|

Greeshma Manoj Assistant Professor Dept of Economics Christ University, Bangalore, Karnataka, India- 560029 Contact No.- +91 7259529756 Email: greeshma.manoj@christuniversity.in |

S.Muraleedharan Associate Professor (Retd) Dept of Economics Maharajas College, Cochin, Kerala, India. |

The Multi Fibre Agreement (MFA) and the system of bilateral quotas that had governed the global trade in textiles and apparel for the past forty years came to an end and were replaced by the Agreement on Textiles and Clothing (ATC) on Jan 1, 2005. The dismantling of quota restrictions had brought about a significant change in the structure of worldwide trade in textiles as there are no quota barriers for the export of textiles and apparels and the hitherto protected textile industry would be exposed to international competition. The withdrawal of the MFA had brought back the comparative advantages of developing economies to large labour surplus economies such as China and India. Since India has a natural comparative advantage in cotton and cotton-based fibres, abolition of the MFA had an implicit potential to benefit India's cotton industry as well as cotton based textiles and clothing sectors. Compared to the competitors India enjoys certain advantage in the production of textiles and clothing. At the same time, Indian textile industry is also facing many challenges in the domestic and export front in the changed scenario. In the given context, the present study attempts to analyse the export performance of Indian textiles in the post quota era. Export performance has been analysed in terms of change in the composition and destination of Indian textile exports in the post MFA period. The period of study is from 1990-2012. In order to examine the impact of quota removal (MFA), the study period have been sub-divided into Pre-MFA (1990-2004) and post MFA (2005-2012) The study is based on secondary data drawn from Ministry of Textiles, RBI and WTO. The study found that Compound Annual Growth Rate (CAGR) of Indian textile exports were low during the post MFA period compared to pre MFA. If we compare the average export value during the study period, it can be seen that the mean value of textile exports are higher during the post MFA compared to pre MFA period. Among the different sub sectors highest mean value was recorded in readymade garments followed by cotton textiles and manmade textiles during the post MFA period. Analysis of percentage share of different subsectors during the study period show that readymade garments still constitute the largest share in terms of overall textile exports followed by cotton textiles and manmade textiles. As far as the destination of exports are concerned, USA could maintain its position as the largest destination for Indian textile exports in the segment of textiles, readymade garments, coir and carpets even during the post MFA period. Emergence of UAE as the single largest destination for cotton textile exports in the post MFA period is noteworthy. It can also be seen the emergence of new trading partners like Turkey (jute textiles and manmade textiles), Egypt (cotton textiles) and UAE (cotton textiles and readymade garments) in the post MFA period.

Key Words: MFA, textiles, quota restrictions, exports and compound annual growth rate.

India’s textiles sector holds a significant role in Indian economy as it is one among the earliest established industries and the growth and development of this sector has a direct bearing on the economic development of India. It is one of the prominent sectors of Indian economy in terms of its contribution to output, employment and foreign exchange earnings. It is the second largest employment provider, after agricultural sector. Currently, it contributes about 14 percent to industrial production, 4 percent to the GDP, and 17 percent to the country’s export earnings. The structure of Indian textile industry is unique and complex. Indian textile industry is characterised by the predominance of organised sector which contributes to around 97 percent of total cloth production and the share of unorganised sector is only 3 percent (Annual Report 2014-15, Ministry of Textiles).

Textiles and clothing is a very important sector of international trade that has served as the engine of growth, particularly for developing and least developed countries. India is the second largest producer of textiles and garments in the world next to China. The Indian textile industry has significant presence in the world textile economy by virtue of its contribution to world textile capacity and production of textile fibres/yarns. The Indian textile industry accounts for about 24 percent of world’s spindle capacity and eight percent of global rotor capacity. At the global level, India’s textile exports account for just 4.72 percent of global textile and clothing exports. The export basket includes a wide range of items including cotton yarn and fabrics, man-made yarn and fabrics, wool and silk fabrics, made-ups and a variety of garments. The Indian textile industry is currently estimated around US $ 108 billion (CCI Report, 2015).

