|

Elaheh Mohseninasab Master of Industrial Engineering Industry Group, Parand Branch Islamic Azad University, Parand, Iran Email: Ela.mohseni@gmail.com |

Davood Jafari Industry Group, Parand Branch Islamic Azad University, Parand, Iran Faculty member and group manager Email: Djafari5071@gmail.com |

Nima Eghtedar Faculty member Department of Management West Branch, Tehran, Islamic Azad University Tehran, Iran Email: nimaeghtedar@yahoo.com |

Evaluating the effectiveness of macroeconomic variables on the stock market and stock prices is noticeably significant. In this study, by defining the relationship between macroeconomic variables including inflation rates, exchange rates, interest rates, and stock prices, we first try to specify a review of the research literature. Next, we examine the relationship between these variables and share prices and their impact in Mapna and Takinco companies. In this regard, Auto-Regression with Delay Lag has been used. Enjoying the required tests, such as the Dickey-Fuller Test, Co-integration Test, Analysis, Error Correction, and the use of Neural Networks, and using Econometric Evaluation Software, it becomes clear that there is a negative relationship between inflation, exchange, interest rates and share prices. Also, the effectiveness of the variables in short-term and long-term is taken into consideration. It should be noted, Neural Network Model has also been used to enhance the validity and reliability of the current research.

Key words: inflation, exchange, interest, share price, Auto Regression with Delay Lag

Since Iran has a state-run economy due to a bureaucratic environment, and a slow decision making process, the reaction in the economic variables takes place with a time delay. In other words, changes in certain variables, such as exchange rate, inflation and interest rates do not immediately affect the costs and revenues of companies and their impacts will appear gradually with the passage of time, and the market reaction is also seen with delay. Micro and macroeconomic factors are changing dynamically over time. The point to be noted is that, different economic sectors are not equally affected by these changes, and this depends on the type and magnitude of that portion of the economy. Given the importance of Tehran Stock Exchange in the economy of the country, identifying the effectual variables can be useful in leading this sector of the economy effectively. The claim that macro-financial variables, such as inflation, exchange and interest rates are stimulating and effective on changes in stock prices, has been accepted as a theory. However, in the past decade, efforts have been made to evaluate the impact of economic forces theoretically and to measure its effects empirically. The dynamic relationship between these variables of macro-financial and stock returns has been investigated extensively. But the key point, which has been less considered in the previous studies, is investigating this subject in the existing specific industries in Tehran Stock Exchange. In other words, it is possible, due to differences in the type and nature of stock companies in various industries; there are different reactions in different industries to macro-financial variables. So, the question of this study is to investigate the relationship between macro-financial exchange rate, inflation rate, interest rate and stock prices in the industry of technical and engineering services in Tehran Stock Exchange. In other words, what the changes in these variables will be like in the afore-mentioned industry, given the nature of the companies active in this field. This subject, according to the importance of issues such as importing raw materials, exporting products and services, contractual expenses, and the implementation of projects, and receiving and repaying bank loans in the engineering industry of the stock market, due to the nature of the activities of the active companies in this field, has a double significance.

Macro-financial variables of the Research

Macro-financial variables considered in this study along with the expected impacts include:

In terms of inflation, the average nominal corporate profits increase after a period of time without any real profitability rise. Therefore, the increased inflation lowers the quality of the company's actual earnings and the intrinsic value of per share is likely to decrease, too. On the other hand, with the rising inflation, the investors’ expected interest rate will increase, therefore, the falling cash flow rate, and the costs of the lost money opportunity will rise as well. Hence, there is expected to be a negative relationship between inflation rate, share prices and yields, and consequently the stock price index. [6]

Exchange rate in developing countries is one of the effectual economic variables. Due to the fact that companies and institutions in this kind of countries mainly supply their needs by imports from developed countries, changes in exchange rate are one of the important factors affecting conversion and paying off debts. Increase in the exchange rate, on the one hand, leads to an increase in the external debt and, on the other hand, causes an increase in the final cost of products and the imported services provided by these companies. Considering that the increase in corporate debt results in the lack of liquidity and lack of liquidity in economic firms has a negative effect on profit distribution, share efficiency and equity price index, and also an increase in the final cost of manufactured products is accompanied with lower margins, lower price and return on equity, and consequently, the reduction in the stock index. [6]

Investors are looking for an efficient basket for investment. Hence, they fill their asset baskets with various items such as cash, stocks, bank deposits, bonds and etc. According to the experiences gained from the results of the investment returns in the Iranian stock market and its being risky, the investors are not satisfied with their investment returns in the stock market in relation to its risks. On the other hand, the existence of risk-free long-term bank deposit interest rates in Iran has made this macro economic variable a competitor for the stock market investment. On the other hand, because of the huge loans taken by the companies active in the country in order to advance their objectives, ‘bank interest rate’ is regarded asa key variable in debt repayment that the higher the bank interest rate is, the more challenges these companies will face. Hence, it is expected that an increase in the real bank interest rate will have a negative correlation with the growth rate of the stock price index.

