|

Dr. N. S. PANDEY EZHIL VEMBU Dr. MEENU PANDEY Assistant Professor, Doctoral Research Scholar, PG & Research Department of Commerce, Kanchi Mamunivar Centre for Post Graduate Studies (Autonomous), (Centre with “A” Grade and Potential for Excellence by UGC) (Affiliated to Pondicherry Central University), Puducherry – 605 008. Email: drnspandey@gmail.com Email: vembud1009@gmail.com Email: meenuacs@gmail.com FCS, Company Secretary, Stellar Group of Companies, Noida, |

This paper makes an attempt to find out the causal relationship between spot and future market of Indian Stock Exchanges. Indian Derivatives market gives significant development of Indian Capital markets. The study is based on secondary data. The period of study covers for six years i.e. from January 2010 to December 2015. Unit root test, Johansen Co-integration test, Granger Causality test and graphical analysis have been used for this study. And the study found that there is an existence of co integration between spot and future market and the price movement of spot and future are similar. Further the study has identified that there is causality between of BSE sensex and S&P CNX nifty spot and future market.

Derivative is a financial instrument that derives their value from their underlying assets. When the underlying asset changes in price, the value of the derivative also changes. A derivative is not a product. It is an agreement that derives its value from changes in the price of the underlying. In a derivative market, there are many ways to trade like options, forwards, futures and swaps. The derivatives can be traded in two ways; one is Over - The - Counter (OTC) of off exchange trading and the other one is Exchange Traded Derivatives Contract (ETD). Forwards and Swaps are traded in Over - The - Counter (OTC) and Options and Futures are traded in Exchange Traded Derivatives (ETD).

Introduction of derivative products has been one of the most important growths in Indian Capital Markets. The impact of index futures and stock futures may influence spot prices if they have a cause on the actions of investors. Since, futures markets consent to investors to hedge the price risk, the existence of futures may affect an investor decision to invest, how much to invest and what investment strategies to use. By adding together, the futures prices may have information about predictable demand that can give the influence for investment decisions.

The main step is taken of the secondary market in the introduction of derivative products in the major Indian Stock Exchanges (NSE and BSE) with a view to present tools for risk management to the investors and furthermore to get better the information about the cash market. The Indian Capital Markets have experienced the introduction of derivative products on June 9, 2000 in Bombay Stock Exchange (BSE) by the introduction of BSE Sensex futures. After just one year, index options were also introduced to help the investors for managing their risks. As of 2005, the NSE trades futures and options.

Derivatives on stock indices and individual stocks have grown rapidly since inception. Both Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) are the standard indices of Indian Stock Exchange. So, the present study uses a leading stick indices in India namely, BSE sensex and NSE nifty on which futures trading. The impact of futures introduction on the restricted and unrestricted instability on the underlying indices is examined.

The aim of this paper is to examine the relationship between the spot and future trading derivatives in India. Derivative futures are very much appreciable on the grounds that it gives yawning insight about the stock market. It would be necessary for the ideal method of trading in stock futures. So the study uses popular benchmark indices of Indian Stock Exchanges i.e. BSE sensex spot and future and S&P CNX nifty spot and future. The study uses monthly data for the analysis over the period from January 2010 to December 2015. This paper will get apparent view of future trading derivatives.

Bandivadekar and Ghosh (2003) conducted a study on “Derivatives and Volatility on Indian Stock Market” and they found that a downward in spot market volatility after the prologue of index futures due to increased recent news and decrease the result of hesitation derived from the old news. The futures market plays a definite position in the decline of volatility in the case of S&P CNX nifty, whereas in BSE sensex, the turnover of derivatives is significantly small. Misra et al. (2006) made a study on “Arbitrage opportunities in the futures market – A study of NSE nifty futures” and they specifies that there is a contravention of spot futures having a partly relationship for many futures in case of NSE nifty futures. And also the arbitrage profits are more for far month futures contracts when compared to near month futures contracts.

