|

Gnyana Ranjan Bal Assistant Professor Department of Commerce Guru Ghasidas Vishwavidyalaya Bilaspur, Chhattisgarh-495009 Contact No.- +91-8109875791 Email: gnyana.friend@gmail.com |

Dr. Budheshwar Prasad Singhraul Assistant Professor Department of Commerce Guru Ghasidas Vishwavidyalaya, Bilaspur, C.G. |

The study attempts to test the random walk behaviour and weak form efficiency of foreign exchange market. For this purpose two exchange rates namely USD and YEN has been selected from April 2007 to Mar 2015. We have applied the Unit root and Variance ratio test to study the random walk hypothesis. The findings shows the both the exchange rates do not exhibit the random walk. Thus implies weak form of market inefficient. Further to analyze the volatility clustering and persistence we have employed GARCH (1, 1). The results show there is evidence of volatility clustering and persistence in case of both the exchange rates. This type of study is highly relevant, as the healthy functioning of foreign exchange market can lead to high economic growth.

Keywords: Efficient Market Hypothesis, Volatility, Foreign Exchange Market, GARCH (1,1)

In the past few decades the area of market efficiency has received a significant attention of the both researchers and academicians all over the world. Generally as per efficient market hypothesis, the past informationcannot be utilized to predict the future returns in an efficient market. In other words the past information are already been reflected in present prices. The efficient market hypothesis can be three typessuch as weak form of efficiency, Semi-strong and strong form of market efficiency (Fama, 1970). Weak form of efficiency means the past prices related information is useless i.e. the current price reflectsthe entire past price information. In semi-strong form of efficiency the present price reflects all past price related information as well as publically available information. The strong form of market efficiency means the current prices reflect all the public as well as non public information. In other word all the information are useless even if the insider trading information. So nobody can make excess or speculative profit in long run.

However, the past studies have given mixed evidence in the context of market efficiency in both stock and foreign exchange market. Like Barnes (1986) has shown evidence of weak form of market efficiency in case of Kuala Lumpur stock exchange. In another study Sharma and Seth (2011) haveanalyzed the impact of global financial crisis on market efficiency. The study has taken both NSE and BSE in two sub-periods (Pre and Post crisis). They did not find evidence of weak form efficiency of Indian stock market. Also the study concluded that the results are similar in both the period,so there is no impact of financial crisis on market efficiency. Arora(2013) has tested the weak form of market efficiency and random walk of Indian stock market. By taking the Nifty returns the study conclude that Indian market rejects the weak form of market efficient hypothesis.Chen (2008) has applied variance ratio test to study the random walk hypothesis of Euro exchange rate. By taking the sample from January 1998 to July 2008 the study conclude that Random walk cannot be rejected, thus the euro exchange rate shows weak form of efficiency. Li and Liu (2012) have studied the random walk in case of 34 MSCI country index. The study concluded that majority of country are in weak form of efficient. Charles and Darne(2009) studied the random walk behavior of major Euro exchange rate. By applying Variance ratio test the study conclude that exchange rates for major trading countries (such as Australia, Canada,Korea, Japan,New Zealand, UK,USA, and Switzerland) follow a random walk hypothesis in case both daily and weekly frequency data. But their findings are different for non major trading currencies especially for Swedish Kroner. In overall among similar studies in Indian market Rao and Shankaraiah (2003), Samanta (2004) and Sharma andMahendru (2009) have supported weak form of efficiency. While the studies like Guptaand Basu (2007),Choudhari (1991), Sharma and Seth (2011) and Arora (2013) have rejected the random walk of market.

The past literature shows that many of the studies have focused on the efficiency of stock market, while very few studies have been made on foreign exchange market. The present study attempts to test the random walk hypothesis and weak form efficiency of foreign exchange market. We have selected two exchange rates such as USD a nd YEN to study the random walk behavior of foreign exchange market. In addition to this the study also analyses the volatility clustering and persistence of the foreign exchange market.

