|

Samreen Akhtar Research Scholar Department of Business Administration Faculty of Management Studies and Research Aligarh Muslim University Aligarh, India Contact No.- +91-9760424645 Email: samreen.rs@amu.ac.in |

Valeed Ahmad Ansari Professor Department of Business Administration Faculty of Management Studies and Research Aligarh Muslim University Aligarh, India |

In this paper, we examine the ability of Indian mutual fund managers to time the market using Treynor and Mazuy model. A successful timing is an endorsement of macro forecasting abilities of investment managers and it also challenges the efficient market hypothesis. The results point out the negative incidence of market timing performance which indicates the unsuccessful market timing abilities of the investment managers in India.

Keywords: Market timing, mutual funds, Treynor and Mazuy model

In view of large investor interest, the performance of mutual fund managers needs continuously evaluated.

The performance studies deal mainly with two aspects: (1) evaluating stock selection skills and (2) examining the market timing abilities of the fund managers. A series of empirical studies deals with the market timing skills of mutual fund managers. Most of the previous work finds little evidence that fund managers possess market timing ability.

Market timing is the strategy wherein attempts are made to predict the future market price movements so as to make buy or sell decisions of financial assets. An outlook of market or economic conditions that result from technical or fundamental analysis may form the basis of these predictions. The outlook of an aggregate market, rather than of a particular financial asset is important for this strategy. Market entry /exit at the right point of time is crucial for the performance of an investment. Superior returns on investment decisions depend on how well a portfolio manager times these decisions. If he is able to predict the future market price movements accurately and times his decisions successfully, he ends up with superior returns. At times, he even fails to predict movements with precision and ends with negative returns(loses). A study of market timing abilities of investment managers is also important as it enables to understand to what he has achieved the desired return targets and to what extent risk has been controlled in the process. He can also know how well he has performed in comparison to other

investment managers or some benchmark index. It also enables the managers to refine the investment decision making by identifying weaknesses in the return generation process. From an academic perspective, the goal of identifying superior fund managers is interesting because it challenges the efficient market hypothesis. In this paper, we examine the ability of mutual fund managers to time the market, that is, to increase a fund’s exposure to market index prior to market advances and to decrease exposure prior to market declines.

Model used

Most of the later studies have essentially used modified versions of the two basic models i.e. Treynor and Mazuy (1966) and Henrikson and Merton (1981). Treynor and Mazuy model has been used to test the market timing abilities of selected fund managers in this study.

Treynor and Mazuy model

Treynor and Mazuy developed an exclusive model to measure investment managers’ market timing abilities. The formula of this model is obtained by adding squared extra return in the excess return version of the CAPM, as given below:

(Rp - Rf) = αp + βp ( Rm – Rf ) + µp ( Rm – Rf )2 + ep

Where,

Rp = return on the fund

Rm = return on the market portfolio

Rf = risk- free rate

ep = random error term

a, b, and µ are parameters of the model

This model involves running a regression for excess investment return as dependent variable and the excess market return as independent variable. The value of coefficient of squared excess market return (µp ) acts as a measure of market timing ability of the fund managers. Significant and positive µp value provides evidence in support of the investment manager’s successful market timing abilities.

Studies have been conducted world over to the investment performance of managed portfolios. A significantly large proportion of these research has pertained to the ex post risk-return relationship. These studies presume investment risk is stationary through time and thus concentrate exclusively on fund managers’ security selection abilities. However, an obvious weakness of this approach is that it is unable to separate the aggressiveness of a fund manager from quality of information he possesses. It is apparent that superior investment performance is not only generated by his ability to forecast the returns on individual assets but also by his ability to time the market correctly. Investment performance on market timing refers to the excess abnormal return earned consequent to the managers’ macro forecasting skills regarding stock market movements. A study of their market timing abilities may help generate inputs to improve managers’ forecasting skills for better timing performance.

In their pioneering work, Treynor and Mazuy (1966) developed a model for testing the market timing abilities of the fund managers and found significant timing ability in only 1 out of 57 funds in their sample.

Fama (1972) suggested a comprehensive mechanism for segregation of observed investment return due to managers’ ability to pick up the best securities at a given level of risk (selectivity) from part that is due to the prediction of general price movements (timing).

