|

Leila Shadman Panabandani Department of Accounting Rasht Branch Islamic Azad University Rasht, Iran |

Mohamad Aghaei Bejarkenari Department of Accounting Rudbar Branch Islamic Azad University Rudbar, Iran Email: Aghaei_m3@yahoo.com |

Mehdi Meshki Department of Accounting Payame Noor University Rasht, Iran |

The main purpose of the study is to investigate the relationship between characteristics of chief executive officer and company ownership with investment cash flow sensitivity. In order to assess the exact impact of each factor on the dependent variables, each of these components were tested in the two main hypotheses. The purpose of the study is applied and its method is descriptive-correlation.In order to test the hypotheses, 74 companies of Tehran Stock Exchange from2010 to 2014 were selected from 370 companies. The results of the study showed a significant negative relationship between the characteristics of chief executive officer and company ownership with investment cash flow sensitivity. According to the tests, there is a significant negative relationship between characteristics of chief executive officer and company ownership with investment cash flow sensitivity; that is, more optimistic chief executive officer and focus on stock can result in the reduction of investment cash flow sensitivity.

Keywords: management optimism, investment cash flow sensitivity, company ownership

An important purpose of financing is investing in companies to be more profitable. To maximize the value of the company, company executives are seeking to implement profitable investments; implementing these profitable projects requires financing. The only source of funding is not shortage of bank liquidity facilities and there are other solutions. Domestic financial constraints are limitations in relation to resources (cash) within the business unit and can be raised under the agency cost. The company reliance on domestic resources can be determined through "investment cash flow sensitivity" of that company. It is argued that companies that are experiencing financial constraints possess more investment cash flow sensitivity.To be able to finance their investment projects, companies that suffer from more severe failure related to the capital market rely more on domestic resources. Based on this idea, Fazzary et al. introduced an index called "investment cash flow sensitivity" (Almedia, 2004). This index is defined as measuring the rate of change in capital expenditure by companies in exchange for a unit change in cash flow. Accordingly, the higher the sensitivity of investment spending to corporate cash flows is, the more reliance the company has on its domestic resources; therefore, it suffers from higher financial limitations. In addition, according to this index, in the case of companies that suffer from serious capital market imperfections, there is a higher sensitivity of investment cash flow (Mohammadi, 2010).

To divide the company in terms of financing constraints, financial constraints must be defined first. The most complete and most correct definition in this case is thatwhen companies are faced with a gap between internal and external costs of allocated funds, they are in the range of financing.From among the main reasons for the differences between internal and external financing costs, asymmetric information and agency problems can be named. In the case of information asymmetry, investors have little information about the status of companies' capital projects; therefore, in order to invest in such companies, they demand a higher rate of return. Agency problems can cause distrust between managers, and investors demand a higher rate of return for financing the investment projects they charge.Based on the abovementioned issues, it can be argued that companies suffering from serious failure related to the capital market rely more on domestic sources in order to finance their investment projects (Haqiqat, 2013).

Based on this idea, Fazzary et al. (1988) introduced an index called "investment cash flow sensitivity." This index is defined as measuring the rate of change in capital expenditure of company in exchange for a unit change in cash flow. Accordingly, the higher the sensitivity of investment spending to corporate cash flows is, the more reliance the company has on its domestic resources; therefore, it suffers from higher financial limitations. In addition, according to this index, in the case of companies that suffer from serious capital market imperfections, there is a higher sensitivity of investment cash flow (Mohammadi, 2013).

Managers have a critical role in organizational dynamics. They provide the possibility of allowing flexibility and responsiveness to environmental changes, pave the way for the coordination of different group activities in the organization, satisfy individual needs, and facilitate organizational membership. Philosophy of management is inextricably linked with decision-making and,with a little thought, we find that managers donot do anything except decision-making.In a sense, all actions of a manager are mixed with decision. In addition to decision-making, managers have features and characteristics that their crystallization in management distinguishes managers from employees who are under their supervision. These characteristics and features can be divided generally and specifically (Sadidi, 2014).

