|

Pradipta Gangopadhyay PhD Research Scholar Deputy Director, Research & Journal Institute of Cost Accountants India CMA Bhawan, 4th Floor, 84 Harish Mukherjee Road, Kolkata - 700025 Contact No.- +91-8697514749 Email: ganguly.pradipta@gmail.com |

Dr. Parimal Kr. Sen Associate Professor (WBES) Goenka College of Commerce and Business Administration 210, B. B. Ganguly Street, Kolkata - 700012 Contact No.- +91 9433131046 Email: parimalsen123@gmail.com |

Brand image could be described as the way in which a particular brand is positioned in the market and how consumers perceive its products and services. As publicity is a practice to convince the consumers to take purchase decisions, they create an emotional impact in their minds. The present study evaluates the effect of various emotions embedded in the advertisements on formation/alteration of brand image of select commercial banks in India. The brand images of the selected banks were evaluated before and after showing these ads and differences thereafter in brand image were evaluated. The results of the study signify that the advertisements embedded with emotions alter the images of the three banks under the study. The results also indicate that different dominant emotions have different effects of the brand images of these commercial banks. The implications of such findings would help the banking and advertisement companies design their message effectively to attract their target audience.

Keywords : emotion, brand image, banking company, customer perception

Brand image is an inscription of overall character or personality that consumers assign to a brand based on their subjective perceptions about the brand. Kotler (1988) defines brand image as ‘the set of beliefs held about a particular brand’ (p. 197). Several studies worldwide have been conducted on brand image. According to Keller (1993), ‘brand associations are other informational nodes linked to the brand node in memory and contain the meaning of the brand for the consumers’. This view of brand image is similar to the definitions of Aaker (1991) and Park et al. (1986). Gardner and Levy, in their classic article, proposed that brands may have an overall character or personality that may be more important to the consumer than the technical facts about the product.

It is clear that consumers form an image of the brand based on the associations that they have remembered with respect to that brand. It is implicit in the various definitions provided by well known authors that brand image is a consumer constructed notion of the brand. Consumers ascribe a persona or an image to the brand based on subjective perceptions of a set of associations that they have about the brand. Keller (1993) suggests that brand associations can be influenced when a brand becomes linked with a celebrity through an endorsement or linked with a sporting event through sponsorship activities.

There have been several attempts to define the concept of emotion by both domains of religion and philosophy. Emotions are complex, organized states consisting of cognitive appraisals, action impulses and patterned somatic reactions. In this regard, taxonomies have been given historically by various philosophers that emphasize the variety of human emotions. Most common dimensions of emotions have been described as calm, excite, negative, positive, happy, sad etc. There are a number of measures considering emotional characteristics of users. These measures had been provided by past researchers that culminated into development of scales. Individual differences in the intensity of emotional responses to a given level of affect stimulus. The need for emotion scale defining the tendency or propensity for individuals to seek out emotional situations and stimuli, and exhibit a preference to use emotion in interacting with the world.

Affective orientation is defined as the degree to which individuals are conscious of affective cues and use these cues to guide decision-making process. Sensation seeking refers to behaviors which involve risk and seeking exciting and thrilling activities during leisure time. It differs from effect intensity concerned with daily events. In this study, we are going to look at effect intensity as an example of these measures and show its relevance to affective image in banking services.

The potential emotional impact on framing effects has received little attention in existing literature, which has tended to adopt the cognitive emphasis of behavioral decision theory (e.g., Loewenstern, Hsee, Weber, and Welsh, 2001). Recent researchers suggest that these concepts of emotional impact on image building, if employed in healthcare advertising and healthcare marketers should choose differently framed messages depending on consumers’ perceived risk toward a product (e.g., Chang, 2003). The brand attitude of customers is due to the presence of certain elements of image that the brand carries with them. The attitude in turn depends on the needs of the consumers. Park et al. (1986) have outlined three categories of basic consumer needs – functional, symbolic and experiential. These three classes are based on the problems that the brand tends to solve.

