|

T. Frank Sunil Justus Assistant Professor Department of Business Administration Annamalai University Email: tfsuniljustus@yahoo.co.in |

B. Vaishnavi computer Engineer with masters in Management Department of Business Administration Annamalai University Email: vaishugreeny1@gmail.com |

T. Sunitha Assistant Professor Government Arts College for women Pudukottai, Tamil Nadu Email: Sunitha.au@gmail.com |

M. Gnanasundari Electrical engineer Annamalai University Email: sundaridheivu@yahoo.co.in |

Perceived risk usually plays an important role in the purchase decision making process and every purchase contains a degree of risk. Manufacturers of cars frequently upgrade their models by changing the exterior appeal and adding bells and whistles to the vehicle. However for a probable consumer who has perceived a risk concerning driving skills, such changes will not lead to purchase of a car. This product orientation will only lead to marketing myopia. Marketing myopia can cause the manufacturers to ignore the fear of driving and in turn concentrate on the product side. The car purchase can take place only when the perceived risk concerning driving reaches below a certain threshold level. Hence fear of driving which is one of the components of perceived risk in purchase of cars has been made the key area of the study. Risk relievers suitable to reduce fear of driving have been drawn.

The scale developed will help marketers to shed their marketing myopia of too much concentration on the features of the car and look at opportunities to reduce the fear of driving an inherent perceived risk in purchase of car. This study will be useful to manufacturers to look at perceived risk in purchase of car from a different perspective. In future studies new risk relievers to reduce fear of driving as a perceived risk in purchase of car can be developed

Perceived risk usually plays an important role in the purchase decision making process, regardless of the nature of the purchase occasion (planned versus impulse). Every purchase contains some degree of risk. Many people feel the need to buy a car but still do not buy a car simply because of the fear of driving a car. Hence fear of driving often comes in as an obstacle between the between the desire to own a car and the actual buying of the car. Bauer (1960) was the first to bring up the idea of perceived risk and observed that consumers perceive uncertainty in contemplating a particular purchase intention. A major factor affecting personal relevance and motivation is perceived risk, the extent to which the consumer is uncertain about the personal consequences of buying, using or disposing of an offering. The area of perceived risk has spawned a lot of studies since Bauer’s 1967 seminal work. However even after going through more than hundred works in perceived risk no study has tried to find out the influence of the inability to master car driving as a perceived risk in purchase of car. This paper explores the impact of fear of driving as a perceived risk in purchase of car.

The important consideration of a purchase decision is the amount of risk perceived by the individual consumer and that consumer’s subjective evaluation of that amount of perceived risk. Manufacturers of cars frequently upgrade their models by changing the exterior appeal and adding bells and whistles to the vehicle. However for a probable consumer who has perceived a risk concerning driving skills, such changes will not lead to purchase of a car. This product orientation will only lead to marketing myopia. Marketing myopia can cause the manufacturers to ignore the fear of driving and in turn concentrate on the product side. The car purchase can take place only when the perceived risk concerning driving reaches below a certain threshold level. Hence fear of driving which is one of the components of perceived risk (Sunitha, Frank & Ramesh 2015) in purchase of cars has been made the key area of the study. Risk relievers suitable to reduce fear of driving have been selected for the study. Schiffman and Kanuk (2007) indicate that perceived risk is more powerful at explaining consumer behavior since consumers are often motivated to reduce mistakes than to maximize utility in purchasing.

Cunningham (1967) observed perceived risk as comprising of two dimensions. the perceived certainty of a known event happening and the consequence concerned if the event should happen. Kogan and Wallach. (1964) recognized perceived risk as a chance feature where the focus was on likelihood of loosing and a danger portion where the importance was on severity of negative consequences. Both these reviews can be related to fear of driving as customers tend to be afraid that if they make a mistake in driving the end result can be catastrophic. The same idea was emphasized by Stone and Winter (1987) who identified risk as an expectation of loss and the higher the expectation, the larger the risk for the individual. Shimp and Bearden, (1982) found that risk perceptions in marketing are negatively connected with willingness to buy Mowen (1995) revealed that the characteristics of the product or service would influence perceived risk and high involvement products were perceived to have a greater degree of risk attached to them. Roselius (1971) concluded that a seller should first determine the kind of risk perceived by his customers and then create a mix of risk relievers suited for his combination of buyer type and loss type.

