|

Bharat Ram Dhungana Assistant Professor School of Business Pokhara University, Nepal |

Dr. Prashant Kumar Professor Faculty of Commerce BHU, Varanasi, India |

The objective of the paper is to examine the status of financial inclusion in Nepal. The study is based on secondary data to analyse the financial inclusion led by banks and financial institutions and 'D class' micro-finance institutions. The status of financial inclusion in Nepal is not satisfactory and majority of people have still no bank accounts at the formal financial institutions. The financial inclusion led by banks and financial institutions as well as 'D class' MFIs shows that far-western and mid-western development region has poor penetration of formal financial services as compared to other development region due to complex geographical location and lack of basic infrastructure. MF industry is necessary to develop as a tool of inclusive financial market through the wider expansion of its services in remote rural and hilly areas of Nepal. T he government should provide enough supports to develop financial infrastructure, sound MF policies, strengthening regulatory authority, and inclusive economic growth that will help to build-up inclusive financial environment in the nation.

Keywords: Financial Inclusion, Financial Institutions, Micro-Finance, Regulatory Authority.

Financial inclusion has become a significant issue in developing countries like Nepal where the large number of people are still far from the access of formal banking services. It is a major aspect of finance that covers various financial services such as savings, insurance, payments, and remittance facilities to those who have been excluded by formal financial system. Marginalized and vulnerable people, who have been exploited by informal lending system and no capacity to pledge any physical collateral for the loan, are the major target of financial inclusion. M icro-finance is an important tool in connecting the unbanked population into a formal financial system. Higher financial inclusion facilitates the economic development of nation through capital formation and savings mobilization into productive sectors.

Financial inclusion refers to the access of financial products and services to the people who are geographically backward, socially marginalised, and financially poor. Financial products and services include broad range of services having financial awareness, knowledge about banks and banking services, and high access of financial services offered by the banking institutions such as savings, short and long-term credit, insurance, pensions, payments, local money transfers, and international remittances. An inclusive financial system can provide wide access of financial services to the poor.

There are various ways to measure the financial inclusion out of which, outreach dimension and actual usage dimension are more common in practice. The outreach dimension can be measured by two types of indicator i.e. geographical penetration and demographic penetration. Geographical penetration of financial inclusion deals with the bank branches and ATMs per thousand square kilometers and it indicates that smaller distances to the nearest physical bank outlets ensure easier geographical access. Demographic penetration measures the average number of people served by each bank branch and ATM. Higher numbers imply that there are fewer clients per branch and ATM that indicates easier access of banking services.

The actual usage dimension of financial inclusion can be measured in terms of users of banking services or access to financial services, and the ratio of deposits to GDP or credit to GDP or deposit plus credit to GDP. The number of loan accounts per thousand people and the number of deposit accounts per thousand people are the major indicators of the actual usage dimension of financial inclusion. The measurement of financial inclusion largely depends on the level of development of a country and varies across countries and the regions.

In most developing economies, financial services are only available to a minority of the population, frequently to only a very small minority. Although financial sectors are expanding as these economies grow, financial assets usually remain highly concentrated in the hands of a few. The majorities of the people in developing countries have no savings accounts, do not receive credit from a formal financial institution, and have no insurance policies (United Nations, 2006).

The objective of paper is to assess the status of financial inclusion in Nepal. The financial inclusion has been measured in terms of zone wise and region wise led by banks and financial institutions as well as 'D class' micro-finance institutions. The followings are the specific objectives of the study:

I . To assess the financial inclusion led by banks and financial institutions.

II. To measure the financial inclusion led by 'D class' micro-finance institutions.

III. To evaluate the outreach performance of micro-finance industry.

Sources of Data

This study is based on secondary data published by Nepal Rastra Bank (Central Bank of Nepal) and Global Findex Data (World Bank).

Statistical Tools

The descriptive statistics has been used to analyse the status of financial inclusion in Nepal.

