Retailing in India has been one of the oldest occupations, which was initialized as family business, run by different members of the family for generations, engaged in mainly grocery, FMCG or apparel retailing. It was only after liberalization that organized retailing started spreading its wings and currently it is one of the most lucrative businesses contributing significantly to the country’s GDP. It was during the 2008 – 2011 recessionary phase that this industry underwent mild difficulties but since India was not majorly affected as the western world, the retail industry continued its growth trajectory. This study was conducted with the objective of understanding consumers’ responses to specific visual stimuli as presented by retailers from time to time within the store and also to find out the various factors that influence consumers’ monthly requirements of FMCG buying behavior from different organized and unorganized formats of retailing. Primary data was collected from 200 respondents across the city of Kolkata. Regression analysis, to establish relationship between variables and Factor Analysis, to identify various shopping factors were done by means of SPSS 20.

Key words: FMCG, Impulse Purchase, Store Attributes, Product Attributes

Aparajita Roy, Asst. Professor, IMS Business School, West Bengal University of Technology, Mob: 9830077629, E-mail: aparajita.roy77@gmail.com

In today’s ‘Post Modern Era’, shopping has become more of a social and leisure activity, reducing the total number of cognitively planned purchases made by consumers (Banerjee & Saha, 2012). This has to a great extent, led marketers to concentrate more and more on individuals’ changing buying pattern, which has further helped them in identifying that such hedonic and pleasure driven shopping endeavors have enhanced impulse buying among consumers making it socially acceptable and very often a common practice.

Impulse buying is generally referred to as “unplanned buying”, where purchase is made without much thinking, that is purchases made by shoppers without advanced planning. In fact it has been found out that unplanned purchases account for 27% – 62% of purchase in a department store context (Bellenger et al, 1978). Broadly, impulse buying is influenced by several personal, social, economic and cultural backgrounds; varying not only among customers buying similar products but also under different buying situations. Thus, impulse buying may be defined as a purchase decision made in-store with no explicit recognition of a need for such a purchase, prior to entry into the store (Kollet & Willett, 1967; Kollet, 1966; Bellenger et al, 1978). Occurrence of impulse buying could be attributed to exposure to in-store stimuli, the latter acting as reminders of shopping needs (Kollet & Willett, 1969) and, in part, to incomplete measure of purchase plans (Kollet & Willett, 1969).

Having identified the strength of impulse purchase, retailers have designed and redesigned their marketing strategies so as to induce shoppers to make more and more unplanned purchases. Both manufacturers and retailers therefore are always in the lookout for opportunities that they might explore in order to determine the efficiency of resources designed to stimulate additional sales and as such increase the basket size of the buyers.

The emergence of organized retail in India dates back to the pre – independence era when the country’s established business houses, mostly textile majors ventured into the retail arena through company owned outlets. Apart from textiles, a number of organized food and grocery businesses also started in the beginning of the early 1900s.

With liberalization, after 1990 and growth of the economy, the Indian consumers witnessed an increasing exposure to new domestic and foreign products through various media. Social changes such as increase in the number of nuclear families and growing number of working couples, resulting in a change in the buying pattern and increased spending power, have also significantly contributed to the increase in Indian consumers’ personal consumption. High income opportunities, changing attitude towards saving, international exposure and necessities of lifestyle have been identified as the key drivers for fast evolving Indian consumers’ buying behavior (KSA, Technopak, 2006).

This rapid growth has attracted not only the convenience sector but also the luxury product segment in an environment of economic liberalization and rising Purchasing Power Parity (PPP) index until the global turmoil, which swayed the total economic scenario of countries around the globe. But despite the widespread effects of the Great Recession of 2007 - 11, India’s economy was resilient during the first half of the five-year meltdown. But, towards the end of 2008, the Indian retail segment experienced significant pressure marked by negative revenue growth and high rental costs, which led many retailers to resize stores, renegotiate rentals and even exit from locations where operations had become unviable.

