|

Dr. Biswajit Prasad Chhatoi Faculty Department of Business Administration Ranenshaw Business School Ranenshaw University |

Purpose: The purpose of this paper is to measure/assess relationship between profitability and dividend payment in select Indian iron & steel industry.

Design/Methodology/Approach: The researchers collect, compile and analyze publically available data like; EPS, DPS, and Payout Ratio of selected companies from the annual reports over the period 2004 to 2012. Descriptive as well as inferential statistical tools are used to arrive at any conclusion. The hypotheses are tested with 95% of significance level.

Findings: The results suggest that the dividend decision is greatly influenced by profitability of the firm.

Research Limitations: The study depends more on empirical procedures rather than a theoretical justification in the anomalies on dividend policy. The research is totally based on publically available information and limited with regard to the time span and sample size.

Practical Implications: Dividend decision is directly associated to the financing and investment decision, it becomes crucial for a firm to decide optimum dividend decision to the shareholders. This also makes a judicious balance between the retention and shareholders’ satisfaction.

Originality: The present study concentrates on matters like; do the companies belonging to the same industry declare similar percentage of dividend? Is the growth rate fluctuate, when dividend is declared? Do the dividends declared by the companies differ significantly from one company to other?

Keywords: Dividend, Earning per Share (EPS), Dividend per Share (DPS) and Dividend Payout Ratio

Classification: Financial economics (JEL: G)

Dividends are referred as reward to the shareholders for providing finance to a firm. So far as ‘dividend payout’ is concerned, there are two schools of thought. The first school gives importance on payment of dividend as because without any dividend payout, shares would not have any value, whereas the other school of thought stressed on no relationship between dividend and market price of the share -‘the irrelevance theory’. Lintner (1956) concluded ‘in developed countries firms target their dividend payout ratio considering current earnings and past dividends’. Miller and Modigliani (1961) suggested ‘ irrelevance of dividend policy in measuring the current worth of shares assuming market perfections, zero transaction costs, perfect certainty and indifferent behaviour of investors’. Payout policy in finance has been the primary puzzle in the economics of corporate finance since the work of Black (1976). However, Miller and Scholes (1982) argue that in the real world, dividend decision is inspired more by high taxes on dividends than capital gains and market imperfections.

In corporate finance, the dividend decision is studied to identify the relation between firm’s financing and investment decisions. The association between these two decisions has posed various questions like; “How much should a firm pay as dividend? How does a dividend payout policy influence the valuation of a firm? Does a firm’s decision to distribute cash correspond to its financing and investing decisions? What is the outcome of changes in the dividend policy assuming steady financing and investment decisions of a firm?” Researchers have attempted to address these questions analyzing dividend practices of some of the steel giants in India. Dividend policy and decisions are still believed to be in ambiguity.

Literature review is not just a theoretical collection of concepts rather it is the work of some people carried out in the same area based on the real time scenario and thus would give the researcher and anyone reading the report a more practical preview about the subject. Different studies those are directly as well as indirectly related to the researcher area have been reviewed. Few of these are as:

Darling (1957) has conducted a study on influence of expectation and liquidity on dividend and concluded that the expectation of the investor has an influence on dividend policy as well as the influence of liquidity also played a vital role in dividend policy.

Babiak et. al., (1968) in their study on ‘Dividend policy: an empirical analysis’ used different models to predict the future dividend for which the study was tested with selected American companies with the help of application of different variables like cash flow, net profit, etc., and it was found that, these variables were able to explain the dividend.

Mohanty (1999) concluded in his study on ‘Dividend and bonus policy of Indian companies’ that firms took decision on dividend depending on the availability of profit and he found that firms adopt constant dividend per share and have fluctuating payout ratio during his study period.

