|

Shafat Maqbool Contact no. 7300916419, 8307521990 An Empirical Examination of the Relationship between Corporate Social Responsibility and Profitability: Evidence from Indian commercial banks. |

Shafat Maqbool Prof. M.Nasir Zameer Research scholar, Professor, Department of commerce, Department of commerce, Aligarh Muslim University Aligarh Muslim University |

The escalating demand to establish corporate social responsibility is getting instigated in India. Corporate social responsibility as a strategic intent has recently established its foothold in the developing economic. The present paper is an attempt to examine the relationship between corporate social responsibility and financial performance, using return on Asset (ROA) as a performance indicator. Secondary data on CSR of 10 commercial banks operating in India have been analyzed by applying the content analysis of annual reports for the period of five years from 2011-2015.The results of this study concluding that there is a direct relationship between CSR and CPF while controlling for employees skill, bank efficiency, and bank size. Ordinary least square was used in the particular panel data to establish results. In the operational level, these results will further motivate the corporate world to strength their contribution to the community in order to enhance economic growth of the company.

With the growing influence of free market economy and its adverse affects, there is a greater voice for ethical conduct of corporate houses. In the most recent years, the call for expanded social duty, by governments, investors, and community at large was distinctive and because of the worldwide crisis that played a focal part. Financial market breakdowns, severe economic declines and food shortages, environment deteriorating and poverty required immediate responses. Corporate social responsibility has become one of the recipes to build confidence among general people regarding corporate sector. More organizations are utilizing corporate non-financial reporting, enveloping the Social, ecological and financial affect of the organization's operations. Corporate social obligation (CSR) has become a lusty issue in contemporary International debate. In the past two decades, CSR appears to have become more ubiquitous and perceived as being relevant to corporations all over the world (Aras and Crowther, 2008). From the perspective of the corporate world, social responsibility has acquired has much importance as it is considered a legitimating activity for the organization in the eyes of society (Wartick & Cochran, 1985). There is an appreciating notion that the corporations are evaluated highly who observes civic and ethical behavior while achieving their primary goal of profit maximization. The Corporate world doesn’t exist in isolation; it has to mend its behavior for the greater good towards society by the tradeoff between economic Benefits and social responsibility. Companies have progressively assumed responsibilities beyond their own economic activities within the social sphere (Carroll, 1999; Waddock, 2004).The companies are trying to establish some kind of nexus with society to build a strong character for companies, corporation establish CSR as it benefits in corporate public relations, media campaigns and reputation management (Boesso, Kumar, & Michelon, 2013). At the present time, management hardly takes care outside the firm (such as community and public) unless it influxes some economic benefits. Wheelen and Hunger (2012) suggest that corporation has responsibilities to society that extend beyond making profit. CSR is just a guise to cope with government regulation and fawn on the public. Companies are not turning to sustainability for altruistic reasons rather to open new wellsprings of income and development. The old theory that business exits profit still has a dominating mandate, but new tactics have been developed to achieve the profit. In the academic world, a lot of research is going on to find how CSR works with CFP.

From the literature review, the main objective was set to check the link between corporate social responsibility and corporate financial performance. Does corporate social responsibility have some effect on the profitability of commercial banks in India?