Currently, India’s retail market is expected to touch a whopping Rs 47 trillion (US$ 782.23 billion) by 2016–17, expanding at a compounded annual growth rate (CAGR) of 15 per cent, according to a study by a leading industrial body. The total organized retail supply in 2013 stood at approximately 4.7 million square feet (sq ft), witnessing a strong year-on-year (y-o-y) growth of about 78 per cent over the total mall supply of 2.5 million sq ft in 2012. (IEBF, May 2014)

As India changes and reinvents itself at an accelerated pace, the private consumption patterns of its population have also been transformed. This shift in consumer buying patterns has far reaching implications, not only for manufacturers, marketers and retailers, but also consumers and the society at large. In fact, the focus of late, has been shifted to developing business intelligence, vendor management, product development and of course stores management.

Fast Moving Consumer goods, also known as packaged goods, are often termed as Consumer packaged goods, consisting of consumable items (except grocery and pulses) that people buy at regular intervals. The most common items are detergents, toilet soaps, shampoos, hair oils, toothpaste, household accessories, etc. These items are generally meant for daily or frequent consumption and have a high return.

The Indian FMCG sector is the fourth largest sector in the economy with a total market size in excess of US$ 13.1 billion. It has a strong MNC presence and is characterized by a well established distribution network, intense competition between the organized and unorganized segments and low operational cost. Availability of key raw materials, cheaper labour costs and presence across the entire value chain gives India a competitive advantage.

The FMCG market is set to treble from US$ 11.6 billion in 2003 to US$ 33.4 billion in 2015. Penetration level as well as per capita consumption in most product categories like jams, toothpaste, skin care, hair wash etc. in India is low indicating the untapped market potential. Burgeoning Indian population, particularly the middle class and the rural segments, presents an opportunity to makers of branded products to convert consumers to branded products. Growth is also likely to come from consumer 'upgrading' in the matured product categories.

According to statistics published by the Population Reference Bureau in 2011 India has more than 50% of its population below the age of 25 and more than 65% below the age of 35. It is expected that, in 2020, the average age of an Indian will be 29 years. According to a report by AC Nielsen, customers spend almost 42% of their monthly expenditure on products in the grocery category (Peter, 2007). Sinha (2003) has argued that Indian Customers are orientated towards shopping because of the entertainment that can be derived out of it. According to him, the majority of the Indian population can be characterized as young, working class, with higher purchasing power. They seek more of the emotional value from shopping than the rational value and they value convenience and variety.

Therefore, a better shopping experience has become the major focus of Indian shoppers today (Hemalatha et al, 2009). According to Bajaj et al, (2005) more than 60 % of purchases in an organized retail outlet are usually unplanned. Thus, it can be concluded that most Indian consumers are impulsive buyers who purchase products either on a whim or when they are emotionally driven to that product. This has led retailers to take on various marketing strategies for attracting and converting customers such as promotional schemes and attractive displays.

With changing lifestyle and hovering demands of customer, retailers in India, similar to their counterparts around the globe are putting in their best to formulate and reformulate their marketing strategies such that no stone is left unturned. For many years, marketing researchers have considered issues relating to consumers’ store choice across various purchasing situations (Moore and Carpenter, 2006). Starting from apparels to footwear, from jewelry to even FMCG and grocery items, both organized and unorganized retailers are trying to reach out to more and more customers in order to satisfy them and in turn increase their own profitability and goodwill in the market. Thus, a Retailer’s marketing objectives can be classified into three broad categories: attraction that focuses on consumers store entry decision; conversion that relates to consumers decisions about whether or not to make a purchase at a store; and spending that represents both monetary value and the composition of their transactions (Taushiff & Gupta, 2013).

Ramanathan & Hari (2011) observed from their study that due to the recent changes in the demographic system of consumers, and the awareness of quality conscious consumption, consumers preferred to buy different products both from the organized and unorganized retailers. Sinha & Banerjee, (2004) in their study concluded that store convenience and customer services positively influenced consumers store selection, while Gupta, (2012) concluded in her study that store attributes like convenient operating hours and accessibility were the factors which lead to customer loyalty and not store appearance.