Aaker (1991) states that ‘a brand image is a set of associations, usually organized in some meaningful way’ (p. 109), while, according to Park et al., (1986) brand image is ‘the understanding consumers derive from the total set of brand image is ‘the understanding consumers derive from the total set of brand related activities engaged by the firm’. From a theoretical position, Keller (1993) suggests that brand associations can be influenced when a brand becomes linked with a celebrity through an endorsement. This transfer of associations is consistent with McCracken’s (1989) view of the celebrity endorsement process. McCracken however does not stress on the ‘credibility’ and ‘attractiveness’ models of endorsement used to explain the persuasive nature of endorsers. According to this theory, the meaning attributed to celebrities moves from the celebrity endorser to the product when the two are paired in an advertisement (McCracken 1989). The transfer process is completed when a consumer acquires/consumes the product, thus transferring the meaning to the user.

Emotions have been defined as states of emotional feelings involving positive or negative affective valence (Fridja, 1988). Tomkins (1962) suggested that there are eight basic emotions: fear, anger, anguish, joy, disgust, surprise, interest and shame. Other emotions are derived from mixing these basic emotions. There are a number of measures considering emotional characteristics of users. Examples are the affect intensity measure (Moore and Harris, 1994), the need for emotion scale (Raman and co, 1995), affective orientation (Booth-Butterfield, 1990), and sensation seeking scale. While communications goals of commercials may be stated in terms of information processing model, they typically focus on comprehension and persuasiveness (Sternthan and Craig 1973). Underlying this popularity is the belief that humor improves advertising effectiveness, of obvious interest to advertisers and agencies alike is whether the presumed positive impact is supported on both theoretical and empirical grounds. To evaluate this assumption properly, empirical investigations must (1) address specific communications goals, (2) draw from theories that describe the humor influence process, (3) operationalise humor to account for individual differences.

A number of methods have been presented to evaluate emotions, which technique should one choose depends on the context, the user group, the type of applications and evidently the goal of the evaluation. Some personality traits have also been studied such as locus of control in connection to usability (Linda, 2002). Reviewing studies from the field of consumer behavior have highlighted an important aspect of emotion, emotional characteristics of users. Examples are the affect intensity measure (Moore and Harris, 1994), the need for emotion scale (Raman and co, 1995), affective orientation (Booth-Butterfield, 1990), and sensation seeking scale.

In this research, we focus on one particular classification of image attributes; that derived by Barwise and Ehrenberg (1985). Their study classified attributes as following ‘evaluative’ or ‘descriptive’ patterns. The advantage of this classification is that there is an empirically derived way to determine if an attribute is displaying evaluative or descriptive patterns, rather than relying simply on researcher judgments. This empirical method involves comparing the percentage of users who associate the brand with the attribute, with the percentage of non-users who associate the brand with the attribute (Barwise & Ehrenberg, 1985).

In this research, we apply the empirical tests to determine if negative image attributes which are, by their nature; ‘evaluative’ (as they are negative evaluations of the brand) do indeed follow expected evaluative patterns. Establishing expected empirical patterns is of importance, since it allows future researchers to employ prior knowledge in an aid to understanding what to expect when measuring the perceptions that consumers hold.

1. To evaluate the effect of emotions on the brand image of some Indian banks.

2. To provide directions for further research.

The Study : The study was exploratory in nature & survey method was used to conduct the study.

Sample Design

Sampling Population : The population for the purpose of study was the bank account holders of Delhi region between the age groups of 18 to 60 years.

Sample Frame : The sample frame included the account holders, both current and savings, of the three banks who were present in the city during the data collection period/phase.

Sampling Techniques : A purposive sampling technique was used to select sample elements.

Sample Size : Thirty respondents were selected for evaluating the effect of each advertisement on the brand image. Six different advertisements were used for evaluating the effect of each campaign on the brand image of one bank. Thus 180 bank account holders of each organization were selected for the study. Therefore, the total sample size was 540 respondents. The average age of the respondents was 35 years. Due care was taken to ensure nearly equal representation from all age groups between 18 & 60 years. The male and female respondents were also selectee in equal number to ensure that no demographic variable affected the results. Proportionate representation was ensured on the basis of educational qualifications and the profession of respondents.

Data collection tools: Self-administered questionnaire was used to collect data on brand image variable used in the study. The elements in the questionnaire were selected after detailed review of literature & in discussions with experts in the area of study. A seven point numerical scale was used to elicit responses. The scale had values from 1 to 7 where 1 indicated minimum value of the variable, and 7 the maximum value of the variable. The data was collected from respondent after developing rapport & after explaining the purpose of the study. The reliability & validity of all the four measures was established through pilot study before undertaking the main study.

