|

AROUL MARIE Research Scholar Department of Commerce Kanchi Mamunivar Centre for Postgraduate Studies (Government of Puducherry) Pondicherry University Puducherry – 605 008, India Contact No.- +91-9443602091 Email: aroulmarie@yahoo.co.in |

Dr. R. AZHAGAIAH Associate Professor Department of Commerce Kanchi Mamunivar Centre for Postgraduate Studies (Government of Puducherry) Pondicherry University Puducherry – 605 008, India Contact No.- +91-9952474095 Email: drrazhagaia@yahoo.co.in |

Working capital can deliver cash today, for growth tomorrow. The present study aims to analyze the working capital management efficiency of firms in Fast Moving Consumer Goods industry in India selecting a sample of all 15 firms of CNX FMCG index of National Stock Exchange of India for the period from 2003-04 to 2014-15. Performance index, utilization index efficiency index and panel data regression model are used to measure the efficiency of working capital management in the study. The t-test and F-test is used to test statistical significance of the regression results of β and R2. The results of t-test and F-test are highly significant which proves that the regression models have been well fitted into the sample data and study period. Therefore, all four null hypotheses set for the study are rejected. Empirical results prove that the Indian FMCG industry performed remarkably well during the study period.

Keywords: Working capital management efficiency; Indian FMCG industry; Performance index; Utilization index; Efficiency index; Panel data regression model.

JEL Classification: C12, C22, C31, C32, C32, Y10

The working capital management is a delicate area in the field of financial management as it involves frequent decision-making (Joginder. S., 2000). The Working Capital Management Efficiency (WCME) is crucial as it decides the survival, liquidity, solvency and profitability of the business (Mukhopadhyya, 2004). The WCME involves planning and controlling Current Assets (CAs) and current liabilities with an aim to eliminate the risk of inability to meet the short term obligations and avoid excessive investment in these assets (Eljelly, 2004).

The WCME helps to avoid financial crises, increase the profitability and enhances the shareholders’ wealth. Modern financial management aims at reducing the level of current assets without ignoring the risk of stock outs (Bhattacharya, 1997). The firms that have sustained working capital improvements have outperformed in terms of earnings. In efficiently run firms, cash runs freely; in others, cash gets trapped in WC, restricting the company’s ability to grow. WC is an indicator of good management, as top WC performers have outperformed across all indicators (PwC Survey, 2014).

1. Importance of working capital management efficiency

Firms try to keep an optimal level of WC that maximizes their value (Howorth and Westhead, 2003, Deloof, 2003, Afza and Nazir, 2007). The importance of good WCM emerges due to the fact a business that manages its WC effectively can survive while meeting its day to day operations successfully, which in turn leads to the long-term success. The target sales level can be achieved only if the firm is supported by adequate WC. Earlier empirical studies show that inefficient management of working capital is one of the important factors causing industrial sickness. It is vital for a business to maintain the trade-off between liquidity and profitability while managing WC. Thus, a well-managed WC is crucial for running a healthy and successful business.

The WCM is an important component of corporate financial management which is not much recognized in financial literature like capital budgeting, capital structure and dividend policies. Therefore, the sufficient valid research should have to be done on the WCME in India owing to its importance listed below:

2. Plan of the Paper

The paper is organized as follows: Section I gives the introduction and plan of the study. Section II presents the review of literature on the WCME. Section III explains research gap, problem statement, research questions, objectives, hypotheses. Section IV covers the research methodology adopted in this study; the empirical analyses and discussions are presented in section V and concluding remarks, limitations, scope for further study, tables and references are reported in section VI.

Section II

Many research studies have focused on financial ratios as a part of WCM, very few of them have discussed the WCME in specific applying the alternative ratio model, which are overviewed in this section.

In the study of Shin and Soenen (1998), the data of 87030 American firms between 1975 and 1994 was analyzed and found a significant negative relationship between cash conversion cycle and the operational income of sales and operational cash flow. The results also revealed that shortening the cash conversion cycle and reducing the time of collecting the received accounts would optimize the function of the firm and operational cash flow.

In his analysis, Deloof (2003) stated that firms with higher profitability need a shorter time to pay their debts and the opposite is also true, that is the lower the power to make profit is the more time is needed to repay the debts. Therefore, if there is a weak management resulting in reduced profitability, certainly more time will be needed to repay the debts. According to his findings, the method by which the working capital is controlled and managed has a significant effect on the firms’ profitability. These results indicate that in order to have a maximum amount of profitability, a specific level of working capital is needed.

Ghosh and Maji (2004) examined the efficiency of working capital practices in Indian cement industry using Bhattacharya model. Three measures, indices of performance, utilization and efficiency were used to measure the overall efficiency of working capital used Indian cement manufacturing firms. The data about 20 large cement firms were collected for 10 years from 1992 to 2001. The results indicated that Indian cement industry not performed well during the study period in terms of working capital management. Industry average for efficiency index of working capital was greater than 1 for only 6 out of 10 years of study. However, some of the

sample firms improved their efficiency index during the study period but a high degree of inconsistency was found into working capital management practices.

Azhagaiah and Muralidharan (2009) aimed at analyzing the relationship between working capital management efficiency and earnings before interest & taxes of the paper industry in India between 1997–1998 and 2005–2006. To measure the working capital management efficiency, three index values viz., performance index, utilization index and efficiency index are computed and are associated with explanatory variables, viz., cash conversion cycle, accounts payable days, accounts receivables days, inventory days. Further, fixed financial assets ratio, financial debt ratio and size (natural log of sales) are considered as control variables in the analysis and are associated with the earnings. The study found that the paper industry has managed the working capital satisfactorily. The paper industry in India performed remarkably well during the period.

Afza and Nazir (2011) examined the WCME in Pakistani cement firms in Karachi stock exchange market between 1998 and 2008. Instead of using the conventional ratios, in which cash conversion cycle is an indicator of effective WCM, they used three other indicators; these indicators included performance index, utilization index and efficiency index. The findings of the study revealed that during the period under study of the mentioned industry, the firms did not have an acceptable performance in the effectiveness of WCM during the period under study.

Farhan Shehzad (2012) examined the working capital management efficiency of the textile companies of Pakistan for the period of 2004 to 2009. Three index variables that were performance index, utilization index and efficiency index were constructed along with Financial Debt Ratio (FDR) and Fixed Financial Asset Ratio (FFAR) which acts as control variables for measuring the efficiency of working capital management. To analyze the relations among WCME and Earning Before Interest Tax (EBIT) in selected firms of Pakistan’s Textile industry, regression analysis was used. Regression results also showed the significant relationship of WCME and earnings before interest and tax. PI, UI & EI showed the positive relationship among EBIT its mean if the company manage WC efficiently it might lead towards increase the earnings. FDR & FFAR ratio showed negative relation with EBIT and firm could increase earnings through reducing the debt and fixed financial resources.

Bagchi, Chakrabarti and Basu Roy (2012) explored the effects of components of working capital management like cash conversion cycle (CCC), age of inventory (AI), age of debtors (AD), age of creditors (AC), debt to total assets (DTA) and debt equity ratio (DER) on profitability of FMCG firms. The profitability of firms is measured in terms of return on total assets (ROTA) and return on investment (ROI). The secondary data for analysis is used for ten year period from 2000-01 to 2009-10. Apart from using Pearson’s correlation analysis, panel data regression analysis like pooled OLS model and fixed effect LSDV model are employed in their study. The results showed a sturdy negative association between working capital management variables and firms’ profitability and also indicated the better explanatory power of fixed effect LSDV model than that of pooled OLS model.