Two exchange rates namely USD and YEN has been taken for the purpose of analysis. The study period ranges from April, 2007 to March, 2015. The common samples in case of all the exchange rates have been selected to make it standardized. The returns in case of both the exchange rates i.e. USDR and YENR have been calculated as Ln (Pt/Pt-1), here Pt price at t period and Pt-1 price at t-1 period and Ln natural log. The methodology of the study can explained as follows.

1. Unit root Test

The stationarity is one of the underlying tests to study the random walk hypothesis. Stationarity of the data means the mean and variance are constant over the period of time; that means they are time invariant. In case of non-stationary the series will have time varying mean and variance. This non-stationarity can be referred as unit root problem. The random walk of exchange rates can be written as follows:

(1)

Here is exchange rate at t period, and exchange

rates at t-1 period, is a white noise error term. We know that a

series will be said to be random walk if value at t period is equal to its

value at t-1 period plus a random shock. In the equation (1), if ρ is significantly equal to 1,

then the stochastic variable is said to be having unit root.

In other case if then series can be said as stationary and does not follow a random

walk. The Unit root has been tested in the basis of Augmented Dickey Fuller

(ADF) and Phillips-Perron (PP).The ADF test consists of the following

regression:

Here

is pure white noise error term and, in ADF we test whether. Similariliy in Phillips-Perron use non-parametric statistical methods

to take care the serial correlations in the error terms without adding lagged

difference terms.

2. Variance Ratio Test

The variance ratio test of Lo and MacKinlay (1988) is based on the fact that if a series follows a random walk in a finite sample then the variance increment is linear in its data interval. The stochastic process with drift can be as follows:

Here is the drift parameter, and expected value of error is zero. The restrictions in this imply, error will grow linearly with time. The Variance Ratio VR (q) can be defined as:

VR (q) = (4)

Where is times the variance of - and is the variance of

The null hypothesis is that a time series or its first difference follows a martingale difference sequence.

3. Volatility clustering and Spillover

We uses the ARCH family models ARCH (Engel, 1982) and GARCH of Bollerslev (1986) to study the volatility clustering and persistence. In the context of volatility standard deviation is one of traditional crude measure of variance to assess unconditional variance. While the GARCH is estimated to measure conditional variance. The equation of GARCH model will be as follows assuming Exchange rate can be represented by AR(1) process.

, (5)

In above equation (5) is the intercept, exchange rate respectively in t-1 period. Similarly is the white noise error term of exchange rate.