To evaluate the effect of discrete emotions embedded in the advertisements a large number of publicity campaign released by the three banking companies in the past five years were evaluated. 12 judges were used to classify these ads based on the dominant emotion in the advertisements. It was found that not all the emotions were found to be dominant emotions for all the three banks. Therefore, the total number of discrete emotions was reduced to six, as these emotions were found to be dominant emotions in the advertisements of all the banks selected for the study. In fact the three banks were selected in such a way that maximum number of discrete emotions could be covered. Thus in all six ads were selected for each bank and therefore the total number of ads for all the three banks was eighteen.

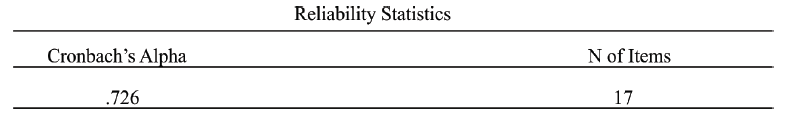

Data analysis tools: The Cronbach’s alpha reliability coefficient was computed for the Brand Image measure using SPSS 17 software. The reliability of all the measures was found to be 0.675. While computing Cronbach’s alpha, ‘scale when item deleted’ option was used to see if dropping any item from the scale would improve reliability of the measure. It was found that dropping item 7 increased the Cronbach’s alpha to 0.681 and dropping item 1 would increase reliability to 0.688. The process of computing Cronbach’s alpha reliability was repeated after dropping item 7 and subsequently dropping one item at a time till the Cronbach’s alpha improved. In all five items got dropped in the process, they were item numbers 1, 3, 7, 11 and 16. The final measure after dropping all the five statements had a Cronbach’s alpha reliability coefficient of 0.726. Thus the reliability of the measure used to evaluate the Brand image of three banks for the study was found to be high.

Content validity was established using a panel of 12 experts for both the measure used in the study separately. The content validity of all the statements of brand image was found to be above 0.85. The effect of emotions embedded in advertisements was evaluated for all the three banking brands separately and for each of the six emotions used in the ads for the study. Since the brand image of the banking companies was evaluated before after showing the ads, paired t-test was used to evaluate the differences in brand images of all the three banks before and after showing the ads.

The differences in the effect of different emotions embedded in the campaigns on brand image of the three banks were evaluated using t-test. T-test was applied between the brand images after showing the six ads. Thus in all 15 tests were computed for each bank brand.

Here we present the statistical analysis and outcomes of hypotheses testing. In the first section consistency measures of the items used in the questionnaire for data collection are discussed. The reliability of the items in all the questionnaires was computed using SPSS and discussed subsequently. To explore the underlying constructs, factor analysis was performed on the data sets, including extraction, rotation, and variance explained.

Using statistical tools, the reliability of the items taken into consideration was found out. The most common test of reliability being the Cronbach’s reliability test was used for it and seventeen items was found to be significantly reliable.

Chart1. Cronbach’s Alpha Reliability Coefficient for Brand Image

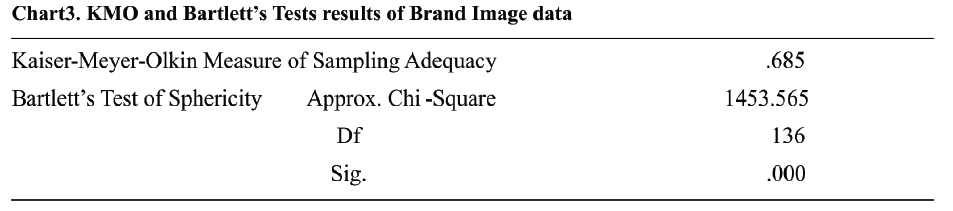

The Barttlet test is 1453.565 which is significant at 0% level of significance. This means that the item to item correlation matrix is not an identity matrix. The above facts indicate that the data collected on brand image of banks is suitable for factor analysis.

