|

Assistant Professor, Department of Economics, NMIMS University, Bangalore |

Association of Southeast Asian nations (ASEAN) is a dynamically progressing group of nations which aims at developing their economies through greater regional cooperation and policy coordination. the collective aim of ASEAN’s current policies is to boost intra- regional trade as well as trade with partners outside the region via reduction in both tariff and non-tariff barriers. This study is an explanatory research aiming at establishing the link between trade openness and human development in a panel consisting of the ASEAN member states. the application of a panel cointegration test along with a fully modified OLS technique revealed a significant relationship between trade per capita (measurement of trade openness) and human development index values (measurement of human development) for the 7 ASEAN members taken into account. The result of this study, with its given limitations, has implications for the policy-makers laying the framework for trade liberalisation in ASEAN and thus aiming at the ultimate goal of setting up of the ASEAN economic community.

Trading of goods and services with minimum impediments to the process across national borders results in a variety of positive effects for the economies involved. DavidRicardo, a classical economist, in his theory of comparative advantage explained how trade tin benefit all the entities involved such as countries, companies, individuals involved in it, as long as the two countries exhibit a difference in the relative costs of producing that good. Trade openness is directly linked to a better allocation of a country’s resources (arising out of comparative advantage), greater utilisation of the productive capacity (leading to achievement of economies of scale), greater tendency to implement technological improvements and higher levels of employment as compared to closed economies (Afonso, 2001). Empirical evidence along with other models of economic integration encourages more and more countries to integrate with their regional neighbours as well as the rest of the world. An increasing number of economies are adopting this extrovert attitude and harnessing the endless opportunities available to boost economic growth. Lowering trade barriers and ensuring smooth flow of goods and services across borders has surfaced as a sound foreign policy in the past several decades. Preferential trade agreements, creation of free trade areas, customs union, and common market and finally an economic union are the common practices seen across the globe. NAFTA, European union, MERCOSUR, AFTA are the some significant integration specimens. There are several other nations with ongoing negotiations of formulating and implementing agreements on furthering economic integration amongst the concerned parties. Union of South American nations, pacific island countries trade agreement, economic community for central African states, euro-Mediterranean free trade area and Arab MAGHREB union are some of the proposed agreements. (World Trade Organization, 2013). Given this scenario of a rapidly globalising world, there is a need to look into the deep seated issues of effects of trade openness. notwithstanding the empirical evidence that minimum cross-border trade barriers have prominent positive effects on the economies and the various macroeconomic variables, the crucial question which must be deliberated upon is how trade has affected human well-being, especially in the developing countries. the need here is to analyse that whether trade effects go beyond parameters like GDP and employment growth to positively

affect parameters of human well-being such as reduced income inequality, educational attainment, life expectancy and similar others. ‘Globalisation has generated opportunities for developing countries that tin be seized and challenges that should be addressed to maximise development gains and minimise the attendant costs’ (United Nations Conference on Trade and Development, 2008). This study attempts to study the impact of trade on countries’ social developments as measured by the human development index in the ASEAN countries using a panel data analysis. ASEAN is a group of countries witnessing wide ranging trade liberalisation policies. The member states per se have varying levels of development and the region as a whole is accelerating its efforts to liberalise ASEAN’s trade regimes. Although studies have been done to investigate the links between the degree of trade liberalisation and human development of a region, yet none of them specifically deal with the 10 ASEAN member states. This study is relevant especially as these Southeast ASIANs nations are moving more rapidly than ever towards the formation of the AEC i.e. the ASEAN economic community, which is an envisaged goal of a single market with free movement of goods and services within the region.