The international trade in textiles and clothing were governed by various trade restrictions. Multi Fibre Agreement (MFA) was an important quantitative trade restriction imposed by the developed countries to restrict the textile exports from developing countries. The Multi Fibre Arrangement grew out of a series of s voluntary export restraints imposed by the United States and Europe on large Asian textile and clothing exporters (Spinanger, 1999). The first of such agreement was in the form of a Short Term Arrangement Regarding International Trade in Cotton Textiles (STA) in 1961under the General Agreement on Tariffs and Trade (GATT) followed by Long Term Agreement Regarding International Trade in Cotton Textiles (LTA) in February 1962 which was negotiated among 22 major trading nations to allow importing nations to use quotas to avoid market disruption [1]. The multi fibre arrangement was later negotiated in 1974 to broaden the scope of regulation as well as to provide a framework of rules and procedures under which countries can impose import restrictions. The MFA was a general, multilateral framework for managing textile and clothing trade for cotton, wool and manmade fibres. MFA quotas were applied on a discriminatory basis to some exporting countries but not to others, thus differing from country to country in both product coverage and the degree of restrictiveness. It is designed to restrict low-cost exports of clothing and textiles to developed-country markets. At the same time, MFA was not applicable to trade between the rich developed countries and to exports from the Least Developed Countries. The MFA resulted in restricting the size of the textile industry in the exporting countries with natural competitive advantage in the area, as no country could export more than the quota allocated to it. In 1995, MFA was integrated into GATT via the Agreement on Textiles and Clothing (ATC).

ATC was a transitory regime between the MFA and the integration of trading in textiles and clothing in the multilateral trading system. The ATC envisaged the dismantling of the Multi Fibre Agreement over 10 year period (1995-2004). The ATC provided for (a) progressive elimination of quotas in selected products in four stages during the transitional period ending in 2005 (b) increase in quota growth rates on remaining products at subsequent stages.

Table 1: Schedule of Quota Integration under ATC

| Stage | Date | Percentage of product to be brought under removal of quotas |

| I | 1 Jan, 1995 | 16 |

| II | 1 Jan, 1998 | 17 |

| III | 1 Jan, 2002 | 18 |

| IV | 1 Jan, 2005 | 49 |

Source: WTO

With the termination of the Agreement on Textiles and Clothing (ATC) at the end of December 2004, all textiles and clothing products were fully subject to multilateral disciplines under the rules of the World Trade Organization (WTO). The elimination of MFA quotas under ATC was expected to create a new environment for world trade in textiles and apparel by vastly increasing the scope for developing countries to expand their exports and thereby creating employment in this sector. Although ATC has removed the quota restrictions on textile trade there was no consensus among the policy makers with regard to the impact of quota removal on developing countries. Within the developing countries there are quite large differences in competitiveness. One of the major perceptions about the removal of quotas was that after the removal India would become a major beneficiary because of the advantage of large manufacturing base and a large supply of relatively low cost skilled workers. The scrapping of MFA has raised many discussions about the new international trade climate. The elimination of quotas was regarded as an opportunity as well as a threat for the competing countries. Opportunity in the sense that the market is no longer restricted by quotas and threat because competition became severe after the quota removal. India had great hopes of achieving a rapid growth in textiles and clothing exports as quotas disappeared. The general perception was that countries that take the opportunity to streamline their policies, and improve their competitiveness would gain from the quota abolition.

There are a plethora of studies which have tried to analyse the impact of removal of quota restrictions on the trading partners. However, they disagree on the impact of quota elimination on developing countries. Most of the review studies done by international organizations such as the WTO, the World Bank, the Asian Development Bank and the United Nations, concluded that there would be enormous gains for both developed and developing countries such as India after the removal of quota restrictions. But there are some studies such as Spinanger (1998) and Martin and Winters (1996) which hold much more cautious views, particularly with regard to developing countries, on this scenario after 2005. Their assertion is that developing countries would experience negative results after the elimination of textile quota restrictions. Here the cited reviews are the ones which have analyzed the implications with reference to Indian context.

Mehta. R (1997) found that the removal of MFA has provided opportunities and challenges to India's exports of textile and clothing sector. The results show that the removal of MFA has been advantageous to India's exports. India's export of textile and apparel has significantly improved in the post-MFA regime. This increase has been due to (i) increased import demand, and (ii) trade diversion of 'other countries' in destination (developed) countries. Further, the increase has not been restricted to a few commodities, but almost all commodities.

(Chadha and Pohit, 1999) analysed the potential gains from abolition of MFA for developing countries, particularly India by using a 23 sector multi country Computable General Equilibrium (CGE) NCAER-UM model of World Trade, Production and Employment. Maximum welfare increase is observed in South Asia other than India. The analysis also showed ASN region as the major gainer, in percentage terms, in the output of textiles (14.5 percent) followed by NIE (8.5 percent), RSA (7.5 percent) and IND (5 percent). India turns out to be a major proportional gainer in exports of both textiles as well as clothing sectors (26 percent and 42 percent) followed by ASN (19.5 percent), RSA (17 percent) and NIE (8 percent).

Nanda and Raikhy (2000) observes that in order to improve the market share in the post MFA regime there is an urgent need to diversify into a high range and classic garments, technology up gradation through imports importation, if necessary; up gradation of labour skill, extension of off-shore production facilities to selected clothing, in special areas like Andaman Nicobar etc.