Thus, a customer’s store choice decision and buying behavior, is to a great extent influenced by several internal and external stimulus, of which, the current research aims at analyzing the impact of visual merchandising within the store, on impulse buying behavior. Recent studies have stated that atmospheric cues in the retail environment (i.e., sights, sounds, and smells) are important triggers that can influence a desire to purchase impulsively (Eroglu and Machleit 1993; Mitchell 1994). Also it has been suggested that marketing innovations such as credit cards, cash machines, instant credit, 24-hour retailing, and telemarketing make it easier than ever before for consumers to buy things on impulse (Rook 1987; Rook and Fisher 1995). Additionally, marketing mix cues such as point-of-purchase, displays, promotions, and advertisements also can affect the desire to buy something on impulse.

Mehta & Chugan (2012), in their study on impact of visual merchandising on impulse buying behavior have identified that there is no relation between forum display and impulse buying but floor merchandising shows a direct relationship. Sujata, et. al (2012) on the other hand, have found that there is a strong correlation between window display, impulse buying and forum display. Tauseff (2011) in his study on consumers’ FMCG buying behavior, found out that impulse purchase behavior and customers’ age group, gender and education level, were significantly different. Youn & Faber (2000) have identified that there are different types of internal states and environmental or sensory stimuli that serve as cues for triggering impulse buying behavior. According to the researchers, internal cues include customer’s state of mind, positive and negative feeling. Environmental or sensory stimuli include atmospheric cues in retail settings, display cues, marketer-controlled cues and marketing mix stimuli.

This paper therefore aims at understanding aspects of consumers’ FMCG purchase behaviour and identifying the various factors that contribute to the growth and development of organized retailing in India.

Considering the above literature, it has been identified that there are several factors which influence the buying pattern of individual consumers with respect to their format choice for purchasing products of their daily needs. Further, it has been observed in the survey that most respondents, shopping in the organized retail environment, tend to be impulsive in buying items for which there was no immediate need, in spite of having a fixed list of products to be bought per month. The following objectives therefore have been identified in order to analyze consumers’ FMCG buying pattern in Kolkata:

1. To find out whether a store’s visual display of items has an effect on consumers’ impulse purchase behavior in buying monthly requirements of FMCG

2. To identify the various factors which influence consumers’ buying pattern and store format choice

After analyzing the available literature and related practical observations during the research, the following hypothesis was formulated to assess the relationship between variables:

H0: There is no significant relationship between a store’s visual display of products and consumer’s impulse purchase behavior

H1: There is a significant relationship between a store’s visual display of products and consumer’s impulse purchase behavior

The present study is descriptive in nature, with the sampling frame consisting of adult retail customers capable of taking independent decision regarding purchasing monthly requirement of FMCG for themselves as well as their families, across different retail formats available in the city. Data was collected from 200 respondents covering 10 unorganized kirana stores, 5 convenience stores (Spencer’s Daily and In & Out), 3 Supermarkets (Food Bazaar, Reliance Fresh and More), in and around Salt Lake and 1 hypermarket (Spencer – South City Mall), by means of a structured questionnaire with a list of questions in a prearranged order.

The self administered questionnaire consisted of mostly closed ended questions which were either dichotomous or multiple choice. The questionnaire was divided into two parts: Part A consisted of seven questions related to the respondents’ demographic characteristics and socio economic backgrounds. The responses were measured using nominal scale. Part B consisted of twenty questions related to respondents’ FMCG buying behaviour and the responses were recorded using Five point Likert Scale (5: Strongly Agree to 1: Strongly Disagree), where respondents were asked to denote their choice over five degrees of responses.