There was much need for the analysis of the significance of trade from the perspective of human development in a region which is witnessing the catalytic power of free trade policies. one of the most popular arguments adhering to conventional wisdom are those regarding the widespread benefits of trade for those countries which are strategically placing their interests to reap gains in a globalized world. These tin be found in the works of Adam smith in his famous ‘wealth of nations’ and DavidRicardo’s ‘theory of comparative advantage’ in ‘on the principles of economy and taxation’. These form a pioneer as well as a backbone for the framework of trade policies. Smithhailed the significance of division of labour as the driver of competitiveness of goods and like Ricardo advocated a free trade regime. Ricardo criticized the mercantilists and claimed that there are ways in which both the parties to the trading agreement tin mutually benefit. Following this there were endowment theories of trade by Heckscher-ohlin and later Samuelson. The new trade theory also brought into the picture the effects of economies of scale on trade patterns. theoretical as well as empirical evidence report benefits of trade which include transfer of technology, optimum resource-use due to low costs, cultural induction, efficiency in production and other wind- autumn gains such as infrastructure development, transfer of superior skills and human capital from other countries, etc. however, the theoretical framework for trade and development was developed primarily by arguments posed against trade. a neo-Marxist approach was used by Emmanuel to depict the inequality in trade deals and led to expropriations of productivity gains from the developing countries to the developed countries. (Emmanuel, 1972) trade liberalisation gained a new dimension since 1948 with the setting up of GATT and since 1995, with the inception of WTO. Globalisation tin be understood by two arguments which form two different ends of the spectrum. One school of thought is the neoliberal school and the other the hegemonic school. As (Simplice, 2012) describes, the neoliberal framework advocates globalisation as a driver of innovation, foreign investments and prosperity. The second school hails globalisation as a hegemonic project, orchestrated by international financial institutions, developed countries to facilitate capital accumulation in a milieu of free trade regimes. (Simplice, 2012) The conceptual framework for the links between globalization and human development can be explored through various channels. (Simplice, 2012).UNDP in its Asia Pacific Human Development Report of 2006 provided a conceptual framework of the channels between trade and human development. According to the report, trade has implications for both labour and capital in a region. Influx of new technologies may create inequality in a developing region. (UNDP , 2006) It also states that the public authorities can harness the benefits if trade and minimize its harmful effects through appropriate policy framework. Rising incomes, new products generate higher living standards and this channel must be tapped to boost human development.

Southeast Asia is a mosaic of nations, each characterized with a unique culture, economy and polity. The region covers an area of approximately 4.5 million square kilometres supporting a population of around 600 million people, which is roughly 8.8% of the total world population. The economies of the Southeast Asian nations have their own idiosyncrasies. All the nations of this region are a part of ASEAN except for East Timor. ASEAN stands for Association of Southeast Asian Nations and includes Indonesia, Malaysia, Singapore, Philippines, Thailand, Myanmar, Cambodia, Brunei, Laos and Vietnam. On one hand, Singapore is a developed economy with a GDP of 274.7 billion USD whereas on the other, the Laos economy is one of the least developed with a GDP of 9.299 billion USD as of 2012 (ASEAN Secratariat, 2012). ‘ASEAN Member states range from international financial hubs to agrarian societies, with income levels stretching from one end of the global scale to the other.[i]Largely, geographical and climatic factors lend themselves to the nature of economies in the region. It is located between China and India and forms a part of the major sea routes connecting Europe and the Middle East with Asia and the Southern Hemisphere countries, i.e., Australia and New Zealand. The climate is mainly tropical, hot and humid all year round with plenty of rainfall. This feature largely supports the extensive agricultural activities of the region, with rice and rubber being the primary export products. Tourism is another major component which has influenced the economic growth of this region, especially for Cambodia which is one of the most ancient seats of Hinduism. Industrialization is going on at a rapid pace in the region, with each country trying to boost its industrial sectors to ensure rapid economic progress. The region’s common economic interests and the zeal to pursue developmental activities by harnessing the common regional resources led to the formation of the ASEAN on 8th August, 1967. At that time, the initial members were Indonesia, Malaysia, Philippines, Singapore and Thailand. Brunei joined in 1984 followed by Vietnam in 1994. Three years later, Laos and Myanmar joined and finally Cambodia in 1999.

ASEAN’s main objectives were political and economic cooperation and regional stability. Reduction of tariff was regarded as the first step to increase trade and strengthen economic ties (Yong, 2011). ASEAN created its first preferential trading arrangement in 1977. Various events spurred ASEAN’s tendency to consult and cooperate. ‘The perceived common threat rallied the ASEAN countries into joint actions to secure peace and stability, from which economic prosperity was derived’.[ii] One such event in particular was the Asian Financial Crisis of 1997-98 which made the member countries realize the significance of policy co-ordination. Thus started the extensive negotiations of the ASEAN Free Trade Agreement, initiatives for ASEAN + 3 (which includes the ASEAN-10 along with PRC, Japan and Republic of Korea, the ASEAN Regional Forum and the East Asia Summit. However, the process of regionalism in the case of ASEAN was not inward-looking. ASEAN economic integration is characterized by open regionalism because it’s most important trade partners lie outside the region. [iii]Intra-ASEAN trade grew from 121 billion USD in 1998 to 598 billion USD in 2011. Extra-ASEAN trade grew from 455 billion USD to 1,790 billion USD between 1998 and 2011. The total trade thus grew from 576 billion USD to 2,389 billion USD between the same time span (ASEAN Secratariat, 2012).

