|

Suhail Ahmad Bhat Research Scholar The Business School University of Kashmir Hazaratbal, Srinagar-190006 Contact No.- +91-9596498734 Email: ahmadsuhail@kashmiruniversity.ac.in |

Dr. Mushtaq Ahmad Darzi Professor The Business School University of Kashmir Hazaratbal, Srinagar-190006 Contact No.- +91-9419089086 Email:mushtaqbs@gmail.com |

CRM and customer retention have increasingly being recognizedas important managerial functions especially in saturated and increasingly competitive markets. Every business firm knows that it costs far less to hold on the existing customer than to acquire new ones. There is limited research available that investigates the effect of customer knowledge and orientation on customer retention in banking sector. In this backdrop the study tries to determine the impact of employee perception towards CRM practices (customer knowledge and customer orientation) on customer retention. Structural Equation Modelling (SEM) has been employed on a sample of 204 respondents who were randomly selected from the population of employees of a particularbank in the Jammu and Kashmir. Finding of the study revealsthat customer knowledge and customer orientationhas significantly positive impact on the customer retention. This paper contributes to the theory by evaluating the role of knowledge management and customer oriented behaviour in developing long-term relationships with the customers. It also analyses the importance of CRM practices for developing better customer retention strategies in the banking sector where NPA rate is continuously increasing.

Keywords: Customer retention, customer knowledge, customer relationship management, employee perception.

After the economic recession of 2009-2011 resulting from global financial crisis, businesses have slowly gaining the momentum. One of the prime causes of the recession was unsecured loans provided by financial institutions which give rise to corrosion of trust and commitment towards the customers (Vella and Caruana, 2012). This has further resulted in a huge customer lossin the banking sector. Peppers and Rogers (1996) have observed that most of the organizations might lose 25% of their existing customers if proper customer retention strategies are not implemented. This was further acknowledged by Pareto’s 80/20 Law that top 20 percent of customers contribute 80 percent of profits to the businesses and are cash cows for the organizations. Therefore, banks need to focus on their existing customers rather than achieving cost leadership as competition isbeing observed a real threat to them (Biederman, 2010). Banks that want to achieve higher profitability need to retain the top 20 percent of customers by satisfying and preventing them from defecting. Happy cows can give more milk but the irony is how to reveal if cows are happy. The answer to this question lies in the fact that banks need to understand and analyse ‘cow sociology’.This can be made possible by acquiring information and knowledge about customers and their behaviour patterns, and customizing the bank offerings according to customer needs (Lin et al., 2009). Consequently, Customer Relationship Management (CRM) emerged as a strategic tool, which utilizes customer information for maintaining and enhancing customer relationships. Understanding the customer’s profitability and retaining profitable customers had been recognized as the core value of customer relationship management (Hawkes, 2000).

Wang et al. (2010) argued that the fundamental aim of CRM is to improve the degree of satisfaction and retention among customers through proper analysis of customer knowledge thereby improving the overall corporate competitiveness of a firm. Drucker (1954) opined that the main purpose of business is to acquire and retain customers. This philosophy can be made operational by employing right CRM strategy, which synchronizes people, process and technology components of a firm. Two main drives viz; customer knowledge and customer orientation have been identified by most of the researchers, which determine the effective implementation of CRM strategy(Yim et al., 2004; Raman et al., 2006; Akroush et al., 2011; Wang and Feng , 2012; Elkordy, 2014). Reichheld (1996) has argued that customer retention rates and customer share are important metrics in CRM. An enhanced relationship with customers can help in accomplishing greater retention and loyalty (Ngai, 2005). There is dearth of literature available on the role of customer knowledge and orientation towards customer retention. No empirical study has been conducted so for, which studies knowledge, orientation and retention together in banking sector. One of the important contributions of the study is that it can prove a remedy against the alarming NPA rate in India and particularly in the state of Jammu and Kashmir.