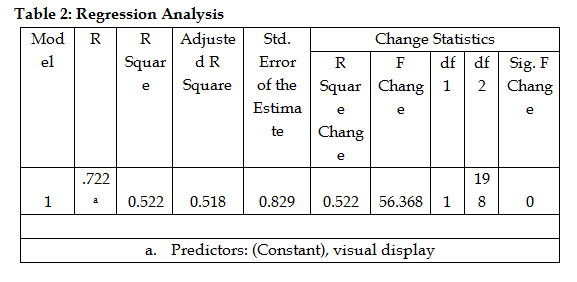

In order to assess the relationship between variables and thus test the hypothesis, Regression Analysis was performed on two variables under study: Independent Variable – Store’s visual display of products and Dependent Variable – Impulse purchase behavior.

The factors that were identified by means of responses based on Likert Scale for understanding consumers’ FMCG buying behavior, were analyzed and grouped through Factor Analysis method using SPSS 20.0.

A total of 235 retail customers were surveyed who walked into either an organized or unorganized grocery store to purchase their monthly requirement of FMCG. After analyzing all the responses, about 200 responses were usable, as the others had to be discarded because of incomplete data. The internal consistency of the data thus collected was tested through reliability analysis using Cronbach’s Alpha, which was found to be 0.854, revealing a high degree of reliability, as reliability results exceeded 0.70 lower limit of acceptability (Hair, et. al, 1998).

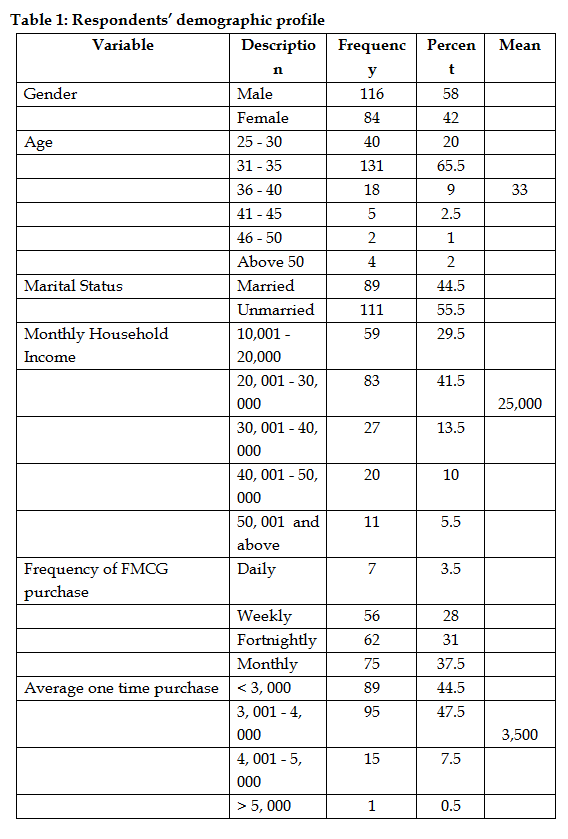

All the respondents were adult male (58%) and female (42%) members with an average age of 33 years (range 21 – 50 and above) and income ranging from Rs. 20, 001 – Rs. 30, 000. The respondents were either single (56%) or married (44%), with mostly graduation (62%) as their educational qualification engaged in either service (54%) or business (25%) as their occupation. Most of the respondents showed cross shopping behavior with a major chunk purchasing their monthly requirement of FMCG from organized retail outlets. (Table 1)

Regression Analysis is done in order to understand the significant impact of Independent Variable on Dependent Variable (Ndubisi, 2006). In this study, the Visual Display of products in the store is considered as an independent variable and Impulse Buying Behaviour of customers as dependent variable.