Vijaya Ramachandran (2001) in her study identified the weak links in the production chain, key obstacles to productivity and to exports, and policy changes that must be made for the growth of production and exports in the textiles and garments sector in the post MFA regime. The study identified three key weaknesses in the production chain -the inability of Indian producers to supply an adequate amount of cloth, particularly manmade; the lack of availability of textile machinery; and the lack of downstream capacity in weaving and processing.

Kathuria, Martin and Bharadwaj (2001) evaluate the possible implications of MFA removal on exports of garments and textiles focusing on India and the study showed the discriminatory character of MFA. While the abolition of quotas on international trade in textiles in 2005 will create opportunities in 2005 will create opportunities for developing countries, it will also expose them to additional competition from other formerly restrained exporters. The outcome for any country will depend on its policy response. Countries that take the opportunity to streamline their policies and improve their competitiveness are likely to gain from quota abolition.

Verma (2002) analyzed the competitive performance of Indian exports in US and EU markets. It was found that except made ups, Indian textile export to the US had no future. The market share of other products was declining. In case of EU, India’s performance was good in synthetic products (yarn and made-ups) in textiles. Among garments; suits, coats, jackets and skirts were leaders. The products whose exports to EU had been constrained by quotas and hence were likely to gain from quota dismantling in 2005 were cotton bleached fabric and woven bed linen.

Exim Bank (2005) estimated that in the short term, both China and India would gain additional market share proportionate to their current market share. Exim Bank estimated that India would have a market share of 13.5 percent in textiles and 8 per cent in garments in USA market. With regard to EU, it was estimated that the benefits were mainly in the garments sector. The potential gain in textile sector was limited in the EU market considering the proposed further enlargement of EU. It was estimated that India would have a market share of 8 percent in EU textiles market as against China‘s market share of 12 percent.

Landes et al. (2005) opined that demand for cotton and manmade fibers in India would likely to strengthen in response to rising consumer demand in India and increased exports of textiles and apparel following the removing of the MFA quotas. The pace of growth in cotton demand would hinge on execution of reforms to policies, including taxes that discriminate against the use of manmade fibers and regulations affecting the scale, technology use and export competitiveness of the textile and apparel industries.

Ananthakrishnan and Chandra (2005) analyse the impact of the quota elimination on India using Global Trade Analysis Project (GTAP -6) in two scenarios. Scenario I assume a full elimination of quotas, while scenario II assumes a partial elimination of quotas for China and a full elimination for other countries. The results of the simulations do not present an optimistic scenario for India in terms of export growth of Textiles and Clothing in quota free world (Scenario I). They also show that Indian exports of textiles and clothing will continue to expand in the presence of the safeguards on China, but will be adversely affected once these are lifted (Scenario II).

Singh and Kundu (2005) analyzed competitiveness of Indian cotton textile industry in the wake of liberalization. The study was conducted through an empirical investigation of 81 senior and middle level executives from cotton textiles manufacturing and exporting firms in India. The study found that even though globalization had opened vast market opportunities for Indian cotton textile industry, the industry was exposed to the threats of fierce competition. The study found that China, Vietnam, Bangladesh and Malaysia were emerging as major competitors in international textile market. It was also found that the industry was competitive in terms of input factors – labour, transportation and raw material but not in terms of finance, power and technology.

From the above reviews, it has been clear that there is no consensus among the researchers regarding the effect of quota phase out on Indian textile exports. Some of the studies have portrayed a beneficial result to India in the post quota scenario while there are studies which depict a gloomy picture for Indian textile exports in the post MFA period. In the given context, the focus of the present study is to understand the impact of quota removal on the exports of Indian textile exports in the post MFA period after 2005.

The analysis of export performance has been done with the help of secondary data collected from published sources. Export data has been collected mainly from Handbook of Statistics on Indian Economy from RBI as well as CMIE data base. The period of study covers 22 years (1990-2012). In order to examine the impact of quota removal (MFA), the study period have been sub-divided into Pre-MFA (1990-2004) and Post MFA (2005-2013). In the Pre MFA period, there are 4 Phases: I phase (1995-96 to 1997-98), II Phase (1998-89 to 2001-02) and III Phase (2002-03 to -2004-05) and IV phase (2005-2012). The export data in current prices has been converted into constant prices by using the WPI deflator to remove impact of price fluctuation. Export data for different subsectors have been deflated with the corresponding price deflators. With respect to readymade garments, silk, carpets and coir textiles corresponding price deflators were not available. These data have been deflated by using the deflator of textiles. The analysis of export performance has been done with regard to the change in the composition of exports and destination of exports. In order to understand the change in the composition of exports during pre and post MFA period, annual growth rate and Compound Annual Growth Rate has been calculated for the period from 1990 to 2012.

This section describes the changes in Indian textile exports in terms of share of textiles exports, composition and direction of textile exports.