Meanwhile, there is the possibility of other macroeconomic factors affecting the stock price, which influence the relationship between dependent and independent variables,among which the political news and disputes between countries, international economy, oil prices, and etc. could be pointed out. This issue in countries which do not have a strong and dynamic economy may lead to this conclusion that the market of these countries might have been more influenced by politics and political issues than their economy. Other economic factors including monetary and…. might have influenced the prices and, consequently, the returns so that the expected relationship between independent and dependent variables is not achieved, or even in some cases, it is possible that the afore-mentioned factors somewhat neutralize each other’s positive or negative results, which may be difficult to be identified. Also, since the return on equity is calculated based on stock prices, there is the option for the prices being affected by qualitative factors other than the mentioned ones, such as rumors and psychological atmospheres in the stock market, not to show the effects of macro-financial returns and, in other words, these qualitative factors fade the impact of macro-financial variables, or lead them to unexpected changes. The lack of adequate participation of the public investors in the stock market or, in other words, investment culture can also be involved. Not only can the development of investment culture give rise to public participation in investment, but also it can cause the absorption of the existing liquidity in the society, which plays an important role in building a healthy economy. [6]

Factors affecting the stock price can be divided into the internal and external ones. Internal factors affecting stock prices are those in connection with the company's operations, and the decisions made in the company. External factors are those outside the company's management authority and somehow affect the company's activities. These factors are those events and decisions that occur outside the company, but affect the stock price. [9] Given the considerable fluctuations in exchange rates, inflation and interest rates in the country and the companies active in the engineering industry, which are noticeably affected by such variables, understanding the relationship between these variables can be of great importance in minimizing or fixing the negative impacts on stock returns and stock prices, and turning threats into opportunities, and can pave the way for the success of any organization, especially in terms of profitability and the return on equity.

International research carried out on stock price and effectual variables affecting it in America, Britain, Japan, Germany, France, Canada, Switzerland and Belgium, is indicative of the relationship between the exchange rate, interest rate , inflation rate, and stock prices as macroeconomic variables affecting the stock price. This has been recorded in other studies in Thailand, Taiwan and the Philippines. Also, other studies that have been done in the countries of G7 show that in the long- run, there is no relationship between exchange rate and stock prices, but in the short- run there is a significant relationship. In this research, the economic situation, policies, government policies, expectation patterns and other factors are known as effectual factors. Studies in India, Bangladesh and Sri Lanka, have shown that there is a relationship between interest rates, exchange rates and financial stock return. Furthermore, the research carried out in three areas of banking, financial services and insurance in 16 different countries across Europe, taking advantage of the model GARCH, has represented a relationship between exchange rates , interest rates and stock returns, however, their impact on the banking industry and insurance services was more than that of the insurance industry.

Research conducted in Pakistan about the relationship between interest rates, exchange rates and financial stock return shows exchange rates and interest rates have had a significant effect.

Research carried out at an international level indicates that there is significant dependency between the exchange rate and stock prices using different methodologies, but there is no general consensus on the type of dependency. In other words, sometimes the relationship is positive and sometimes negative that, depending on the specific circumstances of each country, the intensity of the dependency can vary.

[19] Numerous studies have been conducted in this regard that a number of them are referenced as the following:

Table 1. Conducted Studies

| Used model | Research result | researcher | year |

| The non-linear and inverse relationship between interest rates and stock prices. [11] | Arango | 2002 | |

| An inverse relationship between interest rates and stock prices. [11] | Zordan | 2005 | |

| regression analysis | If there is proper control of interest rates, investors can be found to have positive effects on stock and stock price. [11] | Alam | 2009 |

| Vector error correction | The absence of a meaningful relationship between stock prices and exchange rate [9] | Puja & Pramod | 2012 |

| Fixed effects model | Negative relationship between exchange rate and stock prices [9] | Sayilgan & Suslu | 2011 |

| Extended conditional explanation | Presence of a negative relationship between exchange rate and stock prices [9] | Mushtag | 2011 |

