|

Jayanta K Mohapatra Assistant Professor Administrative Staff College of India |

The Indian Government has identified infrastructure as one of the key sectors for economic development. 45% investment of infrastructure goes towards construction and it is the major employer also. The construction sector contributes around 10% to the Indian GDP. The industry is growing at a high rate with 40% funding coming from private sector. India is poised to be the third largest construction market by 2025.

The industry also has witnessed several business combinations small or big in the form of mergers and acquisitions and is about to increase further. This study provides an overview of the most recent M&A in construction industry and expectations for the future.

The data of the construction industry M&A has been collected from CMIE database. The event study methodology has been used to find the abnormal return to the bidder shareholders and their expectations from the deal.

It has been found that the M&A activity has increased the value to the shareholders of the bidder firm to an extent of 2.2% cumulative abnormal return over a period of 180 days around the merger.

This study helps to understand the rational of M&A in construction industry and guides the practice managers about M&A decisions. When M&A is mostly understood as value destroying for bidders, construction industry proves to be an exception.

Keywords: construction industry, M&A, value creation, shareholders.

Mergers and acquisitions have become form of business expansion strategy in India. Unlike the developed countries in the west, Indian companies have joined the race. The effect of liberalization was witnessed from 1995 onwards with reducing FDI limits and increasing number of M&A transactions both among Indian companies and cross border. M&A increased both in numbers and value. The construction industry was not an exception to this. With the growth of disposable income and urban population the demand for construction gradually started increasing. With infrastructure being identified as a key structure the majority thrust was again on construction. The boom in the construction industry led to the search of rapid growth and market expansion through the inorganic mode of expansion through M&A routes. When managers had an alternative rapid growth model, least attention was given to the benefits of the mergers in the construction industry both by the practitioners and the academicians.

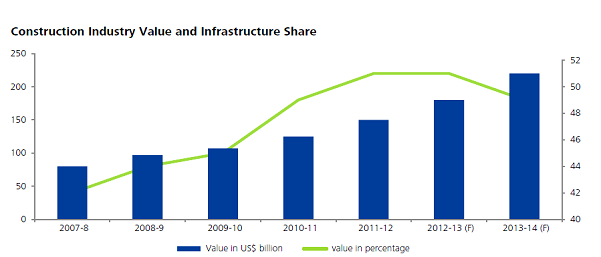

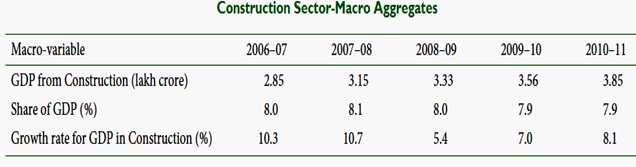

Construction industry is one of the biggest industries (refer exhibit-1) in India as the construction activity creates physical assets for a number of sectors and is one of the major contributors to our national GDP (refer exhibit-2). The two dominant segments are construction of building of residential, commercial, institutional and industrial properties and creating large infrastructure for roads, rails, airports, dams and urban and rural infrastructure for both hard infrastructure like water and sanitary to soft infrastructure like communication and hospitals. Most of the economic activities are highly dependent on the construction sector. It is roughly estimated that 40–45 per cent of steel; 85 per cent of paint; 65–70 per cent of glass and significant portions of the output from automotive, mining and excavation equipment industries are used in the construction industry [1] .

Exhibit – 1 Construction Industry Value

Source: Construction Industry Development Council Working Paper on 12th Five Year Plan

The industry has shown significant growth in the past years and is here to grow exponentially. Industry growth for the forecast period (2014–2018) is 15-18% under which the government expressed plans to invest INR56.3 trillion (US$1.0 trillion) in various long-term development plans. The industry output is expected to have a CAGR of 10.09% [2] .

Exhibit-2 Construction Industry’s Contribution to GDP

The orientation from cost effective construction has now moving towards time and quality constructions and regulatory frameworks has been made liberal to build the physical infrastructure of the nation.

