|

Abolfazl Khosravi Assistant Professor Department of Business management, Farabi Campus University Of Tehran, Iran. |

E-services of banks are being developed and improved every day due to their nature dynamicity. Banks’ major concern is that in evaluating what aspects of e-services and to what extent customers would lower their level of satisfaction with a bank. Competition among state and private banks to gain a higher position of satisfaction and loyalty of customers will reflect possible differences in their services. Using a descriptive and applied method on Karaj state and private banks, this research has attempted to evaluate the attitude of customers toward the differences of e-services aspects. The research confirmed a significant difference in most aspects of e-services among the state and private banks. No significant difference was observed in some of the aspects. Assurance–guarantee and validity-accuracy aspects in private banks and availability and personalization aspects in state banks had maximum score. Moreover, maximum difference was observed in assurance-guarantee and responsiveness aspects. Research results may assist state and private banks in filling the gaps caused by the observed weaknesses among e-services aspects.

Keywords: Service quality, E-services, State Banks, Private Banks

In today’s shocking and rivalry world, the organization that can meet their costumer’s needs and expectations are successful. In other words according to the new marketing philosophy which is customer oriented, the organizations that pay attention to their costumer and put themselves in the costumer’s shoes are leading. Today customer satisfaction is a common term in working environment. There is no doubt that through providing quality product and services customer satisfaction and even delighting them -according to what they expect or even further than what they expect- can be achieved. Therefore quality is the most important factor in the rivalry world and the organizations need to provide quality products and services in order to stay successfully in the market. (1) All over the world internet connection and electronic communication expansion have provided a good chance for economic and business affair among different individuals and organizations. Accessing Electronic service system in the banks which acts in comply with international financial systems and eases electronic trade activities, is one of the essential tools for expanding and spreading electronic trade. For sure, what is making increasingly rivalry diversity is, customer service and support which is in and about the product not only the product quality. By advent of rivalry economy, concepts like customer orientation and customer satisfaction is the basis of work and the organization that is inconsiderate will be dismissed from the market. (2)Therefore because of great economy activity and rivalry expansion, strategic and trading policies concentrate on preserving and improving loyalty and customer confidence to the organization. (3) Because of preserving and attracting customer features, electronic services are specifically important. What compels customers to reuse the website of an organization or bank is the result of loyalty and proper quality electronic services which are all the result of good services the organization has offered. (4) In today’s world services are basis of economy and banks as one of the most important service provider organizations, lead and support many economic activities in the society. In recent years approval and administration of new private bank establishment regulation, rivaled state and private banks as the classic exclusive and non rivalry bank in service providing with the new sector. This obliged private and state banks to be tightly in rival to use these services and each tried to attract more customers by offering better services. Providing proper and secure electronic services that meets costumer needs and expectations, results in their satisfaction and loyalty, guarantees survival and ongoing activity of the financial organization. This would not happen unless business enterprises attempt to preserve and improve quality electronic service as a concept containing customer satisfaction. A good way to evaluate quality electronic services is to use available scientific and valid tests. Electronic providing method, electronic service quality and characteristics that are counted in this regard in one side and in another side the relationship with customers to find out orientation of customers to use the services, all are effective on customer’s satisfaction. Naturally in such a situation these banks customers have greater expectations in receiving electronic services. Lack of integrated and useful model which can cover a variety of electronic services aspect is a problem of researches done in this field.

Therefore, this research offers an integrated model including quality electronic service indexes and factors through an expanded literature review. Therefore, research about quality electronic services in our country’s banks is essential and important. With the aim of comparative review on quality electronic services in state and private banks, this research has been done using quality electronic services evaluation models.

Day by day expansion of economic and trading transactions in the international village and different financial and economic complicated function regimes and organizations working in national, local and international level have created a situation in which a collection of common regimes and connected and allied organization are structured. (5) Defining services always has been troublesome considering its variety. And what even makes it more complicated is the fact that due to being non sensible of most input and output, understanding and perceiving service implementation and presentation ways are mainly difficult. Kotler suggested that service is a intangible activity or benefit that one party offers the other and doesn’t result in possession of something and providing the service can rely on physical product or not. The benefits of electronic services can be considered through two aspects of customers and financial organizations. From customers’ point of view, saving time, time and availability of different channels for doing banking affairs are important. From the financial organizations’ point of view, being innovative and becoming famous, preserving costumer while changing position of banks, creating chances to find new customers in target markets, expanding activities in geographic bounds and preparing thorough rivalry situation are important. According to data monitor researches the most important benefits of electronic services include: concentrating on new presentation channels, providing corrected services to customers and using electronic trade guidance. However electronic service benefits can be reviewed in short term, mediate term and long term regard. Parallel rivalry, preservation and attraction of customers are some of the short term benefits of (less than a year) electronic services. Unison of different channels, data management, customer expanded range, customer guidance towards proper channels with proper features and saving money in trades, providing services to target market customers and creating income are some of the long term benefits of electronic services. (6) Today, on time financial mediates can provide customers proper data related to their needs using information technology and providing the data by banks may increase loyalty, save costumer and bank money and on to other hand banks may use the new opportunities to provide proper product and service to the customers. (7)