| Model EGarch | A Bilateral relationship between inflation and stock price index, and a one-way relationship between interest rates and stock prices [9] | Wang | 2010 |

| Unbalanced data model | A Negative relationship between interest rates , inflation rates and stock prices [11] | Madsen | 2002 |

| Indicating The stock price changes by inflation and interest rate variables with delay, and the weak impact of exchange rates on the stock price changes [11] | Anokye & Tweneboach | 2008 | |

| Strong and negative impact of inflation and interest rates on stock prices. [11] | Duker & Bordo | 2008 | |

| ARIMA model | Weak relationship between exchange rates and stock prices. [11] | Gay | 2008 |

| Elasticity of the stock price index in relation to exchange rate and inelasticity in relation to interest rate [11] | Jayaraman & Puah | 2007 | |

| Significant effect of inflation rate on stock prices eak effect of interest rates and exchange rates and GDP on stock prices [14] | Pal & Mittal | 2011 | |

| The lack of long-term money supply , industrial production and GDP relation with stock prices, but the impact of interest rates on stock prices [14] | Ahmed & Imam | 2007 | |

| Negative relationship between exchange rates, inflation and interest rates, and stock prices [14] | Liu & Shrestha | 2008 | |

| multiple regression | Significant and positive impact of investment and exchange rates on stock prices, a significant negative impact of interest rates and low negative impact of inflation rate on the stock price [14] | Aurangzeb | 2012 |

| multiple regression | Positive and significant relationship between internal variables, administrative value and earning of per share and investment return to share earnings, and stock price [22] | Harsh & Sharifi&Rekha | 2015 |

| Model Garch | The negative impact of inflation rate and the negative impact of exchange rate on stock returns (Butt, Kashif, 2010) | Butt, Kashif | 2010 |

| The meaningful relationship between exchange rates , interest rates, inflation rates and stock returns [15] | Liow | 2006 | |

| Regression and correlation | The positive relationship between exchange rates and stock prices in the short term, and no relationship between interest rates, inflation rates and the stock price and the negative correlation between the exchange rate and the stock price in long term[19] | Mahfoudh | 2012 |

| VAR method | Low impact of inflation rate on stock prices [24] | Zhongqiang | 2014 |

| Multiple regression model | Non-substantial impact of inflation and interest rates on stock returns and significant impact of the exchange rate on return on equity [25] | Zohaib & Lala | 2012 |

| VECM model | Significant negative relationship between the exchange rate and stock price, and a non-significant relationship between interest rates and stock prices. [13] | Aishahton & Mansur | 2013 |

| VCEM models and regression analysis | The more impact of exchange ratescompared with interest rates [16] | Engel | 2015 |

| Johansen and ADF Model | The negative influence of exchange rates and the positive impact of interest rates on stock returns [21] | Prashanta, Bishnu | 2011 |

| ARIMA model | The indirect and weak impact of exchange rates, interest rates and stock prices [17] | Gupta, Chevalier, seyekt | 2012 |

| VAR models | Lack of any relationship between interest rates and stock prices, and a minimal relationship between exchange rates and stock prices [23] | Yutaka | 2006 |

| Autoregressive | Negative relationship between exchange rates and stock price index, and the positive relationship between the inflation rate and the share price [9] | Saidi and Amiri | 2008 |

| And self-explanatory vector error correction model | Direct relationship between stock prices and the general price level, and a reverse relationship with the exchange rate [9] | Pirani and Shahsavar | 2009 |

| ARDL model | A Long-run relationship between the inflation rate, exchange rate and the stock price [9] | Nouri and Mosharrafi | 2006 |

| ARDL model | Negative relationship between exchange rates, interest rates and stock prices [9] | Karimzadeh | 2006 |

| Negative relationship between inflation rate, interest rate and stock returns [6] | Sajadi and Farazmand and Sufi | 2010 | |

| Panel data method | Direct and significant relationship between exchange rates and stock prices [9] | Meidani, Shakeri and Ata | 2013 |

| VAR method | positive relationship between exchange rates and stock prices [10] | Nasrollahi and Mirzababaei | 2010 |

| Johanson method - Juselius | The negative effect of inflation and exchange rates on stock returnsand the positive effect of bank interest on stock returns[7] | Karimizadeh and Sharifi | 2012 |

| Model Garch | Negative relationship between exchange rates and stock prices [3] | Heidari and Bashiri | 2011 |

| VAR method | The negative effect of exchange rates with stock prices [8] | Moghbeli | 2015 |

By studying the research literature, it is clear that many variables affect the stock price, including the following.