Reddy (2002) analyzes the trends and determinants of dividend of Indian companies listed on BSE and NSE during 1990-2001 conducting a study on factors like; number of firms paying dividend, average dividend per share and the average payout . He concluded, “only few companies maintain the dividend payout rate and that firms forming a part of small indices pay higher dividend compared to firms forming a part of broad market indices”. Further, deviations in the tax regime examined using the trade-off theory and it is observed that this theory does not apply to the Indian corporate sector. He concludes that the omission of dividends have information content i.e. such companies expect lower earnings in the future whereas the same does not hold true in case of dividend initiations.

Gugler (2003) analyzed the relationship between dividends, the ownership and control structure of the firm for a panel of Austrian firms over the periods 1991-1999, and found that state-controlled firms engage in dividend smoothing, while family-controlled firms do not. Anand (2004) analyzes the results of Anand (2002) analyzing the factors considered by 81 CFOs in formulate divided policy to find out the determinants of dividend policy of Indian companies. He finds that Indian companies use dividend policy as a signaling mechanism to convey information about their present and future prospects, therefore, affecting their market value. He also reports that while designing a dividend policy, companies take into consideration the investors’ preference for dividends and the clientele effect.

Hu and Liu (2005) analyzed the cash dividend payment in their article ‘Empirical analysis of cash dividend payment in Chinese listed companies’ and observed direct relationship existed between current earnings and dividend payout, but at the same time debt to total asset ratio is inversely proportional to the DPR.

Das (2006) has made an attempt to study about ‘Dividend Practices in selected Company: An empirical analysis’. In his study, he found that the company had a policy of pursuing conservative policy from 1989 to 2005. Further, he tried to find out whether any close association exists among the variables like DPS, EPS and capital employed by the way of using correlation technique and vindicated that coefficient of correlation between DPS, EPS and Capital employed was high.

Kent and Dutta (2007) in their study on "The Perception of Dividend, by an Indian Managers: New Evidence" disclosed that the dividend paying firms are significantly larger have other characteristics like; earn more profit, have greater cash flows, and have growth opportunities. Bhayani (2008) has examined the influence of earnings and lagged dividend on dividend policy of companies listed on the BSE. He found that the current year’s earnings is the foremost factor affecting the dividend behaviour of a firm and concludes that Indian companies follow a stable cash dividend policy.

Azfa & Mirza (2010) present a study, which is investigated “Ownership Structure and Cash Flows as Determinants of Corporate Dividend Policy in Pakistan” on 100 companies listed at Karachi Stock Exchange over the period 2005-2007, by using Ordinary Least Square (OLS). They concluded, “managerial and individual ownership, cash flow sensitivity, size and leverage are negative effect and operating cash-flow and profitability are positively related to cash dividend”.

Mirzaei (2012) in their research paper focus on ownership structure and dividend policy on the companies listed on Tehran Stock Exchange over a period 2004-2009. The researcher takes company dividend policy as a dependant variable and stockholders composition and ownership concentration as independent variables. The findings disclosed that ‘the independent variable had not shows their positivity’.

Al- Gharaibeh et. al., (2013) conducted a study on “The Effect of Ownership Structure on Dividends Policy in Jordanian Companies”. They selected 35 Jordanian corporations listed on the Amman Stock Exchange over the period 2005-2010, using full adjustment and partial adjustment model. The finding of their study is that “the institutional ownership of a company is more it make the shareholder more in power and it increase the value of the firm because the shareholder use their influence and did not allow a company to invest in low return projects. Moreover, managerial ownership has a negative coefficient in the Partial Adjustment”.

Al-Nawaiseh et. al., (2013) studied “Dividend Policy and Ownership Structure: An Applied Study on Industrial Companies in Amman Stock Exchange” on sixty two industrial firms listed in ASE from (2000-2006), by using Tobit Model or censored regression model. The independent variable of the study is Leverage Ratio, Profitability, Firm Size, Family, Multi, Institution, Insider, and Foreigner. The fraction held by insiders (INSD), has negative impact on the level of dividends paid. The other ownership, family is negatively but not significantly but institution is positively and significant influence on the dividend policy. The multiple ownership is negative and insignificant; the finally variable for ownership is foreigner positive and insignificant. More than half of the firm observation is zero dividend.