The corporate world is facing the notion of corporate social responsibility wherever it turns nowadays. On a wide range of issues, corporations are encouraged to behave responsibly (Welford and Frost, 2006; Engle, 2006).CSR has moved from being voluntary to the compulsory act of the business. What encompasses CSR has been one of the debating issues from the time CSR has been recognized. Everybody tries to define CSR with their own methodology and keeping native issues under consideration. Carroll is considered one of the important figures in the development of CSR concept. He has given one of the broad definitions of CSR distinct from traditional ones. He suggested that four kinds of social responsibility constitute total CSR: economic, legal, ethical and philanthropic. Carroll (1979; 1991) systematized these responsibilities distinguishing economic, legal, ethical and philanthropic responsibilities. Furthermore, these four categories or components of CSR might be depicted as a pyramid. To be sure, all of these kinds of responsibilities have always existed to some extent, but it has only been in recent years that ethical and philanthropic activities have taken a significant place. The pyramid of CSR depicted the economic category as the base (the foundation upon which all others rest) and then built upward through legal, ethical and philanthropic categories (Carroll 1991) A concept whereby companies integrate social and environmental concerns in their business operations and in their interaction with their stakeholders on a voluntary basis (commission for the European communities, 2001). Davis (1973) defined CSR as “the firm’s considerations of, and response to, issues beyond the narrow economic, technical, and legal requirements of the firm to accomplish social benefits along with the traditional economic gains which the firm seeks. The definitions are diverse in nature .To be more precise there is still no clear and universally acceptable definition of CSR (Votaw and Sethi, 1969; Preston, 1975). The main problem in defining CSR is that it tries to connect the business with the society which changes with space. There are different aspirations of the society in the time and space arena, which make it difficult what encompasses universal CSR. Management focus on CSR activities reflect the specific business needs of a particular timeframe (Waddock, 2008). Some go similarly as saying 'We have searched for a definition and fundamentally there isn't one' (Jackson and Hawker, 2001) There is no agreed definition of exactly what constitutes CSR (Ortiz Martinez and Crowther, 2005). The definitional confusion surrounding CSR might potentially be a significant problem. If competing definitions have diverging biases, people will talk about CSR differently and thus prevent productive engagements.

Maintaining or improving shareholders return is necessarily the strategic purpose of every company (Jarillo, 2002 and Gemar & Jimenez, 2013) Companies have been in the quest of strategy which will enhance its profit. A Number of techniques have been adopted with the passage of time to achieve this primary goal. Nowadays CSR is used as strategic tool to improve the economic health of the business. Number of studies have been carried in this context .The results of these studies have not been unanimous, relationships are positive, negative and neutral

While a positive consensus seems to appear (Margolis et al. 2009), yet, this consensus is still fragile, since a range of recent studies support for either negative (Mittal et al., 2008) or mixed results (Schreck, 2011).

Some writers claimed that CSR and CFP are positively correlated; CSR does increase the profit of a business. There have been numerous studies that have evaluated the relationship Between CSR and corporate performance. Orlitzky et al. (2003) conducted such a study and found that there is a positive association between CSR and corporate financial performance (CFP) across the industries. In a subsequent study, Margolis et al. (2007) found there only to be a small positive Relationship between CSR expenditure and corporate performance. He states that the strength of this relationship depends on the type of CSR expenditure being undertaken. With most preferred are charitable and environment activities. Nurn and Tan (2010) have identified the intangible benefits of CSR on firms, via, attracting better employees, enhancement of employee commitment and productivity that consequently result in reduction of operating costs leading to improved financial performance. Waddock and Graves (1997) puts that there is a virtuous circle in CSR and CFP based on slack resource and good management.CFP increases CSR and in turn, CSR increases CFP. Many reasons are attached why market appreciated CSR activities i.e. cost saving, improving reputation, future action from authorities otherwise could result in high costs for companies (Bird, Hall, Momentè & Reggiani, 2007).

Henderson (2001) has given a vote against social responsibility. He argued that concept of CSR is severely damaging the competitiveness of business, Adopting CSR can increase cost, he also highlighted that manager will be struck in numerous goals and satisfying outside parties are not easy at all. In this regard, studies have found that there is a negative correlation between CSR and CFP as CSR as an expense are greater than the return as a result of responsible behavior. Those rooted in neoclassical economics argue for a negative correlation between CSR and firm value. They contend that CSR expenditure unnecessarily raises a firm’s costs and so places it at a competitive disadvantage viz-a-viz its competitors (Friedman, 1970; Jensen, 2002).Cordeiro and Sarkis (1997) found a significant and negative relationship between environmental proactively and performance expectations for the profit per share for 5 years, in a sample of 523 U.S. companies. Vance (1975) note a negative relationship between CSR practices and companies’ profits, while Walley and Whitehead (1994) and Korten (2001) reach a similar conclusion. In pursuit of CSR, Firms have to sacrifice their primary goal by subscribing to CSR.CSR has become a shield for the fraudulent business giants, by highlighting CSR contribution business people tries to divert the attention of general public from the foully activities of the business.

