|

Jitendra Shreemali Assistant Professor SPS University Udaipur, Rajasthan |

This study examines the causes for interest rates falling to very low levels in developed countries. Short term interest rates are at 0% for the second time in the last 5000 years with the previous such instance accompanying cataclysmic changes in the world while long term interest rates are at their lowest in the last 2000 years or so. Based on the experience of these countries, it identifies risks associated with very low interest rates as well causes that drive extremely low or sub-zero interest rates. The main factors driving very low interest rates are: (a) Recessionary trends accompanied by reduced investments; (b) Very low rates of inflation coupled with expectation of inflation as well as growth remaining low; (c) Need to control currency appreciation; (d) Demographic changes in the nation due to changing patterns of birth v/s death rates with the older generation having different demands as well as being more risk averse; and (e) Reluctance to carry out required fiscal or structural corrections leading to over utilization of the monetary route reducing its effectiveness. The risks of exceedingly low or sub-zero interest rates include: (a) Squeezing of bank interest margins to an extent that could jeopardize classic bank operations accompanied by households shifting their money into other assets or hoarding it; (b) Creation of credit bubbles that could exacerbate the economic problems further; (c) Failure to boost investments unless the economic scenario looks positive and companies expect sizable demand for their products; and (d) Re-emergence of a changed version of colonial system of forced wealth redistribution. The solution to this challenge lies in understanding that very low or sub-zero interest rates have not proven themselves as long term options for meeting inflation targets or managing currency appreciation nor does it guarantee investments that ensure growth. They are, therefore, a temporary solution at best and national economies or their central banks would do well to explore fiscal measures for sustained growth.

Key Words: Short Term Interest, Long Term Interest, Inflation, Currency appreciation

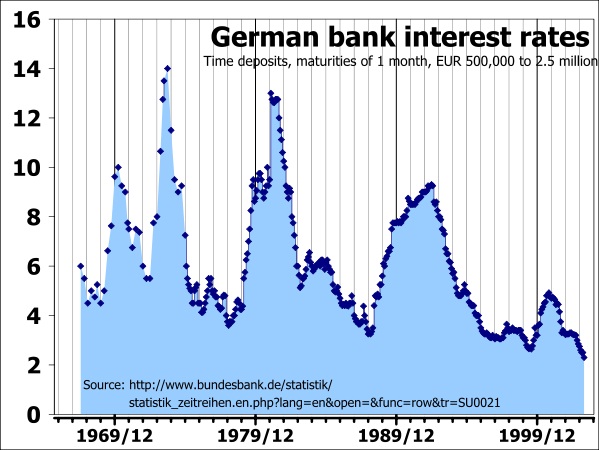

Interest rate or the rate of interest is the amount of interest due in a given period expressed as a percentage or proportion of the amount (referred to as the principal amount) borrowed, deposited or lent. Interest rates have, in the past, been set by a central bank or the national government for the last two centuries or more. Enormous variations have been observed in the interest rates across countries over the last 100 years or so with Wikipedia providing the following examples:

The figure below presents interest rate variation in Germany from 1967 to 2003.

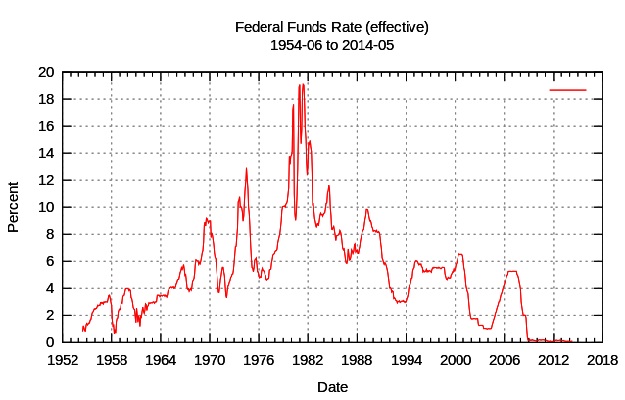

A greater variation was witnessed in the US over an extended period (about 55 years). Comparative Data from Federal Funds Rate is given in the figure below for the period from 1954 to 2009.

