Perception of Women towards Grocery Retailing: A Comparative Study of Traditional and Modern Retail Stores.

Abstract

Retailing is one of the world’s fastest growing industries. Food and Grocery sector has the largest share in the India’s retailing sector. It is divided into traditional and modern grocery stores. In this paper we investigate the perception of women, the largest segment of grocery shoppers. Using empirical research, this paper finds out the factors that influence the perception of women towards grocery stores and compare their perception between traditional and modern grocery retail stores. Due to introduction of FDI in multi brand retailing, foreign players are entering the Indian grocery retail sector. This study will help the domestic retailers to understand what women in a metro city expect from a grocery store as women are usually responsible to buy food & grocery for their family. The sample was collected from 101 women of Delhi and NCR. Factor analysis and paired t-test techniques were used in the research. This paper identifies seven factors that influence perception of women towards a grocery store, namely Attractive and Modern services, Responsiveness, Customer Convenience, Money saving, Time saving, Product variety, and Quality & Location. The study also indicates that there is significant difference in the perception of women between traditional and modern grocery retail stores.The modern grocery retail stores have better perception than traditional grocery retail stores in terms of all the factors named above. This study provides specific knowledge to grocery retailers of the factors that influence women perception while choosing a grocery store.

Keywords: Grocery, traditional, modern, perception

Retail, according to concise Oxford English Dictionary, is the ‘sale of goods to the public for use or consumption rather than for resale’. The term retailing is thought to be derived from the old French word ‘retailer’ which means ‘a piece of’ or ‘to cut up’ (Brown, 1992). This implies the breaking-of-bulk function of the retailer- that is, the acquiring of large amounts of the products they sell and dividing them into smaller amounts to be sold to individual consumer (Boora &Singh, 2012). Retailing include the business activities involved in selling goods and services to consumers for their personal, family, household or business use. It consists of each and every stage in the distribution process. Retailing is the last stage in the distribution process (Kumar & Reddy, 2013).

Retailer Consumer

The retail sector is divided into traditional and modern or unorganized and organized. Traditional or unorganized retailers are low cost retailers like local kirana shops, owner managed general stores, convenience stores, hand cart and pavement vendors etc. These are not even registered for sales tax, VAT etc. On the other hand, organized or modern retailers consist of corporate backed hypermarkets (e.g. Trent’s Star India Bazaar), supermarkets (e.g. Food Bazaar), and privately owned large retail chains (e.g. Wal-Mart).

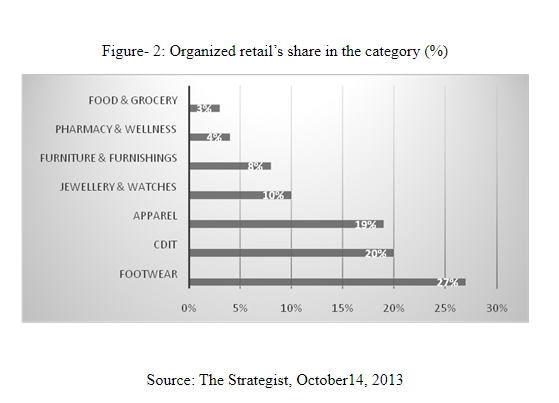

Retailing is one of the world’s fastest growing industries. Retailing in India is one of the pillars of its economy and accounts for 14 to 15 percent of its GDP (Dikshit, 2011).A recent report by Technopak, Emerging Trends in Retail and Consumer Products 2013, states that the Indian retail market, currently estimated at $490 billion will grow at a CAGR of 6 per cent to reach $865 billion by 2023 (c.f. The Strategist).The performance of the retailing sector for the past few years is outstanding and witnesses a huge revamping exercise, significantly contributed by the growth of organized retailing. Organized retailing in India is still at a nascent stage but this form of retailing existed since 1905 in the form of Nilgiris; India’s oldest supermarket chain based in Bengaluru. Organized retail has a penetration of only 7- 10% (c.f. The Economic Times).