Henrikson and Merton (1981) developed another statistical framework for testing timing ability, which was later validated and applied by Henrikson (1984) on a sample of 116 open-end mutual funds for the period 1968-80. He found that only 3 funds out of 116 exhibited significant positive market timing ability.

Kon and Jen (1979) found a large number of funds engaged in the market timing activities, but while extending their analysis, Kon (1983) developed a methodology for measuring the market-timing performance of investment managers and found little evidence that they were successful.

Chang and Lewellen (1984) also tested market timing and security selection skills of the fund managers and found little evidence of both. They employed parametric statistical procedure developed by Henrikson and Merton (1981).

Lee and Rahman (1990) studied market timing and selectivity skills of mutual fund managers by employing simple regression method and found some evidence of both, micro and macro forecasting skills of fund managers.

Ferson and Schadt (1996) state that standard measures of performance designated to detect security selectivity and market timing ability suffer from a number of biases. Most previous work employs traditional performance measures that use unconditional expected returns as a baseline. However, if expected returns and risks vary over time such an unconditional approach is not desirable. Common time variations in returns and risk premia will be confused with average performance.

A growing body of empirical literature shows that the four-factor model captures the major anomalies of Sharpe’s one-factor CAPM. The three additional risk factors may also capture a part of time-varying nature of returns and risk premia as suggested by Ferson and Schadt. Despite the use of high-frequency data as well as a more comprehensive benchmark, the performance results, especially those of market timing, may suffer from Jagannathan and Korajczyk (1986) bias provided the fund returns are more option like compared to the market returns. The correction mechanism involves comparing the timing measures of actual funds with those of synthetic funds where the latter should have no explicit ability by construction.

Goetzmann et al. (2000) argued that monthly frequency might fail to capture the contribution of a manager’s timing abilities to fund returns, because for most of the funds, the decisions regarding market exposures are made more frequently than monthly.

Gupta (2000) used both Treynor and Mazuy , and Henrikson and Merton models to test the market timing abilities of 73 indian mutual fund schemes during 1994-99 and found little evidence of meaningful market timing ability.

Chander (2002) studied portfolio performance attribution in relation to the characteristics- nature, sponsorship, and investment objectives. The study noted that fund managers failed to forecast the market movements correctly. The study observed superior investment performance in private sector sponsored growth funds.

Bollen and Busse (2001) point out that statistical tests used in previous studies are weak as they are based on monthly data. Using daily data, they find evidence of market timing ability in a significant number of funds in their sample.

Chance and Hemler (2001) use daily data to track the allocation strategies of 30 professional fund market timers. They also find significant number of market timers.

Biswadeep Misra (2002) analysed the timing and selectivity skills of Mutual Funds from April 1992 to December 1996 and found that about 25% of the schemes recorded timing skills and 29% registered negative timing ability.

Jow-Rang Chang , Mao- Wei Hung , Cheng-Few Lee(2003) developed a anew performance measure to evaluate fund managers’ hedging ability. According to the new measure, the study found that the sample of 65 U.S. Mutual Funds managers were on an average credited with positive security selection and negative market timing ability.

Nicholas P.B. Bollen and Jeffrey A. Busse (2004) examined the issue of determination in mutual fund performance, emphasizing short measurement period and found no evidence of ability.

Ramesh Chander(2006) studied the market timing abilities of investment managers in the Indian capital market based on the performance outcome of 80 investment schemes from the public and the private sectors for the period 1998 to 2002. The study revisited the market-timing proposition inherited from earlier studies and extended the contour of timing performance to fund characteristics, measurement criteria and benchmark indices to investigate performance variability and persistence. The information inputs were examined through performance

evaluation measures developed by Fama, Treynor and Mazuy, and Henriksson and Merton. The results were unable to generate adequate statistical evidence in support of Indian managers’ successful market timing performance, across measurement criteria, fund characteristics, and benchmark indices. Further, they revealed that successful timers failed to maintain their performance while laggard managers improved upon theirs, thus negating the survivorship bias. These results also point to the success of contrarian investment strategies instead of momentum strategies at the market place.

George J. Jiang,Tong Yao and Tong Yu (2007) implemented new measures of market timing based on mutual fund holdings. The authors found that actively managed U.S. domestic equity funds had positive timing ability in their study period.