Table 2: Growth rate and Descriptive statistics for Indian Textile Exports

| Year | Phase | Value at Constant price (Rs in Millions) | Annual Growth Rate | Share to Total Exports (in %) | CAGR |

| PRE MFA PERIOD | |||||

| 1990-91 | PHASE - I | 131.01 | - | 17.65 | 16.49 |

| 1991-92 | 187.53 | 43.15 | 20.78 | ||

| 1992-93 | 234.38 | 24.98 | 23.63 | ||

| 1993-94 | 222.27 | -5.16 | 18.59 | ||

| 1994-95 | 250.15 | 12.54 | 19.82 | ||

| 1995-96 | 271.77 | 8.64 | 18.17 | ||

| 1996-97 | 358.48 | 31.91 | 21.90 | ||

| 1997-98 | 429.55 | 19.82 | 24.66 | ||

| 1998-99 | PHASE - II | 422.25 | -1.71 | 23.55 | 6.05 |

| 1999-00 | 479.28 | 13.51 | 24.04 | ||

| 2000-01 | 568.86 | 18.69 | 23.10 | ||

| 2001-02 | 534.10 | -6.11 | 21.51 | ||

| 2002-03 | PHASE - III | 638.58 | 19.56 | 21.63 | -3.09 |

| 2003-04 | 658.80 | 3.17 | 20.50 | ||

| 2004-05 | 581.23 | -11.77 | 15.02 | ||

| PRE MFA PERIOD | MEAN (Rs in Millions) | 397.88 | |||

| Standard Deviation (S.D) (Rs in Millions) | 174.84 | ||||

| Coefficient of variation (C.V) | 43.94 | ||||

| Compound Annual Growth Rate (CAGR) (in %) | 10.44 | ||||

| POST MFA PERIOD | |||||

| 2005-06 | PHASE – IV | 726.18 | 24.93 | 15.91 | 5.72 |

| 2006-07 | 779.89 | 7.40 | 14.76 | ||

| 2007-08 | 770.23 | -1.24 | 13.32 | ||

| 2008-09 | 892.16 | 15.83 | 12.77 | ||

| 2009-10 | 882.50 | -1.08 | 12.84 | ||

| 2010-11 | 922.72 | 4.56 | 10.50 | ||

| 2011-12 | 1044.90 | 13.24 | 9.94 | ||

| 2012-13 | 1133.48 | 8.48 | 10.20 | ||

| POST MFA PERIOD | MEAN (Rs in Millions) | 894.01 | |||

| Standard Deviation (S.D) (Rs in Millions) | 140.20 | ||||

| Coefficient of variation (C.V) | 15.68 | ||||

| Compound Annual Growth Rate (CAGR) (in %) | 5.72 | ||||

Source: Researcher’s calculation based on data from RBI

Table 2 depicts the CAGR and change in the share of textile exports to total exports from 1990-91 to 2012-13. It is also evident from the table that the CAGR of textile exports were higher during the pre MFA period (10.44) compared to post MFA (5.72). Textile exports recorded a negative growth rate in the years of 1993-94, 1998-99, 2001-02 and 2004-05 in the pre MFA period. During 2001-02, the share of textile exports to total exports recorded a negative growth rate compared to the previous year. This could be attributed to the slowdown in the economies of some of the major importing countries such as US, one of the largest trading partners for Indian textile products and increasing competition from our neighboring countries like China and Bangladesh. Apart from this India faced the problem of inadequate supply of domestic cotton and high prices of imported cotton during this period. Along with this, the unilateral changes introduced by certain trading partners in their rules of origin also could have adversely affected textile exports during this period. High price of raw material, high transaction cost and the unfavourable exchange rate also could have been the factors, which have influenced India’s textile exports in that year (Annual reports, Ministry of Textiles, 2003)

If we look into the annual growth rate it can be seen that the annual growth of textile exports recorded a sharp increase from (-11.77) in 2004-05 to 24.93 during 2005-06, the period immediately after the quota removal. After that, India could not maintain the same momentum in the growth rate. This can be partly attributed to the effect of economic turbulence in the major exporting market of EU, US and Canada (Ministry of Textiles, 2009). Apart from this, in the post MFA period, India is facing stiff competition from Vietnam and Bangladesh in US Market and Turkey and Bangladesh in the EU market. Bangladesh enjoys duty free access to European markets, while Indian firms have to pay 9.6 per cent duty on their exports. Labour cost in Bangladesh is 25 per cent cheaper than in India and products made in Bangladesh is 15 per cent cheaper than Indian products. Earlier, Bangladesh was known for its cheap labour, now it is competing in terms of quality, variety and design (Yunus and Yamagata, 2012).