Nayak (2008) in a study titled “Growth of financial derivatives in India and its impact on underlying stock assets” and the revealed that the spot and futures returns are interdependent and hence the relationship can be used for forecasting the futures prices. Derivatives help to increase the trading volume of the cash market resulting in the reduction of transaction cost in the long run. Product wise derivatives turnover in India at NSE has stock future as 59% when compared to Index futures, stock options and index options. Debasish and Das (2008) found a study on “An econometric study on impact of futures trading on the stability of stock index in India” and the study depicted that after the introduction of future market, the future period was higher than the pre futures period but the volatility of monthly returns remains unaffected. Further, it was found that there is statistical significant evidence that the sharing of every day returns could that the significant increases in the instability of daily returns after the commencement of futures trading is necessarily futures induced.

Gahlot et al. (2010) investigated a study on “Impact of derivative trading on stock market volatility in India: A study of S&P CNX nifty” and the result of the study explained that the opposing outline of increase in its categorical GARCH volatility. This may be due to bundling effect of constituent stocks of nifty. Sakthivel and Kamaiah (2011) conducted a study on “The effect of derivative trading on volatility of underlying stocks: Evidence from the NSE” and the study depicted that the spot market variation has declined after the introduction of futures trading. In case of individual stocks, there has been a reduction in volatility of the individual stocks. Further, the introduction of futures trading has altered the irregularity behaviour of spot price volatility as well as individual stock volatility. Debasish (2011) concluded in a study titled “Relative volatility in spot and futures market in selected indices of NSE in India – An analysis” and the study resulted that there is a significant change in comparative daily volatility between spot and futures prices for all three NSE indices. Sreenu (2012) found a study on “A study on technical analysis of Derivatives stock futures and the role for debt market derivatives in debt market development in India” and the study depicts that the derivatives turnover on the NSE has go beyond the turnover of equity market. And also, considerably its development in the recent years has surpassed the enlargement of its complement worldwide.

Thomas (2013) conducted a study on “Recent issues in the Indian Capital Market” and the study finished that the Indian capital market has undergone metamorphic reforms in past few years. Every segment of the Indian capital market has experienced an impact of these changes, which has significantly, improves the transparency, efficiency and integration of the Indian market with the global market. Juneja (2013) investigated in a study titled “Understanding the relation between FII and Stock market” and the revealed that there is a significant positive correlation between FII movement and effects on Indian capital markets. It also reveals that the actions in the Indian capital market are moderately give explanation by the FII net inflows. Subha and Musthffa (2014) conducted a study on “Dynamic volatility relationship between Bank nifty futures and bank nifty indices – Evidence from India” and the study resulted that the nifty indices of bank caused the futures showing the result of stabilisation and destabilisation of the market during the underlying assets of the bank nifty indices. Shaline and Roweendra (2014) examined a study on “A study of derivatives market in India and its current position in global financial derivatives market” and the paper completed that the growth of derivatives in recent years has exceeded the expansion of its counterpart globally. In Indian scenario, the equity derivatives market is playing a major role in price discovery. And also there is a big significance and contribution of derivatives to financial system. Satapathy and Kar (2015) found in a study titled “The causal relationship between spot and future prices in India: A select case study of NSE” and the study depicted that the vague improvement conditions are found to be negative and significant which futures validity the relationships. From impulse response, both spot and future markets are highly sensitive to each other’s shocks. The findings of variance decomposition indicate that in case of nifty, Tata motors and ACC future market dominate over the spot market in explaining variations in both spot and future market meaning future price leads to spot price. Further, bidirectional causal relationship is found between spot and future prices of selected indices of both spot and future market plays a significant role in explaining each other movements.

OBJECTIVES OF THE STUDY

Secondary Objectives

SIGNIFICANCE OF THE STUDY

The present study elucidates the role of derivatives futures is in Indian financial markets. Studies of this type are more useful to the investors’ decision making of futures trading derivatives. By that, the investor can get the right underlying for investment, that is totally risk free. The study uses the monthly price movement for the selected indices.

Sources of Data

The study is entirely based on secondary data and which could have been collected from various websites like www.bse.com, www.nseindia.com, www.investing.com and www.moneycontrol.com. Theoretical framework of the data have been collected from various journals, newspapers, magazines and also their relevant websites.