The main research instrument was an interviewer administered survey. The research instrument was developed using the conceptual base of the dimensions of perceived risk and the contextual basis of the focus group outcomes. The resultant questionnaire comprised 26 Likert scales. Exploratory factor analysis with a varimax rotation was conducted on the total 26 questions. Nine risk relievers were identified as suitable for the study. These risk relievers were measured on a five point scale measured as I, 2, 3, 4 &5 and coded as no influence, mild influence, moderate influence, high influence and very high influence respectively. Exploratory factor analysis with a varimax rotation was conducted on the nine questions. A total of 100 respondents were considered for the study taken in Cuddalore district, India. Respondents with a minimum annual income of 10 lacs and those with a desire to buy a car but were yet to buy a car and had taken driving classes were alone included for the study.

Table 1 Components of perceived risk in driving

| Components of driving as a perceived risk in purchase of car | Dimensions | Loading | |||||||

| pr25 | Driving will add to the stress in my work career | Psychological Risk | .936 | ||||||

| pr7 | Am worried that I may hurt other’s property | .925 | |||||||

| pr26 | Dislike driving | .829 | |||||||

| pr8 | Have less confidence level to learn driving | .805 | |||||||

| pr14 | May get confused with different controls of the vehicle while I drive. | .774 | |||||||

| pr5 | Take long time to learn to drive a car | .693 | |||||||

| pr19 | Am afraid of being a danger to others on the road | Physical Risk | .982 | ||||||

| pr2 | Fear that my hands may pain because of driving | .973 | |||||||

| Pr1 | Fear that I may damage my vehicle | .959 | |||||||

| pr13 | May hurt myself if I drive | .951 | |||||||

| pr9 | May not be able to socialize with friends and family members inside the car | Social Risk | .983 | ||||||

| pr20 | Fear that I may not be able to look around and enjoy travelling in the car. | .978 | |||||||

| pr3 | Status may go down if I drive | .950 | |||||||

| pr21 | will look like a novice at the wheels | .920 | |||||||

| pr6 | Have to spend more money for learning | Financial Risk | .977 | ||||||

| pr24 | May opt for higher insurance if I drive | .967 | |||||||

| pr22 | Will need to spend as I by poor driving can scratch the paint in my vehicle | .956 | |||||||

| pr18 | Feel that i may spend higher fuel due to poor driving. | .953 | |||||||

| pr23 | Don’t like cleaning up my vehicle on a regular basis. | Time Risk | .975 | ||||||

| pr11 | Takes a long time to search for a good driver for learning | .974 | |||||||

| pr17 | May have to waste time searching for the parking place | .946 | |||||||

| pr15 | May take long time to reach the destination | .921 | |||||||

| pr16 | May not be able to use mobile | Functional Risk | .970 | ||||||

| pr12 | May lose huge money if vehicle breaks down | .969 | |||||||

| pr10 | Hate traffic and horn sound which would spoils my mood | .929 | |||||||

| pr4 | Can miss the signals getting myself into trouble | .924 | |||||||

| Summary Statistics | F1 | F2 | F3 | F4 | F5 | F6 | |||

| Eigen Values | 5.02 | 4.39 | 4.07 | 3.38 | 3.27 | 2.83 | |||

| % of variance explained | 19.31 | 16.90 | 15.64 | 12.98 | 12.58 | 10.88 | |||

| Cum % of variance explained | 19.31 | 36.21 | 51.86 | 64.84 | 77.42 | 88.30 | |||

| N =100 | Sample = All respondents | Unit = Factor loadings | |||||||

The first factor identified as psychological risk relates to perceived risk concerning how driving affects the consumer at the psychological level. Jacoby and Kaplan (1972) identified psychological risk as the risk that the service will not be consistent with the consumer’s self concept. This factor accounts for 19.31 percent of variance. The second factor identified as physical risk is the risk that driving can cause harm to self and others. Cunningham (1967) revealed physical risk as the risk that the service will be dangerous or harmful to the consumer. This factor accounted for 16.90 percent of variance

The third factor identified as social risk is the risk that their social life will take a beating if one has to drive a car. Stone and Gronhaug (1993) recognized social risk as the Risk that a poor service choice can bruise the consumer’s ego. This factor accounted for 15.64 percent of variance. The fourth factor identified as financial risk is the risk that consumers fear a loss of money if they are not able to master driving skills properly. Peter and Ryan (1976) categorized financial risk as the risk that the service will not be worth the money the customer pays. This factor accounted for 12.98 percent of variance

The fifth factor recognized as time risk is the risk that the consumer will suffer a time loss because of their inability to master driving. Peter and Tarpey (1975) found time risk as the loss incurred when it requires more time and energy to acquire the product or service. This factor accounted for 12.58 percent of variance.