Debdas Rakshid and Chanchal Chatterjee (2012) their study observed that working capital management practice of four selected Indian pharmaceutical companies. For this purpose, three indices of working capital have been used and the appropriate rise in sales was more than the proportionate increase in current assets over a period of study. The study revealed that angle of overall efficiency in WCM, 2 out 4 companies have registered satisfactory performance over the study period. The result of efficiency index value showed more fluctuations and greater than unity value only for four years and thereby proved the improper utilization of the current assets.

Barnali, Sharma, Rabia and Pooja (2013) found out the relationship of working capital management policies on the profitability of FMCG sector’s firms listed in Bombay Stock Exchange (BSE) FMCG sector index. The period of study was from 1991 till 2011 .They took return on total assets as a measure of profitability and average inventory turnover days, average collection period, average payable period and cash conversion cycle as various exogenous variables . The study indicated that all the variables were significant when average collection period factor was dropped and all factors except average inventory turnover days were significant when cash conversion cycle was dropped. This proves that aggressive and conservative working capital management policies affect profitability.

Chitta Ranjan Sarkar and Aniruddha Sarkar (2013) made an attempt to examine the impact of working capital management on corporate performance of selected public sector oil & gas companies in India during the period of 10 years (i.e. from 2000-01 to 2009-10). It also makes an endeavour to measure the degrees of association between the return on capital employed and the selected ratios of working capital management of the selected companies under study during the study period. PI, UI and EI index values have no significant contribution towards the return on owners’ equity for all the concerned companies under study during the study period.

Research Gap

The large share of FMCG in total individual spending along with the large population base makes India one of the largest FMCG markets. Even on an international scale, total consumer expenditure on food in India at US$ 120 billion is amongst the largest in the emerging markets, next only to China (IBEF Report, 2015). Literature review shows that researchers have conducted a number of studies on WCME in capital goods industry, cement industry, paper industry, and telecom industry and so on. It is not found that a study on WCME of FMCG industry in India applying alternative ratio model which is one of the reasons for motivating to conduct a similar kind of study in this industry. Moreover, there is a huge demand for fast moving consumer goods in India. Hence, the present study is an attempt to fill this gap.

Statement of the Problem

Faced with rising costs and competition, Indian FMCG firms are increasingly betting on expanding their geographical footprint with overseas acquisitions, expecting higher returns from international operations to offset lower growth in India (CII Report, 2013). Hence, the present study will help the finance managers to frame policies for WCME of their firms. The importance of WCM in FMCG industry, its different components and the WCME leads to the problem statement in the study.

Research Questions

The current study has raised the following research questions that need an empirical examination in context of Indian FMCG industry:

Research Objectives

The main objective of the study is to analyze the working capital management efficiency practices in Indian FMCG industry for the period 2003-04 – 2014-15.

More specifically, the study focuses the following issues:

Research Hypotheses

In conformity with the objectives of the study, the following are the testable hypotheses:

H01: There is no significant efficiency in performance of various components of current assets for increasing sales in the Indian FMCG industry.

H02: The Indian FMCG Industry does not have the ability to utilize the current assets for generating sales.

H03: The Indian FMCG industry does not have the efficiency in managing working capital.

H04: There is no significant speed in achieving the target level of working capital efficiency by an individual FMCG firm in the industry.

Section IV

Though accounting ratios played a very important role in most of the studies, but a choice of ratios or group of ratios is often a difficult task due to the absence of a proper theory of ratio analysis (Bhattacharya, 1997). To overcome this problem Bhattacharya (1997) developed an alternative ratio model for the measurement and monitoring the WCME which is used in this study.

1. Sample and Data Source

All the 15 firms of Nifty CNX FMCG Index of National Stock Exchange (NSE) India are considered as sample for the study. The CNX FMCG Index is designed to reflect the behaviour and performance of FMCGs which are non-durable, mass consumption products and available off the shelf. The CNX FMCG Index comprises of 15 firms from FMCG industry listed on the NSE, India.

The study is based on a secondary data collected from the database of Centre for Monitoring Indian Economy (CMIE) and NSE India websites and supplemented with other published sources in the form of journals and magazines. The selected sample of 15 firms of NSE, India Nifty CNX FMCG index is presented in Table-1.

2. Period of Study

The data related to a period of 12 years from 2003-04 to 2014-15 implying 180 observations for each index. The reason for taking this particular period is that the financial meltdown happened in the midst of this period challenged with phases of growth and decline due to global instability.

3. Profile of Indian FMCG industry

FMCG, alternatively known as Consumer Packaged Goods (CPG) are products that are sold quickly and generally consumed at a regular basis. The FMCG industry primarily engages in the production, distribution and marketing operations of CPG. The FMCG industry is the fourth largest in the Indian economy, with a total market size of USD 44.9 bn in 2013. The sector grew at a CAGR of 16.2% during 2006–13 (Source: CII, 2013). It has a well established distribution network, intense competition and low operational cost. The FMCG industry will encounter volume growth in the coming years and it will be around 16% in 2016 (NIMR, 2015). Availability of raw materials, cheaper cost of labour force and presence across the entire value chain provide India a competitive advantage.

According to a market research firm, India’s FMCG industry, after witnessing a muted growth in 2014, is now all ready for a healthy recovery due to drop in inflation. The report of MGI, 2015 suggests that if India continues to grow with current pace “average household income will triple over the next decade and it will become the world’s 5th largest consumer economy by 2025 up from 12th place at present”.

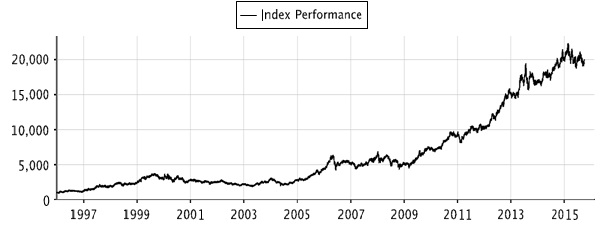

Source: Nifty (CNX) FMCG Index, IISL, Sep., 2015

The above graph of NSE FMCG index performance shows that owing to the globalization of Indian economy, the FMCG industry witnessed an evolutionary change, large number of multinational firms started entering into Indian market and offering wide varieties of products, generating huge employment, raising standard of living and increase the purchasing power of consumers, thereby bringing boom to the Indian FMCG industry. As the name indicates Fast Moving Consumer Goods (FMCG), liquidity is very important for it. Often the major portion of the total assets of the firm is contributed by the CAs.

The FMCG industry has grown at an annual average of about 11% over the last decade. The overall FMCG industry is expected to increase at (CAGR) of 14.7% during 2012-2020, with the rural FMCG industry anticipated to increase at a CAGR of 17.7% to reach US$ 100 billion during 2012-2025. Food product is the leading segment, accounting for 43% of the overall market. Personal care (22%) and fabric care (12%) come next in terms of market share (IBEF, 2015). Indian FMCG industry is growing at a rapid pace and is getting international recognition. It is also attracting new investments both domestic and foreign. Besides, this sector has significant importance in employment generation, industrial, social and economical in nature.

Indian FMCG industry is expected to be in the range of INR 3700 billion-5200 billion by 2020 and is anticipated that it will contribute close to 3% of the GDP (CII Report, 2013). The WC is an important part of finance having a vital bearing on the liquidity of FMCG industry. Therefore, WCM should be given top priority in FMCG firms and this ultimately influence the profitability of the FMCG firms. The present study is an attempt to estimate the WCME of FMCG industry in India.