The study made by Allen, Demirguc-Kunt, and et al. (2012) found that greater financial inclusion is associated with a better enabling environment to access financial services, such as lower banking costs, greater proximity to branches, and fewer documentation requirements to open an account. Policies targeted to promote inclusion- such as government requirements to offer basic or low-fee accounts, exempting small or rural depositors from onerous documentation requirements, and the use of bank accounts for government payments, are especially effective among rural residents and the poor.

Bangladesh government has been pursuing inclusive socio-economic growth aiming at well-being for all outlined in its five year and annual development plans. To cover about one-fifth of adult population who could not get any financial services from any regulated and supervised financial institutions, MFIs and cooperatives, Bangladesh bank's policy is to encourage MFIs for initiating cost saving innovative partnerships and for introducing technology based financial services. Institute of Micro-finance conducted a survey on 'Access to financial services in Bangladesh' in 2011 found that the aggregate access to any financial services stood at 76.8 percent of which access to formal services is about 37.0 percent and access to quasi-formal (MFIs and co-operatives) is about 43.0 percent (Islam and Mamun, 2011).

A growing body of research shows that financial inclusion can have significant beneficial effects for individuals, providing both an economic and a political rationale for policies that promote financial inclusion. The literature has found that providing individuals with access to savings instruments increases savings (Aportela, 1999; Ashraf et al., 2010a), productive investment (Dupas and Robinson, 2009), consumption (Dupas and Robinson, 2009; Ashraf et al., 2010b), and female empowerment (Ashraf et al., 2010b).

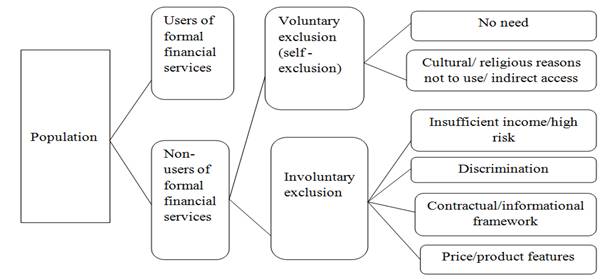

Development theory provides important clues about the impact of financial inclusion on economic development. Available models illustrate how financial exclusion, and in particular, lack of access to finance can lead to poverty traps and inequality (Aghion and Bolton, 1997; Banerjee and Newman, 1993; Galor and Zeira, 1993). The micro-finance and financial inclusion model provides a framework to enhance the financial inclusion to the people those who are under the involuntary exclusion. The financial inclusion model has been presented in the following figure:

Figure 1: Financial Inclusion Model

Source: Demirguc-Kunt, Beck, and Honohan, 2008.

There are two types of population in terms of financial inclusion i.e. users of formal financial services and non-users of formal financial services. The non-users of formal financial services are voluntary and involuntary exclusion. The voluntary exclusion people do not use financial services for cultural and religious reasons or because they do not see any need. Among the involuntarily excluded, there is a group of households and enterprises that are considered un-bankable by commercial financial institutions and markets because they do not have enough income or present too high a lending risk. There might be discrimination against certain population groups based on social, religious, or ethnic grounds. The contractual and informational framework might prevent financial institutions from reaching out to certain population groups because the outreach is too costly to be commercially viable. Finally, the price of financial services may be too high or the product features might not be appropriate for certain population groups.

Financial Inclusion: A Global Scenario

The level of financial inclusion varies widely around the world. More than 2.5 billion adults, about half of the world adult population does not have an account with a formal financial institution. Not all the 2.5 billion unbanked need financial services, but barriers such as cost, travel distance, and documentation requirements are critical. The account penetration differs extremely between high-income and developing economies. More than 99.0 percent of adults in Denmark have a formal account while virtually none do in Niger (The World Bank, 2012). The account penetration of adults (having the age of 15 years and above) at formal financial institutions has been exhibited in the following table:

Table 1: Account Penetration: Adults with an Account at Formal Financial Institutions

| S. N. | Region | Bank Account (Percent of People) | No Bank Account (Percent of People) |

| 1. | High Income Economies | 89.0 | 11.0 |

| 2. | East Asia and Pacific | 55.0 | 45.0 |

| 3. | Europe and Central Asia | 45.0 | 55.0 |

| 4. | Latin America and Caribbean | 39.0 | 61.0 |

| 5. | South Asia | 33.0 | 67.0 |

| 6. | Sub Saharan Africa | 24.0 | 76.0 |

| 7. | Middle East and North Africa | 18.0 | 82.0 |

Source: The World Bank, The Global Findex Database, 2012.