This group has proposed that there are numerable variable that influence on the relationship between CSR and CSP, so the overall impact is neutral (Ullman, 1985). Good number of finding who support the neutral association between CSR and CFP. Abbott and Monsen (1979) studied the contents of the Fortune 500 companies’ annual reports. These show a neutral effect of the companies’ social performance on corporate financial performance. They have the notion that CSR should in no way correlated with financial performance, a business can contribute to the society on rational grounds, as companies holistically depend on the society so it is their utmost duty to return back without intentions of monetary return. Aupperle, Carroll and Hatfield (1985); Williams, Medhurst and Drew (1993); and Gunningham (2003) also find no relationship between social responsibility and profitability. McWilliams and Siegel (2001) states that there exists an “ideal” level of CSR, which managers can decide by doing cost benefit-analysis. They established a neutral relationship between CSR and financial performance.

Concluding the discussion on the link between CSR-CFP, there are different opinions by different researchers. A positive, negative and neutral relationship exists. Inoue and Lee (2011) explained such contradictory results by noting three key methodology issues that have not been resolved: (1) the use of multi-industry samples, (2) cross cutting-observations and (3) the aggregation of different dimensions.

Financial performance can be measured on accounting based measures and market based returns. Accounting based measures are treated as appropriate, as it measures the overall performance of the business. Mostly financial performance is measured by the variables namely return on asset, return on equity, and return on investment. Tafri et al., (2009), Qin & Dickson (2012), have stated that financial performance of banks is also known as profitability which is normally measured by return on asset and return on equity. Hull and Rothenberg (2008, pp.785), “ROA represents the profitability of the firm” Profitability was measured by Hackston and Milne (1996) by average ROE and average ROA. In the current study, we have given preference to ROA.

The present study is analytical and empirical in nature which intends to draw a relationship between corporate social responsibility and financial performance of the commercial banks in India. Regarding Indian banking sector a limited number of studies depicting the present senior. Therefore present study tries to study the relationship between CSR and financial performance in order to improve the understanding of the particular topic and the magnitude of the relationship. For the present study ten banks have been selected based on the basis of market capitalization, five from each private and public sector as representative banks. Secondary data have been used in our study for collecting information on CSR, CFP and control variables which may affect financial performance .Data have been collected mostly from the annual reports of the concerned banks and some relevant websites (moneycontrol.com).Websites are a form of secondary data and have some distinct advantages over other data source for research purpose (Gilbert, 2008). Likewise, annual reports are the main corporate document which represents the company. Besides a number of previous studies have measured CSR on the basis of information disclosed in annual reports (Abbott and Monsen 1979). In order to carry out the present study, five-year data has been taken from 2011-2012 to 2015-2016 from the aforesaid ten banks. This five year period was the recent period for which the data were easily available.ROA has been dependent variable and CSR as a main independent variable, while employee’s skill, bank efficiency, and bank size has been incorporated as control variables.

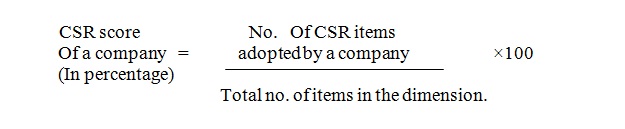

In the present study, in order to measure corporate social responsibility CSR Measurement Instrument has been constructed given in the appendix I. CSR was measured through four dimensions consists of 32 item with each having under its realm of 8 items. The four dimensions were the community, environment, human resource management and others (diverse items).To construct dimension inspiration has been taken from Mishra and Suar (2010) they measured CSRD on employee, customer, supplier, community and environment Dimensions. Further CSR dimensions and items covered in CSR Measurement Instrument are based on review of literature (Abbott and Monsen 1979; Brown 2001; Centre for Corporate Research and Training 2003; Confederation of Indian Industry 2002; Krishna 1992; Rashid and Ibrahim 2002); thereby content analysis was used to measure the CSR score from annual reports of commercial banks. Content analysis is defined as a method of codifying text into different groups depending on selected criteria (Weber, 1990). The more information is disclosed about CSR by the company, more the company is engaged with CSR spending .Different methods have been used to codify the text to make it meaning full. In this study, the inspiration for scoring procedure has been taken Ernst and Ernst (1978) and Abbott and Monsen (1979) according to which an item is scored one if disclosed and zero if not. Thereafter CSR has been converted in percentage terms by the following formula.