Figure 2: Federal Funds Rate from 1954 to 2009

Interest rates have been raised enormously to tackle serious economic problems like hyper-inflation. The Central Bank of Zimbabwe, for instance, raised interest rates to 800% in 2007 to tackle hyperinflation. Interest rates have varied enormously over the years but positive interest rates were the normal practice as lenders expect a certain return on money lent or deposited while borrowers understand the need to pay interest for money borrowed. The South African Reserve Bank factsheet (2007) compares interest rates or price of funds to price of goods or services and emphasizes demand and supply of funds as a primary factor determining interest rates. The factors that are typically important for lenders are determined by uncertainties that future holds for lenders (as well as borrowers). These include duration of term for which funds are borrowed (longer the duration, greater is the uncertainty), borrowers’ ability to repay funds borrowed and inflationary pressures. Abbritti, Dell’Erba, Moreno and Sola (2013) examine the effect of global forces on the dynamics of interest rates (yield curves) of seven industrialized countries, namely, Australia, Canada, Germany, Japan, New Zealand, Switzerland and UK. Their study shows that global factors account for over 80% of term premia and interest rates across countries. Here, global factors include expected global inflation and long run risk factors closely linked to economic and financial instability. This is even more so in the case of long term interest rates than short run fluctuations. Further, term premia dynamics have exhibited a downward trend from 1990 to 2007 primarily on account of global expected inflation.

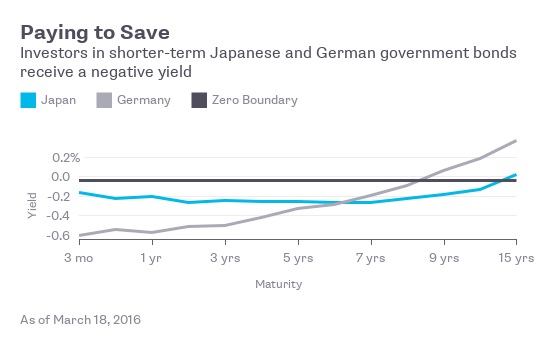

Randow and Kennedy (2016) point out that negative interest rates point to failure of traditional policy options. Those investing in short term German and Japanese government bonds receive a negative yield as shown in the figure below:

Figure 4: Prevalence of Negative Interest Rates in Japan and Germany (Government Bonds)

Source: http://www.bloombergview.com/quicktake/negative-interest-rates

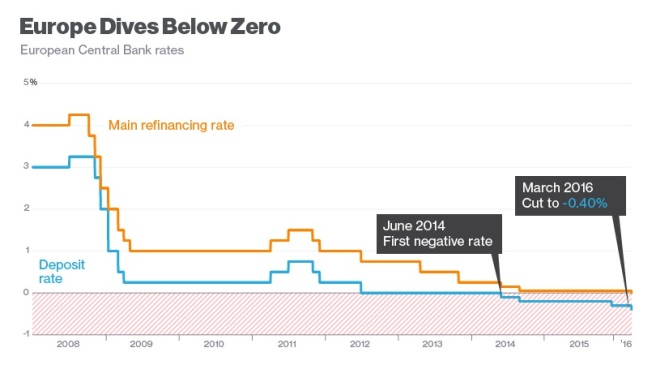

The figure below depicts a recent scenario in Europe.