Percentage growth in total trade of ASEAN was 110% between 1998 and 2011, with 28% increase in intra-ASEAN trade and an 82% growth in Extra-ASEAN trade. The following chart gives depicts the trends in ASEAN trade. (ASEAN Secratariat, 2012). With the ongoing negotiations of more bilateral trade agreements and implementation of the negotiated ones, ASEAN’s total trade is bound to increase in the coming years. The other FTAs include the ASEAN-China Free Trade Area, ASEAN-Japan Comprehensive Economic Partnership, ASEAN-Korea FTA, ASEAN-India FTA and the ASEAN-Australia-New Zealand FTA (AANZFTA). ‘These FTAs added a new dimension to the ASEAN-centric mechanisms in the region and buttressed the role of ASEAN as a hub for multilateral engagement and open regionalism’.[iv]However, the AFTA was not considered a comprehensive mechanism to achieve deeper economic and policy integration. Emerging economies of India and China along with those of Latin America emerged as attractive places for foreign investors and thus appeared as a threat to ASEAN’s economic competitiveness. ASEAN leaders feared being marginalized in the globalized world. [v]There is the realisation that stimulus for future growth in the region has to come from within, given the trend of formation of regional trading blocs in rest of the world.[vi]Against this backdrop, ASEAN leaders devised the idea of forming the ASEAN Economic Community, which envisages turning the area into a single market and production base with high economic competitiveness in order to revitalize the region’s vast economic potential. It would be a region fully integrated with the global economy and also of equitable economic development (ASEAN Secratariat, 2011).

[i][i]Hui, T. (2011). ASEAN integration enters the critical stage: A private sector's narrative. In L. Y. Yoong (Ed.), ASEAN matters: Reflecting on the ASEAN (p. 126). N.p.: World Scientific.

[ii][ii] Yong, O. K. (2011). ASEAN economic integration: The strategic imperative. In L. Y. Yoong (Ed.), ASEAN matters: Reflecting on the ASEAN (p. 87). N.p.: World Scientific.

[ii] Plummer, M. G. (2006, October 27). East Asian integration and Europe: Can ASEAN learn from the EU?. In ResearchGate. Retrieved November 2, 2013, from ccas.doshisha.ac.jp/japanese/conference/confpdf/20061028Plummer.pdf

[iii][iii] Plummer, M. G. (2006, October 27). East Asian integration and Europe: Can ASEAN learn from the EU?. In ResearchGate. Retrieved November 2, 2013, from ccas.doshisha.ac.jp/japanese/conference/confpdf/20061028Plummer.pdf

[iv]Yong, O. K. (2011). ASEAN economic integration: The strategic imperative. In L. Y. Yoong (Ed.), ASEAN Matters: Reflecting on the ASEAN (pp. 88-89). N.p.: World Scientific.

[iv] Hew, D., & Soesastro, H. (2003, December). Realizing the ASEAN Economic Community by 2020: ISEAS and ASEAN-ISIS Approaches. ASEAN Economic Bulletin, 20(3), 292-296. Retrieved December 10, 2013

[iv] What will be the benefits of an Asian Economic Community?. (n.d.). In New Asia Forum. Retrieved February 2, 2014, from http://newasiaforum.org/Potential_of_an_Asian_Economic_Community.htm

[v] Hew, D., & Soesastro, H. (2003, December). Realizing the ASEAN Economic Community by 2020: ISEAS and ASEAN-ISIS Approaches. ASEAN Economic Bulletin, 20(3), 292-296. Retrieved December 10, 2013

[vi] What will be the benefits of an Asian Economic Community?. (n.d.). In New Asia Forum. Retrieved February 2, 2014, from http://newasiaforum.org/Potential_of_an_Asian_Economic_Community.htm