Until 2011, Indian central government denied foreign direct investment (FDI) in multi-brand Indian retail, forbidding foreign groups from any ownership in supermarkets, convenience stores or any retail outlets, to sell multiple products from different brands directly to Indian consumers.Even single-brand retail was limited to 51% ownership and a bureaucratic process. In January 2012, India approved reforms for single-brand stores welcoming anyone in the world to innovate in Indian retail market with 100% ownership, but imposed the requirement that the single brand retailer source 30 percent of its goods from India. On 5 December 2012, the Federal Government of India allowed 51% FDI in multi-brand retail in India (Ramvenkatesh, 2012). Thus, with the introduction of FDI in multi brand retailing, more international players are expected to enter the Indian market thereby bringing more competition for the domestic players. Organized retail penetration is expected to increase from 7.5% in 2013 to 10% in 2018 at a robust CAGR of 19-20% during the same period (Mishra &Rajagopalan, 2014).

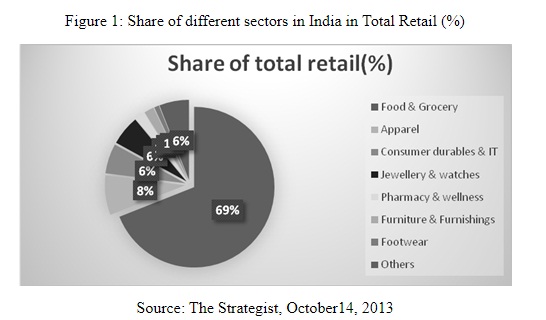

Food & grocery sell irrespective of the state of the economy. You can stop going to the cinema and restaurants, but there's no way you can live without toothpaste, soap, cereals, vegetables etc. (Hans, 2013). Further, food and grocery retail is used by every household, rich or poor, small or big. As given in the Strategist (October 14, 2013), the major share in Indian retail is of the grocery retail (69%).

Figure 1: Share of different sectors in India in Total Retail (%)

It is also stated that organized retail’s share in the Food & Grocery sector is mere 3%.

Modern retail is basically restricted to big cities and metros whereas traditional unorganized retailers are catering to every nook and corner of the country. The Kiranawallas are serving the rural areas, which constitute the majority of the India’s population. Infact, these kirana stores are still the point of sale for most of the FMCG companies. The traditional retailers have coexisted well with modern retailers by upgrading themselves in urban areas. Even the organized sector is trying to imitate the plus points of the mom & pop stores. Recently, Tesco in partnership with Tata’s has launched neighborhood convenience store format, “Star Daily” in Pune. It stocks mainly fresh foods, groceries and essential items and it is opened for almost 15 hours starting at 7am similar to a kirana store (c.f. The Economic Times).

Modern grocery retailing started in May 2006 with the launch of Hyper City in Mumbai and more than 300 hypermarkets have opened since then. But, more than half of the modern grocery retailers have been in losses including Spencer, Reliance retail, Hyper City etc. The CRISIL report suggests that retailer losses will continue to rise, peaking in 2017 after which half of modern retailers will start to break even (Miles, 2014). Though, the organized retail has mere 3% share in Food &Grocery, this sector is growing fast. According to United Nations, India’s population is expected to exceed that of China by 2028 and as per IGD forecasting, its grocery market value will grow by 118% to $847.9bn by 2020. This unleashes the huge potential offered by the Indian Food &Grocery sector. India is expected to overtake the US and become the world's second largest grocery market by 2028 (Miles, 2014).

In India, women are mostly entrusted with the responsibility of shopping of groceries for their entire family. In U.K. also, women were expected to do the grocery shopping and men had the freedom to opt in or out of this task as women were stereotyped as doing all the household chores even when they were working outside home (Wootten et.al, 2008).Women preferences and perception differ from men as well as among themselves when it comes to shopping. There are a couple of emotions that determine shopping behavior. The most fundamental of them are greed, altruism, fear and envy (Biyani&Baishya, 2007, p. 6-7).These emotions tend to differ in each of the customer and can affect their perception or vice versa. Therefore, this study focuses on women perception of grocery retail stores and a comparison of their perception between traditional and modern grocery retail stores.

This section aims to provide a summary of key literature relating to the perception towards grocery retail stores and a comparison between traditional and modern grocery retail stores. The literature review is divided into two parts. The first part examines the research work conducted by different researchers in India and abroad on the factors affecting perception towards grocery retail stores and the second part reviews the significant studies related to the comparison between traditional and modern grocery retail stores.