The sixth factor identified as functional risk is the risk perceived that the consumer will suffer a reduction in functionality due to their inability in mastering driving skills. Cunningham (1967) indicated functional risk as the risk that the service will not perform as expected and this factor accounted for 10.88 percent of variance.

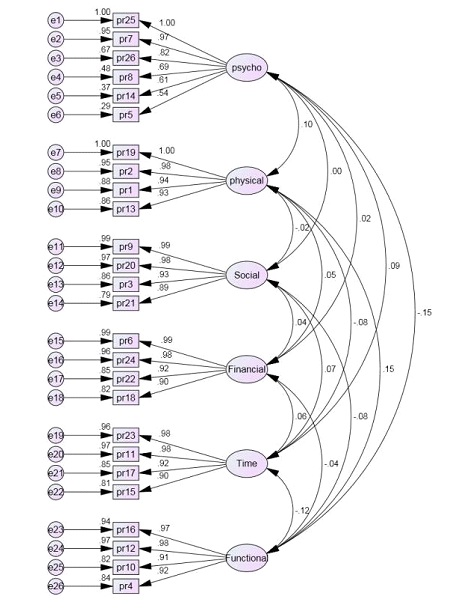

Fig 2 Confirmatory factor analysis for fear of driving as a perceived risk in purchase of car

The above figure shows the confirmatory factor analysis with six risk factors. The factor analysis conducted is the first stage of purification. The second stage is to determine the extent to which the six dimensions were robust over a new subjects, a confirmatory factor analysis was conducted, estimating a six factors for 26 risk components (figure-1). When the six factors were allowed to correlate, the fit statistics suggested a good model fit. Output of CFI Model is shown in below.

Confirmatory fit index (CFI) = 0.974; Goodness-of-fit index (GFI) = 0.788

Adjusted goodness-of-fit index (AGFI) = 0.738; RMSEA = 0.059; CMIN 380.7 DF 284

The reliability for the six factors as indicated in table 2 were considered adequate The list of the final set of components that measure the six dimensions of perceived risk towards driving in purchase of car is given in Appendix 1

Table 2 - Risk relievers to reduce perceived risk towards driving

| Dimensions of risk reliever to reduce perceived risk towards driving | |||||||

| Risk relievers supported by company | |||||||

| RR5 | Safety aspects of the car make me feel secured | .928 | |||||

| RR4 | Better if company provides a short term training | .924 | |||||

| RR6 | Automatic version can make learning process easier | .896 | |||||

| Risk Reliever developed by consumer themselves | |||||||

| RR1 | Insurance makes me feel secured | .913 | |||||

| RR2 | Feel confident when I see my peers driving | .905 | |||||

| RR3 | Better infrastructure makes me feel comfortable | .882 | |||||

| Risk reliever based on neutral sources | |||||||

| RR7 | peer pressure | .908 | |||||

| RR8 | It is the only possible comfortable option to reach my work spot | .904 | |||||

| RR9 | Trust the driving schools in my place | .880 | |||||

| Summary Statistics | F1 | F2 | F3 | ||||

| Eigen Values | 3.349 | 2.633 | 1.573 | ||||

| % of variance explained | 37.215 | 29.261 | 17.479 | ||||

| Cum % of variance explained | 37.215 | 66.476 | 83.956 | ||||

| N = 100 | Sample = All respondents | Unit = Factor loadings | |||||

The first factor identified as Risk relievers supported by company indicates that company takes efforts to develop these risk relievers targeted to reduce perceived risk of consumers. This factor accounts for 37.21 percent of variance. The seller's difficulty is one of choosing the appropriate method, among a wide variety of methods that will most effectively be useful for relieving the specific risks the market segment perceives in the product

The second factor identified as risk relievers created by consumers themselves looks at the effort of consumers to decrease their perceived risk below a threshold value to enable them to confidently learn to drive a car. This factor accounts for 29.26 percent of variance. The third factor identified as risk reliever based on neutral sources concerns risk relievers that are available without the specific effort of any body and this factor accounts for 17.48 percent of variance.