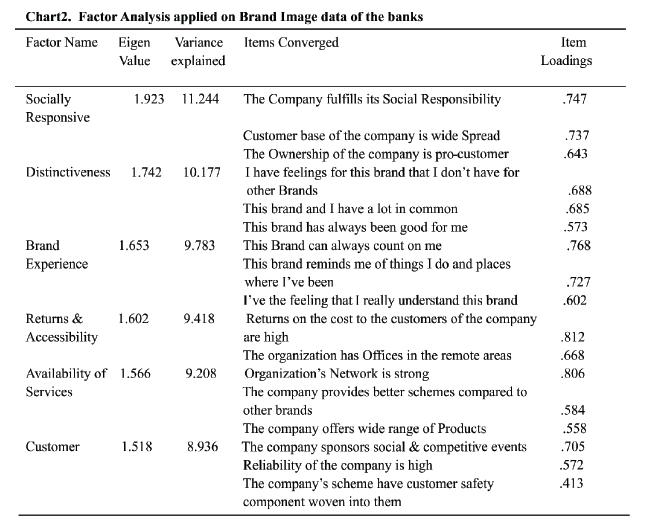

The raw scores of 17 items were subjected to Principle Component Analysis with varimax rotation and Kaizen Normalization to identify the latent factors that contribute towards the prediction of brand image of a bank. Six factors were identified after the analysis. The rotated factor results are tabulated in chart 2 below:

Table1. Showing Cronbach’s Alpha Reliability after dropping all the items that dragged reliability down

| Item-Total Statistics | ||||

| Scale Mean If Item Deleted | Scale Variance If Item Deleted | Corrected Item Total Correlation | Cronbach’s Alpha If Item Deleted | |

| VAR00002 | 90.7664 | 51.748 | .270 | .709 |

| VAR00004 | 91.3589 | 48.564 | .367 | .678 |

| VAR00005 | 91.0622 | 50.023 | .343 | .701 |

| VAR00006 | 90.9434 | 52.380 | .197 | .724 |

| VAR 00008 | 90.9687 | 50.071 | .332 | .703 |

| VAR 00009 | 91.0327 | 50.846 | .391 | .706 |

| VAR 00010 | 91.2673 | 47.321 | .451 | .687 |

| VAR 00012 | 90.9603 | 52.476 | .187 | .723 |

| VAR 00013 | 91.0566 | 49.773 | .385 | .686 |

| VAR 00014 | 91.2475 | 49.626 | .314 | .714 |

| VAR 00015 | 90.9488 | 50.332 | .322 | .712 |

| VAR 00017 | 91.1134 | 51.489 | .244 | .719 |

| VAR 00018 | 91.3412 | 50.010 | .295 | .707 |

| VAR 00019 | 91.2680 | 50.290 | .261 | .710 |

| VAR 00020 | 91.2570 | 48.679 | .474 | .697 |

| VAR 00021 | 91.1958 | 50.184 | .420 | .703 |

| VAR 00022 | 91.1362 | 51.041 | .239 | .713 |

Exploratory Factor Analysis

Factor Analysis applied on Brand Image Measure

Before going for factor analysis, the raw data was checked for sampling adequacy and sphericity & then decided whether the data was suitable or not for factor analysis. The results of these tests for the data of Brand Image are tabulated in chart 3 below:

The KMO and Bartlett test of Sphericity indicates that the data is suitable for factor analysis. The KMO measures the sampling adequacy which should be greater than 0.5 for a satisfactory factor analysis. Looking at the chart above, the KMO measure is 0.685. From the same chart, we can also see that the Bartlett’s test of sphericity is significant.

1. Socially responsive (1.923): This factor has emerged as the most important determinant of brand image with a contribution to total variance of 11.244. This factor includes three elements; the company fulfills its social responsibility (0.747), customer base of the bank is wide spread (0.737) & the ownership of the company is pro-customer (0.643).

2. Distinctiveness (1.742): This factor has emerged as the next important determinant of Brand Image of the banks with a total variance of 10.177. This factor includes three major elements; I have feeling for this brand that I don’t have for other (0.688), this brand and I have a lot in common (0.685) & this brand has always been good to me (0.573).

3. Brand experience (1.653): This factor has emerged as the next important determinant of research with a total variance of 9.783. This factor includes three major elements; the brand can always count on me (0.768), this brand reminds me of things I do & places I’ve visited (0.727), & I’ve a feeling that I really understand this brand (0.602).

4. Returns & accessibility (1.602): This factor has emerged as the next important determinant of research with a total variance of 9.418. This factor includes two major elements; Returns on the cost to the customer are high (0.812) & the organization has offices in the remote areas (0.668).

5. Availability of services offered (1.566): This factor has emerged as the next important determinant of research with a total variance of 9.208. This factor includes three major elements; the organization’s network is strong (0.806), company’s product better schemes compared to other brands (0.584) & company offers wide range of products (0.558).

