|

Ms Vandana Gupta Assistant Professor Department of Marketing Amity University, Noida |

Dr. Asif Ali Syed Assistant Professor Department of Business Administration Aligarh Muslim University Aligarh |

Prof. Mukesh Chaturvedi Sr. Consultant & Founding Partner PDCEducational Services Mayur Vihar Delhi |

Indian Automobile passenger car market is witnessed by the presence of many national and multi-national manufactures post liberalization 1991. The availability of many alternatives within the city provides an opportunity to the consumers to make a rational decision after considering all the options while purchasing the car. Today is an era which is characterized by a consumer’s market where the manufacturers and marketers not only takes into consideration the consumer orientation to make them satisfy but goes one step ahead of achieving consumer delight. Consumers look for those differentiating parameters, which may help them for best decision and can be proved as value to money proposition for them. It makes more important to analyze the consumer behavior towards the hatchback car owners which will give the feedback pertaining to designing the marketing strategies. The objective of this study is to investigate those differentiating parameter and effect of reference group that influence the consumer buying behavior of car owners within the city of Delhi/NCR. The primary data was collected from 197 respondents, located in Delhi/NCR region using convenience sampling. Various statistical tools and techniques were used for the analysis of the study. The results revealed the strong influence of attributes like price, fuel efficiency on the buying decision of the consumer and importance of reference group.

Keywords: Consumer Behaviour, Customer preferences, hatchback cars, purchase behaviour

Today the automobile industry is the growing and profit generating industry. Due to increase in the disposable income of the people and easy finance available in the market, the sales of the passenger cars have increased. As the competition is increasing day by day, new players are entering into the market with their new innovation to attract the potential buyers in the market.

The buying behavior of customer can be studied by knowing their perception about the cars in the market. Basically it is the need to find out what customer expects and what is being offered to them. When a customer is satisfied with the product or service, he recommends that product and service to another prospective customer.

The Indian industry is currently experiencing unprecedented boom in the demand for all types of vehicle.

The Indian car industry is one of the greatest on the planet with a yearly creation of 23.37 million vehicles in FY 2014-15; the development is more than 8.68 for every penny in the course of the most recent year.

The car business contributes in 7.1 for every penny of the nation's total national output (GDP).

The Two Wheelers portion with 81 for every penny piece of the overall industry is the pioneer of the Indian Automobile market inferable from a developing white collar class and a youthful populace. Also, the developing enthusiasm of the organizations in investigating the provincial markets further helped the development of the part. The general Passenger Vehicle (PV) section has 13 for every penny piece of the pie.

India is likewise an unmistakable auto exporter and has solid fare development desires for the not so distant future. In FY 2014-15, car trades developed by 15 for every penny in the course of the most recent year. Likewise, a few activities by the Government of India and the significant car players in the Indian business sector are relied upon to make India a pioneer in the Two Wheeler (2W) and Four Wheeler (4W) market on the planet by 2020.There was a time when there was too less variety of cars available in Indian market, Indian automobile industry has come up with a long way to have a different variety of cars available these days. There are a many of top automobile companies running their operations in India, which have a different range of products and models available in different segments of cars.

Maruti Suzuki has reliably been the predominant pioneer in the Indian car industry. Nonetheless, there are additionally other enormous players in the market like Tata Motors, Mahindra and Mahindra, Hyundai Motors, Hindustan Motors, General Motors etc.

Earlier, the greater part of the Indian auto car makers was utilizing the remote advances. In any case, now the situation has changed throughout the years and instantly, the Indian car makers are utilizing their own particular innovation and have their own manufacturing units and their own body shops. Because of the developing pace of Indian car advertise, various auto makers including the worldwide pioneers have begun importing products that are created in India for their own nation, because of a few components.