Customer satisfaction is one of the primarily goals of the marketers. Without customer satisfaction, there would be no loyalty. It shows the quality of marketing decisions. For achieving these goals 3 conditions are essential: first there should be expectations. Second is evaluation and third is to compare directly based on expectations and evaluations. (8) in 2003 Jamal and Naser searched about the relationship between service quality and customer satisfaction in a Pakistani bank and found that this relation is generally strong. Although they couldn’t see any relationship between customer satisfaction and sensible aspects of services. (6) the general case that customer satisfaction is an important variant for evaluation and control in banking marketing management is well supported. Quality services role in providing financial services is important in parallel with this case. Although in related research customer satisfaction and quality service are interchangeably used. Many others distinguish the two and make a connection between them so that quality service pre requirement of customer satisfaction. (9) Many practical researches confirm the relationship between quality service and satisfaction. In Krotine and Tailor research cause and effect relationship between quality services and customer satisfaction were tested. They finally reported that the quality of received services results in customer satisfaction. (10) Banking quality service evaluation has been already the topic of many Persian thesis and research articles and many international articles. In Iran most of the researches aimed at evaluating banking quality services relationship with customer satisfaction and generally concluded that satisfaction is the result of banking quality service improvement. The following table provides a list of international researches briefly.

| Researchers | Topic | Results | |

| 1 | Anthony (2001) | Employees evaluation about quality services in banks and non profit organizations | This research shows that quality services in non profit organizations of America is more satisfactory than state banks. |

| 2 | Brodrick and Chiraporpek (200) | Internet banking quality services: the importance of customer role | This research provides an internet banking quality service with emphasis on customer role. |

| 3 | Yavas (2007) | Quality service evaluation and review: comparative research on turkey and Germany bank customers. | Results show that German and Turkish bank customers are culturally complied. |

| 4 | Peteridue (2007) | Quality bank services: practical evidence about Greece and Bulgaria banks | Results reveal that Greek bank customers perceive quality services better than Bulgarian customers. |

But the little research is done in this filed (comparing quality electronic services in state and private banks). Among this limited number are: electronic quality services review using E-servqual model Sina bank divisions in Shiraz, quality electronic services and customer satisfaction. Electronic quality services evaluation in Raja train travel companies, effect of electronic banking expansion in increasing customer satisfaction case study of Melli bank. Fusion model of electronic banking quality services improvement through constant quality evaluation of the services and periodic evaluation of customer satisfaction. It is worth mentioning that the present research considers electronic quality services compare of state and private banks which distinguishes this research with other researches. Having innovation in mind there has been no comparative review about electronic quality services in different Iranian banks up to now. But there are thorough articles in this matter published in international magazines. “Comparing banking quality services in Turkey and Cyprus” and “comparison review of banking quality service among 5 Balkan region countries” are two of them.

To evaluate classic quality services in public sector models like servqual quality service charter mark, basic European quality management model, evaluation framework model, ISO 9000, balanced charter model, geometry model are used. But there are some other models for evaluating electronic quality services that are tightly connected with our research topic and therefore we mention them here. Zethamel suggests that an electronic quality service is a basis that eases selling, buying, providing product; effectiveness is through an electronic channel which is a website. There are many models to evaluate electronic quality services. Here are the most popular:

E-servqual model

| Suggested model | Description |

| E-servqual model | Enclosed seven aspects of functionality, consistency, privacy, implementation, responsiveness, compensate and connection that create a basic scale and service retrieving scale. Functionality, consistency, implementation and privacy show the basic scale of servqual. Basic scale is for the time when users don’t encounter problems or issues using websites. Retrieving scale is for the time when users encounter problems using websites. |