PERIOD OF THE STUDY

The data analysed in this paper has been collected from a broad range of reliable sources. The data base maintained by the BSE and NSE relating to their monthly index has been used for the purpose of the study. The data consists of monthly average closing price of 2 major stock indices of India which is BSE Sensex and S&P CNX Nifty. The study has covered the period for six years monthly data of calendar year i.e. from January 2010 to December 2015.

Statistical Tools

For analysing the data, EVIEWS 7 has been used. The appropriate statistical techniques as Augmented Dickey-Fuller Test, Phillips-Perron Test, Johansen Co integration Test and Granger Causality Test have been used for analysing the data.

HYPOTHESES DEVELOPED OF THE STUDY

The following are the hypotheses used in this study:

LIMITATIONS OF THE STUDY

The limitations of the study are as follows:

ANALYSIS AND INTERPRETATION

Table 1

Description of Data

|

Sl. No |

Variables |

Symbols |

|

1 |

BSE Sensex Spot Price |

SSP |

|

2 |

BSE Sensex Future Price |

SFP |

|

3 |

S&P CNX Nifty Spot Price |

NSP |

|

4 |

S&P CNX Nifty Future Price |

NFP |

The study aims to find out the relationship between spot and future market of the selected indices (BSE Sensex spot and future and S&P CNX Nifty spot and future). For this purpose, the study uses the statistical tools like Unit Root test, Johansen Co integration test, Granger Causality test and for the price movement of the indices the graphical representation have been used.

Unit Root Test

Before conducting any econometric test, the stationarity properties of the variables need to be checked through unit root test. Most commonly used method of checking the stationarity the Augmented Dickey-Fuller Test (ADF) and Phillips Perron Test (PP) have been used.

Augmented Dickey-Fuller Test and Phillips Perron Test

The Augmented Dickey-Fuller test is based on the null hypothesis H0: (Yt is not I (0). And Phillips Perron test is an alternative method for unit root test. If the calculated Augmented Dickey Fuller and Phillips Perron test is less than the critical value, then the null hypothesis is rejected, or else accepted. If the variable is non – stationary at level, the Augmented Dickey Fuller and Phillips Perron test will be performed at the first difference.

Table 2

Unit Root Test

|

Indices |

Augmented Dickey-Fuller Test |

Phillips Perron Test |

||

|

T statistics |

Probability |

T statistics |

Probability |

|

|

SSP |

-8.145547 |

0.0000 |

-8.188195 |

0.0000 |

|

SFP |

-8.481447 |

0.0000 |

-8.510150 |

0.0000 |

|

NSP |

-8.155089 |

0.0000 |

-8.200342 |

0.0000 |

|

NFP |

-8.026539 |

0.0000 |

-8.076994 |

0.0000 |

Source: Complied Data

The result of Augmented Dickey-Fuller test (ADF) and Phillips Perron (PP) test are shown in table 3. The null hypothesis of no unit root is rejected at 1% level after taking the first difference. Augmented Dickey-Fuller test (ADF) and Phillips Perron (PP) test statistics are compared with critical values and the result revealed that the null hypothesis “H01: BSE Sensex and S&P CNX Nifty are having non stationary” of unit root test has been rejected at 5% level of significance.

Johansen Co integration Model

The test of Johansen co integration model has been used to identify the long run relationship of the variables. The co integration between non-stationary variables has been tested by the Johansen’s trace statistics and maximum Eigen value tests.

Table 3

Johansen Co integration Test

|

Hypothesized No. of Coefficients |

Eigen Value |

Trace Statistics |

0.05 Critical Value |

Probability |

|

BSE Sensex |

||||

|

None |

0.396576 |

29.71261 |

15.49471 |

0.0002 |

|

At most 1 |

0.007126 |

0.414807 |

3.841466 |

0.5195 |

|

S&P CNX Nifty |

||||

|

None |

0.460337 |

36.12510 |

15.49471 |

0.0000 |

|

At most 1 |

0.006018 |

0.350119 |

3.841466 |

0.5540 |

Trace test indicates 1 co integrating eqn(s) at the 0.05 level.

Denotes rejection of the hypothesis at the 0.05 level.

MacKinnon-Haug-Michelis (1999) p-values.