Top Automobile Manufactures in India

Sangeeta Gupta (2013) reveals that the reference group plays an important role in influencing the car purchase decision. This group which includes family, friends and relatives is a significant source of information and influence. Some of the other factors which influence the purchase decision are promotional offers and fuel efficiency. As per the study, the three attributes – fuel efficiency, price and powerful engine are considered most important by the customers. With the changing market dynamics, information available on the internet also appears in the list of influencers in the car purchase decision. Vikram Shende (2014) has touched upon various topics such as classification of car market, purchase decision process and classification of behaviors and their effect on various car segments. As highlighted in the paper, consumer behavior is a mix of cultural, demographic, economic, technological and political factors. These factors are a reflection of his knowledge, perception, personality, attitude, lifestyle and motivation. It is imperative that a marketer understands this behavior which is a concoction of multiple factors as mentioned above. Different factors appear at different priority levels for various car segments. Mini Car segment customers are usually first time buyers. Though customer of this segment is highly cost conscious, there is a migration which is observed due to increase in disposable income. The focus changes to safety, driving & seating comfort and brand for the customer of mid-size segment. Three other important attributes for this segment include value for money, features and customer friendly vehicles. Executive and Premium class segment customers have preference for brand name, higher horse power, attractive styling and product performance. The customers of this segment use the vehicle for business purpose and thus look for the brand name to reflect their style and personality. The factors such as price, fuel efficiency and maintenance cost are not of significant importance. Also, global brands are preferred by this customer segment. Stella & Rajeshwari (2012) focuses on the relationship between customer satisfaction, brand image and information from mass media. This study included respondents from all age groups, occupation strata, income groups and education backgrounds. Most customers rely upon inputs from their friends/relatives/children/spouse for decision making. Specifically in nuclear families, decisions are taken individually. The most important factors that influence the consumers are price of the car, low maintenance, high quality and long durability in that order. Consumer retention, customer relationship management, personalization and one-to-one marketing are also important factors in the decision making process.

Kusuma (2015) elaborates on the consumer behavior pattern on buying decision of small cars. A framework has been developed to study the behavioral patterns which influence the consumer purchase of small cars. The need to purchase a car is followed by the information gathering from peers and the internet. Factors such as re-sale value, value for money, market goodwill and easy availability constitute market influence. Car financing agencies also have a role to play in this decision making process. External influence factors include family, parents, colleagues and the car being a status symbol. Manufacturer, Brand, Mileage, Performance, Price, Interior & Exterior Design and Safety & Comfort features consist of the product influence. Internet these days is playing an important role in influencing the pre-purchase decision of cars.

Shahir bhatt and Amola bhatt (2015) identified six factors which influence the purchase behavior of consumers for hatchback cars. Brand promise, Features, Reach, Promotions, Perceived Quality and Price. Brand promise describes the elements which consumer’s associates with a particular brand such as comfort, service and trustworthiness. Quality and the price were separately identified as important factors of the buying process. Beena john and S Pragadeeswaran (2013) states that female car users are buying hatchback cars as it convenient to drive and economical too. Value for money and price quality is the important factors which influence small car buying. The new generation people are very difficult to classify on the basis of demographic factors and unless their thought process and buying behavior preferences are fully understood, decisions on product designs, product variants, branding and distribution channels are likely to be confusing. Gupta Bhuwan and Agarwal Nisha (2013) suggested that if the proper advertisement and sales promotion are done, it helps to create the place in the minds of the customers. With the help of celebrity endorsements, it helps to influence the customers. Manufacturer of car can develop the social Interaction program through which they interact with the customers and there family members, it helps to create loyalty towards the brand. According to today’s scenario car manufacturing are focusing on the family size as nuclear family are increasing day by day, so according toned, want, taste, preference of the customer and design the product . Josephine Stella, Dr. K Rajeswari (2012) states that the most important factor that influences the consumer to buy the car is its price followed by the low maintenance, its high quality and the long durability. People usually look for performance, good dealer network and good after sales service. With the help of study, it was identified that there is a significant relationship between income of the customer and brand name. Balakrishnan Menon & Dr.Jagathy Raj V.P (2012) states that, for personal needs, the family wanted a car for functions, social gathering, need to travel long distance on trips and need to upgrade from two-wheeler to four-wheeler. People want good engine performance, safety and security measures; good after sales service are at the top list. Comfort factors, style and look of the car and value for money are at the top requirements.