Budget, the past stock prices, the industry, the country's monetary and fiscal policies, profit-sharing enterprises, development projects and increasing the company's capital, the composition of investment, credit, and company’s history, gossips, supply and demand for shares, the company's management, political factors, trading volume, type of ownership [2], operating cash flows, book value of per share, company size, dividend, return on assets, asset turnover rate [5], the exchange rate, consumer price index, real income of the company [9], GDP, money supply, gold prices, housing prices, exchange rates [18], inflation, industrial production growth, interest rates [15] organizational performance, stock prices in other countries, the volume of money, employment, income distribution [19], investors' expectations, rules and regulations [24] oil prices, inflation, exchange rates, interest rates, money supply [12], social and cultural situation, international economy, liquidity, economic growth rate, the state budget, value-added industry, the volume of trade exchange, the stock liquidity, EPS, P/E, ratio of book value to market value, DPS, business and trade and market risks, financial risks [20]

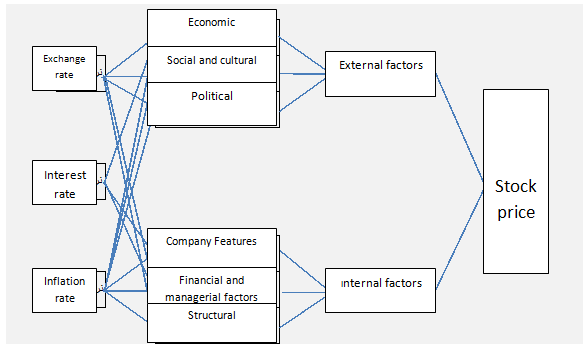

The conceptual model used in the study is as follows, which is derived from research literature and the previous research conducted in this regard.

Figure 1. Research Conceptual Model

Any research to maintain the integrity and objectivity and their application should be organized following a few basic problem. [4] According to the above pattern, the following hypotheses are proposed:

In this article, in order to investigate the negative relationship between the exchange rate, interest rate, inflation rate and the stock price, at first, the intended economy evaluation model is devised by means of Auto-Regression Model with Delay Lag as follows:

Yt=α0+α1Yt-1+ α2Yt-2 +β1X1t+ β2X2t+ β3X3t+ β4X1t-1+ β5X2t-1+ β6X3t-1 + β7X1t-2+ β8X2t-2+ β9X3t-2 + β10 X1t X2t + β11 X1t X3t+ β12 X2t X3t+€t

The items (components) in the above-mentioned model are as follows:

Yt = share price at the time of t

αI = fixed factors

Yt-1 = share price at time of t-1

X1t = inflation rate at the time of t

X2t= exchange rate at the time of t

X3t= interest rate at the time of t

X1t-1= inflation rate at the time of t-1

X2t-1= exchange rate at the time of t-1

X3t-1= interest rate at the time of t-1

€t= degree of error

The research community of this research is the technical and engineering services industry, among which two companies (mapna and takinco) active in this industry were chosen. Regarding the time period of the research, the 7-year period from 1387 to 1393, in terms of seasonal data, is considered. In this article, in order to estimate the model between variables,

the method of economy evaluation of Auto-Regression with Delay Lag (ARDL) has been applied. [1] For this purpose, in the first place, the Steady State and static of the variables were investigated and then the factors of the model were attained. To investigate the competency of the model with respect to the underlying hypotheses of the Regression model, the analysis of residuals (RESIDUAL) was utilized. Next, for the accuracy and for increasing the reliability of the intended pattern, the Neural Network has been used.

1. Evaluation of the Presented Model

Considering the presented model and applying the economy evaluation software, the attained results are as follows. The results are the preliminary estimates of ARDL:

| Item in the model | factor | Lower level | Upper level | meaningfulness |

| α0 | 18021.14 | 8173.571 | 27868.71 | 1 |

| Yt-1 | 0.939591 | 0.424454 | 1.454728 | 1 |

| Yt-2 | 0.277602 | -0.48197 | 1.037171 | 0 |

| X1t | -49467.5 | -95680.2 | -3254.68 | 1 |

| X2t | -1.06437 | 0.00123 | 0.012495 | 1 |

| X3t | -1494.77 | -2103.44 | -886.096 | 1 |

| X1t-1 | 1407.425 | 9842.49 | 12657.34 | 1 |

| X2t-1 | -0.05427 | -0.08249 | -0.02606 | 1 |

| X3t-1 | 337.1283 | 31.1945 | 705.4511 | 1 |

| X1t-2 | -1499.92 | -9038.92 | 6039.079 | 0 |

| X2t-2 | -0.00789 | -0.06727 | 0.051483 | 0 |

| X3t-2 | 20.44541 | -237.855 | 278.7453 | 0 |

| X1t X2t | 0.392505 | -0.09999 | 0.884995 | 0 |

| X1t X3t | 3537.5 | -28.3403 | 7046.66 | 0 |

| X2t X3t | 0.061959 | -0.00179 | 0.12571 | 0 |

R2 = 0.9952

| Item in the model | factor | Lower level | Upper level | meaningfulness |

| α0 | 2821.992 | 5765.9 | 11409.89 | 1 |

| Yt-1 | 0.841605 | 0.08213 | 1.765342 | 1 |

| Yt-2 | -0.66811 | 0.34153 | 1.005306 | 1 |

| X1t | -16236.5 | 23621.3 | 31148.35 | 1 |

| X2t | -0.1523 | 1.00755 | 1.092948 | 1 |

| X3t | -183.557 | 317.567 | 450.4526 | 1 |

| X1t-1 | -4827.12 | 1662.6 | 6975.354 | 1 |

| X2t-1 | -0.02566 | 0.05838 | 0.08706 | 1 |

| X3t-1 | 119.2266 | 46.2161 | 284.6694 | 1 |

| X1t-2 | 2391.449 | -4217.46 | 9000.36 | 0 |

| X2t-2 | -0.02955 | -0.08583 | 0.026727 | 0 |

| X3t-2 | -8.30716 | -180.693 | 164.0783 | 0 |

| X1t X2t | 0.164053 | -0.42368 | 0.751784 | 0 |

| X1t X3t | 1485.94 | -2115.51 | 5087.389 | 0 |

| X2t X3t | 0.004311 | -0.06801 | 0.076637 | 0 |

R2 =0.9754

| Share price of Mapna |

The meaningfulness column is indicative of the intended variables being meaningful in the model. Based on the results achieved, it is clear that none of the reciprocaleffects nor the time delay (delay lag) of level2 are meaningful. Thus, considering the suitable R2 of the preliminary model, the meaningfulness of the reciprocal effects and the time delay of level2, the model is changed. The intended final economy evaluation, taking advantage of Auto-Regression model with delay lag in regard to the share price is as follows:

| Share price of Takinco |

Yt=α0+α1Yt-1+β1X1t+ β2X2t+ β3X3t+ β4X1t-1+ β5X2t-1+ β6X3t-1+€t

Yt=α0+α1Yt-1+β1X1t+ β2X2t+ β3X3t+ β4X1t-1+ β5X2t-1+ β6X3t-1+€t

2. Steady State Test

Static or stationary variables of the model are studied, using improved Dickey-Fuller Test Model.

| Level 0 | variable | statistics | Critical level | meaningfulness |

| Yt | 1.71663 | -1.9497 | 0 | |

| X1t | -0.94458 | -1.9497 | 0 | |

| X2t | -1.34271 | -1.9497 | 0 | |

| X3t | 1.269064 | -1.9497 | 0 |

| Level 0 | variable | statistics | Critical level | meaningfulness |

| Yt | 1.71663 | -1.9497 | 0 | |

| X1t | -0.94458 | -1.9497 | 0 | |

| X2t | -1.34271 | -1.9497 | 0 | |

| X3t | 1.269064 | -1.9497 | 0 |

The results of Dickey-Fuller test, applying economy evaluation software for the static of the final model, indicate that there exists unit root. Therefore, level One subtraction regarding the independent and dependent variables of Auto-Regression is utilized. After repeating Dickey-Fuller test and taking advantage of the subtracted (differences) data, the results in level 1 are as follows:

Dickey-Fuller test results for the static of the final model (level one) in Mapna

| Sig. | Critical Level | Statistics | Variable | Level 1 |

| 1 | -1.9496 | -3.76572 | Yt | |

| 1 | -1.9496 | -2.16844 | X1t | |

| 1 | -1.9496 | -5.12122 | X2t | |

| 1 | -1.9496 | -4.89898 | X3t |

Dickey-Fuller test results for the static of the final model (level one), in Takinco

|

Sig. |

Critical Level |

Statistics |

Variable |

Level 1 |

|

1 |

-1.9496 |

-3.0484 |

Yt |

|

|

1 |

-1.9496 |

-2.16844 |

X1t |

|

|

1 |

-1.9496 |

-5.12122 |

X2t |

|

|

1 |

-1.9496 |

-4.89898 |

X3t |

Therefore, the variables in the Level One subtraction are static and Steady State, consequently, the method of Auto-Regression with Delay Lag (ARDL) is used in order to investigate the relationships among variables.