The current market scenario of the banking sector is highly complex and competitive with little stability due to the entry of national and international financial institution in the emerging economies. The major aggravation in the industry is about obtaining and retaining the customers. It has become a challenging task for a particular bank to gain profits due to the fact that big fishes in the banking sector have dominated the market. Market strategies in the nature of mergers, acquisitions, joint ventures etc. have been adopted by the banks to reduced competition. But still the banks are not able to achieve expected results. Reserve Bank of India has recently released a report on banking sector profits which depicts that most of the private sector banks have incurred loss in their previous fiscal years. One of the reason being the increasing level of non-performing assets (NPA) and loan defaulters. As on March, 2015, the Gross NPA rate of public sector banks (PSBs) in India was 5.20 percent which has gone up to 6.02 percent as of June, 2015. However, the Gross NPA rate in the Jammu and Kashmir in 2014 was 4.73 percent and has gone up by more than one percent to 5.81 which accounts for Rs. 2187 crores in 2014 to Rs. 2658 crores in 2015. The reason for such an NPA rate being that bank is not able to understand its customer, which results in the breach of trust between the customer and bank. This has brought in the issue of customer focus to the forefront. To understand the credit worthiness of a customer bank has to develop an intimate relationship with customers. It has to capture and assimilate all the information and knowledge about the customer by employing right CRM strategy. The banks also need to redesign their CRM strategy periodically to deliver quality services and maintain the existing portfolio of customers in order to survive in the market. Therefore, an immediate need is felt to study and evaluate the best CRM practices and their role in enhancing customer retention in banking sector.

The study has been carried out with the following objectives;

CRM has been conceptualized by different researchers in different way. Chan (2005) has conceptualized CRM by integrating business processes, organizational structures, analytical structures and technological representation to present a unified and comprehensive view of a customer. Another study has put forward a conceptual model of CRM effectiveness consisting of four customer-centric dimensions viz. customer knowledge, interaction, value, and satisfaction (Kim et al., 2003). The researchers further argued that CRM involves understanding and meeting customer’s unique needs through business interactions. Thurau (2004) has argued that service personnel customer-orientation has direct effect on the customer retention. The author has put forth two reasons, firstly customer are willing to return again to companies, whose service providers are customer-oriented because they like the staff that are more customer-oriented. Secondly, customers are more influenced by the service staff and reflect this trust to the whole company. Further, the author has linked service personnel customer-orientation to the customer satisfaction, commitment and retention (Thuran, 2004).

CRM has been viewed as a complex and holistic concept, which requires proper business processes and integrated systems that enhances growth of a firm by developing strong bonds of trust and commitment between customers and employees to enhance customer satisfaction and retention (Xu et al., 2002).CRM practices can help the bank in retention of existing customers in the competitive markets (Hugar and VazD'Costa, 2010). Proper CRM practices can potentially impact customer satisfaction rating and can enhance customer retention. Benton and Maloni (2005) argued that CRM has positively affected the productivity, profitability and efficiency of banks but there is also a need to detect bank frauds. Al-Khouri (2012) has suggested some common dimensions of CRM framework viz. key customer focus, knowledge management, CRM organization and technology based CRM. These dimensions have a significant impact on the customer retention and sales growth of a firm (Yim et al., 2004). It has been concluded by some researchers that long-term relationship between customers and banking organizations can be improved when service personnel’s have more readiness towards customer orientation (Palmer and Bejou, 1994; Williams and Attaway, 1996; Beatty et al., 1996).Boveand Johnson (2000) opines that customer-oriented service personnel, havinga high level of working knowledge, can efficiently recognize customer’s needs and aspirations and can fulfil them in a desirable manner (Thurau, 2004). Verhoef (2003) has found that both the customer’s desire to extend his/her relationship with the institution and his reliance on the customer-loyalty programs positively affect customer retention and the growth of customer’s share.

Customer knowledge management is one of the important processeswhich utilize various knowledge management concepts and technologies in capturing the customer knowledge for developing better relationships (Gebert, 2002).Customer knowledge plays an important role in responding to customer needs by acquiring customer information and knowledge through technology based software (Wood, 2003). According to Kotler and Armstrong (2008), the main aim of any organization should go beyond attracting new customers and creating value for them but it should also include retaining existing customers. Knowledge Management is one of the important dimensions of CRM that enables it to move from mechanical, data-driven technology approach to a comprehensive and holistic customer knowledge management system (Gebert, 2002). Customer retention has been considered as one of the important outcomes of seller-buyer relationship (Crosby et al., 1990). Retaining customers is important for long-term growth and sustainability of the business. It is cheaper to keep current customers than to find new ones (Harley, 1984). The previous literature has theoretically and empirically linked customer relationships to customer retention (e.g. Jackson, 1985; Kumar et al., 1995). A variety of CRM activities can work together to enhance customer retention (Pfeifer and Farris, 2004).