2.1 Factors affecting perception of customers towards grocery retail stores.

Wulf&Kenhove(2000)divided grocery shoppers of a large Belgian retail organization into four segments (‘money-poor, time-rich’, ‘money-poor, time-poor’, ‘money-rich, time-rich’ and ‘money-rich, time-poor’) on the basis of Income and Time pressure (a person-situation segmentation framework). The researchers investigated the interaction effect of person (income) – situation (time pressure) variables on customer behavior and found significant differences among four segments w.r.t demographic variables (age, composition and size of household, marital status etc.), grocery-shopping behavior (amount spent in the store, buying pattern for different product categories and different task definitions) and grocery-shopping attitudes (overall attitude towards grocery shopping and different grocery-shopping attributes).

Morschett, et.al (2005) empirically studied the influence of consumer’s shopping motives on their perception of store attributes and their attitude towards a retailer in one of the major cities of Germany. The researchers extracted four central dimensions of shopping motives using exploratory factor analysis. The four dimensions are scope orientation, quality orientation, price orientation and time orientation. On the basis of these dimensions, four homogeneous groups of consumers were found and it was revealed that shopping motives do affect the store choice decision of the consumers. Further, three perception dimensions were extracted namely quality of performance, scope of offers and price level. It was empirically proved by the researchers that these perception variables were not strongly influenced by the shopping motives whereas shopping motives have profound effect on four indicators of consumer’s attitudes (likeability, trustworthiness, differentiation and store loyalty).

Anand& Sinha (2009) found that affective component of the attitude predicts behavioral intention more strongly than cognitive component. The behavioral intention was found to be a mediator in the attitude-behavior framework. They found that consumer involvement with grocery shopping as a ’category’ and as an ‘activity’ was significant in determining intention, which has a positive impact on the store format choice. The research revealed that factors like perceived behavioral control, subjective norm and perceived operational capability also affect intention significantly, thereby affecting store format choice.

Goswami& Mishra (2009) extracted 12 factors affecting customer patronage of grocery stores using factor analysis. These were store cleanliness, store offers and product quality (COQ), store brands, family grocery shopping and parking facilities (BFP), hedonic shopping (HS), location (L), specific day shopping (SDS), HmS, MS, planned shopping (PS), in-store convenience (IC), helpful and trustworthy salespeople (SP), travel convenience (TC), unplanned purchase (UP). They found using multiple regression that customer patronage is positively-related to location, COQ, SP and HmS and negatively related to SDS, TC and PS.

Jhamb&Kiran (2012) found that income of consumers is positively related with shopping from modern retail formats. The researchers revealed that youngsters preferred to shop from modern retail outlets. The authors extracted three product attribute factors (i.e. core product attributes, secondary product attributes and supplementary product attributes) and two store attribute factors (i.e. shopping experience enhancer attributes and store environment attributes).

Jayasankaraprasada&Kathyayanib (2013) studied four different retail formats i.e. traditional kirana stores, convenience stores, supermarkets and hypermarkets. They found nine cross-format shopping motives i.e. value for money, value for time, price conscious, local shopping, shopping enjoyment, social shopping, variety seeking, entertainment and brand conscious. They also identified five cross format shopper typologies i.e. economic shopper, convenience shopper, price-promotional shopper, hedonic (pleasure) shopper and social shopper based on the nine cross-format shopping motives. The researchers found these five common shopper subgroups in each of these four formats studied. The research revealed that there were differences among cross-format shopper segments in respect of retail format choice and repatronage.

Nair & Nair (2013) found convenience and competitive price to be the two factors which attract customers towards organized retail outlets.

Kumar & Reddy (2013) found four main factors that influence customer perception on retail services in selected organized retail in semi-urban areas. These factors are quality, product information and promotional offers, special offers and availability of brands.The research revealed that organized retail, being a relatively new concept in the semi-urban area has clear cut perception in the minds of shoppers.

2.2 Comparison between traditional and modern grocery retail stores.

Di (2008) studied consumers’ perception towards superstores and family-run stores in Bangkok with a sample size of 400. The study revealed that respondents perceived superstores to be essential and family-run stores to be inadequate in number for consumers. The researcher found that perception of consumers with varying demographic profiles differ between superstores and family-run stores on the basis of marketing, business, economic and social factors.

Sachdeva (2008) found that people visit malls (i.e. modern retail) as well as kirana stores in no specific pattern. The author explored that people went to malls because of its ambience and window shopping freedom whereas they went to kirana stores for personal customized buying, personalized attention and examining products physically before buying.