Soumya Guha Deb, Ashok Banerjee, and Chakrabarti B.B (2007) said that the Indian Mutual Fund Managers suffered from lack of market timing ability but exhibited stock selection ability under conditional and unconditional models during the study period.

Sehgal(2008) evaluate the performance of selected equity-based mutual funds in India. They examine both the stock selection skills and the timing abilities of the sample fund managers. . The fund managers in India do not seem to possess significant market timing ability when they use monthly data. The results - timing ability, and to some extent stock selectivity - improve when they use daily instead of monthly data as such high frequency data captures market timing in a better fashion. 45% and 28% of their sample funds demonstrate significantly positive market timing coefficients for multi-factor versions of Treynor-Muazy and Henrikson-Merton models respectively on daily files. They argue that multi-factor benchmarks provide better selectivity and timing measures compared to one-factor CAPM as they control for style characteristics such as size, value and momentum. They also try to rectify Jagannathan and Korajczyk (1986) bias by constructing synthetic funds using an estimation procedure different from Bollen and Busse (2001). Their timing results are not an outcome of any spurious statistical phenomenon. They argue that timing skills should be evaluated in a multidimensional framework.

B Phaniswara Raju and K Mallikarjuna Rao (2009) also examined the market timing ability of selected Indian Mutual Fund managers. They find that a majority of selected managers are not seriously engaged in any market timing activities and are relying mainly on stock selection skills.

Edwin J. Elton, Martin J . Gruber, Christopher R. Blake (2011) in their study use monthly holdings to study timing ability. Their data differ from holdings data used in previous studies in that the authors’ data have a higher frequency and include a full range of securities, not just traded equities. Using a one index model, the authors find that management appears to have positive and statistically significant timing ability. When they use multi index model, timing decisions do not result in an increase in performance, whether timing is measured using conditional or unconditional sensitivities. The authors show that sector rotation decisions with respect to high-tech stocks are a major contribution to negative timing.

Objective

To find out market timing abilities of mutual fund managers.

Hypotheses

Null Hypotheses: The Indian mutual fund managers are not successful market timers.

Alternate Hypotheses: The mutual fund managers are successful market timers.

Data

The study is based on the performance outcomes of 40 equity and equity- oriented mutual funds (comprising of growth and balanced schemes), chosen both from public and private sector.

The monthly NAVs of sampled mutual fund schemes were taken starting from April 2006 to Dec 2009

The information on the monthly NAVs of sampled schemes are compiled from websites namely www.amfi.com, www.moneycontrol.com, and www.valueresearchonline.com . Data regarding

yield on the 91-day treasury bills of government of India (used as surrogate for riskless return) has been compiled from www.nseindia.com . BSE – Sensex (data collected from www.bseindia.com ) has been used as surrogate for the market portfolio for examining the market timing skills of investment managers.

The empirical results pertaining to market timing abilities of fund managers in terms of the above formulation are presented in Table 1. Results indicated in Tables 1, 2, and 3 do not lend support to the hypothesis that Indian mutual fund managers are successful Market Timers.

Results of Treynor and Mazuy model

The overall market timing performance of the investment managers is indicative of their prudent timing abilities. A successful timing is an endorsement of macro forecasting abilities of investment managers. Failed to read the future market movements with precision and accuracy, fund managers yield negative return on their timing abilities. Instances of superior market timing abilities negate the stock market efficiency. That is probably why a majority of studies document the unsuccessful timing ability of fund managers in the developed capital markets. However, insufficient instances of successful timing ability were also experienced across the globe.