In the light of above discussion, there is very scarcity of literature both theoretical and empirical, to study the variables viz. customer knowledge, orientation and retention together in developing economies. Therefore, the study tried to determine the impact of customer knowledge and orientation on customer retention in banking sector. On the basis of above literature following hypothesis has been formulated;

H1: Customer knowledge has a significantly positive impact on customer retention.

H2: Customer orientation has a significantly positive impact on customer retention.

Proposed Model

The proposed model for the study was developed based on the research problem and the already available literature on CRM and associated concepts. As shown in Figure-1, the model has two independent variables i.e. customer knowledge and customer orientation which influence the customer retention that is presumed as independent variable. The hypotheses are based on this model and in order to test these, a survey has been conducted on the employees of a bank operating in the state of Jammu and Kashmir.

Figure 1: Conceptual Model

| Customer Knowledge |

| Customer Retention |

| Customer Orientation |

The data has been collected from the employees of a bank in Jammu and Kashmir. The particular bank was chosen for the study as having taken a lead in the adoption of CRM in the state of Jammu and Kashmir. Simple random sample technique was adopted to collect the data from the total population of employees of the bank in the state. Data was collected in the year 2014-15 from a sample of 204 employees. However, a total of 225 questionnaires were distributed among the respondents consisting of 12 items but only 204 were received back from them, thus the overall response rate was 91 percent. Before the collection of final data, a pilot study was performed on 25 bank employees to ensure face validity and content validity of the questionnaire. Some items were droppedandmodified which the respondents were not able to understand easily. The sample size was determined on the basis of following criteria;

The sample characteristics are given in Table-1. The table reveals that the sample has high percentage of Male respondents (53.5 percent) than female respondents (46.6 percent). Highest percentage of respondents was observed from Kashmir region (52.9 percent) than Jammu region (47.1 percent). Among various designations in the bank,‘Personal Banker’ (23.5 percent) has highest percentage and ‘Back up Manager’ (12.7 percent) has lowest percentage. The other designations include ‘Assistant Managers’ (18.6%), ‘Branch Sales Officers’ (17.7%), ‘Branch Managers’ (14.3), and ‘Relationship Managers’ (13.2 percent). The ‘Personal Banker’ is a key person in the bank as maximum responsibility towards the banking functions are performed by him/her. Also highest percentage of respondents was observed from the experience group of ‘3-5 years’ and lowest number was found in the ‘above 9 years’ group.

Table 1: Demographic Description of Sample

| Demographic Variables | Category | Frequency | Percentage |

| Gender | Male | 109 | 53.4 |

| Female | 95 | 46.6 | |

| Region | Kashmir | 108 | 52.9 |

| Jammu | 96 | 47.1 | |

| Designation | Branch Manager | 29 | 14.3 |

| Back-up Manager | 26 | 12.7 | |

| Personal Banker | 48 | 23.5 | |

| Relationship Manager | 27 | 13.2 | |

| Assistant Manager | 38 | 18.6 | |

| Branch Sales Officer | 36 | 17.7 | |

| Experience (yrs.) | Below 1yr | 10 | 4.9 |

| 1-3 yrs. | 58 | 28.4 | |

| 3-5 yrs. | 78 | 38.2 | |

| 5-7 yrs. | 35 | 17.2 | |

| 7-9 yrs. | 18 | 8.8 | |

| 9 yrs. Above | 5 | 2.5 |

The research instrument for the study has been divided into two sections. The first section contains demographic description of the respondents like gender, region, designation and experience. The respondents were supposed to write their personal details at the appropriateplace provided for each question. Second section contains items/statements related to the various variables identified in the study i.e. customer knowledge, orientation, retention. The respondents were asked to give their response on five-point Likert scale (1-5), ranging from 1 (strongly agree) to 5 (strongly disagree). The items of the questionnaire were developed from the existing questionnaire items developed by the researchers. Some modifications were made to suit the objectives of the present study. The itemised scale is given in Annexure-I.