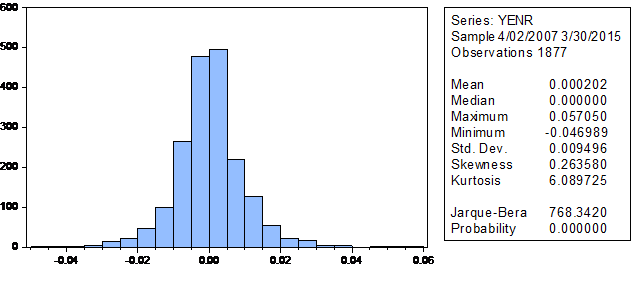

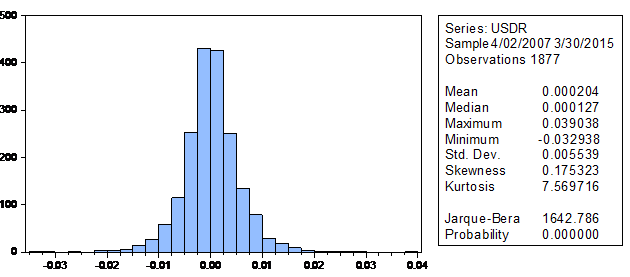

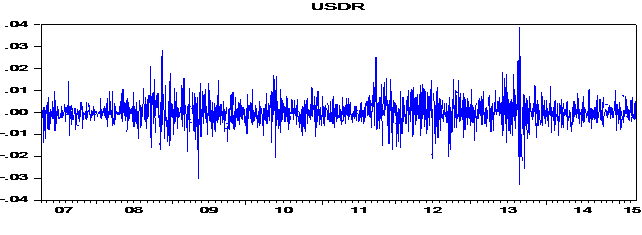

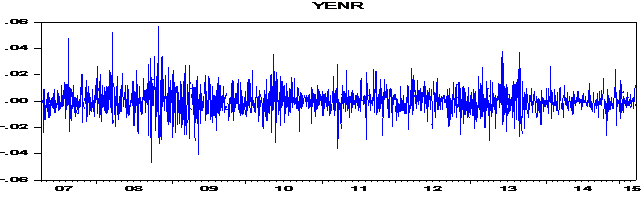

The figure-1 and figure-2 shows the descriptive statistics of USDR and YENR respectively. We can see that the mean of USDR is 0.000204 and Median is 0.000127. While the mean of YENR is 0.000202, so it means the average return of USDR is more as compared to YENR. The standard deviation of USDR is 0.005539 and YENR is 0.009496. The standard deviation of YENR is greater than as of USDR, it indicates the YENR is more volatile as compared to USDR. Both the USDR and YENR are positively skewed in the sample period. Further to study the normalityJarque-bera has been tested. In case both the exchange rates the Prob. is 0.0000 i.e. significant at 1% level. So the null hypothesis of normality has been rejected, that is data are highly non-normal. Figure 3 and 4 shows the plot of return both the exchange rates namely USDR and YENR. It can be observed that these exchange rates exhibit some sort of volatility clustering.

Figure-1 Histogram and Descriptive Statistics of USDR

Figure-2 Histogram and Descriptive Statistics of YENR/b<>

Figure 3: Plot of USDR

Figure 4: Plot of YENR

1. ADF and PP test:

To test the stationarity of data, unit root test has been applied in basis of ADF and PP. As already been discussed stationarity means the series does not contain unit root. The table 1 shows the results of Unit root test on basis of ADF. The results shows that t-statistics is more than the critical value. It indicates statistically significant, so the null hypothesisof non-stationarity has been rejected. The USDR does not follow a random walk. The result is similar in case of YENR, where also the null hypothesis has been rejected. So YENR is stationary at level. Further the stationary has been checked on the basis of PP. The does not vary as compared to ADF (see Table 2). Both the USDR and YENR are stationary at level as the null hypothesis of non-stationarity has been rejected. Thus the random walk hypothesis has been rejected in case of both the exchange rates. This implies weak form inefficient of these exchange rates.

Table 1: Augmented Dickey Fuller test

| Variable | t –Statistics | Prob. |

| USDR | -31.61995*** | 0.0000 |

| YENR | -42.31176*** | 0.0000 |

***indicates significant @1% level

Table 2: Phillips-Perron Test

| Variable | Adj. t-statistics | Prob. |

| USDR | -40.78202*** | 0.0000 |

| YENR | -42.30943*** | 0.0000 |

***indicates significant @1% level

2. Variance Ratio Test

Further to verify the random walk hypothesis the conventional variance test (Lo-Mackinlay, 1988) and the sign and rank test (Wright, 2000) have been applied. The results of USDR have shown in table 3. We can see that the all the variance ratios at different horizon of period are statistically significant. Thus the null hypothesis has been rejected. It shows USDR exhibitnon-random walk. Thus USDR is weak form of inefficient, as earlier been observed in Unit root test.

Table 3 Variance Ratio of USDR

| Variance Ratio of USDR | |||

| Period | Var. Ratio | Rank Var. Ratio | Sign Var. Ratio |

| 2 | 0.567421*** | 0.565437 *** | 0.688699 *** |

| 4 | 0.248658 *** | 0.304772 *** | 0.517591 *** |

| 8 | 0.135856 *** | 0.197216 *** | 0.448294 *** |

| 16 | 0.068313 *** | 0.146277 *** | 0.411381 *** |

***indicates significant @1% level

The results of YENR have shown in table 4. We can see that at different lag all the variance ratios are statistically significant. Thus the null hypothesis has been rejected. It shows YENR exhibitnon-random walk. Thus YENR is weak form of inefficient, as earlier been observed in Unit root test. The similar results have been observed in case of USDR in previous table.

