|

Rachana Vishwakarma Research Scholar Faculty of Commerce, B.H.U. Varanasi, U.P., India, Pin no. 221005 Contact No.- 9454614028 Email: rachana.v88@gmail.com |

Foreign direct investment in India has played a significant role in the development of the Indian economy. FDI in India has in a lot of ways enabled India to achieve a certain degree of financial stability, growth and development. As a developmental tool, it plays an important role in the long-term development of a country not only as a source of capital but also for enhancing competitiveness of the domestic economy through transfer of technology, strengthening infrastructure, raising productivity and generating new employment opportunities. India after liberalizing and globalizing the economy to the outside world in 1991, there was a massive increase in the flow of foreign direct investment due to economic stability of the country. So, this paper have made an attempt to probe bidirectional relationship empirically between the foreign direct investment and economic growth in context of India and it is found that Gross Domestic Product causes Foreign Direct Investment which reveals that there is unidirectional relationship between Foreign Direct Investment and Gross Domestic Product . For FDI to be a noteworthy provider to economic growth, India would do better by focusing on improving infrastructure, human resources, developing local entrepreneurship, creating a stable macroeconomic framework and conditions favourable for productive investments to augment the process of development.

Keywords: Economic Growth, FDI, GDP, Granger Causal Relation, India

Foreign Direct Investment (FDI) has always been a key to the economic growth of countries for centuries. The globalised outlook added fuel to the already swelling FDI among the nations. FDI is of growing importance to global economic growth especially for developing and emerging market countries. The developed nations also receive its fair share of cross-border investment. According to International Monetary Fund (IMF), FDI is defined as “ an investment that is made to acquire a lasting interest in an enterprise operating in a economy other than that of the investor” The investor’s purpose is to have an effective voice in the management of the enterprise (IMF,1977)

FDI refers to the direct investment into production or business in a country by the sources outside the host country, either by buying a company or expanding business in the target host country. FDI plays a vital role in shaping the economic structure of the developing nations. There exists a strong relationship between FDI and economic growth. The main role of FDI in economic growth is that it is not just full filling the short-term capital deficiency problem but it also leads to transfer of technology and know-how, management and labour, training and skills, productivity and employment; and many other relevant materials. Larger foreign investment is a prerequisite for a country to achieve a sustainable economic growth. This is because the national savings of developing countries are far less to meet the ever-growing need of capital-intensive growth. Foreign borrowing and foreign investment have to meet this investment-savings gap. Foreign investment in the form of FDI is preferred over borrowings as it does not lead to national debt and at the same time brings with it the advantage of advanced technology, management and assured markets. It is a long-term investment and is used by the developing countries as a source of their economic development, productivity growth, to improve the balance of payments and employment generation. Its aim is to increase the productivity by utilizing the resources to their maximum efficiency. Exit is relatively difficult in this phenomenon.

There has been a debate in academic studies regarding the relationship of FDI and GDP. In the same perusal, the objectives of the present study have been as follows:

1. To study the growth of FDI inflows and Indian economy after liberalisation.

2. To identify the causality relationship between FDI and GDP.

The relationship between FDI and economic growth has been a topical issue for several decades. Policymakers in a large number of countries are engaged in creating all kinds of incentives (e.g. export processing zones and tax incentives) to attract FDI, because it is assumed to positively affect local economic development (Karimi &Yusop, 2009).Capital flows like FDI are considered to be beneficial to the economic development. But the policies related to such inflows must be designed keeping in mind their cost and disruptive effects. Foreign capital flows may cause imbalance that threaten macroeconomic stability of the host country (Kaur, Yadav & Gautam, 2012).

The massive growth of FDI inflows to the developing countries results in local economic growth and increasing productivity due to better technology and managerial skills. This leads to the significant impact on the economic output or GDP. This demands an analysis of the impact of FDI on GDP. There has been a significant number of studies on FDI and economic growth of various countries. Most of the studies indicated a positive causal relationship between FDI and economic growth.

Karimi and Yusop (2009) explored the causal relationship between foreign direct investment and economic growth. The researchers used Toda-Yamamoto test for examining causality relationship and the bounds testing (ARDL). They studied time-series data covering the period 1970-2005 for Malaysia and found that there is no strong evidence of a bi-directional causality and long-run relationship between FDI and economic growth. Therefore, they further concluded that FDI has some indirect effect on economic growth in Malaysia.