The above literature- reviews pointed out that there is no consensus on a general dividend theory regarding dividend decision making (or) to ensure optimum dividend policy. Therefore, it is necessary to study dividend behavior of companies using the framework of empirical model.

Dividend decision have a significant role in helping the company to take an important decision in which a firm can decide how much it should declare and how much it has to retain from EPS. Dividend decision is directly associated to the financing and investment decision, it becomes imperative of a firm to decide optimum dividend decision to the shareholders. In this context, it is right time to answer the questions; do the companies belonging to the same industry declare similar percentage of dividend? Is the growth rate fluctuate, when dividend is declared? Do the dividends declared by the companies differ significantly from one company to other? In order to find solution, the present study has been carried out.

Objectives

To examine the EPS, DPS and Dividend Pay-Out Ratio (DPR) of selected companies

To examine the relationship between profitability and Return for selected companies

Methodology

The current study is analytical in nature. The authors have used information already available i.e., secondary in nature. Critical evaluations of the publically available data (basically panel type i.e., a sweet blend of cross sectional and time series data) were made to draw any conclusion on research area. The data covered the annual EPS, DPS, and Payout Ratio of selected companies.

During data collection, it was found that some of the sample company has split-up their shares. In case of split –up, the researchers did not consider the split-up value. Rather, they made all computation on the basis of face value as per 2004 financial report. Out of five sample companies, BHUSAN has split the stock in 1:5 in the year 2011, Jindal saw in the year 1:5 in 2010 and Jindal SP in the year 1:5 in 2008. The EPS and DPS data for above mention companies were manipulated from the year of split-up by multiplying the EPS and DPS figures with their split-up ratio to avoid unnecessary extremeness in data.

Sampling

For the purpose of the study, Iron & Steel Industry in India were considered as its universe. The companies those satisfied certain accepted criteria have been identified and taken as sample frame. Purposively two criteria were considered for sieving out the companies.

· The company should be a listed company in any one of the stock exchanges.

· Chronological availability of the data for the period of nine years i.e., 2004 to 2012.

Based on the above conditions five companies from Iron & Steel Industry were selected. Each selected company was treated as a sample unit of research.

Sample Size

The companies selected from Iron & Steel Industry were JINDAL SAW, BHUSAN, JSW, TATA, and JINDAL SP.

Period of the Study

Period of the study for the above research work was covered nine financial years. The cross sectional indicators like; EPS, DPS, and Dividend Payout Ratio of selected companies were collected over a period from 2004 to 2012 that constitute the panel data matrix for the study.

Data

The data for the study collected from secondary sources. The sources for the study were Annual reports and web site of selected companies, web site of BSE and NSE, and money control.com. The data consists of EPS, DPS, and Dividend Payout Ratio for each financial year over 2004 to 2012.

Techniques Used

Descriptive as well as inferential statistical tools were used to arrive at any conclusion. The hypotheses for the study were tested with 95% of significance level.

Hypotheses

In order to conduct the study and examine the objectives, the researchers formed following hypotheses for testing.

H01: Average EPS earned among selected sample are uniform

H02: Average DPS paid among selected sample are uniform

H03: Average DPR among selected sample is uniform

H04: EPS and DPS vary together.

The study depends more on empirical procedures rather than theoretical proof on dividend policy. The researcher has drawn conclusion by way of analyzing the secondary data and not used any theoretical modeling. The period of study was restricted to the financial years covering 2004 -2012. The sample size for the study was only five companies therefore any generalization of the findings of the study may be subjected to certain cautions. Several other qualitative factors, which might have influenced dividend policy were not taken into consideration in this study.