Trade Volume, HDIand Growth in ASEAN

Trade has grown for each of the member countries as well. The following tables summarize the essence of trade dynamism and economic growth in ASEAN as it tries to integrate with the rapidly globalizing world. The tables give the value of exports and imports of merchandise goods for each country in USD between 2000 and 2012. Evidently, both exports and imports of each country have witnessed more than a 100% increase apart from those of Philippines. This exponential growth in trade volumes of ASEAN is an illustration of the dynamic process of trade liberalization going on in the region. The image below extracted from the ASEAN Secretariat Database shows GDP in Purchasing Power Parity Terms along with the rate of change of GDP as of 2012. (ASEAN Secratariat, 2012). The above data gives a clear picture of the growth in the trade volumes and GDP of ASEAN and act as a definite indicator of the efforts towards integration. Several studies have been conducted to analyse the effects of trade liberalization and give an outline of the pros and cons involved. Many researchers have focussed on analysing the future of AEC and the possible benefits it may reap for the region. Michael Plummer and Chia Siow Yue give a comprehensive analysis of the effects of the creation of such a single market. Their analysis concludes that AEC will obviously expand ASEAN’s trade, result in efficient production chains in the region, enhance macroeconomic stability arising out of policy coordination and also make the area attractive for foreign investors. Infrastructure development to support AEC will help in the narrowing of the development gap between the member countries. It will also have its own spill-over effects thus influencing numerous variables positively, namely those of employment and industrial productivity. (Plummer & Siow, 2009). Another study examines the effect of AEC on intra ASEAN trade and concludes that trade creation would occur among the five ASEAN members, i.e. Indonesia, Malaysia, Philippines, Singapore and Thailand. It reasonably deduces that the formation of AEC will help the region in developing international trading mechanisms which will cater to its needs in a better way. A study by Deutsche Bank throws light on the effects of the same on the regional variables such as exports, job opportunities, inflation, capital and labour movements and others. It concludes that job creation will be stronger in low-wage countries due to high demand for educated workers in those countries. Another component which stands to benefit is that of the financial institutions. Its formation will bring more business to the financial institutions. (Hansakul, 2013) ‘The formation of an Asian Economic Community (AEC) will also help the region to play a more effective role in shaping a world trading and financial system that is more responsive to its needs.’ [i]‘The bottom line is that ASEAN as a single unit has a much better chance of achieving prosperity and improving the standard of living of its people than as ten separate states.’ [ii]There is no space for reasonable doubt about the positive effect trade liberalization will have on the various macroeconomic indicators gauging the economic wealth of the region. However, there is a need to look into the deeper issues here. The questions which must be brought up to explore this issue would be: What exactly is the final desirable outcome policy making regarding trade wants to achieve? With most of the studies establishing the benefits of trade, it is indeed of crucial significance to analyse as to how human development of the region would be affected in the given scenario of trade liberalization. The growing trade in goods and services along with increased investment flows into the region continue to spur the process of trade liberalization both within ASEAN and outside ASEAN with other partners. ASEAN is home to a range of diverse economies ranging from the CLMV group (with low levels of development) to the industrialized economies of Singapore and Malaysia. The human development in ASEAN is thus a contrast of sorts. As of 2012, the CLMV countries reported an average of 0.54 HDI value. On the other hand, the other 6 nations reported an average of 0.748. (UNDP, 2013). Human Development Index values for the ASEAN members is just one dimension of the picture. Various areas in this region still experience widespread poverty, inequality arising out of a variety of reasons. Political instability, especially in Cambodia has been a major factor leading to poor living standards and unstable employment patterns amongst its population. Myanmar is classified as a Low Income country by the World Bank and experiences serious financial problems. Although Myanmar is endowed with natural resources and human capital, the country lags behind due to the inability and the reluctance to adopt to market mechanisms. In reality, it has missed out on the economic boom in Southeast Asia and relies primarily on foreign aid which is given in the form of humanitarian aid. Backwardness looms large here, with poor public utilities facilitation, lack of infrastructure development and minimal industrialization. Laos and Vietnam too experience the same situation but they do receive high amounts of foreign aid and are major trading partners with various countries. All in all, human development levels are poor, especially in the CLMV countries which are now on the verge of full-fledged trade liberalization. The average tariff rates on imports in the CLMV countries has been brought down from 7.51% to 1.69% in the time period of 2000 to 2012 and given the recent inception of the ASEAN Economic Community, the tariff rates would be brought down to almost zero. This would obviously result in loss of revenue for the respective governments, along with skewed income distribution in the CLMV nations if ‘inclusive development’ is not given a priority. Policy makers voice their opinions daily on various forums expressing the need for ASEAN to stress upon a strategy to ensure comprehensive development in the region in the wake of trade liberalization via AEC. Thus, given this background, it is deemed necessary to analyse as to how co integrated trade and human development actually are in the case of ASEAN.