The study has employed linear multiple regression to test the relationship between corporate social responsibility and financial performance of commercial banks in India. For the powerful investigation of the information, STATA and Ms-excel has been used. Further, analysis of variance (ANOVA) has been utilized to test the significance of model at 5 percent level of significance. Also, parametric tests like F-test and t-test have been put to use to check the appropriateness and significance of the relationship between the variables under consideration.

Further correlation metric has been drawn to check the relationship between independent variables. Lastly, multi collinearity and Wooldridge tests have been used to understand the multi collinearity and serial correlation respectively. We have transformed one of our control variables, namely, Size (by taking their logarithms) to make the linear regression model more adequate. Lagrange multiplier test shows that OLS is the appropriate technique for analysis of particular data.

For analysis, ordinary least square has been used, and model summarizes as:

FP = α + β1.Csr + β2.ESkill + β3.eff + β4.size + εit

Where:

Table 1-represented the descriptive statistics of all the variables under study. The depended variable Return on assets (ROA) has the mean of 0.010 and standard deviation (SD) of 0.007 that is variables on the average disperse meagerly; the said variable varies from -0.009 to 0.017. Among other four variables which are independent in the model, CSR has a mean of 0.51 and standard deviation of 0.16. Employee’s skill has a mean of 0.09 and standard deviation of 0.02. Likewise, efficiency has a mean of 0.88 and standard deviation of 0.11. Size has a mean of 9.57 and standard deviation of 0.46, size has the highest dispersion among all five variables (0.46) which means assets among banks varies considerably, as total assets represent the size of the banks.

Table-1 descriptive statistics

|

Variable |

Mean |

Std.dev |

Min |

Max |

|

Roa |

0.010 |

0.007 |

-0.009 |

0.017 |

|

Csr |

0.51 |

0.16 |

0.06 |

0.84 |

|

Emp skill |

0.09 |

0.02 |

0.06 |

0.19 |

|

Efficiency |

0.88 |

0.11 |

0.28 |

1.13 |

|

Size |

9.57 |

0.46 |

7.71 |

10.35 |

Source: Results obtained from using stata software.

Table-2 Mean of Banks

|

Items |

Roa |

Csr |

Empskill |

Efficiency |

Size |

|

HDFC Bank |

0.016 |

0.525 |

0.076 |

0.838 |

9.688 |

|

ICICI Bank |

0.015 |

0.475 |

0.078 |

0.723 |

9.769 |

|

KMB bank |

0.015 |

0.612 |

0.126 |

0.856 |

8.998 |

|

AXIS bank |

0.015 |

0.587 |

0.070 |

0.839 |

9.227 |

|

Indus India bank |

0.015 |

0.675 |

0.079 |

0.861 |

8.949 |

|

SBI bank |

0.006 |

0.551 |

0.146 |

0.920 |

10.247 |

|

PNB bank |

0.005 |

0.581 |

0.126 |

0.944 |

9.737 |

|

Canara bank |

0.004 |

0.443 |

0.087 |

0.954 |

9.672 |

|

Bank of Baroda |

0.004 |

0.443 |

0.093 |

0.933 |

9.777 |

|

Bank of India |

0.002 |

0.293 |

0.100 |

0.974 |

9.715 |

Source: Results obtained from using stata software.