Bjorvatn et al. (2002) in their study explored the existing theoretical and empirical literature to find out the determinants of FDI and its role in economic development. They concluded that while FDI is not necessary to achieve economic development, the entry of foreign firms may play an important role in adding technology and competition to the host economies. They further posed a serious hitch that foreign entry may lead to a loss in market shares, and thereby a loss in profits, for local firms. They suggested that this problem is likely to be more important if foreign entry takes place in markets shielded from the competitive pressures of international trade.

Agrawal and Khan (2011) investigated the effect of FDI on economic growth of China and India for time period of 1993-2009. The researcher developed modified growth model from basic growth model by including factors viz. GDP, Human Capital, Labour Force, FDI and Gross Capital Formation, among which GDP was dependent variable while rest four were independent variables. After running OLS (Ordinary Least Square) method of regression the researchers found that 1% increase in FDI would result in 0.07% increase in GDP of China and 0.02% increase in GDP of India. They further concluded that China’s growth is more affected by FDI, than India’s growth.

R. Jayaraj and Sumeet Gupta (2011) examined the inter-relationship between FDI and GDP by using granger causality in India and found that FDI did not Granger cause GDP but interestingly GDP has Granger cause on FDI. An increased domestic economic activity will attract foreign investors to invest in India. Because of the huge population, increased domestic production in various industries, infrastructural facilities, and large domestic market would attract foreign investors.

Kaur, et al. (2012) investigated the relationship between FDI and current account in the context of India. The researchers applied Toda-Yamamoto (T-Y) granger causality technique for the period 1975-2009 and found that FDI and current account are co-integrated in the long run. They found evidence of unidirectional causality from FDI to current account.

Hossain and Hossain (2012) examined co-integration and the causal relationship between FDI and the economic output (GDP) in the both short and long run of Bangladesh, Pakistan and India over the period of 1972-2008. Using Granger Causality (GC) test they suggested that there is no co-integration between FDI and GDP in the both short and long run in Pakistan. Further, there is no causality relationship between GDP and FDI for Bangladesh; and one way or unidirectional relationship was found for Pakistan and India, which means FDI caused economic output in Pakistan and India.

Guech Heang and Moolio (2013) examined the relationship between foreign direct investment and gross domestic product of Cambodia in long run over the period of 1993-2011. The researchers applied Ordinary Least Square (OLS) regression and found that there is long-run relationship between FDI growth rate and GDP growth rate. The relationship is significantly positive.

Chakraborty and Mukherjee (2012) attempted to understand the nexus between the investment and economic growth in India. The researchers undertook a time series analysis to analyse whether there is exists any long-run relationship between FDI, domestic investment and economic growth, and if so, what is the direction of the relationship. The researchers found that there exists a long-run co-integrating relationship between FDI, gross fixed capital formation (GFCF) and GDP. Further, the study found unidirectional causality from India’s economic growth to FDI and from FDI to domestic investment. They also argued that higher FDI inflow in India in recent period is facilitated by the relatively stable GDP growth rate, which in turn acted as a major boost towards a sustainable high domestic investment. They further found that the growth effects of the FDI on GDP in the short run are less pronounced.

From above literature survey, it is found that it is very crucial to know that whether FDI affecting the growth of economy or GDP of our country are boosting due to FDI inflow.

