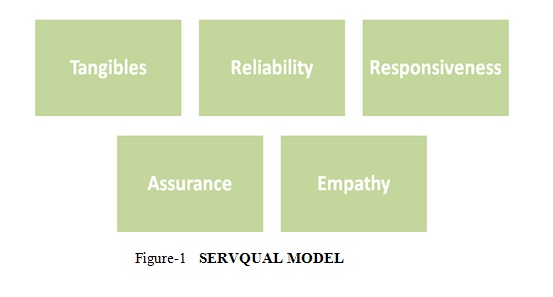

According to this model, SERVQUAL (also called RATER model) scale has planned by Parasuraman for measuring Gap 5. Parasuraman mentioned ten factors for evaluating service quality (including tangible, accessibility, reliability, responsiveness, credibility, security, politeness, communication and understanding the customer).

These ten factors are cut down into five factors. These five dimensions are definite as follows

Tangibles Physical facilities, equipments and appearance of personnel.

Reliability. Ability to perform the promised service dependably and accurately.

Readiness to help customers and provide prompt service.

Assurance. Courtesy, trustworthiness and security, Knowledge and courtesy of employees and their ability to encourage trust and self-assurance.

Empathy access, communication, understanding the customer, Caring and attention to its customers.

Gronroos (1982) assumed that if a firm wants to be successful, it is very important to understand the needs of its existing customers as well as potential customers. Service quality management means identical the perceived quality with expected quality and fill this gap as small as possible in order to obtain customers’ satisfaction. Researcher suggested three dimensions of service quality. The first dimension, Technical (product) means what customers received as a result of statement with a service firm. The other component is Functional (procedure) which means how a technical service usual by customer. The third dimension in this model is Corporate Image which is the customers' view of corporate. The customers’ expectation is influenced by their vision of the firm and it is the result of how consumers perceived firm services. The main difficulty of this model was the lack of explanation for measuring technical quality and functional quality.