4. Variables used for the study

The variables taken into consideration for the empirical analysis are various components of CAs viz., short-term investments, short-term loans and advances, stock of raw materials, stock of work-in-progress, stock-in-trade, stock of packing materials, stores and spares, trade receivables, cash and bank balances, accrued incomes, prepaid expenses.

5. Indices used in the study

The study makes an attempt to measure three indices of WCME are:

(a) Working capital performance index;

(b) Working capital utilization index;

(c) Working capital overall efficiency index.

(a) Working capital performance index

The performance index explains the relationship between the change in sales and the change in current assets. When the proportionate increase in sales is greater than the proportionate increase in current assets during a particular period, then the firm can be said to have managed its WC efficiently.

(b) Working capital utilization index

The utilization index symbolizes the relationship between the volume of CAs used and the volume of sales made. It is the ability of the firm in utilizing its current assets as a whole for the purpose of generating sales. It reflects the operating cycle of a firm.

(c) Working capital overall efficiency index

Efficiency index is a scale of performance which measures the combined effect of both performance index and utilization index. In other words it is the product of performance index and utilization index and measures the ultimate WCME of a firm.

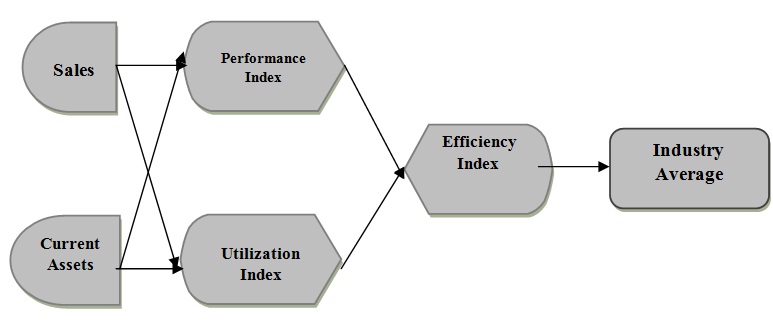

6. Conceptual Framework

The following theoretical model explains the overall analysis adopted in the study:

Performance index and utilization index are calculated using CAs and sales of the firm. Efficiency Index is the result of combination of PI and UI, which is compared with the industry average efficiency.

7. Formulae used for the study

The following formulae are used to measure the three indices of WCME:

The following formulae are used to measure the three indices of WCME:

| PI | |

| Is | Sales in current period Sales in previous period |

| Wit | Different components of current assets of ‘i’ firm in year ‘t‘ |

| N | Number of current assets |

| UI | |

| At | Current assets Sales |

| EI | PI × UI |

8. Regression Model

Pooled ordinary least square model of panel data regression is used for the measurement of firm’s efficiency during the study period. The t-test and F-test is used in the study to test statistical significance of the regression results. Firm’s efficiency in regard to the WCM is equivalent to the average level efficiency of the industry. The advantage of panel data analysis over either time series or cross section modelling is that it captures the differences across individual cross sections much better. This study also tries to capture the speed of adjustment of FMCG firms with their sector performance. In order to measure the firm's efficiency in achieving the target level of efficiency during the study period, following regression model is used:

The model used to test H04

Where, =

= Index of firm‘i’ at time‘t’

= Average index of FMCG industry at‘t-1’

The coefficient of the above regression equation (β) represents the speed of the individual firm in improving its efficiency vis-à-vis the industry norms. In this regard, β = 1 for a firm indicates that the degree of firms efficiency in WCM is equal to the average efficiency level of the sector as a whole. Similarly, β < 1, indicates the need of further improvements by the firms in WCM.

Section V

The results of the empirical evidence and its interpretation are summarized in this section.

1. Performance Index

Table 2 presents PI value of 15 firms for 12 years, which varies from 0.3256 in 2007-08 (Colgate Palmolive (India) Ltd.) to 5.9582 in 2004-05 (Tata Global Beverage Ltd.). It is studied from the table, 13 out of 15 firms with PI >1 in 2008-09 and 2 out of 15 firms in 2010-11. Though Tata Global Beverage Ltd. has the highest mean value (µ=1.33) but only 5 out of 12 years scored the PI > 1 and the lowest mean value (µ=0.9875) of ITC Ltd. for PI > 1 for 4 out of 12 years. Colgate Palmolive (India) Ltd. has PI > 1 in 10 years over the study period. During the study period all the firms (except ITC Ltd.) have the average score of PI > 1.

2. Utilization Index

Table 3 shows that the UI ranges from 0.2463 in 2010-11 (Colgate Palmolive (India) Ltd.) to 2.2580 in 2005-06 (GlaxoSmithKline) during the study period, 14 firms in 2008-09 and 3 firms in 2007-08 have UI > 1. Emami Ltd. has the maximum mean of 1.1375 and has UI > 1 in 10 years and ITC with a minimum mean of 0.9508 and has UI > 1 in 3 years only. Only 3 firms have EI > 1 which reveals that these firms are not able to utilize their CAs efficiently as a whole for generating sales.

3. Efficiency Index

Table 4 reveals that the value of EI varies from 0.0811 in 2010-11 (Colgate Palmolive (India)) to 8.4006 in 2005-06 (GlaxoSmithKline). The EI > 1 for 13 firms out of 15 in 2008-09 and only 3 firms scored well in 2007-08 and 2010-11. Though P&G has the highest mean value, Colgate Palmolive (India) Ltd. performed efficiently for the study period. ITC Ltd. has the least mean (µ=0.9849) having good score of EI in 2 years only. Other than ITC Ltd., all the other firms scored EI well during the period under study.

4. Descriptive Statistics

Table 5 exhibits the minimum and maximum value of the three indices of each sample firm of the FMCG industry during the period study. The results show that GlaxoSmithKline has the lowest EI in 2011-12 (0.1528) indicates that the firm is adopted the conservative WCM strategy and the highest EI in 2005-06 (8.4006) indicates that the firm is adopted the aggressive WCM policy in that particular year. The minimum and maximum values of EI of GlaxoSmithKline Ltd. explain the existence of inconsistency in adopting the working capital policy.

5. Industry Average of PI, UI and EI

Table 6 depicts the industry average of the three indices. The WCME has highlighted the managerial aspects of performance of various CAs (Rao, 1985), this statement is tested in H01,

H01: There is no significant efficiency in performance of various components of current assets for increasing sales in the Indian FMCG industry.

PI of the industry as a whole shows average PI > 1 for 9 out of 12 years. It is found that the industry average of PI (µ=1.1652) indicates that the Indian FMCG industry managed the components of CAs efficiently with respect to their performance. Hence, the H01 is rejected.

The level of WC is a function of sales (Sagan 1955). This statement is tested in H02.

H02: The Indian FMCG Industry does not have the ability to utilize the current assets for generating sales.

The industry average of UI ranges from 0.8186 in 2011-12 to 1.3612 in 2009-10 and 7 out of 12 years have average UI > 1. The overall UI of the Indian FMCG industry for the selected period is 1.0493 which indicates that the selected industry proved the efficiency in utilizing their CAs as a whole for generating sales. Hence, the H02 is rejected.

A poor and inefficient WCM leads to tie up funds in idle assets and reduces the liquidity and profitability of a company (Reddy and Kameswari 2004). This is tested in H03.

H03: The Indian FMCG industry does not have the efficiency in managing working capital.