The first question that arises here thatwe are looking for an answer to it in this study is whether there is a significant relationship between the characteristics of chief executive officer and investment cash flow sensitivity.

Organization for Economic Development (1998) defines corporate governance as: "complex relationships between management (executive), board of directors, shareholders and other relevant parties in a company." In other words, corporate governance specifies a structure through which company objectives are set, methods to achieve goals are determined, and, finally, criteria and mechanisms of supervision and performance guidance are identified (Asgari, 2014). Regardless of the legal framework, ownership structure of companies can also affect the creation and development of the model of corporate governance.Ownership structure has two dimensions: the ownership concentration and identity of shareholders. Shareholders are the owners of the company who assign business operations on behalf of themselves to managers that may result in the conflict of interest. UK and America have a large number of Public Joint Stock Companies which have widely dispersed ownership in most cases and shareholders have little impact on the company's management, and they are almost identical in terms of stock ownership structure;while in the countries that are the origin and source of civil law, such as Japan and Germany, they have concentrated ownership structure in most cases. Dispersed ownership structure leads to faster agency problems. According to Solomon, separation of the role of chief officer (chairman) and executive director is one of the ways to reduce the agency problems. In addition, the study of Peel and Aodnel (1995) confirms this issue and shows that, because of more independent managers' decisions, companies that have such a breakdown, their financial performance has been better. Thus, with the inclusion of recommendations on the roles of chief officer and executive director by separate entities in the Combined Corporate Governance Code, UK seeks to reduce agency problems. Similarly, Canada seeks to strengthen shareholders'control on managers of the company by applying the same procedures and breakdown of responsibilities at the head of the company. In contrast, Daily and Dalton (1997) found no significant positive correlation between company's performance and duty division of chief officers and executive directors. Accordingly, the Sarbanes–Oxley Act considered the possibility of running both roles as practical even though the ownership structure of shareholders in America is highly fragmented.Because countries with civil law have a weaker support of investors, ownership concentration is higher in these countries; therefore, in a company with a relatively concentrated ownership structure, conflict of interests is created between major shareholders and minority shareholders. Conversely, in countries with common law, the rights of investors are protected more effectively and, thus, ownership can be widely distributed (Isfahan Portal). Now, the second question that can be raised here is that "is there any significant relationship between company ownership and investment cash flow sensitivity?"

The hardest step in any research process is to identify the problem being studied. First, there should be an obstacle or an unclear doubt about one thing, doubt that needs to be determined.In any study, the type, nature, objectives, and its scope should be determined first so that it would be possible to achieve reality by using proper rules and tools and finding valid methods. Accordingly, this study is applied in terms of orientation and is descriptive in terms of purpose. Applied research is a research the results of which can be applied to meet needs and solve problems; therefore,the purpose of this type of research is to apply it in solving specific problems in the community. Descriptive research includes a set of methods aiming at describing the conditions or phenomena under investigation. Conducting descriptive research can help in the better understanding of current situation or the decision-making process. Because this study used previous information in order to explore the relationship between variables, it is classified as causal-comparative research. In a causal-comparative research, data are collected and analyzed from an environment that existed in a natural way or from the past events that occurred without the interference of researcher's system; thus, there is not the possibility of manipulating variables. In this study, each of the data of the independent variables of the study was obtained and then the dependent variable was obtained based on thequestionnaires from thecollected samples.In the next stage, research hypotheses about the relationship between each of the characteristics of the company's board of directors and characteristics of the audit committee with the auditors' demands for non-audit services was assessed using linear regression models.

This study raised the issue in a way that it can be explored scientifically, and its measurement and testing will be possible, and it has its scientific value. The points that are considered in this research are as follows:

1. Explaining the main terms

2. Expressing the problem

3. Expressing the hypotheses

4. The tools used in the study

5. The importance of the research topic

Accordingly, the main research question is:

Is there any significant relationship between the characteristics of chief executive officer and company ownership with investment cash flow sensitivity?

Hypothesis is the researcher's solution to address the problem. That's why developing a proper hypothesis depends on how the problem is expressed and the roots of a suitable hypothesis are merged with expressing a problem. Hypothesis is a hypothetical proposition which itsconfirmation or rejection is tested based on concept consistency using empirical evidence and knowledge of the past.