Table 1 presents the empirical results for the Treynor and Mauzy model with the BSE-Sensex as the proxy. A close examination of the table indicates that out of 40 sample mutual fund schemes, 19 schemes yielded positive returns, which could be attributed to fund manager’s timing ability. Rest of the schemes i.e. 21 schemes reported negative returns indicating that they are wrong timers.

| Table 1: Investment Managers' Market Timing Performance | ||||

| SI.No. | Name of the Schemes | Measurement Criteria (BSE Sensex) | ||

| Treynor and Mazuy - 1966 | Rank | |||

| 1 | Baroda Pioneer Balanced Fund-Dividend Plan | -0.00041551 | 24 | |

| 2 | Baroda Pioneer Growth Fund-Growth Plan | 0.00049631 | 18 | |

| 3 | Birla Sun Life Buy India Fund-Plan B (Growth) | -0.00141858 | 28 | |

| 4 | Canara Robeco Infrastructure-Growth | 0.00324409 | 6 | |

| 5 | DBS Chola Mid Cap Fund-Dividend | 0.00337828 | 5 | |

| 6 | DSP BlackRock Balanced Fund-Dividend | -0.00033301 | 23 | |

| 7 | DSP BlackRock Top 100 Equity Fund-Regular Plan-Growth | -0.0017839 | 30 | |

| 8 | DWS Alpha Equity Fund Reg Plan-Growth | -0.00641786** | 39 | |

| 9 | Escorts Balacned Fund-Growth Option | 0.00633001 | 3 | |

| 10 | Escorts Growth Plan-Growth Option | 0.01358211* | 2 | |

| 11 | Fidelity Equity Fund-Growth Option | -0.00132815 | 27 | |

| 12 | Franklin India Flexi Cap Fund-Growth Plan | 0.001231725 | 13 | |

| 13 | FT India Balanced Fund-Dividend Plan | -0.0073748* | 40 | |

| 14 | HDFC Balanced Fund-Growth Option | -0.0008144 | 25 | |

| 15 | HDFC Growth Fund-Growth Option | 0.000991 | 14 | |

| 16 | HSBC Equity Fund-Growth | -0.00369153 | 36 | |

| 17 | ICICI Prudential Services Industries Fund-Growth Plan | -0.00385289 | 37 | |

| 18 | ING Balanced Fund-Growth Option | 1.5323762* | 1 | |

| 19 | ING Core Equity Fund-Growth Option | -0.002731 | 35 | |

| 20 | JM Balanced Fund-Growth | -0.0002325 | 22 | |

| 21 | JM Equity Fund (D) | 0.00175225 | 8 | |

| 22 | Kotak Balance | -0.00094167 | 26 | |

| 23 | Kotak Opportunities Fund (D) | -0.00156792 | 29 | |

| 24 | Kotak Opportunities―Growth | 0.0013861 | 12 | |

| 25 | LICMF Balanced Fund-Dividend | -0.005870975 | 38 | |

| 26 | LICMF Opportunities Fund-Growth | -0.0022685 | 33 | |

| 27 | Morgan Stanley Growth Fund-Growth | -0.0002156 | 21 | |

| 28 | Principal Balanced Fund-Dividend | 0.00159926 | 10 | |

| 29 | Principal Dividend Yield Fund-Growth Plan | -0.00232003 | 34 | |

| 30 | Quantum Long-Term Equity Fund-Growth Plan | -0.0017857 | 31 | |

| 31 | Reliance Regular Savings Fund-Balanced Option-Growth Option | 0.00509055 | 4 | |

| 32 | Reliance Vision Fund-GROWTH PLAN-Growth Option | 0.00174578 | 9 | |

| 33 | Sahara Growth Fund-Growth | -0.0001683 | 20 | |

| 34 | SBI Magnum Balanced Fund-Growth | 0.0014476 | 11 | |

| 35 | Sundaram BNP Paribas India Leadership Fund-Growth | 0.0005341 | 17 | |

| 36 | Tata Balanced Fund-Growth | 0.00035311 | 19 | |

| 37 | Tata Pure Equity Fund-Growth | 0.0006356 | 16 | |

| 38 | Taurus Discovery Fund | 0.00223801 | 7 | |

| 39 | UTI Balanced Fund-Growth | 0.00098225 | 15 | |

| 40 | UTI Equity Fund-Growth Option | -0.0021121 | 32 | |

Table 2 clearly shows market timers and table 3 shows wrong timers. In all there are 19 fund schemes whose fund managers came out to be market timers and 21 schemes show negative returns, meaning thereby they did not display the market timing ability and thus are wrong timers. From the positive timing performers, fund managers of ING Balanced Fund-Growth Option, and Escorts Growth Plan-Growth Option were the significant positive timing performers, while the FT India Balanced Fund Dividend Plan, and DWS Alpha Equity Fund-Regular Plan-Growth ended with significant negative performance on their market timing ability during the study period. Funds yielding significant positive as also significant negative performance on their timing ability are from the private sector.