With opening up of economy and a liberal policy towards investors in construction business the scope for foreign investment in the infrastructure and construction industry has immensely increased. There are already international players in Indian market. But the industry has its own risk. It’s categorised as a high risk business. So from the project owners to construction companies and banks and financial institutes have their own fear.

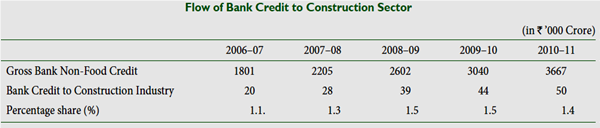

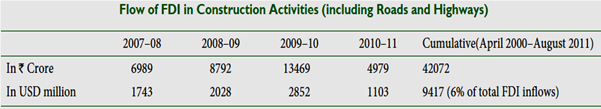

But still the growing Indian market has attracted bank credit (shown in exhibit -3) and FDI inflow (shown in exhibit - 4) to the country. This has triggered the other side of the business management to grow in size and capture market and other benefits of being a bigger business.

Exhibit-3 Bank Credit to Construction Sector

Source: Annual Reports, RBI

Exhibit- 4 FDI Inflow in Construction Industry

Source: DIPP, MoC&I

The construction industry unlike other industries also had several mergers. The number of mergers had gained pace from 1995 and appx. 122 M&As have been reported till 2012 (CMIE Prowess data base). Mergers and acquisitions have been an important phenomenon in US and UK economy from long. Now after liberalization in India the effect of mergers on the economy also has been noticeable.

The studies on mergers and acquisitions are numerous and spread in different dimensions of the field. Most of the studies have been conducted in the developed countries and especially in US and UK. The level of literature in India is limited as M&A is a comparatively new phenomenon in India as compared to the developed countries.

Most of the studies so far done in this field are to measure the performance of the merger or acquisition activity. Studies have been there to judge the performance of merger or acquisition on the basis of gain in market power like increase in monopoly power of the company in the industry, its ability to influence the price on its favour or increase or decrease of market share. But majority of studies have been done to access the financial performance of the company (joint entity) after merger. This is done basically by comparing the pre and post merger returns to the firm. The methods of measuring the returns are normally accounting method or event studies. Further the measure of returns are classified on the basis of several factors as size, structure of ownership, method of payments, size of deals and nature of mergers.

The literature on merger performance studies can be classified in two broad ways on the basis of the method of investigation. Some of the studies have calculated performance on the basis of accounting measures where as others has done it on the basis of an efficient capital market.

Choi and Russell (2004) studied the merger impact in the construction industry. They found total 171 merger cases for a period of 1980 to 2000. D ifferent window periods (–20, +20), (–10, +10), (–5, +5), and (–1, +1) were selected to measure the CAR . They had calculated CAR through market adjusted return. It is concluded that the shareholders of construction firms did not realize significant economic gains around the M&A transactions. The relative size of the transaction tended to have a significant impact on market returns. The industry effect was assessed through comparison of CARs between the building and the non building industries. From the statistical perspective, there is a significant performance difference in some window periods between the two industry groups. Ismail, Davidson and Frank (2009) had studied the pre-tax operating cash flow returns on the market value of assets as a measure of operating performance of the publicly listed bank mergers that were completed between 1992 and 1997. With a sample size of 35 banks they find that industry-adjusted mean cash flow return did not significantly change after merger but stayed positive. Marina Martynova et al. (2006) using four different measures of operating performance based on Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) and found that both acquiring and target companies significantly outperformed the median peers in their industry prior to the takeover, but the raw profitability of the combined firm decreased significantly following the takeover.