The importance of a given hypothesis is judged in connection with its efficiency in the issue. However, judgment about developed hypothesis requires the determination of the criterion or criteria that evaluate features of a hypothesis.

According to the abovementioned issued the following hypothesis can be raised:

1. There is a significant relationship between the characteristics of chief executive officer and investment cash flow sensitivity.

2. There is a significant relationship between company ownership and investment cash flow sensitivity.

This study explores the sensitivity of changes in external financing sources of the company in relation to changes in the cash flows under financial constraints and the economic crisis in listed companies of Tehran Stock Exchange. Accordingly, research hypotheses about the relationship between each of the components of internal cash resources with sensitivity to financing changes will be evaluated using linear regression. In order to test the first and second hypothesis, the following formula was used (Ben Muhammad, et al., 2014):

=investment cash flow sensitivity

= constant value

=

=company's growth opportunities

=net cash flows from operating activities to total assets ratio

=management optimism

=ownership concentration

=company size

=company's financial leverage

=error term

Research variables

The most important and useful way to classify variables is dividing them into independent and dependent variables. Because of the general applicability, simplicity and importance in conceptualizing and planning as well as reporting the results, this type of classificationis very useful.

Dependent variable

Investment cash flow sensitivity (I)

This index is defined as measuring the rate of change in capital expenditures by companies in exchange for a unit change in operating cash flow which is calculated as follows:

Independent variables

Independent variable is a variable through which dependent variable can be predicted. This variable is measured, manipulated or selected by the researcher so that its relationship with or its effect on other variables can be measured.

Management optimism

It is a dummy variable. If executive directors have this condition, they receive number one; otherwise, they receive zero number. To calculate it, the average net purchases of industrial materials is calculated and, then, it is compared with the net purchases of the sample manufacturing companies. If the net purchase of the company is higher than the average, number 1 is attributed to it (manager is optimistic); if it is less than the average, number zero is attributed to it (manager is not optimistic).

Ownership concentration

It refers to share distribution among shareholders of various companies. As the number of shareholders reduces, ownership will be more concentrated. In this study, in order to calculate the ratio of ownership concentration, the Herfindahl-Hirschman index (HHI) was used. This index is obtained from the sum of squared percentage of shares owned by the shareholders of the company. This index is increased in parallel with the increased concentration of ownership, and in situations where the stock is owned by one person, it allocates most of the value to itself and is calculated equivalent to 10,000 units. If the ownership structure is dispersed and all shareholders have equal ratios, HHI find the least valueand is calculated equivalent to N/10,000. Herfindahl index can be calculated as follows (Mohammadi, Qalibaf Asl, & Meshki, 2010).

Control variable

Company's growth opportunity (QTobin)

This proportion is used as a measure of value. The mentioned ratio can be calculated by dividing the market value of assets into their final replaced cost which can be calculated as follows:

=the market value of equity

=book value of debts

=. book value of assets

Net cash flows from operating activities to total assets ratio (CF)

Company size

Company size is calculated through natural logarithm of total assets as follows:

Company's financial leverage

It is obtained by dividing total debt (TL) into total asset (TA) of the company which formula is as follows:

To determine the specific sample in this study, companies that their data was available were used. The statistical sample was selected from the companies listed in Tehran Stock Exchange which had all the following conditions:

1. Companies that had activities in Tehran Stock Exchange and the data related to them were available from2010 to 2014.

2. Companies that their stock had been traded in the exchange from 2010 to 2014 and their symbolwill have not been removed from the exchange board by the end of the fiscal year of 2014.

3. The fiscal year ended on March of each year.

4. Companies do not lose money in these years.

5. Companies that their symbol had not a trading delay more than 6 month.

6. The companies should not be banks, financial institutions, insurance companies, holding, investors, andthe like.

7. The companies should be manufacturing.

According to the abovementioned terms, 74 companies listed on the Tehran Stock Exchange, whose information was disclosed, were selected and their financial statements were examined. Therefore, according to table (1), 74 companies were selected as sample.