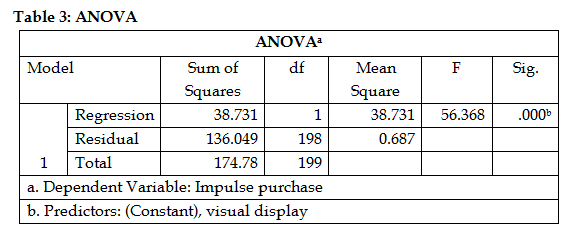

According to the Regression table (Table 2), Adjusted R square is 0.518, which indicates that there is a 51.8% impact of Visual Display (Independent Variable) on Impulse Purchase (Dependent Variable). From the ANOVA Table (Table 3) in the Regression Analysis, Significant P Value is .000, which is less than the significant level .05, indicating that the impact of 51.8% is significant.

Thus, from the calculations we can conclude that the Null Hypothesis (H0) has been rejected, indicating a significant relationship between visual display and impulse purchase.

In order to understand the various factors which affect an individual customer’s FMCG purchase behaviour and hence fulfill the second objective of the dissertation, Factor Analysis was performed using SPSS 20.

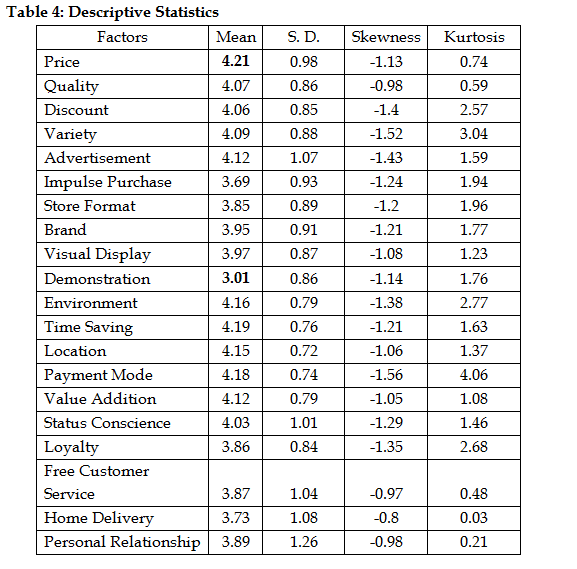

The Descriptive Statistics of the Consumers’ FMCG buying Behaviour is represented in Table 4, which highlights Pricing factor having the highest Mean Score (4.21) and Demonstration factor having the lowest Mean Score (3.01). As it is generally known that Indian consumers are extremely price conscious, they will always look for products from which they get enough value for the money they spend in procuring products of their choice. Likewise, since purchasing FMCG products is generally a low involvement practice, demonstration in this context is least applicable.

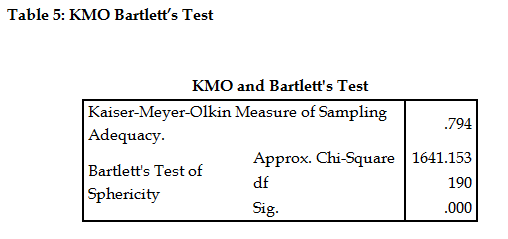

In analyzing the various factors influencing buying behavior, the first step is to find out the adequacy of the sample through KMO and Bartlett’s Test, the result of which was found to be 0.794 and Sig.000, indicating that the sample under study was quite accurate. (Table 5)

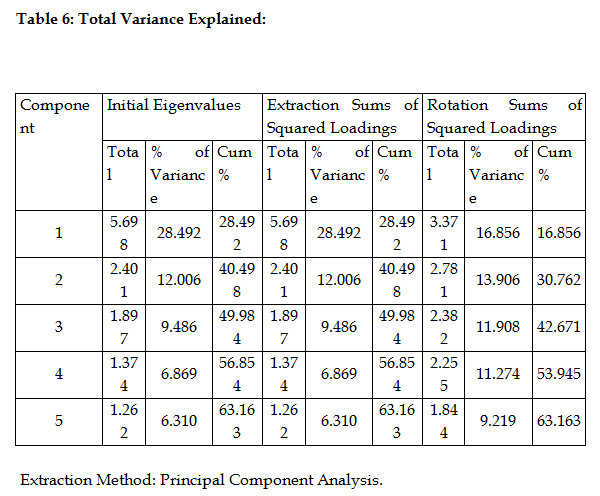

The second step would be to calculate the total variance and hence Eigen Values of all the factors. Only those factors were considered whose Eigen Values were more than 1 and in this study, five components were identified. (Table 6)