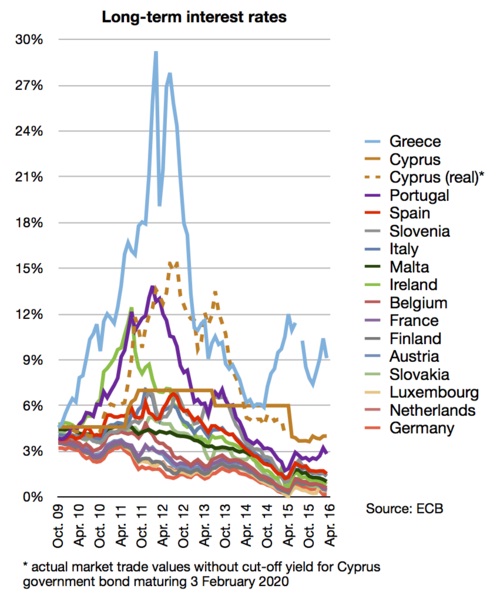

Figure 5: Prevalence of Negative Interest Rates in Europe

Benoît Cœuré (2013) of the Executive Board of ECB highlights the low policy rates of the European Central Bank. The interest rate on the Main Refinancing Operation was cut to 1% in May 2009 and remained low for four years reaching 50 basis points in October 2013 while deposit facility rate was zero and the marginal lending facility rate stood at 100 basis points making the interest rate corridor unprecedentedly narrow. Despite lower interest rates, borrowing costs for profitable companies have not reduced consistently across Europe, at least, partly because of the sovereign debt crisis of 2009 leading to ‘financial fragmentation’ with small and medium sized companies facing greater difficulties. Such financial fragmentation prevents residents as well as companies of the Euro area from getting uniform benefits of a single currency and market. The figure below shows how long term interest rates have differed across countries from October 2009 to April 2016.

Figure 3: Variation in long term interest rate across European countries (Oct.’09 - Apr.’16)

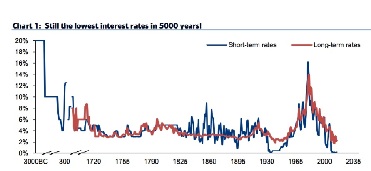

The fall in interest rates in the figure above requires investigation into the past on when were interest rates last observed at the present levels. Holodny (2015) presents short term and long term interest rates as a line graph since 3000 BC (please refer to the figure below). The graph shows short term interest rates at 0% for the second time in the last 5000 years while long term interest rates are at their lowest in the last 2000 years or so.

Figure 4: Short and long Term Interest Rates over the last 5000 years

The actual interest charged is a function of various factors that can be as varied as political scenario, lender expectations on account of deferred consumption, inflation, alternate investment opportunities available to lenders, associated risks, liquidity associated with lending, prevailing tax structure and the overall economic scenario that may require banks raising or lowering interest rates. Global Economic Prospects (2015) discusses the causes of negative values for short term policy rates and long term sovereign bonds in Europe considering that negative interest rates are a very rare phenomenon with short term rates never falling below zero even during the great depression in USA. The reasons include: (a) Central banks wanting to discourage commercial banks holding excess reserve with Central bank, a situation resulting from heightened risk aversion as well as reduced opportunities for profitable lending. Negative interest rates are also likely to encourage commercial banks to buy alternative assets; and (b) Demand pressure resulting from ECB’s extended asset program with purchases announced by ECB totaling to € 1.1 trillion and use of bonds as collateral in repurchase agreements, a fact that adds to their attraction despite low, or even negative, yield. Krishnamurthy and Jorgensen (2011) studied the impact of purchase of long term treasuries and other long term bonds by Federal Reserve to observe that while the stated objective was to lower long term interest rates, thereby, providing an impetus to economic activity, the lowering of interest rates itself takes place through various channels that affect different assets differently.

NAB Group Economics (2016) explores reasons for growing incidence of very low or negative interest rates and suggests the reason as including inflation below target forcing central banks to adopt very low/negative interest rates to avoid deflation as was seen in Japan. Very low interest rates squeeze bank interest margins and could jeopardize the classic bank operations with increased likelihood of households shifting their money into other assets or hoarding it. Further, there is indication that negative interest rates appear to push exchange rate of currencies down.

Patnaik (2016) suggests the following reasons for negative interest rates that are primarily rooted in recessionary trends: (a) An effort by banks to nullify the effect of increase in “liquidity preference” of private wealth holders by demonstrating the opposite preference i.e. for capital goods instead of cash so that finance becomes cheaper and investments go up; and (b) A tendency to avoid the fiscal route of correction as it could raise fiscal deficit beyond the 3% level generally accepted. A negative interest rate is unlikely to boost investments unless the economic scenario looks positive and companies expect sizable demand for their products. The phenomenon of negative interest rates are, therefore, unlikely to revive a system that historically required props like a colonial system of forced wealth redistribution or providing stimuli through fiscal policies.