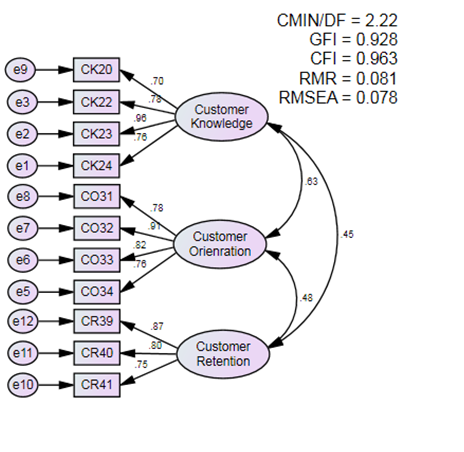

Confirmatory factor analysis (CFA) was adopted to examine the reliability and validity of the measurements. A measurement model was developed for the constructs consisting of variables as customer knowledge, orientation and retention as shown in Figure-2. After examining the model summary of measurement it was observed that the fit indices are in the acceptable range and it fits the data well (Figure-2). The threshold for model fit includes, CMIN/DF (< 2 is good and 2 – 4 acceptable); Goodness-of-fit Index (GFI> 0.90 is good and > 0.80 acceptable); Comparative Fit Index (CFI > 0.90); Root Mean Residual (RMR < 0.10) and Root Mean Square Error of Approximation (RMSEA < 0.10) (Chau, 1997). Furthermore, a factor loading of the constructs with their items was determined from the measurement model and the items with loading below 0.70 were droppedand a loading above 0.60 has also been acceptable by reserachers (Hair et al., 1998).

Figure 2: Measurement Model

On the basis of item loadings, convergent validity of the research instrument was determined that includes average variance extracted (AVE), construct reliability (CR) and discriminant validity (DV) as shown in Tables-2. The threshold for AVE should be 0.5 or above; CR should be 0.7 or above to indicate adequate convergence or internal consistency.For DV, the square of the correlation between factors should not exceed the variance extracted (Fornelland Larcker, 1981), which indicates the degree to which measures of conceptually distinct construct differ.

Table 2: Factor Loadings of CFA

| Latent Variables | Scale Items | Path Estimate* | Average Variance Extracted | Construct Reliability |

| Customer Knowledge | CK20 | 0.70 | 0.65 | 0.88 |

| CK22 | 0.78 | |||

| CK23 | 0.96 | |||

| CK24 | 0.76 | |||

| Customer Orientation | CO31 | 0.78 | 0.67 | 0.89 |

| CO32 | 0.91 | |||

| CO33 | 0.82 | |||

| CO34 | 0.76 | |||

| Customer Retention | CR39 | 0.87 | 0.65 | 0.85 |

| CR40 | 0.80 | |||

| CR41 | 0.75 |

*All the paths are significant at p < 0.05; Source: AMOS Output

Table-2 reveals that the loadings of all the items are above the threshold of 0.70 but item CK21 from customer knowledge construct was dropped because of loading below 0.70. The three constructs have AVE and CR above the acceptable limit suggested by Nunnally and Bernstein (1994). The table-3 shows discriminant validity results, diagonal variance of constructs are given and are above the square correlation between the variables in the table.

Table 3: Discriminant Validity Results

| CK | CO | CR | ||

| CK | 0.65a | |||

| CO | 0.40 | 0.67a | ||

|

0.20 | 0.23 | 0.65a |

Note: a Variance Extracted

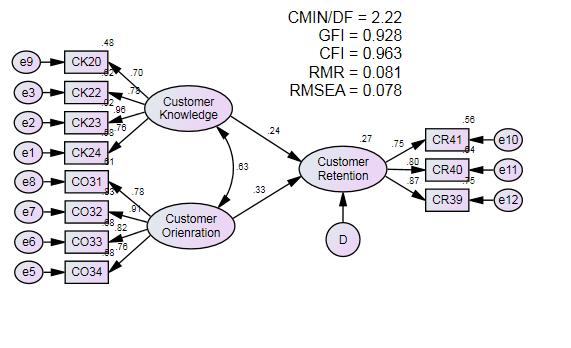

SEM has been employed to determine the model fit of structural model and to test the various hypotheses formulated in the proposed model. Maximum Likelihood (ML) estimation with 5000 sub-samples bootstrapping procedure using AMOS 20 has been used for testing the proposed hypotheses. The various model fit indices were estimated and it was observed that the model fits the data well. CMIN/DF of the model is 2.22; GFI is 0.928; CFI = 0.963; RMR = 0.081 and RMSEA being 0.078 as shown in Figure 3. The model fit indices are above the acceptable range and reveal that the structural model is in conformity to the proposed model.