Numerically the overall EI > 1 indicates the WCME. EI of the industry as a whole shows average EI > 1 for 9 out of 12 years. The average WCME of the industry in respect of EI ranges from 0.7160 to 2.1988 explains on an average, firms of the industry adopted the aggressive WCM practices in 2011-12 and followed the conservative WCM practices in 2009-10. In terms of mean value of EI (µ =1.2674), GlaxoSmithKline Consumer Healthcare is the most efficient firm followed by Colgate Palmolive (India) Ltd. Therefore, H03 is rejected.

6. Efficient Firms

The Table 7 presents the number of efficient firms considering PI, UI and EI. On an average, 2008-09 is the significant year for the Indian FMCG industry during when more number of firms are efficient in respect of all three indices, 13 (87%), 14 (93%) and 13 (87%) and the insignificant year for the industry where number of inefficient firms in respect of the three indices are maximum, 11 (73%).

7. Regression Analysis

As stated earlier in section IV, in order to test the H04, the regression equation model is used with a view to measure how fast the sample FMCG firms able to improve their WCME with respect to industry average as target level during the study period.

H04: There is no significant speed in achieving the target level of working capital efficiency by an individual FMCG firm in the industry.

Using industry mean as the target level of efficiency for each firm, an evaluation of the speed of achieving that target level has been analyzed. Statistical tests, t-test, F-test are used to test the significance of results of empirical study. The regression equation results of PI, UI and EI for all the 15 firms are presented in Table 8 to 10.

Dabur India Ltd. (β=1.5991) is the most efficient firm in achieving industry norm in terms of PI and followed by Godrej Consumer Products Ltd. (β=1.5037) with R2 value of 87.69% and 86.98% and both are significant at 1% level. Table 9 shows Godrej Industries Ltd. (β=1.5991, R2 =71.45%) significantly proved its efficient utilization of current assets followed by Colgate Palmolive (India) Ltd. with β=1.4108 and R2 =86.42% which are highly significant in terms of t-test and F-test.

EI is a measure which reflects the combined effects of PI and UI. From the regression results for EI (Table 10), it is understood that Dabur India Ltd. (β=1.4143; R2=73.39%) and Emami Ltd. (β=1.4108; R2=89.93%) at 1% level of significance occupied first and second position respectively in achieving the targeted industry average of EI. 11 out of 15 firms are having β >1 with t-value at 1% significant level.

R2 is a statistical measure that represents the percentage of the index value that can be explained by the targeted industry average and which is tested by the F-value which is statistically significant at 1% level for 13 firms and 5% level for 1 firm out of 15 firms which signifies that the regression models (the predictors) did a good job of predicting the outcome variables and there is a significant relationship between the set of predictors (industry averages of PI, UI and EI) and the dependent variables (individual firm’s PI, UI and EI). It is proved that the regression models have been well fitted into the data. Hence, the H04 is rejected.

The ranking of the firms with respect to β values of the indices are presented in Table 11. Dabur India Ltd. stood first and achieved the maximum level of industrial average efficiency of WCM. When compared to other sample firms in the industry, P&G failed to prove its efficiency to attain the targeted industrial level of WCME on PI, UI and EI over the analysis period.

Section VI

Empirical results reveal that the Indian FMCG firms performed remarkably well during the study period. The industry average for EI >1 is for 9 out of 12 years. Except one firm all other 14 FMCG firms are significantly proved their efficiency in achieving the industry average in terms of PI, UI and EI during the period of study. Therefore, firms of Indian FMCG industry are considered as efficient with respect to PI, UI and EI of WCM.

The results and conclusion of present study are consistent with the previous empirical studies by Azhagaiah & Muralidharan (2009), Afza & Nazir (2011), Farhan Shehzad (2012) and Harsh & Sukhdev (2014) and are inconsistent with the other studies by Ghosh & Maji (2004) and Debdas & Chanchal (2012) found that the firms are inefficient in managing their WC.

As all the regression results except one firm are statistically significant at 1% and 5% level, it can be concluded that all the null hypotheses from H01 to H04 are rejected. Thus, it can be said that the scope for the improvement in managing the components of current assets for generating increased sales is found well in the study. In the context of the present highly challenging and competitive market situation, this scope should be properly utilized.

The study is limited to the sample of 15 firms (CNX FMCG index, NSE India) for 12 years from 2003-04 to 2014-15. The finding of the study can only be generalized to selected FMCG firms similar to those that are included in the research. The study is based on secondary data collected from the CMIE and NSE India websites, therefore the quality of the study depends purely upon the accuracy, reliability and quality of the secondary data source.

As evident from the empirical results, the selected firms of Indian FMCG industry performed well operationally in relation with WCME during 2003-04 – 2014-15. The question is left for future research to investigate the determinants of profitability in FMCG industry of India. The study also suggests that a further investigation may be helpful for identifying the forces that govern the nature of inefficiency present in all the firms of Indian FMCG industry in terms of WCM. Future research should investigate generalization of the findings beyond the Indian FMCG industry.

Table – 1

Sample firms selected for the study

| Sl. No. | Firm |

| 1. | Britannia Industries Limited |

| 2. | Colgate Palmolive (India) Ltd. |

| 3. | Dabur India Limited |

| 4. | Emami Limited |

| 5. | GlaxoSmithKline Consumer Healthcare |

| 6. | Godrej Consumer Products Ltd. |

| 7. | Godrej Industries Ltd. |

| 8. | Hindustan Unilever Limited |

| 9. | ITC Limited |

| 10. | Marico Limited |

| 11. | Nestle India Limited |

| 12. | Procter & Gamble India Ltd. |

| 13. | Tata Global Beverage Ltd. |

| 14. | United Breweries Ltd. |

| 15. | United Spirits Ltd. |

Source: NSE, CNX FMCG Index.

Table 2

Performance index of selected firms under FMCG industry during 2003-04 – 2014-15

| Sl. No | Firm | 03-04 | 04-05 | 05-06 | 06-07 | 07-08 | 08-09 | 09-10 | 10-11 | 11-12 | 12-13 | 13-14 | 14-15 | µ | SD |

| 1 | Unit Spt | 0.9235 | 1.0771 | 1.1512 | 0.5662 | 1.0231 | 1.1384 | 2.0480 | 0.7792 | 0.8449 | 1.3628 | 1.0239 | 1.7425 | 1.1496 | 0.3954 |

| 2 | P&G | 1.6187 | 0.9693 | 2.4008 | 3.7122 | 1.4807 | 0.7658 | 0.9039 | 0.6917 | 0.8632 | 1.0725 | 1.0386 | 0.8316 | 1.3168 | 0.8610 |

| 3 | Nestle | 0.9767 | 1.1041 | 1.5997 | 0.5916 | 1.0462 | 1.4912 | 0.8018 | 1.3233 | 0.5702 | 1.2166 | 0.8341 | 1.2283 | 1.0659 | 0.3143 |

| 4 | Marico | 0.8787 | 1.3756 | 0.9559 | 1.9431 | 0.4976 | 2.0585 | 1.1584 | 0.7904 | 1.0652 | 1.1572 | 0.7468 | 1.4032 | 1.1392 | 0.4602 |

| 5 | ITC | 1.0201 | 0.8476 | 1.0020 | 0.6725 | 0.7979 | 1.8490 | 0.8940 | 0.7344 | 0.7155 | 0.9825 | 0.9386 | 1.3289 | 0.9875 | 0.3121 |

| 6 | HUL | 1.0122 | 1.3735 | 1.1040 | 0.8964 | 0.8443 | 1.5476 | 0.7789 | 0.6100 | 1.2713 | 1.1307 | 0.9785 | 1.0973 | 1.0446 | 0.2525 |