Table 4 shows the result of Johansen Co integration. It shows that the number of co-integrated equations (0) is none which means there is no co-integrated equation. The trace statistics is greater than the 0.05 critical value, so “H02: Both BSE sensex and S&P CNX nifty spot and future are not co integrated” is rejected. And also by looking the probability value the null hypothesis can be rejected at 5% level at none for both BSE Sensex and S&P CNX Nifty. Therefore, the test indicates that co integrating exists at 5% level of significance.

Granger Causality Test

The pair wise Granger Causality test is performed between all the possible pairs of variables to determine the direction of causality. Only the rejected hypotheses are reported in Table 5.

Table 4

Granger Causality Tests

|

Null Hypotheses |

Obs. |

F-Statistics |

Probability |

Decision |

|

NSP does not Granger Cause NFP |

58 |

5.27784 |

0.0081 |

Rejected |

|

SFP does not Granger Cause NFP |

58 |

8.17489 |

0.0008 |

Rejected |

|

SSP does not Granger Cause NFP |

58 |

7.13299 |

0.0018 |

Rejected |

|

SSP does not Granger Cause NSP |

58 |

4.16474 |

0.0209 |

Rejected |

|

SSP does not Granger Cause NSP |

58 |

3.35120 |

0.0426 |

Rejected |

|

NSP does not Granger Cause SSP |

58 |

3.18368 |

0.0495 |

Rejected |

Source: Complied Data

Table 5 reveals the result of Granger Causality test. Both BSE sensex and S&P CNX nifty have an impact of their indices. Nifty spot price cause Nifty future price at 1% level. The Sensex future price cause Nifty future price at 1% level. Sensex spot price may also cause Nifty future price at 1% level. Sensex spot price cause Nifty spot price at 5% level. Sensex spot price cause Nifty spot price at 5% level. And Nifty spot price cause Sensex spot price at 5% level. Therefore, the null hypothesis “H03: Causality does not exist between BSE sensex and S&P CNX nifty spot and future” is rejected. And also it indicates that the causality exist between BSE sensex and S&P CNX nifty spot and future.

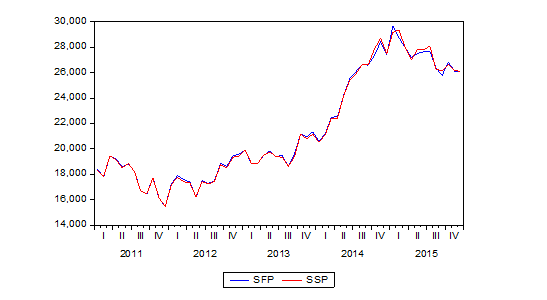

Figure 1

Price movement of BSE sensex spot and future

Figure 1 shows the clear picture of price movement of spot and future trading derivatives in BSE sensex. The movement of the price is very much similar and parallel trend in nature. It shows that spot and future price of BSE sensex are moving in a same direction. And it depicts that there is a strong association in spot and future price.

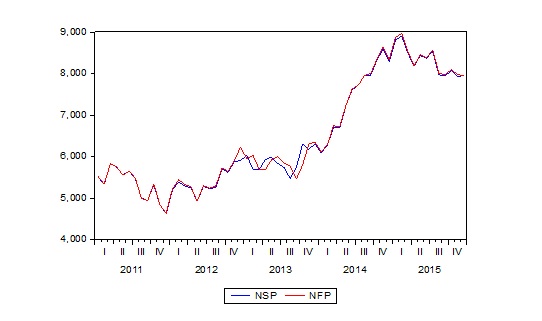

Figure 2

Price movement of S&P CNX nifty spot and future

Figure 2 shows the price movement trend of S&P CNX nifty spot and future price. The movement of the spot and future price is almost similar. This shows the spot and future price of S&P CNX nifty are having a strong connection. And it reveals that the S&P CNX nifty spot and future price are following similar trend.

From both the figure 1 and 2 shows the trend of spot and future price of BSE sensex and S&P CNX nifty and it clearly reveals that there is a similar trend of price movement in spot and future of BSE sensex and S&P CNX nifty. So, the null hypothesis “H04: There is no similar trend of price movement in spot and future of BSE sensex and S&P CNX nifty” is rejected. And hence, there is a similar trend of price movement in spot and future of BSE sensex and S&P CNX Nifty.