Amit Sharma (2010) pointed out that when a buyer thinks of purchasing the new car, the average time taken in researching for the product is average 9.8 days and the people who have used the car make up their mind in 7.7 days on an average. More than half the car buyers in these cities use the internet to read reviews compare specifications and prices of different models and to locate dealerships. More than half the consumers look at video advertisements, sponsored links & animated advertisements of cars.

Liu Dongyan (2012) identified safety as the most important characteristics for them and they take value for money on the second characteristic and driving pleasure is the third factors they keep in mind while purchasing the car. Safety and value for money is the most important factors for them to purchase the car. Chinese consumers take after-sale service and exterior design as the forth most important factors when making the purchase decision. Consumers get information from different channels, car sales staff, Internet, family/friend, word of mouth, car shows etc.

Deloitte (2014) revealed that the first time car buyer, looks to buy a car for his family primarily. The first time buyer has really no comparable reference, it is natural that this buying decision is not influenced by the improvement of fuel efficiency factor. The study details that the first-time buyers use reliability, the dealer services and resale value as filters while making brand choices. However, it was observed that female respondents attached less importance to reliability and dealer ability as compared to the male respondents.

Ashutosh Nigam & Rajiv kaushik (2012) identified that brand equity factors helps to influence the purchase decisions of customers. The study concluded that the brand manager should focus on the customer loyalty, trustworthiness, brand distinction, innovative feature to manage brand equity. It is not only the brand image which influences the customer but dealer image plays a important role in influencing the purchaser.

Kotler and Armstrong (2006) stated that the marketers identify the factors which are important to identify potential buyers and then produce products as per the needs of customers. Each of these factors has a special dimension. For instance, social factors play a very important role in the decision of the buyer’s purchase.

Research Design

The research is Descriptive in nature. The study is done to understand the purchase behavior of consumers towards hatchback cars in Delhi/NCR region. For this purpose, a structured Questionnaire is used and results are interpreted.

Sample Unit: Respondents who owns or are planning to buy a hatchback car.

Sample Area: Delhi and NCR

Research Instrument: Structured Questionnaire

Tools Used: Factor analysis, cross tabulation

Software used for analysis: SPSS

Data Collection

Primary data:

Primary data was collected with the help of structured questionnaire.

Secondary data:

Secondary data was compiled with the help of Articles, Reports, Journals, Magazines,Newspapers and Internet.

Sample Size:

197 respondents is the sample size for the study conducted within Delhi NCR.

The test used is factor analysis.

|

Kaiser-Meyer-Olkin Measure of Sampling Adequacy. |

.791 |

|

|

Bartlett's Test of Sphericity |

Approx. Chi-Square |

2641.617 |

|

Df |

300 |

|

|

Sig. |

.000 |

|

HYPOTHESIS

H0=the sample is adequate

H1=the sample is inadequate

Since KMO value is greater than 0.6, thus the sample is adequate.

Thus H0 is accepted

| Component | Initial Eigen values | Extraction Sums of Squared Loadings | Rotation Sums of Squared Loadings | ||||||

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | |

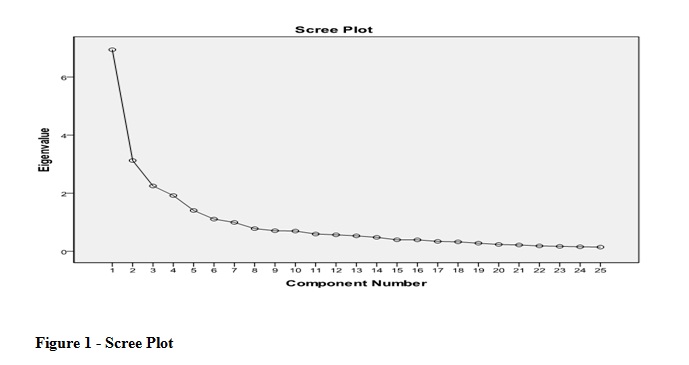

| 1 | 6.941 | 27.764 | 27.764 | 6.941 | 27.764 | 27.764 | 4.114 | 16.456 | 16.456 |

| 2 | 3.127 | 12.507 | 40.271 | 3.127 | 12.507 | 40.271 | 2.996 | 11.986 | 28.442 |