Analysis

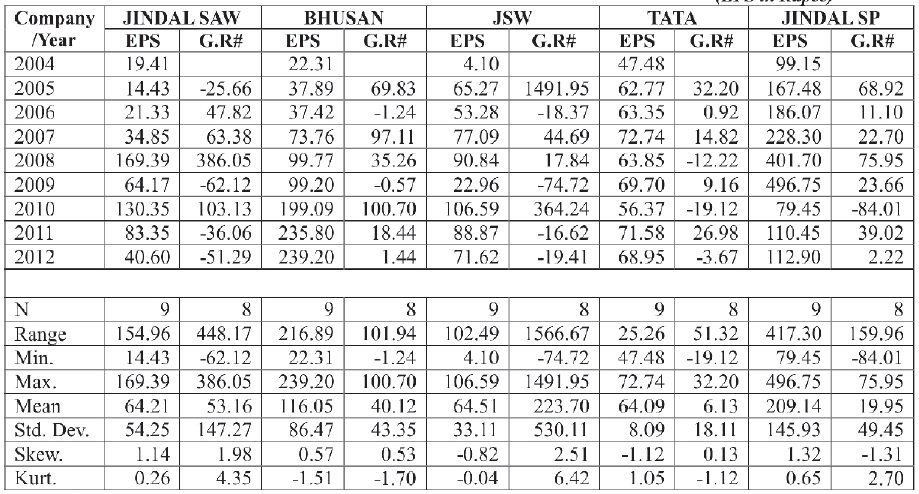

Table-1: EPS and Year over Year Growth in EPS of Selected Iron & Steel Companies

(EPS in Rupee)

Source: Compiled and computed from Annual Reports

[BHUSAN has Split the Stock (1:5) in 2011, Jindal Saw (1:5) in 2010 and Jindal SP (1:5) in 2008]

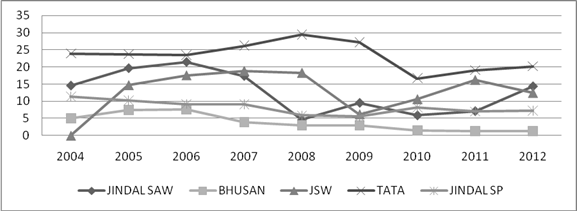

Figure-1: EPS Trend of Selected Iron & Steel Companies

.png)

Sources: Plotted from the data in the Table -4

Table-1 and Figure -1 discloses EPS of five selected Iron & Steel companies. Out of which, JSW has recorded minimum EPS in 2004 whereas Jindal SP has highest EPS in 2009. The average EPS earned by Jindal SP as well as the deviation of EPS was highest among all the companies. Further, in year over year growth of EPS, highest growth, highest average growth and maximum deviation in growth rate was recorded for JSW whereas the minimum average growth and deviation in growth rate was recorded for TATA Steel. EPS of JSW and TATA Steel was slightly negatively skewed with a variation towards lower value of EPS. Referring to kurtosis values of EPS it gave a less convex shape curve where in all cases ẞ2 <3.

