|

Dr. Vinod K. Bhatnagar Assistant Professor Department of Management Prestige Institute of Management, Gwalior, MP Contact No.- 9329082151 Email: dr.vinodbhatnagar@gmail.com |

Javed Khan Student (MBA Finance) Prestige Institute of Management, Gwalior, MP |

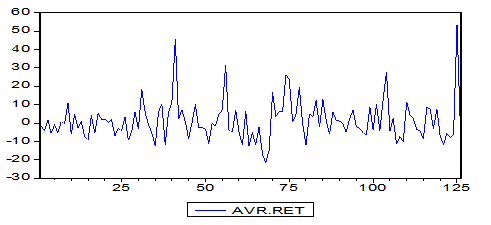

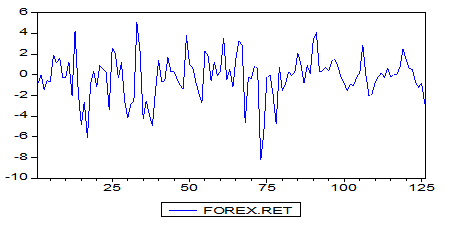

Indian companies can raise foreign currency resources abroad through the issue of ADRs/GDRs, in accordance with the Scheme for issue of Foreign Currency Convertible Bonds and Ordinary Shares. This research aims to analyze the effect of Foreign Exchange Rate on ADRs monthly return for the period 2004-05 to 2013-14. The Augmented Dickey-Fuller (ADF) technique was used for testing stationarity. The study was causal in nature and secondary data was used. Population was ADRs listed in Asian Countries. Sample size was ADRs of top 10 Indian companies. Convenience sampling method was used. The period of the study was based on 10 years data from 2004-05 to 2013-14. Data have been collected from www.StocksAbroad.com and www.oanda.com. We found that the p-value for both ADR returns and FOREX returns is significant at p value 0.000 and shows that the datasets were significant at 5% level of significance. Hence all the series were stationary. Our study revealed that Forex Returns has significant relation on ADR Return while ADR Returns were not Granger Cause on Forex Return.

Key Words: ADR, Foreign Exchange Rate and Return

Economic growth and development of the nation are dependent on the progress of tradable sector. In these days all economies are finding themselves incorporated to each other in some or other way through forces of liberalization and globalization (Goel, Kumar and Singh 2012). Indian has received overseas money in the form of ADRs, GDRs, FDI, FII, ECB and Bonds etc.

The capital market of a country holds great importance with value to its economic growth. The new financial instrument for rhythm the international markets may be termed as Depository Receipts (DRs). Depositary Receipt is a negotiable financial instrument issued by a bank to represent a foreign company’s publicly traded securities. American Depository Receipts (ADR) and Global Depository Receipts (GDR) have become an admired investment option for the investors in India (Ghosh, 2014).

In present, here are two choices for investment in Depository Receipts: American Depository Receipt (ADR) which gives companies to right of entry the US capital market and Global Depository Receipt (GDR) which gives companies to right of entry the global market outside the home market.

As firms in developing countries fostered a progressively more global outlook over the last two decades, American Depository Receipts became a universal method for foreign firms to raise capital. ADRs generally trade close to equality with their domestic stocks, with their returns almost entirely being dependent on underlying stock and foreign exchange movements (Gupta, 2010).

An American Depository Receipt, or ADR, is a security issued by a U.S. depository bank to domestic buyers as a substitute for direct ownership of stock in foreign companies. An ADR can represent one or more shares, or a fraction of a share, of a non-U.S. company. (Bathiya, 2014)

ADR/ GDR flows have not received much attention despite the fact that the Indian corporate sector has increasingly used ADR/GDR mechanism to raise foreign capital. This study thus examines the macroeconomic determinants of not only FII but also ADR/GDR flows to India in order to fill the existing gap in the literature (Dua and Garg, 2013).

American Depositary Receipts (ADRs) are instruments representing foreign (non- US) stocks (or debt) that are tradable in the USA. They serve as evidence of the original share being held in an American bank, known as the custodian. They are quoted and pay dividends in US dollars. (Chakrabarti, 2003)

Indian companies can raise foreign currency resources abroad through the issue of ADRs/GDRs, in accordance with the Scheme for issue of Foreign Currency Convertible Bonds and Ordinary Shares (Through Depository Receipt Mechanism) Scheme, 1993 and guidelines issued by the Government of India there under from time to time (RBI 2013).

A company can issue ADRs / GDRs, if it is eligible to issue shares to person resident outside India under the FDI Scheme. However, an Indian company, which is not eligible to raise funds from the Indian Capital Market including a company which has been restrained from accessing the securities market by the Securities and Exchange Board of India (SEBI) will not be eligible to issue ADRs/GDRs.

The two main functions of the foreign exchange market are to determine the price of the different currencies in terms of one another and to transfer currency risk from more risk-averse participants to those more willing to bear it (Chakrabarti).

Trading Forex is buying one currency while at the same time selling a different currency. Some companies who do business in other countries use Forex markets to convert profits from foreign sales into their domestic currency. Other reasons for trading Forex include speculation for profit, or to hedge against currency fluctuations.