The Middle East and North Africa has the lowest account penetration with only 18.0 percent people. In several economies around the world including Cambodia, the Democratic Republic of Congo, Guinea, the Kyrgyz Republic, Turkmenistan, and the Republic of Yemen, more than 95.0 percent of adults do not have still an account at a formal financial institution (The World Bank, 2012).

The scenario of financial inclusion in South Asia has been exhibited in the following table:

Table 2: Financial Inclusion in South Asia

(Percent)

| S. N. | Name of Country | Account at Formal Financial Institutions | Women Account at Formal Financial Institutions |

| 1 | Afghanistan | 9.0 | 3.0 |

| 2 | Bangladesh | 40.0 | 35.0 |

| 3 | Bhutan | NA | NA |

| 4 | India | 35.0 | 26.0 |

| 5 | Maldives | NA | NA |

| 6 | Nepal | 25.0 | 21.0 |

| 7 | Pakistan | 10.0 | 3.0 |

| 8 | Sri Lanka | 69.0 | 67.0 |

Source: The World Bank, The Global Findex Database, 2012 .

The financial inclusion in South Asia is not also satisfactory. The account penetration in this region is only 33.0 percent and still two third people have no bank accounts at formal financial institutions. The status of financial inclusion in Afghanistan and Pakistan is seen very poor in South Asia. It shows that 91.0 percent still do not have bank account at formal financial institutions in Afghanistan where as 90.0 percent in the case of Pakistan. Sri Lanka has the highest level of financial inclusion in the South Asia. The account penetration of women is also significantly lower in Afghanistan and Pakistan as compared to the other members of the region.

Enhancing financial inclusion requires the policy and market problems that lead to financial exclusion to be addressed. The government and regulatory bodies should give adequate attention to achieve this goal by developing an appropriate legal and regulatory framework and supporting the information environment as well as by educating and protecting the users of financial services.

The Status of Financial Inclusion in Nepal

The financial inclusion is a serious issue in the context of developing countries like Nepal. The status of financial inclusion in Nepal is not satisfactory and three-fourth (75.0 percent) of the people still has no bank accounts at the formal financial institutions. The development region-wise and zone-wise financial inclusion led by banks and financial institutions as well as led by 'D class' MFIs have been studied to explore the status of financial inclusion in Nepal.

Region-wise Financial Inclusion Led by Banks and Financial Institutions

The region-wise financial inclusion led by banks and financial institutions for mid-July, 2013 has been presented in table 3.

Table 3: Region-wise Financial Inclusion Led by Banks and Financial Institutions

| S. N. | Dev. Region | Branches | Total Population | Population per Branch | ||

| No. | Percent | No. | Percent | |||

| 1 | Eastern | 570 | 18.2 | 5,811,555 | 21.9 | 10,196 |

| 2 | Central | 1,411 | 45.0 | 9,656,985 | 36.4 | 6,888 |

| 3 | Western | 725 | 23.1 | 4,926,765 | 18.6 | 6,795 |

| 4 | Mid Western | 278 | 8.8 | 3,546,682 | 13.5 | 12,758 |

| 5 | Far Western | 154 | 4.9 | 2,552,517 | 9.6 | 16,575 |

| Total | 3,138 | 100.0 | 26,494,504 | 100 | 8,443 | |

Source: Banking and Financial Statistics, NRB, Mid July 2013.

The number of branches in central development region is very high (45.0 percent) as compared to other development region. The far western development region has the lowest number of branches (4.9 percent) of banks and financial institutions whereas mid western development region has 8.8 percent. Similarly, the population per branch in western development region is lower (6,795) whereas this proportion in far western development region is very high (16,575). The study shows that financial inclusion led by banks and financial institutions in western development region is better. But in the case of far western and mid western development region, the status of financial inclusion is very poor. Due to complex geographical location and lack of basic infrastructure, there is limited number of banks and financial institutions in the region. The government and regulatory authority should give adequate attention regarding the enhancement of financial inclusion towards these geographical regions.