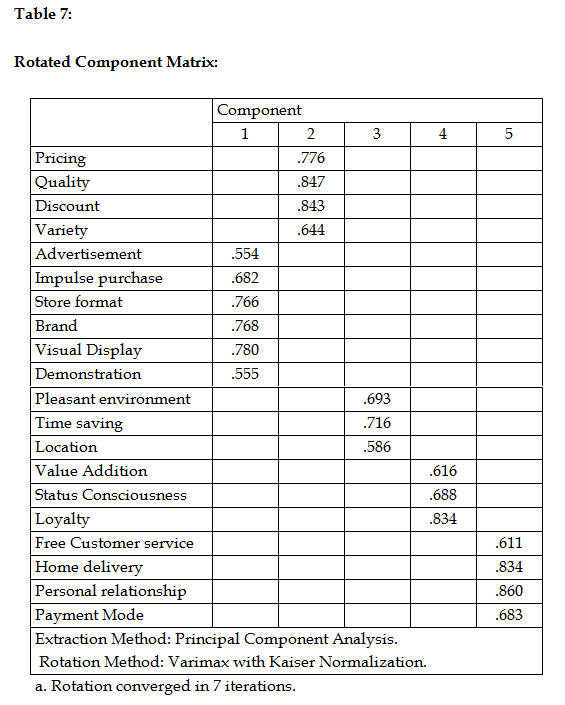

The third step consisted of grouping different factors under the five identified components through Rotated Component Matrix and calculating their respective communalities (Table 7). In this case, all the twenty factors were grouped under different components each of which has been identified as having different aspects of customers’ preferences regarding their store format decisions.

The Rotated Component Matrix indicates that there are five components under which all the factors have been grouped. In this study, five components have been identified as:

1. Promotional Factors

2. Product Attributes

3. Store Attributes

4. Psychographic Factors

5. Customer Delight

The study demonstrates shoppers’ purchase behavior with respect to FMCG products, which indicates that although this segment is considered as one showing low involvement, yet there are several factors which have a significant impact on the purchase pattern. It was found in the study that although the retail industry is currently showing an up gradation in various aspects, yet consumers prefer cross format shopping in purchasing consumer goods for the month. It is evident that impulse purchase plays an important role and as such marketers consciously display their products at POP (Point of Purchase) points so that visual display may lead to such purchase. The results also to some extent implied that format choice decisions are altered when consumers need something urgent to purchase and they are unwilling to face the constraints of time and convenience (C. Jayashankaraprasad, 2010), as found in earlier studies. Above all, with increasing competition and changing retail formats, this study will enable marketers to understand shoppers’ store choice behavior for purchasing FMCG requirements.

Study of consumer behavior denotes that there are mainly two different types of involvement as far as purchasing products are concerned, which again to a great extent is dependent on the price, availability, usage and quality of the product purchased. Fast Moving Consumer Goods are generally those classified under Low Involvement products as they are purchased without spending too much of time and money and generally on a more regular basis. Most of such products are bought on a weekly, fortnightly or monthly basis indicating that these products have a constant and continuous demand throughout the year.

This paper has highlighted that such goods are often bought on impulse because of the influence of visual displays in the stores from where they are bought. Secondly, most retailers selling such goods are always in the lookout for satisfying customers through various promotional methods, providing additional incentives in the form of free home delivery, credit payment facilities, etc. Previously such services were generally rendered by organized retailers, but with the turning of the Wheel of Retail, several neighbourhood kirana stores which are in the continuous process of up grading themselves are also keen on fulfilling the growing demands of consumers in tune with their changing lifestyle. The various factors responsible for such stores to flourish have also been identified in this study, which if retailers can incorporate in their marketing strategy, they will be able to acquire, satisfy and retain more and more customers.