6. Customer Orientation (1.518): This factor has emerged as the next important determinant of research with total variance of 8.936. This factor includes two major elements; the company sponsors social & competitive events (0.705), Reliability of the company is high (0.572) & company’s schemes have customer safety component woven into them (0.413).

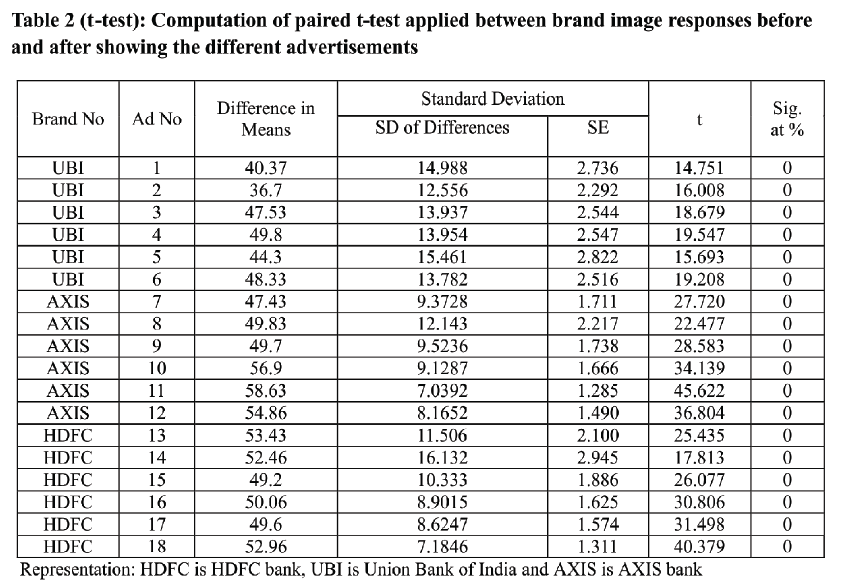

T-test Results: T-Tests were applied between the mean brand image values obtained after showing the advertisements. Three brands were selected for evaluating the effect of emotions on brand image. Six ads were selected for each brand having six different dominant emotions displayed in them. Thus in all eighteen ads were shown to the respondents. The Table 2 below indicates the t-test values computed between brand images of all the three banks before & after showing all the six ads embedded with different dominant emotions.

The table 2 above shows that the brand images of all the three banking brands change significantly when measured after showing six different ads embedded with six different dominant emotions as indicated by all the t-values (significant at 0% level of significance) computed between before & after showing these ads. That is, advertisement loaded with different emotions could be used to alter the brand images of banks in the desired direction.

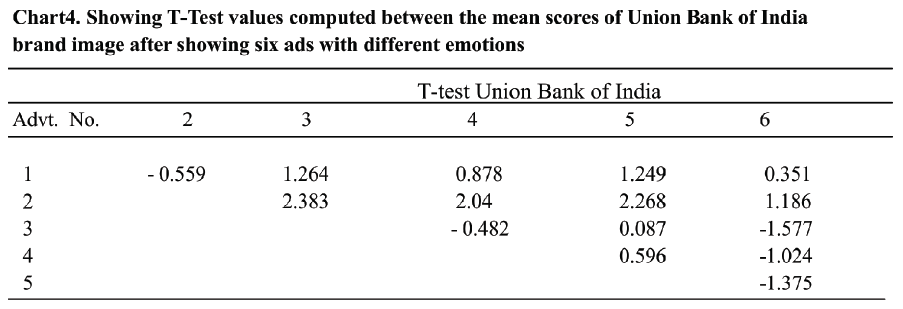

After the various advertisements were shown to the respondents, their perceptions were noted and for each bank the t-test values had to be computed. Chart 4 below shows the mean scores of Union Bank of India.

The mean brand values of Union bank of India after showing different ads were compared using t-test to evaluate the effect of each of the advertisements on customers’ image of the bank. From chart 4, there is significant difference between the mean Union Bank of India brand images after showing second ad (with excitement as dominant emotion) compared with after showing third ad (with Affection as dominant emotion); after showing fourth ad (with love as dominant emotion) and after showing fifth ad (with Secured emotion as dominant emotion) as showing by t-values of: 2.383, 2.04 and 2.268 respectively; all significant at 5% level of significant.