Merger performance studies using event study is more often used. Normally the market begins to anticipate mergers at least three months on average before mergers were announced (Frank, Broyles, Hecht; 1977). Antoniou, Arbour and Zhao (2008) examine the effects of the cross-correlation of stock returns on the long-run post-merger stock performance of 332 UK acquiring firms over the period 1985-2001. They test the method of payment, diversification, book-to-market, and size effects in mergers. After controlling for the cross-correlation of stock returns in long-run, post-merger event studies acquiring firms generally experience significant negative abnormal returns in three years following mergers. The study reveals that UK acquirers experience large wealth losses following mergers; the one to three years BHARs are –7%, –23%, and –11% respectively. It is also found that long-run effects simply disappear after accounting for the cross-sectional dependence of sample returns. Stock-financed mergers underperform cash-financed ones. Acquirers, whether making diversifying or focused deals, experience significant wealth losses in the long-run. Small acquirers tend to underperform Large acquirers in the long-run. Similar conclusion s has been witnessed by Firth (1979), Franks and Harris (1989), Limmack (1991), Kennedy and Limmack (1996), and Gregory (1997).

A brief summary of the Indian literature is also tabulated here and can be summarised as follows.

1. Many studies are focused on banking sector mergers only and other sectors are neglected. A general industry view is missing.

2. A higher amount of studies are carried out on the basis of accounting measures. Event studies however take the second place in India.

3. So far literature on mergers is unable to provide clear conclusion on the performance of M&A.

Table -1

Brief summary of Indian M&A Literature Reviewed (Chronological Order)

| Author | Year | Measure | Period | Sample | Industry | Performance/result |

| Shobna & Deepa | 2012 | MM, MAR, BHAR | 1991-2005 | 6 | Banks | Negative or negligible effect on shareholder wealth |

| Banga & Gupta | 2012 | Survey & Multivariate analysis | 2000-07 | 65 | Mutual Fund | Expansion of marketing & management capabilities, expansion of asset size and benefits of diversification are dominant motives |

| Shukla & Gekara | 2010 | Both | NA | 1 | Steel | Operating performance increased but there is decline in CAR over short run |

| Ramakrishnan | 2008 | Accounting | 1993-2005 | 87 | All | Positive return to shareholders of acquiring firms |

| Anand & Singh | 2008 | Market Model and two factor model | 1999-2005 | 5 | Banks | Positive return in the short run at various window periods |

| Singh & Mogla | 2008 | Accounting | 1994-2002 | 56 | All | Profitability declined after merger but there might be chances of improvement in long run. |

| Kumar & Rajib | 2007 | Accounting | 1995-2002 | 57 | All | Different models have given different result |

| Mantravadi & Reddy | 2007 | Accounting | 1991-2003 | 96 | All | Deteriorations in performance |

| Shrinivasan & Mishra | 2007 | Content analysis | 2002-04 | 30 | All | Market entry as a dominant motive |

| Mishra & Goel | 2005 | Both | NA | 1 | RIL | Positive returns to target but negligible returns to acquirer |

| Swaminathan S | 2002 | Accounting | 1992- 2000 | 5 | All | No formal conclusion regarding value creation |

Data

The data for the research consists of all successful mergers and acquisitions from April 1995 to March 2012. The merger data has been collected from Prowess data base of the Centre for Monitoring Indian Economy (CMIE) which is one of the most reliable data base in India. We have cross checked the data with India Info line data base and other sources like Bombay stock Exchange (BSE) historical data and announcements, Security Exchange Board of India (SEBI) announcements of delisting and money control news. The following process has been used to construct the data set.

1. All cross border mergers where bidder is not listed in BSE are eliminated from the data set as getting the daily stock price was difficult. Without stock price the calculation of abnormal return to the bidder firm shareholders is not possible in the event study methodology.

2. All bidder companies for which confusion regarding announcement date is there, have been eliminated from data base as choosing the right event date is difficult and hence dilutes the measurement of abnormal return. If the deal was predicted or private information existed before the announcement was done, then these deals have been removed.

3. If the acquisition or merger was not having proper market announcement (like news paper, website) then it has been eliminated as they don’t create market wide impact.