In 2007-08, the share of textiles exports to total exports recorded a negative growth of -1.24. During this time textile exports suffered badly due to a perceptible slowdown of the US economy and the sharp appreciation of rupee by 15per cent against the dollar. Although the rupee has depreciated sharply vis-à-vis the US dollar since April 2008, the export prospects of the Indian textiles sector continues to be adversely affected. Some of the reasons attributed to this decline are the financial sector melt down and economic slowdown in international markets, liquidity crunch, increased cost of production because of increasing raw material costs, power and other input costs which have affected the profitability of textiles and garments units in India and their exports (Annual Report, Ministry of Textiles, 2009). USA, the single largest importer of textiles and clothing items, observed a negative growth of 13.22 per cent and 10.3 per cent in its imports of T&C from the world and India, respectively in 2009 (Ministry of Textiles, 2010). This could have adversely affected Indian textile exports in the US market.

It can also be seen from table 2 that the average export of textiles during the post MFA period (Rs.894.01 million) is higher compared to the pre MFA period (Rs.397.88 million). If we compare the fluctuations in the level of textile exports, it can be inferred that exports during the post-MFA period was more consistent as coefficient of variation (CV) was less during then (15.68) compared to pre MFA period (43.94).

Figure 1: Share of Subsectors to Total Textile Exports

Source: Compiled from the RBI data

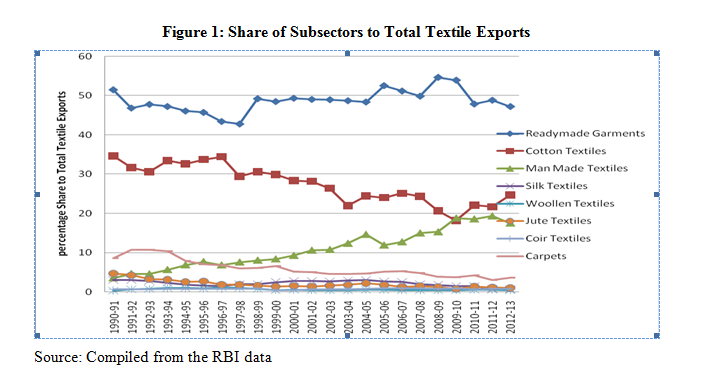

Figure 1 depicts the share of subsectors to total textile exports from 1990-91 to 2012-13. It can be seen that readymade garments constitute the largest share in the overall textile exports accounting for more than 40 percent during the entire analysis period. The share of cotton textile exports shows a slow declining trend from 1997-98 to 2003-04. From 2005-06 onwards the share of this sector remains more or less constant. The share of cotton textile exports to total exports was lowest during 2009-10. This can be attributed to the decline in the production of cotton fabrics, which constitute around 48 percent of the total fabric produced. Cotton fabrics registered a yearly decline of over 17 percent during this time period (Ministry of Textiles, 2009-10). The share of manmade textiles to total textile exports shows an upward trend during the study period. This indicates the fact that there is a marginal improvement in the share of manmade textiles to total textile exports during the post MFA period. The above analysis points to the fact that readymade garments still constitute the largest share of total textile exports from India. It is also to be noted that the share of cotton textiles shows a marginal decline whereas the share of manmade textiles shows a marginal increase during the post MFA period. From this it can be concluded that the composition of textile exports have undergone only a minor change in the post MFA period.

Table 3: Phase wise CAGR of subsectors of Indian Textile Exports under MFA

| Year Sector | I Phase (1995-97) | II phase (1998-2001) | III Phase (2002-2004) | IV phase (2005-10) |