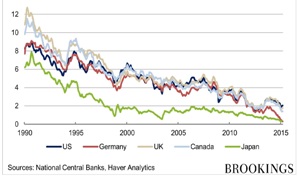

The continuous lowering of long term interest rates remains a challenge for experts and policy makers. Bernanke (2015) discusses, on his blogs, variation in percentage yield on 10-year government bonds as shown in the figure below.

Figure 5: Variation in Percent Yield on 10-year Government Bonds in leading economies

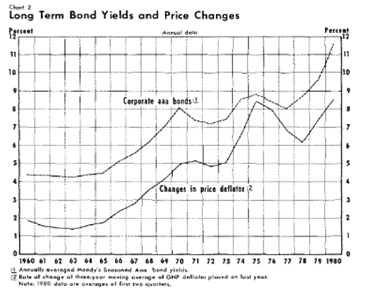

Bernanke (2015) recommends viewing the yield on any particular bond (eg. US government’s Treasury bonds) as the outcome of three components: (a) Expected inflation; (b) Expectation regarding future trends in real short term interest rates; and (c) Term premium. The figure below shows inflation and interest rates plotted on the same scale and brings out a strong correlation between the two.

Figure 6: Interest Rates and Inflation in US in the period from 1960-2015

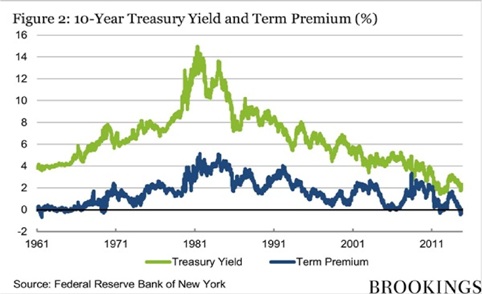

Bernanke (2015) believes that perception of poor growth prospects and sustainable returns on capital in the years to come is likely to keep short term interest rates low meaning that the second component is also contributing to long term interest rates remaining low. That leaves Term Premiums as the third component requiring examination. It represents the extra return lenders expect for investing long term instead of holding short term securities. Terms premiums are estimated based on short term and long term interest rates data and are presented in Figure 7 below with the graph showing sub-zero values on two occasions in about a decade. Term premiums, themselves, are greatly impacted by risk perceptions of long term securities and the demand-supply dynamics for specific securities or class of securities. In times of low inflation (or likely deflation) and poor economic outlook, long term bonds act as a hedge against falling consumer prices and Term Premiums, therefore, show much lower values as observed in the figure below.

Figure 7: Term Premium (USA) from 1961-2011 and beyond

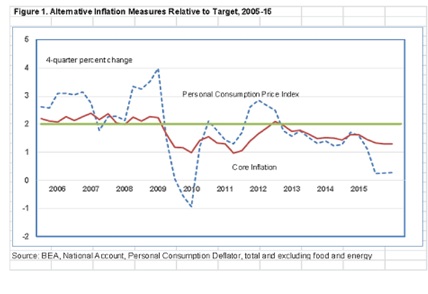

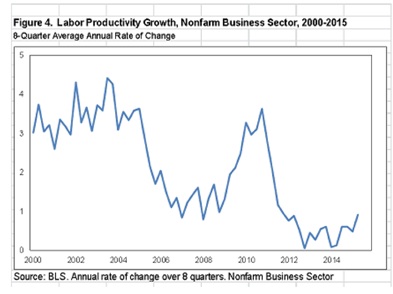

Irwin (2015) observes that in the period from 1876 to 1919, the interest rate on a 10 year treasury note was less than 4% in the US and the same was true from 1924 to 1958. The long term rates in Britain too were below 4% for almost a century from 1920 till start of World War I. This suggests the high interest rates from 1970s till about 2007 were an aberration that is not likely to recur. Bosworth (2016) study for reasons of continued decline in global interest rates suggests multiple factors being responsible including continuously falling inflation and repeated down ward revision of expectations of the global economy. This is supported by the US data on inflation and growth. Data on inflation using an alternative measure from Dallas Federal Reserve gives little evidence of acceleration though it does yield a relatively higher estimate of the rate of average inflation. The global economic outlook continues to look weak with leading bodies scaling down growth expectations on account of several leading economies showing little signs of revival or rapid growth and China appearing to have entered a phase of modest expansion. Low interest rates appear to be caused by a continued underutilization of available resources in the broader global economy as well as frequent use of extreme use of monetary stimulus weakening its beneficial effects.