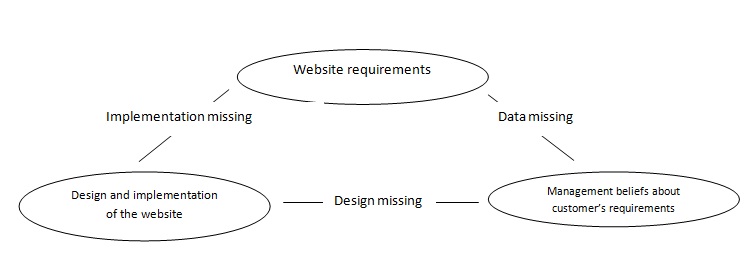

| Davidson and cooper model | Based on the model there is no electronic quality service missing when: - Managers know what the customer needs and there is not data missing - Website designers implements what the managers know and there is no design missing. - Customers get his need met and there is no implementation missing. |

| Webqual | Webqual TM is a website quality evaluator with 12 aspects: Data duty compliance interaction trust responsiveness, design, direct understanding listening attraction, innovation, emotion attraction, integrated connection, working processes, constant replacement. |

| SiteQual | This is a conceptual model about effective factors on user’s realizations of B 2 C websites. Underlying hypothesis of this model consists of two basic quality structures. One of which concentrates on data (access quality, content quality, agent quality, nature quality) and other concentrates on processes (responsiveness, confidence, sympathy, sensible) and therefore recognize quality. |

| Asymmetric function effect model | This model evaluates satisfaction of website it can explicit why key factor function improvement doesn’t result in general satisfaction. |

| Equal model | This model relies on user’s realization of quality. In equal usability design, data, confidence and sympathy are five factors that are merged into usability data quality service interaction factors. |

We can say that researches about electronic services are mainly derived from electronic quality services evaluation model in public environment. The researches have defined quality service features in common sense and specific sense. On the other hand none of these models follow an integrated complete approach towards all of electronic banking quality aspects. Based on above mentioned, we conclude there is a need to have integrated model containing all electronic service aspects. After through reviewing of articles, research resources relating to electronic service literature and evaluation style and integrated collection of indexes and criterion are submitted that are used for evaluating electronic trade quality services electronic government, electronic banking services.

| Evaluation factor | Evaluation index | |

| 1 | Availability | Correct and technical error free function |

| Providing electronic banking services 24 solid hours | ||

| 2 | Website design | Appearance and graphic design (fonts, colors…) |

| Providing adequate and relevant services to customer | ||

| How acceptable is it in customer’s view | ||

| Adequate and complete website content | ||

| Adequate organizing and website structure | ||

| Accuracy and correction of provided services and its capabilities. | ||

| Speed in website opening | ||

| Easy content search | ||

| 3 | System flexibility | How flexible electronic banking service providing is (in general) |

| 4 | Quality service providing | Accurate and error free bank exchanges |

| Quickly receive banking services | ||

| Number of receivable electronic services | ||

| 5 | Security | How secure one feels doing banking affairs |

| Paying attention to security features for doing banking affairs by the bank | ||

| 6 | Accuracy and correction | How accurate and correct is the data |

| How accurate and correct is the banking service | ||

| 7 | data quality | Understandable banking sentences and terms |

| Usable provided banking data | ||

| Having frequently asked question pages | ||

| Availability to adequate data about bank. | ||

| Adequate and available data | ||

| 8 | Service easiness | Easy banking act and data availability |

| Easiness (not complicated) steps for inquiring and receiving banking services | ||

| 9 | System efficiency | Electronic banking services efficiency (generally) |

| 10 | Privatizing | Providing privatized services for each customer based on his needs |

| Providing data based on customer’s needs and preferences | ||

| 11 | Responsiveness | Assistant when there is a problem using services and compensating errors caused by the bank |

| Availability of supporting services (responsiveness towards customers) through having online contact | ||

| Receiving support services through hotline (responsiveness towards customer problems) | ||

| Receiving online support services (responsiveness towards customer problems) | ||

| 12 | Reliability | Reliability of doing banking and financial transactions |

| 13 | Meeting needs | How much of customer expectations are met by the bank (websites) |

| 14 | Confidence and guarantee | Bank guarantee about providing electronic banking services |

| 15 | Interaction and connection | Interacting with customers via chat, forum and so on |

| 16 | Usability of the website | Having practical and usable links on the website |

| Having map of the website | ||

| How powerful is the search engine of the website | ||

| Easiness of search and data finding | ||

| 17 | Complaint management | Quick and effective responsiveness to customer complaints |

| Complaint registration for customers | ||

| 18 | confidence | Bank’s tendency to get feedbacks from the customers (including complaints and critics) |

| How loyal is the provided data on the website | ||

| The banks trade name and popularity | ||

| 19 | Privacy | Keeping personal secrets of customers |

| Keeping secrets related to the customer’s received services (customer buying behavior) |

As far as the research topic is comparative review of banking electronic services in state and private sectors, research topic consists of two parts: state bank electronic quality services, private bank electronic quality services. From customer’s point of view many factors come into play. Availability, reliability, system function, website design, electronic service providing quality, accuracy and correction is at use, privatizing, privacy, confidence and guarantee. Usability, trust, flexibility, security data quality, responsiveness how much needs are met, interaction, connection, complain management. In this regard the following hypotheses are prepared:

Hypothesis 1: There is a meaningful difference in availability of electronic services in state and private banks

Hypothesis 2: There is a meaningful difference in electronic service trust in state and private banks.