Table 4 Variance Ratio of YENR

| Variance Ratio of YENR | |||

| Period | Var. Ratio | Rank Var. Ratio | Sign Var. Ratio |

| 2 | 0.524906 *** | 0.576886 *** | 0.703625 *** |

| 4 | 0.250479 *** | 0.312084 *** | 0.529318 *** |

| 8 | 0.129252 *** | 0.185763 *** | 0.453891 *** |

| 16 | 0.066379 *** | 0.141602 *** | 0.418577 *** |

***indicates significant @1% level

3. Volatility Clustering and Persistence

Further our study applies the GARCH (1, 1) model to study the volatility of two exchange rates. The results are presented in the following table 5 and 6 for both USDR and YENR respectively. The results in table 5 signifythe coefficients of lagged squared residuals and conditional variances are statistically significant. And also the aggregate of this two is near to 1, so there is presence of both volatility clustering and persistence in USDR. The GARCH (1, 1) results of YENR are presented in table 6. The similar results also observed in case of YENR. The aggregate of lagged squared residuals and conditional variances are near to 1 and both are statistically significant. So there is a presence of volatility persistence.

Table 5: GARCH(1, 1) of USDR

| GARCH of USDR | |||

| Parameters | Coefficient | Z-stat | P-Value |

| 7.53 | 0.685428 | 0.4931 | |

| 6.00 | 5.491459 | 0.0000 | |

| 0.10123 | 9.658968 | 0.0000 | |

| 0.881305 | 79.15431 | 0.0000 | |

Table 6: GARCH (1, 1) of YENR

| GARCH of YENR | |||

| Parameters | Coefficient | Z-stat | P-Value |

| -0.00013 | -0.69389 | 0.4878 | |

| 3.40 | 5.059509 | 0.0000 | |

| 0.109688 | 8.689931 | 0.0000 | |

| 0.853594 | 49.16145 | 0.0000 | |

The studies in the context of weak form of market are highly relevant with regards to usefulness of the past information that is typically used in technical analysis, speculation and arbitrage phenomenon. Also from the regulatory point of view this type of study has significant implications, as the market inefficiency ensures the efficient and optimal allocation of capital, savings and investment of the economy. This is highly essential for a healthy economy growth.Our study concludes that the foreign exchange market does not exhibit a random walk, so weak form of market inefficient. So the usefulness of past information cannot be completely rejected. As in inefficient market the future price can be predicted, one can earn abnormal returns. This type of inefficiency may attract the investors in short run because of excess return but in long run disturb the pricing phenomenon. As the current price may not reflect all the past information’s, and lead to over and under valuation.

Armeanu, D. S., & CioacĂ, S. (2014). Testing the Efficient Market Hypothesis on the Romanian Capital Market. Proceedings of The 8th International Management Conference “Management Challenges For Sustainable Development”, November 6th -7th , 2014, Bucharest, Romania Testing.

Arora, H. (2013). Testing Weak Form of Efficiency of Indian Stock Market. Pacific Business Review International, 5(12), 16–23.

Barnes, P. (1986). Thin Trading and Stock Market Efficiency: Case Study of the Kuala Lumpur Stock Exchange. Journal of Business Finance & Accounting, 13(4), 609-617.

Bollerslev, T. (1986).Generalized Autoregressive Conditional Heteroskedasticity, Journal of Econometrics, 31,307--327.

Brooks, Chris(2008). .Introductory Econometrics for Finance. Cambridge university press.

Charles, A., & Darné, O. (2009). Testing For Random Walk Behavior In Euro Exchange Rates. Économie Internationale, 119, 25–45.

Chen, J. (2008). Variance Ratio Tests Of Random Walk Hypothesis Of The Euro Exchange Rate. International Business & Economic Research Journal, 7(12), 97–106.

Chinhamu, K., & Chikobvu, D. (2014). A Garch Model Test of the Random Walk Hypothesis: Empirical Evidence from the Platinum Market. MJSS. http://dx.doi.org/10.5901/mjss.2014.v5n14p77.