Figure 8: Inflation in US (based on alternative measure from Dallas Federal Reserve)

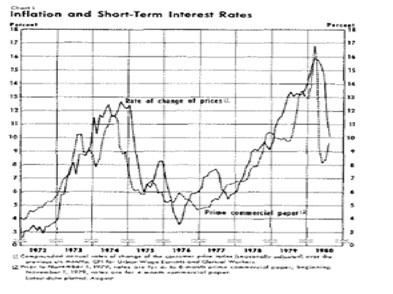

Similar findings were presented earlier by Bowsher (1980) by viewing nominal (market) rate of interest as being made up of the real rate of interest, expected inflation and added factors that differentiate one yield from another. Since mid 1960’s rising inflationary expectations caused rising market interest rates.

Figure 10: Plot of Inflation and Short Term Interest Rates

Figure 11: Plot of Price Changes and Long Term Bond Yields

Interest rates that were rising since mid 1960’s began falling rapidly from second quarter of 1980 with the three month US treasury bill yield falling from 14.8% in early April 1980 to 10.3% in September 1980. The figures for 1976, 1977 and 1978 were 5%, 5.3% and 7.2% respectively and by June 1979 this figure was 9.1%. The reason for the continuous fall since 1980s includes falling inflation because of fall in average rate of money expansion, rate of inflation being largely determined by rate of growth of money over the previous five years and falling economic activity.

Wolf (2015) suggests that the reason for low interest rates are a combination of real, monetary and financial forces. The Keynesian view of short run equilibrium in economy is determined by the intersection of real and monetary forces with central banks trying to deliver the equilibrium (natural) interest rates. Doing so, at high levels of activity or growth, requires central banks to foster credit growth and that can be destabilizing on account of massive leveraging of property assets leading to possibilities of busts and booms. The implications of this apparent conflict under present day conditions include: (a) At the moment peoples’ savings are not very valuable given the near-zero interest rates; and (b) The bursting of credit bubbles whether in high-income economies or in China creates a global savings glut as investments go down. The debt build up and overhangs caused by credit booms constrain spending for a long time till another credit boom offers new opportunities.

Bean, Broda, Ito and Kroszner (2015) point to change in demographic changes driving an increased propensity to save as an important contributing factor to reducing real interest rates along with a preference for safer (less risky) bonds. With Japan leading the ageing of population, other highly advanced economies have followed with a shift in saving and investment behaviour being influenced by the needs of an ageing population. For keeping inflation at their desired rate, Central Banks seek to strike a balance between aggregate demand and natural (potential) level of output which is the level of supply resulting from wages and prices being fully flexible. When inflation is already at the desired level, the corresponding interest rate shall be the sum of the natural real interest rate and target inflation. When inflation is not at the targeted level, the Central Bank needs to fix a policy rate above or below the natural rate depending upon whether starting inflation is above or below the targeted level. To predict how interest rates will evolve in the medium term or beyond, research needs to focus on identifying and understanding the real forces driving the natural rate of interest besides factors that cause changes in inflation targets of central banks.

Jackson (2015) discusses four economies that have introduced negative policy interest rates, namely, Switzerland, Denmark, Sweden and Euro Area since mid of 2014. While Switzerland and Denmark introduced negative rates to reduce appreciation pressures by deterring capital inflows, ECB and Sweden opted for negative deposit rates on account of recession, reduced expected inflation and inflation repeatedly falling below target. The figures below shows that inflation in Europe Area moved above zero in November 2015 (Deposit Facility Rate was reduced below 0% in June 2014 (to -0.1%) and further in September 2014 (to -0.2%) but fell back into the sub-zero zone in the first half of 2016.