4. Small deals (less than 300 Cr) have been eliminated as they will not have measurable impact on the share price fluctuations. The value has been taken arbitrarily. Most of the researchers have taken value around this. The larger the value the larger is the impact in the market.

5. Mergers or acquisitions across the same group has been eliminated as already they have significant cross holdings earlier and there ware early anticipations regarding transactions.

6. To find merger or acquisition with a clean period of three years, all mergers or acquisitions having any other merger or acquisition or any major event which might have significant impact on the share price of the company has been removed.

7. If the stock price for the estimation period is not available properly for the bidder company then it is eliminated from the list as the entire calculation is based on the daily closing stock return.

8. All failed deals have been removed. Only announcements which were materialized have been taken. There is no specific reason for the same but it was difficult to find the news about the revocation of the deal.

Event study methodology has been used. Special care has been taken for the following steps

1. Defining the date on which market would have received the news

2. Return of individual companies in the absence of news

3. Measure the difference between observed returns and no news returns for each firm to find the abnormal return

4. Aggregate the normal returns across firms and across time

5. Statistically test the aggregated return to determine whether the abnormal returns are significant or not.

The first media announcement date of acquisition or merger has been taken. This is derived from the CMIE prowess website and other sites like BSE and money control and cross checked with several sources.

The market model adjusted return or single index market model has been used as follows. The parameters of the market model (α and β) are estimated using ordinary least square (OLS) regression over the estimation period (-365 days to -90 days). This model is used to control the stock return and market returns or allows the variation in the risk associated with a selected stock.

Daily closing stock price for the acquirer company has been collected from the BSE website for the estimation period.

Daily BSE Sensex 500 closing price has been collected for the matching dates for the same estimation period for each company. BSE 500 has been chosen as the benchmark index as it has a wide array of companies in its portfolio and perfectly represents the market. In cases where the BSE 500 data is unavailable the BSE 200 is taken as the index.

Market (Sensex 500) return has been taken as the independent variable (X).

Company stock return has been taken as dependent variable (Y)

Market return for each day is calculated using the following formula

Rmt = (Pmt - Pmt-1) / Pmt-1 ×100

Where

Rmt = Market return for day t

Pmt = closing price of sensen 500 for day t

Pmt-1 = closing price of sensex 500 for the previous day.

Daily stock return (Rit) is also calculated in the similar way.

Rit = (Pit – Pit-1) / Pit-1 ×100

Where

Rit = Stock return for day t

Pit = closing price of a particular stock for day t

Pit-1 = closing price of a particular stock for the previous day.

OLS regression has been run on excel file to find the variables α and β.

Expected return for a particular stock (I) is calculated using the variables (α and β) of OLS regression for the test period.

Rit = αi + βi Rmt + εit

Where

Rmt = the rate of return of the market index (BSE SENSEX 500) on event day t

αi = the regression co-efficient (intercept) for stock “i”

βi = the regression co-efficient (slope) for stock “i”.

For each stock “i” the market model is used to calculate an abnormal return (AR) for event day “t” as the following equation

ARit = Rita – Rit

Where

Rita = actual return from security “i” on time “t”

Rit = the estimated normal rate of return on security “i” for the event day “t”

Ø Aggregating the return

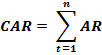

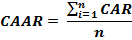

All the daily abnormal return for any company is aggregated mathematically over the window period to find the cumulative abnormal return (CAR) for any company as shown.

The cumulative average abnormal return (CAAR) for the entire sample of companies is done through averaging the individual CARs for the window period as follows.

The CAR for most of the acquisitions in the industry is found to be positive. As shown in table -2, 5 M&As out of 17 in the sample have reported negative cumulative CAR and others in positive over a 180 days’ time horizon around the merger. The Cumulative Average Abnormal Return (CAAR) is found to be positive at 2.27% which signifies that the shareholders of the acquiring companies have been benefited by 2.27% as a result of the merger or acquisition.