| 3 | 2.251 | 9.004 | 49.275 | 2.251 | 9.004 | 49.275 | 2.865 | 11.460 | 39.901 |

| 4 | 1.922 | 7.689 | 56.964 | 1.922 | 7.689 | 56.964 | 2.596 | 10.385 | 50.286 |

| 5 | 1.407 | 5.629 | 62.593 | 1.407 | 5.629 | 62.593 | 2.311 | 9.243 | 59.529 |

| 6 | 1.110 | 4.441 | 67.034 | 1.110 | 4.441 | 67.034 | 1.876 | 7.505 | 67.034 |

| 7 | .996 | 3.984 | 71.018 | ||||||

| 8 | .783 | 3.130 | 74.149 | ||||||

| 9 | .711 | 2.844 | 76.993 | ||||||

| 10 | .700 | 2.799 | 79.792 | ||||||

| 11 | .597 | 2.389 | 82.181 | ||||||

| 12 | .569 | 2.277 | 84.458 | ||||||

| 13 | .534 | 2.135 | 86.593 | ||||||

| 14 | .483 | 1.930 | 88.523 | ||||||

| 15 | .399 | 1.598 | 90.121 | ||||||

| 16 | .396 | 1.586 | 91.707 | ||||||

| 17 | .343 | 1.372 | 93.079 | ||||||

| 18 | .327 | 1.308 | 94.387 | ||||||

| 19 | .281 | 1.126 | 95.513 | ||||||

| 20 | .238 | .952 | 96.465 | ||||||

| 21 | .220 | .879 | 97.344 | ||||||

| 22 | .187 | .748 | 98.093 | ||||||

| 23 | .172 | .689 | 98.781 | ||||||

| 24 | .158 | .632 | 99.413 | ||||||

| 25 | .147 | .587 | 100.000 | ||||||

Table 3 - Rotated Component Matrix

|

Component |

||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

|

|

Interior |

.103 |

.838 |

.044 |

.094 |

.086 |

-.068 |

|

Exterior |

.107 |

.804 |

.144 |

.133 |

.046 |

-.090 |

|

Technical Specification |

.204 |

.775 |

.189 |

.034 |

.004 |

.215 |

|

Safety Measures |

-.013 |

.710 |

.251 |

-.019 |

.182 |

.293 |

|

Fuel Type |

.591 |

.339 |

-.107 |

.164 |

.337 |

.222 |

|

Price |

.776 |

.112 |

-.048 |

.104 |

.264 |

.042 |

|

Maintainence Cost |

.794 |

.063 |

-.048 |

.048 |

.272 |

.266 |

|

Mileage |

.784 |

.071 |

-.152 |

.083 |

.283 |

.119 |

|

Exchange Offer |

.727 |

.069 |

.013 |

.096 |

-.306 |

.078 |

|

Promotion & Discount |

.745 |

.081 |

.300 |

-.104 |

-.124 |

-.136 |

|

Easy Availability Of Finance |

.679 |

-.005 |

.230 |

.379 |

.022 |

-.075 |

|

Test Drive |

.166 |

.269 |

.215 |

.128 |

.507 |

-.199 |

|

Treatment At Dealers |

.096 |

.110 |

.707 |

.004 |

.471 |

-.020 |

|

Behaviour Of Salesperson |

-.059 |

.111 |

.795 |

.023 |

.128 |

.123 |

|

Infrastructure Of Sales Station |

-.049 |

.265 |

.751 |

.250 |

-.082 |

.204 |

|

Dealership Reputation |

.077 |

.121 |

.741 |

.135 |

-.042 |

.104 |

|

Advertisments |

.167 |

.079 |

.302 |

.437 |

-.012 |

.368 |

|

Brand Name |

.110 |

-.065 |

.266 |

.576 |

.375 |

.181 |

|

Word Of Mouth |

.227 |

-.074 |

.030 |

.567 |

.408 |

.324 |

|

Celebrity Endorsment |

.034 |

.056 |

.207 |

.088 |

.098 |

.821 |

|

Promotion |

.237 |

.164 |

.142 |

.386 |

.026 |

.676 |

|

Service Network |

.178 |

.077 |

.079 |

.104 |

.756 |

.180 |

|

After Sales Service |

-.040 |

.133 |

-.053 |

.549 |

.622 |

.061 |

|

Road Assistance |

-.096 |

.367 |

-.043 |

.606 |

.202 |

.128 |

|

Ease Of Exchange |

.259 |

.091 |

.180 |

.761 |

-.043 |

.013 |

|

Extraction Method: Principal Component Analysis. Rotation Method: Varimax with Kaiser Normalization. |