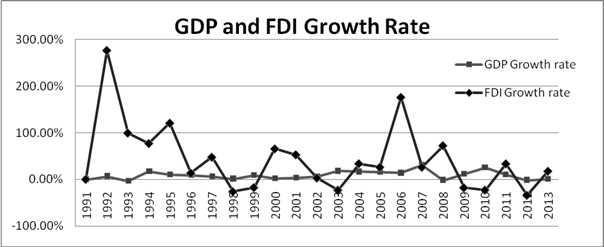

FDI is a predominant and vital factor in influencing the contemporary process of global economic development. Economic reforms taken by Indian government in 1991 makes the country as one of the prominent performer of global economies by placing the country as the 4th largest and the 2nd fastest growing economy in the world. For Indian economy which has tremendous potential, FDI inflow supplements domestic capital, as well as technology and skills of existing companies. It also helps to establish new companies. All of these contribute to economic growth of the Indian Economy. As evident from chart 1, the GDP growth rate has been consistent throughout the study period. Though in 2008, there has been a fall in GDP growth rate and in case of the FDI inflow in India, the overall trend of FDI inflow is fluctuating during the study period. The above table shows the FDI inflow and GDP in India from the year 1991-92 to 2011-2013 i.e. after post-liberalization period. It showed that FDI inflow has been increased by more than 380% during the study period because the FDI Inflow has been increased from USD 73.53 million in 1991-92 to USD 28.15 billion in 20011-2013. The Indian Government has used many steps to attract more FDI due to technological up gradation, access to global managerial skills and practices, optimal utilization of human and natural resources, making Indian industry internationally competitive, opening up export markets, providing backward forward linkages and access to international quality goods and services. After liberalization, growth of GDP has been raised by 7 percent and FDI inflow has been increased by 276 percent. After that growth rate of both are showing in positive way. During 1998 and 1999, FDI growth rate has been fallen negatively by 26 percent and 18 percent due to…. But again it walks in positive trend. The highest amount of FDI was received in the year 2008 and 2009, amounting to USD 43.4 billion and USD 36.49 billion. The highest growth rate of FDI inflow is in the year 2006-07 i.e., 175 percent. After that economic growth rate has slipped to a decade low due to poor performance of farming, manufacturing and mining sector which leads to decrease in FDI inflow rate. Decline investment could put pressure on the country’s balance on payment and may also impact the value of the rupees. So, Government has been relaxed FDI norms in several sectors including telecom, Defence, PSU at refineries etc. due to which growth rate of FDI have been by 17 percent. Thus, it indicates that foreign investor has been made investment in Indian economy due to economic stability.

Chart 1 . Annual growth rate of FDI Inflow and GDP

Source: data.worldbank.org

Source: data.worldbank.org

The scope of this study covers from 1991 to 2013 because Indian economic policy has liberalised in 1991 as foreign investment was introduced in 1991 under Foreign Exchange Management Act (FEMA), driven by then finance minister Dr. Manmohan Singh. Time series data was collected of the Inda for the period of 1991-2013 from databank of the World Bank. The study included two mainly variables such as GDP (proxy for economic growth) and FDI of India to test the bi-directional effect and their logarithm form (LGDP and LFDI) has been used for stability of data. Two econometric models were used i.e. Augmented Dicky-Fuller (ADF) test for testing stationary of data and Granger Causality test were used to test the bi-directional causal relationship between FDI and GDP. The logarithm value of GDP and FDI were used for analysis for make normality of data.

1. Augmented Dicky-Fuller test (ADF test)-

Augmented Dickey Fuller unit root test establishes the maximal integration order of the variables by carrying out on the GDP growth and FDI series in their log-levels and log differenced forms.

![]()

Where x and y are variables and εt is the error term. The test is performed under null of non-stationarity.

![]()

Where, Y t indicates variable of interest= (GDP and FDI), Δ is the difference operator, L=number of lags, t= time subscript, and εt is a white noise error term, constant variance {β 1 , β 2 , δ, α1 … α2} is a set of parameters to be estimated and ΔY t-1 =Y t-1 - Y t-2 etc. If the probability value is less than 5% level of significance, the null hypothesis can be rejected which depicts that the series is stationary and vice versa and The hypothesis of the study is described as follows:

Null hypothesis: A Unit Root (Non-Stationary)

Alternative hypothesis: No Unit Root (Stationary)

2. Granger Causality test-

Granger causality test is carried out to determine causality relationship between two variables viz.DLGDP, DLFDI for Indian economy. According to this approach, assume y is a variable indicates economic growth caused by another variable x (foreign direct investment), and y can be assumed to be better from past values of y and x than from past values of y alone. The hypotheses are model with the following equations:

![]() ......... (1)

......... (1)

![]() .......... (2)

.......... (2)

Where, LGDP and LFDI denote the logarithm form of economic growth and foreign direct investment respectively. These are assumed that distribution of ε1t and ε2t are uncorrelated. Equation (1) states that current LGDP is related to past values of itself as well as that of LFDI and equation (2) explains a similar behaviour for LFDI. From the equations, (1) and (2) we may get different kinds of hypothesis based on OLS coefficient estimates about the relationship between LFDI and LGDP are as follows:

· Unidirectional Granger causality from LFDI to LGDP Thus

![]() and

and

![]() . It may happen other way round as well.