Table – 2

M&A Performance in 180 days Window Period

| Company | Date | Target | CAR |

| Asian Paints Ltd | 30-Mar-09 | Technical Instruments Mfrs. (India) Ltd. [Merged] | 13.6 |

| Binani Cement Ltd. | 04-Mar-08 | Mukundan Holdings Ltd. | 11.4 |

| Hindustan Construction Co | 15-Mar-10 | Karl Steiner Ag | -43.5 |

| Hubtown Ltd | 30-Jun-07 | Akruti Security Plates Pvt. Ltd. | 6 |

| IVRC ltd | 13-Nov-07 | Alkor Petroo Ltd. | 3.45 |

| IVRC ltd | 28-Apr-05 | Hindustan Dorr-Oliver Ltd. | 21.2 |

| Larsen & Toubro Ltd. | 02-Feb-02 | Tractor Engineers Ltd. | 12 |

| Larsen & Toubro Ltd. | 09-Jan-99 | Narmada Cement Co. Ltd. [Merged] | 24.36 |

| Noida Toll Bridge Co. Ltd. | 14-Sep-06 | D N D Flyway Ltd. | -30.8 |

| P V P Ventures Ltd. | 10-Feb-03 | Aptech Ltd. | 14.8 |

| Peninsula Land Ltd. | 28-Oct-10 | Topstar Mercantile Pvt. Ltd. [Merged] | -3.7 |

| Shristi Infrastructure Devp. Corpn. Ltd. | 31-Mar-09 | Finetune Engineering Services Pvt. Ltd. | -64.3 |

| Somany Ceramics Ltd. | 13-Oct-11 | Vintage Tiles Pvt. Ltd. | 52 |

| Unitech Ltd. | 23-Nov-05 | Home Solutions Retail (India) Ltd. | 20.3 |

| Unitech Ltd. | 20-Apr-10 | Aditya Properties Pvt. Ltd. | -24.5 |

| Zandu Realty Ltd. | 03-Nov-06 | Z C L Chemicals Ltd. | 12.1 |

| Zandu Realty Ltd. | 18-Aug-11 | Emami Realty Ltd. | 14.2 |

| CAAR | 2.27 |

Mergers and acquisitions represent a diversification act. The success of merger is dependent on several factors starting from environment condition to farm specific factors. The growth rate of the market plays an important role. Similarly the value creation through a merger is dependent on the synergy achievable. This depends on the logical relationship that exists between the target, acquirer, nature of business, type of arrangements made to achieve better performance. The amount of strategic fit is dependent on several environmental conditions also.

All care has been taken from selection and filtration of data to the analysis and conclusion. But at the same time data was not available for non listed companies and the event study methodology does not support the calculation of performance for the non listed companies. Bidders who are not listed in the share market have been excluded. But at the same time there are very few non listed acquirers in India. There are few bidders who are frequent acquirers for whom finding the performance of individual acquisitions is very difficult as isolitationg the individual event is not possible.

Mergers and acquisitions are very huge transactions and long term strategic affair. This present study takes the medium range stock market reaction to the M&A announcements. Whether synergy gains have actually happened or not can only be possible through the study of the operational parameters. Each industry has different operational parameters and has different ways to judge their performance.

Anand, M., Singh, J. (2008); Impact Of Merger Announcements On Shareholders. Wealth: Evidence From Indian Private Sector Banks; Vikalpa • Volume 33 • No 1 • January – March.

Antoniou, A. and Arbour, P. and Zhao, H. (2008). 'How much is too much: are merger premiums too high?', European financial management., 14 (2). pp. 268-287.

B. Rajesh B K And Rajib, P. (2007); Mergers And Corporate Performance In India: An Empirical Study; Decision , Vol. 34, No.1, January – June.