Zone-wise Financial Inclusion Led by Banks and Financial Institutions

The financial access has increased with the expansion of network of financial institutions. As per mid-July 2013, the total number of banks and financial institutions stood at 207 which include 31 commercial banks, 86 development banks, 59 finance companies and 31 micro-finance institutions. The numbers of deposit accounts and borrowers in A, B and C class financial institutions were about 11.1 million and 845,000 respectively. Total depositors and borrowers in micro-finance institutions are about 1.16 million and 849,000 respectively (Economic Survey, 2013).

The banks and financial institutions include commercial banks (class A), development banks (class B), finance companies (class C), and micro-finance development banks (class D). The zone-wise financial inclusion led by banks and financial institutions for mid-July, 2013 has been presented in table 4.

Table 4: Zone-wise Financial Inclusion Led by Banks and Financial Institutions

| S. N. | Dev. Region | Zone | Class A | Class B | Class C | Class D | Total | Population | Population per Branch |

| 1. | Eastern | Mechi | 74 | 30 | 8 | 58 | 170 | 1,422,182 | 8,366 |

| 2. | Koshi | 137 | 64 | 15 | 66 | 282 | 2,335,047 | 8,280 | |

| 3. | Sagarmatha | 61 | 13 | 4 | 40 | 118 | 2,054,326 | 17,410 | |

| 4 | Central | Janakpur | 71 | 35 | 4 | 69 | 179 | 2,837,481 | 15,852 |

| 5 | Narayani | 138 | 112 | 22 | 101 | 373 | 2,975,908 | 7,978 | |

| 6 | Bagmati | 527 | 157 | 112 | 63 | 859 | 3,843,596 | 4,475 | |

| 7 | Western | Gandaki | 110 | 115 | 32 | 47 | 304 | 1,549,857 | 5,098 |

| 8 | Lumbini | 123 | 124 | 30 | 77 | 354 | 2,834,612 | 8,007 | |

| 9 | Dhavalagiri | 29 | 25 | 5 | 8 | 67 | 542,296 | 8,094 | |

| 10 | Mid Western | Rapti | 46 | 32 | 4 | 34 | 116 | 1,456,202 | 12,553 |

| 11 | Karnali | 13 | 0 | 0 | 3 | 16 | 388,713 | 24,295 | |

| 12 | Bheri | 70 | 33 | 4 | 39 | 146 | 1,701,767 | 11,656 | |

| 13 | Far Western | Seti | 53 | 13 | 2 | 24 | 92 | 1,575,003 | 17,120 |

| 14 | Mahakali | 34 | 11 | 0 | 17 | 62 | 977,514 | 15,766 | |

| Total | 1,486 | 764 | 242 | 646 | 3,138 | 26,494,504 | 8,443 | ||

Source: Banking and Financial Statistics, NRB, Mid July 2013.

As of mid-July 2013, the branch network of commercial banks reached 1,486, development banks 764, finance companies 242 and micro-finance development banks 646. As a result, in mid-July 2013, each branch has covered approximately 8,443 population on an average. There is poor outreach of banks and financial institutions in Karnali zone (24,295 population per branch), Sagarmatha zone (17,410 population per branch), Seti zone (17,120 population per branch), Janakpur zone (15,852 population per branch), and Mahakali zone (15,766 population per branch). The study shows that there is imbalanced regional development of financial institutons in Nepal. The government and regulatory authority should give proper attention to maintain regionally balanced financial inclusion in the region.

Region-wise Financial Inclusion Led by D Class Micro-finance Institutions

The region-wise financial inclusion led by 'D class' MFIs for mid-July, 2013 has been presented in table 5.