| 7 | Gdj.cons | 1.0020 | 2.0164 | 0.8829 | 0.6884 | 0.7715 | 1.7617 | 0.8401 | 0.7353 | 0.7870 | 0.9540 | 1.6842 | 0.8738 | 1.0870 | 0.4400 |

| 8 | Godrej | 2.0540 | 0.9268 | 1.1791 | 0.8463 | 1.2228 | 1.5652 | 0.7550 | 0.8747 | 1.0696 | 0.9166 | 2.9108 | 1.0006 | 1.2613 | 0.6054 |

| 9 | Glaxo | 1.3404 | 1.0304 | 3.7203 | 0.9825 | 0.7359 | 1.7367 | 1.1841 | 1.4442 | 0.5333 | 1.0096 | 1.0592 | 0.7721 | 1.2660 | 0.8022 |

| 10 | Emami | 2.2310 | 1.4796 | 1.3244 | 0.8576 | 0.3256 | 1.9453 | 0.9169 | 0.6377 | 1.1649 | 1.1484 | 1.0268 | 1.3052 | 1.1793 | 0.5069 |

| 11 | Unit Bre | 1.0064 | 1.4822 | 1.3244 | 1.3997 | 1.7792 | 0.8574 | 1.6281 | 0.7580 | 1.1148 | 1.4581 | 0.5654 | 1.3252 | 1.1978 | 0.3655 |

| 12 | Dabur | 2.2334 | 1.1312 | 1.3895 | 0.5573 | 0.8577 | 1.7015 | 0.9483 | 0.5848 | 0.9685 | 1.0517 | 1.0298 | 1.6459 | 1.1506 | 0.4761 |

| 13 | Colgate | 1.1991 | 1.8255 | 1.3899 | 1.1893 | 0.5851 | 1.8009 | 1.5784 | 0.3292 | 1.1170 | 1.1637 | 1.4324 | 1.1087 | 1.2398 | 0.4240 |

| 14 | Tata Glo | 0.8469 | 5.9582 | 0.9996 | 0.5837 | 0.6836 | 1.2346 | 1.1324 | 0.9401 | 0.7562 | 1.1846 | 1.0295 | 0.9725 | 1.3300 | 1.4035 |

| 15 | Britann | 1.4346 | 0.7395 | 1.5379 | 0.5839 | 0.8063 | 1.6995 | 1.6146 | 0.9029 | 1.1201 | 0.8588 | 1.2431 | 0.8423 | 1.1089 | 0.3650 |

Source: Computed results from Financial Statements.

Table 3

Utilization index of selected firms under FMCG industry during 2003-04 – 2014-15

| Sl. No | Firm | 03-04 | 04-05 | 05-06 | 06-07 | 07-08 | 08-09 | 09-10 | 10-11 | 11-12 | 12-13 | 13-14 | 14-15 | µ | SD |

| 1 | Unit Spt | 0.9482 | 1.1566 | 1.1227 | 0.6723 | 0.8004 | 1.2666 | 1.2132 | 0.8781 | 0.8898 | 1.1497 | 1.0040 | 1.2066 | 1.0278 | 0.1805 |

| 2 | P&G | 1.6473 | 0.9565 | 1.4785 | 1.6245 | 1.4944 | 0.6509 | 1.0430 | 0.4616 | 0.8792 | 1.1496 | 0.9399 | 0.6349 | 1.0528 | 0.3990 |

| 3 | Nestle | 1.0673 | 1.1792 | 0.9780 | 0.7564 | 0.9042 | 1.2935 | 0.9786 | 1.0920 | 0.7378 | 1.1260 | 0.7203 | 1.2236 | 1.0093 | 0.1863 |

| 4 | Marico | 0.9776 | 1.1375 | 1.0884 | 0.8349 | 0.6232 | 1.5062 | 0.7799 | 0.9260 | 1.1224 | 0.8897 | 0.9815 | 1.1763 | 1.0009 | 0.2172 |

| 5 | ITC | 0.8926 | 0.9563 | 0.9551 | 0.7238 | 0.7510 | 1.3349 | 1.0964 | 0.7685 | 0.7264 | 0.9857 | 0.9871 | 1.1329 | 0.9508 | 0.1809 |

| 6 | HUL | 0.9365 | 1.0791 | 1.1532 | 0.8497 | 0.8856 | 1.3220 | 0.8874 | 0.6417 | 1.2028 | 1.1671 | 0.9492 | 1.0812 | 1.0063 | 0.1819 |

| 7 | Gdj.cons | 0.8939 | 1.0963 | 0.9409 | 0.6361 | 0.8646 | 1.7392 | 0.8279 | 0.8868 | 0.6385 | 0.9631 | 1.6035 | 0.8127 | 0.9907 | 0.3284 |

| 8 | Godrej | 1.2063 | 0.9673 | 0.9855 | 0.5648 | 1.4582 | 1.0460 | 0.9675 | 0.9783 | 1.1376 | 0.5886 | 1.7885 | 1.0629 | 1.0627 | 0.3180 |

| 9 | Glaxo | 0.7678 | 1.0059 | 2.2580 | 0.8494 | 0.8364 | 1.0873 | 1.2165 | 1.0548 | 0.2866 | 0.9201 | 1.1684 | 0.7288 | 1.0023 | 0.4456 |

| 10 | Emami | 1.0754 | 1.4363 | 1.6484 | 1.0873 | 0.3278 | 2.1994 | 1.0259 | 0.5195 | 1.0484 | 1.1477 | 1.0352 | 1.1322 | 1.1375 | 0.4613 |

| 11 | Unit Bre | 0.7932 | 1.8835 | 0.4140 | 1.3607 | 1.2052 | 1.0104 | 1.3627 | 0.9421 | 0.8758 | 0.6484 | 0.6717 | 1.1446 | 1.0088 | 0.3851 |

| 12 | Dabur | 1.8683 | 1.0372 | 1.3525 | 0.5828 | 0.8258 | 1.2589 | 1.0093 | 0.6337 | 0.9762 | 1.0813 | 1.0206 | 1.3151 | 1.0705 | 0.3329 |

| 13 | Colgate | 1.1161 | 1.3786 | 0.8915 | 1.2396 | 0.5653 | 1.8485 | 1.1271 | 0.2463 | 1.1961 | 1.0386 | 1.3861 | 1.1660 | 1.1217 | 0.3968 |

| 14 | Tata Glo | 1.0361 | 1.3223 | 0.8759 | 0.7355 | 0.7072 | 1.2015 | 1.0053 | 1.2301 | 0.8824 | 1.0458 | 0.9986 | 0.9833 | 0.9992 | 0.1796 |

| 15 | Britann | 0.9140 | 0.9470 | 1.0946 | 0.6549 | 0.8270 | 1.6528 | 1.1505 | 1.0187 | 1.0094 | 1.0975 | 1.0926 | 0.9386 | 1.0204 | 0.2330 |

Source: Computed results from Financial Statements.