| Textiles (Excluding Readymade Garments) | 16.49 | 6.05 | -3.09 | 5.72 |

| Readymade garments | 13.94 | 5.96 | -3.47 | 4.33 |

| Cotton Textiles | 11.27 | 3.88 | -5.52 | 6.08 |

| Manmade Textiles | 15.8 | 13.54 | 7.32 | 10.94 |

| Woollen Textiles | 19.38 | -7.03 | 6.67 | 3.6 |

| Jute Textiles | 2.46 | 2 | 7.76 | -1.16 |

| Silk Textiles | 22.95 | 15.23 | 0.19 | -11.95 |

| Carpets | 15.23 | -2.55 | 3.93 | 4.1 |

| Coir Textiles | 10.75 | 0.78 | -2.32 | 1.01 |

Source: Researcher’s calculation based on data from RBI

Table 3 shows the CAGR of subsectors of Indian textiles under different phases of MFA. If we compare the CAGR of overall textile exports under different phases, it can be seen that textiles as a whole recorded the highest CAGR in I phase (16.49 percent). If we compare this with the IVth phase (post MFA), the growth has come down to 5.72 percent. A comparison of the CAGR of the different subsectors in I phase shows that the highest CAGR was recorded in the silk textiles (22.95 percent) followed by woollen textiles (19.38 percent) and manmade textiles (15.8 percent). In the II phase, also silk textiles (15.23 percent) recorded the highest CAGR followed by manmade textiles (13.54 percent) and readymade garments (5.96 cent). In the III phase, most of the subsectors recorded a negative CAGR except manmade textiles, woollen, jute, silk and carpets. This may due to the impact of recession in US economy, which is one of the major export destinations for Indian textiles. In the IV phase (post MFA), highest CAGR was recorded in manmade textiles (10.94 percent) followed by cotton textiles (6.08 percent) and readymade garments (4.3 percent). Likewise, if we compare the CAGR across the different phases it can be seen that all the sectors recorded highest CAGR in the I phase compared to other phases. This indicates the fact that in the liberalized trading regime India is losing its position to its competitors. One of the areas where India could have lost out to competitors is in terms of the integrated production facility. Countries that have emerged globally competitive have a significantly consolidated supply chain (Bharath textiles.com, 2013).

The elimination of quotas has opened new vistas for the international market for textile and clothing export especially for the developing economies. Most of the reviews cite US and EU as the two major trading partners for Indian textile products. In the given background table 2 portrays the change in the destinations of Indian textile exports during the pre and post MFA period.

Table 4: Destination for Indian Textile Exports- Pre and Post MFA Analysis

| Sectors | Pre MFA (%) | Post MFA (%) |

| Textiles (Excluding Readymade Garments) | USA (21.4) UK (9.2) Germany (8.8) | USA (20.6) UAE (8) Bangladesh (6.82) |

| Readymade Garments | USA (33.94) Germany (9.99) UK (9.71) | USA (28.72) UK (12.35) UAE (9.23) |

| Cotton Textiles | USA (24.33) Bangladesh (11.9) UK (11.47) | UAE (14.3) Japan (10.17) Egypt (6.6) |

| Manmade Textiles | UAE (27.23) UK (10.09) Italy (6.48) | UAE (16.84) Turkey (8.64) Italy (3.3) |

| Woolen Textiles | UK (34.59) USA (18.22) Japan (16.28) | Italy (30.4) UK (27.09) USA (11.03) |

| Jute Texiles | Belgium (27.08) USA (24.3) UK (11.99) | USA (17.9) UK (10.61) Turkey (9.23) |

| Coir Textiles | USA (32.6) UK (10.91) Netherlands (10.1) | USA (32.2) China (10.3) Netherlands (8.2) |

| Carpets | USA (42.64) Germany (26.86) UK (4.89) | USA (42.41) Germany (16.81) UK (6.47) |

Source: Compiled from Economic Outlook, CMIE.

Table 4 depicts the change in the destinations of Indian textile exports with respect to different subsectors. India’s major textile destinations for textiles (excluding readymade garments) during the pre MFA period were USA (21.4 per cent), UK (9.2 percent), Germany (8.8 percent), UAE (8 per cent) and Bangladesh (5.9 percent). During the post MFA period, USA remained as the major textile exports destinations with a share of 20.62 per cent. However, the share of USA has decreased from 21.4 per cent in the pre MFA period to 20.62 per cent in the post MFA period. A decrease in the share of US can be attributed to lower domestic demand and increased imports from preferential trading partners. An interesting trend in the post MFA period is that UK which was holding the second position in terms of destination with a share of 9.2 in the pre MFA period has come down to the 7th position with a share of 4.7 per cent in the post MFA period. UAE that had a share of 8 per cent in the Pre MFA period could improve its position as the second most important destination with a share of 7.67 per cent followed by Bangladesh (6.82) and Germany (5.73).

In the case of readymade garments, the major export destinations during the pre MFA period were USA (33.94 per cent), Germany (9.99 per cent), UK (9.71 per cent) followed by UAE (7.82 percent) and France (7.65 percent). Post MFA analysis shows that the share of US in Indian garment imports has come down from 33.94 per cent to 28.72 per cent. However, US still could maintain its rank as the largest importer of Indian readymade garment products. In 2008-09, US, single largest importer of Indian textile products observed a negative growth rate of 0.55 per cent in its imports of textiles from India. This has reduced the Post MFA share of US in Indian textile imports. One of the most remarkable shifts in the trend of Indian apparel trade is that UK, which was in the third position with a share of 9.71 per cent during Pre MFA period, has improved its position as the second largest importer of Indian textiles in the Post MFA period with a share of 12.35 per cent. This shows the compensatory gain of India in EU market at the expense of US during the post MFA period. The share of UAE in the Indian garment imports has increased from 7.82 per cent during the pre MFA to 9.23 per cent. This is a clear indication that India has taken the step to diversify its export market to other countries rather than depending on US and EU alone.