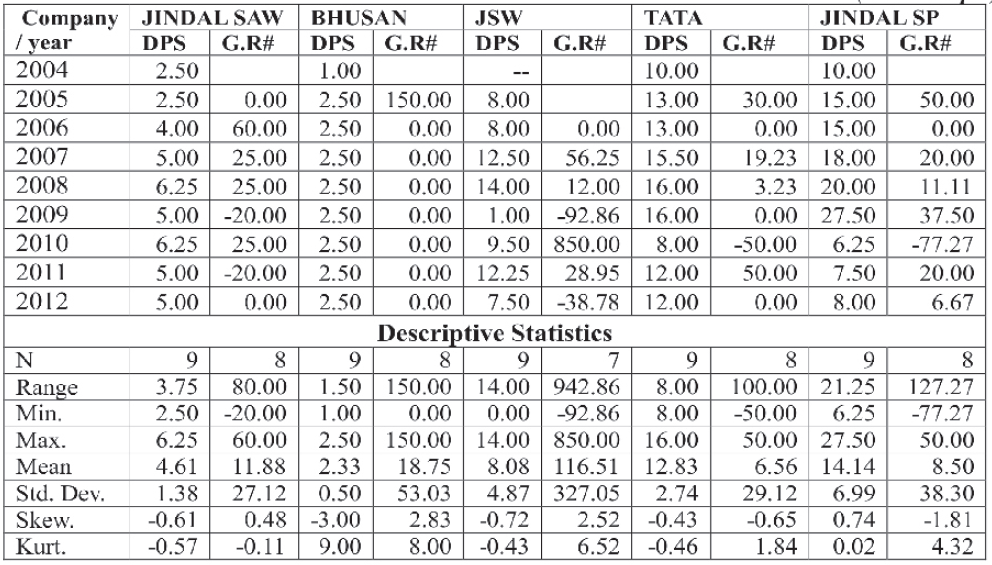

Table-2: DPS and Year over Year Growth in DPS of Selected Iron & Steel Companies

(DPS in Rupee)

Source: Compiled and computed from Annual Reports

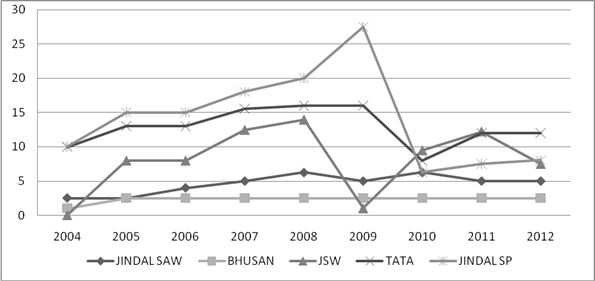

Figure-2: DPS Trend of Selected Iron & Steel Companies

Sources: Plotted from the data in the Table -5

Table- 2 and corresponding figure discloses the DPS of five selected Iron & Steel companies. Out of which, Bhusan has paid minimum DPS whereas Jindal SP has paid highest dividend. The average DPS of Jindal SP and Bhusan was recorded highest and lowest respectively among five companies. Similarly, in year over year growth of DPS, highest year over year growth, highest average growth, and maximum deviation was recorded for JSW.