Figure 3: Structural Model

The hypotheses were tested through evaluation of regression estimate, critical ratio (CR), level of significance (p-value). For the current study 5 percent significance level has been set. The results are shown in Table-4, which reveals that the path from customer knowledge to customer retention has regression weight of 0.24; CR of 2.48 and p-value of 0.013. These parameters are above the threshold and provide support to the hypothesis H1 that customer knowledge has a significantly positive impact on customer retention. Further, the path from customer orientationto customer retention has regression weight of 0.33; CR of 3.33 and significant at 0.01, which provide support to the second hypothesis H2 that customer orientation has a significantly positive impact on customer retention. The coefficient of determination (R-square is 0.27) in the model reveals that 27 percent of variance in customer retention is explained by customer knowledge and customer orientation. However, there might be some other variables that will explain rest of variance in the customer retention.

Table 4: Results of Structural Model

| Paths | Std. Estimates | Critical Ratios (CR) | P-value | Decision | R2 | ||

| CR | <--- | CK | 0.24 | 2.48 | 0.013 | H1 Supported | 0.27 |

| CR | <--- | CO | 0.33 | 3.33 | *** | H2 Supported | |

| Notes: *** p-value < 0.01 | |||||||

Source: AMOS Output

The study has empirically validated the two key dimensions of customer retention i.e. customer knowledge and customer orientation. It has been found that customer knowledge has a significant positive impact on the customer retention. Through customer knowledge management the bank can keep its customers informed about the latest benefits and offers regarding their products and services. The bank can be able to understand the needs of customers by encouraging two-way communication between customers and employees.Knowledge management when used in combination with information technology can help in acquiring customer data that can become a source of competitive advantage for the firm. Valuable information regarding the purchase behaviour of customer can be retrieved from the data. This information can be used to customize the bank offerings according to the customer needs and preferences resulting in better and more profitable relationships. Thus customer knowledge management can aid in retention of existing customer and acquiring new customers. These findings are in context with the earlier findings which depicts that the customer knowledge has a significant impact on the retention of customers (Wood, 2003; Pfeifer and Farris, 2004; Wang et al., 2010).

The finding of the study also reveals that customer orientation has positive impact on customer retention. Employees while adopting customer oriented approach in a bank can track the customer complaints and can effectively address them. Customer oriented personnel can provide information to customers regarding the new services and developments in the existing services regularly. The service personnel can also provide support to the customers while utilising services of the bank. Therefore, it has reconfirmed the findings of earlier studies which have found that customer focused service or customer oriented services play an important role in facilitating mutual relationship between organizations and their customers (Varki and Colgate, 2005; Gan et al., 2006). The results, again, are in consistence with the earlier findings which reveal that different CRM practices can work together to enhance customer retention (Pfeifer and Farris, 2004). Thus the findings of the study indicate that the banks that are able to understand their customers and manage customer information properly are in a better position to prevent customer defection.

The study attempts to determine the perception of bank employees towards the CRM practices and their subsequent impact on customer retention. It has empirically proved the inter-relationship between CRM practices and customer retention. Two prominent CRM practices highlighted by the study include customer knowledge and customer orientation that have significantly positive impact on the customer retention. In addition it has been discovered that CRM has a potential to create value for the customer in long run.The customer knowledge captured through systematic gathering of uncluttered feedback from customers on continual basis helps everyone in the organization ranging from front-line employees to branch manager in understanding the customer’s experience to the bank service. Organizations need not only to take pulse of customer opinions but should strategize to correct weaknesses, fine-tune their offerings and motivate employees towards relationship development in both monetary and non-monetary terms. Customer orientation is more important for developing and maintaining relationship with customer as the study has empirically proved. So, banks need to adopt customer-centric approach and should prioritize customer retention. While developing and implementing retention strategies, the banks should consider the nature of product/service to be sold, type of customer to be retained and objectives of the owners. By taking these conditions into consideration, banks can have more individualistic and customized retention strategies.

The study has established a positive relationship between customer orientation, knowledge and retention and provides some implication to managers. The Marketing Personnel has a profound role in connecting bank to the customers as they are in direct touch with the customers. Their attitude towards customer affects the perception of customer towards the bank. Marketing staff with strong customer orientation are more likely to create favourable perception of the bank in the mind of customers thereby enhancing customer retention.

The managers should give more emphasis on promoting customer-oriented values and behaviours among employees that will encourage in developing customer-oriented culture in the bank. Managers need to periodically assess the level of customer-oriented behaviour of its employees and should make efforts to maintain a friendly, supportive working environment in the bank. Also training programs and reward systems should be designed in such a way that promotes customer orientation among employees.