Goswami& Mishra (2009) studied whether there will be a shift in the consumer’s choice from kirana stores to large organized retailers in case of grocery shopping. The authors found that traditional grocery retailers have location benefit; which is the most important deciding factor for grocery retail store patronage. On the other hand, organized grocery retailers are preferred for their exclusive store brands, offers, cleanliness, helpful and trustworthy salespeople. The researchers concluded that kiranas have location advantage in the short term but they face threat from the organized retailers in the long run as organized retail stores scored higher than Traditional stores.

Boora & Singh (2012) found convenience in terms of location to be the most important purchase attribute for customers that led them to prefer traditional retailers. Price came out to be the only attribute that was equally important for customers of both traditional and modern retailers. Ambience and credit facility came out to be the least important attributes.

Gupta (2012) found that factors like quality of products, choice of brands, easy availability, shelf display, cleanliness, shopping environment, entertainment for children and parking facility draw customers towards organized retail outlets. On the contrary, attributes like immediacy of the store, billing duration and replacement of defected items negated the purchase from organized retail formats. The researcher revealed that higher age group people, families with annual income less than 4 lakhs and less qualified people preferred kirana stores whereas younger generation, families with income higher than 4 lakhs and highly qualified people preferred organized retail outlets.

Talreja& Jain (2013) found that kirana stores have a low-cost structure, convenient location and customer intimacy whereas modern retail offers product width, depth and a better shopping experience. Due to changes in the disposable income and increased awareness of quality, the consumers’ perception towards organized and unorganized retailers differed on the basis of quality and price.

Food & Grocery sector, although having the largest share in the retailing,is still dominated by the unorganized sector i.e. mom & pop stores. This makes Food &Grocery sector attractive for organized retailers who have entered this sector recently and growing rapidly. Organized retailers being new to the sector need to learn from mom & pop stores whereas mom & pop stores need to imbibe new things from modern retailers so that they can face the threat posed by these organized retail stores. After review of literature, it was found that none of the studies have been conducted specifically on women, who are mainly responsible for food and grocery shopping of their households. Also, there is a paucity of research that has attempted to compare perception of customers between traditional and modern grocery retail stores. The study attempts to fill the gap by determining factors affecting women perception towards a grocery retail store and finding whether there exists a difference in their perception between traditional and modern grocery retail stores.

3.1Objectives of the study

Particularly, the two objectives of the study are:

1) To determine the factors affecting women perception towards a grocery retail store.

2) To compare women perception between traditional and modern grocery retail stores.

4.1 Sample –Response was obtained from101 women from Delhi &NCR. Modern grocery retail stores are found in large number in metros along with traditional mom & pop stores, thus this study was conducted in Delhi & NCR. The useful questionnaires came out to be 100. Only 1 questionnaire was found to be incomplete and was dropped out. The sampling method used was convenience sampling.

4.2 Data collection – The data were collectedusing a structured questionnaire based on review of literature (c.f. Sondeep, 2010). Total 30 statements were there for perception towards a grocery retail store. The questionnaire was based on 5-point Likert scale starting from strongly disagree (1) to strongly agree (5).

4.3 Data Analysis–Factor analysis and paired t-test techniques have been used in the study. Factor analysis is a data reduction technique. It is basically used to condense the larger number of variables to find out important factors that influence the perception of women customers towards grocery retail stores. Paired t-test is used to test the effect of an intervention i.e. to compare before and after effect. Paired t-test was used to compare the perception of women between traditional and modern grocery retail stores based on the factors extracted using factor analysis.

5.1 Factor Analysis

Factor Analysis is used to determine significant factors affecting women perception towards grocery retail stores. Before we proceed for factor analysis first the researcher tested the eligibility of the data by checking KMO and Bartlett’s test. KMO is a measure of sampling adequacy. The KMO value is 0.787 >0.5(Table 1) indicates multivariate normality among variables. The Bartlett’s test of Sphericity is used to test the null hypothesis that the variables are uncorrelated in the population. Here the significance value is less than .005 the researcher, therefore, proceeds with factor analysis. Both these measures examine the appropriateness of factor analysis.

Table 1: KMO and Bartlett’s Test

|

KMO and Bartlett’s Test |

||

|

Kaiser-Meyer-Olkin Measure of Sampling Adequacy. |

.787 |

|

|

Bartlett's Test of Sphericity |

Approx. Chi-Square |

1060.165 |

|

Df |

325 |

|

|

Sig. |

.000 |

|

Factor: The initial number of factors is the same as the number of variables used in the factor analysis. Out of 30 statements, only 26 were found useful and used for factor analysis. However not all 26 factors will be retained. In this study, only the first 7 factors will be retained since their Eigen value is greater than1.