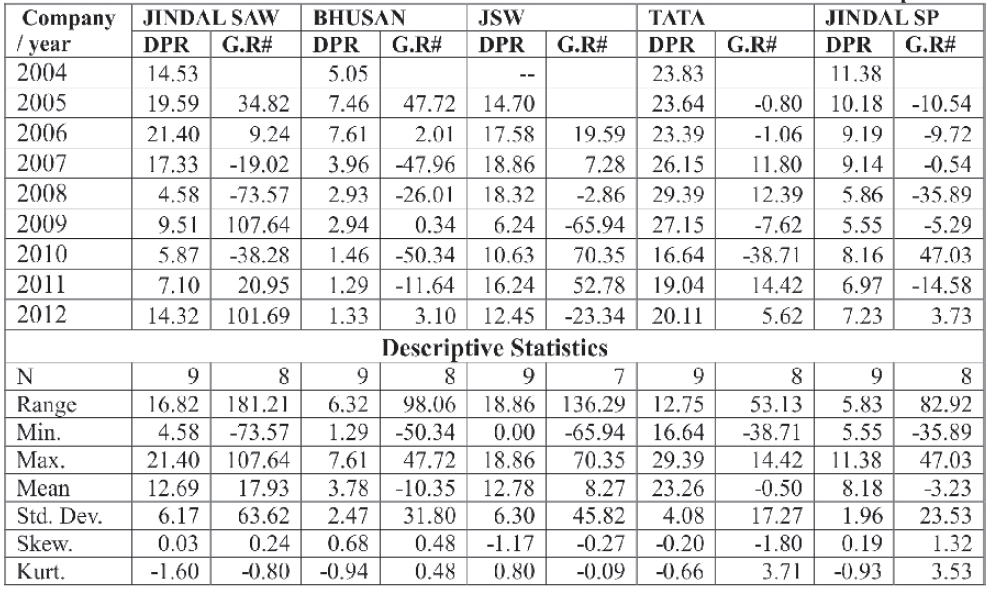

Table-3: DPR and Year over Year Growth in DPR of Selected Iron & Steel Companies

Source: Compiled and computed from Annual Reports

Figure-3: DPR Trend of Selected Iron & Steel Companies

Sources: Plotted from the data in the Table -6

As would be observed from above Table and Figure that the Dividend Payout Ratio (DPR) of JSW was minimum among five companies whereas minimum average DPR belongs to Bhusan Steel. DPR of Tata Steel has the highest payout ratio as well as highest average DPR. In year over year growth of DPR, highest average growth as well as highest year over year growth was recorded for Jindal SAW.

H01: Average EPS earned among selected sample are uniform

From the Table-1 & 4, it was observed that the EPS earned by Iron & Steel as well as growth in EPS were fluctuating over the period of study. At this juncture, the researchers have applied ANNOVA to justify whether the difference among the mean EPS was uniform or not.

Table-4: ANNOVA Summary; EPS and Growth in EPS for Iron & Steel Companies

| EPS Value of Iron & Steel Companies | |||||||

| Details | Sum of Squares | df | Mean Square | F | Sig. | ||

| Between Groups | 143406.673 | 4 | 35851.668 | 5.453 | .001 | ||

| Within Groups | 263010.208 | 40 | 6575.255 | ||||

| Total | 406416.881 | 44 | |||||

| Growth in EPS Value of Iron & Steel Companies | |||||||

| Between Groups | 250999.195 | 4 | 62749.799 | 1.021 | .410 | ||

| Within Groups | 2151531.361 | 35 | 61472.325 | ||||

| Total | 2402530.557 | 39 | |||||

Source: Computed Data

Table-7 contains ANNOVA summary of EPS and Growth in EPS for Iron & Steel Companies. The results of EPS for Iron & Steel Companies in summary table leads to rejection of null hypothesis whereas results of Growth in EPS result leads to acceptance of null hypothesis. So the null hypothesis (Average EPS earned among selected sample are uniform) were to be rejected with 95% confidence.

H02: Average DPS paid among selected sample are uniform

Table-5: ANNOVA Summary; DPS and Growth in DPS for Iron & Steel Companies

| DPS Value of Iron & Steel Companies | ||||||

| Details | Sum of Squares | df | Mean Square | F | Sig. | |

| Between Groups |

934.647 |

4 |

233.662 |

14.217 |

.000 |

|

| Within Groups |

657.403 |

40 |

16.435 |

|||

| Total |

1592.050 |

44 |

||||

| Growth in DPS Value of Iron & Steel Companies | ||||||

| Between Groups |

54763.226 |

4 |

13690.806 |

.685 |

.607 |

|

| Within Groups |

699864.861 |

35 |

19996.139 |

|||

| Total |

754628.087 |

39 |

||||

Source: Computed Data

The ANNOVA test result in the Table-5 disclosed that the ‘F’ value were significant at 95% of confidence level being the observed significant value was less than 0.01 for DPS of Iron & Steel Companies. But, in case of Growth in DPS, for Iron & Steel Companies the ‘F’ value is not significant. So the null hypothesis (Average DPS paid among selected sample are uniform) were to be rejected with 95% confidence.

H03: Average DPR among selected sample is uniform

Table-6: ANNOVA Summary; DPR for Iron & Steel Companies

| Details | Sum of Squares | df | Mean Square | F | Sig. |

| Between Groups |

934.647 |

4 |

233.662 |

14.217 |

.000 |

| Within Groups |

657.403 |

40 |

16.435 |

||

| Total |

1592.050 |

44 |

Source: Computed Data

The ANNOVA test result in the Table-6 disclosed that the ‘F’ value were significant at 95% of confidence level being the observed significant value was less than 0.01 for DPR of Iron & Steel Companies. So the null hypothesis (Average DPS paid among selected Iron & Steel companies are uniform) were to be rejected with 95% confidence.