Table 5: Region-wise Financial Inclusion Led by D Class Micro-finance Institutions

| S. N. | Dev. Region | Branches | Total Population | Population per Branch | ||

| No. | Percent | No. | Percent | |||

| 1 | Eastern | 164 | 25.4 | 5,811,555 | 21.9 | 35,436 |

| 2 | Central | 233 | 36.1 | 9,656,985 | 36.4 | 41,446 |

| 3 | Western | 132 | 20.4 | 4,926,765 | 18.6 | 37,324 |

| 4 | Mid Western | 76 | 11.8 | 3,546,682 | 13.5 | 46,667 |

| 5 | Far Western | 41 | 6.3 | 2,552,517 | 9.6 | 62,256 |

| Total | 646 | 100 | 26,494,504 | 100 | 41,013 | |

Source: Banking and Financial Statistics, NRB, Mid July 2013.

The branches of 'D class' MFIs are more located in central development region (36.1 percent) whereas lower in far western (6.3 percent) and mid western development region (11.8 percent). Similarly, the population per branch of 'D class' MFIs is lower in eastern development region (35,436) and higher in far western development region (62,256). The region-wise financial inclusion led by 'D class' MFIs shows that far western and mid western development region has poor penetration of MF services as compared to other development region. The reason behind poor financial inclusion is due to complex geographical location and tendency of locating the branches in urban and city areas where road facilities and other basic services are available. The government should develop basic financial infrastructure to expand formal financial services especially in remote rural and hilly areas.

Zone-wise Financial Inclusion Led by D Class Micro-finance Institutions

The zone-wise financial inclusion led by 'D class' micro-finance institutions for mid-July, 2013 has been presented in table 6.

Table 6: Zone-wise Financial Inclusion Led by D Class Micro-finance Institutions

| S. N. | Dev. Region | Zone | Branches | Population | ||

| Numbers | Percent | Total | Per Branch | |||

| 1. | Eastern | Mechi | 58 | 9.0 | 1,422,182 | 24,520 |

| 2. | Koshi | 66 | 10.2 | 2,335,047 | 35,380 | |

| 3. | Sagarmatha | 40 | 6.2 | 2,054,326 | 51,358 | |

| 4 | Central | Janakpur | 69 | 10.7 | 2,837,481 | 41,123 |

| 5 | Narayani | 101 | 15.6 | 2,975,908 | 29,464 | |

| 6 | Bagmati | 63 | 9.8 | 3,843,596 | 61,009 | |

| 7 | Western | Gandaki | 47 | 7.3 | 1,549,857 | 32,976 |

| 8 | Lumbini | 77 | 11.9 | 2,834,612 | 36,813 | |

| 9 | Dhavalagiri | 8 | 1.2 | 542,296 | 67,787 | |

| 10 | Mid Western | Rapti | 34 | 5.3 | 1,456,202 | 42,829 |

| 11 | Karnali | 3 | 0.5 | 388,713 | 129,571 | |

| 12 | Bheri | 39 | 6.0 | 1,701,767 | 43,635 | |

| 13 | Far Western | Seti | 24 | 3.7 | 1,575,003 | 65,625 |

| 14 | Mahakali | 17 | 2.6 | 977,514 | 57,501 | |

| Total | 646 | 100.0 | 26494,504 | 41,013 | ||

Source: Banking and Financial Statistics, NRB, Mid July 2013.

The branches of 'D class' MFIs are higher in Narayani zone (15.6 percent) whereas lower in Karnali zone (0.5 percent). Similarly, Dhavalagiri zone (1.2 percent), Mahakali zone (2.6 percent), and Seti zone (3.7 percent) have lower number of branches of 'D class' MFIs as compared to the other zones. The population per branch of 'D class' MFIs is lower in Mechi zone (24,520) whereas this proportion is higher in Karnali zone (129,571). The zone-wise financial inclusion led by 'D class' MFIs shows that Karnali zone, Dhavalagiri zone, and Seti zone has poor penetration of micro-finance services as compared to other zones of Nepal. The reason behind the poor financial inclusion in the region is difficult topography and lack of basic infrastructure. Thus, government and regulatory authority should develop inclusive financial environment in the nation.