. It may happen other way round as well.

· Bidirectional Causality Thus

![]() and

and

![]()

The decision criterion is that accept null hypothesis (no causal relationship between variables) if p – value is greater than the significance level, otherwise we reject the null- hypothesis and accept the alternative hypothesis (there exist causal relationship between variables) if p – value is less than significance level and the hypothesis is:

Null hypothesis: GDP doesn’t granger cause FDI of Indian economy and vice-versa.

This section describes the causal relationship between GDP and FDI of India by using Granger causality mechanism. Firstly we conducted Augmented Dickey-Fuller (ADF) test for testing the stationarity of log value of FDI and GDP and found that it has unit root meaning that FDI inflow and GDP were not stationary. For making data stationarity we are taken first difference of the both variables. In following table 1, P-value of LGDP and LFDI is greater than 5% level of significance indicates that null hypothesis at level of both FDI and GDP are accepted which meaning that it has unit root and after first differencing the variables, null hypothesis are rejected which indicates FDI inflow and GDP of India are stationary. So for further analysis purpose, we are using first difference of logarithm of GDP and FDI inflow to test the bi-directional relationship between each other. Thus the two variables are integrated of order one, I(1).

Table 1: Augmented Dickey fuller test for FDI and GDP of India

| Variables | Level/ 1st difference | Augmented Dickey Fuller Statistic(ADF) test | |||

| With Intercept | With trend and Intercept | ||||

| t-statistics | P-Value | t- statistics | P-Value | ||

| LGDP | Level | -0.788526 | 0.9912 | -1.701489 | 0.7144 |

| 1stDifference | -3.996909 | 0.0067 | -4.140586 | 0.0201 | |

| LFDI | Level | -3.521531 | 0.0177 | -3.223158 | 0.1068 |

| 1stDifference | -6.105933 | 0.0134 | -3.909010 | 0.0313 | |

The optimal lags for conducting the Granger causality test were determined by AIC (Akaike information criteria) indicates the 4 lag and Schwarz Information criteria that indicates 1 lag for optimum for analysis. We conducted the Granger causality test to verify if the coefficients λ1 and λ2 of the lagged variables are significantly different from zero in the respective equations 1 and 2. After determining that the most appropriate lag length as k=1 & 4 and difference =1. The results of the granger causality test are reported in Table 2 for all the estimated period.

Table 2: Result of Granger causality test

| Null Hypothesis | Probability value | Lag | Decision | Outcome |

| DLGDP does not Granger Cause DLFDI | 0.0036 | 1 | Reject null | GDP Causes FDI |

| DLFDI does not Granger Cause DLGDP | 0.6430 | 1 | Accept null | FDI doesn’t Causes GDP |

| DLGDP does not Granger Cause DLFDI | 0.0106 | 4 | Reject null | GDP Causes FDI |

| DLFDI does not Granger Cause DLGDP | 0.9121 | 4 | Accept null | FDI doesn’t Causes GDP |

From the table, probability value indicates that the variables in regression are not equal to zero. So the null hypothesis that “ GDP does not Granger causes FD I” with lag 1 and 4 were rejected which indicates GDP causes FDI for India and “ FDI does not Granger causes GDP ” were not rejected for the sample period which indicates that FDI doesn’t cause GDP in of context Indian economy. Here results are significant upto 4 lag as shown in table which indicates that at both lag, result are same as GDP causes FDI. Thus, There is unidirectional causality between both variable as economic growth of India are potential factor that causes foreign direct investment for the capital formation, advancing know how, corporate governance practices etc as found by Chakraborty & Mukherjee (2012) . Therefore, there isn’t a strong evidence of a bi-directional causality between FDI inflows and GDP which is also supported by qualitative studies that is based on the collection of existing studies from recognized domestic and international institutions, people in senior positions, and researchers.