||||||

|

a. Rotation converged in 9 iterations. |

||||||

Table 4 - Factors Drawn from Factor Analysis

|

1 |

2 |

3 |

4 |

5 |

6 |

|

V6 |

V1 |

V13 |

V24 |

V22 |

V20 |

|

V7 |

V2 |

V14 |

V25 |

V23 |

V21 |

|

V8 |

V3 |

V15 |

|||

|

V9 |

V4 |

V16 |

|||

|

V10 |

|||||

|

V11 |

V1-Interior

V2-Exterior

V3-Technical Specification

V4-Safety Measures

V6-Price

V7-Maintainence Cost

V8-Mileage

V9-Exchange Offer

V10-Promotion & Discounts

V11-Easy Availability of Finance

V13-Treatment at Dealers Outlet

V14-Behaviour of Salesperson

V15-Infrastructure of Sales Station

V16-Dealership Reputation

V20-Celebrity Endorsement

V21-Promotion

V22-Service Network

V23-After Sales Service

V24-Road Assistance

V25-Ease of Exchange

Thus the factors withdrawn are:

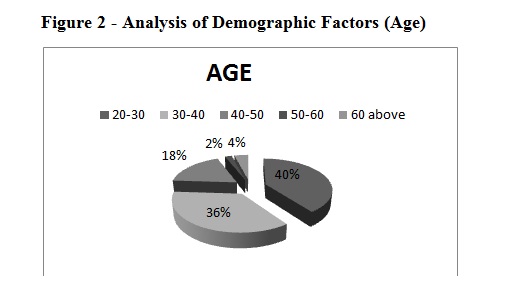

Table 5 - Analysis of Demographic Factors - Age

|

AGE |

RESPONDANT |

|

20-30 |

80 |

|

30-40 |

69 |

|

40-50 |

36 |

|

50-60 |

4 |

|

60 above |

8 |

|

TOTAL |

197 |

It has been found that the total people of age group 20-30 years are 40% who are owning hatchback cars with them whereas the people with age group of 30-40 are slightly lesser, that is 36% who are having hatchback cars, the people with age group of 40-50 are comparatively less in number that is 18%.

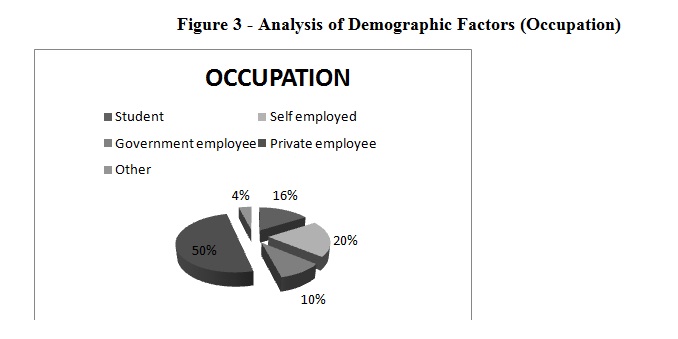

Table 6 - Analysis of Demographic Factors – Occupation

|

OCCUPATION |

RESPONDANT |

|

Student |

32 |

|

Self employed |

40 |

|

Government employee |

17 |

|

Private employee |

100 |

|

Other |

8 |

|

TOTAL |

197 |

With the help of above pie chart we get to know that 50% sample are the private employees, 20% people are self employed, followed by students and government employees who are comparatively less in number that is 16% and 10%.