Figure 12: 5 Year Fluctuation in Inflation Rate in Euro Area

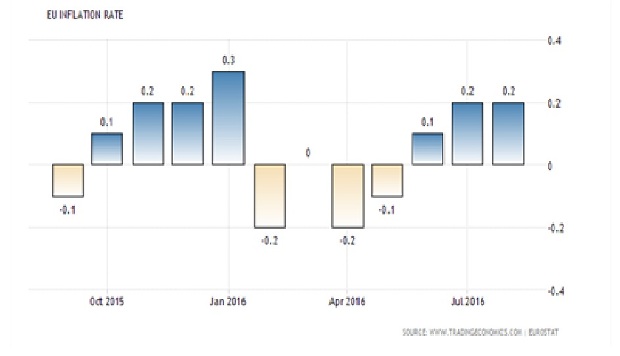

Inflation rate in Euro Area continued to fall till late 2014 but has moved marginally upwards since then. A review of inflation in the last two years suggests that the move upward has not been steady and inflation alternated between negative and positive (0.3 to -0.2) over the last two years as shown in the figure below.

Figure 13: Inflation Rate in Euro Area (Oct 2015 to August 2016)

Source: http://www.tradingeconomics.com/euro-area/inflation-cpi

The figures below present inflation data relating to Sweden for a 5 year period and 2 year period. The trend for Sweden suggests that Sweden came closer to achieving the desired objective as compared to Euro Area with inflation having dipped to a value well below zero in 2014 and rising, almost steadily, to 1.1% in August 2016. The cases of Sweden and Euro Area suggest partial success of negative interest rates as an instrument to address issues relating to recession, reduced inflation and inflation repeatedly falling below target.

Figure 14: 5 Year Fluctuation in Inflation Rate in Sweden

Figure 15: Inflation Rate in Sweden (Sept. 2015 to August 2016)

Denmark and Switzerland adopted negative rates to reduce appreciation pressures by deterring capital inflows

Figure 16: US Dollar per 1 DKK (2012-2016)

As far arresting the appreciation of Danish Krone is concerned the plot of five year data above indicates success in arresting the fall. The experience of appreciation in the value of Swiss Franc appears to be similar.

Figure 17: US Dollar per 1 Swiss Franc (2012-2016)

Jackson (2015) lists the main concerns associated with negative interest rates as including: (a) lowering of bank margins, profitability and adversely impact financial intermediation though banks with large retail business are more likely to be impacted adversely on account of associated difficulty in passing negative interest rates to retail clients; (b) Cash lying idle instead of being utilized productively since lending entails a cost; and (c) Creation of asset price bubbles. Though the period of implementing negative policy rates is not large making any definite conclusions difficult, the rather short experience suggests that negative policy rates have not caused a run on banks, impaired market functioning or led to significant volatility.

Ramayandi, Rawat and Tang (2014) find that very low interest rates increase bank risk. They voice a fear that very low interest rates will interfere with the goal of domestic stabilization besides fueling risk-taking channel. Forbes (2015) compares very low (near-zero interest rates to the Midas touch) that was seen as highly rewarding in the short range but had an exceedingly heavy price soon after to find that till date near zero interest rates have not gone the Midas way. The cost of very low interest rates includes: (i) Inflationary pressures; (ii) Financial vulnerabilities including asset bubbles; (iii) Limitation in terms of tools to address future challenges; (iv) Inefficient allocation/utilization of resources leading to lowering of productivity; (v) Shifting sources of demand leading to poorly balanced and less sustainable growth; and (vi) Rising inequalities.

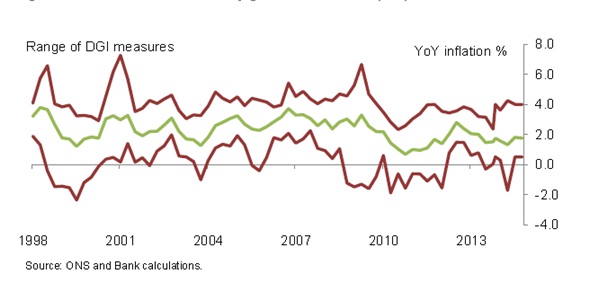

As far as UK is concerned, inflationary pressures, despite low interest rates have remained very stable as shown below with the line in the middle showing mean values of the other two, lower and higher values. While inflation may not necessarily remain as low as this in times to come, available monetary tools would permit handling inflationary pressures in the foreseeable future.