There are so many arguments for and against of the relationship between foreign direct investment and the economic growth (GDP) of a country. Some researchers discovered stronger relationship between FDI and economic growth and some others could not. Finally it is concluded after empirically investigation of the relationship between FDI and GDP are there is a unidirectional relation as GDP Granger causes FDI. India is a preferred destination for FDI because of the third-largest economy in the world in PPP terms. It has a large pool of skilled managerial and technical expertise. India's recently liberalised FDI policy (2005) allows up to a 100% FDI stake in ventures. Industrial policy reforms have substantially reduced industrial licensing requirements, removed restrictions on expansion and facilitated easy access to foreign technology and foreign direct investment FDI. The upward moving growth curve of the real-estate sector owes some credit to a booming economy and liberalised FDI regime. The government amended the rules to allow 100% FDI in the construction sector, including built-up infrastructure and construction development projects comprising housing, commercial premises, hospitals, educational institutions, recreational facilities, and city- and regional-level infrastructure. The inordinately high investment from Mauritius is due to routing of international funds through the country given significant tax advantages; double taxation is avoided due to a tax treaty between India and Mauritius, and Mauritius is a capital gains tax haven, effectively creating a zero-taxation FDI channel. Although the influx of FDI inflows dramatic increase probably because of the internal factors such as the huge population, increased domestic production in various industries, infrastructural facilities, large domestic market would attract foreign investors in India . The other factors also that affect the FDI such as political stability, economic stability, budget discipline, Inflation, Interest rates, Openness of the economy, Governance, institutional and infrastructural development conducive to attract competitive FDI, policy consistency, tax consideration, legal and regulatory framework. GDP is vital contributor as well as a significant driver for the economic growth of India.

Agrawal, G. and Khan, M.A. (2011). Impact of FDI on GDP: A Comparative Study of China and India. International Journal of Business and Management , 6(10): 71-79.

Anitha, R. (2012).Foreign Direct Investment and Economic Growth in India. International Journal of Marketing, Financial Services & Management Research , 1(8): 108-125.

Bjorvatn, K., Kind, H.J. and Nordas, H.K. (2002). The Role of FDI in Economic Development. Nordic Journal of Political Economy , 28: 109-126.

Chakraborty, D. and Mukherjee, J. (2012). Is There Any Relationship between Foreign Direct Investment, Domestic Investment and Economic Growth in India? A Time Series Analysis. Review of Market Integration , 4(3): 309-337.

GuechHeang, L. and Moolio, P. (2013).The Relationship between Gross Domestic Product and Foreign Direct Investment: TheCase of Cambodia. KASBIT Business Journal , 6: 87-99.

Hossain, A. and Hossain, M.K. (2012). Empirical Relationship between Foreign Direct Investment and Economic Output in South Asian Countries: A Study on Bangladesh, Pakistan and India. International Business Research , 5(1): 9-21.

Karimi, M.S. and Yusop, Z. (2009). FDI and Economic Growth in Malaysia. Munich Personal RePEc Archive , Paper No. 14999.

Kaur, M., Yadav, S.S. and Gautam, V. (2012). Foreign Direct Investment and CurrentAccount Deficit- A Causality Analysis in Context of India. Journal of International Business and Economy , 13(2): 85-106.

Lall, S. and Narula, R. (2004).Foreign Direct Investment and its Role inEconomic Development: Do We Needa New Agenda?. The European Journal of Development Research , 16(3): 447-464.

Jayaraj R. & Gupta S. (2011) . An Empirical Analysis of the Impact of Foreign Direct Investment on Economic Activity of India. Journal of Global Economy,Volume (Year): 7 (2011) Issue (Month): 2 (June),Pages: 100-120

Ray S. (2012). Impact of Foreign Direct Investment on Economic Growth in India: A Co integration Analysis. Advances in Information Technology and Management (AITM) 187 Vol. 2, No. 1, 2012, ISSN 2167-6372.

Malhotra B. (2014). Foreign Direct Investment: Impact on Indian Economy .Global Journal of Business Management and Information Technology, ISSN 2278-3679 Volume 4, Number 1 (2014), pp. 17-23

UNCTAD Report, “Global Investment Trends Monitor” (No. 15, 28th January, 2014).

International Monetary Fund report, 1977

www.worldbank.org