H04: EPS and DPS vary together.

Table - 7: Correlation Result of EPS and DPS for Iron & Steel Companies

| Details | JINDAL SAW | BHUSAN | JSW | TATA | JINDAL SP | ||||||

| EPS | DPS | EPS | DPS | EPS | DPS | EPS | DPS | EPS | DPS | ||

| EPS | Correlation# | 1 | .823** | 1 | .407 | 1 | .818* | 1 | .642 | 1 | .946** |

| Sig. (2-tailed) | .006 | .278 | .013 | .062 | .000 | ||||||

| N | 9 | 9 | 9 | 9 | 8 | 8 | 9 | 9 | 9 | 9 | |

| DPS | Correlation# | .823** | 1 | .407 | 1 | .818* | 1 | .642 | 1 | .946** | 1 |

| Sig. (2-tailed) | .006 | .278 | .013 | .062 | .000 | ||||||

| N | 9 | 9 | 9 | 9 | 8 | 9 | 9 | 9 | 9 | 9 | |

| *. Correlation is significant at the 0.05 level (2-tailed).**. Correlation is significant at the 0.01 level (2-tailed). | |||||||||||

Source: Computed Data # Pearson Correlation Coefficient

Table-7 shows that there have been positive correlation between EPS and DPS for all the sample companies selected. This basically means that there was a strong association between EPS and DPS as indicated by positive correlation. While testing the nature of relationship, the correlation is significant at the 5% level, for JSW in Iron & Steel whereas the correlation is significant at the 1% level for Jindal SAW and Jindal SP. The correlation between EPS and DPS for Bhusan steel (.407) was least among all the Iron & Steel Companies. Further, the correlation between EPS and DPS for TATA Steel (.642) is not significant at the 5% level. So the hypothesis that EPS and DPS vary together holds good.

Summary of Findings

The key objective behind the research work is to examine the relationship between profitability and dividend for selected steel companies over the period of study. The researchers arrived at following points viz:

· In relation to the EPS, Jindal SP earned highest amount of EPS (496.75) in 2009, as well as registered highest average EPS value (209.14), whereas Tata steel registered lowest average value of EPS (64.09).

· So far as the DPS is concerned, JSW has adopted ‘no dividend policy’ in 2004 whereas Bhusan has declared minimum DPS (Rs. 1) in that year. Jindal SP declared highest amount of DPS (27) in 2009, as well as registered highest average value (14.14) of DPS.

· As far as the association between EPS and DPS, the correlation is significant at the 1% level for Jindal SAW and Jindal SP, whereas the correlation is significant at the 5% level for JSW. The correlation between EPS and DPS for Bhusan and TATA Steel is not significant at the 5% level. It has been inferred that with the increase in EPS, DPS also increases.

Concluding Note

Dividend decision is a crucial decision for a firm because it makes a trade-off between requirement of fund for long-term commitments and shareholders expectations. A liberal dividend decision brings satisfaction to the shareholders who expect a fat and regular income but at the other hand, the firm's financing decision is affected when the firm finds an opportunity to reinvest its surplus. As because retained earnings do not involve any explicit cost, finance managers prefer retained earnings as a mode of financing towards its investment decision. Steel industry in India is one of the potential sectors to grow in the years to come. The study has brought to the light the impact of dividend decision on corporate financing pattern by the way of studying the trends and progress of selected corporate dividend decision during the period of study. The study has revealed that the sample companies, which were selected for the purpose of the research, exercised precautionary measures in declaring dividend decision as well as they has maintained consistency in terms of EPS, DPS and DPR.