Table 2: Total Variance Explained

|

Component |

Initial Eigen values |

Extraction Sums of Squared Loadings |

Rotation Sums of Squared Loadings |

||||||

|

Total |

% of Variance |

Cumulative % |

Total |

% of Variance |

Cumulative % |

Total |

% of Variance |

Cumulative % |

|

|

1 |

7.394 |

28.438 |

28.438 |

7.394 |

28.438 |

28.438 |

3.431 |

13.196 |

13.196 |

|

2 |

2.501 |

9.618 |

38.055 |

2.501 |

9.618 |

38.055 |

2.601 |

10.006 |

23.201 |

|

3 |

1.768 |

6.801 |

44.856 |

1.768 |

6.801 |

44.856 |

2.420 |

9.309 |

32.510 |

|

4 |

1.391 |

5.351 |

50.207 |

1.391 |

5.351 |

50.207 |

2.275 |

8.750 |

41.260 |

|

5 |

1.324 |

5.093 |

55.299 |

1.324 |

5.093 |

55.299 |

2.249 |

8.648 |

49.908 |

|

6 |

1.134 |

4.363 |

59.662 |

1.134 |

4.363 |

59.662 |

1.849 |

7.113 |

57.021 |

|

7 |

1.109 |

4.264 |

63.926 |

1.109 |

4.264 |

63.926 |

1.795 |

6.905 |

63.926 |

|

8 |

.948 |

3.647 |

67.573 |

||||||

|

9 |

.906 |

3.486 |

71.059 |

||||||

|

10 |

.808 |

3.109 |

74.169 |

||||||

|

11 |

.792 |

3.046 |

77.214 |

||||||

|

12 |

.710 |

2.730 |

79.944 |

||||||

|

13 |

.675 |

2.597 |

82.541 |

||||||

|

14 |

.589 |

2.264 |

84.805 |

||||||

|

15 |

.559 |

2.150 |

86.955 |

||||||

|

16 |

.497 |

1.910 |

88.865 |

||||||

|

17 |

.477 |

1.833 |

90.698 |

||||||

|

18 |

.415 |

1.595 |

92.293 |

||||||

|

19 |

.355 |

1.365 |

93.658 |

||||||

|

20 |

.316 |

1.214 |

94.872 |

||||||

|

21 |

.300 |

1.154 |

96.026 |

||||||

|

22 |

.268 |

1.031 |

97.057 |

||||||

|

23 |

.222 |

.855 |

97.912 |

||||||

|

24 |

.220 |

.845 |

98.757 |

||||||

|

25 |

.190 |

.733 |

99.490 |

||||||

|

26 |

.133 |

.510 |

100.000 |

||||||

|

Extraction Method: Principal Component Analysis. |

|||||||||

Table 3: Rotated Component Matrix

| Component | |||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

| F1: Attractive and Modern Services | |||||||

| Attractive store advertisement | .768 | ||||||

| Attractive décor | .700 | ||||||

| Membership card | .694 | ||||||

| Convenient parking facility | .667 | ||||||

| Free attractive carry bags | .608 | ||||||

| Computerized checkout scanners | .590 | ||||||

| F2: Responsiveness | |||||||

| Courteous staff | .694 | ||||||

| Prompt service by staff | .666 | ||||||

| Wide brand selection & variety | .661 | ||||||

| Knowledgeable staff | .552 | ||||||

| Easy return & exchange | .453 | ||||||

| F3: Customer convenience | |||||||

| Individual attention by staff | .713 | ||||||

| Attractive displays | .620 | ||||||

| Home delivery service | .555 | ||||||

| Convenient storehours | .524 | ||||||

| F4: Money saving | |||||||

| Reasonable pricing | .816 | ||||||

| Value for money | .720 | ||||||

| Regular schemes & offers | .681 | ||||||

| F5: Time saving | |||||||

| Sufficient cash counters | .715 | ||||||

| Save time of shopping | .639 | ||||||

| Easy checkout counters | .601 | ||||||

| F6: Product variety | |||||||

| Availability of substitutes | .700 | ||||||

| Easy to move through store | .505 | ||||||

| F7: Quality&Location | |||||||

| Cleanliness | .784 | ||||||

| Convenient location | .621 | ||||||

| High quality | .598 | ||||||

The PRINCIPAL COMPONENT MATRIX gives the component matrix which is rotated using the VARIMAX rotation technique which gives the ROTATED COMPONENT MATRIX. Rotation of factors helps in the better interpretation of factors. The Reliabilityof extracted factors has been checked by calculating Cronbach’s Alpha.