Figure 18: Measures of Domestically Generated Inflation (DGI) in UK

Negative interest rates have a strong tendency to hit banking and insurance profits and tend to extend beyond the narrow boundaries for which they are constructed. NAB Group Economics (2016) reports flow of negative central bank policy rates into money markets and sovereign bond rates thereby squeezing bank margins and raising concerns on the long term viability of, at least, some of the banks if negative central bank policy rates persist though all banks may not be affected equally. Torres (2016) discusses the rationale for recent prevalence of negative interest rates across countries like Denmark, Eurozone, Sweden, Switzerland and Japan wherein central banks opted for negative interest rates following a series of failures of monetary measures to push up inflation and growth rates. This failure to push up inflation and growth rates is, at least, partly on account of inadequate fiscal measures as well as much needed structural reforms. Negative interest rates encourage immediate spending and likelihood of increased investments through (negative cost of) borrowing. However, there is a possibility of negative rates leading to scenarios where the market funds’ income does not cover investment losses or the operating income forcing closure/shut down of the funds or lead to depository institutions to shift a significant part of their reserve balances into currency.

The study by Patnaik and Shah (2004) on interest rate volatility in India on account of easing of controls since 1993 to observe that India has one of the highest level of interest rate volatility in the world (refer to Table below) consistent with the crawling peg currency regime in the context of a capital account being liberalized.

Table 1: Interest Rate Volatility across Countries

Source: Patnaik, I. and Shah, A. (2004). Interest Rate Volatility and Risk in Indian Banking. IMF Working Paper, January 2004, pp 5.

Indian banks may be exposed in case interest rates increase either on account of high fiscal deficit, economic growth or inflationary expectations. Retaining low interest rates, therefore, could become a necessity for some time to come to manage bank exposure, thereby, limiting monetary policy options available to governments.

Asset bubbles can be the result of low cost of borrowing with investors considering higher returns-providing riskier investments in debt markets or even emerging markets. This can lead to inefficient utilization of and high risk exposure for some investors. Besides, such possibilities tend to increase with the length of duration of low interest rates for all groups of investors/lenders be it individuals, banks, corporations or broader credit markets. Long periods of low interest rates, therefore, enhance chances of credit booms, inefficient allocation of funds/resources and even banking collapses or financial instability.

Nishioka and Baba (2004) examine the mechanism of the observed (since March 2001) negative yen funding costs for foreign banks in the forex swap market. During relative financial instability in 1997-98, Japanese bank had to depend upon the FX swap market to meet their requirement of US Dollars, thereby yielding negative yen funding costs for foreign banks. The fact that the credit-risk premium for domestic banks is higher in the US Dollar market than the yen market also contributes to the negative yen funding costs for foreign banks.

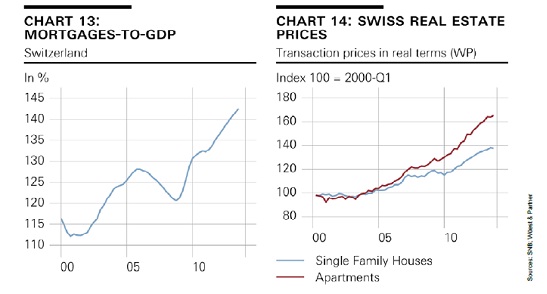

Danthine (2013) explained the very low interest rates in the context of Switzerland as being caused by: (a) A decline in long term interest rates since the 1980s that brought policy rates very low even before the financial crisis; (b) A Cyclical component that led to the extreme lows witnessed in the recent past; and (c) A perceived need for safe assets that caused huge capital flows in safe havens/economies like Switzerland. While the long term impact of very low interest rates entails the risk of very high inflation rates as well as financial instability, high inflation is not very likely in the foreseeable future. The same cannot be said of financial stability since lower credit costs along with increased relative value of assets increases chances of asset price and credit booms as seen in the real estate mortgage credit markets of Switzerland (see figure below). Low policy rates could well induce excessive risk taking in financial markets without increasing productive risk taking with debtors over estimating debt affordability or under estimating risks associated with debts.