1. Afza, T., Mirza, H, H., (2010), Ownership Structure and Cash Flows As Determinants of Corporate Dividend Policy in Pakistan, International Business Research, 3(3), 2010-2021

2. Al- Gharaibeh , M., Ziad, Z., and Al-Harahsheh, K., (2013), The Effect of Ownership Structure on Dividends Policy in Jordanian Companies, Interdisciplinary Journal Of Contemporary Research In Business, 4(9), 769-796

3. Al-Nawaiseh, M., (2013), Dividend Policy and Ownership Structure: An Applied Study on Industrial Companies in Amman Stock Exchange, Journal of Management Research. 5(2), 83-106

4. Anand, M. (2004). Factors Influencing Dividend Policy Decisions of Corporate India. The ICFAI Journal of Applied Finance, 2(10): 5 – 16.

5. Anand, M.( 2002). Corporate Finance Practices in India: A Survey. Vikalpa, 27(4): 29 – 56.

6. Babiak Harvey Sugene and Fama (1968) "Dividend Policy: An Empirical Analysis", journal of American Statistical Association, December, pp. 1132-1161.

7. Bhayani, S. J. (2008). Dividend Policy Behaviour in Indian capital Market: A Study of BSE – 30 Companies. DIAS Technology Review, 4(1): 30 – 39.

8. Black, F. (1976), The dividend puzzle, The Journal of Portfolio Management 2, 72-77.

9. Darling P G (1957), "The Influence of Expectations and Liquidity on Dividend Policy', Journal of Political Economy, June, pp. 209-224.

10. Das P K (2006), "Dividend Practices in Selected Company: An Empirical Analysis", The Management Accountant, Vol. 41, No. 4, pp. 288-293.

11. Gugler, K. (2003). Corporate governance, dividend payout policy, and the interrelation between dividends, r&d and capital investment. Journal of Banking and Finance 27 (7): 1297–321.

12. Hu Y and Liu S (2005), "Empirical Analysis of Cash Dividend Payment in Chinese Listed Companies", Nature and Science, Vol. 3, No. 1, pp. 65-70.

13. John Ltnter (1956), "Distribution of Income of Corporations among Dividends Retained Earnings and Taxes", The American Economic Review, May, 46(2): 97 – 113.

14. Kent Baker H and Dutta Gandhi D (2007), "The Perception of Dividend, by an Indian Managers: New Evidence", International journal of Managerial Finance, Vol. 3, No. 1, pp. 70-91.

15. Miller, M. H. and Scholes, M. (1982). Dividends and Taxes: Some Empirical Evidence. Journal of Political Economy, December, 1118-1141.

16. Miller, M. H., & Modigliani, F. (1961). Dividend Policy, Growth and Valuation of shares. The Journal of Business , 4 (34), 411-433.

17. Mirzaei, H., (2012), A survey on the relationship between ownership structure and dividend policy in Tehran stock exchange, International Conference on Management, Applied and Social Sciences, 24(25), 327-332

18. Mohanty P (1999), "Dividend and Bonus Politicies of the Indian Companies” Vikalpa. Vol. 24, No. 4, pp. 35-42.

19. Reddy, Y. S. (2002). Dividend Policy of Indian Corporate Firms: An Analysis of Trends and Determinants. NSE Working Paper No. 19, December: 1 – 47.

20. Singhania Monica (2005), "Trends in Dividend Payout: A Study of Select Indian Companies", Journal of Management Research, Vol. 5, No. 3, pp. 129-142

Books

1. Prasanna Chandra (2001), Financial Management Theory and Practice, Tata Mcgraw Hill Publishing Company Ltd., New Delhi.

2. Jain and Khan (2004), Financial Management, Tata Mcgraw Hill Publishing Company Ltd., New Delhi.

3. R. P. Rustagi (2006), Financial Management Theory, concepts and Problems, Galgotia Publishing Company, New Delhi.

Website