Hypothesis 3: There is a meaningful difference in electronic service functions in state and private banks.

Hypothesis 4: There is a meaningful difference in electronic service website design in state and private banks.

Hypothesis 5: There is a meaningful difference in electronic service provides quality in state and private banks.

Hypothesis 6: There is a meaningful difference in electronic service accuracy and correction in state and private banks.

Hypothesis 7: There is a meaningful difference in electronic service easiness in state and private banks.

Hypothesis 8: There is a meaningful difference in electronic service privatizing in state and private banks.

Hypothesis 9: There is a meaningful difference in electronic service privacy in state and private banks.

Hypothesis 10: There is a meaningful difference in electronic service confidence and guarantee in state and private banks.

Hypothesis 11: There is a meaningful difference in electronic service usability in state and private banks.

Hypothesis 12: There is a meaningful difference in electronic service trust in state and private banks.

Hypothesis 13: There is a meaningful difference in electronic service flexibility in state and private banks.

Hypothesis 14: There is a meaningful difference in electronic service security in state and private banks.

Hypothesis 15: There is a meaningful difference in electronic service data quality in state and private banks.

Hypothesis 16: There is a meaningful difference in electronic service responsiveness in state and private banks.

Hypothesis 17: There is a meaningful difference in electronic service meeting needs in state and private banks.

Hypothesis 18: There is a meaningful difference in electronic service interaction and connection in state and private banks.

Hypothesis 19: There is a meaningful difference in electronic service complaint management in state and private banks.

The method of present research is description-survey using electronic service quality evaluation questionnaire of bank customers. Research region includes all states and private banks in Karaj province. Research population includes all customers of Karaj province bank who have account in state and private banks simultaneously and have used bank electronic banking services at research time. Sampling method and sample mass recognition: in order to take samples through customers in state and private banks of Karaj, customers with the previous experience in using electronic services in state and private banks, were being evaluated in terms of quantity of sample and statistics population. therefore population of the current research “ all Karaj bank customers who at least have one account simultaneously in a state and private banks and have used electronic banking services at research time.

In this research random sampling method is used. One of the main issues most research deal with while planning the research is sample mass. Considering unlimited population of present research sample mass derived from sampling formula used for unlimited societies (Kukran Formula) estimations based on similar researches have been calculated with the following formula:

Consequently, p-value q=0.5 or derived relation of p= 0.5 and also permitted error of d=0.04 sample mass was 645 people. (Za/2=+ - 1.96)

“In this research Tejarat, Sepah, Saderat, Keshavarzi, Maskan, Mellat and Melli are state banks and Eqtesad novin, parsian, Saman, Karafarin, Sina, Ansar and Pasargad are private banks.

Customer population owing accounts in state and private banks is as following table:

| Bank | Tejarat | Sepah | Saderat | Keshavarzi | Maskan | Mellat | Melli | Total | Relative frequancy |

| Eqtesad novin | 7 | 7 | 16 | 11 | 11 | 4 | 24 | 80 | 12.4 |

| Parsian | 16 | 6 | 24 | 13 | 13 | 7 | 56 | 135 | 21 |

| Saman | 4 | 6 | 8 | 15 | 9 | 5 | 15 | 62 | 96 |

| Karafarin | 4 | 5 | 9 | 16 | 9 | 7 | 15 | 65 | 10 |

| Sina | 7 | 5 | 25 | 29 | 20 | 9 | 19 | 114 | 176 |

| Ansar | 8 | 6 | 19 | 11 | 21 | 5 | 70 | 140 | 22 |

| Pasargad | 11 | 5 | 10 | 9 | 4 | 6 | 4 | 49 | 7.4 |

| Total | 57 | 40 | 111 | 104 | 87 | 43 | 203 | 645 | 100 |

| Relative Frequency | 9 | 6.2 | 17.2 | 16.1 | 13.4 | 6.7 | 31.4 | 100 |

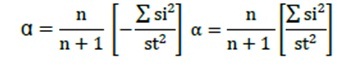

Consistency – to determine consistency of questionnaire, the Cronbach Alpha coefficient has been used based on the below formula:

n: number of questions

Si2 question variance

St2 the whole questionnaire variance

Reliability statistics

| Number of Questions | Cronlach Alpha |

| 48 | .798 |

This method is used to calculate internal correlation of measuring tools that measures different features. Seventy Alpha shows high credit 40 to 70 Alpha shows medium and less than 40 shows little credit. Results suggest that the coefficient of questionnaire is 0/798 and it means the answers are not random but because of the variant value that is tested.