Table 1. The number of companies being studied

| Number | Explanation |

| 317 | The initial number |

| - 58 | Investment and holding companies |

| - 66 | The companies that are not leading up to 29/12 |

| - 48 | Companies that lose money |

| - 13 | Companies that their data was not available |

| - 58 | Companies that did not purchase raw materials |

| 74 | Companies being studies |

The first step in any statistical and data analysis is the calculation of descriptive indices. Therefore, in order to start data analysis, descriptive statistics of data including central tendency, dispersion and deviations from symmetry and also Jarque and Bera test checks for normally distributed residuals were calculated, and the results are shown in the following table.

Table 2. Introduction and separation of the symbols used for the variables of the model

| Row | Variable symbol | Variable name | Variable type |

| 1 | I | Investment cash flow sensitivity | Dependent |

| 2 | OPTIMISM | Management optimism | Independent |

| 3 | OWNER | Ownership concentration | Independent |

| 4 | CF | The ratio of net cash flows | Control |

| 5 | QTobin | Company's growth opportunity | Control |

| 6 | SIZE | Company size | Control |

| 7 | LEV | Company's financial leverage | Control |

Table 3. Descriptive statistics of variables before normalization

| LEV | SIZE | OWNER | OPTIMISM | CF | QTobin | I | |

| 0/59 | 6/025 | 4080/897 | 0/5 | 0/1354 | 1/841 | 7/2 | Mean |

| 0/603 | 5/964 | 3782 | 0/5 | 0/114 | 1/576 | 0/051 | Median |

| 1/009 | 7/817 | 9218 | 1 | 0/558 | 15/851 | 2470/07 | Maximum |

| 0/048 | 4/441 | 1246 | 0 | -0/298 | 0/864 | - 25/618 | Minimum |

| 0/16 | 0/533 | 1817/071 | 0/5 | 0/129 | 1/104 | 128/53 | Standard deviation |

| -0/41 | 0/544 | 1/0646 | 0 | 0/496 | 6/484 | 19/094 | Skewness |

| 3/159 | 4/144 | 3/812 | 1 | 3/371 | 73/929 | 366/653 | Elongation |

| 10/741 | 38/409 | 80/066 | 61/667 | 23/397 | 80151/94 | 2057871 | Jarque-Bera |

| 0/005 | 0/000 | 0/000 | 0/000 | 0/000 | 0/000 | 0/000 | The statistics probability |

| 370 | 370 | 370 | 370 | 370 | 370 | 370 | Total data |

| 74 | 74 | 74 | 74 | 74 | 74 | 74 | Section |

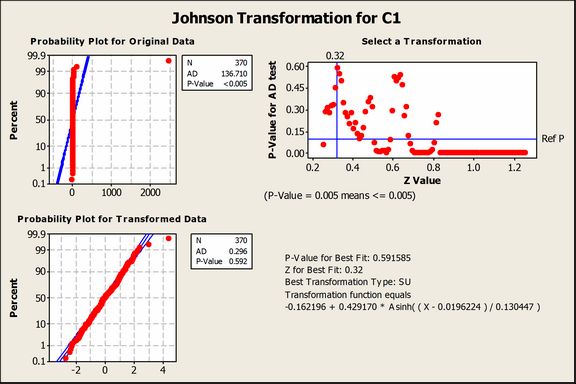

Given that the probability of Jarque-Bera statistics for the dependent variable is less than 5%, H0 hypothesis is rejected based on the normality of the error term and the dependent variable. To normalize, Johnson transformation in the MINITAB software was used; the dependent variable transfer function is provided in the diagram (1).

Diagram 1. Johnson transformation normality test for the dependent variable I

As can be seen in the diagram (1), the dependent variable of the study was not normal at first. After doing Johnson transformation, the dependent variable became normal. In an abnormal mode, the probability of Jarque-Bera statistics was not at the significant level of 95% (p-value<0.05 ( , but, after doing Johnson transformation test, the probability of this statistics was at the significant level of 95% (p-value<0.05 ( .