Table 4: Cronbach’s Alpha (Reliability statistics)

| Factors | Cronbach’s Alpha |

| F1 | .82 |

| F2 | .73 |

| F3 | .62 |

| F4 | .72 |

| F5 | .70 |

| F6 | .59 |

| F7 | .60 |

The Extracted Factors: Factors affecting women perception towards grocery retail stores.

Now we explain the factors that we extracted using factor analysis (refer to Table 3).

Factor 1 – Attractive and Modern services: The first factor extracted in the analysis is named as “Attractive and Modern services”. This factor includes the variables which represent attractive and modern services provided by a grocery retail store. This shows that women expect a grocery retail store to have attractive decor, advertisement and carry bags. Also, women expect modernized and high technology services from a store such as computerized checkout scanners, membership cards and convenient parking facility. The Cronbach’s alpha is 0.73 for this factor. As we can see from table 3, attractive store advertisement has the highest factor loading of 0.768 in this factor.

Factor2 – Responsiveness: The second factor extracted in the analysis is named as “Responsiveness”. This factor includes the variables which represent helpful and courteous behavior of the staff towards customers and wide brand selection available at a grocery store. This shows that women expect a grocery store to have staff that is courteous, knowledgeable and provides prompt service to customers. Also, they expect that store should be responsive to their brand variety and easy return & exchange needs. The Cronbach’s alpha is 0.73 for this factor. Courteous staff has the highest factor loading of 0.694 in this factor.

Factor 3 – Customer Convenience: The third factor extracted in the analysis is named as “Customer Convenience”. This factor includes the variables which represent convenience offered to customers while shopping from the grocery store. This shows that women expect a grocery retail store to provide individual attention by staff, attractive displays, home delivery services and convenient store hours for their shopping needs. The Cronbach’s alpha value for this factor comes to 0.62. The highest factor loading variable in this factor is individual attention by staff having factor loading of 0.713.

Factor 4 – Money saving: The fourth factor extracted in the analysis is named as “Money saving”. This factor includes the variables which represent economical and money saving offers provided by a grocery retail outlet. This shows that women expect a grocery retail store to have reasonable pricing, value for money products and regular schemes & offers. The Cronbach’s alpha is 0.72 for this factor. Reasonable pricing has the highest factor loading of 0.816 in this factor.

Factor 5 – Time saving: The fifth factor extracted in the analysis is named as “Time saving”. This factor includes the variables which represent time saving services provided by a grocery store. This shows that women expect a grocery retail store to have sufficient cash counters, easy checkout counters and a time saving experience. The Cronbach’s alpha is 0.70 for this factor. The highest factor loading is 0.715 of sufficient cash counters variable.

Factor 6 – Product variety: The sixth factor extracted in the analysis is named as “Product variety”. This factor includes the variables which represent product variety and comfortable movability provided by the store. This shows that women expect a grocery retail store to have substitutes available for the products and such layout of the store that substitutes can be easily located. The Cronbach’s alpha value is 0.59 of this factor. The variable which is heavily loaded in this factor is availability of substitutes with factor loading 0.700.

Factor 7 – Quality & Location: The seventh and the last factor extracted in the analysis is named as “Quality & Location”. This factor includes the variables which represent quality products and clean store atmosphere along with convenient store location. This shows that women expect a grocery store to have cleanliness, convenient location and high quality products. The Cronbach’s alpha of this factor is 0.60. The Cleanliness variable has the highest factor loading of 0.784 in this factor.

5.2 Paired t-test

Here, paired t-test is used to compare women perception towards traditional and modern grocery retail stores on the basis of the factors extracted above.