The findings of the study are applicable to one single bank only as the data has been collected from one bank only. So the results of this study should be cautiously generalised. This study can be extended to other banks or organizations as well. The data has been collected from employees only, customers and other stakeholders associated with CRM have not been taken. Future research should consider all the stakeholders associated with CRM. The study uses a cross-sectional research design however, for better understanding of customer behaviour longitudinal design should be employed. As the finding of study reveal that only 27 percent of variance in customer retention is explained by customer knowledge and customer orientation,there might be some other variables which will explain more of variance in the dependent variable.

Akroush, M.N., Dahiyat S.E., Gharaibeh H.S. and Abu-Lail, B.N. (2011). Customer relationship management implementation: An investigation of a scale’s generalizability and its relationship with business performance in a developing country context. International Journal of Commerce and Management, 21(2), 158-191.

Al-Khouri, A.M. (2012). Customer relationship management: proposed framework from a government perspective. Journal of Management and Strategy, 3, 34-54.

Beatty, S.E., Mayer, M., Coleman, J.E., Reynolds, K.E. and Lee, J. (1996). Customer-sales associates retail relationships. Journal of Retailing, 73(3), 223-247.

Benton, W.C. and Maloni, M. (2005).The influence of power driven buyer/seller relationships on supply chain satisfaction, Journal of Operations Management, 23, 1-22.

Biederman, D. (2010). The customer is king, again. The Journal of Commerce, May, available at: www.nrsonline.com/pdfs/JOC.pdf.

Bove, L.L. and Johnson, L.W. (2000).A customer-service worker relationship model.International Journal of Service Industries Management, 11(5), 491-511.

Chan, J.O. (2005). Toward a unified view of customer relationship management.Journal of American Academy of Business, 6(1), 32-8.

Chau, P. (1997). Re-examining a model for evaluating information center success using a structural equation modeling approach.Decision Sciences, 28(2), 309-333.

Crosby, L.A., Evans, K.R. and Cowles, D. (1990). Relationship quality in services selling: an interpersonal influence approach. Journal of Marketing, 54(7), 68-81.

Drucker, P. (1954). The Practice of Management.Harper and Row, New York, NY.

Elkordy, M. (2014).The Impact of CRM Capability Dimensions on Organizational Performance.European Journal of Business and Social Sciences, 2(10), 128-146.

Fornell, C. and Larcker, D.F. (1981).Evaluating structural equation models with unobservable variables and measurement error.Journal of Marketing Research, 18, 39-50.

Gan, C., Cohen, D., Clemes, M. and Chong, E. (2006). A survey of customer retention in the New Zealand banking industry: banks and bank systems. Journal of Business Research, 1, 83-99.

Gebert, M., Probst, G., and Leibold, M. (2002).Five Style of Customer Knowledge Management and How Smart Companies Use them to Create Value. European Management Journal, 20(5), 459-469.

Hair, J., Anderson, R., Tatham, R. and Black, W. (1998).Multivariate Data Analysis, 5th ed., Prentice-Hall, Upper Saddle River, NJ.

Harley, D.R. (1984). Customer satisfaction tracking improves sales, productivity, morale of retail chains. Marketing News, June, p. 15.

Hawkes, V.A. (2000). The heart of the matter: the challenge of customer lifetime value. CRM Forum Resource.

Hill, N. and Alexander, J. (2002).Handbook of Customer Satisfaction and Loyalty Measurement, Second Edition, Gower Publishing Company, Hampshire.

Hugar, S.S. and Vaz (D'Costa), N.H. (2010). A model for CRM implementation in Indian public sector banks.International Journal of Business Innovation and Research, 4(1), 143-162.

Jackson, B.B. (1985). Winning and Keeping Industrial Customers: The Dynamics of Customer Relationships, Lexington Books, Lexington, MA.

Kim, J., Suh, E. and Hwang, H. (2003).A model for evaluating the effectiveness of CRM using the balanced scorecard.Journal of Interactive Marketing, 17(2), 5-19.

Kotler, P. and Armstrong, G. (2008).Principles of Marketing.(12th edn), McGraw-Hill, New York.

Kumar, N., Scheer, L.K. and Steenkamp, J.E.M. (1995).The effects of perceived interdependence on dealer attitudes.Journal of Marketing Research, 32(8), 348-356.