Table-2 provides information about the mean values of the selected commercial banks. While amongst all the banks, HDFC scores highest on ROA variable, which is 0.016, which mean HDFC has sound financial performance amongst other banks. As far as CSR is concerned Indus India bank score highest, which is 0.675, means the bank invests much for the society, and is second on the profitability parameters, gives a raw indication of CSR-CPF linkage likewise, Kotak Mahindra bank, axis bank and PNB follows the CSR spending.SBI tops the list in employees skills by scoring 0.146.Bank of India and SBI tops in efficiency and size by scoring 0.974 and 10.247 respectively. In CSR and ROA private banks lead while public sector banks lead in employees’ skill, efficiency, and size. Private Banks lags behind public banks in size show that some giant banks are still controlled by the state, but are less capable of putting them to use effectively, as HDFC leads as far as ROA is concerned.

Table-3 correlation matrix

|

Roa |

Csr |

empskill |

efficiency |

size |

|

|

Roa |

1.000 |

||||

|

Csr |

0.284 |

1.000 |

|||

|

Empskill |

-0.372 |

0.009 |

1.000 |

||

|

Efficiency |

-0.698 |

-0.109 |

0.296 |

1.000 |

|

|

size |

-0.698 |

-0.079 |

0.285 |

0.176 |

1.000 |

Correlation is significant at the 0.05 level (two tailed).

Source: Results obtained from using stata software.

Table-3 Depicts correlation among all the variables under consideration.ROA and CSR has a significant positive correlation at 5% level of significance, which means when one is increased or decreased another follows the same direction. But, ROA has significant negative correlation with other three variables I.e. employees skill, bank efficiency, and bank size that means an increase in one variable is accompanied by a decrease in another and vice versa. Among the independent variables size and efficiency correlates negatively while empskill have positive correlation with the CSR, but the relationship is statistically insignificant. Employee’s skills have a significant correlation with efficiency and size. Likewise, efficiency has a positive correlation with size but is statistically insignificant.

Table 4 depicts the collinearity among the independent variables. The threshold limit to check collinearity is 10; if VIF exceeds 10 then there is multi collinearity (Kutner 2004). It is quite clear that VIF value doest exceed the threshold limit of 10. So there is no multi collinearity as the VIF value for all the variables ranges from 1.02 to 1.17. In addition to VIF tolerance level is also used to detect chance of multicollinearity among independent variables, for which the value in the above table is not near to zero. In the sequel of these maxims, we conclude that there is no issue of multicollinearity between the particular variables (Gujarati & Porter 2009 and Marquardt, 1970).

Table- Collinearity statistics

|

variables |

VIF |

Tolerance |

|

CSR |

1.02 |

0.980716 |

|

Empskill |

1.17 |

0.852800 |

|

Efficiency |

1.12 |

0.891902 |

|

Size |

1.11 |

0.904487 |

|

Mean VIF |

1.10 |

Source: Results obtained from using stata software

VIF-value inflation factor

From the table 5, we can draw inferences that there are four independent variable which have bearing on profitability of the commercial banks, all the concerned variables are quantified and measured by respective parameters. Any undesirable deviation from the variables will negatively affect the profit and will be treated as risk. The F-stat of 19.10(p-value = 0.00) is significant at 5% shows that model is apt and fit, and accepting the hypothesis of significant linear relationship between dependent and independent variables. It is also indicative of the joint statistical significance of the model. The goodness of fit (R²) value is 0.62 which is quite appropriate and suggests that model explains 62% of the systematic variations in ROA with an adjusted value of 0.59.In other words, 62% change in ROA is explained by these 4 variables and rest 38% are outside the parameters of this model, which are excluded.

Table-5, the coefficient of correlation for ROA is 8.1% which infers that holding all the independent variable zero there would be a profitability of 8%.

Table-5, Model T reveals a significant positive relationship between corporate social responsibility and financial performance. The regression coefficient of 8% reveals that if there is 1% change in CSR profit will change by 8% .The findings of our study are in consonance with those observed by Russo and Fouts (1997), Waddock and Graves (1997), Ruf et al. (2001), Simpson and Kohers (2002) and Tsoutsoura (2004). The costs involved in CSR are much lesser than the return made. Momentè and Reggiani, (2007) pointed out that CSR is appreciated in market because it creates positive word of mouth, saves implicit costs of the company. Moreover, an authority gives less attention towards these companies.