ADR issued by the India companies are traded in US $ therefore effect of change in foreign exchange rate affected return of ADR. JP Morgan introduced the first American Depository Receipt (ADR) in 1927 to allow Americans invest in the British retailer Selfridges. Since then, the ADR market has evolved in sophistication and in importance to become an instrument used widely by companies to trade their shares in equity markets of more developed countries.

ADR and GDR developments in financial arena have created enormous investment for Indian investors abroad and vice-versa. Indian companies are raising finance from abroad and are available on foreign exchange to raise finance by way of American Depository Receipts (ADRs) and Global Depository Receipts (GDRs).

Previous studies broadly relating to this subject have been reviewed.

Gupta R. (2010) stated that the Indian economy benefited from financial sector reforms in 1991, when foreign institutional investors (FII) were permitted access to the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), and Indian corporations were permitted to raise capital from foreign investors through Global Depository Receipts (GDR) and American Depository Receipts (ADR). In addition, the start of Foreign Currency Convertible Bonds (FCCB) allowed firms to access debt capital markets and opened the unused Indian corporate debt sector to global investors.

Nath and Samanta gave explanation for the relation among exchange rates and stock prices can be provided through ‘collection balance approaches’ that anxiety the role of capital account transaction. Like all commodities, exchange rates are determined by market mechanism, i.e., the demand and supply condition. Exchange rates and the stock prices are directly related to each other if the rates of dollar strong on the Rupees than the stock market face the negative effect but the rates of dollar are decreases.

Padhi and Pallavi (2012) identified that negotiable instrument issued by a bank in a domestic country that represents ownership of shares in companies of other countries. Cross listing, particularly through DRs such as American Depositary Receipts (ADRs) or Global Depositary Receipts (GDRs), is a popular way of internationalisation among firms from emerging economies. American Depositary Receipt is the way which gives the way to entre in to the foreign markets.

RBI (2013) defined that Depository Receipts (DRs) are negotiable securities issued external India by a Depository bank, on behalf of an Indian company, which signify the local Rupee denominated equity shares of the company held as deposit by a Custodian bank in India. DRs are traded on Stock Exchanges in the US, Singapore, Luxembourg, London, etc. DRs listed and traded in the US markets are known as American Depository Receipts (ADRs) and those listed and traded elsewhere are known as Global Depository Receipts (GDRs). Indian companies can raise foreign currency outside the Indian Territory through the issues of ADRs/GDRs.

Ghosh (2014) analyzed the trend in ADR premiums and the movement in ADR premium levels over 2001-2005 period. He also analyzed the relation in movement of ADR prices with the prices of underlying equity and concluded that ADR prices do not move in lock-step with underlying equity prices.

Majumdar (2007) found that companies around the world, particularly those in the developing nations, are increasingly tapping international equity markets, in an attempt to enhance their global existence and to raise capital outside the borders of their home market.

Dua and Garg (2013) evolved that American/Global Depository Receipts provide a mechanism of indirect listing of Indian companies in foreign stock exchange. The Indian company that wants to get listed indirectly in the foreign stock exchange, deposits its shares in a bank in that country. The bank then issues receipts against these shares, which are sold to the residents of that country.

Saxena S. (2006) analyzed the continued existence of premiums on Indian ADRs over the last 3-4 years and investigates the reasons for the same. If any security, carrying the same risk-reward characteristics, trades at two different prices in different markets, the arbitrageurs will soon step in to take advantage of the situation, till the time the security trades at one price, across all markets. He found that premiums on ADRs of Indian companies have been in existence for some time, ADR prices do not move in lock-step with the prices of underlying equity, despite sharing exactly the same risk-return characteristics and the impact of liquidity and currency risk premium on ADR premiums is relatively insignificant.

Ghosh S. (2014) analyzed the relationship between the ADR price with their underlying equity and the S&P 500 Index. It also tries to show the sensitivity of the underlying equity prices to one of the Indian stock market index i.e. BSE Sensex. He found that ADR are a derivative of underlying equity, yet there may exists a significant difference in the ADR prices compared to the price of underlying equity (i.e. the ADR premium).

Gupta R. (2010) investigated possible reasons that led to a persistent premium for ADRs of Indian firms when compared to their domestically listed stocks, and to gain insight as to why the aforementioned premium on some of these ADRs rose to levels higher than 50% during the financial crisis. He investigated the existence of a persistent premium on ADRs on account of them being good diversifiers for portfolios of American investors.

Nath C. and Samanta P. examined the dynamic linkages between the foreign exchange and stock markets for India. They found that generally returns in these two markets are not inter-related, though in recent years, the return in stock market had causal influence on return in exchange rate with possibility of mild influence in reverse direction.

Srikanth P. (2013) analyzed the impact of issue of ADRs on the return and volume of transaction of underlying stock of the Wipro Ltd. and the change in volatility after the issue of ADRs by the company. It was revealed that ADR issue has been resulted in decrease in volatility underlying stocks, but the decrease in volatility is not significant.