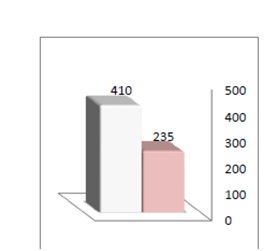

Gender Frequency Distribution

| Frequency | Frequency percentage | Cumulative percent | |

| Female | 235 | 36.0 | 36.0 |

| Male | 410 | 64.0 | 100.0 |

| Total | 645 | 100.0 |

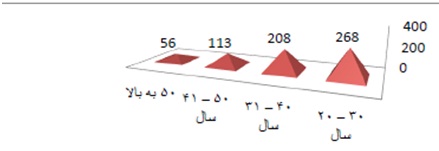

Age Frequency Distribution

| Frequency | Frequency percentage | Cumulative percent | ||

| Respondents | 20-30 years old | 268 | 41.6 | 41.6 |

| 31-40 years old | 208 | 32.2 | 73.8 | |

| 41-50 years old | 113 | 17.5 | 91.3 | |

| Upper than 50 years old | 56 | 8.7 | 100 | |

| Total | 645 | 100 |

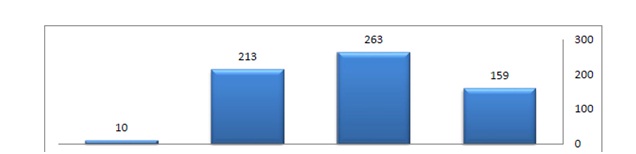

Frequency distribution of respondents education distinguish

| Education | Frequency | Frequency percentage | Cumulative percent | |

| Respondents | Diploma | 159 | 24.7 | 24.7 |

| MD | 263 | 40.8 | 65.4 | |

| BA | 213 | 33.0 | 98.4 | |

| MA | 10 | 1.6 | 100.0 | |

| Total | 645 | 100.0 | ||

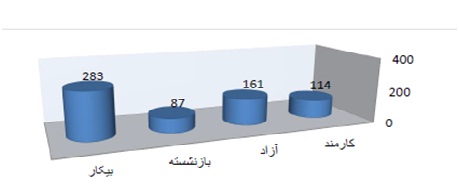

Job Distribution Frequency

| Frequency | Frequency percentage | Cumulative percent | ||

| Respondents | working | 114 | 17.6 | 17.6 |

| Own business | 161 | 25.0 | 42.6 | |

| retired | 87 | 13.4 | 56.0 | |

| unemployed | 283 | 44.0 | 100 | |

| Total | 645 | 100 |

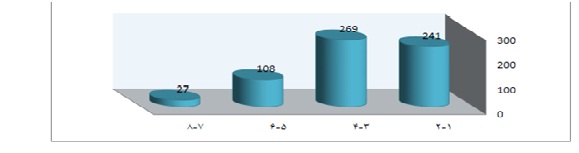

Frequency distribution of bank electronic services use history

| Frequency | Frequency percentage | Cumulative percent | |

| 1-2 | 241 | 37.4 | 37.4 |

| 3-4 | 269 | 41.7 | 79.1 |

| 5-6 | 108 | 16.7 | 95.8 |

| 7-8 | 27 | 4.2 | 100.0 |

| Total | 645 | 100.0 |

Research hypothesis are mainly considered in management and behavioral science to compare 2 statistics societies. This type of hypothesis is comparative hypothesis. To test the hypothesis and confirm them we can follow tests steps related to statistic hypothesis in order to derive two society averages. To review hypothesis in this research average comparison test and freedman preference is used. Using this method the variant and their aspects were ranked and prioritized. And then research aspects between private and state banks were compared.

As far as resulted data from questionnaire fall into two relevant groups (independent) – it means customers in private and state banks at the same time, are under evolution of electronic bank quality. Hypothesis based on “comparative test for average of two societies and freedman preference” is being examined. In the following table, the summary of data prepared in SPSS software to check the hypothesis of this research is shown. The defining level of the current research is regarded as 5 percent.