3. Auto-Regression with Delay Lag

The Intended economy evaluation model; utilizing Auto-Regression with Delay Lag model is as follows:

ΔYt=α0+α1ΔYt-1+β1ΔX1t+ β2ΔX2t+ β3ΔX3t+ β4ΔX1t-1+ β5ΔX2t-1+ β6ΔX3t-1+€t

| Item in the model | factor | deviation | Lower limit assurance gap | Upper limit assurance gap | meaningfulness |

| α0 | 143.6069 | 84 | 68.7132 | 355.9269 | 1 |

| ΔYt-1 | 0.809359 | 0.03 | 0.477592 | 0.981127 | 1 |

| ΔX1t | -1114.89 | 1215 | 706.08 | 4838.305 | 1 |

| ΔX2t | -0.00037 | 0.001 | 0.02201 | 0.025268 | 1 |

| ΔX3t | -574.506 | 83 | -715.497 | -433.515 | 1 |

| ΔX1t-1 | 3447.472 | 2028 | 1980.34 | 8875.288 | 1 |

| ΔX2t-1 | -0.04632 | 0.01 | -0.07181 | -0.02082 | 1 |

| ΔX3t-1 | 313.0272 | 110 | 125.9923 | 500.0621 | 1 |

The results of estimating the model of share price of Mapna company by the method of ARDL with R2 = 0.8696

| Item in the model | factor | Lower level | Upper level | deviation | meaningfulness |

| α0 | 109.0734 | 55.4041 | 273.5509 | 64 | 1 |

| ΔYt-1 | 0.270807 | 0.19483 | 0.736448 | 0.08 | 1 |

| ΔX1t | -1799.87 | 603.61 | 2431.875 | 538 | 1 |

| ΔX2t | -0.00893 | 0.0085 | 0.010647 | 0.0006 | 1 |

| ΔX3t | -86.5149 | 10.567 | 13.53748 | 0.87 | 1 |

| ΔX1t-1 | 1479.178 | 2653.65 | 5612.009 | 870 | 1 |

| ΔX2t-1 | -0.02238 | -0.00042 | -0.00275 | 0.0007 | 1 |

| ΔX3t-1 | 33.90455 | 75.2886 | 143.0977 | 20 | 1 |

The results of estimating the model of share price of Takinco company by the method of ARDL with R2 = 0.8696

In Mapna, according to the statistics of R2, independent or explanatory variables of the model have explained 87 percent of the changes of the dependent variable, which represents the high explanatory power of the model.

According to the attained results in the previous table, the intended mathematical model in the company of Mapna is as follows.

ΔYt=143+0.8ΔYt-1-1114 ΔX1t-0.0004 ΔX2t -574 X3t+ 3447 X1t-1 -0.05 ΔX2t-1 + 313ΔX3t-1+€t

As specified in the model, there is a negative relationship between inflation rate, interest rate and exchange rate, and the share price of Mapna, which is also compatible with the theory.

In Takinco, according to the statistics of R2, independent or explanatory variables have explained 88 percent of the changes of the dependent variable, which is indicative of the high explanatory power of the model.

According to the results gained in the previous table, the intended mathematical model in the company of Takinco is as follows.

ΔYt=109+0.27 ΔYt-1-1799 ΔX1t-0.0089 ΔX2t -86 X3t+ 1479 X1t-1 -0.022 ΔX2t-1 + 34 ΔX3t-1+€t

As specified in the model, there is a negative relationship between inflation rate, interest rate exchange rate, and the share price of Takinco, which is consistent with the theory.

4. Co-integration Test

Considering the fact that the obtained absolute value of t (6.7-) in Mapna company, and also the obtained absolute value of t (9.1-) in the company of Takinco is greater than the absolute value of critical measures provided by Banerjee, crouch and MasterCard (3.9), the null hypothesis, that there is no long-term relationship, is rejected by 95 percent. The result is that there is a long-term relationship between macroeconomic variables and stock index rate.

5. The Analysis of the Error Correction Equation (ECM)

Error correction factor or (1-) ECM represents the balance in the long-run equilibrium rate. This factor shows how much of an imbalance in the dependent variable of the share price y t over the previous period, will be corrected in the current period. The Model related to share price is as follows.