Numerous studies have been conducted to investigate the impact trade volume, tariff reduction have on economic growth rates, employment generation, etc. for a nation or a group of nations like the EU. However, in contrast to this, only a handful of studies have been conducted to study the impact trade openness has on human development in particular for a given region or country. Various studies explore the relationship between openness and growth by performing a regression to draw inferences. This area is one of the most thoroughly analysed areas in the field of international trade. The studies conducted in this area primarily base their empirical framework on the argument that trade, specifically free trade has wide ranging effects on the macroeconomic variables of a country. Most studies in this filed do support the theoretical argument that trade has a positive influence on growth of a nation. A study for OECD and NBER countries for the 1960s and 1970s concludes that trade leads to higher growth rates which are sustainable over a given time period (Srinivasan & Bhagwati, 1999) .These invariably conclude that trade openness has a significant impact on per capita growth of nations. (See (Irwin & Tervio, 2000)(Dollar & Kraay, 2002)(Barro & Lee, 1994)). One study employs OLS estimation along with IV on a cross section of countries in 1985 to study the effect trade has upon income and growth of a country owing to its geographical factors. They conclude that trade positively influences the income of a nation as well as boost the productivity of the resources it is endowed with. This also results in accelerated GDP Growth for the nation. (Frankel & Romer, 1999). Another such study used a robust regression technique to analyse the link between trade openness and economic performance for 93 countries. Economic performance was operationalized using Total Factor Productivity growth of the countries. The study concludes that free trade policies positively influence TFP growth over a long period of time. (Edwards, 1997)Another study uses correlation technique to study the links between trade openness and growth. Trade openness is measured by a wide spectrum of variables. The results indicate that both the concerned variables are positively correlated for the panel concerned. (Harrison, 1996). The study concludes that there is a long run cointegrating relationship along with a positive causal relationship from openness to growth as well as from growth to openness. The study also concludes that those economies which are witnessing numerous adjustments in the short run are adversely affected by trade openness. (Gries & Redlin). One argument presented is that all the economies which have a greater degree of trade openness have better capabilities to absorb and adopt the innovations and the global technologies. (Barro & Sala-i-Martin, 1995).

A few selected studies focus on the effects of trade on HDI with most of them using panel data analysis with trade volume as the independent variable and HDI which measures the living standards as the dependent variable. Hence, the analysis encompasses multiple countries over a given time period. Certain studies conclude that trade openness as measured by per capita trade evidently has a positive effect on human development of nations as measured by the HDI. (See (Davies & Quinlivan, 2006), (Kabadayi, 2013), (Nourzad & Powell, 2003), (Simplice, 2012), (Eusufzai, 1996)).Davies and Quinlivan (2006) study the impact of per-capita trade on the Human Development Index of 154 countries over the time period of 1975 to 2002. They pitch for the argument that the relationship between trade and human development follows a lag pattern. Trade directly affects income, which will in turn positively affect the literacy and the health standards of the people in the future. Also, trade liberalization of a nation exposes its people to a whole new range of goods (especially health-related goods), ideas and leads to “cross-cultural fertilization” over time. They employ the Generalized Method of Moments (GMM) to study this relationship between trade per capita (proxy variable for trade openness) and HDI (measure of human development). Through this analysis, they demonstrate that there indeed is a significant positive relationship between improvements in social welfare and increased per capita trade. Burhan Kabadayi (2013) uses panel data analysis to analyse the effects of trade openness on the living standards of medium-high income level countries for the time period 1995-2010. It is a case study on a selected number of 30 developing countries. He argues along the same lines of Davies and Quinlivan. Other control variables such as GDP per capita growth rates, health expenditure and the number of scientific and technical journal articles were also used. Fixed effect panel data analysis was applied as it focused on a fixed set of countries. The results indicated a positive relationship between the dependent and the independent variables. Nourzad and Powell (2003) examine the way the three entities: trade openness, economic growth and human development interact with each other. They use a panel of 47 developing countries for the time period 1969 to 1990. The aim of this study is to establish whether trade openness directly affects the living standards or not when the indirect effect of openness on growth is controlled. They use a two- equation simultaneous-equations model of development and growth. They conclude that trade openness has a positive impact on growth as well as development. Simplice (2012) not only assesses the impact of trade liberalization on development but also that of financial globalization on human development. Thus, explores empirically the neoliberal stand on trade and the hegemony thesis regarding financial globalization. The study specifically focusses on 52 African countries using data for the years 1996 to 2010. Human development is measured using the Inequality-adjusted HDI to cover for the shortcoming in the previous index. Trade volume is the proxy for economic globalization while FDI and private capital flows are the proxy variables for financial globalization. The study employs a Two-Stage-Least Squares Instrumental Variable methodology. The findings confirm the positive link between trade and development but a negative one between financial globalization and human development. Zaki Eusufzai (1996) examines the relationship between trade openness and development for a specific set of developing countries. He uses both HDI and distribution adjusted HDI. Along with this, he uses two other variables to measure the level and improvement in human development. These are the under-five mortality rate and the proportion of population with access to potable water. His analysis involves calculation of Pearson Coefficients of Correlation between Dollar’s Openness Index (DOI) and the above mentioned measures of HDI. Through the findings, the study concludes that more open countries have higher human development as indicated by higher HDI values, lower under-five mortality rate and a higher proportion of population having access to safe drinking water. A few studies draw the same above conclusions but limit this relationship only to specific channels of transmission. Trade affects human development only through income channels and it does not affect other components such as longevity, literacy level and educational attainment. ( (Hamid & Amin, 2013)(Gunduz, Hisarciklilar, & Kaya, 2009).Hamid and Amin (2013) examine the impact of trade openness on human development for all the OIC (Organization for Islamic Cooperation) countries using GMM in a panel data distributed lag model for the years 1980 to 2005 with five year increments along with annual data from 2000 to 2009. They conclude that trade has a positive effect on development for all income categories but only through the income channel. Gunduz, Hisarciklilar and Kaya (2009) conduct their study on 106 countries over the period of 1975 to 2005. The panel data consists of five yearly series. According to World Bank classifications, they categorize the countries based on their GNI. GMM procedure is applied to this panel. Their findings indicate that when the income component is removed from the HDI then trade does not affect the non-income HDI much. They also suggest that middle and high income countries benefit from trade but for the low income countries, trade does not improve human development per se.