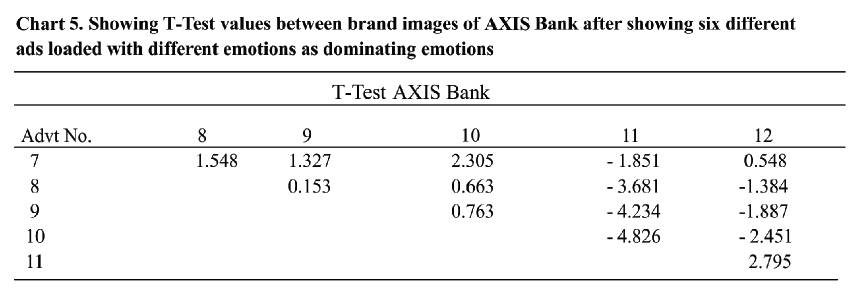

The mean brand values of AXIS Bank after showing different ads were compared using t-test to evaluate the effect of each of the ads were having on the brand image of AXIS Bank. As can be seen from the chart 5 above, there is significant difference between the mean AXIS Bank brand images after showing first ad (with happiness as dominant emotion) compared with after showing fourth ad (with love as dominant emotion); after showing fifth ad (secured) compared with after second (excitement), third (affection), fourth (love) and sixth (safe) ads and after showing fifth ads (secured) as compared with after showing sixth ad (safe) as shown by t-values: of: 2.305, 3.681, 4,234, 4.826 & 2.795 respectively; all significant at 5% level of significant.

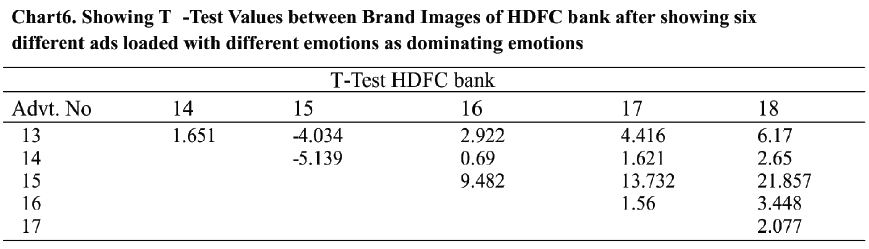

The brand image of HDFC bank after showing the advertisement with happiness emotion is significantly different than the brand image of the bank after showing affection ((4.034), love (2.922), secured (4.416) and safe (6.17) emotions. Similarly, the brand image of the bank after showing ad with excitement emotion is significantly different with image after showing ads with affection (5.139) and safe (2.65) emotions. The brand image of HDFC bank after showing ads with affection emotion is significantly different than the brand image after showing ads with all other emotions indicated by t-test values of 4.034, 5.139, 9.482, 13.732 and 21.857. The brand image of the bank after showing ads with love and secured emotions are significantly different from the image after showing safe emotions indicated by t-values of 3.448 and 2.077 respectively.

The study has some very important implications for the commercial banks in IChart4. Showing T-Test values computed between the mean scores of Union Bank of India brand image after showing six ads with different emotions

1. The review of literature for this study indicates that company image in case of services organizations is more important than individual products provided by the company. This fact has also been established by an earlier study by S S Bhakar and N S Sikarwar in 2012, on insurance companies. The same is pronounced for banking companies as well. Therefore, the companies need to concentrate on building organizational image in addition to images for each banking product.

2. The results of the study are thus very important for the promoters of service organizations and the advertisers in the sense that desired brand image can be created especially for organizations that are new in the market or are entering in the new markets through the use of ads loaded with emotions that would have desired effect on the brand image.

1. Indeed more research is needed to evaluate the effect of each type of emotion on the brand image. So that the ad agencies can decide the emotions to be embedded based on the requirements of changes needed in the brand images of advertised brands.

2. Research inputs are also needed to understand whether the effects of emotions on the brand image of products and services are same, or do they differ.

3. The review of literature, included in this research is strong and the same may be used for understanding the concepts used in this research further.

Review of literature has indicated that emotions embedded in the advertisements contribute in defining the image of service organizations. Studies regarding creation of different brand images through use of different emotional content in advertisements are supported by Chattopadhyay and Basu (1990) and Weinberger and Gulas (1992) where they found that a particular type of emotional appeal (humor) resulted in more favorable responses in the case of existing products, while this was not the case for new brands.