ΔYt=α0+ β1ΔX1t+ β2ΔX2t+ β3ΔX3t+ β4ECM(-1)+ €t

In Mapna, the coefficient of ECM (-1) in the model has been estimated to be equal to -0.57 and, in Takinco, it is -1.17, which implies a suitable speed of fixing the short- term imbalance to a long-term balance. This factor, which is statistically meaningful, suggests that at any period in Mapna 0.57 Riyals and in Takinco 1.17 Riyals of the imbalance in the share price has been adjusted, and it is close to its long-term trend.

6. Neural Network Model

The results attained show that the neural network model is able to predict the share price of Takinco Company with an accuracy of 96.19 percent and that of Mapna Company with the accuracy of 96.66 percent, which is a very good result. It is noteworthy that, the neural network model with linear correlations and linear impacts is capable of modeling complex non-linear relationships as well because of its network structure. The accuracy achieved in predicting the share price of Takinco is the result of modeling nonlinear relationships between input and output variables. The input variables are the same as inflation, exchange and interest rates in both current and previous periods along with the share price in the previous period. Output variables are the share price in the intended period. The results of NN model are indicative of the very high explanatory power of these variables in determining the share price. Comparing the predicted results, based on neural networks, with the actual values shows that the predicted values coincide with the actual values in most places.

7. Thefindings of the Research

According to the hypotheses, the results are as follows.

Based on the results in the company of Mapna, there will be 1% increase in the inflation rate in the short term, which would be equivalent to 11 Riyals decline in stock prices, as well as a 1% increase in the inflation rate, in the long-term, equivalent to 116 Riyals increase in the share price. Based on the results in the company of Takinco, there will be 1% increase in inflation rate, which is equivalent to18 Riyals decline in the share price in the short term. Also, the inflation rate will see a 1%- increase which is equal to 4.4 Riyals decline in the share price, in the long term.

Based on the results of the research carried out in Mapna Company, the exchange rate will see 1000 Riyals increase which is equivalent to a 252-Riyal decline in the share price, in the long run. Also, there will be 1000 Riyals rise in exchange rates, equal to a 0.4-decline in the share price in the short-term. Based on the results in the company of Takinco, 1000 riyals increase in exchange rates, in the short term, will be equal to a decline in the share price with 9 Riyals. Also, 1,000 Riyals increase in the exchange rate, in the long-term, will equal a decline in the share price with 42 Riyals.

Based on the results of the research conducted in the company of Mapna, 1% increase in interest rates, in the short term, will be equal to a decline in the share price with 574 Riyals. Also, a 1% increase in interest rates, in the long-term, would be equivalent of a 1305-Riyal decline in stock prices. Based on the results of the Company of Takinco, 1% increase in interest rates, in the short term, will be equivalent to an 86-Riyal reduction in the share price. Also, a 1% increase in interest rates, in the long-term, will be equal to a decline in the share price with 71 Riyals.

In recent years, the impact of macroeconomic variables on corporate matters is one of the most important topics. The impact of these factors, according to the type and the industry of the companies active in different industries, can vary. The main objective of this study is to evaluate the effectualness of macro-economic variables, including inflation, exchange and interest rates on stock price index in Tehran Stock Exchange; Technical Services Industry, enjoying Auto-Regression model. For this purpose, two companies active in this industry known as Mapna and Takinco were studied in a period of 7 years. The results show that, in Mapna, there will be 1% increase in the inflation rate, in the short term equivalent of a decline in the share price of 11 Riyals and in the long-term, equivalent of 116 Riyals increase in the share price. On the other hand, based on the results gained in the company of Takinco, there will be 1% increase in the inflation rate in the short term, equivalent of an 18- Riyal decline in the share price and in the long-term equivalent of a 4.4-Riyal decline. Also, based on the results attained in the company of Mapna, there will be an increase by 1000 riyals in the exchange rate, equivalent of a 252- Riyal reduction in the share price in the long- run and in the short-run equivalent of a 0.4-Riyal reduction. Based on the results in Takinco Company, there will be a rise by 1000 riyals in the exchange rate, in the short term equivalent of 9 Riyals decline in the share price and in the long term equivalent of 42 Riyals decline. Based on the results in Mapna Company, there will be 1% increase in interest rates, equivalent to 574 Riyals decline in the share price in the short term, and 1305 Riyals decline in the long term. In Takinco, there will be 1% increase in interest rates, in the short term equivalent of 86 Riyals decline in share prices and in the long term equivalent of 71 Riyals. Moreover, in order to enhance the credibility of the results, in addition to Auto-Regression model, and different tests used, the neural network model has also been utilized and the attained results are expressing the accuracy of them.