Table-5 Regression analysis

|

Independent variable |

Dependent variable |

Beta coefficient |

Standard error |

T-statistics |

T value or sig.value |

|

(constant) |

ROA |

0.081 |

0.014 |

2.05 |

0.000 |

|

Csr |

0.080 |

0.003 |

2.05 |

0.046 |

|

|

Empskill |

-0.030 |

0.025 |

-1.21 |

0.234 |

|

|

Efficiency |

-0.036 |

0.005 |

-6.18 |

0.000 |

|

|

Size |

-0.004 |

0.001 |

-2.90 |

0.006 |

|

|

R square |

0.629 |

||||

|

Adjusted R square |

0.596 |

||||

|

F statistics |

19.10 |

||||

|

Prob (f stats) |

0.000 |

||||

|

Autocorrelation |

Prob > 0.1995 |

Predictor: Csr-corporate social responsibility, Empskill-employees skills, Efficiency-Bank efficiency, size-size of the bank.

Dependent variable: ROA-Return on Assets.

Source: Results obtained from using stata software.

|

The regression equation for the model would be: ROA=0.081+0.080Csr+ (-0.030) Eskil+ (-0.036) eff+ (-0.004) size. |

Table 5, the regression coefficient for employee’s skill is – 3 percent which highlights that there is a negative correlation between ROA and employees skills. If employee’s skills are increased by 1 percent profit will get reduced by 3 percent, but the results are statistically insignificant, means that higher expenditure on employees may not always be fruitful due to faulty and ineffective personal policies of the management. Since employee’s skill is measure by salary divided by Net sales, these results are expected. Another thing is that as salary increases there may be negative profits, because money does not guarantee you a return.

Table-5, the statistical observation for this variable is – .036.which signifies that for every 1 percent decrease in efficiency profit will increase by 3.6 percent. Since efficiency was calculated by total expenditure/ total profit then the high ration would mean the company is inefficient, hence inverse relationship found in this study is expected and justifiable.

Table-5, our study shows a significant negative correlation between size and profitability as our coefficient if -.4 percent. It is worth mentioning that our findings resembles with Simpson and kohers (2002) and ruf et al. (2001). The reasons for such kind of results are that with the increase in the size of a firm, its diseconomies (expensive land, less control) overpower scale of economies.

The point of this exploration is to inspect the relationship amongst CSR and CFP. The study used regression analysis to set up the relationship between CSR and CFP among commercial banks. Firms were selected on the basis of market capitalization with employees’ skills, bank efficiency, and bank size as control variables. The noteworthy finding of the study is that corporate social responsibility does impact financial performance. The consequences of this investigation shows that firm should display more prominent worry to enhance profitability and reputation by means of expanding their CSR expenditure. This outcome likewise is in line with earlier studies that discovered huge and positive relationship amongst CSR and CFP. As indicated by Waddock and Graves (1997), the better social execution of organizations would guarantee more noteworthy financial outcomes. The Corporate world continually is in search activities which will enhance their goodwill, CSR is one among them. Where the company can build a reputation via corporate social responsibility, in the past, CSR which was receiving a trivial response from corporate world has become a crucial concern in recent times as a result of the global attention that the subject of has attracted. Likewise, CSR should be the part of strategic planning in order to create value for their products and ultimately benefiting shareholders. Effective CSR strategies can attract stakeholders, such as socially conscious consumers and investors, to increase their willingness to buy and invest, respectively.

Wan Suhazeli, 2014.Does Corporate Social Responsibility Lead to Improve in Firm Financial Performance? Evidence from Malaysia, International Journal of Economics and Finance; Vol. 6, No. 3.

Shveta Kapoor, 2010. Does it pay to be Socially Responsible? An Empirical Examination of Impact of Corporate. Global Business Review, 11:2 (2010): 185–208.

Joscha Nollet, 2015. Corporate social responsibility and financial performance: A non-linear and disaggregated approach, ECMODE-03803; No of Pages 8.