| Aspects | Average difference | Standard deviation | Average Standard deviation | 95% confidence difference Min max | t | Level significance | Test result | |

| Website design | 3.30349 | 0.40645 | .01610 | -0.1912 | -0.1019 | 6.437 | .000 | H0 unacceptable H1 Acceptable |

| Service providing quality | 3.35562 | 0.422335 | .01795 | -0.0172 | 0.07577 | 1.233 | .218 | H0 Acceptable H1 Unacceptable |

| Accuracy and correction | 3.52016 | 1.11655 | .01754 | 0.1806 | 0.4542 | 4.551 | .000 | H0 unacceptable H1 Acceptable |

| Ease at service use | 3.38734 | 0.43155 | .01129 | 0.0060 | 0.1003 | 2.213 | .027 | H0 Acceptable H1 Unacceptable |

| Privatizing | 3.52054 | 0.5074 | .01301 | 0.1128 | 0.2237 | 5.953 | .000 | H0 unacceptable H1 Acceptable |

| Privacy | 3.45736 | 0.5461 | .01227 | 0.0451 | 0/1689 | 3.391 | .001 | H0 acceptable H1 unacceptable |

| Confidence and guarantee | 3.56853 | 0.31768 | .03371 | -0.0867 | -0.0171 | 2.927 | .003 | H0 unacceptable H1 Acceptable |

| Website compatibility | 3.36357 | 0.44808 | .01272 | -0.0605 | 0/3802 | -0.448 | .654 | H0 acceptable H1 unacceptable |

| Trust | 3.43721 | 0.835 | .01640 | -0.17 | 0.100 | 1.401 | .162 | H0 acceptable H1 unacceptable |

| Availability | 3.53178 | 0.620425 | .00770 | 0.17486 | 0.31504 | 6.856 | .000 | H0 unacceptable H1 Acceptable |

| System flexibility | 3.49981 | 0.51 | .01017 | -0.265 | -0.154 | -7.370 | .000 | H0 unacceptable H1 Acceptable |

| Safety | 3.43721 | 0.5325 | .01314 | -0.057 | 0/060 | .052 | .958 | H0 Acceptable H1 Unacceptable |

| Data quality | 3.45891 | 0.541225 | .01701 | 0.22986 | 0.35463 | 9.191 | .000 | H0 unacceptable H1 Acceptable |

| Reliability | 3.33256 | 0.41976 | .01574 | 0.25302 | 0.35094 | 12.103 | .000 | H0 Acceptable H1 Unacceptable |

| System efficiency | 3.33333 | 0.524255 | .02025 | 0.21182 | 0.09419 | 5.104 | .000 | H0 unacceptable H1 Acceptable |

| Responsiveness | 3.41143 | 0.421895 | .01315 | 0.07162 | 0.2257 | 1.022 | .307 | H0 Acceptable H1 Unacceptable |

| Requirement supply quantity | 3.39509 | 0.381105 | .01338 | 0.13527 | 0.21898 | 8.325 | .000 | H0 unacceptable H1 Acceptable |

| Interaction and communication level | 3.26305 | 0.392735 | .01169 | 0.09394 | 0.18057 | 6.216 | .000 | H0 unacceptable H1 Acceptable |

| Complaint management | 3.38682 | 0.45142 | .01271 | 0.1638 | 0.0648 | 4.529 | .000 | H0 unacceptable H1 Acceptable |

In order to review hypothesis number 1 to 19th of this research, that is to say electronic services in state and private banks and its aspects review, the test has been used based on the table. According to analysis the meaningful amount of comparison between the societies for all of the relations is 0/000.

Fridman preference method has been used to review the research hypothesis, variable preferences and its aspects in state and private banks. The two society’s average rate and, rank in aspect and rank in total of state and private banks is represented in the following table:

Review of average rate of electronic services quality in private banks shows that reliability, guarantee and accuracy and correction are the highest rated. Aspects of electronic services ranking is represented in order in the following table:

| Quality of electronic services in private banks | Minimum | Maximum | Average | Scale deviation |

| Website design | 2.00 | 4.00 | 3.3767 | .54595 |

| Service providing quality | 2.88 | 4.00 | 3.4727 | .78323 |

| Accuracy and correction | 2.00 | 4.00 | 3.5426 | .57656 |

| Ease at service use | 2.67 | 4.00 | 3.3452 | .40190 |

| Privatizing | 2.50 | 4.00 | 3.4581 | .47755 |

| Privacy | 3.00 | 4.00 | 3.4364 | .36307 |

| Confidence and guarantee | 2.80 | 4.00 | 3.7957 | 1.68334 |

| Website compatibility | 3.00 | 4.00 | 3.3946 | .43226 |

| Trust | 3.00 | 4.00 | 3.5008 | .50039 |

| Accessibility | 2.50 | 4.00 | 3.4806 | .39505 |

| System flexibility | 3.00 | 4.00 | 3.5310 | .29225 |

| Safety | 3.00 | 4.00 | 3.4574 | .49857 |

| Data quality | 2.00 | 4.00 | 3.4589 | .57667 |

| Reliability | 2.00 | 4.00 | 3.2496 | .52101 |

| System efficiency | 2.00 | 4.00 | 3.4171 | .57214 |

| Responsiveness | 3.00 | 4.00 | 3.5419 | .35926 |

| Requirement supply quantity | 3.00 | 4.00 | 3.4584 | .35761 |

| Interact and communication level | 3.00 | 4.00 | 3.3070 | .33255 |

| Complaint management | 3.00 | 4.00 | 3.3558 | .33804 |

Review of electronic services aspect average rates in state banks also shows that accessibility and privatizing are first rates. The following table represents the aspects of electronic services of state banks by order.