In this section of the study, after entering data into the software and initial estimates of parameters, the presence or absence of a separate y-intercept for each of the companies should be examined. At first, F-Limer test should be examined and chosen between fixed or random effects in which H0 hypothesis, the same y-intercept (Pool), is in contrast with H1 hypothesis, inconsistency of y-intercept (Panel).In the Eviews 8 software, after testing the effect of fixed effects, if the probability of the output statistics of the software is less than 0/05, the panel method is accepted at the level higher than 95 percent; but if it is greater than 0/05, the pooled method is accepted.

Chow test or structural changes test related to the hypotheses (F-Limer)

Table 4. Chow test output

| Test Summary | Statistics | Degrees of freedom | The statistics probability |

| Section F | 2/561 | 73,290 | 0/000 |

As can be seen, the statistics probability is less than 0/05. Therefore, regression has a different y-intercept; that is, y-intercepts are not alike. Thus, model is accepted with the panel data.

H0 = There is no correlation between individual effects and explanatory variables Random effects model

H1 = There is a correlation between individual effects and explanatory variables Fixed effects model

Table 5. Results of Hausman test

| Test Summary | Statistics | Degrees of freedom | The statistics probability |

| Hausman | 9/617 | 6 | 0/0474 |

As it is evident in the above table, regarding the significant level which is less than 0/05, H1 hypothesis is accepted and the fixed effects model is selected as the preferred model for research hypotheses at this stage.

1. There is a significant relationship between the characteristics of the chief executive officer and investment cash flow sensitivity.

2. There is a significant relationship between company ownership and investment cash flow sensitivity.

Table 6. The results of estimating the model of the first main hypothesis

| Statistics probability | t statistics | Standard deviation | coefficient | Variable name |

| 0/9133 | 0/109 | 0/26 | 0/028 | C |

| 0/0029 | 3/0169 | 0/01 | 0/027 | Q |

| 0/000 | 7/044 | 0/131 | 0/921 | CF |

| 0/0042 | 2/895 | 0/099 | - 0/288 | OPTIMISM |

| 0/0465 | - 2/002 | -5/68 | - 0/001 | Owner |

| 0/0027 | 3/029 | 0/241 | 0/730 | Lev |

| 0/000 | -9/029 | 0/04 | - 0/358 | AR (1) |

| 5/308 | F statistics | 0/536 | Adjusted | |

| 2/41 | Durbin Watson | 0/000 | F significant level | |

As can be seen in the above table, considering F statistics, it can be said that the above regression model is significant. And the Durbin-Watson statistic is equal to 2,41 after the arrival of the self-return at the first time and the value of this statistic becomes suitable and showed no correlation between model components. The adjusted coefficient of determination of the model indicates that the model variables have the explanatory power (54 percent) in order to explain the dependent variable. According to the probability statistics of management optimism (OPTIMISM) that is less than 0.05, it can be said that there is a significant negative relationship between the characteristics of the chief executive officer and investment cash flow sensitivity with a 95% margin of error, and hypothesis H0 is accepted. Moreover, considering the probability statistics of ownership concentration that is less than 0.05, it can be stated that there is a significant negative relationship between company ownership and investment cash flow sensitivity with a 95% margin of error, and hypothesis H0 is accepted.

In this section, the results of testing the research hypotheses are generally reflected in the following table.

Table 7. Summary of the general results of the study

| Hypothesis | Research hypotheses | Results |

| 1 | There is a significant relationship between the characteristics of the chief executive officer and investment cash flow sensitivity | Accepted |

| 2 | There is a significant relationship between company ownership and investment cash flow sensitivity. | Accepted |

Testing the first research hypothesis showed a significant negative relationship between the characteristics of the chief executive officer and investment cash flow sensitivity. In addition, testing the second hypothesis indicated a significant negative relationship between company ownership and investment cash flow sensitivity; that is, as management optimism and ownership concentration decrease, investment cash flow sensitivity increase. The findings of the study are consistent with the findings of Ben Muhammad et al. (2014) who believe that management bias can explain investment policies in large companies and can change the cash.