India’s major trading destinations of cotton yarn, fabrics and made ups were USA (24.33 per cent), Bangladesh (11.9 per cent), UK (11.47 per cent) followed by Germany (8.13 per cent) and Hong Kong (7.82 per cent) during the pre MFA period. UAE, a non quota country which had a share of 5.28 per cent in the pre MFA period became the largest destination for cotton textiles in the post MFA period with a share of 14.3per cent followed by Japan (10.17 per cent), Egypt (6.6 per cent), Turkey (6.27 per cent) and Bangladesh (5.83 per cent). USA, which was the single largest destination in the pre MFA period, has come down to ninth position in terms of import destination with a share of 3.55per cent. This clearly shows that India has diversified its export market in the post MFA period by exporting to different countries, including the non-quota member countries.

Major destinations of manmade textiles during the pre MFA period were UAE (27.23per cent), UK (10.09 per cent), Italy (6.48 per cent), Saudi (6.47 per cent) followed by Turkey (5.95 percent) and USA. Share of UAE has decreased to 16.84 per cent in the post MFA period. But it still remains as the largest destination for Indian manmade imports. Turkey, which had a share of 5.95per cent during pre MFA period, has increased its share to 8.64 percent to become the second largest destination for manmade imports. UK, which was the second largest importer of manmade textiles during the pre MFA period, has relegated to the 8th position in terms of its imports from India. Likewise, Italy, which had a share of 6.48 per cent before 2005, has experienced a decrease in its share to 3.3per cent during post MFA period.

India’s major woolen textiles export destinations were UK (34.59 per cent), USA (18.22 per cent), Japan (16.28 per cent) followed by Italy (14.57 per cent) and UAE (6.67per cent). An interesting observation during the post MFA period is that Italy, which had a share of 14.57 per cent, has increased its share to 30.40 per cent to become the single largest destination for Indian woolen exports. UK, which was the largest destination for woolen exports with a share of 34.59 per cent during pre MFA period, has moved to the second position with a share of 27.09 per cent during the post MFA period.

In the case of jute textiles, during the pre MFA period, Belgium was the highest destination for exports with a share of 27.08 per cent, followed by USA (24.3 per cent), UK (11.99 per cent), Turkey (9.55 per cent) and Egypt (6.89 per cent). Belgium, which was the largest single destination for Indian jute exports during the pre MFA period, experienced a decline in their imports share after the removal of quota. Share of Belgium imports has come down to 8.4 per cent thereby occupying the sixth important position as the destination for Indian jute imports during the post MFA period. Other major export destinations also experienced decline in their import share. In the post MFA period, USA became the largest destination for jute exports with a share of 24.3 per cent. Even though USA has become the largest importer of jute products USA’s share has decreased to 17.9 per cent and UK experienced a marginal decline in their import share 10.61 per cent. At the same time, India was able to improve its market share in countries like Egypt and Saudi to the extent of 8.52 per cent and 9.23 per cent respectively. A decline in the share of major destinations like Belgium, USA and UK may be due to the predominance of Bangladesh in these markets. (Ministry of Textiles, 2010).

A comparison of the coir exports destinations during the pre and post MFA period shows the USA has been remaining as the single largest destination for Indian coir exports with a share of 32.6 per cent (Pre MFA) and 32.2 per cent (post MFA) respectively. At the same time UK, which had a share of 10.9 per cent during the pre MFA period, has experienced a decline in their share to the extent of 7.9 per cent in the post MFA period. China, which had an import share of 0.03 per cent during the pre MFA period, has experienced a huge increase in their share to the extent of 10.3 and became the second largest destination for Indian coir exports during the post MFA period. This may be due to the Export Market Development Assistance scheme initiated by the government to improve the performance of coir textile exports in the international markets China mainly uses this yarn to manufacture value added products and export to other countries, including India. This has improved the Chinese demand for coir textiles from India (Coir board, 2014).

With regard to the carpet export destinations, USA maintained as the largest trading partner during the entire study period followed by Germany and UK. In the case of Germany and UK, the share has come down in the post MFA period.

The above analysis throws light upon the fact that India could marginally improve her performance in the post MFA period. A comparison of the CAGR during the study period shows that textile exports as well as the sub sector exports showed a low CAGR in the post MFA period compared to pre MFA. In terms of the CAGR, highest growth was recorded in the manmade textiles followed by cotton textiles in the post MFA period. Total textile exports also show a low CAGR in the post MFA period.

An important observation that emerges from the study is that USA could maintain its position as the largest destination for Indian textile exports in the segment of textiles, readymade garments, coir and carpets even during the post MFA period. Even though USA remains as the largest export destination in the post MFA period, the share of India exports to USA has come down in the post MFA period. This contradicts the results of the previous studies which has projected India to increase its market share in the US in the post MFA period (Exim Bank, 2005). Emergence of UAE as the single largest destination for cotton textile exports is another important noteworthy observation in the post MFA period.