Abrishami, Hamid, Foundations of Econometrics (Volume II), Tehran University Press, 2014

Emami, Solmaz, factors affecting investment in the Tehran Stock Exchange, 2010

Heidari, Hassan and Bashiri, Sahar, examines the relationship between exchange rate uncertainty and stock price index at Tehran Stock Exchange: observations based on the model VAR-GARCH, Tehran, Journal of Economic Modeling Research, 2012

Khaki, Gholamreza, with the approach of the end of the programming methodology, Tehran, reflections, 2005

Rezaei, Farzin, Shafi'i, conductors, Evolving Relationship between accounting variables and stock prices in the company's life cycle, financial accounting research journal, in 2013

Sajadi, and FarazmandHosein, Hassan and Sufi, Hashem, the relationship between macroeconomic variables and indicators of return on cash Stock Exchange Tehran, Journal of Economic Sciences, 2011

Karimizadeh, Saeed and Sharif Hussein and Ghasemian, Lotfali, the effect of macroeconomic variables on bank stock price index, Tehran, Economic Journal, 2013

Moghbeli, M, The Effect of devaluation of national currency on industry stock index, the Tehran International Conference on Management, Economics and Accounting, 2015

Meidani, Ali Akbar, shaker, Z, Bta, F, monetary macroeconomic variables effect on the stock price Group vehicle and parts manufacturing companies listed in Tehran Stock Exchange, Journal of Monetary Economics, Financial (Knowledge and Development), 2013

Nasrollahi, Z and NasrollahiKhadijeh and Mirzababaei, M, explores the relationship between macroeconomic variables and stock price index in Iran - with vector error correction model approach, Tehran, Quarterly Journal of Economics, 2011

Alam, Mahmudul, Relationship between Interest Rate and Stock Price: Empirical Evidence from Developed and Developing Countries, International Journal of Business and Management, 2009

Aroni, Joshua Makiya , Factors Influencing Stock Prices for firms, International Journal of Business and Social Science, 2011

AishahtonAyub and Mansur Masih , Interest Rate, Exchange Rate, and Stock Prices of Islamic Banks , Munich Personal RePEc Archive, 2013

Aurangzeb. D. , Factors Affecting Performance of Stock Market, International Journal of Academic Research in Business and Social Sciences, 2012

Butt, Babar Zaheer, Kashif Ur Rehman, M. AslamKhan3 ,Safwan, Nadeem , Do economic factors influence stock returns? A firm and industry level analysis, African Journal of Business Management, 2010

Engel Charles , Exchange Rates, Interest Rates, and the Risk Premium , University of Wisconsin, 2015

Gupta, P., Chevalier, Alain, Seyekt, Fran , Interest rate, Exchange rate and stock price, School of Management , Institute of Technology, 2012

Hasanzadeh, Ali, MehranKianvand , The Impact of Macroeconomic Variables on Stock Prices, Money and Economy journal, 2012

Mahfoudh Hussein Mgammal, The Effect of Inflation, Interest Rates and Exchange Rates on Stock Prices , International Journal of Finance and Accounting, 2012

Nazari, Maryam, Nafooti, Nikoo, Sharifi, Mohammad, Shomali, Faezeh, pasandeh, HajarGholi, Tadrisi, Elham, Yousefi ,Maryam, Factors Affecting Risk and Return of Financial Stocks in Stock Exchange, SINGAPOREAN JOuRNAl Of BusinessEconomics and Management Studies, 2013

Prashanta K. Banerjee ,Bishnu Kumar Adhikary, Dynamic Effects of Changes in Interest Rates and xchange Rates on the Stock Market Return in Bangladesh, 2011

Sharifi, Taimur, Harsh Purohit, RekhaPilla, Analysis of Factors Affecting Share Prices, International Journal of Economics and Finance, 2015

Yutaka Kurihara, The Relationship between Exchange Rate and Stock Prices during the Quantitative Easing Policy in Japan, International Journal of Business, 2006

ZhongqiangBai, Study on the Impact of Inflation on the Stock, International Journal of Business and Social Science, 2014

Zohaib Khan, LalaRukh, Impact of Interest rate, Exchange rate and Inflation on Stock Returns , International Journal of Business and Social Science, 2012

Also, in order to collect the required data, the following two sites will be used.