Outreach Performance of Micro-finance Industry

The outreach performance measures the institutional coverage and their access of services to the people. Higher outreach indicates the ability of MFIs to maintain financial coverage to a large number of clients. The outreach dimension may include both geographical and demographic penetration of services. It includes district coverage, number of branches, number of members, number of savers, number of borrowers, and so on. Higher outreach performance indicates greater degree of social performance of the institution and vice-versa. The outreach performance of Micro-finance Industry for the year January, 2014 has been presented in table 7.

| Table 7: Outreach Performance of Micro-finance Industry in Nepal | |||||||

| Indicators | GMFIs | PMFIs | WLMFIs | Total | |||

| No. | % | No. | Percent | No. | % | No. | |

| District coverage to target district | - | 80.0 | - | 60.0 | - | 90.0 | 76.7 |

| No. of branches | 170 | 21.9 | 597 | 76.8 | 10 | 1.3 | 777 |

| No. of members | 190,089 | 13.4 | 890,715 | 63.0 | 333,279 | 23.6 | 1,414,083 |

| No. of borrowers | 136,941 | 13.3 | 678,691 | 65.9 | 214,623 | 20.8 | 1,030,255 |

| No. of savers | 150,902 | 13.7 | 947,736 | 86.3 | 0 | 0.0 | 1,098,638 |

Source: Monthly Statistics of NRB, Mid January 2014 .

The outreach performance of Nepalese MF industry shows that 'D class' MFIs have 76.7 percent district coverage to target district ratio. The outreach performance in terms of number of branches, members, borrowers, and savers of private MFIs is significantly high as compared to the government MFIs and wholesale lending MFIs. Although district coverage of MFIs is high (76.7 percent), its services have not been extended in remote rural areas. The MF services are basically confined in the surrounding areas of district headquarters, city, and towns where road and basic amenities are available. The inclusive financial system should be developed in the nation that will help in expanding formal financial services to the marginalized and poor people.

Role of Government for Financial Inclusion in Nepal

Financial inclusion has become an emerging issue in developing countries like Nepal because mass number of people is still deprived from formal banking services. The existing financial system has excluded the marginalized and vulnerable people of rural community and they have been still exploited by the informal lending system. The commercial banks and other formal financial institutions demands physical collateral security for the loan and the poor people are unable to pledge such collateral. The MFIs provide collateral-free micro-credit to the people who are excluded by the formal financial institutions. Therefore, MF industry is necessary to develop as a tool of inclusive financial market through the wider expansion of its services in remote rural and hilly areas of Nepal.

Building inclusive financial system, in fact, is a challenging task of the government and regulatory authority for which high degree of efforts and commitment is essential. Inclusive financial environment provides opportunities of formal financial services to the people living in the rural part of the country. Micro-finance is an appropriate way of reaching to the poor and marginalised people. Moreover, it helps to bring socio-economic transformation of the people through micro-business and enterprises generation. MF services encourage the people to participate fully in the economic life of their societies, create employment for them/others, and realize their full potential. Once the level of income increases after MF intervention, they may utilize their earnings on better nutrition, housing, health, and educational expenditure to enhance socio-economic status. Government can build inclusive financial system through the following three major ways:

I. The Government has to deliver financial services directly and indirectly, often by disbursing credit to preferred groups and developing a good mechanism for managing resources to the financial institutions through wholesale arrangements. Governments are not good at offering credit directly to poor people, although government banks can expand their outreaches to maintain financial inclusion over the rural part of the country.

II. The Government has to develop and implement new plans and policies in the financial system that may help to build-up inclusive financial system. These policies may include ensuring macro-economic stability, liberalizing interest rates, encouraging banking and financial institution to the remote rural areas, and establishing effective banking regulation and supervision that make viable micro-finance services.

III. The Government has to promote inclusion by offering fiscal incentives to serve poor and low-income people.

A sound financial system plays a significant role to promote financial inclusion in the nation. The role of government is to ensure wider access of financial services to the people who are deprived from the formal financial services. Thus, government and regulatory authority should play supportive role to maintain inclusive financial environment in the nation through appropriate management of basic infrastructure, sound MF policies, strengthening MFIs, and other necessary supports.