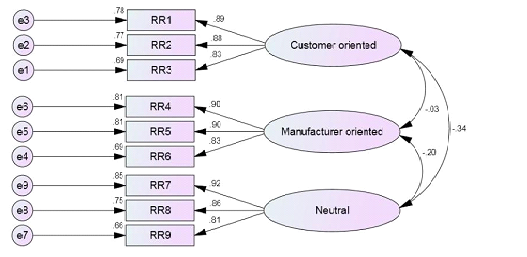

Fig 2 Confirmatory factor analysis for risk relievers to driving as a perceived risk in purchase of car

The overall GFI statistics of the general model suggested that the proposed model was consistent with the data according to relative (GFI, and CFI) and absolute (RMSEA) indexes of fit:

Confirmatory fit index (CFI) = 1.000

Goodness-of-fit index (GFI) = 0.963

Adjusted goodness-of-fit index (AGFI) = 0.931

RMSEA = 0.000

CMIN 17.432 DF = 24

The list of the final set of components that measure the three dimensions of risk relievers towards reducing the fear of driving in purchase of car is given in Appendix 2

| Dimensions | Cronbach's Alpha | Cronbach's Alpha | |

| Psychological risk | 0.918 | Perceived Risk | 0.773 |

| Physical risk | 0.845 | ||

| Social risk | 0.972 | ||

| Financial risk | 0.976 | ||

| Time risk | 0.971 | ||

| Functional risk | 0.969 | ||

| Company based | 0.909 | Risk Reliever | 0.700 |

| Consumer based | 0.897 | ||

| Neutral releiver | 0.900 |

The scale developed will help marketers to shed their marketing myopia of too much concentration on the features of the car and look at opportunities to reduce the fear of driving an inherent perceived risk in purchase of car especially in countries like India where car density is as low as 13 per 1000 people (Joseph, 2011). Marketers should develop ways to train customers on driving through their dealerships and thus focus on shedding the fear of driving should be subtly brought out in all communication with probable customers. Marketers should come out with safety enhancing features like anti-skid braking system (ABS) and airbags as standard fitments which can go a long way to increase the confidence of customers. Customers who have a driving license should be encouraged to take trial of vehicle along with trained drivers to shed their fear of driving. This study is more relevant to a country like where the culture to have the car chauffeured is still considered a safer alternative to driving. Hence car manufacturers can come together to start driving schools so that together they can develop a whole lot of possible future customers. This study will be useful to manufacturers to look at perceived risk in purchase of car from a different perspective. In future studies new risk relievers to reduce fear of driving as a perceived risk in purchase of car can be developed

Annexure 1 Dimensions of fear of driving as a perceived risk in purchase of car

| Components of Psychological risk | Mean | SD | Dimension | Mean | SD |

| Driving will add to the stress in my work career | 3.80 | 1.36 | Psychological risk | 3.74 | 1.13 |

| Am worried that I may hurt other’s property | 3.76 | 1.34 | |||

| Dislike driving | 3.60 | 1.23 | |||

| Have less confidence level to learn driving | 3.74 | 1.38 | |||

| May get confused with different controls while I drive. | 3.75 | 1.36 | |||

| Take long time to learn to drive a car | 3.81 | 1.50 | |||

| Components of Physical risk | Physical risk | 3.56 | 1.37 | ||

| Am afraid of being a danger to others on the road | 3.62 | 1.36 | |||

| Fear that my hands may pain because of driving | 3.59 | 1.39 | |||

| Fear that I may damage my vehicle | 3.52 | 1.50 | |||

| May hurt myself if I drive | 3.52 | 1.40 | |||

| Components of Social risk | Social risk | 2.60 | 1.418 | ||

| May not be able to socialize with friends and family members inside the car | 2.59 | 1.47 | |||

| Fear that I may not be able to look around and enjoy travelling in the car. | 2.59 | 1.47 | |||

| Status may go down if I drive | 2.62 | 1.51 | |||

| will look like a novice at the wheels | 2.61 | 1.46 | |||

| Components of Financial risk | Financial risk | 2.87 | 1.41 | ||

| Have to spend more money for learning | 2.85 | 1.49 | |||

| May opt for higher insurance if I drive | 2.91 | 1.45 | |||

| Will need to spend as I may scratch the paint in my vehicle | 2.87 | 1.49 | |||