This study has been restricted to only a very limited area of the city Kolkata, which is the cultural capital of our country. The city consists of people from various cultural and educational backgrounds having varied tastes and preferences, food habits, usage patterns, family structure, etc. all of which could not be considered in the study. Moreover data was collected from a limited number of organized and unorganized stores across the city.

Future research can be carried out keeping the above parameters in mind along with other situational and demographical. A study can also be done to distinguish between the purchase pattern of male and female members of the city, between nuclear families and joint families and also at different stages of family life cycle.

· Banerjee, S., Saha, S. (2012). Impulse buying behavior in retail stores triggering the senses. Asia Pacific Journal of Marketing & Management Review, Vol.1 No.2, October 2012, ISSN 2319-2836.

· Bellenger, D.N., Robertson, D.H. and Hirschman, E.C. (1978), ``Impulse buying varies by product'', Journal of Advertising Research, Vol. 18, pp. 15-18.

· Carpenter, J.M. and Moore, M. (2006), ‘‘Consumer demographics, store attributes, and retail format choice in the US grocery market’’, International Journal of Retail and Distribution Management, Vol. 34 No. 6, pp. 434-52.

· Eroglu, S. A. and Machleit, K. A. (1993), "Atmospheric Factors in the Retail Environment: Sights, Sounds and Smells," Advances in Consumer Research, 20, 34.

· Gupta, U. (2012). Customer Loyalty towards Kiranas in Competitive Environment; A Case study. International Journal of Marketing and Technology, II (8), 249-268.

· Hair, J.F., Anderson, R.E., Tatham, R.L. and Black, W.C. (2003), Multivariate Data Analysis, Pearson Education, Delhi, pp. 119-20.

· Kollat, D.T. and Willett, R.P. (1967), “Customer impulse purchasing behaviour”, Journal of Marketing Research, Vol.6,pp. 21-31.

· Mehta, N.P., Chugan, P.K. (2012). Visual merchandising: Impact on consumer behavior. Global Business and Technology Association, pp.607-614, New York USA.

· Mitchell, V-W. (1998), “A role of consumer risk perceptions in grocery retailing,” British Food Journal, 100 (4), pp.171-183.

· Park, W.C., Iyer, E.S. and Smith, D.C. (1989), “The effects of situational factors on in store grocery shopping behaviour: the role of store environment and time available for shopping,” Journal of Consumer Research, 15 (4), pp. 154-168.

· Prasad, C.J.S. and Babu, S.S. (2009), “A study on role of consumerism in modern retailing in India”, GITAM Journal of Management, Vol. 7 No. 1, pp. 227-47.

· Rook, D. W. (1987).The buying impulse. Journal of Consumer Research, 14, 189–199

· Rook, D.W., & Fisher, R.J. (1995). Normative influences on impulsive buying behavior. Journal of Consumer Research, 22 (3), 305-313.

· Sinha, P., & Banerjee, A. (2004). Store Choice Behaviour in an Evolving Market. Journal of Retail and Distribution Management, 32 (10), 482-494.

· Sinha, P.K. and Kar, S.K. (2007), “An insight into the growth of new retail formats in India”, Working Paper No. 2007-03-04, IIMA.

· Sinha, Piyush Kumar; Krishnaswamy Gopi (2009), "The Path to Purchase during Shopping", W.P. No. 2009-11-05, Indian Institute of Management, Ahmedabad.

· Sridhar, G. (2007), “Consumer involvement in product choice: role of perceived risk,” Decision, 34 (2), pp.51-66.

· Teller, C., Kotzab, H. and Grant, D.B. (2006), ‘‘The consumer direct services revolution in grocery retailing: an exploratory investigation’’, Managing Service Quality, Vol. 16 No. 1, pp. 78-96

· Youn, S. and Faber, R. J. (2000), “Impulse Buying: Its Relation to Personality Traits and Cues”, Advances in Consumer Research, Vol. 27, pp. 179-185.