| Quality of electronic services in state banks | Minimum | Maximum | Average | Scale deviation |

| Website design | 2.50 | 4.00 | 3.2302 | .45710 |

| Service providing quality | 2.75 | 3.75 | 3.2386 | .26266 |

| Accuracy and correction | 2.00 | 4.00 | 3.4977 | .64659 |

| Ease at service use | 3.00 | 4.00 | 3.4295 | .36646 |

| Privatizing | 2.50 | 4.00 | 3.5829 | .44983 |

| Privacy | 2.00 | 4.00 | 3.4783 | .54984 |

| Confidence and guarantee | 2.20 | 4.00 | 3.3414 | .43077 |

| Website compatibility | 2.00 | 4.00 | 3.3326 | .51441 |

| Trust | 2.00 | 4.00 | 3.3736 | .69710 |

| Accessibility | 3.00 | 4.00 | 3.5829 | .34311 |

| System flexibility | 3.00 | 4.00 | 3.4686 | .39759 |

| Safety | 3.00 | 4.00 | 3.4171 | .49345 |

| Data quality | 3.00 | 4.00 | 3.4589 | .49870 |

| Reliability | 3.00 | 4.00 | 3.4155 | .49319 |

| System efficiency | 2.00 | 4.00 | 3.2496 | .72319 |

| Responsiveness | 2.75 | 4.00 | 3.2810 | .40380 |

| Requirement supply quantity | 2.00 | 4.00 | 3.3318 | .50991 |

| Interact and communication level | 2.00 | 4.00 | 3.2191 | .44684 |

| Complaint management | 2.00 | 4.00 | 3.4178 | .49398 |

Most of the averages of electronic services in private banks are higher than state banks. The most differences in average rates are seen among confidence and guarantee and responsiveness. The following table represents the order of average differences of electronic services quality in state and private banks.

| Aspects of electronic services quality | Private banking | State banking | Average discrepancy |

| Website design | 3.3767 | 3.2302 | 0.1465 |

| Service providing quality | 3.4727 | 3.2386 | 0.2341 |

| Accuracy and correction | 3.5426 | 3.4977 | 0.0449 |

| Ease at service use | 3.3452 | 3.4295 | -0.0843 |

| Privatizing | 3.4581 | 3.5829 | -0.1248 |

| Privacy | 3.4364 | 3.4783 | -0.0419 |

| Confidence and guarantee | 3.7957 | 3.3414 | 0.4543 |

| Website compatibility | 3.3946 | 3.3326 | 0.062 |

| Trust | 3.5008 | 3.3736 | 0.1272 |

| Accessibility | 3.4806 | 3.5829 | -0.1023 |

| System flexibility | 3.5310 | 3.4686 | 0.0624 |

| Safety | 3.4574 | 3.4171 | 0.0403 |

| Data quality | 3.4691 | 3.4589 | 0.0102 |

| Reliability | 3.2496 | 3.4155 | -0.1659 |

| System efficiency | 3.4171 | 3.2496 | 0.1675 |

| Responsiveness | 3.5419 | 3.2810 | 0.2609 |

| Requirement supply quantity | 3.4584 | 3.3318 | 0.1266 |

| Interact and communication level | 3.3070 | 3.2191 | 0.0879 |

| Complaint management | 3.3558 | 3.4178 | -0.062 |

As it is obvious electronic service quality in private banks in contrast with private banks, is not in a good situation. It is essential that state banks consider ways like the following to improve their services: electronic services quality, modern equipment, improving make up services, accuracy and dedicating adequate time to each costumer, keeping private secrets of costumers, improving connection, improving responsiveness of provided services, meeting customer’s needs and expectations, increasing reliability of provided services based on costumers needs, increasing efficiency, giving updates about new services and encourage people to use them, Reduce errors, giving confidence to customers about doing banke affairs, accessibility, reliability, being trustworthy, system efficiency, website design, providing quality electronic services, Accuracy and correction, ease at use, privatizing, privacy, confidence and guarantee, being useable, trust, flexibility, safety, data quality, responsiveness, meeting needs, interaction and communication, complaint management. Also private banks need to do their best to be up to date and increase their abilities (electronic service quality) in order to encourage the positive view point of their customers. It is obvious that the bank which obeys the rules in a parallel situations, with customer care and quality basis,will keep going.