Table 5: Paired t-test Results

| Factors | Category | Mean | t-test statistic | P-value |

| F1: Attractive and Modern Services | Traditional | 3.05 | -13.398 | .000 |

| Modern | 4.20 | |||

| F2: Responsiveness | Traditional | 3.73 | -4.779 | .000 |

| Modern | 4.15 | |||

| F3: Customer Convenience | Traditional | 3.72 | -3.008 | .003 |

| Modern | 4.02 | |||

| F4: Money Saving | Traditional | 3.84 | -4.306 | .000 |

| Modern | 4.22 | |||

| F5: Time Saving | Traditional | 3.43 | -7.843 | .000 |

| Modern | 4.30 | |||

| F6: Product Variety | Traditional | 3.26 | -10.121 | .000 |

| Modern | 4.33 | |||

| F7: Quality & Location | Traditional | 4.01 | -5.052 | .000 |

| Modern | 4.41 |

Table 5 shows that there is significant difference in perception of women between traditional and modern grocery retail stores (p-value< 0.05) w.r.t all the seven factors influencing perception of women that were extracted using factor analysis. As shown in the table above, the mean value of modern grocery retail stores is more than the traditional grocery retail stores in case of all the seven factors.

From the above study it was found that there are seven factors that influence perception of women towards a grocery retail store, namely Attractive and Modern services, Responsiveness, Customer Convenience, Money saving, Time saving, Product variety, and Quality & Location. It was also found using paired t-test that there is significant difference in the perception of women between traditional and modern grocery retail store. The modern grocery retail stores have better perception than traditional grocery retail stores in terms of all the factors named above.

The women perception of the factors that influence them in choosing grocery retail store is of significant importance to the emerging and the existing retailers in understanding their behavior. With invent of the FDI in retailing, present grocery retailers in India whether kirana stores or modern stores will face tough competition from foreign brands. Online retailing is the new buzzword these days. To compete with this new form of grocery retailing, both traditional and modern retailers need to understand customer perception and adapt accordingly. This study will help the present grocery retail stores to improve their product and service quality variables to make their existing customers loyal towards them and attract new customers. It will also help new entrants, both domestic and foreign, in understanding the factors that influence the perception of women customers in choosing a store for grocery shopping in India.

This study is limited to females of Delhi & NCR. A similar study can be conducted for tier II and tier III cities of different regions of the country. Males can also be studied in future research. Further, this study focuses on grocery sector only. Thus, a similar study can be carried out for other segments such as apparel, jewellery etc. The sample size of the study may be inadequate to generalize the findings of the study. This study cannot be generalized for rural India as it has been conducted in a metro city like Delhi. Finally, there is scope for comparing the perception of housewives and working women in future.

Food & Grocery sector is the largest in the whole retailing sector of India. Traditional and modern stores coexist in this sector. Food & Grocery sector is still dominated by the traditional mom and pop stores. Recently, this sector has seen the increase of organized retail outlets in small cities and towns apart from metros and big cities. Due to introduction of FDI in multi brand retailing, foreign players are entering the Indian grocery retail sector. This study will help the domestic retailers to understand what women in a metro city expect from a grocery store as women are usually responsible to buy food & grocery for their family. The study has given the factors that influence women perception towards a grocery store in a metro. Also, the research has revealed that women perceives modern grocery retail store to be better than traditional stores in terms of the extracted factors. To compete with the modern grocery retailers, it is imperative for the traditional retailers to upgrade and adapt themselves according to the customer’s changing perception.

Traditional grocery retailers have their presence in every part of the country including rural India. Rural India constitutes majority of India’s population, therefore, a large part of India is still uncovered by the modern retailers. Modern retailers have a huge scope to expand in the food & grocery sector as they are mere 3% of the organized retail. Modern grocery retailers are in growth and expansion stage of their life cycle. Most of the modern retailers have not been able to break even yet. This study will be of immense help to the modern grocery retailers in this stage of growth and expansion. It will serve as a guide to them to overcome their weaknesses and attract customers in large number.

References

Anand, K.S. and Sinha, P.K. (2009).Store format choice in an evolving market: role of affect, cognition and involvement. The International Review of Retail, Distribution and Consumer Research, 19(5), 505-534

Bailay, R. and Chakravarty, C. (2013, November 20).Earlier Attempt to Sell Nilgiris had Come a Cropper.The Economic Times. P.12

Bailay, R. and Chakravarty, C. (2013, October 21).Reliance Retail Plans to Take Online Plunge Soon. The Economic Times.

Biyani, K. and Baishya, D. (2007)It Happened in India: The story of Pantaloons, Big Bazaar, Central and the great Indian consumer.Rupa& Co.,New Delhi.

Boora, A.S. and Singh, P. (2012).Organized Vs. Unorganized Retailing: A Three Dimensional Study Of Purchase Attributes Preference in Grocery Retailing.IIM Journal,1(1), 73-81.