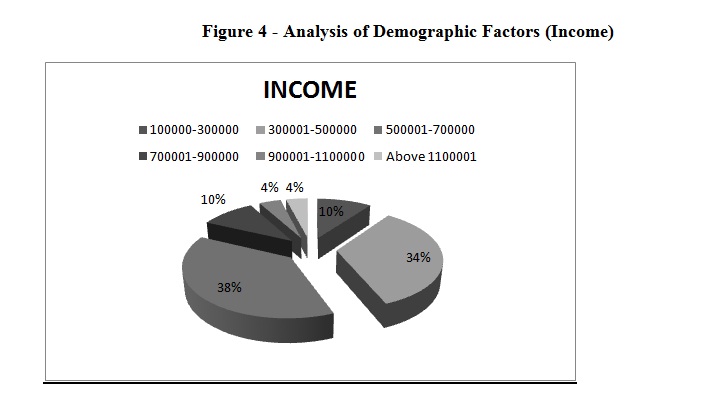

Table 7- Analysis of Demographic Factors – Income (in Rupees)

|

INCOME |

RESPONDANTS |

|

100000-300000 |

20 |

|

300001-500000 |

68 |

|

500001-700000 |

73 |

|

700001-900000 |

20 |

|

900001-1100000 |

8 |

|

Above 1100001 |

8 |

|

TOTAL |

197 |

The above chart states that 38% people are in the income group of 5L-7L per annum and people with the income group of 3L-5L per annum are 34% , followed by 7L-9L and 9L-11L which is comparatively less in number that is 10% for both the groups and people with the income of 1L-3L and above 11L is only 4%.

Table 8 - Analysis - Information Source

|

Information |

Respondents |

|

Friends & Relatives |

96 |

|

Official Website Of Brand |

36 |

|

Auto Review Shows |

45 |

|

Review On The Trading Websites |

20 |

|

Total |

197 |

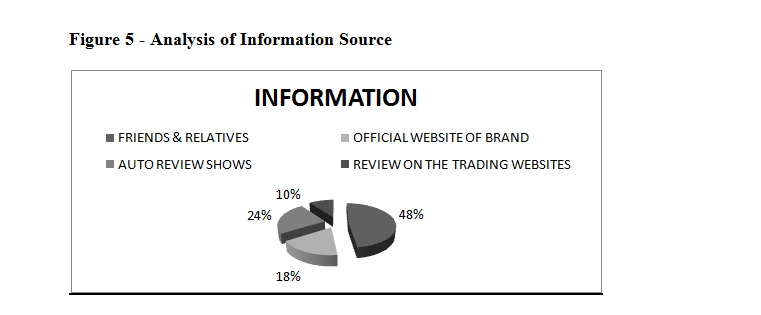

From the above pie charts, it was observed we got the information about the source, that from where people get influenced for buying or taking the decision for purchasing the vehicle. So, 48% of the people get influenced from their friends and relatives, 24% people get influenced from the auto review shows, whereas 18% of people get influenced from official website of brand and 10% of people get influenced from the review from the trading websites.

Consumer behavior is very important for before and post purchase choices. One cannot succeed in the aggressive market without understanding the consumer behavior. An understanding of the buyer empowers an advertiser to take promoting choices which are perfect with its customer needs. From the study, there are various major classes of consumer behavior determinants and expectations, namely socioeconomic, demographic, Product and Technology. Further classification of human behaviors under main categories will enable car manufacturer to align their strategies in concurrence to customer behavior. While buying hatchback cars however customer is exceedingly taken is highly cost conscious but this segment is also upgrading their requirements because of increasing disposable income. Customer is more leaned to buy Maruti Suzuki and Hyundai brands. In hatchback segment, the customer also focuses on security, driving and seating comfort, brand.

In mid size segment, like affordability and convenience are the key focal segment. .The reference group plays a vital part in purchasing decision for hatchback cars. Companions, family and relatives reference has been found the main influencers in car purchasing. Additionally, Price-off amongst the special offers and fuel effectiveness in the hatchback cars are observed to be the premier purposes behind the purchase of the vehicle. The study additionally saw the relationship between the respondents age is the main influencer in buying a hatchback car. Furthermore, the companions, family and relatives are the main influencer, customers also trust on the data that is present on internet. All the features or attributes are considered to be vital by the consumers. Among attributes, the three most essential ones are Cost, specification and value added services. Passenger car makers should enhance their item as far as fuel-efficiency and enhance innovation to enhance the mileage in order to attract more customers.