The financial inclusion has become a serious issue in the context of developing countries like Nepal. The status of financial inclusion in Nepal is not satisfactory and three-fourth (75.0 percent) of the people still has no bank accounts at the formal financial institutions (World Bank, 2012). Due to complex geographical location and lack of basic infrastructure, there is limited number of banks and financial institutions in mid-western and far-western development region. MF services are basically confined in the surrounding areas of district headquarters, city, and towns where road and basic amenities are available. MF industry is necessary to develop as a tool of inclusive financial market through the wider expansion of its services in remote rural and hilly areas of Nepal. The government and regulatory authority should give adequate attention regarding the enhancement of financial inclusion towards these geographical regions.

Inclusive economic growth has been one of the priority agenda in developing countries like Nepal. It is widely acknowledged that inclusive economic growth cannot be accomplished without achieving financial inclusion. In fact, building inclusive financial system is a challenging task that requires high degree of efforts and commitment. Unless government adequate support is available, financial inclusion will remain poor in the nation. So, the government should provide enough supports to develop financial infrastructure, sound MF policies, strengthening regulatory authority, and inclusive economic growth that will help to build-up inclusive financial environment in the nation.

Building inclusive financial sector improves the livelihood status of the people through productive application of micro-credit. A small loan, a savings account or an insurance policy can make a great difference to a low-income family. They enable people to invest in better nutrition, housing, health and education for their children. Since there is poor financial inclusion basically in rural and hilly areas, so, high degree of efforts and investment is necessary to scale-up its operation to the majority people.

Aghion, P., & Bolton, P. (1997). A theory of trickle-down growth and development. Review of Economics Studies, 64 (2): 151–72.

Allen, F., Demirguc-Kunt, & et al. (2012). The foundations of financial inclusion: Understanding ownership and use of formal accounts. Policy Research Working Paper, WPS 6290, The World Bank, Development Research Group, 1-59.

Aportela, F. (1999). Effects of financial access on savings by low-income people. Unpublished Dissertation, MIT Department of Economics.

Ashraf, N., Aycinena, C., Martinez, A., & Yang., D. (2010). Remittances and the problem of control: A field experiment among migrants from El Salvador. Mimeo.

Ashraf, N., Karlan, D., & Yin, W. (2010). Female empowerment: Further evidence from a commitment savings product in the Philippines. World Development, 28 (3): 333-44.

Banerjee, A., & Newman, A. (1993). Occupational choice and the process of development. Journal of Political Economy, 101(2): 274-98.

Demirgüç-Kunt, A., Beck, T., & Honohan, P. (2008). Finance for all? Policies and pitfalls in expanding access. World Bank Policy Research Report, The World Bank, Washington, DC.

Dupas, P., & Robinson, J. (2009). Savings constraints and micro-enterprise development: Evidence from a field experiment in Kenya. National Bureau of Economic Research Working Paper 14693.

Galor, O., & Zeira, J. (1993). Income distribution and macro-economics. Review of Economics Studies, 60 (1): 35–52.

Islam, M. E., & Mamun, M. S. A. (2011). Financial inclusion: The role of Bangladesh bank. Working Paper Series: WP 1101, Research Department, Bangladesh Bank, 1-21.

Ministry of Finance (2013). Economic survey for the fiscal year 2012/13. Ministry of Finance, Kathmandu, Nepal.

Nepal Rastra Bank (2013). Banking and financial statistics for mid-July 2013. Nepal Rastra Bank , Kathmandu, Nepal.

The World Bank (2012). Measuring financial inclusion. The global Findex Database, Policy Research Working Paper, The World Bank Development Research Group Finance and Private Sector Development Team, 1-58.

Nepal Rastra Bank (2014). Banking and financial statistics (monthly) for mid-January 2014. Nepal Rastra Bank, Kathmandu, Nepal.

United Nations (2006). Building inclusive financial sectors for development. New York: United Nations.