Lin, N-H., Tseng, W-C., Hung, Y-C.and Yen, D.C. (2009). Making customer relationship management work: evidence from the banking industry in Taiwan. The Service Industries Journal, 29(9), 1183-1197.

Ngai, E.W.T. (2005). Customer relationship management research (1992-2002): an academic literature review and classification. Marketing Intelligence & Planning, 23(6), 582-605.

Nunnally, J.C. and Bernstein, I.H. (1994).Psychometric Theory, 3rd ed., McGraw-Hill, New York, NY.

Palmer, A. and Bejou, D. (1994). Buyer-Seller Relationships: A Conceptual Model and Empirical Investigation. Journal of Marketing Management, 10, 495-512.

Peppers, D. and Rogers, M. (1996). The one to one future: Building relationships one customer at a time, 102–122.

Pfeifer, P.E. and Farris, P.W. (2004). The elasticity of customer value to retention: the duration of a customer relationship. Journal of Interactive Marketing, 18, 20-31.

Raman, P., Wittmann, C.M. and Rauseo, N.A. (2006).Leveraging CRM for Sales: The Role of Organizational Capabilities in Successful CRM Implementation.The Journal of Personal Selling and Sales Management, 26(1), 39-53.

Reichheld, F.F. (1996). The Loyalty Effect, Harvard Business School Press, Boston, MA.

Tabachnick, B.G. and Fidell, L.S. (2007). Using Multivariate Statistics, (5th ed.) Pearson: Boston.

Thurau, T. (2004). Customer Orientation of Service Employee… International Journal of Service Industry Management, 15(5), 460-478.

Varki, S. and Colgate, M. (2005).The role of price perceptions in an integrated model of behaviour intentions.Journal of Service Research, 3, 232-240.

Vella, J. and Caruana, A. (2012). Encouraging CRM systems usage: a study among bank managers. Management Research Review, 35(2), 121-133.

Verhoef, P.C. (2003). Understanding the Effect of Customer Relationship Management Efforts on Customer Retention and Customer Share Development.Journal of Marketing, 67(4), 30-45.

Wang, F., Hu, F. and Yu, L. (2010).The application of customer relationship management in investment banks.Asian Social Science, 6(10), 178-183.

Wang, Y. and Feng, H. (2012). Customer relationship management capabilities: Measurement, antecedents and consequences. Management Decision, 50(1), 115 – 129.

Williams, M.R. and Jill S.A. (1996).Exploring Salesperson’s Customer Orientation as a Mediator of Organizational Culture’s Influence on Buyer-Seller Relationships.Journal of Personal Selling & Sales Management, 16(4), 33-52.

Wood, R.A. (2003). Customer Knowledge Management.Knowledge Roundtable.

Xu, Y., Yen, D.C., Lin, B. and Chou, D.C. (2002), Adopting customer relationship management technology, Industrial Management and Data Systems, 102(8), 442-452.

Yim, F. Hong-Kit, Anderson, R.E. and Swaminathan, S. (2004). Customer relationship management: Its dimensions and Effect on Customer Outcomes. Journal of Personal Selling and Sales Management, 24(4), 263-278.

Customer Knowledge (Yim et al., 2004; Arnett and Badrinarayanan, 2005; Sin et al., 2005; Khodakarami and Chan, 2014)

CK20. The bank provides channels to enable on-going two-way communication between customers and employees.

CK21. The customers are kept informed about the latest benefits and offers regarding various products and services.

CK22. The bank fully understands the needs of customers.

CK23. Bank always provides statements with accurate data.

CK24. Our bank offers overdraft facility to the high net-worth.

Customer Orientation (Bowen et al., 1989; Jayachandran et al., 2005; Evans et al., 2007; Donnelly, 2009; Elkordy, 2014)

CO31. Our bank has access to 24*7 helpline for receiving complaints from the customers.

CO32. The bank provides access to information regarding banking services via internet and mobile.

CO33. The bank has the mechanism to evaluate the customer-centric performance standards at all customer touch points.

CO34. The bank has not enough resources and expertise for the successful relationship development.

Customer Retention (Yim et al., 2004; Schweidel et al., 2008; Chinje, 2013)

CR39. The feedback is taken from customers on regular (weekly) basis.

CR40. The customer is empowered through personalized messages which encourage healthy relations.

CR41. Bank has a culture where customer is given first preference.