Data and methodology

The study uses secondary data and employs a panel of 7 out of the 10 ASEAN members over the time period of 1975 to 2005. Data for HDI was not available for Brunei, Cambodia and Myanmar for that time period. The secondary data regarding trade per capita and HDI has been taken into account on a five-yearly basis for the years ranging from 1975 to 2012. Trade Per Capita data has been extracted from UN data, an internet based data service developed by the United Nations Statistics Division. HDI data has been retrieved from the Human Development Report of 2007/2008 which is a publication of the United Nations Development Programme for the 7 countries namely, Malaysia, Singapore, Indonesia, Lao People’s Democratic Republic, Thailand, Vietnam and Philippines. The panel data was analysed for a cointegrating and causal relationship using Pedroni’s Panel Cointegration tests and FMOLS (Fully Modified Ordinary Least Square) estimation. The data was also checked for unit roots via Panel Unit Root tests before applying the above tests. Inferences were drawn from the test statistics and appropriate conclusions were framed on that basis. The panel consists of 7 ASEAN countries with data for the years 1995 to 2005. In order to analyse the empirical link between Trade per Capita and the HDI values for these countries, the study applies a Panel Unit Root Test and a Panel Cointegration Test. This is followed by the application of FMOLS.

Test for Unit Roots

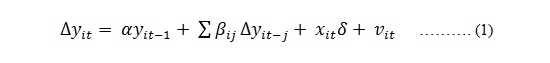

Various analytical methods used to investigate time series data are also applied to panels such as the unit root tests and the Cointegration test. Unit root tests for time series have been a popular tool for researchers over the years for varied applications. Panel unit root tests however are relatively a new development in the field of econometrics. Contributions come from Levin, Lin and Chu in 2002; Im et al. in 2003; Harris and Tzavalis in 1999; Maddala and Wu in 1999; Choi in 2001; Hadri in 2002. Older contributions include that by Bhargava et al. in 1982; Bouhmadi and Thomas in 1991; Quah in 1994. These tests help in determining the order of integration of the variables. If the order of integration is zero i.e. I (0) then the data is said to be stationary. In other words the data is free from unit roots. This study applies the methodology suggested by Levin, Lin and Chu (Baltagi B. H., 2005)in order to test the panel data for stationarity. The LLC test assumes that all the cross sections exhibit a common or the same unit-root process. Hence, instead of advocating individual unit root tests for each cross section, they devised a single test. The null hypothesis is that there is a unit root process in each individual time series and the alternate hypothesis is that each individual time series is stationary. The null hypothesis of a unit root has been specified by them by using the Augmented Dickey Fuller (ADF) specification:

[i]What will be the benefits of an Asian Economic Community?. (n.d.). In New Asia Forum. Retrieved February 2, 2014, from http://newasiaforum.org/Potential_of_an_Asian_Economic_Community.htm

[ii] Hui, T. (2011). ASEAN integration enters the critical stage: A private sector's narrative. In L. Y. Yoong (Ed.), ASEAN Matters: Reflecting on the ASEAN (p. 125). N.p.: World Scientific.

Where yit is the pooled variable, xit represents the exogenous variables in the model such as country fixed effects and time trends of each individual country. vit represents the error terms which are assumed to be disturbances which are independent of each other and are normally distributed.

α = ρ-1 is assumed to be identical across all the cross-sections. The lag order for the difference terms is allowed to vary. A simple average of the individual countries is taken to calculate the t-statistics. If the presence of a unit root is detected in the variables, then it is imperative to check if the two variables are co integrated or not.

Panel Cointegration Test

Two variables are cointegrated if there is a linear combination of both the variables that yields a stationary series. Thus, if both the variables are I(1) but there is a linear relationship which is I(0), then the two variables are said to be cointegrated. The methodology used to establish cointegration in time series data can also be extended to panel data. Pedroni (1999) specified tests to check if there is a long-term relationship between the two variables or not and thus proposed various tests for hypothesis testing of cointegration in a panel data with heterogeneity. He developed seven statistics to test for panel cointegration, with 4 of them being panel statistics and 3 of them being group panel statistics. The panel cointegration statistics are based on within-dimension statistics and the group mean cointegration statistics are between-dimension based. These statistics are constructed by using the residuals derived from panel regression. This is a technique based on the two-step residual-based strategy of Engle and Granger (1987). (Pedroni, 1999)

The seven tests and the calculation of their statistics is based on the following panel regression-

yi,t=αi + β1X1,i,t + β2X2,i,t +…..+ βnXn,i,t + μi,t ……..(2)

Xi,t are the explanatory variables for ‘n’ cross-sections. Following this, a regression is applied on the residual terms of equation (2)-

μi,t = ρi μi,t-1 + νi,t …… (3)

Where μi,t refers to the residuals from the panel regression in equation (2). According to this estimation, the seven statistics are calculated. These are panel-v, panel-rho, panel-PP, panel-ADF statistic. The between-dimension based are group-rho, group-PP and group-ADF statistic. For the estimation of within-dimension based or panel cointegration statistics, the null hypothesis of no cointegration is specified as-H0: ρi = 1, for all I. The alternate hypothesis is- H1: ρi = ρ<1, for all i

Fully Modified OLS (FMOLS)

Once cointegration has been established, the relationship is estimated by using FMOLS which was also proposed by Pedroni in 2000. The FMOLS technique is superior to the OLS technique because applying OLS on a panel will lead to biased results. Only if there is sufficient homogeneity present in the panel data, only then will the results be unbiased. FMOLS generates estimators which can control serial correlation as well as underlying problems regarding the dynamics of the panel. (Pedroni, 2000).Given the context of this study, FMOLS application is advantageous also because it allows for heterogeneity of the country-specific fixed effects while estimating long-run relationships. As is the case with cointegration statistics, the group mean statistics are less restrictive in the case of alternative hypothesis than the panel statistics. In other words, between-dimension framework the null hypothesis is tested by a common value for all the cross-sections, but for the alternate hypothesis, this framework allows the cointegrating vectors’ values to vary across groups. Pesaran and Smith conducted an investigation to compare the within-dimension and the between-dimension frameworks. They concluded that having varying values of cointegrating vectors across countries, the group mean statistics provide consistent estimates of the mean of those vectors unlike the within-dimension statistics which do not give consistent estimates. (Pesaran & Smith, 1995)The FMOLS provides estimators based on the following cointegrated panel

yi,t = αi + βxi,t +μi,tand,

xi,t = xi,t-1 + νi,t

In this equation, αi allows for the fixed effects specific to each country, β is the cointegrating vector when yi,t is an I(1) process. Ɛi,t is a stationary vector error process represented by Ɛi,t = (μi,t , νi,t).