Banga C and Gupta A; (2012); Motives For Mergers And Takeovers In The Indian Mutual Fund Industry; Vikalpa • Volume 37 • No 2 • April – June

Choi, J. And Russell, Jeffrey, S.; (2004). Economic Gains Around Mergers And Acquisitions In The Construction Industry of the United States Of America; Canadian Journal of Civil Engineering. Vol. 31.

Firth M.,(1980). “Takeovers, Shareholder Returns, and the Theory of the Firm,” Quarterly Journal of Economics, 94: Pp. 235-260.

Frank, Broyles, Hecht; (1977). An Industry Study Of The Profitability Of Mergers In The United Kingdom; The Journal of Finance, Volume 32, Issue 5 pages 1513–1525; Article first published online: 30 APR 2012 | DOI: 10.1111/j.1540-6261.1977.tb03351.

Franks, J.R. and R.S. Harris, (1989). “Shareholder Wealth Effects Of Corporate Takeovers: The U.K. Experience 1955-1985”, Journal Of Financial Economics, 23,2,Pp.225-249, 1989.

Gregory, A., (1997). “An Examination of The Long Run Performance of UK Acquiring Firms,” Journal Of Business And Accounting, 24 (7-8), 1997, 971-1002.

Ismail, A, I. Davidson, and R. Frank. (2009). Operating Performance after European Bank Mergers. Service Industries Journal, Volume 29, issue 3, pages 345 – 366.

Limmack, R.J. (1991), “Corporate Mergers And Shareholder Wealth Effects: 1977-1986,” Accounting And Business Research, 21: 239-251.

Limmack, R.J. and N. Mc Gregor. (1995). Industrial relatedness, structural factors and bidder returns Applied Financial Economics, 5. Pp. 179-190.

Mantravadi, P, And Reddy, V. A.;(2007); Mergers And Operating Performance: Indian Experience; The ICFAI Journal Of Mergers & Acquisitions, Vol. Iv, No. 4.

Martynova M., Renneboog L. (2006); A century of corporate takeovers: What have we learned and where do we stand? Journal of Banking & Finance; Volume 32, Issue 10, October 2008, Pages 2148–21.

Meeks, G. (1977)., Disappointing marriage: a study of the gains from merger. Cambridge: Cambridge University Press.

Mishra, A.K., Goel, Rashmi. (2005). Returns To Shareholders From Mergers: The Case Of Ril And Rpl Merger; Iimb Management Review, September 2005; Pp69-79.

Pawaskar, Vardhana. (2001). “Effect Of Mergers On Corporate Performance In India”, Vikalpa ; Vol. 26, No. 1, January-March 2001; Pp19 – 32.

Ramakrishnan K.; (2008); Long-Term Post-Merger Performance of Firms In India; Vikalpa • Volume 33 • No 2 • April – June.

Shobhana,V.K., Deepa, N. (2012). Impact Of Mergers And Acquisitions On The Shareholder Wealth Of The Select Acquirer Banks In India: An Event Study Approach; The IUP Journal Of Bank Management , Vol. XI, No. 2, 2012; Pp 26-31.

Shrinivasan, R. & Mishra, P. B.; (2007). Why Do Firms Merge/Acquire: An Analysis Of Strategic Intent In Recent M&A Activity Among Indian Firms; IIMB Management Review, December.

Shukla A And Gekara G. M; (2010); Effects Of Multinational Mergers And Acquisitions On Shareholders’ Wealth And Corporate Performance; The Iup Journal Of Accounting Research & Audit Practices, Vol. Ix, Nos. 1 & 2.

Singh F And Mogla M; (2008) Impact Of Mergers On Profitability Of Acquiring Companies; The Icfai University Journal Of Mergers &Acquisitions, Vol. V, No. 2.

Web References

[1] 12th Plan Vol 2 Construction Sector

[2] Construction in India – Key Trends and Opportunities to 2018 browsed at http://www.rnrmarketresearch.com/the-insurance-industry-in-palestine-key-trends-and-opportunities-to-2018-market-report.html