According to the terms of variables, the possibility of doing research on all companies was not possible and so this issue tends to reduce the number of the samples, and generalizing the results to other enterprises should be done with cautious.

Since managers tend to indulge in the use of internal funds, they act with greater sensitivity regarding investment decisions and capital expenditures. For example, it is better to invest more in the purchase of raw and related production materials. In addition, because ownership concentration or stock distribution has a significant effect on the investment sensitivity, it is better that stock be distributed among fewer individuals.

Table 8. Descriptive statistics of the variables after normalizing

| LEV | SIZE | OWNER | OPTIMISM | CF | QTobin | I | |

| 0/59 | 6/025 | 4080/897 | 0/5 | 0/1354 | 1/841 | -0/013 | Mean |

| 0/603 | 5/964 | 3782 | 0/5 | 0/114 | 1/576 | -0/061 | Median |

| 1/009 | 7/817 | 9218 | 1 | 0/558 | 15/851 | 4/362 | Maximum |

| 0/048 | 4/441 | 1246 | 0 | -0/298 | 0/864 | -2/726 | Minimum |

| 0/16 | 0/533 | 1817/071 | 0/5 | 0/129 | 1/104 | 1 | Standard deviation |

| -0/41 | 0/544 | 1/0646 | 0 | 0/496 | 6/484 | 0/179 | Skewness |

| 3/159 | 4/144 | 3/812 | 1 | 3/371 | 73/929 | 3/484 | Elongation |

| 10/741 | 38/409 | 80/066 | 61/667 | 23/397 | 80151/94 | 5/598 | Jarque-Bera |

| 0/005 | 0/000 | 0/000 | 0/000 | 0/000 | 0/000 | 0/061 | The statistics probability |

| 370 | 370 | 370 | 370 | 370 | 370 | 370 | Total data |

| 74 | 74 | 74 | 74 | 74 | 74 | 74 | Section |

The nature of scientific research is continuous and diverse. Perhaps this sentence that in order to reach results, there are thousands of untested methods in scientific approach is not far from reality. Therefore, based on this reality, the following suggestions are presented below:

ü It is suggested that this type of research be conducted in various industries and then the results be compared in these industries.

ü Regarding the importance of investment sensitivity and its effect on the operating cash flow, it seems that further studies could reveal new dimensions of the matter and boost literature in this area. Research on different aspects of this subject is suggested to future researchers.

ü Using other methods to calculate the variables of the study, such as the independent variable of management optimism using the interest prediction rate per share and the independent variable of ownership concentration using Tower index, is suggested.

ü There are various methods to calculate the index of ownership concentration, such as total stock of real and legal entities who hold more than 10% of shares (Tower, 2006), but this study used the Herfindahl-Hirschman index.

ü To calculate the size variable, the natural logarithm of market capitalization can be used, but, in this study, with the assumption of reevaluation in the companies being studied, the natural logarithm of the book value of assets was used based on Base article.

Almeida, H., Campello, M., Weisbach M.S., 2004. The cash flow sensitivity of cash. Journal of Financial . No 59,1777– 1804

Asgar, A. A. (2014). Exploring the relationship between investment structure with ownership structure and corporate diversification. Master's thesis, Azad University of Rasht.

Fazzary, s, hubbard, R,G,& Petersen, B.(1988).Financing constraints and corporate investment.

Haqiqat, H. & Zargar Fayuji, Y. (2013). The impact of financial constraints and held cash on the sensitivity of investment to cash flow. Applied research on financial reporting, 2nd year, No. 3. Autumn and winter 2014.

Mohammadi, Sh., Ghalibaf Asl, H., & Meshki, M. (2010). Exploring the effect of ownership structure (concentration and composition) on the performance and value of companies listed on the Tehran Stock Exchange. Financial research, Vol. 11, Issue 28, pp. 69-88.

Sadidi, M. & Mohammadi, A. (2014). On the relationship between investment cash flow sensitivity with the level of investment spending. Experimental Studies Quarterly of Financial Accounting, eleventh year, spring, No. 41.