Table 4

Efficiency index of selected firms under FMCG industry during 2003-04 – 2014-15

| Sl No | Firm | 03-04 | 04-05 | 05-06 | 06-07 | 07-08 | 08-09 | 09-10 | 10-11 | 11-12 | 12-13 | 13-14 | 14-15 | µ | SD |

| 1 | Unit Spt | 0.8757 | 1.2457 | 1.2925 | 0.3806 | 0.8188 | 1.4418 | 2.4847 | 0.6842 | 0.7518 | 1.5668 | 1.0279 | 2.1026 | 1.2311 | 0.5839 |

| 2 | P&G | 2.6665 | 0.9271 | 3.5496 | 6.0306 | 2.2128 | 0.4985 | 0.9428 | 0.3193 | 0.7590 | 1.2329 | 0.9762 | 0.5280 | 1.6309 | 1.6365 |

| 3 | Nestle | 1.0424 | 1.3019 | 1.5645 | 0.4475 | 0.9460 | 1.9288 | 0.7847 | 1.4450 | 0.4207 | 1.3699 | 0.6008 | 1.5029 | 1.1151 | 0.4618 |

| 4 | Marico | 0.8590 | 1.5648 | 1.0404 | 1.6222 | 0.3101 | 3.1004 | 0.9034 | 0.7320 | 1.1956 | 1.0295 | 0.7330 | 1.6506 | 1.1919 | 0.6959 |

| 5 | ITC | 0.9106 | 0.8106 | 0.9570 | 0.4867 | 0.5992 | 2.4682 | 0.9801 | 0 .5644 | 0.5198 | 0.9685 | 0.9265 | 1.5054 | 0.9849 | 0.5257 |

| 6 | HUL | 0.9479 | 1.4822 | 1.2731 | 0.7616 | 0.7477 | 2.0459 | 0.6912 | 0.3915 | 1.5292 | 1.3196 | 0.9287 | 1.1864 | 1.0901 | 0.4401 |

| 7 | Gdj.cons | 0.8957 | 2.2106 | 0.8307 | 0.4379 | 0.6670 | 3.0640 | 0.6955 | 0.6521 | 0.5025 | 0.9189 | 2.7006 | 0.7101 | 1.1840 | 0.8759 |

| 8 | Godrej | 2.4778 | 0.8965 | 1.1620 | 0.4781 | 1.7830 | 1.6373 | 0.7305 | 0.8557 | 1.2168 | 0.5395 | 5.2060 | 1.0636 | 1.4761 | 1.2461 |

| 9 | Glaxo | 1.0292 | 1.0365 | 8.4006 | 0.8345 | 0.6155 | 1.8882 | 1.4405 | 1.5233 | 0.1528 | 0.9289 | 1.2376 | 0.5627 | 1.5711 | 2.1013 |

| 10 | Emami | 2.3991 | 2.1251 | 2.1832 | 0.9325 | 0.1067 | 4.2786 | 0.9406 | 0.3313 | 1.2212 | 1.3180 | 1.0630 | 1.4778 | 1.4958 | 1.0731 |

| 11 | Unit Bre | 0.7984 | 2.7916 | 0.5483 | 1.9047 | 2.1443 | 0.8663 | 2.2187 | 0.7141 | 0.9764 | 0.9454 | 0.3798 | 1.5169 | 1.2696 | 0.7620 |

| 12 | Dabur | 4.1727 | 1.1733 | 1.8794 | 0.3248 | 0.7083 | 2.1420 | 0.9571 | 0.3706 | 0.9455 | 1.1371 | 1.0511 | 2.1645 | 1.3728 | 1.0295 |

| 13 | Colgate | 1.3383 | 2.5165 | 1.2391 | 1.4742 | 0.3307 | 3.3289 | 1.7790 | 0.0811 | 1.3360 | 1.2087 | 1.9856 | 1.2928 | 1.5265 | 0.8416 |

| 14 | Tata Glo | 0.8774 | 7.8785 | 0.8755 | 0.4293 | 0.4834 | 1.4834 | 1.1384 | 1.1564 | 0.6673 | 1.2388 | 1.0281 | 0.9563 | 1.4729 | 1.9468 |

| 15 | Britann | 1.3112 | 0.7002 | 1.6834 | 0.3823 | 0.6668 | 2.8090 | 1.8576 | 0.9198 | 1.1306 | 0.9426 | 1.3583 | 0.7905 | 1.1883 | 0.6392 |

Source: Computed results from Financial Statements.

Table 5

Minimum and maximum value of respective index of selected firms under FMCG industry during 2003-04 – 2014-15

| Firm | Performance Index | Utilization Index | Efficiency Index | |||

| Minimum | Maximum | Minimum | Maximum | Minimum | Maximum | |

| United Spirit | 0.5662 (06-07) | 2.0480 (09-10) | 0.6723 (06-07) | 1.2666 (08-09) | 0.3806 (06-07) | 2.4847 (09-10) |

| P&G | 0.6917 (10-11) | 2.4008 (05-06 | 0.4616 (10-11) | 1.6473 (03-04) | 0.3193 (10-11) | 6.0306 (06-07) |

| Nestle | 0.5702 (11-12) | 1.5997 (05-06) | 0.7203 (13-14) | 1.2935 (08-09) | 0.4207 (11-12) | 1.9288 (08-09) |

| Marico | 0.4976 (07-08) | 2.0585 (08-09) | 0.6232 (07-08) | 1.5062 (08-09) | 0.3101 (07-08) | 3.1004 (08-09) |

| ITC | 0.6725 (06-07) | 1.8490 (08-09) | 0.7238 (06-07) | 1.3349 (08-09) | 0.4867 (06-07) | 2.4682 (08-09) |

| HUL | 0.6100 (10-11) | 1.5476 (08-09) | 0.6417 (10-11) | 1.3220 (08-09) | 0.3915 (10-11) | 2.0459 (08-09) |

| Godrej Consum | 0.6884 (06-07) | 2.0164 (04-05) | 0.6361 (06-07) | 1.7392 (08-09) | 0.4379 (06-07) | 3.0640 (08-09) |

| Godrej | 0.7550 (09-10) | 2.9108 (13-14) | 0.5648 (06-07) | 1.7885 (13-14) | 0.4781 (06-07) | 5.2060 (13-14) |

| GlaxoSmith | 0.5333 (11-12) | 3.7203 (05-06) | 0.2866 (11-12) | 2.2580 (05-06) | 0.1528 (11-12) | 8.4006 (05-06) |

| Emami | 0.3256 (07-08) | 2.2310 (03-04) | 0.3278 (07-08) | 2.1994 (08-09) | 0.1067 (07-08) | 4.2786 (08-09) |

| Unitd Brewer | 0.5654 (13-14) | 1.7792 (07-08) | 0.4140 (05-06) | 1.8835 (04-05) | 0.3798 (13-14) | 2.7916 (04-05) |

| Dabur | 0.5573 (06-07) | 2.2334 (03-04) | 0.5828 (06-07) | 1.8683 (03-04) | 0.3248 (06-07) | 4.1727 (03-04) |

| Colgate | 0.3292 (10-11) | 1.8255 (04-05) | 0.2463 (10-11) | 1.8485 (08-09) | 0.0811 (10-11) | 3.3289 (08-09) |

| Tata Global | 0.5837 (06-07) | 1.2346 (08-09) | 0.7355 (06-07) | 1.3223 (04-05) | 0.4293 (06-07) | 7.8785 (04-05) |

| Britannia | 0.5839 (06-07) | 1.6995 (08-09) | 0.6549 (06-07) | 1.6528 (08-09) | 0.3823 (06-07) | 2.8090 (08-09) |

Source: Computed results from Financial Statements.