The differences between the effects of all the six emotions on brand images of the three banks were evaluated separately. It was found that different emotions embedded in the advertisements have different impact on the brand image of different banking companies. The results indicated that the advertisements with all the six dominant emotions created a change in the brand image of all the three bank brands, indicating that the emotional ads contribute in reshaping the brand image of public sector bank (Union bank of India) as well as private sector banks (AXIS bank and HDFC bank).

Brands may therefore be regarded as having duality appealing to both the head and the heart whereby 'strong brands blend product performance responses to the brand'. Whereas Park et al. (1986) first proposed that a brand concept can either be functional or symbolic, with brands positioned as either but not both, more recent researches show that a strong brand provides consumers with multiple access points to the brand while reducing competitive vulnerability (Keller 1998). Indeed, it can be assumed that consumers are more interested in rational, objective product information when they do not know the product. In the case of an existing and well known brand, a positive emotional message might be more effective in supporting the brand. A non-emotional media context could serve as a primer to make consumers more motivated to pay attention to information about a new brand, as a result of which an advertisement for this new brand could be processed more intensively. On the other hand, the results of current study and the review of literature for the same have indicated that the brand image of banks is very sensitive, showing that the consumers may be swayed by emotional advertisements. Therefore, they need to look at the rational content of the services offered to maintain correct balance.

Aaker. D. (1991), 'Managing Brand Equity: Capitalizing on the Value of Brand Name', the Free Press

Keller, K. L. (1993), 'Conceptualizing, measuring and managing customer-based brand equity,' Journal of Marketing, 57 (January), Pp. 1-22

Kotler, P. (1988), Marketing Management, Prentice-Hall

Park, C. Whan, Bernard J. Jaworski, and Deborah J. Maclnnis (1986), 'Strategic Brand Concept-Image Management,' Journal of Marketing, 50 (October), Pp. 135-45

Loewenstern, G. F., Hsee, E. U. Weber, and N. Welsh (2001), 'Risk as Feelings,' Psychological Bilhtin 127, 2 (2001): Pp. 267-86

Chang, C. T. (2003), 'The Influences of Message Framing, Perceived Product Innovativeness, and Consumer Health Consciousness on Advertising Effectiveness of Healthcare Products,' in European Advances in Consumer Research, D. Turlev and S. Brown, eds. Provo, UT: Association for Consumer Research, 2003

McCracken, Grant (1989), 'Who is the Celebrity Endorser? Cultural Foundations of the Endorsement Process,' Journal of Consumer Research, 16 (3), Pp. 310-321

Frijda (1988), 'The emotions,' The Cambridge press: Cambridge

Tomkins S. (1962), 'Affect, imaginary, consciousness: the positive effects,' Springer: New York

Moore D. and W. Harris (1994), 'Exploring the role of individual differences in affect intensity on the consumer's response to advertising appeals,' Advances in consumer research, 24, Pp. 181-187

Raman N., Chattopadhyay P. and W. Hoyer (1995), 'Do consumers seek emotional situations: the need for emotion scale,' Advances in consumer research 22, Pp. 537-542

Booth-Butterfield M. and S. Booth-Butterfield (1990), 'Conceptualization affect as information in communication production', Human communication research 16(4), Pp. 663-668

Sternthal, Brian and C. Samuel Craig (1973), 'Humor in Advertising,' Journal of Marketing, 37 (October), Pp. 12-18

Bhakar, S.S., Sikarwar, N.S. (2012), 'Impact of emotions in development of brand image with reference to insurance industry – an exploratory study', Gitam Journal of Management, 10(4), Pp. 54-77

Linda B. (2002), 'Can personality be used to predict how we use the internet,' Usability News (www.usabilitynews.com)

Barwise, T. R. & Ehrenberg, A.S.C. (1985), 'Consumer beliefs and brand usage', Journal of the Market Research Society, 27(2), Pp. 81-93

Chattopadhyay, A. & Basu, K. (1990), 'Humor in Advertising: The Moderating Role of Prior Brand Evaluation,' Journal of Marketing Research, 27, Pp. 466-476

Weinberger, M. G. & Gulas, C. S. (1992), 'The Impact of Humor in Advertising – A Review,' Journal of Advertising, 18(2), Pp. 35-59