| Feel that i may spend higher fuel due to poor driving. | 2.84 | 1.41 | |||

| Components of Time risk | Time risk | 2.92 | 1.45 | ||

| Don’t like cleaning up my vehicle on a regular basis. | 2.94 | 1.52 | |||

| Takes a long time to search for a good driver for learning | 2.92 | 1.51 | |||

| May have to waste time searching for the parking place | 2.93 | 1.52 | |||

| May take long time to reach the destination | 2.92 | 1.51 | |||

| Components of Functional risk | Functional risk | 3.12 | 1.46 | ||

| May not be able to use mobile | 3.14 | 1.54 | |||

| May lose huge money if vehicle breaks down | 3.11 | 1.52 | |||

| Hate traffic and horn sound which would spoils my mood | 3.10 | 1.51 | |||

| Can miss the signals getting myself into trouble | 3.11 | 1.52 | |||

Annexure 2 Dimensions of risk reliever to reduce fear of driving as a perceived risk in purchase of car

| Components of customer oriented risk relievers | Mean | SD | Dimension | Mean | SD |

| Feel confident when I see my peers driving | 3.00 | 1.41 | Customer oriented | 2.91 | 1.28 |

| Insurance makes me feel secured | 2.85 | 1.37 | |||

| Better infrastructure makes me feel comfortable | 2.88 | 1.44 | |||

| Components of manufacturer oriented risk relievers | Manufacturer oriented | 2.55 | 1.29 | ||

| Better if company provides a short term training | 2.59 | 1.36 | |||

| Safety aspects of the car make me feel secured | 2.50 | 1.43 | |||

| Automatic version can make my learning process easier | 2.57 | 1.41 | |||

| Components of neutral risk relievers | Neutral | 3.01 | 1.36 | ||

| peer pressure | 3.00 | 1.50 | |||

| the only possible comfortable option to reach my work spot | 2.91 | 1.51 | |||

| Trust the driving schools in my place | 3.12 | 1.46 | |||

Bauer, R .A. Consumer behavior as risk taking, in: D.F. Cox (Ed.), (1960) Risk Taking and Information Handling in Consumer Behavior, Harvard Business Press, Boston, MA, pp. 23–33.

Cunningham, S.M., , (1967) "The major dimensions of perceived risk" in Cox, D.F. (Ed.), Risk Taking and Information Handling in Consumer Behavior, Graduate School of Business Administration, Harvard University Press, Boston, MA, pp. 82-108.

Jacoby, &.Kaplan, L.B. (1972). The components of perceived risk in: Annual Conference of the Association for Consumer Research, pp. 382–393

Joseph, Lancelot. “Zipping ahead.” Business India (July 10, 2011): 50 – 58

Kogan, N. & M.A. Wallach (1964), Risk Taking: A Study in Cognition and Personality, New York: Holt Rinehart and Winston

Mowen C. John, Consumer Behavior, Prentice Hall Engelwood Cliff, New Jersey, 1995.

Peter, Paul.J.& Michael J Ryan.( 1976).An investigation of perceived risk at the brand level. Journal of Marketing Research VIII , 184 – 188

Roselius, T. (1971) “Consumer Rankings of Risk Reduction Methods,” Journal of Marketing (35),.pp 56-61.

Schiffman, Leon .G & Kanuk, Leslie Lazar. (2007). Consumer Behavior, Prentice Hall of India, New Delhi

Shimp T. A. & Bearden W. O. (1982), Warranty and Other Extrinsic Cue Effects on Consumer’s Risk Perceptions, Journal of Consumer Research, 9 (1), 38-46Mowen C. John, Consumer Behavior, Prentice Hall Engelwood Cliff, New Jersey, 1995

Simcock, Peter, Lynn Sudbury & Gillian Wright (2003) “The Impact of Age on Perceived Risk and Risk Reduction in High Involvement Consumer Decision Making” Third European Marketing Trends Conference, Venice

Stone, R.N. & Grønhaug, K. (1993) Perceived Risk: Further Considerations for the Marketing Discipline. European Journal of Marketing, 27(3), 39-50

Stone, Robert N. and Frederick W. Winter (1987), "Risk: Is it Still Uncertainty Times Consequences?," in Proceedings of the Winter Educators’ Conference, Russell W. Belk, et al. (eds.), Chicago, IL: American Marketing Association, 261-265.

Sunitha .T, Frank. Sunil Justus T & Dr. M. Ramesh. (2015) Influence of risk relievers on dimensions of perceived risk in car purchase, Management Today, 5 (1 january – March) p 7 -11http://dx.doi.org/10.11127/gmt.2015.03.02