Table 6

FMCG industry average of PI, UI and EI index during 2003-04 – 2014-15

| Index | Esti mate | 03-04 | 04-05 | 05-06 | 06-07 | 07-08 | 08-09 | 09-10 | 10-11 | 11-12 | 12-13 | 13-14 | 14-15 | µ | SD |

| PI | µ | 1.0060 | 1.3185 | 1.5558 | 1.4641 | 1.0714 | 0.8971 | 1.5436 | 1.1455 | 0.8091 | 0.9308 | 1.1112 | 1.1695 | 1.1652 | 1.1683 |

| SD | 0.1721 | 0.4927 | 1.2688 | 0.7259 | 0.8247 | 0.3738 | 0.3835 | 0.3935 | 0.2773 | 0.2254 | 0.1615 | 0.5495 | 0.2957 | 0.1009 | |

| UI | µ | 0.9835 | 1.0760 | 1.1693 | 1.1491 | 0.8782 | 0.8717 | 1.3612 | 1.0461 | 0.8186 | 0.9073 | 1.0000 | 1.0898 | 1.0493 | 1.0308 |

| SD | 0.1537 | 0.3033 | 0.2519 | 0.4187 | 0.3120 | 0.3103 | 0.3820 | 0.1547 | 0.2690 | 0.2430 | 0.1779 | 0.2982 | 0.1940 | 0.0501 | |

| EI | µ | 1.0088 | 1.5068 | 1.9107 | 1.8986 | 1.1285 | 0.8760 | 2.1988 | 1.2363 | 0.7160 | 0.8883 | 1.1110 | 1.4135 | 1.2674 | 1.3201 |

| SD | 0.1537 | 0.3033 | 0.2519 | 0.4187 | 0.3120 | 0.3103 | 0.3820 | 0.1547 | 0.2690 | 0.2430 | 0.1779 | 0.2982 | 0.1940 | 0.0501 |

Source: Computed results from Financial Statements.

Table 7

Number of efficient firms (Index > 1) of selected firms under FMCG industry

during 2003-04 – 2014-15

| Year | Performance Index | Utilization Index | Efficiency Index | |||

| Efficient firms | Percentage | Efficient firms | Percentage | Efficient firms | Percentage | |

| 2003-04 | 11 | 73 | 07 | 47 | 08 | 53 |

| 2004-05 | 11 | 73 | 11 | 73 | 11 | 73 |

| 2005-06 | 12 | 80 | 08 | 53 | 11 | 73 |

| 2006-07 | 04 | 27 | 04 | 27 | 04 | 27 |

| 2007-08 | 05 | 33 | 03 | 20 | 03 | 20 |

| 2008-09 | 13 | 87 | 14 | 93 | 13 | 87 |

| 2009-10 | 07 | 47 | 10 | 67 | 06 | 40 |

| 2010-11 | 02 | 13 | 04 | 27 | 03 | 20 |

| 2011-12 | 07 | 47 | 06 | 40 | 06 | 40 |

| 2012-13 | 11 | 73 | 09 | 60 | 09 | 60 |

| 2013-14 | 10 | 67 | 08 | 53 | 09 | 60 |

| 2014-15 | 10 | 67 | 10 | 67 | 10 | 67 |

Source: Computed results from Financial Statements.

Table 8

Regression result for performance index of selected firms under FMCG industry

during 2003-04 – 2014-15

| Firm | α | β | R2 | F value |

| United Spirits | -0.0313 | 0.8719* | 0.48 | 9.23* |

| -(0.23) | (3.04) | |||

| P&G | 0.1062 | 0.5756 | 0.3185 | 4.67NS |

| (0.43) | (2.16) | |||

| Nestle | -0.1576 | 1.3174** | 0.7561 | 31.00** |

| -(1.71) | (5.57) | |||

| Marico | -0.0249 | 1.1903** | 0.7642 | 32.40** |

| -(0.20) | (5.69) | |||

| ITC | -0.2076 | 1.0346** | 0.6735 | 20.63** |

| -(2.16) | (4.54) | |||

| HUL | -0.1562 | 1.1989** | 0.7937 | 38.47** |

| -(2.49) | (6.20) | |||

| Godrej Consumers | -0.1375 | 1.5037** | 0.8698 | 66.81** |

| -(1.76) | (8.17) | |||

| Godrej | 0.1314 | 1.3596** | 0.6517 | 18.71** |

| (0.72) | (4.33) | |||

| GlaxoSmithKline | 0.1317 | 1.1416** | 0.6677 | 20.11** |

| (0.59) | (4.48) | |||

| Emami | 0.0098 | 1.4077** | 0.8403 | 52.61** |

| (0.10) | (7.25) | |||

| United Breweries | 0.0429 | 0.9727* | 0.4705 | 8.89* |

| (0.31) | (2.98) | |||

| Dabur | -0.0502 | 1.5991** | 0.8336 | 50.10** |

| -(0.55) | (7.08) | |||

| Colgate | 0.0618 | 1.2470** | 0.8769 | 71.21** |

| (0.86) | (8.44) | |||

| Tata Global Brev. | 0.2198 | 1.2330** | 0.6358 | 17.46** |

| (0.55) | (4.18) | |||

| Britannia | -0.0678 | 1.0248** | 0.6631 | 19.69** |

| -(0.64) | (4.44) |

Figures in bracket are ‘t’ values; NS – Not significant.

*Significant at 5% level; **Significant at 1% level.

Table 9

Regression result for utilization index of selected firms under FMCG industry

during 2003-04 – 2014-15

| Firm | α | β | R2 | F value |

| United Spirits | -0.0074 | 0.9233** | 0.7892 | 37.44** |

| -(0.20) | (6.12) | |||

| P&G | 0.0337 | 0.7811 | 0.3282 | 4.89* |

| (0.25) | (2.21) | |||

| Nestle | -0.0395 | 1.2202** | 0.7177 | 25.42** |

| -(0.77) | (5.04) | |||

| Marico | -0.0437 | 1.2610** | 0.8776 | 71.70** |

| -(1.06) | (8.47) | |||

| ITC | -0.0849 | 0.9267** | 0.8439 | 54.08** |

| -(2.64) | (7.35) | |||

| HUL | -0.0260 | 1.1240** | 0.7781 | 35.07** |

| -(0.62) | (5.92) | |||

| Godrej Consumers | -0.0537 | 1.3751** | 0.8271 | 47.83** |

| -(0.81) | (6.92) | |||

| Godrej | 0.0446 | 1.5991** | 0.7145 | 25.03** |

| (0.49) | (5.00) | |||

| GlaxoSmithKline | -0.0194 | 0.9702** | 0.5961 | 14.76** |

| -(0.15) | (3.84) | |||

| Emami | 0.1369 | 1.3037** | 0.835 | 50.60** |

| (1.42) | (7.11) | |||

| United Breweries | -0.0185 | 1.2643** | 0.6125 | 15.81** |

| -(0.15) | (3.98) | |||

| Dabur | 0.0498 | 1.2864** | 0.7286 | 26.85** |

| (0.62) | (5.18) | |||

| Colgate | 0.0995 | 1.4108** | 0.8642 | 63.63** |

| (1.30) | (7.98) | |||

| Tata Global Brev. | -0.0269 | 0.8293** | 0.5866 | 14.19** |

| -(0.51) | (3.77) | |||

| Britannia | -0.0013 | 0.9566** | 0.7588 | 31.46** |

| -(0.03) | (5.61) |

Figures in brackets are ‘t’ values; NS – Not significant.

*Significant at 5% level; **Significant at 1% level.