Figure 19: Consequences of low interest rates in Switzerland (on real estate & mortgage credit markets)

Very low or negative inflation rates present a big challenge to policy makers and entail the risk of seriously altering the financial structure of the business world. The limited experience in implementing negative interest rates does not provide adequate data or comfort that policy makers have mastered the ability to deal with all challenges relating to negative interest rates, thus keeping the risk levels relatively high.

Bosworth (2016) discusses the impact of interest rates hovering around zero, making an important tool available to policy makers largely ineffective besides increasing the risk of a downward spiral of lower inflation, enhanced real interest rates further leading to increased downward pressure on economic activity. Torres (2016) too emphasized the need for fiscal policy and structural reforms to compliment monetary policy rather than depending only on monetary easing for sustainable growth. Adler (2015) reported decreasing benefits of negative interest rates in Switzerland based on experience of negative interest rates for a year.

Masson (2013) discusses causes of the record low interest rates in Canada that were initially a response to the global financial crisis of 2008 but continued for over 5 years bringing in dangers of excessive risk taking and inefficient/unprofitable investments including asset bubbles. The study recommends reversing the monetary stimulus in Canada and raising interest rates considering that GDP has returned to a value close the economy’s potential and an artificially low interest rate could add fuel to an underlying inflationary process (besides the factor mentioned earlier) with some symptoms of asset price bubbles and inefficient investments already showing themselves in Canada.

Jackson (2015) indicates that negative interest rates are certainly an option worth considering for countries to reduce appreciation pressures by deterring capital inflows or countries facing recession, reduced expected inflation and inflation repeatedly falling below target. The experience of about 2 years since middle of 2014, however, is too short for drawing reliable conclusions about negative interest rates and the risks associated with deploying negative interest rates for a longer period. Conwill (2016) suggests that Bank of Japan adopting negative interest rates like some European countries indicates a failed policy that does not even take into account the real causes of poor performance of Japanese economy as including demographic, cultural, regulatory, and geopolitical factors coupled with an obsessive desire to target inflation at 2% rooted in the belief that deflation is at the root of most of Japan’s economic problems.

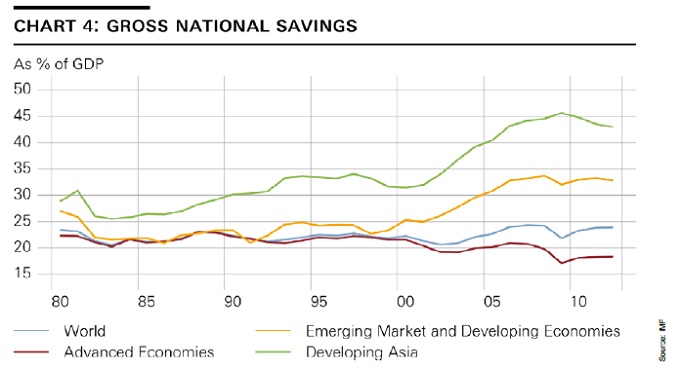

Danthine (2013) points to the key cause of low interest rates being linked to high savings leading to increased supply compared to the past lowering real interest rates (see figure below). Further, reduced growth expectations in most economies and slower recovery after the financial crisis have kept nominal rates of interest at very low levels. The solution lies in government led fiscal adjustments and demand generation to drive productive investments and growth. This is especially true of emerging economies and India if the increased savings are not to be lost to real estate booms or financially risky investments in place of productive investments that generate jobs, create demand and provide sustainable growth.

Figure 20: Increased Savings (1980 onwards) in economies

World economies and central banks of nations have had rather limited experience of very low or sub-zero interest rates. The long term consequences of such rates are yet to show themselves very clearly especially in a world with demographic changes driving changes in demand as well as risk taking capacity. Further, most economies have not tested this approach meaning that comparative data is not available. Any conclusion formed on the basis of a limited number of countries entails the risk of not being applicable, in entirety, to rest of the countries more so when the countries are at very different levels of economic and technological development.