Even though India could improve the performance after the quota removal, the present analysis shows that the gain of Indian textiles and clothing exports in the post MFA era have not been commensurate with its expectation. In the international markets India is facing stiff competition from a host of countries especially Bangladesh, Vietnam and China. Indian textile exports are suffering because raw materials are phenomenally high priced. This makes the end product expensive by 15-30 per cent than other competing markets. Also, the presence of more low end and low value added items in India’s export basket also would have affected the competitiveness of Indian textiles in the international market. The absence of contemporary designing facilities and the failure to provide quality value added fabrics and garments act as a hindrance for India to move up in the value chain. In order to improve the export performance, India needs to continue pushing its exports to non-traditional emerging markets of Africa, Asia CIS and Latin America. Indian textile industries inherent strength such as availability of raw materials, especially cotton, integrated operations and design skills would favour the shift of world export of textile industry to India.

Ananthakrishnan, P., & Jain-Chandra, S. (2005). The impact on India of trade liberalization in the textiles and clothing sector. International monetary fund (IMF).

Bharath Textiles. (2013). Indian Textile Exports: Post-MFA Scenario Opportunities and Challenges. http://www.bharattextile.com/

Chadha, R., Pohit, S., Stern, R. M., & Deardorff, A. V. (1999). Phasing out the Multi-Fibre Arrangement: Implications for India. Global Trade Analysis Project (GTAP) at Purdue University.

Cline, W. R. (1990). Chapter 12: Textile and Apparel Negotiations in the Uruguay Round: an Evaluation of the Proposals. Institute for International Economics.

Corporate Catalyst India Pvt Limited, (CCI) . (2015). A Brief Report on Textile Industry in India. July 2015.

dhallenge

CMIE. Economic Outlook. Various issues. Center for Monitoring Indian Economy Pvt. Ltd, Mumbai.

Coir Board. (2014). Evaluation Study of Domestic Market Development Assistance Scheme implemented by Coir Board. Coir Board.

Exim Bank: Research Brief. (2005). Textile Exports: Post MFA Scenario Opportunities and Challenges, No.11, Feb., online available at www. Eximbankindia.com. pp. 1-4.

Kathuria, S., Martin, W. and Bhardwaj, A. (2001). Implications for South Asian countries of abolishing the multifibre arrangement, World Bank Working Paper 2721, Washington, D.C. www.worldbank.org

Landes, Maurice ,Stephen Macdonald,Santosh K.Singh and Thomas Vollrath .(2005). Growth Prospects for India’s Cotton and Textile Industry, CWS-05d-01, Economic Research Service, US Dept. of Agriculture.

Martin, W. and Winters, L.A. (1996).The Uruguay Round and Developing Countries, Cambridge University Press, Cambridge, pp.216-250.

Mehta, R. (1997). Trade Policy Reforms, 1991-92 to 1995-96: Their Impact on External Trade. Economic and Political Weekly, 779-784.

Nanda, P., & Raikhy, P. S. (2001). WTO, Environmental and Labour Standards and India's Textile Exports—Some Implications. WTO and the Indian economy, 298-311.

Ministry of Textiles Annual report. (2003-04). available at: http://apparel.indiamart.com/annual-report/highlights.html.

Ministry of Textiles Annual report. (2008-09). available at: http://apparel.indiamart.com/annual-report/highlights.html.

Ministry of Textiles. (2009-10).Annual Report, Available at http://texmin.nic.in/texpolicy

Ramachandran, V. (2001). Export Competitiveness and the Market for Textiles: A Summary of Research. Harvard Studies – 7, Harvard University, January.

RBI .( Various Years). Data base on Indian Economy. Available at http://dbie.rbi.org.in/

Singh, Narendra and Surinder S. Kundu. (2005). An analysis of the Competitive Dimensions of Indian Cotton Textile Industry. Foreign Trade Review. Vol. XL No.1 (April-June) pp 70-86.

Spinanger, D. (1999). Textiles Beyond the MFA Phase‐Out. The World Economy, 22(4), 455-476.

Verma, Samar. (2002). Export Competitiveness of Indian Textile and Garment Industry. ICRIER, November. Working Paper No.94 pp 1-43.

World Trade Organization (WTO). International Trade Statistics, Various Issues. Geneva.

Yunus, M., & Yamagata, T. (2012). The garment industry in Bangladesh, Chapter 6, Experience of Asia and Africa (Interim Report). Chousakenkyu Houkokusho, IDE-JETRO.

[1] Market disruption’’ was defined as instances of sharp import increases associated with low import prices not attributable to dumping or subsidies (Cline, 1990).