Di, A. (2008).Consumers’ Perceptions Toward Retail Stores Comparing Between Superstores and Family-Run Stores in Bangkok. Thesis submitted for the fulfillment of the degree of Master of Business Administration in Management, School of Management, Shinawatra University, Bangkok.

Dikshit, A. (2011). The Uneasy Compromise. Retrieved 29th October, 2013 from http://online.wsj.com/news/articles/SB10001424053111903461104576461540616622966?mg=reno64-wsj&url=http%3A%2F%2Fonline.wsj.com%2Farticle%2FSB10001424053111903461104576461540616622966.html .

Goswami, P. and Mishra, M.S. (2009).Would Indian consumers move from kirana stores to organized retailers when shopping for groceries? Asia Pacific Journal of Marketing and Logistics, 21(1), 127-143.

Gupta, U. (2012).Changing Consumer Preferences From Unorganized Retailing Towards Organized Retailing: A Study in Jammu.Journal of Emerging Knowledge on Emerging Markets, 4(1), 1-20.

Hans, P.P. (2013). Virtual Grocer. Retrieved 29th October, 2013 fromhttp://businesstoday.intoday.in/story/online-grocery-shopping-vegetables-new-trend-in-india/1/197141.html.

Jayasankaraprasada, C. and Kathyayanib, G. (2013).Cross-format shopping motives and shopper typologies for grocery shopping: a multivariate approach. The International Review of Retail, Distribution and Consumer Research, 24(1), 79-115.

Jhamb, D. and Kiran, R. (2012).Emerging Trends of Organized Retailing in India: A Shared Vision of Consumers and Retailers Perspective. Middle East Journal of Scientific Research, 11(4), 481-490.

Kenhove, P.V. and Wulf, K.D. (2000). Income and time pressure: a person-situation grocery retail typology. The International Review of Retail, Distribution and Consumer Research, 10(2), 149-166.

Kumar, E.S. and Reddy, M.S. (2013).A Study on Customer Perception on Retail Services in Select Organized Retail Stores in Semi Urban Areas (A Case Study in Kadapa City, A.P.). International Journal of Computational Engineering and Management, 16(3), 86-92.

Malviya, S. (2013, October 17).Tata takes Tesco cue in Retail Push. The Economic Times. P5.

Miles, N. (2014).Tackling India’s Modern Grocery Sector. Retrieved 23rd July, 2014 fromhttp://retailanalysis.igd.com/Hub.aspx?id=23&tid=3&nid=12725 .

Mishra, P. and Rajagopalan, K. (2014).Pulse of Indian retail market: A survey of CFOs in theIndian retail sector. Retrieved 23rd July, 2014 fromhttp://www.rai.net.in/EY-RAI_Pulse_of_Indian_retail_market_Final.pdf .

Morschett, D.D., Swoboda, B. and Foscht, T. (2005).Perception of store attributes and overall attitude towards grocery retailers: The role of shopping motives. The International Review of Retail, Distribution and Consumer Research, 15(4), 423-447.

Nair, G.K. and Nair, H. (2013).An Analysis On Customer Perception Towards Service Quality Variables In Selected Organized Retail Outlets. International Journal of Management and Social Sciences Research, 2(1), 56-61.

Ojha, A. (2013, October 14) Reinventing Retail. The Strategist. P1and 4.

Ramvenkatesh, M. (2012). SMEs welcome FDI in retail. Retrieved 29th October, 2013 from http://www.ciol.com/ciol/news/122864/smes-welcome-fdi-retail .

Sachdeva, J.K. (2008).Study of Consumers’ perceptions about Malls and Traditional Retail Outlets. Journal of Global Economy, 4(4), 259-278.

Sondeep, M. (2010).Emerging Trends in Indian Retailing: Strategies for Successful Management. Ph.D. Thesis submitted to Guru Nanak Dev University, Amritsar, India.

Talreja, M. and Jain, D. (2013).Changing Consumer Perceptions Towards organized Retailing From Unorganized Retailing - An Empirical Analysis. International Journal of Marketing, Financial Services and Management Research, 2(6), 73-85.

Wootten, C.C., Pritchard, A., Morgan, N. and Jones, E. (2008).It’s her shopping list! Exploring gender, leisure, and power in grocery shopping. Leisure/ Loisir, 32(2), 407-436.