| Table 2: Investment Managers as Market Timers | ||

| SI.No. | (BSE-Sensex ) Treynor and Mazuy | |

| Market Timers | ||

| 1 | ING Balanced Fund-Growth Option | 1.5323762 * |

| 2 | Escorts Growth Plan-Growth Option | 0.01358211 * |

| 3 | Escorts Balanced Fund-Growth Option | 0.00633001 |

| 4 | Reliance Regular Savings Fund-Balanced Option-Growth Option | 0.00509055 |

| 5 | DBS Chola Mid Cap Fund-Dividend | 0.00337828 |

| 6 | Canara Robeco Infrastructure-Growth | 0.00324409 |

| 7 | Taurus Discovery Fund | 0.00223801 |

| 8 | JM Equity Fund (D) | 0.00175225 |

| 9 | Reliance Vision Fund-Growth Plan-Growth Option | 0.00174578 |

| 10 | Principal Balanced Fund-Dividend | 0.00159926 |

| 11 | SBI Magnum Balanced Fund-Growth | 0.0014476 |

| 12 | Kotak Opportunities―Growth | 0.0013861 |

| 13 | Franklin Ibdia Flexi Cap Fund-Growth Plan | 0.001231725 |

| 14 | HDFC Growth Fund-Growth Option | 0.000991 |

| 15 | UTI Balanced Fund-Growth | 0.00098225 |

| 16 | Tata Pure Equity Fund-Growth | 0.0006356 |

| 17 | Sundaram BNP Paribas India Leadership Fund-Growth | 0.0005341 |

| 18 | Baroda Pioneer Growth Fund-Growth Option | 0.00049631 |

| 19 | Tata Balanced Fund-Growth | 0.00035311 |

* Significant at 0.05 level, ** Significant at 0.01 level

| Table 3: Investment Managers as Wrong Timers | |||

| SI.No. | (BSE-Sensex) Treynor and Mazuy | ||

| Wrong Timers | |||

| 1 | FT India Balanced Fund-Dividend Plan | -0.0073748 * | |

| 2 | DWS Alpha Equity Fund-Regular Plan-Growth | -0.00641786 ** | |

| 3 | LICMF Balanced Fund-Dividend | -0.00587 | |

| 4 | ICICI Prudential Services Industries Fund-Growth Option | -0.00385 | |

| 5 | HSBC Equity Fund-Growth | -0.00369 | |

| 6 | ING Core Equity Fund-Growth Option | -0.00273 | |

| 7 | Principal Dividend Yield Fund-Growth Plan | -0.00232 | |

| 8 | LICMF Opportunities Fund-Growth | -0.00227 | |

| 9 | UTI Equity Fund-Growth Option | -0.00211 | |

| 10 | Quantum Long-Term Equity Fund-Growth Plan | -0.00179 | |

| 11 | DSP BR Top 100 Equity Fund-Regular Plan-Growth | -0.00178 | |

| 12 | Kotak Opportunities Fund (D) | -0.00157 | |

| 13 | Birla Sun Life Buy India Fund Plan (B)-Growth | -0.00142 | |

| 14 | Fidelity Equity Fund-Growth Option | -0.00133 | |

| 15 | Kotak Balance | -0.00094 | |

| 16 | HDFC Balanced Fund-Growth Option | -0.00081 | |

| 17 | Baroda Pioneer Balanced Fund-Dividend Plan | -0.00042 | |

| 18 | DSP BR Balanced Fund-Dividend | -0.00033 | |

| 19 | JM Balanced Fund-Growth | -0.00023 | |

| 20 | Morgan Stanley Growth Fund-Growth | -0.00022 | |

| 21 | Sahara Growth Fund-Growth | -0.00017 | |

* Significant at 0.05 level, ** Significant at 0.01 level

R2 and Mutual Funds:

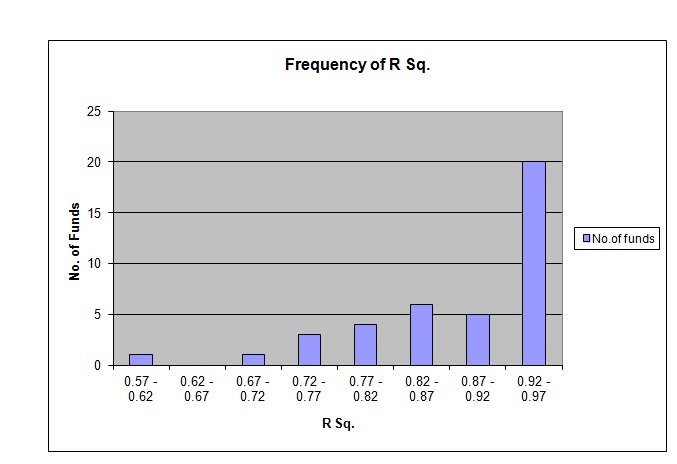

Values of R2 plotted against number of mutual fund schemes reveal that most of the funds are well diversified (their R2 falling in the range of 0.72 – 0.97) and only two schemes are such which are not diversified, namely DSP BR Balanced Fund-Dividend and LICMF Balanced Fund-Dividend. Below is the graphical presentation of the number of fund schemes falling in different ranges of R2 values.

Market Timing and Fund Objectives:

The market timing should be more of an attribute of growth schemes rather than schemes having other investment objectives. The reason being that growth schemes by virtue of their investment objectives are expected to have heavy exposure to equity shares. There is likelihood that the managers of these funds change their risk exposure and bring adjustments in the betas of fund portfolios in relation to market expectations. The balanced schemes are less likely to exhibit market timing in comparison to growth funds due to growth funds due to their relatively less exposure to equities. Hence, fund managers of these schemes are less likely to change asset allocation to gain from changes in the direction of the market. As such, fund managers are less likely to change their portfolio risk in relation to stock market movements. Thus, one would expect growth funds to exhibit market timing more than funds with other investment objectives. Table 4 presents a summary of the results pertaining to market timing of fund objective sector-wise in Treynor and Mazuy model, by taking the BSE-Sensex index. This table classifies the selected schemes as ‘market timers’ and ‘wrong timers’. Table 4 reveals that in respect of Treynor and Mazuy formulation, there were 19 schemes where some market timing was reflected in terms of BSE-Sensex. On the whole there is a strong evidence of wrong market timing in a majority of funds.

| Table 4: Summary Results of Treynor and Mazuy: Market Timing, Sector-wise and Fund Objectives | ||||

| objectives | Sector | Sample Schemes | BSE | |

| Market-Timers | Wrong-Timers | |||

| Balanced | Public | 4 | 2 | 2 |

| Private | 0 | 5 | 5 | |

| a) Total | 14 | 7 | 7 | |

| Growth | Public | 5 | 2 | 3 |

| Private | 21 | 10 | 11 | |

| a) Total | 26 | 12 | 14 | |

| (a + b) Total | 40 | 19 | 21 | |

in terms of BSE-Sensex, 21 mutual fund scheme managers were found to be wrong timers of the market. Of these schemes, a majority of wrong timers were growth funds. Interestingly most of the wrong timers (growth funds) were in private sector.

When we compare public sector and private sector mutual fund scheme managers, relatively better performance is exhibited by most of the private sector scheme managers.

Thus, it can be seen that the empirical results reported here do not support the contention that managers of growth funds are more likely to exhibit market timing abilities than those of the schemes with other objectives.

Out of 9 public sector mutual fund schemes, only 4 schemes showed positive returns, thereby indicating market timing ability of these fund managers. In case of private sector, 15 schemes out of 31 exhibited positive market timing abilities. Out of 9 schemes in public sector, 4 were balanced schemes, and 5 were growth schemes. On the other hand out of 31 schemes in private sector, 10 were balanced and 21 were in the growth category. Thus it can be concluded that the market timing ability of the fund managers of private sector mutual funds was relatively better than that of the fund managers of public sector mutual funds.

This paper analyses the market timing ability of selected mutual fund managers, which is a vital aspect in the success of a mutual fund. In order to measure the market timing ability of the fund managers, an important model has been used with BSE-Sensex as market proxy. The following are the important observations of the study:

Using Monthly Holdings Data. Review of Finance. 0: 1–27