FINDINGS OF THE STUDY

The findings of the study are following:

CONCLUDING REMARKS

This paper concludes that the spot and future price of BSE sensex and S&P CNX nifty are having a strong connection. And also there is a strong collision of spot and future price. So, the investor can able to choose the right underlying for investment, which is risk free. The study included the changes in monthly price movement of the selected indices. These helps the investor to take right decisions regarding trading in derivative index futures.

SCOPE FOR FURTHER RESEARCH

The study was concentrated only on the selected two indices (BSE sensex and S&P CNX nifty). The study has covered the period, only for five years. With the two indices we cannot able to judge the whole market. So, for further the study may concentrated on the individual stocks or individual indices of the future market. It may able to give an apparent view of futures derivatives market.

Bandivadekar, Suchal and Ghosh, Saurabh (2003). Derivatives and Volatility on Indian Stock Markets. Reserve Bank of India Occasional Papers. 24(3): 187-201.

Debasish, Sathya Swaroop and Das, Bhagaban. (2008). An Econometric Study on Impact of Futures Trading on the Stability of Stock Index in India. International Journal of Business and Management. 3(12): 70-80.

Debasish, Sathya Swaroop. (2011). Relative Volatility in Spot and Futures Market in Selected Indices of NSE in India – An Analysis. Vidyasagar University Journal of Commerce. 16: 5-20.

Gahlot, Ruchika, Datta Suroj K. and Kapil, Sheeba. (2010). Impact of Derivative Trading on Stock Market Volatility in India: A Study of S&P CNX Nifty. Eurasian Journal of Business and Economics. 3(6): 139-49.

Juneja, Sanjana. (2013). Understanding the Relation Between FII and Stock Market. IRACST International Journal of Commerce, Business and Management. 2(6): 328-34.

Misra, Dheeraj, Kannan, R. and Misra, Sangeetha D. (2006). Arbitrage Opportunities in the Futures Market – A Study of NSE Nifty Futures. 8th Global Conference of Actuaries.:401-11.

Nayak, Keyur M. (2008). Growth of Financial Derivatives in India and its Impact on Underlying Stock Market. SMART Journal of Business Management Studies. 4(1): 10-16.

Sakthivel, P and Kamaiah, B. (2011). The Effect of Derivative Trading on Volatility of Underlying Stocks: Evidence from the NSE. Indian Journal of Economics and Business. Vol. 10(4): 511-31.

Satapathy, Sarita and ChandraKar, Nirmala. (2015). The Causal Relationship Between Spot and Future Prices in India: A Selected Case Study of NSE. Indian Journal of Applied Research. 5(9): 490-99.

Shaline, H. S. and Raveendra, P. V. (2014). A Study of Derivatives Market in India and its Current Position in Global Financial Derivatives Market. IOSR Journal of Economics and Finance. 3(3): 25-42.

Sreenu, Nenavath. (2012). A study on Technical Analysis of Derivatives Sock Futures and the Role for Debt Market Derivatives. ZENITH International Journal of Business Economics and Management Research. 2(3): 81-98.

Subha, M. V. and Musthaffa, A. (2014). Dynamic Volatility Relationship Between Bank Nifty Futures and Bank Nifty Indices – Evidence from India. International Journal of Business, Management and Allied Sciences. 1(2): 228-35.

Thomas, George P. (2013). Recent Issues in the Indian Stock Market. ABHINAV – International Monthly Referred Journal of Research in Management and Technology. 2: 89-97.

Websites

http://in.investing.com/indices/sensex-futures-historical-data?cid=104426 accessed on 15.02.2016.

http://in.investing.com/indices/s-p-cnx-nifty-historical-data accessed on 15.02.2015.

http://in.investing.com/indices/india-50-futures-historical-data accessed on 15.02.2015.

http://www.bseindia.com/indices/IndexArchiveData.aspx accessed on 15.02.2015.

http://www.nseindia.com/products/content/derivatives/equities/historical_fo.htm accessed on 15.02.2015.