Banks are one of the main aspects of a country’s economy and they have high level of importance. From the beginning of privatizing in banking industries, this industry has been changing into a competitive market in which providing the valuable electronic services are the main reason of development in customer’s view. Knowing priorities in today’s competitive world can be a factor for manager’s solutions. In this research, regarding the analysis which have been done, we have tried to check the quality of electronic services in private and state bank of Karaj province. In order to make the framework for evaluating customer’s reviews, questionnaire has been used as a tool of collecting data. Results have revealed that accessibility and privatizing are important factors for evaluation of state banks and security, guarantee, accuracy are factors in private banks. Other factors are considered between these scales. In Hypothesis of the current research, researcher has identified the clear difference between information quality, trustworthy, website designing, system efficiency, quantity of requirement supplies, accuracy, privacy, security and guarantee, accessibility, flexibility, interactions and communications and complaint management in electronic services of private and state banks. These hypotheses have been confirmed with 95% accuracy and the clear difference has been recognized. The apparent differences for some factors like responsiveness, security, trust, website access, ease at service use and service providing quality were not observed in 6 hypotheses of this research..

According to the results, the below recommendations are useful for state and private banks which are providing electronic services to their customers:

Security control with regard to customer’s contact information

Set passwords for individuals or companies, financial entities and new customers

Clarify the pending transactions Avoid any break in rules and regulations in people’s privacy, bribery or any action which causes personal information release.

Avoid any negative idea (for example: continuous access to online services)

Security control and keep the confidential information when transferring money

Suggestions for improving service providing quality of electronic service machines:

Suggestions to improve the quality of electronic service system:

[1] Zanjirchy Mahmood & Farsijani Zahra(2008). QFD approach in improving the quality of banking services, Tadbir journal. No:193, May 2008,in Persian

[2] Beykzad Jaafar , Moulavi Zahra(2009). Electronic service quality and customer satisfaction , Journal of Banking and Economics,No:104, in Persian

[3] Athanassopoulos, Antreas, Gounaris, Spiros and Stathakopoulos, Valssis. (2001). Behavioral responses to customer satisfaction: an empirical study. European Journal of Marketing, 35 (5/6), pp. 687-707.

[4] Poorbabaei Zohreh (2008). A model based on the exchange process in the quality of electronic services, monthly journal E-Banking,No:24, in Persian

[5] Hassanzadeh Ali & Sadeghi Touraj(2003). Effect of electronic banking on the development of the banking system, Economic Journal,No:25-26, in Persian

[6] Jamal, A., K. Nasser, "Factors influencing customer satisfaction in the retail banking sector in Pakistan", International Journal of Commerce and Management, 13:2, pp. 29-53, (2003).

[7] Berry.L.(1995). “Relationship marketing between financial services providers and retail customers" International Jornal of Bank Marketing, Vol. 16 No. 1, pp. 15-23.

[8] Goode, M.H, L. Moutinho, C. Chien, “Structural equation modeling of overall satisfaction and full use of services for ATM’s”, International Journal of Bank Marketing, 14:7, pp. 4-11, (1996).

[9] Moutinho, L., A. Smith, ‘Modelling bank customer satisfaction through mediation of attitudes towards human and automated banking’, International Journal of Bank Marketing, 18:3, pp. 124-134, (2000).

[10] Cronin J. Jr., Taylor S. A. (1992), “Measuring Service Quality: A Reexamination and Extension”, Journal of Marketing, Vol.56 No.3.

[11] Lovelock, C., L. Right, “ Essentials of service marketing ”, Translated by A. Tajzadeh, Samt Publishing, (1382), (inPersian).

[12] Joseph, M., G. Stone, "An empirical evaluation of US bank customer perceptions of the impact of technology on service delivery in the banking sector", International Journal of Retail & DistributionManagement, 31:4, pp. 190-202, (2003).

[13] Zeithamlvalarie A.,Parasuraman A.,Arvind Malhotra.Service(2002) quality delivery through web sites:A critical review of knowledge.journal of the Academy of Marketing Science 2002;30(4):362-375.

[14] Davidson Robyn, Joan Cooper.(2005) Determining the existence of electronic Service quality gaps in the Australian wine industry. School of Commerce, Research Paper Series; 5(2): 1441-3906.

[15] webb Harold w., Linda A.Webb,Sitequal: (2004)An integrated measure of website quality .the journal of Enterprise Information Management 2004:17(6):430-440.