Table 10

Regression result for efficiency index of selected firms under FMCG industry

during 2003-04 – 2014-15

| Firm | α | β | R2 | F value |

| United Spirits | -0.0764 | 0.7505* | 0.4632 | 8.63* |

| -(0.39) | (2.94) | |||

| P&G | 0.2200 | 0.5906 | 0.3045 | 4.38NS |

| (0.45) | (2.09) | |||

| Nestle | -0.2751 | 1.1597** | 0.7115 | 24.66** |

| -(1.84) | (4.97) | |||

| Marico | -0.1566 | 1.2030** | 0.824 | 46.83** |

| -(0.98) | (6.84) | |||

| ITC | -0.3467 | 0.9394** | 0.7201 | 25.73** |

| -(2.38) | (5.07) | |||

| HUL | -0.2457 | 1.0320** | 0.7429 | 28.89** |

| -(2.01) | (5.37) | |||

| Godrej Consumers | -0.2038 | 1.3943** | 0.8445 | 54.30** |

| -(1.18) | (7.37) | |||

| Godrej | 0.2042 | 1.2814** | 0.6271 | 16.82** |

| (0.53) | (4.10) | |||

| GlaxoSmithKline | 0.3266 | 1.1134** | 0.6261 | 16.75** |

| (0.54) | (4.09) | |||

| Emami | 0.2476 | 1.4108** | 0.8993 | 89.32** |

| (1.45) | (9.45) | |||

| United Breweries | -0.0396 | 1.1102** | 0.5008 | 10.03** |

| -(0.14) | (3.17) | |||

| Dabur | 0.0566 | 1.4143** | 0.7339 | 27.58** |

| (0.22) | (5.25) | |||

| Colgate | 0.2109 | 1.3220** | 0.8911 | 81.85** |

| (1.47) | (9.05) | |||

| Tata Global Brev. | 0.2157 | 1.2587** | 0.6434 | 18.05** |

| (0.39) | (4.25) | |||

| Britannia | -0.1213 | 0.9038** | 0.7096 | 24.43** |

| -(0.76) | (4.94) |

Figures in brackets are ‘t’ values; NS – Not significant.

*Significant at 5% level; **Significant at 1% level.

Table 11

Ranking of selected firms of FMCG industry during 2003-04 – 2014-15

| Firm | Performance Index | Utilization Index | Efficiency Index |

| United Spirit | 14 | 13 | 14 |

| P&G | 15 | 15 | 15 |

| Nestle | 05 | 08 | 08 |

| Marico | 09 | 07 | 07 |

| ITC | 11 | 12 | 12 |

| HUL | 08 | 09 | 11 |

| Godrej Consumer | 02 | 03 | 03 |

| Godrej | 04 | 01 | 05 |

| GlaxoSmithKline | 10 | 10 | 09 |

| Emami | 03 | 04 | 02 |

| United Breweries | 13 | 06 | 10 |

| Dabur | 01 | 05 | 01 |

| Colgate Palmolive | 06 | 02 | 04 |

| Tata Global Brev. | 07 | 14 | 06 |

| Britannia | 12 | 11 | 13 |

Source: Computed results from Financial Statements.

Afza, T. and Nazir, M. S. (2007) ‘Is it better to be Aggressive or Conservative in Managing Working Capital?’, Proceedings of the Singapore Economic Review Conference (SERC), pp. 1-15.

Afza, T. and Nazir, M. S. (2011) ‘Working capital management efficiency of cement sector of Pakistan’, Journal of Economics and Behavioral Science, Vol. 2 No. 5, pp. 223 – 235.

Atrill, P. (2006) Financial Management for Decision Makers, London: Pearson Education Ltd.

Bagchi, B., Chakrabarti, J. and Piyal, B. R. (2012) ‘Influence of Working Capital Management on Profitability: A Study on Indian FMCG Companies’, International Journal of Business and Management, Vol. 7 No. 22. pp. 1-10.

Barnacle, C., Sharma, R. K., Rabia, K. and Pooja, G. (2013) ‘Relationship of Working Capital Management with FMCG Sector Firm’s Profitability’, International Journal of Trends in Finance, Vol.1 No. 2. Pp. 103-116.

Bhattacharya, H. (1997) Total Management by Ratios, New Delhi, Sage Publication India Pvt. Ltd.

Chitta, R. S. and Aniruddha, S. (2013) ‘Impact of Working Capital Management on Corporate Performance: An Empirical Analysis of Selected Public Sector Oil & Gas Companies in India’, International Journal of Financial Management, Vol. 3 No. 2. Pp. 17-28.

Confederation of Indian Industry, (2013) ‘FMCG Roadmap to 2020’, The

Game Changers.Debdas, R. and Chanchal, C. (2012) ‘An Empirical Study on Working

Capital Management Practices of Selected Indian Pharmaceuticals Companies’,

Financial Management,

Vol. 47 No. 9. pp. 1065-1071.

Deloof, M. (2003) ‘Does working capital management affect profitability of Belgian firms?’ Journal of Business Finance & Accounting, Vol. 30 No.3. pp. 573-587.

Eljelly, A. M. A. (2004) ‘Liquidity-profitability trade-off: An empirical investigation in an emerging market’, International Journal of Commerce and Management, Vol. 14 No.2. pp. 48-61.

Farhan Shehzad. (2012) ‘The relationship between working capital management efficiency and EBIT: Evidence from textile sector of Pakistan’, Interdisciplinary Journal of Contemporary Research in Business, Vol. 4 No.5, pp. 211 – 225.

Ghosh, S. and Maji, S. G. (2004) ‘Working capital management efficiency: A study on the Indian Cement Industry’, The Management Accountant, Vol. 39 No. 5. pp. 363-372.

Harsh, V. K. and Sukhdev, S. (2014) ‘Efficient management of working capital: A study of healthcare sector in India’, Management Strategies Journal, Vol. 25 No. 3. pp. 53-65.

Howorth, C. A. and Westhead, P. (2003) ‘The focus of working capital management in the UK small firms’. Management Accounting Research, Vol.14. pp. 94-111.

Joginder, S. (2000) ‘Working Capital Management of Horticulture Industry: A case study of Himachal Pradesh’, Management Accountant, Vol. 4. pp. 644-657.

Mukhopadhyya, (2004) ‘Working Capital Management in Heavy Engineering Firms. Business Analyst’, Vol. 39 No. 4 pp. 317-323.

NSE Nifty CNX FMCG Index, India Index Services & Products Ltd., Sep., 2015.

PwC Annual Global Working Capital Survey (2014).

Rajeswara, Rao K. (1985) ‘Working Capital Planning and Control in Public Enterprises in India’, Ajantha Publications, Jaipur.

Ramachandran, Azhagaiah and Janakiraman, Muralidharan (2009) ‘The Relationship between Working Capital Management Efficiency and EBIT’, Managing Global Transitions. Vol. 7. Issue.1, pp. 61-74.

Reddy, D. R. and Kameswari, P. (2004) ‘Working capital management practices in pharma industry: A case study of ‘Cipla Limited’, Management Accountant, August, pp. 638–44.

Report of India Brand Equity Foundation on FMCG Industry (2015).

Report of McKinsey Global Institute (2015).

Report of Nielsen India Market Research Firm on FMCG Industry (2015).

Sagan, J. (1955) ‘Towards a Theory of Working Capital Management’, The Journal of Finance, Vol.10 No.2, pp. 121–129.

Shin, H. H. and Soenen, L. (1998) ‘Efficiency of working capital management and corporate profitability’, Financial Practice and Education, Vol. 8, pp. 37-45.

Yadav, R. A. (1986) ‘Working Capital Management: A Parametric Approach’, The Chartered Accountant, pp. 952-955.