Pasquariello P., Yuan K. and Zhu Q. (2006) examined whether foreign firms issuing American Depositary Receipts (ADRs) have the ability to time their corresponding exchange rate market when doing so. They found that these firms tend to issue ADRs after their local currency has been abnormally strong against the U.S. dollar and before their local currency becomes abnormally weak. We further show that currency market timing ability is most pronounced for companies with higher currency exposure, value companies, manufacturing firms, relatively small (yet large in absolute terms) companies issuing relatively large amounts of ADRs.

Agrawal G. et al. (2010) studied the dynamics between stock returns volatility and exchange rates movement. We focus our study towards Nifty returns and Indian Rupee-US Dollar Exchange Rates. This research empirically examined the dynamics between the volatility of stock returns and movement of Rupee-Dollar exchange rates, in terms of the extent of interdependency and causality. To begin with, absolute values of data were converted to log normal forms and checked for normality.

Chakravarty S., Chiyachantana C. and Jiang C. (2007) investigated how institutions trade a firm’s stock in its home exchange versus trading the same firm’s stock as an ADR in the U.S. They examined the importance of factors that measure liquidity, information and the regulatory environment at order, stock and country levels. For stocks traded as both ADRs and also in their respective local exchanges, we find that the distribution of institutional decisions in the ADR market is higher for less complex orders, for stocks with deeper ADR markets,

Karoui A. (2006) examined the relationship between the volatilities of equity indexes returns and FX rates for a set of emerging countries with respect to USD, GBP and JPY. He found that a significant relationship between FX volatility and stocks returns volatility for a large part of the indexes studied. The number of indexes that are significantly sensitive to the FX rates is almost the same for JPY (69%), USD (66%) and GBP (63%).

OBJECTIVE

This research aims to analyze the effect of Foreign Exchange Rate on ADRs monthly return for the period 2004-05 to 2013-14.

It is a common knowledge that most macroeconomic time series are non-stationary. This means that their mean, variances and co-variances are not time independent, rendering all estimated results unreliable. Thus testing for presence of unit root was necessary in empirical studies. The Augmented Dickey-Fuller (ADF) technique was used for testing stationarity. The study was causal in nature and secondary data was used . Population was ADRs listed in Asian Countries. Sample size was ADRs of top 10 Indian companies. Convenience sampling method was used. The period of the study was based on 10 years data from 2004-05 to 2013-14. Data have been collected from www.StocksAbroad. com and www.oanda.com .

Unit Root Test

Unit root test is most commonly used methodological procedure to examine the data series that satisfy stationary assumption. In an effort to confirm such requirement, unit root test methodology was evolved. The Unit-Root test is conducted based on Augmented Dicky-Fuller (ADF) test. . The ADF test is based on following regression:

ΔXt = θ + (ρ − 1) Xt−1 +Xpi =1 βiΔXt−i + ut (A1)

The null hypothesis is (ρ−1) = 0, i.e. Xt possesses a unit root. One issue in computing the ADF test is the choice of the maximum lag in the equation (A1).

Table – 1 Augmented Dicky-Fuller (ADF) test for stationarity

| t-STATICS | PROBABILITY VALUE | UNIT ROOT | |

| ADR return | -9.870679 | 0.0000 | Stationary at [I (1)] |

| FOREX return | -8.191866 | 0.0000 | Stationary at [I (1)] |

The null hypothesis of a unit root is rejected in favour of the stationary alternative in each case if the test statistic is more negative than the critical value. In the above table, the p-value for both ADR return and FOREX return is significant at p value 0.000 and shows that the datasets are significant at 5% level of significance. Hence all the series were stationary.

Granger causality test

Table – 2 Granger Causality Test

| Pairwise Granger Causality Tests | |||

| Date: 12/12/14 Time: 20:50 | |||

| Sample: 1 126 | |||

| Lags: 2 | |||

| Null Hypothesis: | Obs | F-Statistic | Probability |

| FOREX_RET does not Granger Cause AVR_RET | 124 | 10.8456 | 4.7E-05 |

| AVR_RET does not Granger Cause FOREX_RET | 2.00704 | 0.13891 | |

Based on the Probability values reported in table, the null hypothesis that Forex Return does not Granger Cause ADR Return in the market is rejected but ADR returns does not Granger cause Forex Return does not rejected, which implies that Forex Return has significant relation on ADR Return while ADR Return does not Granger Cause on Forex Return and it is found that Granger Causality runs one way from Forex returns to ADR returns, but not the other way.

We examined the relationship between Forex returns and ADR returns using Foreign Exchange Rate and ADRs monthly returns average for the period 2004-05 to 2013-14. We examined stationarity of data applying Unit-Root test based on Augmented Dicky-Fuller (ADF) test, found that the p-value for both ADR returns and FOREX returns were significant at p value 0.000 and shows that the datasets were significant at 5% level of significance. Our study revealed that Forex Return does not contemporaneously lead ADR returns in the market. According to the Granger causality tests presented in Table (2), we reject the null hypothesis, which implies that Forex Return has significant relation on ADR Return while ADR Return does not Granger Cause on Forex Return.