Choudhari, S.K. (1991). Short Run Price Behaviour: New Evidence on Weak Form of Market Efficiency. Vikalpa, 16(4), 17-21.

Dickey, D. A.; Fuller, W. A. (1979). Distribution of the Estimators for Autoregressive Time Series with a Unit Root. Journal of the American Statistical Association, 74 (366): 427–431.doi:10.2307/2286348. JSTOR 2286348.

Enders, W. (2008). Applied Econometric Time Series. Wiley, New Delhi.

Engel RF (1982). Auto regressive conditional heteroskedasticityand estimates of the variance of UK inflation. Econometrica50(4):987–1008.

Fama, E. (1965), Random Walks in Stock Market Prices, Financial Analyst Journal, 21(5), 55-59.

Fama, E. (1970), Efficient Capital Markets: A Review of Theory and Empirical Work, Journal of Finance, 25(2), 383-417.

Fama, E. (1991), Efficient Market Hypothesis: II, Journal of Finance, 46(5), 1515-1617.

Gupta, R. and Basu, P.K. (2007). Weak Form Efficiency in Indian Stock Markets. International Business & EconomicsResearch Journal, 6(3), 57-64.

Harrison, B. (2007). Do fat tails matter in GARCH estimation: testing market efficiency in two transition economies. Economic Issues, 12(Part-2), 15–27. Retrieved from http://www.economicissues.org.uk/Files/207Harrison.pdf

Jain, Kapil and Jain, P. (2013). Empirical Study of the Weak Form of EMH on Indian Stock Market. International Journal of Management and Social Science Research, 2(11), 52–59.

Li, B., & Liu, B. (2012). A Variance-Ratio Test of Random Walk in International Stock Markets. The Empirical Economic Letters, 11(8).

Lo, A.W. and Mackinlay, A.C. (1988). Stock Market Prices Do Not Follow Random Walks: Evidence from a Simple Specification Test. Review of Financial Studies, 1(1), 41-66.

Nisar, S. & Hanif, M. (2012). Testing Weak Form of Efficient Market hypothesis: Empirical Evidence from South Asia. World Applied Science Journal, 17 (4), 414-427.

Phillips, P. C. B.; Perron, P. (1988). Testing for a Unit Root in Time Series Regression. Biometrika, 75 (2): 335–346. doi:10.1093/biomet/75.2.335.

Rao, D.N. and Shankaraiah, K. (2003). Stock Market Efficiency and Strategies for Developing GCC Financial Markets: A Case Study of the Bahrain Stock Market. The Arab Bank Review, 5(2), 16-21.

Samanta, G.P. (2004). Evolving Weak-Form Informational Efficiency of Indian Stock Market, Journal of Quantitative Economics, 2(1), 66-75.

Sekar, P. C., & Arasu, B. S. (2007). Indian stock market efficiency before and after the introduction of derivatives, Journal of Contemporary Research in Management(1), 139–154.

Sharma A.K. and Seth N. (2011), Recent Financial Crisis and Market Efficiency: An Empirical Analysis of Indian Stock Market, Indore Management Journal, 2 (4), 27-39.

Sharma, G.D. and Mahendru, M. (2009). Efficiency Hypothesis of the Stock Markets: A Case of Indian Securities. International Journal of Business and Management, 4(3), 136-144.

Singh, B.-P., & Kumar, B. (2007). Variance Ratio Tests of the Random Walk Hypothesis for Indian Stock Index Futures : Evidence from High Frequency Data, (2002), 3–7. Retrieved from www.nseindia.com/content/press/NS_may2009_1.pdf.

Tiwari, A. K., & Mutascu, M. (2011). Economic Growth and FDI in Asia: A Panel-Data Approach. Economic Analysis and Policy, 41(2), 173–187. http://doi.org/10.1016/S0313-5926(11)50018-9.

Wright, J. H., 2000.Alternative Variance-Ratio Tests Using Ranks and Signs, Journal of Business and Economic Statistics, 18, 1-9.