Pedroni also affirms through his analysis that the group mean FMOLS estimator generated is consistent and the test statistic is an appropriate measure even for small samples (7 countries as is the case in this study).

Results for Unit Root Tests (Levin, Lin and Chu) and FMOLS

Table 1: Unit Root Test Results

|

Variables |

Statistic |

Probability |

|

HDI |

-7.76707 |

0.0000 |

|

TPC |

-8.52745 |

0.0000 |

(Generated by using Eviews 8.0 with automatic selection of maximum lags)

The LLC test failed to reject the null hypothesis (which indicates presence of a unit root) for both the variables HDI and TPC in their level form, but rejected the null hypothesis in their first difference form, as seen by the above figures. This shows that both the variables HDI and TPC are first difference integrated processes or I(1) processes. Thus, this shows that the data is non-stationary and application of OLS would result in unbiased and inconsistent results. Thus, to check for a long run relationship between the two variables, panel co-integration methodology is employed.

Table 2: Panel Cointegration Results

|

Within-Dimension (Panel) |

Between-Dimension (Group) |

|||

|

Statistic |

Probability |

Statistic |

Probability |

|

|

V Statistic |

1.47145 |

0.0706 |

- |

- |

|

PP Statistic |

-6.2512 |

0 |

-6.7532 |

0 |

|

ADF Statistic |

-4.9656 |

0 |

-4.8806 |

0 |

(Generated by using Eviews 8.0)

As seen above, the null is rejected for all the three statistics which are v, PP and ADF in both the frameworks- within dimension as well as between-dimension. Rejection of the null in the panel case (as seen from the 3 statistics) signifies that HDI and TPC are cointegrated for all the 7 ASEAN countries. Rejection of the null in the group mean or the between-dimension framework (as depicted by the values of group PP and group ADF statistics) indicates that HDI and TPC are cointegrated for at least one of the 7 ASEAN countries included. These results imply that there is a long-run relationship between Trade Per Capita and the values of Human Development Index for all the 7 ASEAN nations, namely, Malaysia, Singapore, Indonesia, Lao PDR, Thailand, Vietnam and Philippines. The same is also true for the group mean of these 7 nations. This shows that as trade liberalization increases, as depicted by the increasing volumes of trade per capita, is cointegrated with the increases in human development. The more a country increases its trading intensity, the greater is the increase in its income levels, the greater is the influx of innovative technologies, transfer of superior human skills, boosting its productive efficiency, more availability of new goods. Regions invest more in education and training of human capital as the economy is opened up to the world. Also, trade liberalization is cointegrated with human development because the influx of new cheaper goods allows the citizens to easily access utilities especially in the education and the health sector. This, in turn, depicts that there is a long-run relationship between trade and human development.

Results of FMOLS

|

Variable |

t- Statistic |

Probability |

|

TPC |

2.426067 |

0.0207 |

(Generated using Eviews 8.0)

For the given panel of 7 countries, FMOLS results signify that Trade Per Capita significantly influences HDI of these countries, as seen from the above value of t-statistic. This is a follow-up of the Panel Cointegration analysis. The above results indicate that Trade Per Capita in the ASEAN region significantly influences its levels of human development. The above described channels again come into play to facilitate the link between trade regimes and human development. Although HDI values of a region may be affected by other factors, yet Trade Per Capita is also one of the major factors influencing its values.

Summary and Conclusions

The study was an encapsulation of two methods for analysing the links between trade openness and human development in 7 ASEAN nations. The Panel Co-integration was applied to analyse whether there is a long-run co-integrating relationship between trade and human development or not. The results indicate that there indeed is one. This is a significant inference, especially for the case of ASEAN which is a hub of numerous FTAs. A region which is accelerating its efforts to make trade free at an increasing pace, needs to look into the implications they would have on the levels of human development. After all, the people and their prosperity is the real wealth of a nation. ASEAN needs to frame policies which minimize the harmful effects of free trade policies and tap at the most beneficial elements of free trade in order to ensure all- round development in the region. The more a country increases its trading intensity, the greater is the increase in its income levels, the greater is the influx of innovative technologies, transfer of superior human

skills, boosting its productive efficiency, more availability of new goods. The recent ASEAN Economic Community 2015 forum in Cebu also stressed upon the need to look into inclusive development as the way forward for ASEAN integration if benefits are to be ensured for all. Thus ASEAN cannot ignore the implications its free trade regime will have on the people of the region.

Reference