Osemwegie ero omeghie joy, 2016. Corporate social responsibility and corporate financial performance in developing economies: the Nigerian experience, ng-journal of social development, vol. 5, no. 4, august 2016.

Theofanis Karagiorgos, 2010. Corporate Social Responsibility and Financial Performance:

An Empirical Analysis on Greek Companies, European Research Studies, Volume XIII, Issue (4), 2010.

WALTER F. ABBOTT, 1979. On the Measurement of Corporate Social Responsibility:

Self-Reported Disclosures as a Method of Measuring Corporate Social Involvement, ©Academy of Management Journal 1979, Vol. 22, No. 3, 501-515.

Porter, M.E. and M.R. Krammer. 2002. ‘The Competitive Advantage of Corporate Philanthropy’, Harvard Business Review, 80(12): 56–68.

Calcutta: Centre for Social Markets. Available at www.csmworld.org/public/pdf/social_respons.

Namita Rajput, 2012. Linking CSR and financial performance: an empirical validation, Problems and Perspectives in Management, Volume 10, Issue 2, 2012.

Rusnah Muhamad, 2008. Corporate Social Responsibility, Corporate Financial Performance and Institutional Ownership: Evidence from Malaysia, https://www.researchgate.net/ publication/ 263969716.

Milton Friedman, 1970. The Social Responsibility of Business is to Increase its Profits, The New York Times Magazine

Guajarati, D.N and Porter, D.C. (2009). Basic Econometrics Fourth Edition, Tata McGraw Hill E d u c a t i o n Private Limited, New Delhi.

Hair, J.F. Jr, R.E. Anderson, R.L. Tatham and W.C. Black. 2005. Multivariate Data Analysis. Delhi: Pearson Education Pte. Ltd.

Milne, M.J. and Adler, R.W., 1999. Exploring the reliability of social and environmental disclosures content analysis. Accounting, Auditing and Accountability Journal, 12(2), pp.237–256.

Hsiu-Fang Hsieh, 2005. Three Approaches to Qualitative Content Analysis, QUALITATIVE HEALTH RESEARCH, Vol. 15 No. 9, November 2005 1277-1288.

Nelling, E., & Webb, E. (2008). Corporate social responsibility and financial performance: the virtuous circle, Revisited. Springer Science & Business Media, 32(8), 197–209.

Stephen Cavanagh RGN, 2014. Content analysis: concepts, methods and applications, Downloaded from rcnpublishing.com by ${individualUser.displayName}.

Baron, D. 2001. “Private politics, corporate social responsibility and integrated strategy,” Journal of Economics and Management Strategy, 10:7-45.

UN Report (2007), “Climate Change will Cost 1.6% of Global GDP”, Times of India, IST, AFP, November 28, http://timesofindia.indiatimes.com/World/Rest of World/Climate change.

Glenn Growe, 2014. The profitability and performance measurement of U.S. regional banks using the predictive focus of the “fundamental analysis research”.

Alexiou, C., & Sofoklis, V. (2009). Determinants of bank profitability: Evidence from the Greek banking sector. Economic Annals, 54, 93118.

Ali, K., Akhtar, M. F., & Ahmed, H. Z. (2011). Bank-specific and macroeconomic indicators of profitability Empirical evidence from the commercial banks of Pakistan. International Journal of Business and Social Science, 2, 235242.

Adrian Cadbury, 2006. Corporate social responsibility. ISSN: 1745-0144 (Print) 1745-0152 (Online) Journal homepage: http://www.tandfonline.com/loi/rsoc20.

Alexander Dahlsrud, 2006. How Corporate Social Responsibility is Defined: an Analysis of 37 Definitions, (www.interscience.wiley.com) DOI: 10.1002/csr.132.

http://www.moneycontrol.com/stocks/marketinfo/marketcap/bse/banks-private-sector.html.

http://www.moneycontrol.com/stocks/marketinfo/marketcap/bse/banks-public-sector.html.

Appendix 1

CSR Measurement Instrument

CSR Dimensions and Items